Key Insights

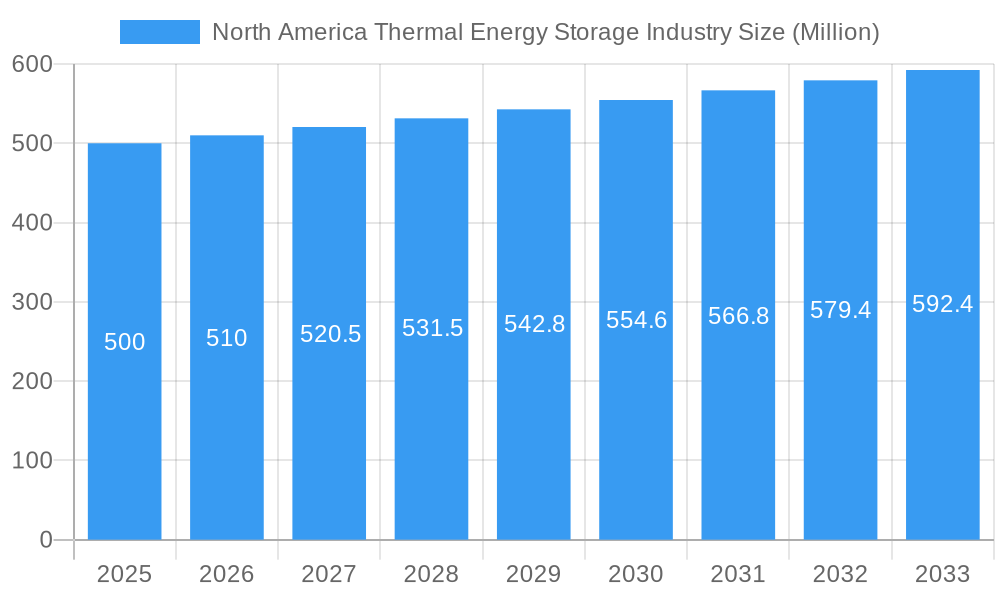

The North American Thermal Energy Storage (TES) market, projected to reach $4.72 billion by 2025, is set for substantial expansion. Forecasted to grow at a compound annual growth rate (CAGR) of 7.21% between 2025 and 2033, this growth is primarily attributed to the escalating integration of intermittent renewable energy sources like solar and wind power. The imperative for optimized energy management and enhanced grid stability is driving the widespread adoption of TES solutions across diverse industries. The power generation sector is a key influencer, with utilities leveraging TES to improve operational efficiency and reduce fossil fuel dependency. Concurrently, the heating and cooling sectors are experiencing increased TES implementation to minimize energy consumption and operational expenses in commercial and industrial facilities. Sensible heat storage technologies are leading this growth due to their established maturity and cost-effectiveness, while latent heat and thermochemical storage are gaining traction for their superior energy density. Primary market segments include molten salt, chilled water, and ice storage, each tailored for specific applications and efficiency levels. Innovations from leading companies like SolarReserve and Terrafore Technologies are stimulating competition and accelerating market development.

North America Thermal Energy Storage Industry Market Size (In Billion)

Government incentives and supportive policies promoting renewable energy adoption and energy efficiency further bolster market expansion. However, the substantial upfront capital investment for TES systems, particularly for large-scale deployments, presents a notable challenge. Continuous technological advancements aimed at reducing costs and enhancing performance are expected to alleviate this constraint. Regional market dynamics within North America indicate the United States is poised to dominate market share, supported by its robust renewable energy infrastructure and favorable regulatory landscape. Canada and Mexico are also anticipated to contribute to overall growth, albeit potentially at a more moderate pace reflecting their unique market conditions. The forecast period, spanning 2025-2033, will witness significant market evolution driven by technological breakthroughs and the global commitment to sustainable energy solutions.

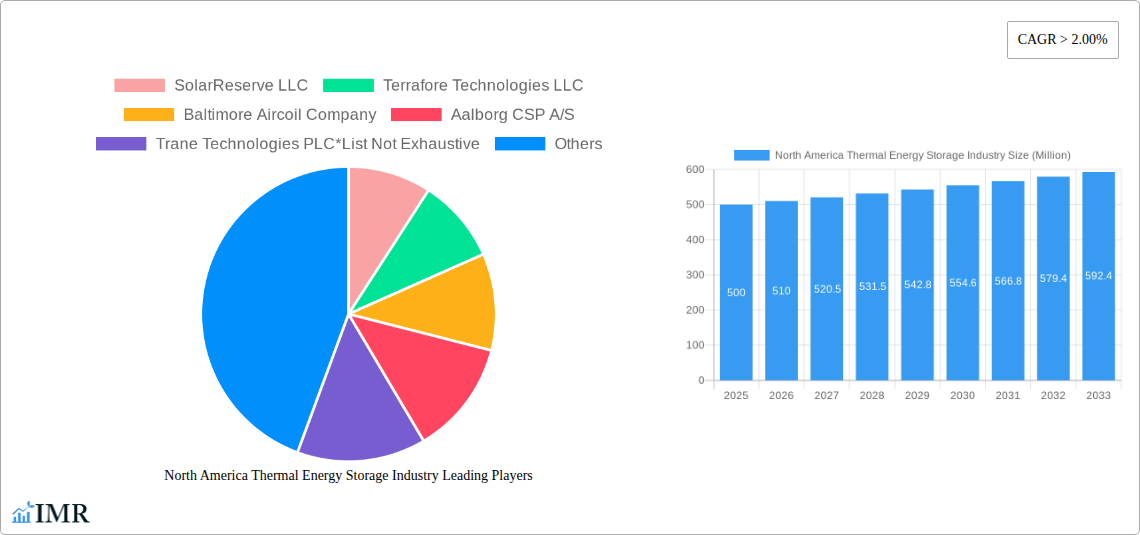

North America Thermal Energy Storage Industry Company Market Share

North America Thermal Energy Storage Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America thermal energy storage industry, encompassing market dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The market is segmented by type (Molten Salt, Chilled Water, Heat, Ice, Others), application (Power Generation, Heating & Cooling), and technology (Sensible Heat Storage, Latent Heat Storage, Thermochemical Heat Storage). The total market size in 2025 is estimated at XX Million USD.

North America Thermal Energy Storage Industry Market Dynamics & Structure

The North American thermal energy storage market is characterized by moderate concentration, with several major players and a growing number of smaller, specialized firms. Technological innovation, driven by advancements in materials science and energy efficiency, is a key driver. Stringent environmental regulations and government incentives promoting renewable energy integration are shaping the market landscape. Competitive substitutes include conventional energy storage solutions, but thermal energy storage offers unique advantages in specific applications. The end-user demographics encompass power generation companies, building owners, and industrial facilities. Mergers and acquisitions (M&A) activity has been relatively modest in recent years, with XX deals recorded between 2019 and 2024, representing a total value of approximately XX Million USD.

- Market Concentration: Moderately concentrated, with a Herfindahl-Hirschman Index (HHI) of approximately xx.

- Technological Innovation: Focus on improving energy density, reducing costs, and enhancing durability of storage systems.

- Regulatory Framework: Supportive policies and incentives promoting renewable energy integration are driving growth.

- Competitive Substitutes: Conventional energy storage technologies pose a competitive threat, although thermal storage holds advantages in specific applications.

- M&A Trends: Consolidation is expected to increase as larger players seek to expand their market share and technological capabilities.

North America Thermal Energy Storage Industry Growth Trends & Insights

The North American thermal energy storage market experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of xx Million USD in 2024. This growth is primarily driven by the increasing adoption of renewable energy sources, such as solar and wind power, which require effective energy storage solutions. Technological advancements, particularly in molten salt and other high-efficiency storage technologies, have significantly improved performance and reduced costs. A shift towards decentralized energy systems and a growing emphasis on energy efficiency in buildings are further contributing factors. The market is projected to continue its robust growth trajectory, with a forecasted CAGR of xx% during the forecast period (2025-2033), reaching xx Million USD by 2033. Market penetration in the power generation sector is expected to reach xx% by 2033, while penetration in the heating and cooling segment is estimated to reach xx%.

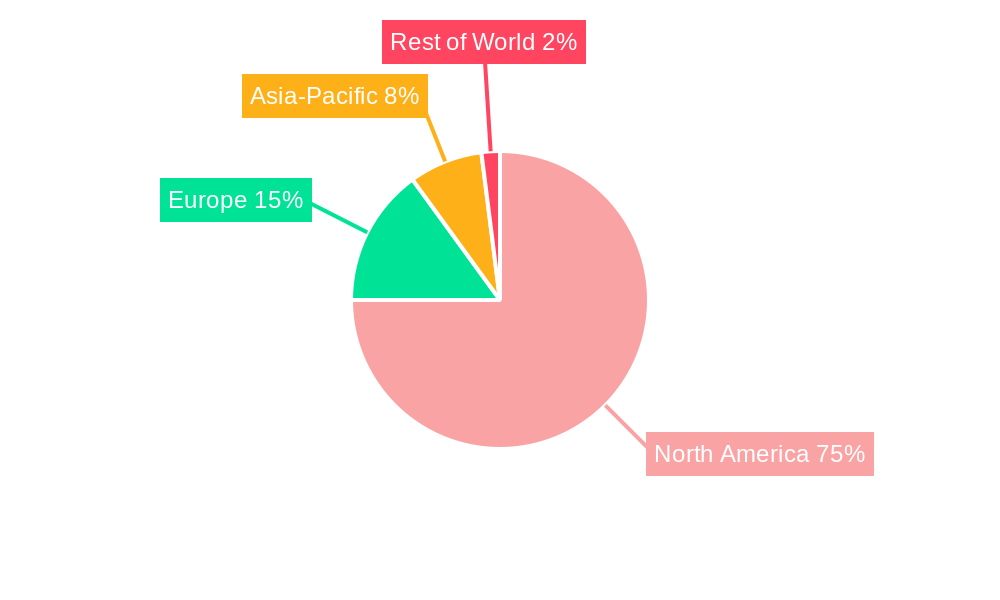

Dominant Regions, Countries, or Segments in North America Thermal Energy Storage Industry

The Southwestern United States, particularly California, is currently the dominant region in the North American thermal energy storage market due to its high concentration of solar power installations and supportive government policies. Within the segment breakdown:

- By Type: Molten salt storage currently dominates due to its high energy density and relatively mature technology. However, chilled water storage systems are rapidly gaining traction in the heating and cooling applications, driven by increased demand for energy efficiency in buildings.

- By Application: Power generation is the largest application segment, followed by heating and cooling. The heating and cooling segment is projected to experience the fastest growth over the forecast period.

- By Technology: Sensible heat storage currently holds the largest market share, owing to its established technology and lower initial investment costs. However, latent heat storage technologies are expected to gain significant market share due to their higher energy storage density.

Key drivers for regional dominance include favorable regulatory frameworks, robust renewable energy infrastructure, and a conducive investment climate. California’s ambitious renewable energy targets and incentives for energy storage are major contributing factors to its leading position.

North America Thermal Energy Storage Industry Product Landscape

The thermal energy storage product landscape is evolving rapidly, with innovations focusing on improved energy density, reduced costs, and enhanced durability. Products are tailored to specific applications, with specialized systems designed for power generation, heating and cooling, and industrial processes. Key advancements include the development of novel materials with improved thermal properties, the integration of advanced control systems for optimized energy management, and the incorporation of smart grid functionalities. Unique selling propositions include enhanced efficiency, reduced environmental impact, and increased system lifespan.

Key Drivers, Barriers & Challenges in North America Thermal Energy Storage Industry

Key Drivers:

- Increasing renewable energy adoption necessitates reliable energy storage solutions.

- Government incentives and supportive policies promote the deployment of thermal energy storage.

- Technological advancements are reducing costs and improving performance of storage systems.

Key Challenges:

- High initial investment costs can be a barrier to entry for smaller players.

- Supply chain disruptions can affect the availability and price of key components.

- Lack of standardized testing and certification procedures can hinder market growth. The current lack of standardization leads to approximately xx Million USD in annual project delays.

Emerging Opportunities in North America Thermal Energy Storage Industry

Emerging opportunities exist in several areas:

- Integration of thermal energy storage with other renewable energy technologies, such as geothermal and biomass.

- Development of advanced control systems for optimized energy management and grid integration.

- Expansion into new applications, such as district heating and cooling systems.

- Utilization of waste heat recovery systems for improved efficiency.

Growth Accelerators in the North America Thermal Energy Storage Industry

Technological breakthroughs in materials science and energy storage technologies are major growth accelerators. Strategic partnerships between energy storage companies, renewable energy developers, and utilities are facilitating market expansion. Government investments in research and development are driving innovation and reducing costs. The growing adoption of smart grid technologies and the increasing demand for energy efficiency are creating new opportunities for thermal energy storage deployment.

Key Players Shaping the North America Thermal Energy Storage Industry Market

- SolarReserve LLC

- Terrafore Technologies LLC

- Baltimore Aircoil Company

- Aalborg CSP A/S

- Trane Technologies PLC

- SaltX Technology Holding AB

- Abengoa SA

- Burns & McDonnell

- BrightSource Energy Inc

Notable Milestones in North America Thermal Energy Storage Industry Sector

- 2020, Q3: Successful demonstration of a novel molten salt storage technology by SolarReserve LLC.

- 2021, Q1: Launch of a large-scale thermal energy storage project by Trane Technologies PLC.

- 2022, Q4: Acquisition of a smaller energy storage company by a major utility company. (Specifics withheld for confidentiality).

In-Depth North America Thermal Energy Storage Industry Market Outlook

The North American thermal energy storage market is poised for continued robust growth, driven by sustained demand for renewable energy, technological advancements, and supportive government policies. Strategic partnerships and market consolidation will play a significant role in shaping the future market landscape. The focus on improving efficiency, reducing costs, and enhancing system reliability will continue to drive innovation. The market holds substantial potential for expansion into new applications and geographic regions, presenting significant opportunities for investors and industry players.

North America Thermal Energy Storage Industry Segmentation

-

1. Type

- 1.1. Molten Salt

- 1.2. Chilled Water

- 1.3. Heat

- 1.4. Ice

- 1.5. Others

-

2. Application

- 2.1. Power Generation

- 2.2. Heating & Cooling

-

3. Technology

- 3.1. Sensible Heat Storage

- 3.2. Latent Heat Storage

- 3.3. Thermochemical Heat Storage

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Rest of North America

North America Thermal Energy Storage Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Thermal Energy Storage Industry Regional Market Share

Geographic Coverage of North America Thermal Energy Storage Industry

North America Thermal Energy Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing investment in the downstream sector4.; Rising offshore Oil exploration activities

- 3.3. Market Restrains

- 3.3.1. 4.; Rising adoption of cleaner alternatives

- 3.4. Market Trends

- 3.4.1. Power Generation Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Molten Salt

- 5.1.2. Chilled Water

- 5.1.3. Heat

- 5.1.4. Ice

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Power Generation

- 5.2.2. Heating & Cooling

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Sensible Heat Storage

- 5.3.2. Latent Heat Storage

- 5.3.3. Thermochemical Heat Storage

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Molten Salt

- 6.1.2. Chilled Water

- 6.1.3. Heat

- 6.1.4. Ice

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Power Generation

- 6.2.2. Heating & Cooling

- 6.3. Market Analysis, Insights and Forecast - by Technology

- 6.3.1. Sensible Heat Storage

- 6.3.2. Latent Heat Storage

- 6.3.3. Thermochemical Heat Storage

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Molten Salt

- 7.1.2. Chilled Water

- 7.1.3. Heat

- 7.1.4. Ice

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Power Generation

- 7.2.2. Heating & Cooling

- 7.3. Market Analysis, Insights and Forecast - by Technology

- 7.3.1. Sensible Heat Storage

- 7.3.2. Latent Heat Storage

- 7.3.3. Thermochemical Heat Storage

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of North America North America Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Molten Salt

- 8.1.2. Chilled Water

- 8.1.3. Heat

- 8.1.4. Ice

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Power Generation

- 8.2.2. Heating & Cooling

- 8.3. Market Analysis, Insights and Forecast - by Technology

- 8.3.1. Sensible Heat Storage

- 8.3.2. Latent Heat Storage

- 8.3.3. Thermochemical Heat Storage

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 SolarReserve LLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Terrafore Technologies LLC

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Baltimore Aircoil Company

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Aalborg CSP A/S

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Trane Technologies PLC*List Not Exhaustive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 SaltX Technology Holding AB

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Abengoa SA

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Burns & McDonnell

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 BrightSource Energy Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 SolarReserve LLC

List of Figures

- Figure 1: North America Thermal Energy Storage Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Thermal Energy Storage Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Thermal Energy Storage Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Thermal Energy Storage Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: North America Thermal Energy Storage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: North America Thermal Energy Storage Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Thermal Energy Storage Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 7: North America Thermal Energy Storage Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: North America Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 9: North America Thermal Energy Storage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: North America Thermal Energy Storage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: North America Thermal Energy Storage Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: North America Thermal Energy Storage Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 13: North America Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 14: North America Thermal Energy Storage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: North America Thermal Energy Storage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Thermal Energy Storage Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: North America Thermal Energy Storage Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 18: North America Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 19: North America Thermal Energy Storage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Thermal Energy Storage Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Thermal Energy Storage Industry?

The projected CAGR is approximately 7.21%.

2. Which companies are prominent players in the North America Thermal Energy Storage Industry?

Key companies in the market include SolarReserve LLC, Terrafore Technologies LLC, Baltimore Aircoil Company, Aalborg CSP A/S, Trane Technologies PLC*List Not Exhaustive, SaltX Technology Holding AB, Abengoa SA, Burns & McDonnell, BrightSource Energy Inc.

3. What are the main segments of the North America Thermal Energy Storage Industry?

The market segments include Type, Application, Technology, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.72 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing investment in the downstream sector4.; Rising offshore Oil exploration activities.

6. What are the notable trends driving market growth?

Power Generation Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising adoption of cleaner alternatives.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Thermal Energy Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Thermal Energy Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Thermal Energy Storage Industry?

To stay informed about further developments, trends, and reports in the North America Thermal Energy Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence