Key Insights

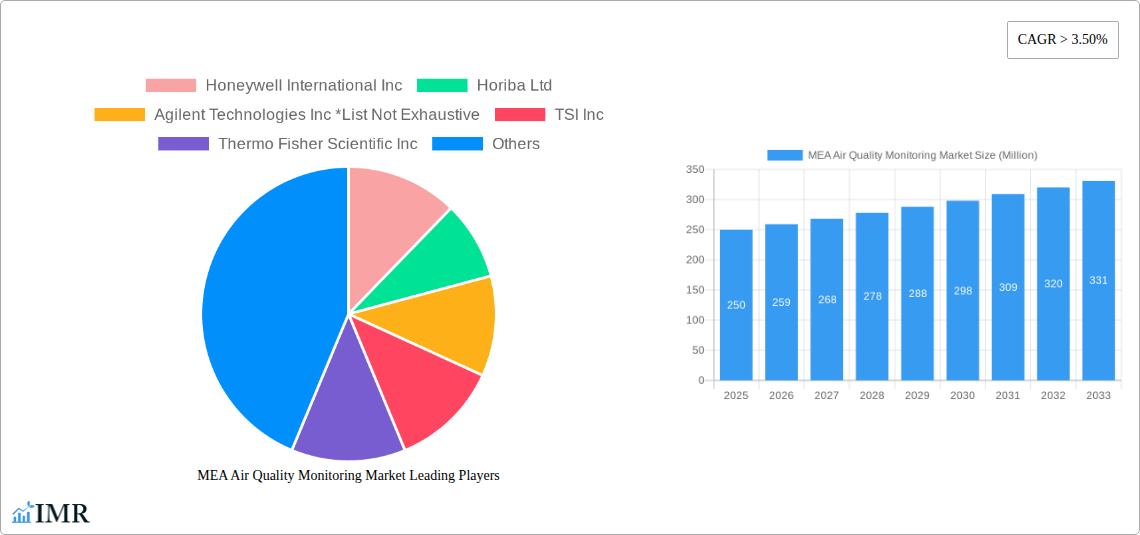

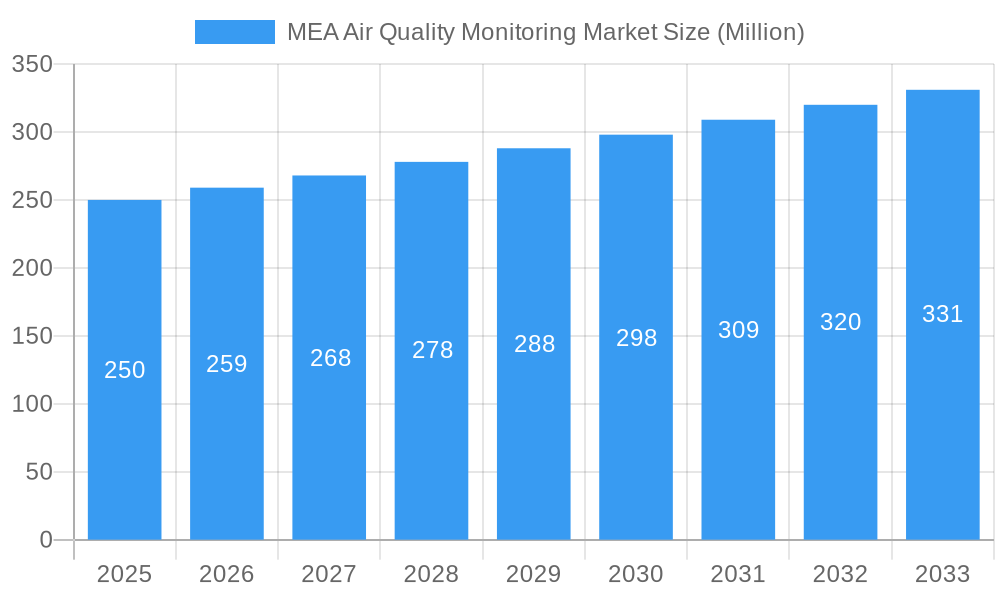

The MEA Air Quality Monitoring Market is poised for significant expansion, driven by escalating environmental awareness, rigorous regulatory frameworks, and accelerated urbanization. The market, projected to reach $5.5 billion by 2025, is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2025 and 2033. Key growth drivers include the increasing incidence of respiratory diseases linked to air pollution, prompting demand for advanced monitoring solutions. Government initiatives focused on infrastructure development and stringent emission controls across the MEA region further stimulate market growth. The proliferation of smart city projects and the integration of sophisticated monitoring technologies also contribute to this upward trend. The continuous monitoring segment is expected to lead, offering real-time data critical for effective pollution management. Chemical pollutant monitoring holds a substantial share due to the region's prominent industrial activities. Primary end-user sectors include power generation, petrochemicals, and the burgeoning commercial and residential segments. Leading market participants such as Honeywell, Horiba, and Agilent Technologies are capitalizing on their technical prowess and established distribution channels.

MEA Air Quality Monitoring Market Market Size (In Billion)

Market segmentation highlights promising opportunities in specialized areas. Demand for outdoor monitoring systems is anticipated to exceed indoor systems, reflecting a broader emphasis on environmental surveillance. While less prevalent than continuous monitoring, manual sampling methods retain relevance for specific applications and areas with limited infrastructure. Growth in the petrochemical and power generation sectors will directly influence the demand for air quality monitoring solutions, fostering segment-specific expansion. However, substantial initial investments in advanced monitoring equipment and the requirement for skilled personnel for operation and maintenance present potential growth impediments. Notwithstanding these challenges, the overall outlook for the MEA Air Quality Monitoring Market remains optimistic, underpinned by the imperative for improved air quality and continuous technological innovation. Future expansion will be contingent on sustained governmental support, advancements in sensor technology, and the development of economically viable solutions.

MEA Air Quality Monitoring Market Company Market Share

MEA Air Quality Monitoring Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa (MEA) Air Quality Monitoring Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report offers valuable insights for industry professionals, investors, and policymakers seeking to understand and capitalize on opportunities within this rapidly evolving market. The total market size is predicted to reach xx Million by 2033.

MEA Air Quality Monitoring Market Market Dynamics & Structure

The MEA air quality monitoring market is characterized by a moderately fragmented landscape, with several established players and emerging companies competing for market share. Technological innovation, driven by the need for more accurate and efficient monitoring systems, is a key driver. Stringent government regulations aimed at improving air quality, particularly in response to growing concerns about public health and environmental protection, are shaping market growth. The market witnesses continuous development of substitute technologies, with a constant push for more efficient and cost-effective solutions. The end-user demographics are diverse, encompassing residential, commercial, industrial, and governmental sectors. Mergers and acquisitions (M&A) activity is moderate, reflecting strategic consolidation and expansion efforts by key players.

- Market Concentration: Moderately fragmented, with a few dominant players. The top 5 players account for approximately xx% of the market share (2025).

- Technological Innovation: Focus on IoT integration, advanced sensors, data analytics, and cloud-based platforms.

- Regulatory Framework: Stringent emission standards and air quality regulations in several MEA countries are driving demand.

- Competitive Product Substitutes: Continuous development of cost-effective and portable monitoring devices poses a challenge.

- End-User Demographics: Significant demand from industrial sectors (power generation, petrochemicals), followed by government agencies and commercial establishments.

- M&A Trends: Strategic acquisitions to expand product portfolios and geographical reach. xx M&A deals were recorded between 2019 and 2024.

MEA Air Quality Monitoring Market Growth Trends & Insights

The MEA air quality monitoring market is experiencing robust growth, driven by increasing urbanization, industrialization, and rising awareness of air pollution's impact on public health. Government initiatives to enhance air quality monitoring infrastructure and strengthen regulatory frameworks are further stimulating market expansion. The market is witnessing a transition towards advanced monitoring technologies, with a growing adoption of continuous monitoring systems and sophisticated data analytics tools. Consumer behavior is shifting towards greater demand for real-time air quality information and personalized solutions.

- Market Size Evolution: The market size grew from xx Million in 2019 to xx Million in 2024, with a projected CAGR of xx% during the forecast period (2025-2033).

- Adoption Rates: Continuous monitoring systems are gaining popularity due to their ability to provide real-time data.

- Technological Disruptions: Integration of IoT and AI is revolutionizing data collection, analysis, and decision-making.

- Consumer Behavior Shifts: Growing demand for user-friendly, portable, and cost-effective monitoring devices.

Dominant Regions, Countries, or Segments in MEA Air Quality Monitoring Market

The UAE and Saudi Arabia are the dominant markets in the MEA region, driven by significant investments in infrastructure development, stringent environmental regulations, and heightened awareness of air pollution. The outdoor monitoring segment holds the largest market share, followed by the continuous monitoring method. Chemical pollutants constitute the major pollutant type monitored, reflecting the significant contribution of industrial emissions to air pollution. The industrial end-user segment (power generation and petrochemicals) dominates market demand.

- Key Drivers: Stringent government regulations, growing industrial activity, and investments in environmental protection initiatives.

- Dominance Factors: High level of government investment in air quality monitoring infrastructure.

- Growth Potential: Significant untapped potential in other MEA countries with rapidly growing economies and industrialization. Growing focus on the health sector is also expected to drive the adoption of indoor air quality monitors.

MEA Air Quality Monitoring Market Product Landscape

The MEA air quality monitoring market offers a diverse range of products, including stationary and portable monitors, sensors, data loggers, and software solutions. Recent innovations focus on enhancing accuracy, reliability, and ease of use, with emphasis on IoT connectivity and cloud-based data analytics. The unique selling propositions (USPs) of different products include improved data resolution, portable designs, remote monitoring capabilities, and user-friendly interfaces. Technological advancements such as miniaturization of sensors and development of advanced algorithms for data analysis are improving the overall performance of monitoring devices.

Key Drivers, Barriers & Challenges in MEA Air Quality Monitoring Market

Key Drivers:

- Stringent government regulations to combat air pollution.

- Growing awareness of health risks associated with poor air quality.

- Increasing urbanization and industrialization leading to higher pollution levels.

- Technological advancements in sensor technology and data analytics.

Challenges & Restraints:

- High initial investment costs for advanced monitoring systems.

- Lack of skilled personnel to operate and maintain complex systems.

- Interoperability issues between different monitoring systems.

- Data security and privacy concerns related to cloud-based solutions. The impact of these challenges is estimated to slow down market growth by approximately xx% during the forecast period.

Emerging Opportunities in MEA Air Quality Monitoring Market

- Expanding into untapped markets within the MEA region, particularly in countries with less developed air quality monitoring infrastructure.

- Development of innovative applications for air quality data, such as predictive modeling and personalized health recommendations.

- Growing demand for integrated solutions combining monitoring, analysis, and remediation technologies.

- Focus on cost-effective and user-friendly technologies to enhance market penetration.

Growth Accelerators in the MEA Air Quality Monitoring Market Industry

Long-term growth in the MEA air quality monitoring market will be fueled by several factors, including continued advancements in sensor technology, increasing collaborations between technology providers and government agencies, and expansion of monitoring networks in both urban and rural areas. The development of more robust and user-friendly software for data analysis and reporting will also support long-term market expansion.

Key Players Shaping the MEA Air Quality Monitoring Market Market

Notable Milestones in MEA Air Quality Monitoring Market Sector

- July 2022: Ajman Free Zone implements AirSense technology for air quality monitoring. This showcases the adoption of advanced technologies in industrial areas for pollution control.

- June 2022: Launch of the UAE's National Air Quality Agenda 2031 signifies a long-term commitment to improving air quality and provides a supportive regulatory framework for market growth.

- March 2022: Expansion of Abu Dhabi's air monitoring network highlights the growing investment in infrastructure and signifies the importance placed on air quality by the government.

In-Depth MEA Air Quality Monitoring Market Market Outlook

The MEA air quality monitoring market is poised for significant growth in the coming years, driven by a combination of factors, including the increasing prevalence of air pollution, stringent environmental regulations, and technological advancements. Strategic opportunities exist for companies that can provide innovative and cost-effective solutions tailored to the specific needs of the region. The market's future potential lies in developing comprehensive integrated solutions and strengthening collaborations to overcome challenges.

MEA Air Quality Monitoring Market Segmentation

-

1. Product Type

- 1.1. Indoor Monitor

- 1.2. Outdoor Monitor

-

2. Sampling Method

- 2.1. Continuous

- 2.2. Manual

- 2.3. Intermittent

-

3. Pollutant Type

- 3.1. Chemical Pollutants

- 3.2. Physical Pollutants

- 3.3. Biological Pollutants

-

4. End User

- 4.1. Residential and Commercial

- 4.2. Power Generation

- 4.3. Petrochemicals

- 4.4. Other End Users

-

5. Geography

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Rest of Middle-East and Africa

MEA Air Quality Monitoring Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Rest of Middle East and Africa

MEA Air Quality Monitoring Market Regional Market Share

Geographic Coverage of MEA Air Quality Monitoring Market

MEA Air Quality Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Awareness and Favorable Government Policies and Non-government Initiatives for Curbing Air Pollution

- 3.3. Market Restrains

- 3.3.1. 4.; High Costs of Air Quality Monitoring Systems

- 3.4. Market Trends

- 3.4.1. The Outdoor Monitor Segment is Expected to be the Fastest growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Indoor Monitor

- 5.1.2. Outdoor Monitor

- 5.2. Market Analysis, Insights and Forecast - by Sampling Method

- 5.2.1. Continuous

- 5.2.2. Manual

- 5.2.3. Intermittent

- 5.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 5.3.1. Chemical Pollutants

- 5.3.2. Physical Pollutants

- 5.3.3. Biological Pollutants

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Residential and Commercial

- 5.4.2. Power Generation

- 5.4.3. Petrochemicals

- 5.4.4. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. Saudi Arabia

- 5.5.2. United Arab Emirates

- 5.5.3. Rest of Middle-East and Africa

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.6.2. United Arab Emirates

- 5.6.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia MEA Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Indoor Monitor

- 6.1.2. Outdoor Monitor

- 6.2. Market Analysis, Insights and Forecast - by Sampling Method

- 6.2.1. Continuous

- 6.2.2. Manual

- 6.2.3. Intermittent

- 6.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 6.3.1. Chemical Pollutants

- 6.3.2. Physical Pollutants

- 6.3.3. Biological Pollutants

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Residential and Commercial

- 6.4.2. Power Generation

- 6.4.3. Petrochemicals

- 6.4.4. Other End Users

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. Saudi Arabia

- 6.5.2. United Arab Emirates

- 6.5.3. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates MEA Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Indoor Monitor

- 7.1.2. Outdoor Monitor

- 7.2. Market Analysis, Insights and Forecast - by Sampling Method

- 7.2.1. Continuous

- 7.2.2. Manual

- 7.2.3. Intermittent

- 7.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 7.3.1. Chemical Pollutants

- 7.3.2. Physical Pollutants

- 7.3.3. Biological Pollutants

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Residential and Commercial

- 7.4.2. Power Generation

- 7.4.3. Petrochemicals

- 7.4.4. Other End Users

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. Saudi Arabia

- 7.5.2. United Arab Emirates

- 7.5.3. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of Middle East and Africa MEA Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Indoor Monitor

- 8.1.2. Outdoor Monitor

- 8.2. Market Analysis, Insights and Forecast - by Sampling Method

- 8.2.1. Continuous

- 8.2.2. Manual

- 8.2.3. Intermittent

- 8.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 8.3.1. Chemical Pollutants

- 8.3.2. Physical Pollutants

- 8.3.3. Biological Pollutants

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Residential and Commercial

- 8.4.2. Power Generation

- 8.4.3. Petrochemicals

- 8.4.4. Other End Users

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. Saudi Arabia

- 8.5.2. United Arab Emirates

- 8.5.3. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Honeywell International Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Horiba Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Agilent Technologies Inc *List Not Exhaustive

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 TSI Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Thermo Fisher Scientific Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Emerson Electric Co

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Siemens AG

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 3M Co

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Teledyne Technologies Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Honeywell International Inc

List of Figures

- Figure 1: MEA Air Quality Monitoring Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: MEA Air Quality Monitoring Market Share (%) by Company 2025

List of Tables

- Table 1: MEA Air Quality Monitoring Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: MEA Air Quality Monitoring Market Revenue billion Forecast, by Sampling Method 2020 & 2033

- Table 3: MEA Air Quality Monitoring Market Revenue billion Forecast, by Pollutant Type 2020 & 2033

- Table 4: MEA Air Quality Monitoring Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: MEA Air Quality Monitoring Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: MEA Air Quality Monitoring Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: MEA Air Quality Monitoring Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: MEA Air Quality Monitoring Market Revenue billion Forecast, by Sampling Method 2020 & 2033

- Table 9: MEA Air Quality Monitoring Market Revenue billion Forecast, by Pollutant Type 2020 & 2033

- Table 10: MEA Air Quality Monitoring Market Revenue billion Forecast, by End User 2020 & 2033

- Table 11: MEA Air Quality Monitoring Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: MEA Air Quality Monitoring Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: MEA Air Quality Monitoring Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: MEA Air Quality Monitoring Market Revenue billion Forecast, by Sampling Method 2020 & 2033

- Table 15: MEA Air Quality Monitoring Market Revenue billion Forecast, by Pollutant Type 2020 & 2033

- Table 16: MEA Air Quality Monitoring Market Revenue billion Forecast, by End User 2020 & 2033

- Table 17: MEA Air Quality Monitoring Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: MEA Air Quality Monitoring Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: MEA Air Quality Monitoring Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: MEA Air Quality Monitoring Market Revenue billion Forecast, by Sampling Method 2020 & 2033

- Table 21: MEA Air Quality Monitoring Market Revenue billion Forecast, by Pollutant Type 2020 & 2033

- Table 22: MEA Air Quality Monitoring Market Revenue billion Forecast, by End User 2020 & 2033

- Table 23: MEA Air Quality Monitoring Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: MEA Air Quality Monitoring Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Air Quality Monitoring Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the MEA Air Quality Monitoring Market?

Key companies in the market include Honeywell International Inc, Horiba Ltd, Agilent Technologies Inc *List Not Exhaustive, TSI Inc, Thermo Fisher Scientific Inc, Emerson Electric Co, Siemens AG, 3M Co, Teledyne Technologies Inc.

3. What are the main segments of the MEA Air Quality Monitoring Market?

The market segments include Product Type, Sampling Method, Pollutant Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Awareness and Favorable Government Policies and Non-government Initiatives for Curbing Air Pollution.

6. What are the notable trends driving market growth?

The Outdoor Monitor Segment is Expected to be the Fastest growing Segment.

7. Are there any restraints impacting market growth?

4.; High Costs of Air Quality Monitoring Systems.

8. Can you provide examples of recent developments in the market?

July 2022: Ajman Free Zone established an ambient air quality monitoring system in Gate 2 of its industrial sector in collaboration with the Municipality and Planning Department of Ajman. As part of the project, the free zone implemented cutting-edge AirSense technology to measure and evaluate the industrial area's pollution levels by current international regulations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Air Quality Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Air Quality Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Air Quality Monitoring Market?

To stay informed about further developments, trends, and reports in the MEA Air Quality Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence