Key Insights

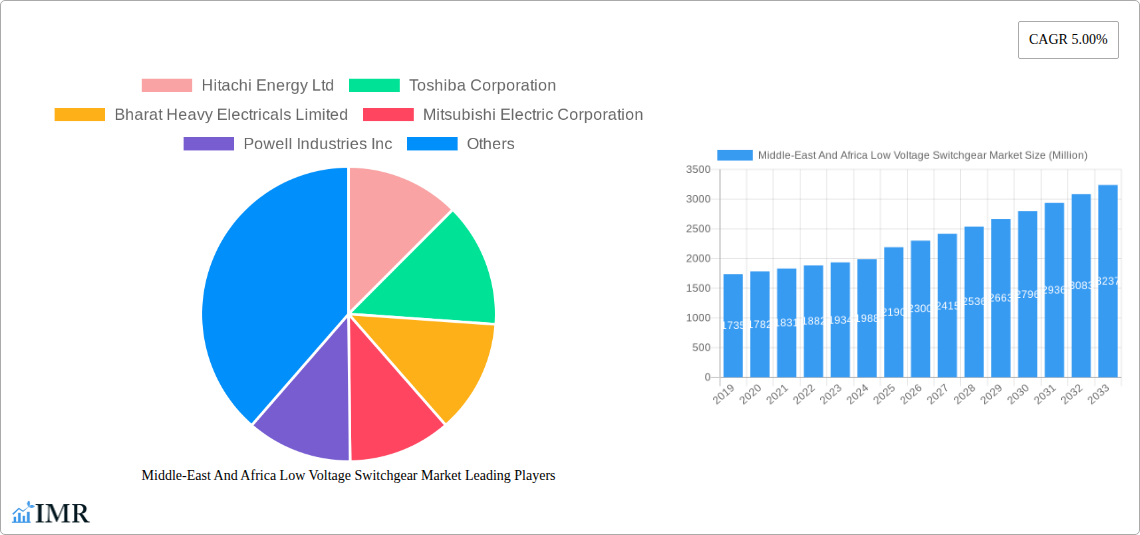

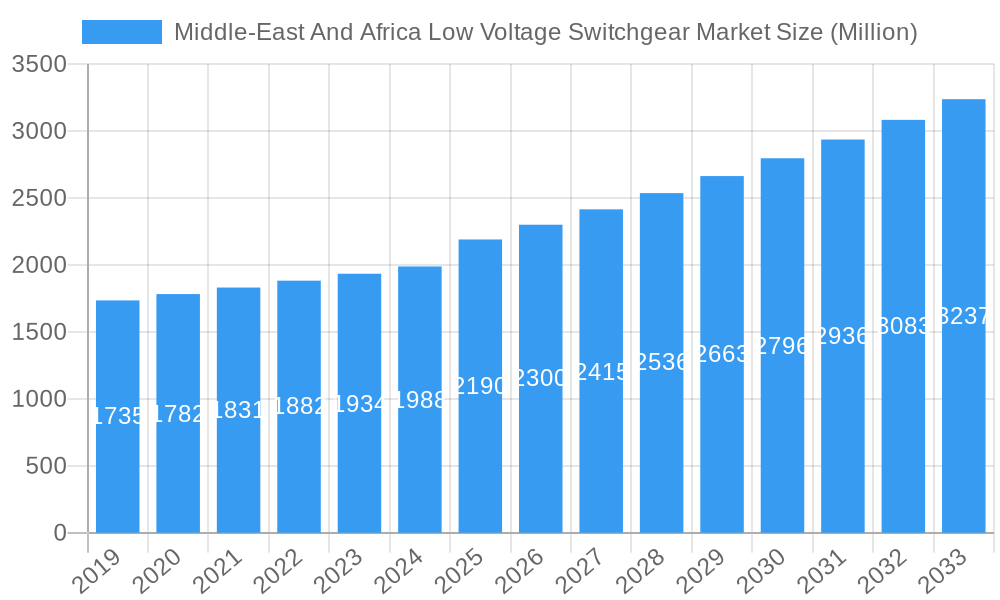

The Middle-East and Africa (MEA) Low Voltage Switchgear Market is poised for significant expansion, projected to reach approximately USD 2.19 billion in 2025 with a robust Compound Annual Growth Rate (CAGR) of 5.00% through 2033. This growth is primarily fueled by escalating investments in infrastructure development across the region, particularly in expanding and modernizing power distribution networks. The increasing demand for reliable and efficient electrical power for industrial, commercial, and residential applications, coupled with a growing focus on grid modernization and the integration of renewable energy sources, are key market drivers. Furthermore, stringent safety regulations and the need for enhanced protection against electrical faults are compelling end-users to adopt advanced low voltage switchgear solutions. The market is segmented by application, with Substations and Distribution networks representing substantial segments due to their critical role in power delivery. Utilities are also a significant end-user, as they continuously invest in upgrading their existing infrastructure.

Middle-East And Africa Low Voltage Switchgear Market Market Size (In Billion)

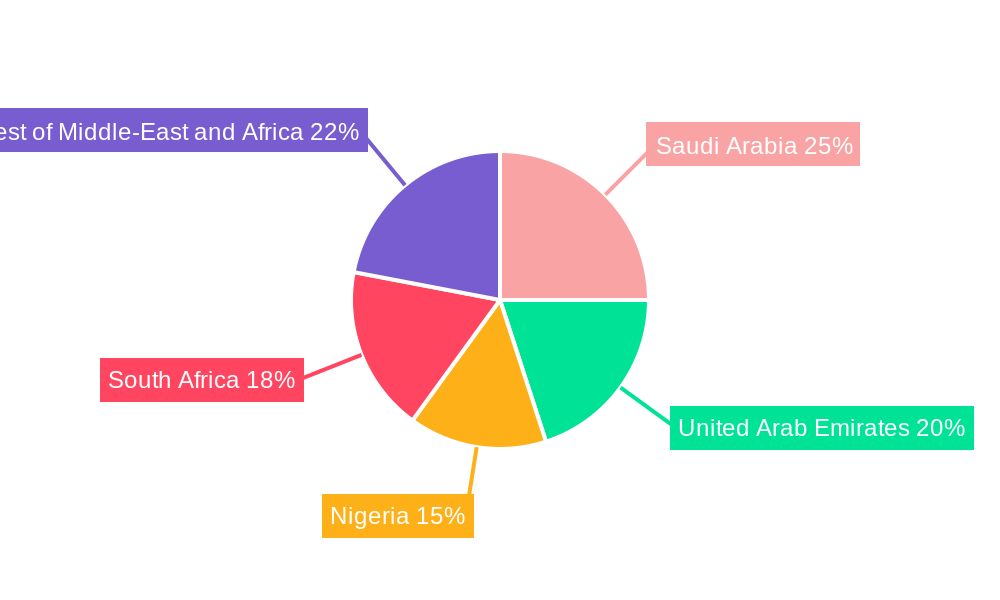

The MEA region presents a dynamic landscape for low voltage switchgear, with diverse growth opportunities across its sub-regions. Saudi Arabia and the United Arab Emirates are expected to lead market growth, driven by ambitious national development plans, smart city initiatives, and substantial investments in the energy sector. Nigeria and South Africa, with their growing populations and industrial bases, also represent key markets. The trend towards smart grid technologies and the increasing adoption of intelligent switchgear solutions that offer remote monitoring, control, and diagnostics are shaping the market's trajectory. While the market is driven by infrastructure needs, potential restraints include the high initial cost of advanced switchgear and the availability of skilled labor for installation and maintenance. However, the long-term benefits of increased efficiency, reliability, and safety are expected to outweigh these challenges, ensuring sustained market growth.

Middle-East And Africa Low Voltage Switchgear Market Company Market Share

This in-depth report provides a detailed analysis of the Middle-East and Africa (MEA) Low Voltage Switchgear market, covering historical trends, current dynamics, and future projections from 2019 to 2033. With a base year of 2025, the study offers unparalleled insights into market size, growth drivers, key players, and emerging opportunities, specifically targeting industry professionals seeking a strategic advantage in this rapidly evolving sector. Explore critical segments such as Application (Substation, Distribution, Utility), Installation (Outdoor, Indoor), and Voltage Rating (Less Than 250 V, 250 V - 750 V, 750 V - 1000 V), and regional markets including Saudi Arabia, United Arab Emirates, Nigeria, South Africa, and the Rest of MEA. This report is your definitive guide to understanding and capitalizing on the MEA Low Voltage Switchgear market.

Middle-East And Africa Low Voltage Switchgear Market Dynamics & Structure

The Middle-East and Africa Low Voltage Switchgear market is characterized by a moderate level of concentration, with leading global players holding significant market shares. Technological innovation remains a key driver, fueled by increasing demand for smart grid solutions, energy efficiency, and automation in power distribution. Regulatory frameworks are gradually evolving, with governments in the region prioritizing infrastructure development and the adoption of international safety and performance standards. Competitive product substitutes, while present, are largely overshadowed by the superior reliability and advanced features offered by established low voltage switchgear manufacturers. End-user demographics are diverse, ranging from large-scale utility providers and industrial facilities to commercial enterprises and residential projects, all demanding robust and safe electrical power distribution solutions. Mergers and acquisitions (M&A) trends indicate a strategic consolidation, with companies aiming to expand their geographical reach and product portfolios.

- Market Concentration: Leading manufacturers account for approximately 65% of the market share.

- Technological Innovation Drivers: Growing investments in renewable energy integration and smart city initiatives.

- Regulatory Frameworks: Increasing adoption of IEC standards and local safety mandates.

- Competitive Product Substitutes: Limited impact due to the established trust and performance of key players.

- End-User Demographics: Diversified across utility, industrial, commercial, and residential sectors.

- M&A Trends: Focus on expanding market presence and acquiring innovative technologies, with an estimated 5-7 significant M&A activities annually.

Middle-East And Africa Low Voltage Switchgear Market Growth Trends & Insights

The Middle-East and Africa Low Voltage Switchgear market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% between 2025 and 2033. This significant expansion is driven by a confluence of factors, including escalating demand for electricity across rapidly urbanizing populations, substantial government investments in infrastructure development, and the growing imperative for modernizing aging electrical grids. The increasing adoption of renewable energy sources, such as solar and wind power, necessitates sophisticated low voltage switchgear for seamless integration and efficient power management. Furthermore, the drive towards industrialization and economic diversification in several MEA nations is creating substantial demand for reliable power distribution systems in manufacturing plants, commercial complexes, and other industrial facilities. Consumer behavior is shifting towards safer, more energy-efficient, and digitally connected electrical infrastructure, pushing manufacturers to innovate and offer intelligent switchgear solutions with enhanced monitoring and control capabilities.

The market penetration of advanced low voltage switchgear is steadily increasing as awareness of its benefits, including improved safety, reduced downtime, and operational efficiency, grows among end-users. Technological disruptions, such as the integration of IoT sensors and AI-powered diagnostics into switchgear, are transforming traditional electrical systems into smarter, more responsive networks. This evolution is crucial for addressing the challenges of grid stability and reliability in a region experiencing rapid economic and demographic shifts. The overall market size is expected to grow from an estimated USD 4,500 million in 2025 to over USD 7,500 million by 2033, reflecting sustained demand and the successful implementation of new technologies. Insights reveal a strong preference for modular and compact switchgear solutions that optimize space utilization and simplify installation, particularly in densely populated urban areas. The increasing focus on sustainability and reducing carbon footprints further propels the demand for energy-efficient switchgear that minimizes power loss during distribution.

Dominant Regions, Countries, or Segments in Middle-East And Africa Low Voltage Switchgear Market

The Middle-East and Africa Low Voltage Switchgear market showcases dynamic growth across various segments, with Saudi Arabia and the United Arab Emirates emerging as dominant geographical regions. These nations are leading the charge due to their substantial investments in mega-projects, ambitious infrastructure development plans, and a strong focus on diversifying their economies beyond oil and gas. The utility application segment, particularly for substation and distribution networks, represents the largest and most influential segment, driven by the ongoing expansion and modernization of power grids to meet escalating energy demands.

Dominant Geographical Hubs:

- Saudi Arabia: Spearheading the market with massive infrastructure projects aligned with Vision 2030, including new cities, industrial zones, and renewable energy initiatives. The kingdom's demand for robust substation and distribution switchgear is immense, driving significant market share. Its focus on localized manufacturing and technology transfer further bolsters its position.

- United Arab Emirates: A key player driven by continuous urban development, smart city initiatives, and a burgeoning tourism and hospitality sector. The UAE's investment in upgrading its power infrastructure and adopting advanced technologies makes it a significant consumer of high-performance low voltage switchgear. The expansion of Vertiv's factory in Ras Al Khaimah exemplifies the region's commitment to local production and innovation in this sector.

Dominant Application Segments:

- Substation: This segment is critical, as substations form the backbone of the power distribution network. The ongoing need to build new substations and upgrade existing ones to handle increased power loads and integrate renewable energy sources makes this the largest application.

- Distribution: Closely following substations, the distribution segment focuses on the networks that deliver power to end-users. The expansion of residential areas, commercial establishments, and industrial zones directly fuels the demand for distribution switchgear.

Dominant Installation & Voltage Rating Segments:

- Indoor Installation: This segment holds a dominant position due to the majority of switchgear being installed within protected environments in buildings, substations, and control rooms, ensuring safety and longevity.

- 250 V - 750 V: This voltage range is prevalent for a wide array of industrial, commercial, and residential applications, making it a consistently high-demand segment within the low voltage switchgear market.

The combined strength of these dominant regions and segments creates a powerful engine for the MEA Low Voltage Switchgear market's growth. Government policies supporting local manufacturing, foreign direct investment in infrastructure, and the increasing adoption of smart grid technologies further solidify the dominance of these areas and applications. The strategic importance of reliable and efficient power distribution in these regions ensures sustained demand for advanced low voltage switchgear solutions.

Middle-East And Africa Low Voltage Switchgear Market Product Landscape

The product landscape for Middle-East and Africa Low Voltage Switchgear is characterized by a commitment to enhanced safety, reliability, and energy efficiency. Manufacturers are focusing on developing advanced circuit breakers, fuse switch units, and distribution boards equipped with sophisticated protection mechanisms and intelligent monitoring capabilities. Innovations include the integration of digital technologies such as IoT sensors for remote diagnostics and predictive maintenance, enabling proactive identification of potential faults. The emphasis is on modular designs that offer flexibility in installation and scalability, catering to diverse project requirements. Performance metrics are consistently being pushed, with an aim to reduce power losses, increase operational lifespan, and ensure compliance with stringent international safety standards. Unique selling propositions often revolve around enhanced arc fault detection, compact footprints for space optimization, and user-friendly interfaces for simplified operation and maintenance.

Key Drivers, Barriers & Challenges in Middle-East And Africa Low Voltage Switchgear Market

Key Drivers:

The Middle-East and Africa Low Voltage Switchgear market is propelled by significant growth drivers. Foremost among these is the substantial investment in infrastructure development across the region, including the construction of new cities, industrial parks, and transportation networks, all demanding robust electrical distribution systems. The increasing integration of renewable energy sources necessitates advanced switchgear for grid stability and efficient power management. Furthermore, a growing awareness of energy efficiency and the need to modernize aging electrical infrastructure are driving demand for reliable and technologically advanced solutions. Government initiatives promoting industrialization and economic diversification also contribute significantly to the market's expansion.

- Infrastructure Development: Major government-backed projects and private sector investments.

- Renewable Energy Integration: Growing solar and wind power projects requiring grid modernization.

- Energy Efficiency Mandates: Increasing focus on reducing energy consumption and power loss.

- Industrial Growth: Expansion of manufacturing and processing industries.

Barriers & Challenges:

Despite robust growth, the market faces several challenges. Fluctuations in raw material prices, particularly for copper and steel, can impact manufacturing costs and profit margins. The presence of counterfeit or lower-quality products in some localized markets poses a threat to established manufacturers and can undermine safety standards. Skilled labor shortages in certain regions can hinder the efficient installation and maintenance of complex switchgear systems. Additionally, navigating diverse and sometimes evolving regulatory landscapes across different MEA countries can present compliance hurdles for international players. Supply chain disruptions, though less pronounced now, remain a potential risk, affecting timely delivery.

- Price Volatility: Fluctuations in commodity prices impacting manufacturing costs.

- Counterfeit Products: Presence of low-quality alternatives in some markets.

- Skilled Labor Shortage: Difficulty in finding qualified technicians for installation and maintenance.

- Regulatory Diversity: Navigating complex and varied regulations across countries.

- Supply Chain Vulnerabilities: Potential for disruptions impacting logistics.

Emerging Opportunities in Middle-East And Africa Low Voltage Switchgear Market

Emerging opportunities in the Middle-East and Africa Low Voltage Switchgear market are abundant, driven by digitalization and the growing demand for smart infrastructure. The increasing adoption of the Internet of Things (IoT) presents a significant opportunity for manufacturers to develop and deploy intelligent switchgear with advanced monitoring, control, and predictive maintenance capabilities. The expansion of smart grids and microgrids, particularly in off-grid or remote areas, offers untapped market potential. Furthermore, the growing focus on sustainable development and energy conservation is creating demand for highly energy-efficient switchgear solutions that minimize power loss. The development of localized manufacturing hubs and the adoption of industry 4.0 principles in production processes also present avenues for growth and competitive advantage.

Growth Accelerators in the Middle-East And Africa Low Voltage Switchgear Market Industry

Catalysts driving long-term growth in the MEA Low Voltage Switchgear industry are multifaceted. Technological breakthroughs, such as advancements in digital protection relays, smart metering integration, and enhanced cybersecurity for electrical systems, will continue to push the boundaries of innovation. Strategic partnerships between global manufacturers and local entities are crucial for expanding market reach, understanding regional needs, and facilitating technology transfer. Market expansion strategies focused on underserved regions within Africa, coupled with targeted product development for specific climatic conditions and application requirements, will unlock new revenue streams. The increasing global emphasis on decarbonization and the transition to cleaner energy will also serve as a significant accelerator, driving demand for switchgear that can efficiently manage distributed energy resources and grid modernization efforts.

Key Players Shaping the Middle-East And Africa Low Voltage Switchgear Market Market

- Hitachi Energy Ltd

- Toshiba Corporation

- Bharat Heavy Electricals Limited

- Mitsubishi Electric Corporation

- Powell Industries Inc

- Schneider Electric SE

- Eaton Corporation PLC

- Hyosung Heavy Industries Corporation

- Siemens Energy AG

- General Electric Company

Notable Milestones in Middle-East And Africa Low Voltage Switchgear Market Sector

- January 2023: Vertiv announced the expansion of its factory in Ras Al Khaimah, United Arab Emirates, to support its low voltage switchgear, integrated modular solutions (IMS), and busway businesses, signaling an increased regional production capacity and commitment.

- October 2022: ABB Ltd. supplied and installed low-voltage switchgear at the largest potato processing factory in Egypt, demonstrating its capability to deliver critical power management solutions for industrial applications.

- September 2022: Civil & Electrical Projects Contracting Company (CEPCO), Saudi Arabia, announced signing a contract agreement with Saudi Electricity Company (SEC) for the complete EPC of a substation, including various types of switchgear, highlighting significant project wins and the importance of switchgear in major infrastructure developments.

In-Depth Middle-East And Africa Low Voltage Switchgear Market Market Outlook

The future outlook for the Middle-East and Africa Low Voltage Switchgear market is exceptionally promising, fueled by sustained economic growth, aggressive infrastructure development, and the transformative adoption of digital technologies. Market growth accelerators will continue to include the rapid expansion of renewable energy portfolios, demanding sophisticated grid integration solutions, and the ongoing urbanization requiring advanced power distribution networks. Strategic opportunities lie in tapping into the vast, yet relatively underdeveloped, African markets with tailored, cost-effective, and reliable switchgear solutions. Manufacturers who invest in smart grid technologies, enhanced cybersecurity, and localized production will be well-positioned to capitalize on the region's evolving energy landscape, ensuring a robust and sustainable market trajectory.

Middle-East And Africa Low Voltage Switchgear Market Segmentation

-

1. Application

- 1.1. Substation

- 1.2. Distribution

- 1.3. Utility

-

2. Installation

- 2.1. Outdoor

- 2.2. Indoor

-

3. Voltage Rating

- 3.1. Less Than 250 V

- 3.2. 250 V - 750 V

- 3.3. 750 V - 1000 V

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. Nigeria

- 4.4. South Africa

- 4.5. Rest of Middle-East and Africa

Middle-East And Africa Low Voltage Switchgear Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Nigeria

- 4. South Africa

- 5. Rest of Middle East and Africa

Middle-East And Africa Low Voltage Switchgear Market Regional Market Share

Geographic Coverage of Middle-East And Africa Low Voltage Switchgear Market

Middle-East And Africa Low Voltage Switchgear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Infrastructure Projects in the Region

- 3.3. Market Restrains

- 3.3.1. 4.; High Operations and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Upcoming Power Transmission Projects Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East And Africa Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Substation

- 5.1.2. Distribution

- 5.1.3. Utility

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Outdoor

- 5.2.2. Indoor

- 5.3. Market Analysis, Insights and Forecast - by Voltage Rating

- 5.3.1. Less Than 250 V

- 5.3.2. 250 V - 750 V

- 5.3.3. 750 V - 1000 V

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Nigeria

- 5.4.4. South Africa

- 5.4.5. Rest of Middle-East and Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. United Arab Emirates

- 5.5.3. Nigeria

- 5.5.4. South Africa

- 5.5.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Saudi Arabia Middle-East And Africa Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Substation

- 6.1.2. Distribution

- 6.1.3. Utility

- 6.2. Market Analysis, Insights and Forecast - by Installation

- 6.2.1. Outdoor

- 6.2.2. Indoor

- 6.3. Market Analysis, Insights and Forecast - by Voltage Rating

- 6.3.1. Less Than 250 V

- 6.3.2. 250 V - 750 V

- 6.3.3. 750 V - 1000 V

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. United Arab Emirates

- 6.4.3. Nigeria

- 6.4.4. South Africa

- 6.4.5. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. United Arab Emirates Middle-East And Africa Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Substation

- 7.1.2. Distribution

- 7.1.3. Utility

- 7.2. Market Analysis, Insights and Forecast - by Installation

- 7.2.1. Outdoor

- 7.2.2. Indoor

- 7.3. Market Analysis, Insights and Forecast - by Voltage Rating

- 7.3.1. Less Than 250 V

- 7.3.2. 250 V - 750 V

- 7.3.3. 750 V - 1000 V

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. United Arab Emirates

- 7.4.3. Nigeria

- 7.4.4. South Africa

- 7.4.5. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Nigeria Middle-East And Africa Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Substation

- 8.1.2. Distribution

- 8.1.3. Utility

- 8.2. Market Analysis, Insights and Forecast - by Installation

- 8.2.1. Outdoor

- 8.2.2. Indoor

- 8.3. Market Analysis, Insights and Forecast - by Voltage Rating

- 8.3.1. Less Than 250 V

- 8.3.2. 250 V - 750 V

- 8.3.3. 750 V - 1000 V

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. United Arab Emirates

- 8.4.3. Nigeria

- 8.4.4. South Africa

- 8.4.5. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South Africa Middle-East And Africa Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Substation

- 9.1.2. Distribution

- 9.1.3. Utility

- 9.2. Market Analysis, Insights and Forecast - by Installation

- 9.2.1. Outdoor

- 9.2.2. Indoor

- 9.3. Market Analysis, Insights and Forecast - by Voltage Rating

- 9.3.1. Less Than 250 V

- 9.3.2. 250 V - 750 V

- 9.3.3. 750 V - 1000 V

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. United Arab Emirates

- 9.4.3. Nigeria

- 9.4.4. South Africa

- 9.4.5. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Rest of Middle East and Africa Middle-East And Africa Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Substation

- 10.1.2. Distribution

- 10.1.3. Utility

- 10.2. Market Analysis, Insights and Forecast - by Installation

- 10.2.1. Outdoor

- 10.2.2. Indoor

- 10.3. Market Analysis, Insights and Forecast - by Voltage Rating

- 10.3.1. Less Than 250 V

- 10.3.2. 250 V - 750 V

- 10.3.3. 750 V - 1000 V

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Saudi Arabia

- 10.4.2. United Arab Emirates

- 10.4.3. Nigeria

- 10.4.4. South Africa

- 10.4.5. Rest of Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hitachi Energy Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Toshiba Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bharat Heavy Electricals Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mitsubishi Electric Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Powell Industries Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Schneider Electric SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Eaton Corporation PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hyosung Heavy Industries Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Siemens Energy AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 General Electric Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Hitachi Energy Ltd

List of Figures

- Figure 1: Middle-East And Africa Low Voltage Switchgear Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle-East And Africa Low Voltage Switchgear Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 3: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Installation 2020 & 2033

- Table 4: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Installation 2020 & 2033

- Table 5: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Rating 2020 & 2033

- Table 6: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Voltage Rating 2020 & 2033

- Table 7: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 9: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 11: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 13: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Installation 2020 & 2033

- Table 14: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Installation 2020 & 2033

- Table 15: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Rating 2020 & 2033

- Table 16: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Voltage Rating 2020 & 2033

- Table 17: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 19: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 21: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 23: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Installation 2020 & 2033

- Table 24: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Installation 2020 & 2033

- Table 25: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Rating 2020 & 2033

- Table 26: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Voltage Rating 2020 & 2033

- Table 27: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 29: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 31: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 33: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Installation 2020 & 2033

- Table 34: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Installation 2020 & 2033

- Table 35: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Rating 2020 & 2033

- Table 36: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Voltage Rating 2020 & 2033

- Table 37: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 39: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 41: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Application 2020 & 2033

- Table 42: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 43: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Installation 2020 & 2033

- Table 44: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Installation 2020 & 2033

- Table 45: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Rating 2020 & 2033

- Table 46: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Voltage Rating 2020 & 2033

- Table 47: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 48: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 49: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 51: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Application 2020 & 2033

- Table 52: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 53: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Installation 2020 & 2033

- Table 54: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Installation 2020 & 2033

- Table 55: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Rating 2020 & 2033

- Table 56: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Voltage Rating 2020 & 2033

- Table 57: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 58: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 59: Middle-East And Africa Low Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Middle-East And Africa Low Voltage Switchgear Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East And Africa Low Voltage Switchgear Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Middle-East And Africa Low Voltage Switchgear Market?

Key companies in the market include Hitachi Energy Ltd, Toshiba Corporation, Bharat Heavy Electricals Limited, Mitsubishi Electric Corporation, Powell Industries Inc, Schneider Electric SE, Eaton Corporation PLC, Hyosung Heavy Industries Corporation, Siemens Energy AG, General Electric Company.

3. What are the main segments of the Middle-East And Africa Low Voltage Switchgear Market?

The market segments include Application, Installation, Voltage Rating, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.19 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Infrastructure Projects in the Region.

6. What are the notable trends driving market growth?

Upcoming Power Transmission Projects Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; High Operations and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

January 2023: Vertiv announced the expansion of its factory in Ras Al Khaimah, United Arab Emirates, to support its low voltage switchgear, integrated modular solutions (IMS), and busway businesses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East And Africa Low Voltage Switchgear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East And Africa Low Voltage Switchgear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East And Africa Low Voltage Switchgear Market?

To stay informed about further developments, trends, and reports in the Middle-East And Africa Low Voltage Switchgear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence