Key Insights

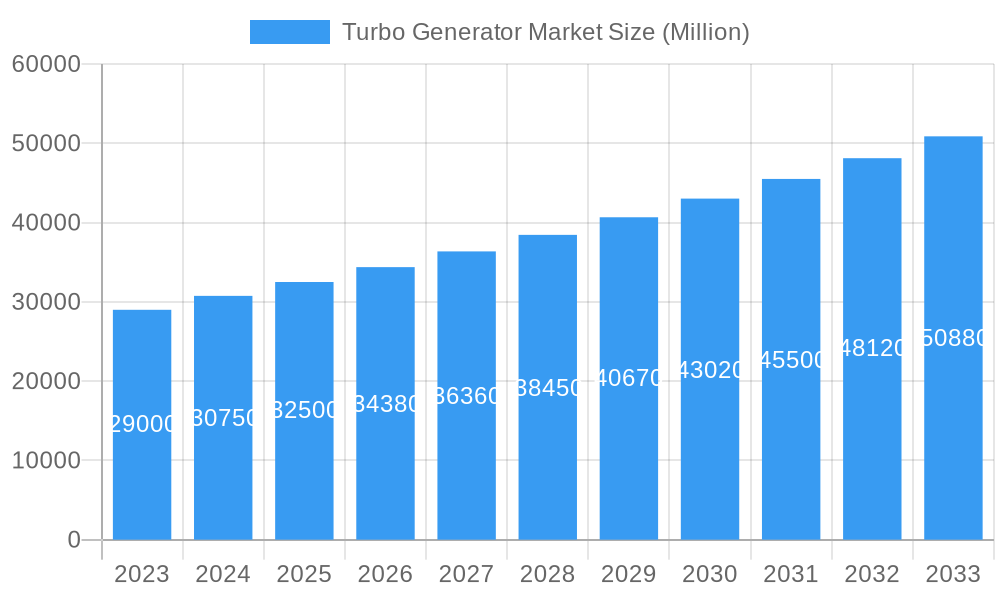

The global Turbo Generator Market is poised for robust expansion, projected to reach an estimated market size of approximately $32,500 million by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 3.80% through 2033. This significant growth is fueled by the escalating global demand for electricity, driven by industrialization, urbanization, and the increasing adoption of renewable energy sources that often necessitate advanced turbo generator technologies for grid integration and power conditioning. Key market drivers include the continuous need for reliable and efficient power generation solutions to meet growing energy consumption, alongside ongoing investments in upgrading existing power infrastructure and developing new power plants across various fuel types.

Turbo Generator Market Market Size (In Billion)

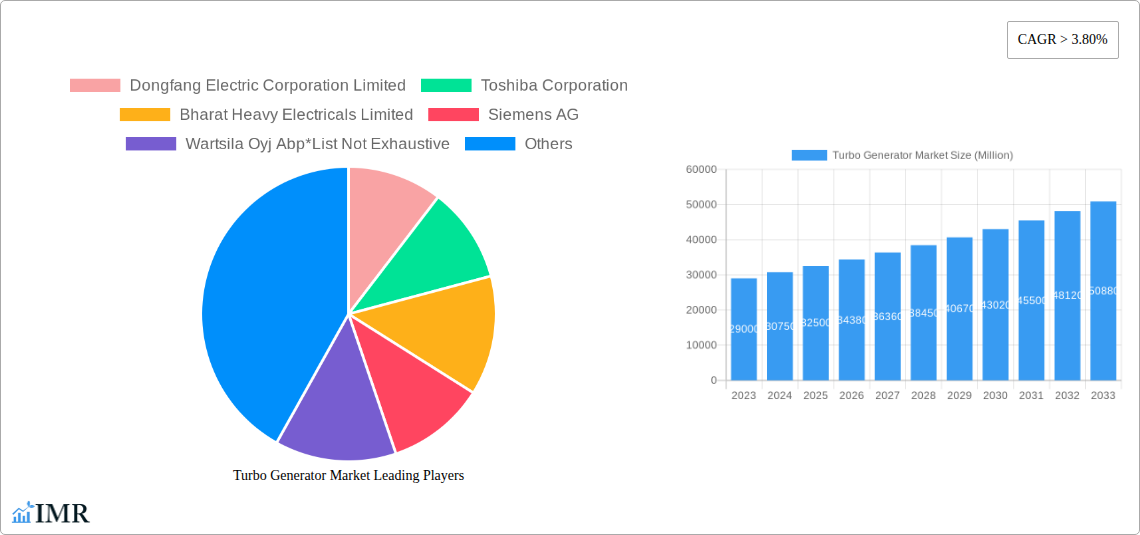

The market dynamics are further shaped by significant trends such as the transition towards cleaner energy sources, which, while posing challenges for traditional fossil fuel-based generation, also creates opportunities for advanced turbo generator systems designed for hybrid power plants and enhanced efficiency in gas and nuclear facilities. Air-cooled turbo generators are gaining traction due to their lower water consumption, a crucial factor in water-scarce regions. Conversely, the market faces restraints related to the high capital expenditure involved in new power plant construction and the lengthy approval processes for such projects. The competitive landscape is dominated by established players like Siemens AG, General Electric Company, and Dongfang Electric Corporation Limited, all vying for market share through technological innovation and strategic partnerships.

Turbo Generator Market Company Market Share

Turbo Generator Market: Comprehensive Analysis and Forecast (2019-2033)

This in-depth report provides a panoramic view of the global turbo generator market, meticulously analyzing its dynamics, growth trajectories, and future outlook. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this research delivers actionable insights for stakeholders navigating the evolving energy landscape. Our analysis incorporates crucial data points, including market size evolution in million units, CAGR projections, and key segment performance. The report delves into both parent and child market segments, offering a granular understanding of market drivers, barriers, and emerging opportunities. Optimized with high-traffic keywords such as "power generation equipment," "industrial turbines," "energy infrastructure," "renewable energy integration," and "power plant efficiency," this report is your essential guide to understanding the trajectory of the global turbo generator industry.

Turbo Generator Market Market Dynamics & Structure

The turbo generator market exhibits a moderately concentrated structure, with key players like Siemens AG, General Electric Company, Dongfang Electric Corporation Limited, Toshiba Corporation, and Mitsubishi Heavy Industries Ltd holding significant market share, estimated to be over 60% collectively in the base year of 2025. Technological innovation remains a primary driver, with continuous advancements in efficiency, reliability, and emissions reduction fueling market growth. Regulatory frameworks, particularly those promoting decarbonization and cleaner energy sources, are increasingly shaping investment and product development. Competitive product substitutes, while present in niche applications, are yet to pose a significant threat to the dominant steam and gas turbine-based turbo generators in large-scale power generation. End-user demographics are shifting, with a growing demand from Gas-fired Power Plants and a sustained, albeit gradually declining, contribution from Coal-fired Power Plants, alongside a nascent but promising growth in applications within Nuclear Power Plants. Mergers and acquisitions (M&A) trends, though less frequent in recent periods, are characterized by strategic consolidations aimed at enhancing technological capabilities and expanding market reach, with an estimated 2-3 significant M&A deals in the historical period (2019-2024). Barriers to innovation include the high capital expenditure required for R&D and the long product lifecycle of existing installations.

- Market Concentration: Moderately concentrated, dominated by a few global leaders.

- Technological Innovation: Driven by efficiency gains, reduced emissions, and integration with advanced grid technologies.

- Regulatory Frameworks: Increasingly influenced by environmental policies and the push for sustainable energy.

- Competitive Landscape: Characterized by established players with strong intellectual property and manufacturing capabilities.

- End-User Dominance: Gas-fired Power Plants projected to be the leading segment in the forecast period.

- M&A Activity: Strategic, focused on portfolio enhancement and market expansion.

Turbo Generator Market Growth Trends & Insights

The global turbo generator market is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period of 2025–2033. This expansion is underpinned by a substantial increase in global energy demand, driven by industrialization, urbanization, and the ongoing electrification of various sectors. The market size, estimated at USD 25,500 million units in the base year of 2025, is expected to reach USD 36,200 million units by 2033. Adoption rates for advanced turbo generator technologies are accelerating, particularly in emerging economies seeking to modernize their power infrastructure. Technological disruptions are playing a pivotal role, with the development of more efficient turbine designs, advanced materials, and digital control systems significantly enhancing performance and reducing operational costs. Consumer behavior shifts are evident, with power generation utilities prioritizing reliability, fuel flexibility, and lower environmental impact in their investment decisions. The increasing integration of renewable energy sources necessitates flexible and responsive conventional power generation, further bolstering the demand for advanced turbo generators capable of rapid ramp-up and ramp-down. The penetration of hybrid power solutions, combining conventional and renewable energy sources, is also a key trend influencing market dynamics.

- Market Size Evolution: From USD 25,500 million units in 2025 to an estimated USD 36,200 million units by 2033.

- CAGR Projection: Approximately 4.5% from 2025 to 2033.

- Key Growth Drivers: Rising global energy demand, infrastructure modernization, and technological advancements.

- Adoption Rates: Increasing, especially in developing regions adopting newer, more efficient technologies.

- Technological Disruptions: Focus on efficiency, emissions control, and grid integration capabilities.

- Consumer Behavior: Prioritization of reliability, fuel flexibility, and environmental sustainability.

- Market Penetration: Expanding to accommodate the growing need for flexible backup power for renewables.

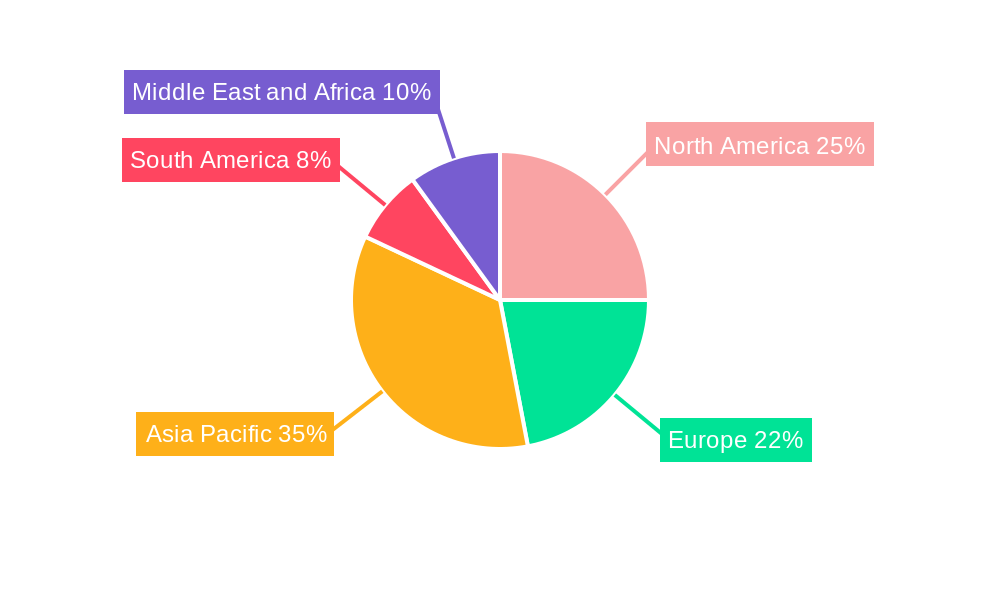

Dominant Regions, Countries, or Segments in Turbo Generator Market

The Gas-fired Power Plant segment is anticipated to be the dominant force in the global turbo generator market throughout the forecast period (2025–2033). This dominance stems from the inherent flexibility and relatively lower emissions profile of natural gas power generation compared to coal, making it an attractive transition fuel in many regions' decarbonization strategies. The segment's market share in 2025 is estimated at 45% of the total market. Asia Pacific, particularly countries like China and India, is projected to be the leading region, driven by rapid industrial growth, increasing energy demand, and substantial investments in new power generation capacity. China alone is expected to account for over 30% of the regional turbo generator market share by 2030. Economic policies favoring energy security and the development of robust power grids are key drivers in this region.

The Air Cooled cooling type segment is also expected to witness significant growth, driven by its lower water consumption and suitability for regions facing water scarcity, accounting for approximately 35% of the market in 2025. The Coal-fired Power Plant segment, while historically significant, is projected to see a gradual decline in its market share due to increasing environmental regulations and the global shift towards cleaner energy sources. However, its substantial existing infrastructure will continue to drive replacement and upgrade orders. Nuclear Power Plants, while representing a smaller segment, are experiencing renewed interest in some regions, leading to potential growth opportunities for specialized turbo generators.

- Dominant End User Segment: Gas-fired Power Plant (estimated 45% market share in 2025).

- Leading Regional Market: Asia Pacific (driven by China and India).

- Key Regional Drivers: Industrialization, rising energy demand, government support for power infrastructure.

- Dominant Cooling Type Segment: Air Cooled (estimated 35% market share in 2025).

- Impact of Coal-fired Power Plants: Declining but still significant due to existing infrastructure and replacement needs.

- Growth Potential for Nuclear: Renewed interest in select markets.

Turbo Generator Market Product Landscape

The turbo generator market is characterized by continuous product innovation focused on enhancing efficiency, reducing emissions, and improving operational reliability. Leading manufacturers are developing advanced turbine designs, such as aerodynamically optimized blades and high-efficiency combustion systems, to maximize energy conversion. The integration of advanced materials, like composite alloys, allows for higher operating temperatures and pressures, further boosting performance metrics. Digitalization plays a crucial role, with the incorporation of smart sensors, predictive maintenance algorithms, and remote monitoring capabilities improving uptime and reducing lifecycle costs. Applications span across large-scale power generation, including base load, peak load, and co-generation plants, as well as specialized industrial uses. Unique selling propositions include higher power output per unit, lower fuel consumption, and extended service intervals, catering to the evolving demands for cost-effectiveness and environmental compliance.

Key Drivers, Barriers & Challenges in Turbo Generator Market

The turbo generator market is propelled by several key drivers. The increasing global demand for electricity, fueled by industrial expansion and urbanization, is a primary growth catalyst. The ongoing energy transition, with a focus on natural gas as a bridge fuel and the need for flexible backup power for renewables, further boosts demand for advanced turbo generators. Technological advancements leading to improved efficiency and reduced emissions are also significant drivers.

However, the market faces notable challenges and restraints. High upfront capital investment for new installations and replacement projects can be a barrier, particularly for smaller utilities or in developing economies. Stringent environmental regulations, while driving innovation, can also increase compliance costs and lead to the phasing out of older, less efficient technologies. Supply chain disruptions, as witnessed in recent years, can impact manufacturing timelines and costs. Intense competition among established players can also put pressure on profit margins.

- Key Drivers:

- Rising global electricity demand.

- Energy transition and the role of natural gas.

- Need for flexible power generation for renewables.

- Technological advancements in efficiency and emissions reduction.

- Key Challenges & Restraints:

- High capital investment costs.

- Stringent environmental regulations.

- Supply chain volatility.

- Intense market competition.

Emerging Opportunities in Turbo Generator Market

Emerging opportunities in the turbo generator market are abundant, particularly in the realm of hybrid energy systems and advanced grid modernization. The growing integration of renewable energy sources like solar and wind creates a significant demand for flexible and responsive conventional power generation, where advanced turbo generators can play a crucial role in ensuring grid stability. Furthermore, the development of smaller, more efficient turbogenerator units for distributed power generation and industrial co-generation offers a promising avenue. The adoption of green hydrogen as a fuel source presents a long-term opportunity, with significant R&D efforts underway to adapt turbo generators for hydrogen combustion. Untapped markets in developing regions with rapidly expanding energy needs also offer substantial growth potential.

Growth Accelerators in the Turbo Generator Market Industry

Several catalysts are accelerating the long-term growth of the turbo generator market industry. Technological breakthroughs in areas such as advanced combustion techniques, materials science for higher temperature tolerance, and digital control systems are continuously enhancing the performance and efficiency of turbo generators. Strategic partnerships between established manufacturers and technology providers are fostering innovation and expanding market reach. Furthermore, government initiatives and incentives aimed at modernizing power infrastructure, promoting energy efficiency, and supporting the transition to cleaner energy sources are significant growth accelerators. Market expansion strategies, including the development of customized solutions for specific regional needs and the penetration into emerging sectors, are also playing a crucial role in driving sustained growth.

Key Players Shaping the Turbo Generator Market Market

- Dongfang Electric Corporation Limited

- Toshiba Corporation

- Bharat Heavy Electricals Limited

- Siemens AG

- Wartsila Oyj Abp

- Ansaldo Energia SpA

- General Electric Company

- Andritz AG

- Harbin Electric Company Limited

- Mitsubishi Heavy Industries Ltd

Notable Milestones in Turbo Generator Market Sector

- June 2022: Rolls-Royce announced the development of turbogenerator technology for more efficiency and a small engine for hybrid-electric use.

- September 2022: Hindustan Aeronautics Limited (HAL) and Honeywell jointly signed a memorandum of understanding (MoU) to manufacture high-power, high-voltage turbogenerators.

In-Depth Turbo Generator Market Market Outlook

The turbo generator market is set for a promising future, driven by the persistent global demand for reliable and efficient power. Growth accelerators such as rapid technological advancements in efficiency and emissions reduction, coupled with strategic market expansion by key players, will continue to shape the industry. The ongoing energy transition and the increasing integration of renewable energy sources will further necessitate the deployment of flexible and responsive conventional power generation, creating sustained demand for advanced turbo generators. Opportunities in emerging markets and the potential of hydrogen fuel integration present significant long-term growth prospects. Stakeholders can anticipate a dynamic market characterized by continuous innovation and strategic collaborations, offering substantial opportunities for investment and development.

Turbo Generator Market Segmentation

-

1. End User

- 1.1. Coal-fired Power Plant

- 1.2. Gas-fired Power Plant

- 1.3. Nuclear Power Plant

- 1.4. Other End Users

-

2. Cooling Type

- 2.1. Air Cooled

- 2.2. Hydrogen Cooled

- 2.3. Water-hydrogen Cooled

Turbo Generator Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Turbo Generator Market Regional Market Share

Geographic Coverage of Turbo Generator Market

Turbo Generator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Gas-fired Power Plants to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Turbo Generator Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Coal-fired Power Plant

- 5.1.2. Gas-fired Power Plant

- 5.1.3. Nuclear Power Plant

- 5.1.4. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Cooling Type

- 5.2.1. Air Cooled

- 5.2.2. Hydrogen Cooled

- 5.2.3. Water-hydrogen Cooled

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Turbo Generator Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Coal-fired Power Plant

- 6.1.2. Gas-fired Power Plant

- 6.1.3. Nuclear Power Plant

- 6.1.4. Other End Users

- 6.2. Market Analysis, Insights and Forecast - by Cooling Type

- 6.2.1. Air Cooled

- 6.2.2. Hydrogen Cooled

- 6.2.3. Water-hydrogen Cooled

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Turbo Generator Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Coal-fired Power Plant

- 7.1.2. Gas-fired Power Plant

- 7.1.3. Nuclear Power Plant

- 7.1.4. Other End Users

- 7.2. Market Analysis, Insights and Forecast - by Cooling Type

- 7.2.1. Air Cooled

- 7.2.2. Hydrogen Cooled

- 7.2.3. Water-hydrogen Cooled

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Turbo Generator Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Coal-fired Power Plant

- 8.1.2. Gas-fired Power Plant

- 8.1.3. Nuclear Power Plant

- 8.1.4. Other End Users

- 8.2. Market Analysis, Insights and Forecast - by Cooling Type

- 8.2.1. Air Cooled

- 8.2.2. Hydrogen Cooled

- 8.2.3. Water-hydrogen Cooled

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. South America Turbo Generator Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Coal-fired Power Plant

- 9.1.2. Gas-fired Power Plant

- 9.1.3. Nuclear Power Plant

- 9.1.4. Other End Users

- 9.2. Market Analysis, Insights and Forecast - by Cooling Type

- 9.2.1. Air Cooled

- 9.2.2. Hydrogen Cooled

- 9.2.3. Water-hydrogen Cooled

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East and Africa Turbo Generator Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Coal-fired Power Plant

- 10.1.2. Gas-fired Power Plant

- 10.1.3. Nuclear Power Plant

- 10.1.4. Other End Users

- 10.2. Market Analysis, Insights and Forecast - by Cooling Type

- 10.2.1. Air Cooled

- 10.2.2. Hydrogen Cooled

- 10.2.3. Water-hydrogen Cooled

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dongfang Electric Corporation Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Toshiba Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bharat Heavy Electricals Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Siemens AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wartsila Oyj Abp*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ansaldo Energia SpA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 General Electric Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Andritz AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Harbin Electric Company Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mitsubishi Heavy Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dongfang Electric Corporation Limited

List of Figures

- Figure 1: Global Turbo Generator Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Turbo Generator Market Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Turbo Generator Market Revenue (undefined), by End User 2025 & 2033

- Figure 4: North America Turbo Generator Market Volume (K Units), by End User 2025 & 2033

- Figure 5: North America Turbo Generator Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Turbo Generator Market Volume Share (%), by End User 2025 & 2033

- Figure 7: North America Turbo Generator Market Revenue (undefined), by Cooling Type 2025 & 2033

- Figure 8: North America Turbo Generator Market Volume (K Units), by Cooling Type 2025 & 2033

- Figure 9: North America Turbo Generator Market Revenue Share (%), by Cooling Type 2025 & 2033

- Figure 10: North America Turbo Generator Market Volume Share (%), by Cooling Type 2025 & 2033

- Figure 11: North America Turbo Generator Market Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Turbo Generator Market Volume (K Units), by Country 2025 & 2033

- Figure 13: North America Turbo Generator Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Turbo Generator Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Turbo Generator Market Revenue (undefined), by End User 2025 & 2033

- Figure 16: Europe Turbo Generator Market Volume (K Units), by End User 2025 & 2033

- Figure 17: Europe Turbo Generator Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe Turbo Generator Market Volume Share (%), by End User 2025 & 2033

- Figure 19: Europe Turbo Generator Market Revenue (undefined), by Cooling Type 2025 & 2033

- Figure 20: Europe Turbo Generator Market Volume (K Units), by Cooling Type 2025 & 2033

- Figure 21: Europe Turbo Generator Market Revenue Share (%), by Cooling Type 2025 & 2033

- Figure 22: Europe Turbo Generator Market Volume Share (%), by Cooling Type 2025 & 2033

- Figure 23: Europe Turbo Generator Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Turbo Generator Market Volume (K Units), by Country 2025 & 2033

- Figure 25: Europe Turbo Generator Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Turbo Generator Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Turbo Generator Market Revenue (undefined), by End User 2025 & 2033

- Figure 28: Asia Pacific Turbo Generator Market Volume (K Units), by End User 2025 & 2033

- Figure 29: Asia Pacific Turbo Generator Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific Turbo Generator Market Volume Share (%), by End User 2025 & 2033

- Figure 31: Asia Pacific Turbo Generator Market Revenue (undefined), by Cooling Type 2025 & 2033

- Figure 32: Asia Pacific Turbo Generator Market Volume (K Units), by Cooling Type 2025 & 2033

- Figure 33: Asia Pacific Turbo Generator Market Revenue Share (%), by Cooling Type 2025 & 2033

- Figure 34: Asia Pacific Turbo Generator Market Volume Share (%), by Cooling Type 2025 & 2033

- Figure 35: Asia Pacific Turbo Generator Market Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Turbo Generator Market Volume (K Units), by Country 2025 & 2033

- Figure 37: Asia Pacific Turbo Generator Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Turbo Generator Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Turbo Generator Market Revenue (undefined), by End User 2025 & 2033

- Figure 40: South America Turbo Generator Market Volume (K Units), by End User 2025 & 2033

- Figure 41: South America Turbo Generator Market Revenue Share (%), by End User 2025 & 2033

- Figure 42: South America Turbo Generator Market Volume Share (%), by End User 2025 & 2033

- Figure 43: South America Turbo Generator Market Revenue (undefined), by Cooling Type 2025 & 2033

- Figure 44: South America Turbo Generator Market Volume (K Units), by Cooling Type 2025 & 2033

- Figure 45: South America Turbo Generator Market Revenue Share (%), by Cooling Type 2025 & 2033

- Figure 46: South America Turbo Generator Market Volume Share (%), by Cooling Type 2025 & 2033

- Figure 47: South America Turbo Generator Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: South America Turbo Generator Market Volume (K Units), by Country 2025 & 2033

- Figure 49: South America Turbo Generator Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Turbo Generator Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Turbo Generator Market Revenue (undefined), by End User 2025 & 2033

- Figure 52: Middle East and Africa Turbo Generator Market Volume (K Units), by End User 2025 & 2033

- Figure 53: Middle East and Africa Turbo Generator Market Revenue Share (%), by End User 2025 & 2033

- Figure 54: Middle East and Africa Turbo Generator Market Volume Share (%), by End User 2025 & 2033

- Figure 55: Middle East and Africa Turbo Generator Market Revenue (undefined), by Cooling Type 2025 & 2033

- Figure 56: Middle East and Africa Turbo Generator Market Volume (K Units), by Cooling Type 2025 & 2033

- Figure 57: Middle East and Africa Turbo Generator Market Revenue Share (%), by Cooling Type 2025 & 2033

- Figure 58: Middle East and Africa Turbo Generator Market Volume Share (%), by Cooling Type 2025 & 2033

- Figure 59: Middle East and Africa Turbo Generator Market Revenue (undefined), by Country 2025 & 2033

- Figure 60: Middle East and Africa Turbo Generator Market Volume (K Units), by Country 2025 & 2033

- Figure 61: Middle East and Africa Turbo Generator Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Turbo Generator Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Turbo Generator Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 2: Global Turbo Generator Market Volume K Units Forecast, by End User 2020 & 2033

- Table 3: Global Turbo Generator Market Revenue undefined Forecast, by Cooling Type 2020 & 2033

- Table 4: Global Turbo Generator Market Volume K Units Forecast, by Cooling Type 2020 & 2033

- Table 5: Global Turbo Generator Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Turbo Generator Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Turbo Generator Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Global Turbo Generator Market Volume K Units Forecast, by End User 2020 & 2033

- Table 9: Global Turbo Generator Market Revenue undefined Forecast, by Cooling Type 2020 & 2033

- Table 10: Global Turbo Generator Market Volume K Units Forecast, by Cooling Type 2020 & 2033

- Table 11: Global Turbo Generator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Turbo Generator Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Global Turbo Generator Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 14: Global Turbo Generator Market Volume K Units Forecast, by End User 2020 & 2033

- Table 15: Global Turbo Generator Market Revenue undefined Forecast, by Cooling Type 2020 & 2033

- Table 16: Global Turbo Generator Market Volume K Units Forecast, by Cooling Type 2020 & 2033

- Table 17: Global Turbo Generator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Global Turbo Generator Market Volume K Units Forecast, by Country 2020 & 2033

- Table 19: Global Turbo Generator Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 20: Global Turbo Generator Market Volume K Units Forecast, by End User 2020 & 2033

- Table 21: Global Turbo Generator Market Revenue undefined Forecast, by Cooling Type 2020 & 2033

- Table 22: Global Turbo Generator Market Volume K Units Forecast, by Cooling Type 2020 & 2033

- Table 23: Global Turbo Generator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Turbo Generator Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Global Turbo Generator Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 26: Global Turbo Generator Market Volume K Units Forecast, by End User 2020 & 2033

- Table 27: Global Turbo Generator Market Revenue undefined Forecast, by Cooling Type 2020 & 2033

- Table 28: Global Turbo Generator Market Volume K Units Forecast, by Cooling Type 2020 & 2033

- Table 29: Global Turbo Generator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global Turbo Generator Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Global Turbo Generator Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 32: Global Turbo Generator Market Volume K Units Forecast, by End User 2020 & 2033

- Table 33: Global Turbo Generator Market Revenue undefined Forecast, by Cooling Type 2020 & 2033

- Table 34: Global Turbo Generator Market Volume K Units Forecast, by Cooling Type 2020 & 2033

- Table 35: Global Turbo Generator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Turbo Generator Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turbo Generator Market?

The projected CAGR is approximately 5.32%.

2. Which companies are prominent players in the Turbo Generator Market?

Key companies in the market include Dongfang Electric Corporation Limited, Toshiba Corporation, Bharat Heavy Electricals Limited, Siemens AG, Wartsila Oyj Abp*List Not Exhaustive, Ansaldo Energia SpA, General Electric Company, Andritz AG, Harbin Electric Company Limited, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Turbo Generator Market?

The market segments include End User, Cooling Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Gas-fired Power Plants to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

June 2022: Rolls-Royce announced the development of turbogenerator technology for more efficiency and a small engine for hybrid-electric use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turbo Generator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turbo Generator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turbo Generator Market?

To stay informed about further developments, trends, and reports in the Turbo Generator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence