Key Insights

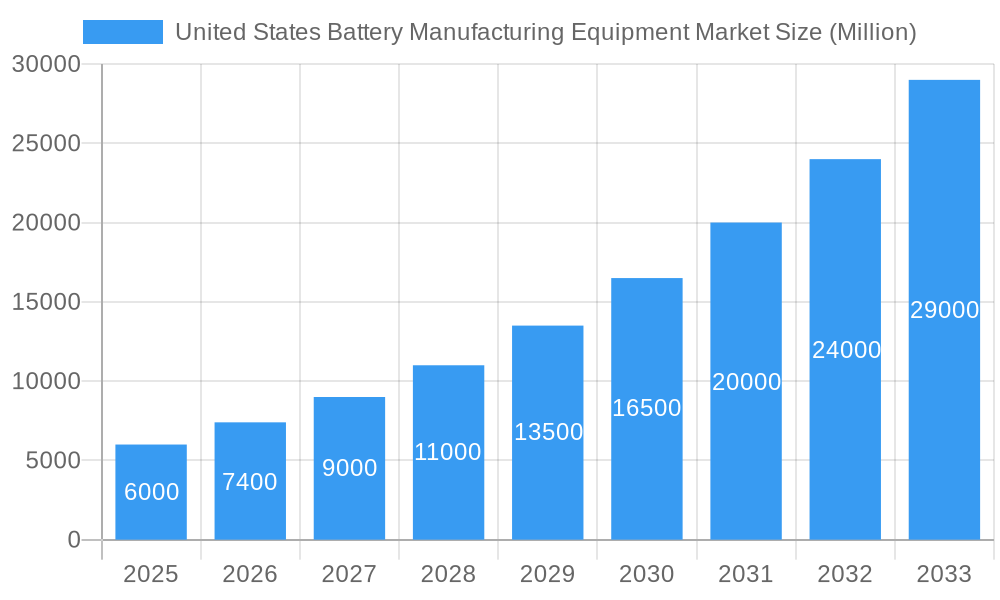

The United States battery manufacturing equipment market is experiencing significant expansion, propelled by the escalating demand for electric vehicles (EVs) and energy storage systems (ESS). This growth is underpinned by government incentives for clean energy, heightened climate change awareness, and technological advancements in battery performance and cost-effectiveness. The US market size is projected to reach $9.77 billion by 2025, with a compound annual growth rate (CAGR) of 27.61% from the base year 2025. This projection considers substantial investments in domestic battery production facilities by leading automotive and energy corporations. The market is segmented by machine type (coating & drying, calendaring, slitting, mixing, electrode stacking, assembly & handling, formation & testing) and end-user (automotive, industrial, others). The automotive sector leads current demand, while the industrial segment is set for robust growth due to the expanding use of batteries in grid-scale energy storage and other industrial applications. Key market participants include global leaders such as Hitachi, Dürr, and Schuler, alongside agile domestic companies specializing in bespoke equipment and automation. Intensifying competition is anticipated as new entrants are drawn to the market's promising growth trajectory.

United States Battery Manufacturing Equipment Market Market Size (In Billion)

Future growth for the US battery manufacturing equipment market is contingent upon sustained government backing for clean energy initiatives, including production tax credits and subsidies. Crucial factors for advancement include innovations in battery chemistries and enhanced manufacturing efficiencies. However, potential impediments involve supply chain vulnerabilities, particularly for critical raw materials like lithium and cobalt, and the necessity for a skilled workforce proficient in operating advanced manufacturing equipment. Addressing these challenges is vital for fully capitalizing on this dynamic market. The forecast period of 2025-2033 predicts sustained strong growth, potentially surpassing the global CAGR due to robust domestic demand and favorable policy frameworks within the United States.

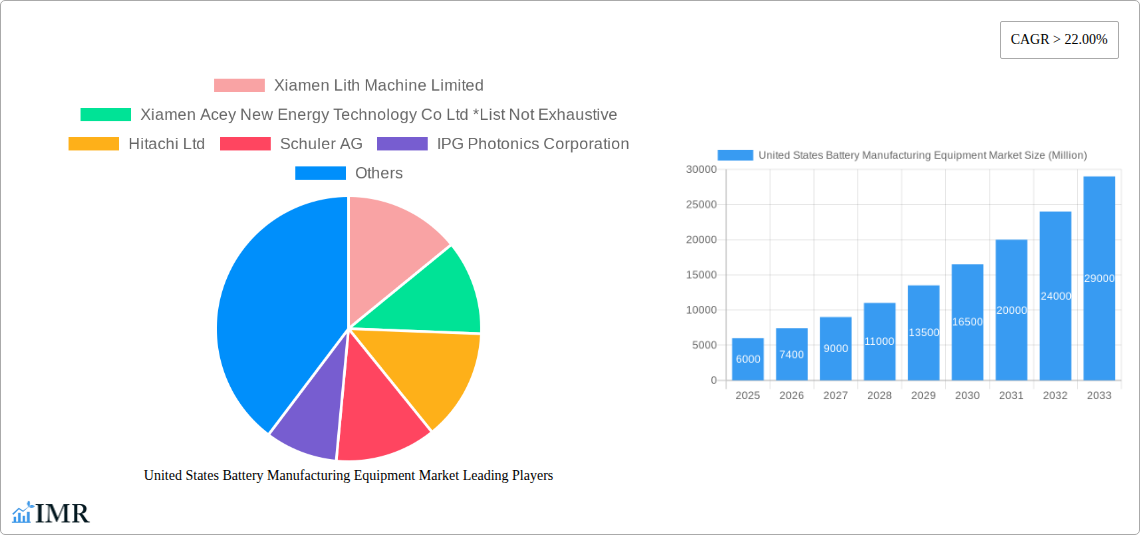

United States Battery Manufacturing Equipment Market Company Market Share

United States Battery Manufacturing Equipment Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Battery Manufacturing Equipment Market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report utilizes both quantitative and qualitative data to offer actionable insights for industry professionals and investors. The market is segmented by machine type (Coating & Dryer, Calendaring, Slitting, Mixing, Electrode Stacking, Assembly & Handling Machines, Formation & Testing Machines) and end-user (Automotive, Industrial, Other End Users). Key players analyzed include Xiamen Lith Machine Limited, Xiamen Acey New Energy Technology Co Ltd, Hitachi Ltd, Schuler AG, IPG Photonics Corporation, Durr AG, and Xiamen Tmax Battery Equipments Limited. The total market value in 2025 is estimated at xx Million units.

United States Battery Manufacturing Equipment Market Dynamics & Structure

The United States battery manufacturing equipment market is experiencing significant growth driven by the burgeoning electric vehicle (EV) industry and increasing demand for energy storage solutions. Market concentration is moderate, with a few large players and several smaller specialized companies. Technological innovation, particularly in automation and process efficiency, is a major driver. Stringent environmental regulations are also shaping the market, pushing adoption of cleaner and more sustainable technologies. Competitive pressures are high, with companies focusing on innovation and cost optimization to gain market share. Mergers and acquisitions (M&A) are prevalent, as larger companies seek to expand their market presence and technological capabilities.

- Market Concentration: Moderate (xx% held by top 5 players in 2025)

- Technological Innovation: Focus on automation, AI-powered process optimization, and sustainable manufacturing.

- Regulatory Framework: Stringent environmental regulations driving demand for efficient and clean equipment.

- Competitive Substitutes: Limited, due to specialized nature of equipment.

- End-User Demographics: Primarily automotive and industrial sectors, with growing contributions from other end-users.

- M&A Trends: Increasing consolidation in the market with xx M&A deals recorded between 2019-2024.

United States Battery Manufacturing Equipment Market Growth Trends & Insights

The US battery manufacturing equipment market exhibits robust growth, driven by increasing EV adoption and the expanding energy storage sector. The market size experienced significant growth from xx Million units in 2019 to an estimated xx Million units in 2025, and is projected to reach xx Million units by 2033. This represents a CAGR of xx% during the forecast period. The rising adoption of battery electric vehicles and hybrid electric vehicles is significantly impacting market growth, coupled with governmental incentives and investments in renewable energy infrastructure. Technological disruptions, including the emergence of solid-state batteries, are poised to further accelerate market expansion. Consumer behavior shifts, particularly towards environmentally friendly transportation, support market growth trends.

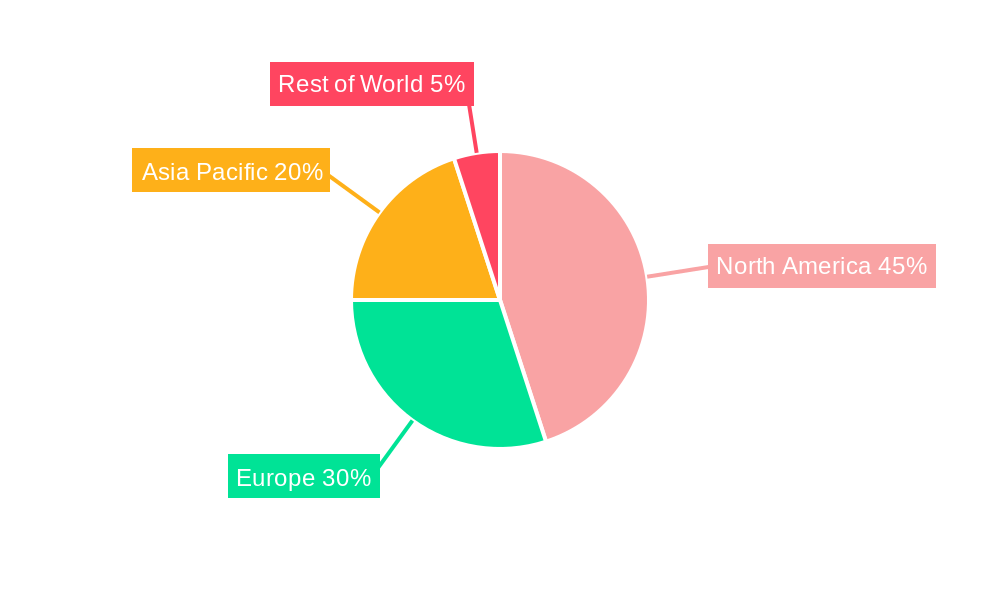

Dominant Regions, Countries, or Segments in United States Battery Manufacturing Equipment Market

The automotive segment dominates the US battery manufacturing equipment market, accounting for xx% of the total market share in 2025, driven by the rapid growth in EV production. California and Michigan are the leading states due to significant automotive manufacturing activity and supportive government policies. The Coating & Dryer, and Assembly & Handling Machines segments also exhibit strong growth, driven by the need for efficient and high-quality battery production.

- Key Drivers (Automotive Segment):

- Strong government incentives for EV adoption.

- Increasing investments in domestic EV manufacturing.

- Growing demand for electric vehicles.

- Key Drivers (Coating & Dryer Segment): Need for high-throughput, precise coating processes.

- Key Drivers (Assembly & Handling Segment): Demand for automated and efficient assembly lines.

United States Battery Manufacturing Equipment Market Product Landscape

The US battery manufacturing equipment market is characterized by ongoing product innovation, focusing on increasing efficiency, precision, and sustainability. Recent advancements include the integration of AI for real-time process optimization, the use of advanced materials for enhanced durability, and the adoption of modular designs for flexible manufacturing setups. These innovations enhance production output, reduce defects, and minimize energy consumption. Unique selling propositions include superior process control, reduced downtime, and optimized lifecycle costs.

Key Drivers, Barriers & Challenges in United States Battery Manufacturing Equipment Market

Key Drivers:

- Government support for domestic battery production via subsidies and tax credits.

- Growing demand for electric vehicles and renewable energy storage.

- Technological advancements leading to enhanced efficiency and cost reductions.

Key Challenges:

- Supply chain disruptions impacting component availability.

- High initial investment costs associated with advanced equipment.

- Intense competition from established international players. This is further complicated by xx% import share in 2025.

Emerging Opportunities in United States Battery Manufacturing Equipment Market

Emerging opportunities lie in the development of equipment for next-generation battery technologies, such as solid-state batteries and lithium-sulfur batteries. The growing demand for energy storage solutions in the renewable energy sector presents significant growth prospects. Furthermore, expansion into niche markets, such as microgrids and off-grid energy storage, offers untapped potential.

Growth Accelerators in the United States Battery Manufacturing Equipment Market Industry

Long-term growth is fueled by technological advancements in battery production, strategic collaborations between equipment manufacturers and battery producers, and expansion into new geographical markets. Furthermore, the increasing adoption of automation and Industry 4.0 technologies is crucial for enhancing efficiency and scalability. Government support for battery production and the growing awareness of environmental sustainability are other key growth accelerators.

Key Players Shaping the United States Battery Manufacturing Equipment Market Market

- Xiamen Lith Machine Limited

- Xiamen Acey New Energy Technology Co Ltd

- Hitachi Ltd

- Schuler AG

- IPG Photonics Corporation

- Durr AG

- Xiamen Tmax Battery Equipments Limited

Notable Milestones in United States Battery Manufacturing Equipment Market Sector

- December 2022: General Motors and LG Energy Solution invest an additional USD 275 million in their Tennessee battery plant, increasing production capacity by over 40%.

- November 2022: Hyundai Motor Group and SK On announce a USD 4-5 billion investment in a new EV battery manufacturing facility in Georgia, creating over 3,500 jobs.

In-Depth United States Battery Manufacturing Equipment Market Outlook

The US battery manufacturing equipment market is poised for sustained growth, driven by the continued expansion of the EV sector, increasing demand for energy storage, and ongoing technological advancements. Strategic partnerships and investments in innovative technologies will be crucial for capturing market share and maximizing future potential. The market presents attractive opportunities for both established players and new entrants, with a focus on efficiency, sustainability, and the adoption of next-generation battery technologies.

United States Battery Manufacturing Equipment Market Segmentation

-

1. Machine Type

- 1.1. Coating & Dryer

- 1.2. Calendaring

- 1.3. Slitting

- 1.4. Mixing

- 1.5. Electrode Stacking

- 1.6. Assembly & Handling Machines

- 1.7. Formation & Testing Machines

-

2. End User

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Other End Users

United States Battery Manufacturing Equipment Market Segmentation By Geography

- 1. United States

United States Battery Manufacturing Equipment Market Regional Market Share

Geographic Coverage of United States Battery Manufacturing Equipment Market

United States Battery Manufacturing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 27.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adopting of Alternative Clean Energy Sources (Ex

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Coating & Dryer

- 5.1.2. Calendaring

- 5.1.3. Slitting

- 5.1.4. Mixing

- 5.1.5. Electrode Stacking

- 5.1.6. Assembly & Handling Machines

- 5.1.7. Formation & Testing Machines

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Xiamen Lith Machine Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xiamen Acey New Energy Technology Co Ltd *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schuler AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IPG Photonics Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Durr AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Xiamen Tmax Battery Equipments Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Xiamen Lith Machine Limited

List of Figures

- Figure 1: United States Battery Manufacturing Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Battery Manufacturing Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 2: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Machine Type 2020 & 2033

- Table 3: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by End User 2020 & 2033

- Table 5: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 8: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Machine Type 2020 & 2033

- Table 9: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by End User 2020 & 2033

- Table 11: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Battery Manufacturing Equipment Market?

The projected CAGR is approximately 27.61%.

2. Which companies are prominent players in the United States Battery Manufacturing Equipment Market?

Key companies in the market include Xiamen Lith Machine Limited, Xiamen Acey New Energy Technology Co Ltd *List Not Exhaustive, Hitachi Ltd, Schuler AG, IPG Photonics Corporation, Durr AG, Xiamen Tmax Battery Equipments Limited.

3. What are the main segments of the United States Battery Manufacturing Equipment Market?

The market segments include Machine Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.77 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Automotive Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar. Hydro).

8. Can you provide examples of recent developments in the market?

In December 2022, General Motors and LG Energy Solution will spend an additional USD 275 million in their joint venture battery plant in Tennessee to increase production by more than 40%. The joint venture, Ultium Cells LLC, announced that the new investment is in addition to the USD 2.3 billion announced in April 2021 to build the 2.8 million-square-foot facility. Production at the plant is expected to begin in late 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Battery Manufacturing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Battery Manufacturing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Battery Manufacturing Equipment Market?

To stay informed about further developments, trends, and reports in the United States Battery Manufacturing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence