Key Insights

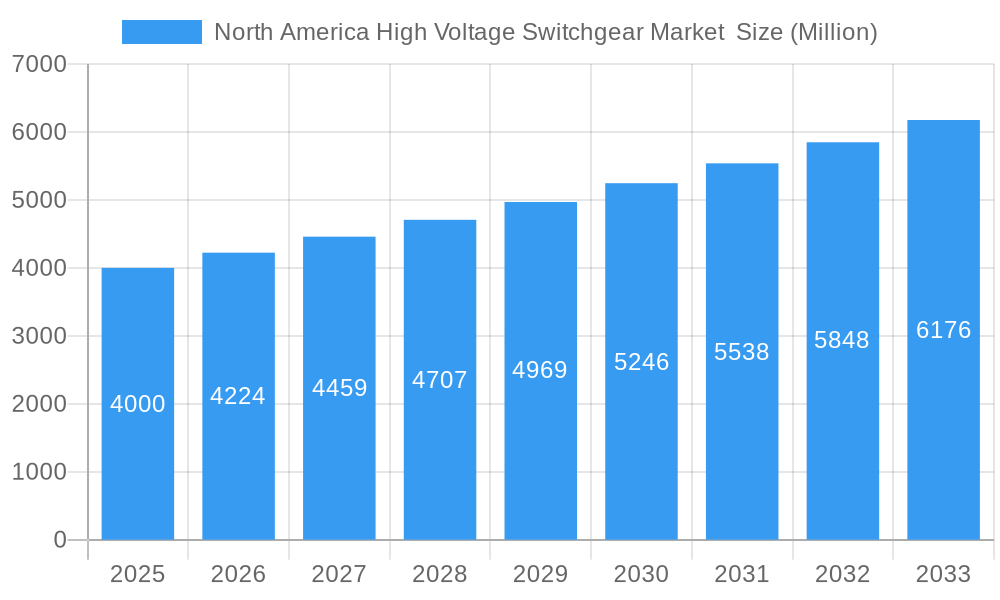

The North American High Voltage Switchgear Market is poised for significant growth, with a current market size estimated at USD 4,000 million. This robust expansion is driven by a projected Compound Annual Growth Rate (CAGR) of 5.60% over the forecast period of 2025-2033. The primary drivers behind this upward trajectory include the continuous need for grid modernization and expansion to accommodate rising energy demands, coupled with substantial investments in renewable energy infrastructure, particularly solar and wind power projects. The integration of smart grid technologies, including advanced automation and digital monitoring systems, is also a key catalyst, enhancing grid reliability, efficiency, and security. Furthermore, stringent government regulations and a focus on replacing aging electrical infrastructure are compelling utilities and industrial players to upgrade their high voltage switchgear. The market is segmented by type, with Air-insulated switchgear and Gas-insulated switchgear dominating the landscape due to their proven reliability and widespread application in power transmission and distribution networks.

North America High Voltage Switchgear Market Market Size (In Billion)

The market's growth is further bolstered by ongoing technological advancements that offer improved performance, reduced environmental impact, and enhanced safety features. Innovations in SF6-free alternatives and digitalization are expected to shape the future of high voltage switchgear. However, the market also faces certain restraints, including the high initial cost of advanced switchgear systems and the complex regulatory framework surrounding their implementation. Despite these challenges, the overwhelming demand for a stable and efficient power supply, coupled with supportive government initiatives for energy transition, paints a positive outlook for the North American High Voltage Switchgear Market. Key players like Siemens Energy AG, ABB Ltd, and General Electric Company are actively investing in research and development to introduce cutting-edge solutions and maintain their competitive edge in this dynamic market. The United States, Canada, and Mexico are expected to witness substantial growth, with ongoing infrastructure development and a strong emphasis on grid resilience.

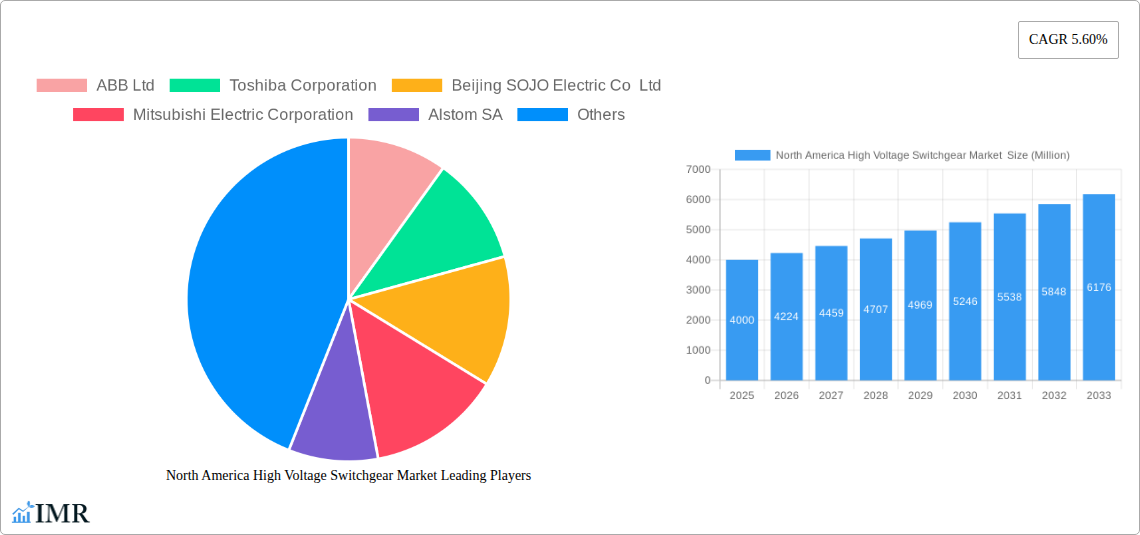

North America High Voltage Switchgear Market Company Market Share

North America High Voltage Switchgear Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a strategic analysis of the North America High Voltage Switchgear Market, covering critical segments such as Air-insulated, Gas-insulated, and Other Types of switchgear across the United States, Canada, and Mexico. With a study period spanning from 2019 to 2033, and a base year of 2025, this research offers actionable insights for industry stakeholders, investors, and decision-makers. The report meticulously examines market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and the competitive strategies of leading players. Values are presented in Million units for clarity and comparability.

North America High Voltage Switchgear Market Market Dynamics & Structure

The North America High Voltage Switchgear Market is characterized by a moderate level of market concentration, with a few key players dominating the landscape. Technological innovation serves as a primary driver, propelled by the increasing demand for advanced grid modernization solutions, smart grid integration, and the adoption of renewable energy sources that necessitate sophisticated switchgear for efficient power management. Regulatory frameworks, particularly concerning grid reliability, safety standards, and environmental compliance (e.g., SF6 gas phase-out initiatives), significantly influence market strategies and product development. Competitive product substitutes, while present in lower voltage segments, are less of a direct threat in the high voltage domain due to stringent performance and safety requirements. End-user demographics are diverse, ranging from utility companies and independent power producers to industrial facilities and data centers, each with unique demands for switchgear performance and reliability. Merger and acquisition (M&A) trends are a constant feature, as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, the historical period (2019-2024) witnessed several strategic acquisitions aimed at consolidating market share and acquiring specialized technologies.

- Market Concentration: Moderate, with dominant players holding significant market share.

- Technological Innovation Drivers: Grid modernization, smart grid adoption, renewable energy integration, enhanced grid resilience.

- Regulatory Frameworks: Stringent safety standards, environmental regulations (SF6 alternatives), grid reliability mandates.

- Competitive Product Substitutes: Limited in the high voltage segment due to performance and safety requirements.

- End-User Demographics: Utilities, IPPs, industrial sectors, data centers, infrastructure projects.

- M&A Trends: Driven by market consolidation, technology acquisition, and geographical expansion.

North America High Voltage Switchgear Market Growth Trends & Insights

The North America High Voltage Switchgear Market is poised for robust growth, fueled by a confluence of factors that are reshaping the energy landscape. The escalating integration of renewable energy sources, including solar and wind power, is a significant catalyst, demanding sophisticated switchgear solutions for efficient grid connection and stable power distribution. The ongoing push for grid modernization, aimed at enhancing reliability, resilience, and the ability to manage bidirectional power flow, further propels market expansion. Investments in upgrading aging infrastructure and building new transmission lines, especially to connect remote renewable energy generation sites, are critical contributors to market size evolution. The adoption of advanced technologies such as digital substations, intelligent switchgear with enhanced monitoring and control capabilities, and the increasing preference for gas-insulated switchgear (GIS) due to its compact design and environmental benefits, are shaping consumer behavior shifts. The market is experiencing steady adoption rates for these advanced solutions, driven by their superior performance and reduced environmental impact. Technological disruptions, particularly in areas like SF6-free switchgear and advanced sensor technologies for predictive maintenance, are expected to accelerate market penetration. The overall market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period (2025-2033). This growth is underpinned by a strategic shift towards a more decentralized and intelligent power grid, where high voltage switchgear plays a pivotal role in ensuring seamless and secure energy transmission.

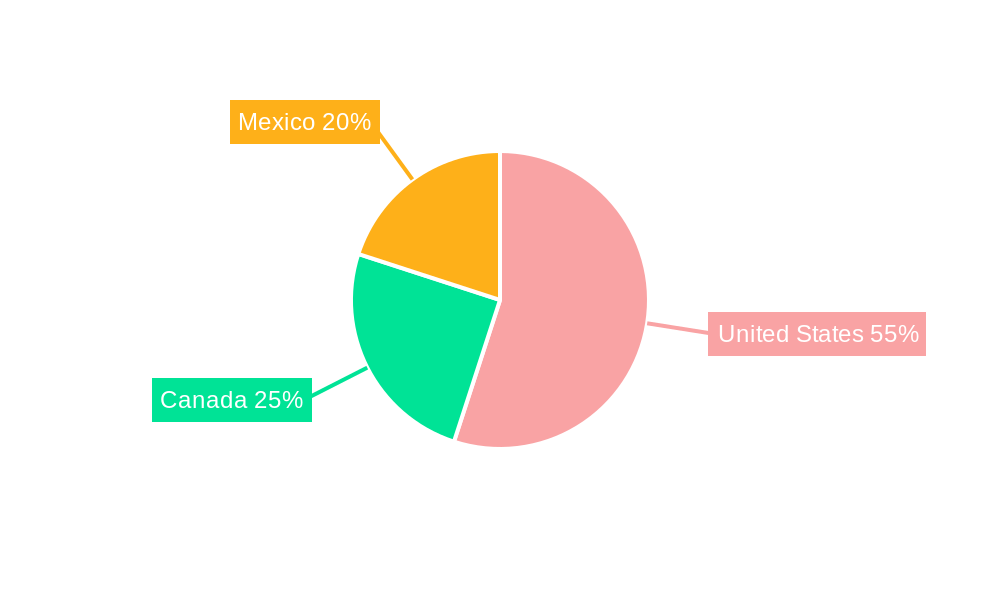

Dominant Regions, Countries, or Segments in North America High Voltage Switchgear Market

The United States unequivocally dominates the North America High Voltage Switchgear Market, driven by a combination of factors including its vast geographical expanse, significant electricity consumption, and substantial investments in both traditional and renewable energy infrastructure. The country's extensive electricity grid, coupled with ongoing modernization efforts and the rapid expansion of renewable energy projects, creates a continuous demand for high voltage switchgear. Economic policies that incentivize renewable energy development, such as tax credits and clean energy mandates, further bolster this demand. The presence of major utility companies and industrial consumers with substantial infrastructure requirements solidifies the United States' leading position.

United States: Holds the largest market share due to extensive grid infrastructure, high energy consumption, and significant renewable energy investments.

- Key Drivers: Grid modernization initiatives, renewable energy expansion (solar, wind), infrastructure upgrades, stringent reliability standards, government incentives.

- Market Share: Estimated to account for over 75% of the North American market.

- Growth Potential: High, driven by ongoing grid modernization and the transition to a cleaner energy mix.

Canada: Represents a significant market, largely driven by its vast hydropower resources and a growing interest in expanding its renewable energy export capabilities. Investments in new transmission lines to connect remote generation facilities and support inter-provincial power trading contribute to market growth. Economic policies supporting clean energy and carbon reduction targets also play a crucial role.

- Key Drivers: Hydropower development, renewable energy export projects, inter-provincial grid connections, climate change mitigation policies.

- Market Share: Approximately 15% of the North American market.

- Growth Potential: Moderate to high, influenced by large-scale infrastructure projects and energy transition goals.

Mexico: While smaller in market size compared to the US and Canada, Mexico presents a growing opportunity, particularly with its efforts to modernize its energy sector and integrate more renewable energy sources. Investments in grid infrastructure to support industrial growth and meet increasing electricity demand are key drivers. Regulatory reforms aimed at attracting private investment in the energy sector are also contributing to market expansion.

- Key Drivers: Energy sector modernization, increasing electricity demand, industrial growth, renewable energy integration efforts.

- Market Share: Approximately 10% of the North American market.

- Growth Potential: High, driven by ongoing sector reforms and infrastructure development.

Among the product segments, Gas-Insulated Switchgear (GIS) is emerging as a dominant segment due to its compact size, enhanced safety features, and superior insulation properties, making it ideal for space-constrained urban environments and critical substations. Air-insulated switchgear remains a significant segment, particularly for substations with ample space and cost-sensitive applications.

North America High Voltage Switchgear Market Product Landscape

The product landscape of the North America High Voltage Switchgear Market is characterized by continuous innovation focused on enhancing reliability, safety, and efficiency. Key product innovations include the development of SF6-free switchgear, addressing environmental concerns and regulatory pressures. Advanced digital substation technologies, incorporating intelligent electronic devices (IEDs), sensor networks, and communication protocols, are enabling real-time monitoring, remote diagnostics, and predictive maintenance capabilities. Gas-Insulated Switchgear (GIS) variants are gaining prominence due to their compact footprint, fire resistance, and suitability for harsh environmental conditions. Performance metrics such as interruption capacity, insulation levels, and operational lifespan are continuously being improved. Unique selling propositions revolve around enhanced grid stability, reduced operational costs, and adherence to stringent environmental regulations, making these advanced switchgear solutions increasingly attractive to utilities and industrial clients.

Key Drivers, Barriers & Challenges in North America High Voltage Switchgear Market

Key Drivers: The North America High Voltage Switchgear Market is propelled by several key forces. The urgent need for grid modernization and upgrades to accommodate the influx of renewable energy and improve resilience against extreme weather events is paramount. Significant investments in renewable energy infrastructure, including new transmission lines and substations to connect solar and wind farms, directly fuel demand. The drive towards digitalization and smart grid technologies, offering enhanced monitoring, control, and automation, is a major growth accelerator. Furthermore, the increasing emphasis on grid reliability and security by utilities and governments mandates the deployment of advanced switchgear solutions.

Barriers & Challenges: Despite robust growth, the market faces several challenges. High initial capital investment for advanced switchgear and substation projects can be a significant barrier for some utilities. Complex regulatory environments and lengthy approval processes for new infrastructure projects can delay deployment. Supply chain disruptions, as witnessed in recent years, can impact the availability of critical components and lead to project cost escalations. The scarcity of skilled labor for installation, maintenance, and operation of sophisticated switchgear systems also poses a challenge. Moreover, the phase-out of SF6 gas presents a technical challenge, requiring significant R&D for effective and cost-competitive alternatives.

Emerging Opportunities in North America High Voltage Switchgear Market

Emerging opportunities within the North America High Voltage Switchgear Market are abundant, driven by evolving energy needs and technological advancements. The expansion of the electric vehicle (EV) charging infrastructure necessitates upgrades to distribution networks and substations, creating demand for specialized high voltage switchgear. The burgeoning data center industry, with its substantial and growing power requirements, presents another significant opportunity for reliable and high-capacity switchgear solutions. Furthermore, the development of microgrids and distributed energy resources (DERs) requires sophisticated switchgear for seamless integration and islanding capabilities. The increasing focus on asset management and predictive maintenance opens avenues for smart switchgear with advanced diagnostic and communication features, offering significant operational cost savings for end-users.

Growth Accelerators in the North America High Voltage Switchgear Market Industry

Several growth accelerators are poised to significantly boost the North America High Voltage Switchgear Market in the long term. Technological breakthroughs in SF6-free insulation technologies and the development of more efficient and cost-effective digital switchgear solutions will lower barriers to adoption. Strategic partnerships and collaborations between switchgear manufacturers, utility companies, and technology providers are fostering innovation and accelerating the deployment of advanced solutions. Market expansion strategies, including the development of modular and scalable switchgear systems, cater to diverse project needs. The ongoing decarbonization efforts and energy transition mandates across North America will continue to drive investments in grid modernization and renewable energy integration, serving as a consistent growth engine.

Key Players Shaping the North America High Voltage Switchgear Market Market

- ABB Ltd

- Toshiba Corporation

- Beijing SOJO Electric Co Ltd

- Mitsubishi Electric Corporation

- Alstom SA

- Schneider Electric SE

- REV Engineering Ltd

- Siemens Energy AG

- Fuji Electric Co Ltd

- General Electric Company

Notable Milestones in North America High Voltage Switchgear Market Sector

- May 2023: A power utility in New Hampshire, United States, proposed the Twin State Clean Energy Link, a USD2 billion, 211-mile transmission line project designed to transport renewable energy, including hydropower from Canada and wind and solar power from the US, to New England. This project highlights the growing need for robust high voltage switchgear to manage complex energy flows from diverse renewable sources.

- May 2023: Pattern Energy selected Hitachi Energy to supply its high-voltage direct current (HVDC) and other advanced technologies for the SunZia Transmission Project. This massive undertaking will connect the 3,500-megawatt (MW) SunZia Wind project in New Mexico to the power grid in Arizona and Southern California, underscoring the critical role of advanced switchgear in enabling large-scale renewable energy transmission across significant distances.

In-Depth North America High Voltage Switchgear Market Market Outlook

The North America High Voltage Switchgear Market exhibits a promising outlook, driven by sustained investment in grid modernization and the accelerating transition to renewable energy. Growth accelerators such as technological advancements in SF6-free switchgear and the widespread adoption of digital substations will continue to shape the market. Strategic partnerships and expanding market footprints by key players will further consolidate growth. The ongoing decarbonization efforts and the increasing demand for reliable and resilient power infrastructure across the United States, Canada, and Mexico present significant strategic opportunities for market participants. The market is expected to witness continued expansion, characterized by innovation and a growing emphasis on sustainable and intelligent energy solutions.

North America High Voltage Switchgear Market Segmentation

-

1. Type

- 1.1. Air-insulated

- 1.2. Gas-insulated

- 1.3. Other Types

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

North America High Voltage Switchgear Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America High Voltage Switchgear Market Regional Market Share

Geographic Coverage of North America High Voltage Switchgear Market

North America High Voltage Switchgear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Expansion of Power Transmission and Distribution (T&D) Infrastructure4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Self-generated Renewable Power in the Residential and Commercial Sectors

- 3.4. Market Trends

- 3.4.1. Government Initiatives Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America High Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Air-insulated

- 5.1.2. Gas-insulated

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America High Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Air-insulated

- 6.1.2. Gas-insulated

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America High Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Air-insulated

- 7.1.2. Gas-insulated

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America High Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Air-insulated

- 8.1.2. Gas-insulated

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 ABB Ltd

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Toshiba Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Beijing SOJO Electric Co Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Mitsubishi Electric Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Alstom SA

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Schneider Electric SE

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 REV Engineering Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Siemens Energy AG

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Fuji Electric Co Ltd

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 General Electric Company*List Not Exhaustive

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 ABB Ltd

List of Figures

- Figure 1: North America High Voltage Switchgear Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America High Voltage Switchgear Market Share (%) by Company 2025

List of Tables

- Table 1: North America High Voltage Switchgear Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America High Voltage Switchgear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: North America High Voltage Switchgear Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America High Voltage Switchgear Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: North America High Voltage Switchgear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: North America High Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: North America High Voltage Switchgear Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: North America High Voltage Switchgear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: North America High Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: North America High Voltage Switchgear Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: North America High Voltage Switchgear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America High Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America High Voltage Switchgear Market ?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the North America High Voltage Switchgear Market ?

Key companies in the market include ABB Ltd, Toshiba Corporation, Beijing SOJO Electric Co Ltd, Mitsubishi Electric Corporation, Alstom SA, Schneider Electric SE, REV Engineering Ltd, Siemens Energy AG, Fuji Electric Co Ltd, General Electric Company*List Not Exhaustive.

3. What are the main segments of the North America High Voltage Switchgear Market ?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.00 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Expansion of Power Transmission and Distribution (T&D) Infrastructure4.; Government Initiatives.

6. What are the notable trends driving market growth?

Government Initiatives Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Self-generated Renewable Power in the Residential and Commercial Sectors.

8. Can you provide examples of recent developments in the market?

May 2023: A power utility in New Hampshire, United States, proposed a new power transmission line to carry renewable energy from Canada to the United States. The 211-mile transmission line project, which includes an investment of USD2 billion, called as Twin State Clean Energy Link, would not only carry hydropower from Canada to New England but also wind and solar power from the power facilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America High Voltage Switchgear Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America High Voltage Switchgear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America High Voltage Switchgear Market ?

To stay informed about further developments, trends, and reports in the North America High Voltage Switchgear Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence