Key Insights

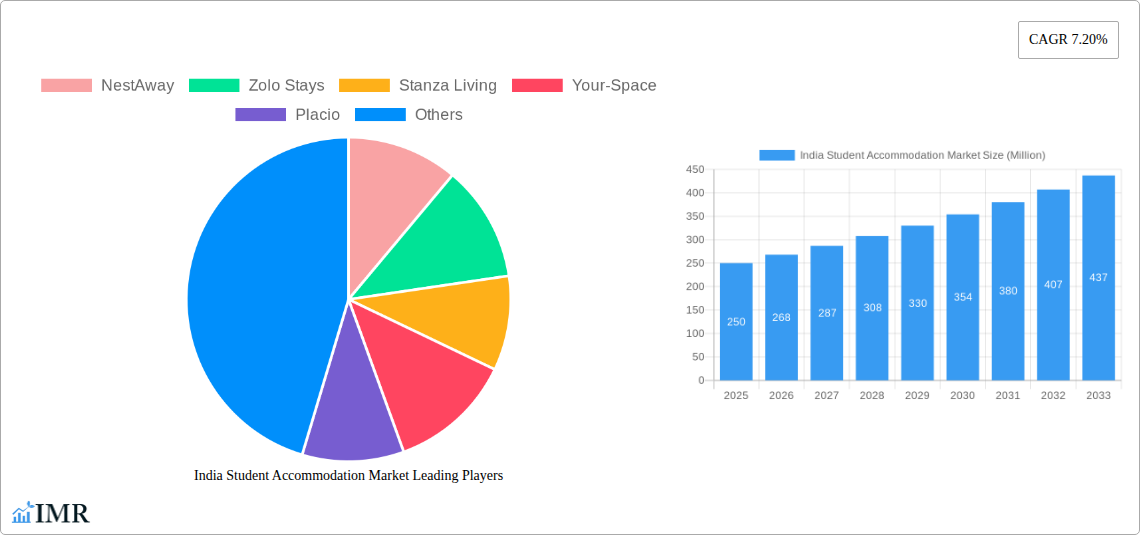

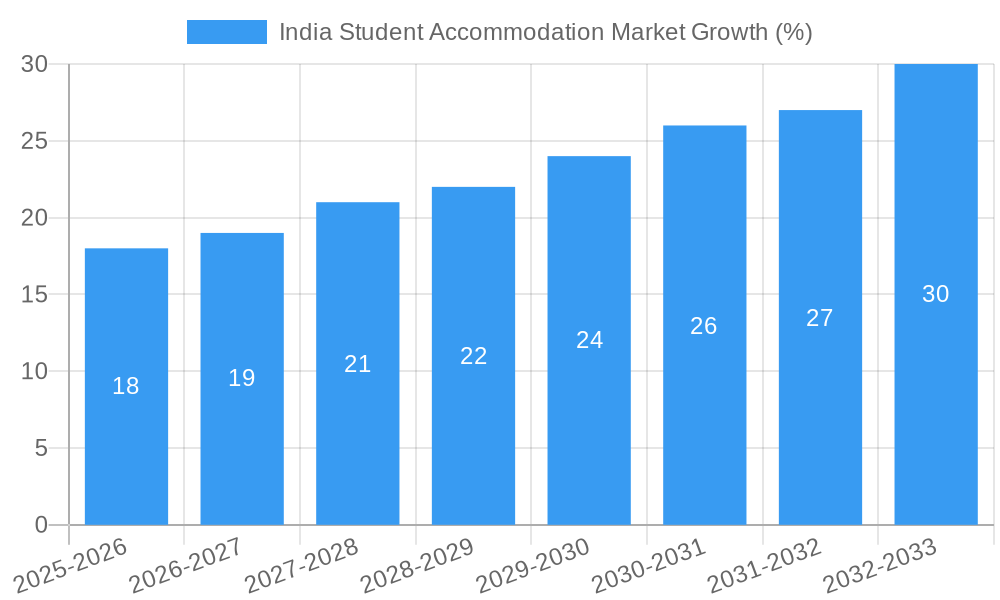

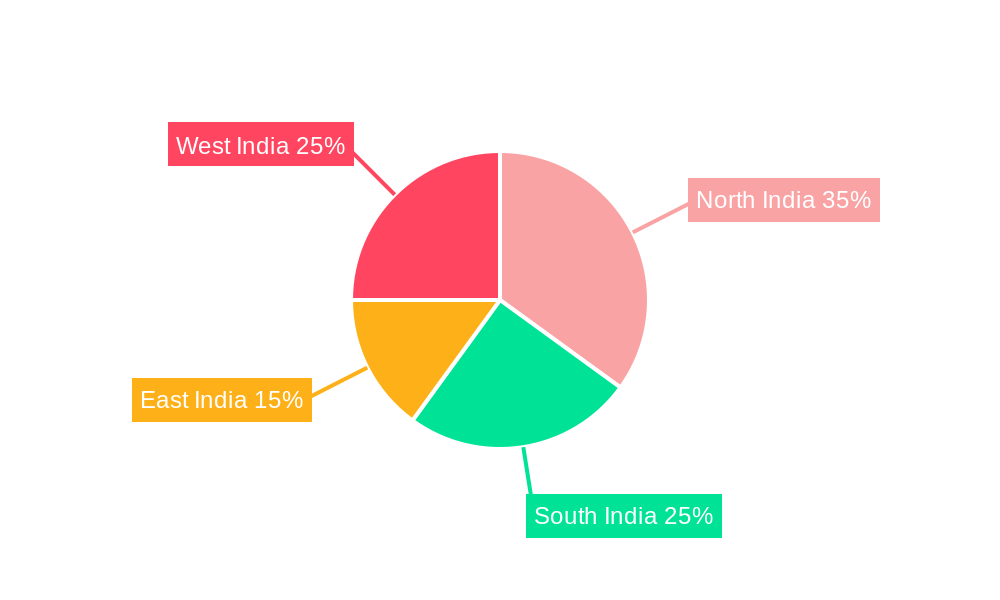

The Indian student accommodation market, valued at approximately ₹250 million in 2025, is experiencing robust growth, projected to reach ₹500 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 7.20%. This expansion is fueled by several key drivers: a burgeoning student population, increasing urbanization, a rising preference for managed accommodations offering amenities like Wi-Fi, laundry, and parking, and a shift from traditional, less-amenitized options. The market is segmented by service type (Wi-Fi, laundry, utilities, dishwasher, parking) and accommodation type (PGs, PBSAs, studio apartments, on-campus, and off-campus housing). While PGs currently dominate, the demand for PBSAs and studio apartments is steadily increasing, driven by a preference for privacy and modern amenities. This trend is particularly pronounced in metropolitan areas within North and West India, which are witnessing rapid infrastructural development and higher student enrolment in educational institutions. However, the market faces constraints such as high real estate costs in major cities, regulatory challenges related to property management, and the need for consistent quality control across various operators.

Despite these challenges, the market presents significant opportunities for established players like NestAway, Zolo Stays, Stanza Living, and emerging players. The increasing adoption of technology for property management, online bookings, and enhanced customer experience will further fuel market growth. Strategic partnerships with educational institutions and developers are crucial to expand reach and access a larger target audience. The future of the Indian student accommodation market hinges on addressing affordability concerns while maintaining service quality and technological advancements that create a convenient and attractive living experience for students. Focus on sustainable practices and community building within these accommodations will also prove to be differentiating factors in this competitive market.

India Student Accommodation Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning India student accommodation market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). Targeting industry professionals, investors, and policymakers, this report offers invaluable insights into market dynamics, growth trends, key players, and emerging opportunities within the parent market of Real Estate and the child market of Student Housing. The report utilizes rigorous data analysis to project a market valued at XX Million units by 2033.

India Student Accommodation Market Dynamics & Structure

The Indian student accommodation market is experiencing rapid growth fueled by a burgeoning student population and increasing urbanization. Market concentration is currently moderate, with key players like NestAway, Zolo Stays, and Stanza Living holding significant but not dominant shares. Technological innovation, particularly in online booking platforms and smart home integration, is a major driver. Regulatory frameworks, while evolving, play a crucial role in shaping market standards and safety regulations. The market faces competition from traditional PG accommodations and privately rented rooms, though the organized sector is steadily gaining ground. End-user demographics are primarily comprised of undergraduate and postgraduate students, with a growing demand for premium, amenity-rich accommodations. M&A activity has been moderate, with a total of XX deals recorded between 2019 and 2024, indicating a potential for consolidation in the coming years.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately XX% market share in 2025.

- Technological Innovation: Focus on online platforms, mobile apps, and smart home technology for enhanced user experience.

- Regulatory Framework: Developing regulations focusing on safety, hygiene, and tenant rights are impacting market growth positively.

- Competitive Substitutes: Traditional PGs and privately rented rooms remain a significant competition.

- End-User Demographics: Primarily undergraduate and postgraduate students, with increasing demand from international students.

- M&A Trends: XX M&A deals between 2019-2024; consolidation expected in the forecast period.

India Student Accommodation Market Growth Trends & Insights

The Indian student accommodation market has witnessed substantial growth from XX Million units in 2019 to an estimated XX Million units in 2025, exhibiting a CAGR of XX% during the historical period. This growth is driven by factors including rising student enrollment, increased disposable incomes among students and their families, and a preference for safe, convenient, and amenity-rich accommodations. Technological disruptions, such as the rise of online booking platforms and proptech solutions, have significantly enhanced market accessibility and efficiency. Consumer behavior is shifting towards premium services, with a growing demand for features like Wi-Fi, laundry facilities, and shared common spaces. Market penetration of organized players is expected to increase from XX% in 2025 to XX% by 2033, driven by improved affordability and access to high-quality accommodations. The increasing demand for PBSA (Purpose-Built Student Accommodation) is also a key growth driver, with a projected market size of XX Million units by 2033.

Dominant Regions, Countries, or Segments in India Student Accommodation Market

Metropolitan cities such as Mumbai, Delhi-NCR, Bengaluru, Chennai, and Hyderabad are currently the dominant regions, owing to the high concentration of educational institutions and a large student population. Within the service type segment, Wi-Fi and Laundry services are the most sought-after amenities, with high market penetration across all accommodation types. The PBSA segment is experiencing the fastest growth, driven by increased investment and development of purpose-built student housing projects. Key drivers include favorable government policies promoting affordable housing and supportive infrastructure development in major cities.

- Leading Regions: Mumbai, Delhi-NCR, Bengaluru, Chennai, and Hyderabad.

- Dominant Service Types: Wi-Fi and Laundry, followed by Utilities and Parking.

- Fastest Growing Segment: PBSA (Purpose-Built Student Accommodation).

- Key Drivers: High student population in metropolitan areas, favorable government policies, and increased investment in infrastructure.

India Student Accommodation Market Product Landscape

The market offers a diverse range of accommodation options, from traditional PGs to modern studio apartments and PBSA developments. Innovation is focused on improving safety, comfort, and convenience, with features like biometric access systems, online payment gateways, and integrated management systems. Technological advancements in smart home automation, energy efficiency, and waste management are also gaining traction. Unique selling propositions often include value-added services, such as curated social events, career counseling, and academic support.

Key Drivers, Barriers & Challenges in India Student Accommodation Market

Key Drivers: Rising student enrollment, increasing urbanization, growing preference for organized accommodation, and technological advancements in proptech are key growth drivers. Government initiatives promoting affordable housing also play a crucial role.

Challenges: High land costs in major cities, stringent regulatory requirements, and competition from the unorganized sector pose significant challenges. Supply chain disruptions and the need for skilled manpower are also notable limitations. The high cost of construction and maintenance, in addition to potential difficulties in securing financing, can hinder expansion.

Emerging Opportunities in India Student Accommodation Market

Untapped markets in Tier 2 and Tier 3 cities, expansion into specialized student housing for specific academic disciplines, and the incorporation of sustainable and eco-friendly technologies represent key emerging opportunities. Growing demand for co-living spaces and flexible lease terms further presents potential for market expansion.

Growth Accelerators in the India Student Accommodation Market Industry

Strategic partnerships with educational institutions, technological advancements improving operational efficiency and safety, and expansion into underserved markets can significantly accelerate market growth. Government incentives, focusing on affordable housing and infrastructure development in strategic locations, will also prove a catalyst for expansion.

Key Players Shaping the India Student Accommodation Market Market

- NestAway

- Zolo Stays

- Stanza Living

- Your-Space

- Placio

- StayAbode

- Weroom

- OYO Life

- CoHo

Notable Milestones in India Student Accommodation Market Sector

- 2020: Launch of several online booking platforms.

- 2021: Increased investment in PBSA projects.

- 2022: Implementation of new safety and security regulations.

- 2023: Several mergers and acquisitions between smaller operators.

- 2024: Growing focus on sustainable practices in student accommodation.

In-Depth India Student Accommodation Market Market Outlook

The Indian student accommodation market is poised for continued robust growth in the coming years, driven by sustained demand, technological innovations, and supportive government policies. Strategic expansion into underserved markets, technological advancements in smart housing, and further consolidation within the industry present significant strategic opportunities for market participants. The forecast indicates a strong potential for market expansion, creating new avenues for investment and growth.

India Student Accommodation Market Segmentation

-

1. Service Type

- 1.1. Wi-Fi

- 1.2. Laundry

- 1.3. Utilities

- 1.4. Dishwasher

- 1.5. Parking

-

2. Type

- 2.1. PG

- 2.2. PBSA

- 2.3. Studio Apartment

- 2.4. Live in On-Campus Housing

- 2.5. Live in Off-Campus Housing

India Student Accommodation Market Segmentation By Geography

- 1. India

India Student Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Education Sector; Rising Demand for Quality Accomodation

- 3.3. Market Restrains

- 3.3.1. Enrolment Fluctuations

- 3.4. Market Trends

- 3.4.1. Urbanization Helping to Grow the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Student Accommodation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Wi-Fi

- 5.1.2. Laundry

- 5.1.3. Utilities

- 5.1.4. Dishwasher

- 5.1.5. Parking

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. PG

- 5.2.2. PBSA

- 5.2.3. Studio Apartment

- 5.2.4. Live in On-Campus Housing

- 5.2.5. Live in Off-Campus Housing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North India India Student Accommodation Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Student Accommodation Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Student Accommodation Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Student Accommodation Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 NestAway

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Zolo Stays

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Stanza Living

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Your-Space

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Placio

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 StayAbode

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Weroom**List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 OYO Life

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 CoHo

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 NestAway

List of Figures

- Figure 1: India Student Accommodation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Student Accommodation Market Share (%) by Company 2024

List of Tables

- Table 1: India Student Accommodation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Student Accommodation Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: India Student Accommodation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: India Student Accommodation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Student Accommodation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Student Accommodation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Student Accommodation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Student Accommodation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Student Accommodation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Student Accommodation Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 11: India Student Accommodation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: India Student Accommodation Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Student Accommodation Market?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the India Student Accommodation Market?

Key companies in the market include NestAway, Zolo Stays, Stanza Living, Your-Space, Placio, StayAbode, Weroom**List Not Exhaustive, OYO Life, CoHo.

3. What are the main segments of the India Student Accommodation Market?

The market segments include Service Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of Education Sector; Rising Demand for Quality Accomodation.

6. What are the notable trends driving market growth?

Urbanization Helping to Grow the Market.

7. Are there any restraints impacting market growth?

Enrolment Fluctuations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Student Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Student Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Student Accommodation Market?

To stay informed about further developments, trends, and reports in the India Student Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence