Key Insights

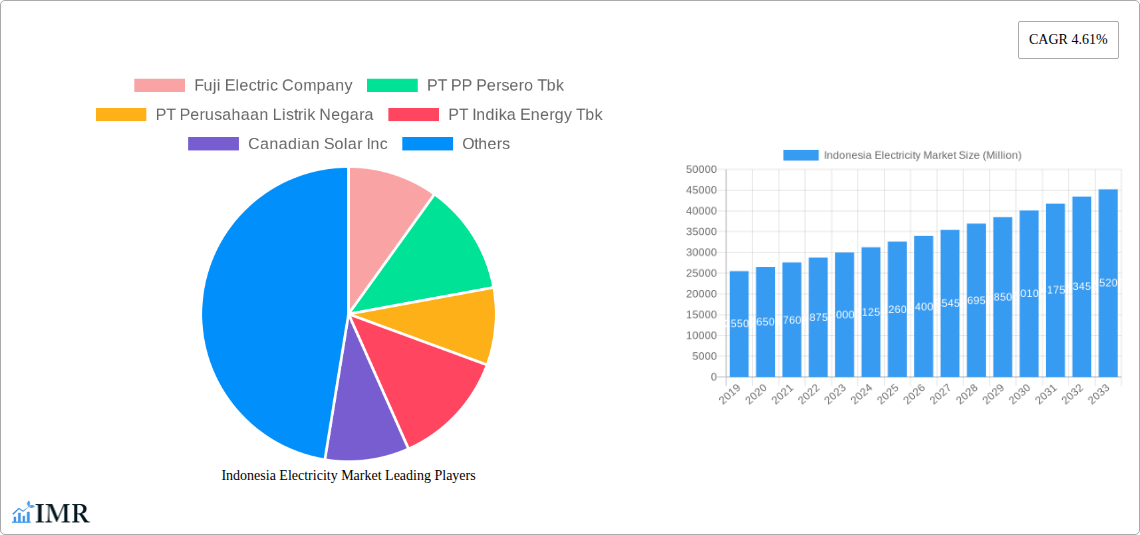

Indonesia's electricity market is projected for significant expansion, anticipated to reach a market size of 353.59 billion by 2025, with a CAGR of 3.53% through 2033. This growth is driven by increasing demand from a growing population and a developing economy, alongside government efforts to expand electricity access and enhance energy security. The transition to cleaner energy sources, such as solar and geothermal, is creating substantial opportunities within the renewable sector, supported by global sustainability initiatives and Indonesia's commitment to reducing its carbon footprint. Modernizing grid infrastructure to manage increased loads and integrate diverse power sources is also a key market trend.

Indonesia Electricity Market Market Size (In Billion)

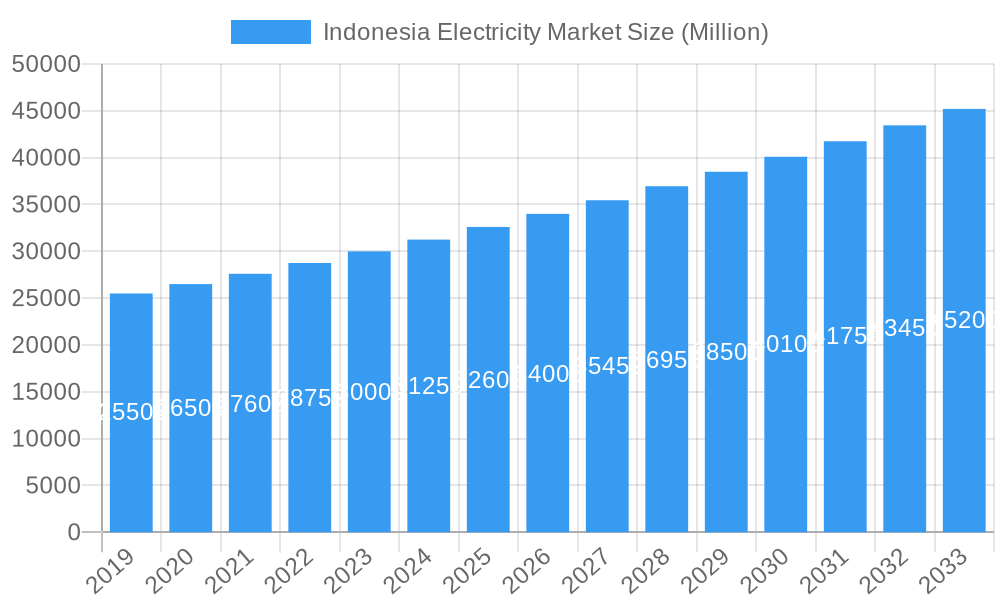

Challenges to market expansion include the substantial capital expenditure required for new power plant development and grid upgrades, alongside complex regulatory frameworks and land acquisition hurdles. Despite these restraints, significant domestic and international investments are bolstering the market's positive outlook. Key industry players such as Fuji Electric Company, Mitsubishi Power Ltd, and Canadian Solar Inc. are contributing advanced technologies and solutions. The market is segmented by power sources, with a mix of traditional sources (oil, natural gas, coal) and a rapidly growing renewables sector. Investment in the power transmission and distribution segment is crucial for efficient electricity delivery across the archipelago, especially with the rise of distributed generation. Enhancing grid stability and modernizing infrastructure for variable renewable energy integration will be vital for continued growth.

Indonesia Electricity Market Company Market Share

Indonesia Electricity Market: Comprehensive Analysis of Power Generation, Transmission, and Distribution (2019-2033)

This in-depth report provides a panoramic view of the Indonesia electricity market, meticulously analyzing power generation sources, power transmission and distribution infrastructure, and emerging energy technologies. Delve into parent and child market segments, gaining critical insights into the nation's evolving energy landscape. With a study period spanning from 2019 to 2033, and a base and estimated year of 2025, this report offers unparalleled predictive accuracy and strategic foresight for industry stakeholders. We meticulously detail historical data from 2019 to 2024 and project future trends through the forecast period of 2025–2033. This report is a must-have for anyone seeking to understand and capitalize on the growth of Indonesia's energy sector.

Indonesia Electricity Market Market Dynamics & Structure

The Indonesia electricity market is characterized by a dynamic interplay of regulatory frameworks, technological advancements, and evolving end-user demographics. Market concentration remains significant, with PT Perusahaan Listrik Negara (PLN) holding a dominant position in generation, transmission, and distribution. However, increasing policy support for renewable energy sources is fostering greater diversification and attracting new entrants. Technological innovation is primarily driven by the need for grid modernization, energy efficiency, and the integration of intermittent renewable sources. Regulatory frameworks are continually adapting to support the nation's ambitious energy transition goals, promoting private sector investment and sustainable power development. Competitive product substitutes are emerging, particularly in distributed generation and energy storage solutions, challenging traditional utility models. End-user demographics are shifting, with a growing demand for reliable and affordable electricity across residential, commercial, and industrial sectors. Merger and acquisition trends are indicative of strategic consolidation and expansion, particularly in the renewable energy space, as companies seek to secure project pipelines and technological expertise.

- Market Concentration: Dominated by PT PLN, with increasing private sector participation in renewables.

- Technological Innovation Drivers: Grid modernization, energy storage, smart grid technologies, and renewable energy integration.

- Regulatory Frameworks: Evolving policies to support renewable energy targets, foreign investment, and grid reliability.

- Competitive Product Substitutes: Distributed solar PV, battery energy storage systems, and demand-side management solutions.

- End-User Demographics: Growing demand from urban and industrial centers, with an increasing focus on sustainability.

- M&A Trends: Strategic partnerships and acquisitions in the renewable energy sector to enhance market presence and technological capabilities.

Indonesia Electricity Market Growth Trends & Insights

The Indonesia electricity market is poised for substantial growth, driven by a burgeoning economy, expanding industrial base, and increasing electrification rates. The market size is projected to witness a significant upward trajectory, fueled by robust investments in new power generation capacity and the modernization of existing power transmission and distribution networks. Adoption rates for renewable energy technologies, particularly solar PV and geothermal energy, are accelerating as government incentives and falling technology costs make them increasingly competitive. Technological disruptions, such as advancements in battery storage and smart grid solutions, are playing a crucial role in enhancing grid stability and enabling higher penetration of renewable energy sources. Consumer behavior is shifting towards a greater demand for cleaner and more reliable energy, with a growing awareness of environmental sustainability. These shifts are reshaping the market dynamics, creating opportunities for innovative energy solutions and services. The Indonesia power sector is undergoing a transformative period, with opportunities for both established players and new market entrants.

Dominant Regions, Countries, or Segments in Indonesia Electricity Market

Within the Indonesia electricity market, the Power Generation Source segment, particularly Renewables, is emerging as a dominant growth driver. While Oil and Natural Gas and Coal have historically been the backbone of the nation's energy supply, a strategic pivot towards cleaner energy sources is reshaping the landscape. Hydroelectricity also plays a significant role, leveraging Indonesia's rich water resources. However, the rapid advancements and favorable economics are positioning Renewables, especially solar PV and geothermal energy, for unparalleled expansion.

- Renewables as a Dominant Segment: Government targets and international commitments are accelerating investment in renewable energy projects.

- Market Share Growth: Significant projected increase in the share of renewables in the overall energy mix.

- Growth Potential: Vast untapped potential for solar, geothermal, and other renewable sources across the archipelago.

- Key Drivers for Renewables:

- Economic Policies: Feed-in tariffs, tax incentives, and renewable purchase obligations are encouraging investment.

- Infrastructure Development: Focus on upgrading the grid to accommodate distributed and intermittent renewable generation.

- Technological Advancements: Decreasing costs of solar panels and battery storage solutions enhance competitiveness.

- Environmental Concerns: Growing awareness of climate change and the need for sustainable energy solutions.

- Dominance Factors:

- Abundant Resources: Indonesia's geographical location and natural endowments are ideal for solar and geothermal energy.

- Energy Security: Diversifying the energy mix reduces reliance on imported fossil fuels.

- International Support: Access to green financing and technological collaboration from global partners.

The Power Transmission and Distribution segment is also experiencing substantial development to support the integration of these new generation sources and meet the growing demand across the vast Indonesian archipelago. This includes crucial investments in grid modernization and expansion to ensure reliability and efficiency across all regions.

Indonesia Electricity Market Product Landscape

The Indonesia electricity market is witnessing a surge in innovative products and applications within the power generation and power transmission and distribution segments. Key product innovations include advancements in highly efficient solar PV panels, integrated battery energy storage systems (BESS) designed for grid-scale applications, and sophisticated smart grid technologies that enable real-time monitoring and control. The application of these technologies extends from utility-scale renewable energy farms to distributed generation solutions for commercial and industrial clients, enhancing energy independence and reliability. Performance metrics are continuously improving, with higher conversion efficiencies for solar technologies and increased energy density for storage solutions. Furthermore, the development of co-firing technologies for existing fossil fuel power plants signifies a pragmatic approach to decarbonization, allowing for the gradual integration of less carbon-intensive fuels.

Key Drivers, Barriers & Challenges in Indonesia Electricity Market

The Indonesia electricity market is propelled by several key drivers, including the government's ambitious renewable energy targets, a rapidly growing industrial and commercial sector demanding increased power, and the ongoing need for grid modernization and expansion to improve reliability and reach underserved areas. Technological advancements in solar PV and battery storage are also significantly reducing costs and improving efficiency.

- Key Drivers:

- Government Policies: Strong commitment to increasing renewable energy share and attracting foreign investment.

- Economic Growth: Expanding industrial and commercial activities drive electricity demand.

- Electrification Efforts: Efforts to increase electricity access in remote and rural areas.

- Technological Advancements: Falling costs and improved performance of renewable energy and storage solutions.

Conversely, the market faces significant barriers and challenges. Regulatory hurdles and bureaucratic complexities can slow down project development and investment. Financing access, particularly for large-scale renewable projects, remains a concern, despite growing international interest. Grid infrastructure limitations, especially in remote islands, pose challenges for integrating new generation sources and ensuring stable supply. Supply chain vulnerabilities for key components and the competition from established fossil fuel interests also present obstacles.

- Key Barriers & Challenges:

- Regulatory Complexity: Streamlining permitting processes and ensuring policy consistency.

- Financing Accessibility: Securing adequate and affordable capital for large-scale projects.

- Infrastructure Gaps: Upgrading and expanding transmission and distribution networks.

- Supply Chain Issues: Ensuring reliable availability of specialized equipment and components.

- Fossil Fuel Dominance: Transitioning away from established coal and gas infrastructure.

Emerging Opportunities in Indonesia Electricity Market

Emerging opportunities in the Indonesia electricity market are centered around the rapid growth of distributed renewable energy solutions, particularly rooftop solar PV for residential and commercial consumers. The increasing demand for energy storage systems to complement intermittent renewables presents a significant opportunity for technological innovation and deployment. Furthermore, the development of green hydrogen production and its integration into the energy mix is an emerging frontier. Untapped potential exists in off-grid and mini-grid solutions for remote islands, enhancing energy access and economic development. Evolving consumer preferences for sustainable and digitally integrated energy services are also creating avenues for new business models and service providers.

Growth Accelerators in the Indonesia Electricity Market Industry

Several catalysts are accelerating long-term growth in the Indonesia electricity market. Technological breakthroughs in solar efficiency, battery technology, and smart grid management are making renewable energy increasingly viable and cost-effective. Strategic partnerships between domestic utilities, international developers, and technology providers are crucial for knowledge transfer and project execution. Market expansion strategies, including government-led initiatives to electrify remote areas and encourage private investment in underserved regions, are driving broader adoption. The ongoing focus on decarbonization and energy transition globally is also creating a favorable environment for sustained investment and innovation within Indonesia's power sector.

Key Players Shaping the Indonesia Electricity Market Market

- Fuji Electric Company

- PT PP Persero Tbk

- PT Perusahaan Listrik Negara

- PT Indika Energy Tbk

- Canadian Solar Inc

- BCPG Public Company Limited

- PT Pertamina Geothermal Energy

- Harbin Power Engineering

- Sindicatum Renewable Energy Company Pte Ltd

- Mitsubishi Power Ltd

Notable Milestones in Indonesia Electricity Market Sector

- March 2023: Mitsubishi Heavy Industries, Ltd. and PT. PLN Nusantara Power, a sub-holding of Indonesia's state-owned electricity provider PT. PLN (Persero) (PLN) signed an agreement to start off three technical studies related to co-firing of less carbon-intensive fuels at power plants owned and operated by Nusantara Power. This milestone signifies a proactive approach to reducing the carbon footprint of existing infrastructure.

- November 2022: ACWA Power Company announced that PT Perusahaan Listrik Negara (Persero), Indonesia's sole state-owned electricity utility chose the company to develop two floating solar PV projects. The company's first venture into Southeast Asia as well as its first floating solar PV project are being built by ACWA Power. The facilities will be named the Saguling Floating Solar PV Project and the Singkarak Floating Solar PV Project, and will each have an installed capacity of 60 MWac and 50 MWac, respectively, and represent a combined investment value of USD 105 million. This development underscores the growing importance of floating solar PV and Indonesia's commitment to expanding its renewable energy portfolio.

In-Depth Indonesia Electricity Market Market Outlook

The Indonesia electricity market outlook is exceptionally promising, driven by strong growth accelerators such as supportive government policies, increasing foreign investment, and significant technological advancements. The strategic focus on expanding renewable energy sources, particularly solar and geothermal, coupled with substantial investments in power transmission and distribution infrastructure, will ensure a robust and reliable energy future. Future market potential is vast, with opportunities in grid modernization, energy storage integration, and the development of smart grid solutions. Strategic opportunities lie in capitalizing on the nation's abundant renewable resources and its commitment to a sustainable energy transition, positioning Indonesia as a key player in the global energy landscape.

Indonesia Electricity Market Segmentation

-

1. Power Generation Source

- 1.1. Oil and Natural Gas

- 1.2. Coal

- 1.3. Hydroelectricity

- 1.4. Renewables

- 2. Power Transmission and Distribution

Indonesia Electricity Market Segmentation By Geography

- 1. Indonesia

Indonesia Electricity Market Regional Market Share

Geographic Coverage of Indonesia Electricity Market

Indonesia Electricity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Coal-based Power Generation to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Electricity Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 5.1.1. Oil and Natural Gas

- 5.1.2. Coal

- 5.1.3. Hydroelectricity

- 5.1.4. Renewables

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Fuji Electric Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT PP Persero Tbk

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Perusahaan Listrik Negara

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Indika Energy Tbk

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Canadian Solar Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BCPG Public Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Pertamina Geothermal Energy

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Harbin Power Engineering

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sindicatum Renewable Energy Company Pte Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mitsubishi Power Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Fuji Electric Company

List of Figures

- Figure 1: Indonesia Electricity Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia Electricity Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Electricity Market Revenue billion Forecast, by Power Generation Source 2020 & 2033

- Table 2: Indonesia Electricity Market Volume gigawatt Forecast, by Power Generation Source 2020 & 2033

- Table 3: Indonesia Electricity Market Revenue billion Forecast, by Power Transmission and Distribution 2020 & 2033

- Table 4: Indonesia Electricity Market Volume gigawatt Forecast, by Power Transmission and Distribution 2020 & 2033

- Table 5: Indonesia Electricity Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Indonesia Electricity Market Volume gigawatt Forecast, by Region 2020 & 2033

- Table 7: Indonesia Electricity Market Revenue billion Forecast, by Power Generation Source 2020 & 2033

- Table 8: Indonesia Electricity Market Volume gigawatt Forecast, by Power Generation Source 2020 & 2033

- Table 9: Indonesia Electricity Market Revenue billion Forecast, by Power Transmission and Distribution 2020 & 2033

- Table 10: Indonesia Electricity Market Volume gigawatt Forecast, by Power Transmission and Distribution 2020 & 2033

- Table 11: Indonesia Electricity Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Indonesia Electricity Market Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Electricity Market?

The projected CAGR is approximately 3.53%.

2. Which companies are prominent players in the Indonesia Electricity Market?

Key companies in the market include Fuji Electric Company, PT PP Persero Tbk, PT Perusahaan Listrik Negara, PT Indika Energy Tbk, Canadian Solar Inc, BCPG Public Company Limited, PT Pertamina Geothermal Energy, Harbin Power Engineering, Sindicatum Renewable Energy Company Pte Ltd, Mitsubishi Power Ltd.

3. What are the main segments of the Indonesia Electricity Market?

The market segments include Power Generation Source, Power Transmission and Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD 353.59 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Coal-based Power Generation to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

March 2023: Mitsubishi Heavy Industries, Ltd. and PT. PLN Nusantara Power, a sub-holding of Indonesia's state-owned electricity provider PT. PLN (Persero) (PLN) signed an agreement to start off three technical studies related to co-firing of less carbon-intensive fuels at power plants owned and operated by Nusantara Power.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Electricity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Electricity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Electricity Market?

To stay informed about further developments, trends, and reports in the Indonesia Electricity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence