Key Insights

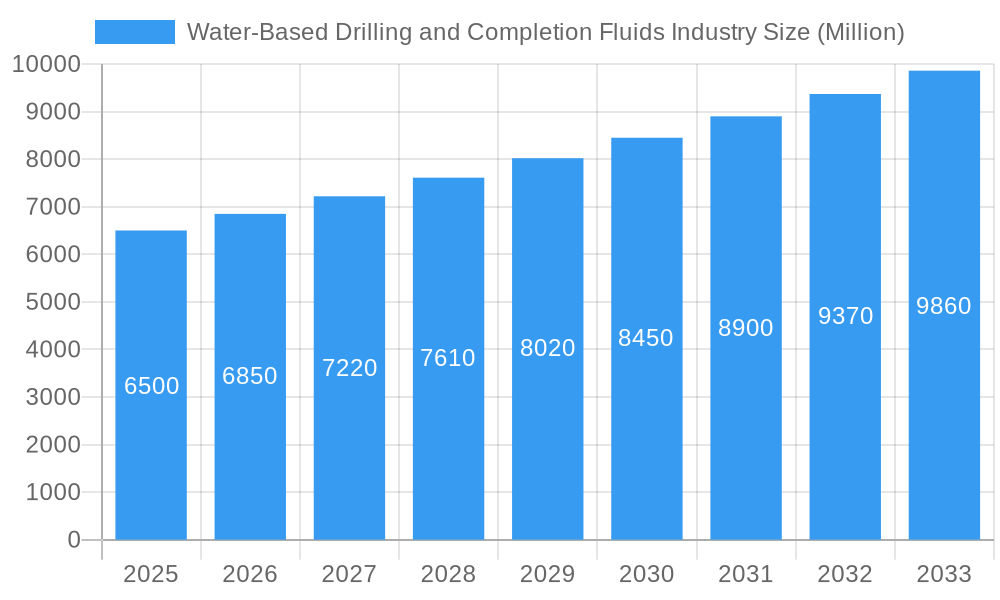

The global Water-Based Drilling and Completion Fluids market is projected for substantial growth. The market size was valued at $12.4 billion in 2024 and is expected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5% through 2033. This expansion is driven by increasing global energy demand and sustained upstream oil and gas exploration. Advancements in drilling technologies and the growing adoption of environmentally friendly solutions are key market enablers. Water-based fluids are increasingly favored due to their reduced environmental impact, aligning with stringent regulations and corporate sustainability goals. Critical growth drivers include the demand for enhanced wellbore stability, superior lubrication, and effective cuttings removal, all areas where water-based formulations excel. The development of specialized water-based fluid systems for challenging geological conditions, such as High Pressure High Temperature (HPHT) wells, further stimulates market expansion.

Water-Based Drilling and Completion Fluids Industry Market Size (In Billion)

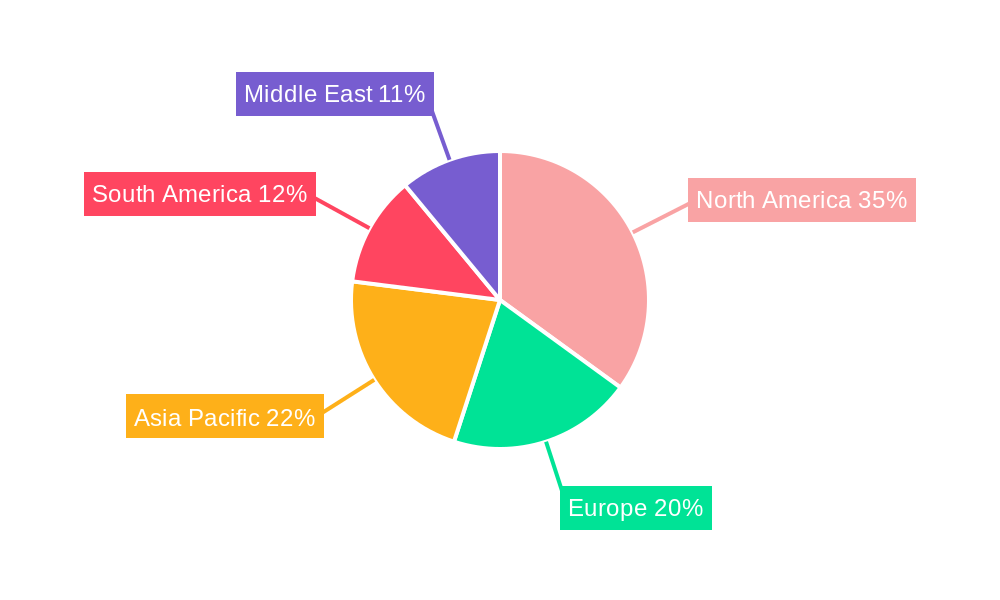

The market encompasses diverse applications, with onshore operations dominating due to prevalent land-based drilling. Offshore drilling also contributes significantly, driven by deepwater reserve exploration. Water-based systems are the preferred fluid type. Conventional wells represent a major segment, while increasing investment in HPHT exploration presents significant opportunities for advanced water-based fluid solutions. Industry players are actively investing in research and development to improve fluid performance and environmental profiles, fostering innovation. Geographically, North America is expected to lead, supported by extensive oil and gas reserves and advanced technological adoption. Asia Pacific and the Middle East are also poised for considerable growth, fueled by expanding exploration and infrastructure development.

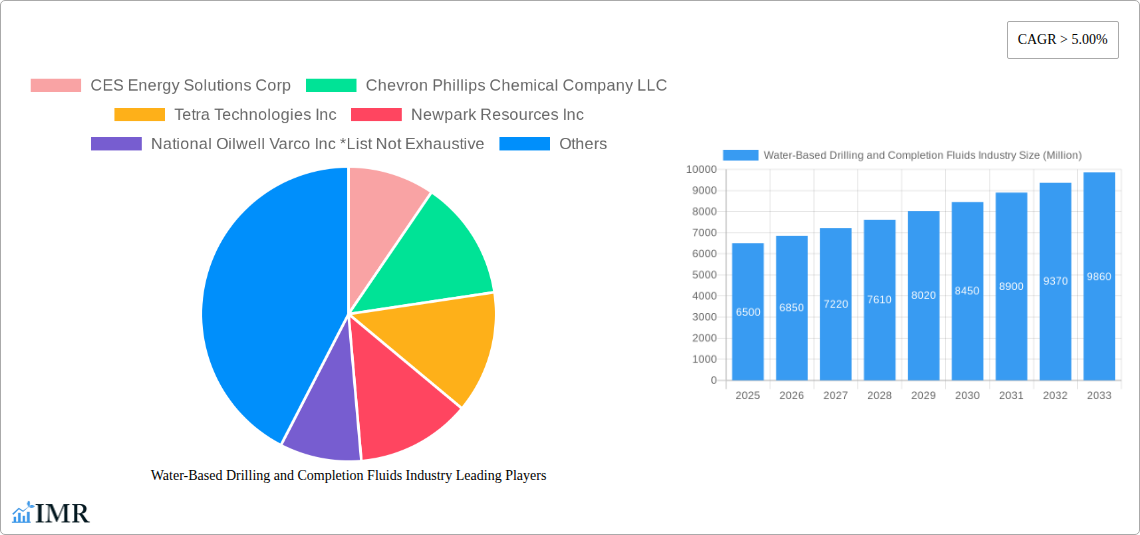

Water-Based Drilling and Completion Fluids Industry Company Market Share

Comprehensive Analysis of the Water-Based Drilling and Completion Fluids Market (2019-2033)

This in-depth report provides a critical analysis of the global Water-Based Drilling and Completion Fluids market, offering invaluable insights for industry professionals, investors, and stakeholders. Spanning a historical period from 2019 to 2024, with a base and estimated year of 2025 and a comprehensive forecast period extending to 2033, this study delves into market dynamics, growth trends, regional dominance, product landscapes, and key player strategies. With a focus on high-traffic keywords such as "drilling fluids," "completion fluids," "water-based drilling fluids," "oil and gas exploration," and "well construction," this report is optimized for maximum search engine visibility.

Water-Based Drilling and Completion Fluids Industry Market Dynamics & Structure

The Water-Based Drilling and Completion Fluids market exhibits a moderately concentrated structure, characterized by the strategic presence of major global oilfield service providers and specialized chemical companies. Technological innovation remains a primary driver, with a continuous push for environmentally friendly and high-performance fluid systems. Regulatory frameworks, particularly those focused on environmental impact and worker safety, significantly shape product development and market entry. Competitive product substitutes, primarily advanced oil-based and synthetic-based fluids, present a constant challenge, necessitating ongoing R&D for water-based alternatives. End-user demographics are increasingly influenced by a growing demand for sustainable practices and cost-effective solutions in both onshore and offshore operations. Mergers and acquisitions (M&A) activity plays a crucial role in market consolidation, with companies seeking to expand their service portfolios and geographic reach. In 2023, an estimated 15 significant M&A transactions were recorded, with a total deal value exceeding $2,500 Million. Barriers to innovation include the high cost of developing novel fluid formulations and the stringent testing and certification processes required for oilfield applications.

- Market Concentration: Moderately concentrated, with top 5 players holding an estimated 65% market share.

- Technological Innovation Drivers: Demand for eco-friendly fluids, enhanced wellbore stability, and improved drilling efficiency.

- Regulatory Frameworks: Strict environmental regulations (e.g., EPA, REACH) driving adoption of safer fluid alternatives.

- Competitive Product Substitutes: Advanced oil-based and synthetic-based fluids, alongside emerging bio-based alternatives.

- End-User Demographics: Growing preference for sustainable solutions from major E&P companies and independent operators.

- M&A Trends: Focus on acquiring specialized fluid technologies and expanding service capabilities.

- Innovation Barriers: High R&D costs, complex regulatory approvals, and long product qualification cycles.

Water-Based Drilling and Completion Fluids Industry Growth Trends & Insights

The global Water-Based Drilling and Completion Fluids market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.8% between 2025 and 2033. This expansion is fueled by the increasing global demand for energy, leading to higher exploration and production (E&P) activities. The shift towards more environmentally sustainable drilling practices is a significant catalyst, as water-based fluids generally possess a lower environmental footprint compared to their oil-based counterparts. Advancements in fluid chemistry have led to the development of high-performance water-based systems that can rival the efficacy of traditional fluids in challenging well conditions, including high pressure and high temperature (HPHT) environments. Adoption rates for advanced water-based fluids are steadily increasing as operators recognize their cost-effectiveness and environmental benefits. Technological disruptions, such as the integration of nanotechnology for enhanced fluid properties and the development of smart fluids that can adapt to changing downhole conditions, are expected to further accelerate market penetration. Consumer behavior shifts are evident, with a growing emphasis on lifecycle assessment and a preference for service providers demonstrating strong ESG (Environmental, Social, and Governance) commitments. The market size for water-based drilling and completion fluids is estimated to reach approximately $18,500 Million by 2033, up from an estimated $10,800 Million in 2025. This growth is also influenced by the increasing complexity of reservoirs and the need for specialized fluid solutions to ensure successful well construction and production optimization. The market penetration of water-based fluids in total drilling fluid applications is expected to rise from an estimated 55% in 2025 to 62% by 2033.

Dominant Regions, Countries, or Segments in Water-Based Drilling and Completion Fluids Industry

The Onshore Application segment is projected to be the dominant force driving growth in the global Water-Based Drilling and Completion Fluids market. This dominance is primarily attributed to the vast number of onshore wells drilled annually, particularly in regions with significant unconventional resource plays and mature conventional fields requiring enhanced recovery techniques. North America, led by the United States and Canada, is expected to remain the largest regional market due to its extensive shale oil and gas production, which heavily relies on water-based drilling fluids for hydraulic fracturing and horizontal drilling operations. Economic policies supporting domestic energy production and substantial investments in infrastructure for exploration and transportation further bolster this segment's growth.

- Dominant Segment: Onshore Application.

- Key Drivers: High volume of onshore drilling, shale oil & gas production, cost-effectiveness, and environmental regulations favoring water-based systems.

- Market Share (Onshore): Estimated to hold approximately 70% of the total market in 2025.

- Growth Potential: Sustained growth driven by continued E&P activities and technological advancements in onshore drilling techniques.

Another significant contributor to market growth is the Water-based Fluid Type. This segment's dominance stems from its inherent environmental advantages and cost-competitiveness compared to oil-based and other specialized fluids. As regulatory pressures concerning fluid disposal and environmental impact intensify globally, water-based formulations are increasingly favored by operators.

- Dominant Fluid Type: Water-based.

- Key Drivers: Environmental compliance, lower cost of raw materials, biodegradability, and ongoing innovation in performance additives.

- Market Share (Water-based): Expected to represent around 60% of the total fluid volume in 2025.

- Growth Potential: Strong growth driven by increasing adoption in conventional and HPHT wells.

The Conventional Well Type segment also plays a crucial role, representing the majority of drilling operations worldwide. While High Pressure High Temperature (HPHT) wells demand highly specialized fluids, the sheer volume of conventional wells ensures a consistent demand for reliable and cost-effective water-based drilling and completion fluids.

- Significant Well Type: Conventional.

- Key Drivers: High volume of global drilling, established operational procedures, and availability of cost-effective water-based solutions.

- Market Share (Conventional): Estimated to constitute over 75% of all well types.

Water-Based Drilling and Completion Fluids Industry Product Landscape

The product landscape for water-based drilling and completion fluids is characterized by continuous innovation aimed at enhancing performance, environmental sustainability, and cost-efficiency. Key product innovations include the development of advanced clay inhibitors, emulsifiers, and viscosifiers that improve wellbore stability and reduce fluid loss in challenging geological formations. High-performance additives are being integrated to create fluids suitable for High Pressure High Temperature (HPHT) applications, previously the domain of oil-based fluids. Unique selling propositions often revolve around reduced environmental impact, improved rheological properties, and enhanced shale inhibition. Technological advancements are also focusing on formulating fluids with lower toxicity and greater biodegradability.

Key Drivers, Barriers & Challenges in Water-Based Drilling and Completion Fluids Industry

Key Drivers:

- Environmental Regulations: Increasing global emphasis on sustainable drilling practices and stricter environmental regulations are compelling operators to adopt water-based fluids.

- Cost-Effectiveness: Water-based fluids generally offer a lower cost of procurement and disposal compared to oil-based or synthetic-based fluids.

- Technological Advancements: Ongoing R&D leading to improved performance and applicability of water-based fluids in diverse well conditions, including HPHT environments.

- Growing Energy Demand: The persistent global demand for oil and gas necessitates continuous E&P activities, driving the demand for drilling and completion fluids.

Barriers & Challenges:

- Performance Limitations: In certain extreme downhole conditions, traditional water-based fluids may still exhibit performance limitations compared to their oil-based counterparts, requiring specialized formulations.

- Supply Chain Volatility: Fluctuations in the availability and pricing of raw materials for fluid additives can impact production costs and lead times.

- Regulatory Hurdles: Navigating complex and evolving regulatory frameworks across different regions can be challenging for fluid manufacturers and service providers.

- Competition: Intense competition from established oil-based and emerging synthetic-based fluid providers.

Emerging Opportunities in Water-Based Drilling and Completion Fluids Industry

Emerging opportunities lie in the development of novel bio-based and biodegradable drilling fluid components, catering to the growing demand for ultra-low environmental impact solutions. Untapped markets in developing regions with expanding E&P activities present significant growth potential. The application of nanotechnology to enhance fluid properties, such as improved lubrication and cuttings transport, offers a new frontier. Furthermore, the increasing focus on water management and reuse in the oil and gas industry creates opportunities for specialized water treatment and fluid recycling services, closely linked to water-based fluid operations. The development of smart fluids that can dynamically adjust their properties based on real-time downhole conditions also represents a promising avenue.

Growth Accelerators in the Water-Based Drilling and Completion Fluids Industry Industry

Long-term growth in the Water-Based Drilling and Completion Fluids industry will be significantly accelerated by breakthroughs in nanotechnology for superior fluid performance and reduced environmental impact. Strategic partnerships between fluid manufacturers, E&P companies, and technology providers will foster collaborative innovation and faster adoption of new solutions. Market expansion strategies, including penetration into emerging E&P regions and offering integrated fluid management services, will be crucial. The continuous development of cost-effective and high-performance additives for water-based systems, particularly for challenging HPHT and unconventional well applications, will act as a major growth catalyst. Investment in R&D focused on circular economy principles and waste minimization will also drive sustainable growth.

Key Players Shaping the Water-Based Drilling and Completion Fluids Industry Market

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International PLC

- National Oilwell Varco Inc

- Tetra Technologies Inc

- Newpark Resources Inc

- Chevron Phillips Chemical Company LLC

- CES Energy Solutions Corp

Notable Milestones in Water-Based Drilling and Completion Fluids Industry Sector

- November 2021: Danish offshore drilling contractor Maersk Drilling announced a definitive agreement to merge with US rival Noble Corporation in a primarily all-stock transaction, creating a combined company with a fleet of 20 floaters and 19 jack-up rigs. This consolidation impacts the overall demand and operational landscape for drilling fluids.

- October 2021: CWC Energy Services Corp. announced that its wholly-owned subsidiary, CWC Energy Services (USA) Corp., entered a definitive agreement to acquire 10 active high-spec triple drilling rigs and all related and ancillary equipment and inventory from a privately held contract drilling company based in Casper, Wyoming, United States. This expansion of drilling capacity directly influences the demand for drilling fluids.

In-Depth Water-Based Drilling and Completion Fluids Industry Market Outlook

The future market potential for water-based drilling and completion fluids appears exceptionally strong, driven by an ongoing global energy demand and an unwavering commitment to environmental sustainability. Strategic opportunities abound in regions with nascent E&P activities and in the development of advanced fluid formulations capable of tackling increasingly complex wellbore challenges, including ultra-deepwater and unconventional resource extraction. The emphasis on ESG compliance by major oil and gas operators will continue to propel the adoption of eco-friendly drilling fluid systems, creating fertile ground for innovation and market expansion. Companies focusing on the development of high-performance, cost-effective, and environmentally sound water-based fluid solutions are well-positioned for significant growth and market leadership in the coming decade.

Water-Based Drilling and Completion Fluids Industry Segmentation

-

1. Application

- 1.1. Onshore

- 1.2. Offshore

-

2. Fluid Type

- 2.1. Water-based

- 2.2. Oil-based

- 2.3. Other Fluid Types

-

3. Well Type

- 3.1. Conventional

- 3.2. High Pressure High Temperature (HPHT)

Water-Based Drilling and Completion Fluids Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East

Water-Based Drilling and Completion Fluids Industry Regional Market Share

Geographic Coverage of Water-Based Drilling and Completion Fluids Industry

Water-Based Drilling and Completion Fluids Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Recovery in the Oil and Gas and Mining Industries4.; Surge in the Construction Industry

- 3.3. Market Restrains

- 3.3.1. 4.; High Maintenance and Operation Costs of Submersible Pump Restrain the Market

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Water-Based Drilling and Completion Fluids Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Fluid Type

- 5.2.1. Water-based

- 5.2.2. Oil-based

- 5.2.3. Other Fluid Types

- 5.3. Market Analysis, Insights and Forecast - by Well Type

- 5.3.1. Conventional

- 5.3.2. High Pressure High Temperature (HPHT)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Water-Based Drilling and Completion Fluids Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Fluid Type

- 6.2.1. Water-based

- 6.2.2. Oil-based

- 6.2.3. Other Fluid Types

- 6.3. Market Analysis, Insights and Forecast - by Well Type

- 6.3.1. Conventional

- 6.3.2. High Pressure High Temperature (HPHT)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Water-Based Drilling and Completion Fluids Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Fluid Type

- 7.2.1. Water-based

- 7.2.2. Oil-based

- 7.2.3. Other Fluid Types

- 7.3. Market Analysis, Insights and Forecast - by Well Type

- 7.3.1. Conventional

- 7.3.2. High Pressure High Temperature (HPHT)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Water-Based Drilling and Completion Fluids Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Fluid Type

- 8.2.1. Water-based

- 8.2.2. Oil-based

- 8.2.3. Other Fluid Types

- 8.3. Market Analysis, Insights and Forecast - by Well Type

- 8.3.1. Conventional

- 8.3.2. High Pressure High Temperature (HPHT)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Water-Based Drilling and Completion Fluids Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Fluid Type

- 9.2.1. Water-based

- 9.2.2. Oil-based

- 9.2.3. Other Fluid Types

- 9.3. Market Analysis, Insights and Forecast - by Well Type

- 9.3.1. Conventional

- 9.3.2. High Pressure High Temperature (HPHT)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East Water-Based Drilling and Completion Fluids Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.2. Market Analysis, Insights and Forecast - by Fluid Type

- 10.2.1. Water-based

- 10.2.2. Oil-based

- 10.2.3. Other Fluid Types

- 10.3. Market Analysis, Insights and Forecast - by Well Type

- 10.3.1. Conventional

- 10.3.2. High Pressure High Temperature (HPHT)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CES Energy Solutions Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Chevron Phillips Chemical Company LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tetra Technologies Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Newpark Resources Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 National Oilwell Varco Inc *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Weatherford International PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Baker Hughes Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Halliburton Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schlumberger Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 CES Energy Solutions Corp

List of Figures

- Figure 1: Global Water-Based Drilling and Completion Fluids Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Fluid Type 2025 & 2033

- Figure 5: North America Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Fluid Type 2025 & 2033

- Figure 6: North America Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Well Type 2025 & 2033

- Figure 7: North America Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Well Type 2025 & 2033

- Figure 8: North America Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Fluid Type 2025 & 2033

- Figure 13: Europe Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Fluid Type 2025 & 2033

- Figure 14: Europe Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Well Type 2025 & 2033

- Figure 15: Europe Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Well Type 2025 & 2033

- Figure 16: Europe Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Application 2025 & 2033

- Figure 19: Asia Pacific Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Asia Pacific Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Fluid Type 2025 & 2033

- Figure 21: Asia Pacific Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Fluid Type 2025 & 2033

- Figure 22: Asia Pacific Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Well Type 2025 & 2033

- Figure 23: Asia Pacific Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Well Type 2025 & 2033

- Figure 24: Asia Pacific Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Application 2025 & 2033

- Figure 27: South America Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: South America Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Fluid Type 2025 & 2033

- Figure 29: South America Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Fluid Type 2025 & 2033

- Figure 30: South America Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Well Type 2025 & 2033

- Figure 31: South America Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Well Type 2025 & 2033

- Figure 32: South America Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Application 2025 & 2033

- Figure 35: Middle East Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Application 2025 & 2033

- Figure 36: Middle East Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Fluid Type 2025 & 2033

- Figure 37: Middle East Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Fluid Type 2025 & 2033

- Figure 38: Middle East Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Well Type 2025 & 2033

- Figure 39: Middle East Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Well Type 2025 & 2033

- Figure 40: Middle East Water-Based Drilling and Completion Fluids Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East Water-Based Drilling and Completion Fluids Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Fluid Type 2020 & 2033

- Table 3: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Well Type 2020 & 2033

- Table 4: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Fluid Type 2020 & 2033

- Table 7: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Well Type 2020 & 2033

- Table 8: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Fluid Type 2020 & 2033

- Table 11: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Well Type 2020 & 2033

- Table 12: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Fluid Type 2020 & 2033

- Table 15: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Well Type 2020 & 2033

- Table 16: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Fluid Type 2020 & 2033

- Table 19: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Well Type 2020 & 2033

- Table 20: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Fluid Type 2020 & 2033

- Table 23: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Well Type 2020 & 2033

- Table 24: Global Water-Based Drilling and Completion Fluids Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Water-Based Drilling and Completion Fluids Industry?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Water-Based Drilling and Completion Fluids Industry?

Key companies in the market include CES Energy Solutions Corp, Chevron Phillips Chemical Company LLC, Tetra Technologies Inc, Newpark Resources Inc, National Oilwell Varco Inc *List Not Exhaustive, Weatherford International PLC, Baker Hughes Company, Halliburton Company, Schlumberger Limited.

3. What are the main segments of the Water-Based Drilling and Completion Fluids Industry?

The market segments include Application, Fluid Type, Well Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.4 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Recovery in the Oil and Gas and Mining Industries4.; Surge in the Construction Industry.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Maintenance and Operation Costs of Submersible Pump Restrain the Market.

8. Can you provide examples of recent developments in the market?

In November 2021, Danish offshore drilling contractor Maersk Drilling announced that it had entered a definitive agreement to merge with its US rival Noble Corporation in a primarily all-stock transaction, which will result in the creation of a combined company with a fleet of 20 floaters and 19 jack-up rigs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Water-Based Drilling and Completion Fluids Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Water-Based Drilling and Completion Fluids Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Water-Based Drilling and Completion Fluids Industry?

To stay informed about further developments, trends, and reports in the Water-Based Drilling and Completion Fluids Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence