Key Insights

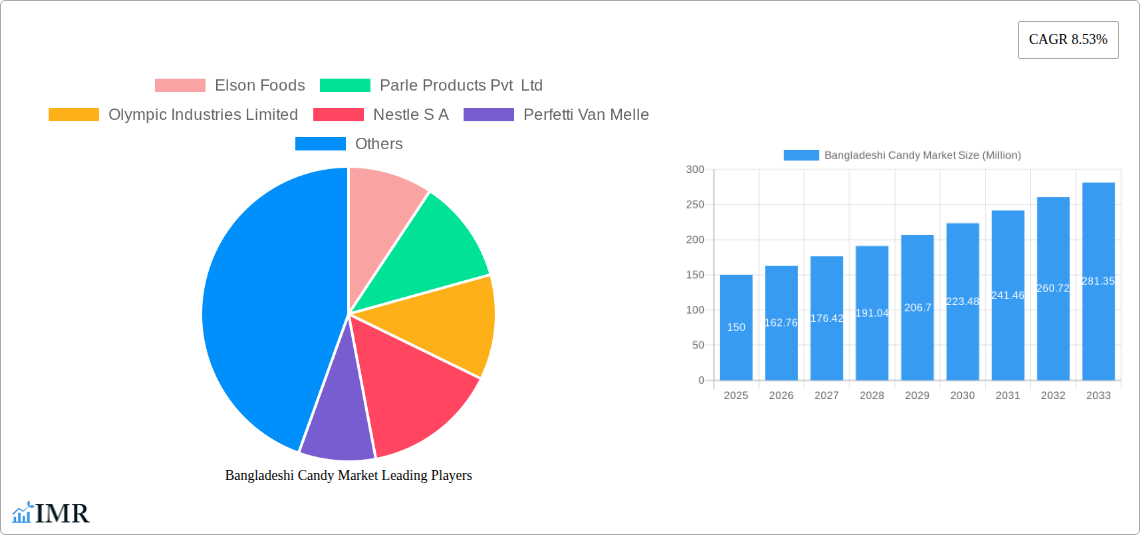

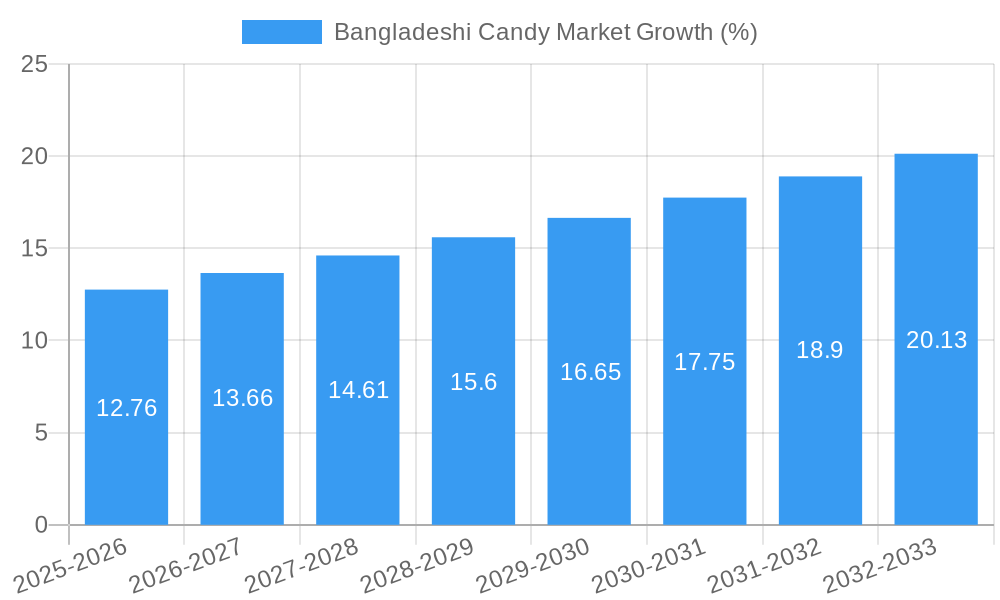

The Bangladeshi candy market, valued at approximately $X million in 2025 (assuming a logical extrapolation from the provided CAGR and market size data), is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.53% from 2025 to 2033. This growth is fueled by several key drivers. Rising disposable incomes among the burgeoning middle class are increasing consumer spending on discretionary items like confectionery. A young and growing population with a penchant for sweet treats further contributes to market expansion. The increasing availability of diverse candy types, including fruit-based, coffee-flavored, and milk-based candies, through various distribution channels such as hypermarkets, convenience stores, and the rapidly expanding online retail sector, caters to evolving consumer preferences and boosts market penetration. However, factors like fluctuating raw material prices and intense competition among established players like Elson Foods, Parle Products Pvt Ltd, and Nestle S.A., along with regional players such as ACI Foods Limited and PRAN RFL Group, present challenges to consistent market growth. The market segmentation reveals a strong preference for certain product types and distribution channels; understanding these preferences is crucial for strategic market entry and success.

The forecast period (2025-2033) suggests a significant expansion of the market, driven primarily by the factors mentioned above. Growth in the online retail segment is expected to outpace traditional channels, reflecting broader shifts in consumer behavior. The competitive landscape is characterized by both established multinational companies and local players, leading to innovative product launches and aggressive marketing strategies to capture market share. Successful players will likely focus on product diversification, strategic partnerships, and robust supply chain management to navigate the challenges and capitalize on the growth opportunities presented by the dynamic Bangladeshi candy market. Further research into specific consumer preferences and regional variations will provide a more granular understanding of the market dynamics.

Bangladeshi Candy Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Bangladeshi candy market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and anyone seeking to understand this dynamic market. The report analyzes the parent market (confectionery) and the child market (candy specifically) to provide a nuanced perspective. Market values are presented in million units.

Bangladeshi Candy Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends shaping the Bangladeshi candy market. We delve into market concentration, identifying key players and their market share percentages. We examine the impact of technological innovation, exploring both drivers and barriers to adoption. The regulatory framework impacting the industry is also examined, including any relevant food safety standards or import/export regulations. Furthermore, the report explores the presence of substitute products and their competitive impact, along with an analysis of end-user demographics and their evolving preferences. Finally, we assess the landscape of mergers and acquisitions (M&A) activity within the sector, analyzing deal volumes and their influence on market structure.

- Market Concentration: The market is characterized by a mix of both large multinational companies and smaller domestic players. Market share data for key players (e.g., Nestle SA, Perfetti Van Melle) will be provided. xx% of the market is dominated by the top 5 players.

- Technological Innovation: Technological advancements in production, packaging, and distribution are driving efficiency and product diversification. However, limited access to advanced technology and high implementation costs pose significant barriers.

- Regulatory Framework: Compliance with food safety regulations and labeling requirements significantly impacts market dynamics.

- Competitive Substitutes: The market faces competition from other confectionery products, including chocolates and biscuits.

- End-User Demographics: The growing young population and rising disposable incomes are driving market growth.

- M&A Activity: xx M&A deals were recorded in the historical period (2019-2024), primarily involving smaller companies being acquired by larger players.

Bangladeshi Candy Market Growth Trends & Insights

This section provides a detailed analysis of the Bangladeshi candy market's growth trajectory, leveraging quantitative data and qualitative insights to paint a comprehensive picture. We explore the evolution of market size over the historical and forecast periods, identifying key growth drivers and decelerating factors. Adoption rates for various candy types are analyzed, exploring consumer preferences and shifts in demand. The impact of technological disruptions, such as automation in production or the emergence of e-commerce, is assessed. Finally, the report investigates changes in consumer behavior, including factors influencing purchasing decisions and brand loyalty.

- Market Size Evolution: The market size grew from xx million units in 2019 to xx million units in 2024, exhibiting a CAGR of xx%. The forecast period (2025-2033) projects a CAGR of xx%.

- Adoption Rates: Adoption of specific candy types (fruit, milk, coffee, etc.) is detailed, with analysis of market penetration for each.

- Technological Disruptions: The adoption of automated manufacturing processes is increasing efficiency and reducing production costs.

- Consumer Behavior Shifts: Changing consumer preferences towards healthier options and premium brands are influencing market dynamics.

Dominant Regions, Countries, or Segments in Bangladeshi Candy Market

This section identifies the leading regions, countries, or segments within the Bangladeshi candy market, providing a granular understanding of market performance across geographical areas and product categories. We determine the dominant segment based on product type (fruit, coffee, milk, other) and distribution channel (hypermarkets/supermarkets, convenience/grocery stores, online retail stores, other). We analyze factors contributing to their dominance, such as economic policies, infrastructure development, and consumer preferences. The growth potential of each dominant segment is also evaluated.

- Dominant Product Type: The "Other Product Types" segment (e.g., hard candies, lollipops) currently holds the largest market share.

- Dominant Distribution Channel: Convenience/Grocery Stores currently dominate the distribution channel landscape.

- Key Drivers: Factors such as growing urbanization, increasing disposable incomes, and improved retail infrastructure are driving market growth in major cities.

Bangladeshi Candy Market Product Landscape

This section provides an overview of the product landscape, encompassing product innovations, applications, and key performance indicators. We describe the unique selling propositions of leading candy brands, highlighting technological advancements employed to enhance product quality and appeal.

The market offers a diverse range of candies, including fruit-flavored candies, milk candies, coffee-flavored candies, and various other types. Recent innovations focus on healthier options, unique flavors, and improved packaging designs to appeal to diverse consumer preferences. The incorporation of natural ingredients and the reduction of artificial additives are also emerging trends.

Key Drivers, Barriers & Challenges in Bangladeshi Candy Market

This section identifies the key factors driving the growth of the Bangladeshi candy market and analyzes significant challenges and restraints.

Key Drivers:

- Growing disposable incomes and rising consumer spending on discretionary items.

- Increasing urbanization and the expansion of retail channels.

- The popularity of candies as a convenient and affordable treat.

Key Challenges and Restraints:

- Intense competition among numerous domestic and international brands.

- Fluctuations in raw material prices, impacting production costs.

- The presence of counterfeit products, which undermines brand reputation and market integrity.

- Stringent food safety regulations which necessitate compliance.

Emerging Opportunities in Bangladeshi Candy Market

This section highlights emerging opportunities for growth within the Bangladeshi candy market.

- Expansion into Rural Markets: Significant untapped potential exists in rural areas with growing consumer base.

- Premiumization: There is growing demand for premium and niche candy products.

- Online Sales Channels: The increasing popularity of e-commerce presents opportunities for online sales channels.

Growth Accelerators in the Bangladeshi Candy Market Industry

Long-term growth in the Bangladeshi candy market will be driven by several factors. Technological advancements in production and packaging will enhance efficiency and product quality. Strategic partnerships between domestic and international brands will foster innovation and market penetration. Continued expansion into underserved markets, both geographically and in terms of product offerings, will create significant growth opportunities.

Key Players Shaping the Bangladeshi Candy Market Market

- Elson Foods

- Parle Products Pvt Ltd

- Olympic Industries Limited

- Nestle S.A.

- Perfetti Van Melle

- ACI Foods Limited

- Banga Millers limited

- Rangpur Dairy and Food Products Ltd

- PRAN Rfl Group

Notable Milestones in Bangladeshi Candy Market Sector

- September 2022: Olympic Industries imported machinery to boost production capacity, increasing corrugated carton production by 102 million pieces annually.

- August 2021: ACI Foods Limited launched its new "Baker's Treat Butter cookies," expanding its premium biscuit and bakery line.

In-Depth Bangladeshi Candy Market Market Outlook

The future of the Bangladeshi candy market appears bright. Continued economic growth, urbanization, and the expansion of organized retail will drive market expansion. The strategic adaptation of companies to evolving consumer preferences, including increased focus on health and premium products, will be crucial for long-term success. The market presents significant opportunities for both established players and new entrants to capitalize on.

Bangladeshi Candy Market Segmentation

-

1. Product Type

- 1.1. Fruit

- 1.2. Coffee

- 1.3. Milk

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Bangladeshi Candy Market Segmentation By Geography

- 1. Bangladesh

Bangladeshi Candy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Growing Consumer Inclination Towards Sugar-free Candies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bangladeshi Candy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fruit

- 5.1.2. Coffee

- 5.1.3. Milk

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Elson Foods

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Parle Products Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Olympic Industries Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nestle S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Perfetti Van Melle

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ACI Foods Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Banga Millers limited*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rangpur Dairy and Food Products Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PRAN Rfl Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Elson Foods

List of Figures

- Figure 1: Bangladeshi Candy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bangladeshi Candy Market Share (%) by Company 2024

List of Tables

- Table 1: Bangladeshi Candy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bangladeshi Candy Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Bangladeshi Candy Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Bangladeshi Candy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Bangladeshi Candy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Bangladeshi Candy Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Bangladeshi Candy Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Bangladeshi Candy Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bangladeshi Candy Market?

The projected CAGR is approximately 8.53%.

2. Which companies are prominent players in the Bangladeshi Candy Market?

Key companies in the market include Elson Foods, Parle Products Pvt Ltd, Olympic Industries Limited, Nestle S A, Perfetti Van Melle, ACI Foods Limited, Banga Millers limited*List Not Exhaustive, Rangpur Dairy and Food Products Ltd, PRAN Rfl Group.

3. What are the main segments of the Bangladeshi Candy Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Growing Consumer Inclination Towards Sugar-free Candies.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

September 2022: Olympic Industries decided to import machinery to boost its production capacity as the demand for its candy products is rising. The company will import production line accessories to increase the production of corrugated cartons of various sizes by 102 million pieces a year. The company claimed to have installed a new line of products that includes a slitter, stacker, overhead crane, trolley, and other machinery that facilitates increasing production capacity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bangladeshi Candy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bangladeshi Candy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bangladeshi Candy Market?

To stay informed about further developments, trends, and reports in the Bangladeshi Candy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence