Key Insights

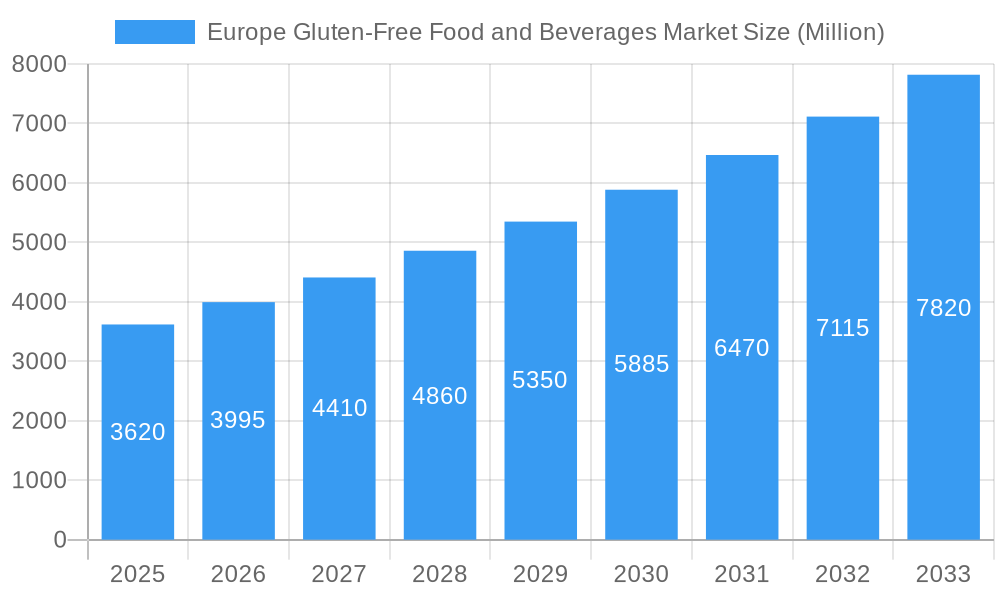

The European gluten-free food and beverages market is poised for significant expansion, projected to reach a substantial market size of approximately USD 3.62 billion in 2025. This growth is fueled by an impressive compound annual growth rate (CAGR) of 10.33%, indicating robust demand and a dynamic market landscape. The rising prevalence of celiac disease and gluten intolerance, coupled with an increasing consumer awareness regarding healthier dietary choices, are the primary drivers propelling this market forward. Consumers are actively seeking out gluten-free alternatives not only for medical necessity but also for perceived health benefits, leading to a broader adoption across various product categories. Key segments such as bakery products, dairy/dairy substitutes, and meats/meat substitutes are experiencing strong traction, reflecting a growing demand for diverse and accessible gluten-free options. Furthermore, evolving consumer lifestyles and the convenience offered by online retail channels are significantly influencing purchasing patterns, making gluten-free products more accessible than ever before.

Europe Gluten-Free Food and Beverages Market Market Size (In Billion)

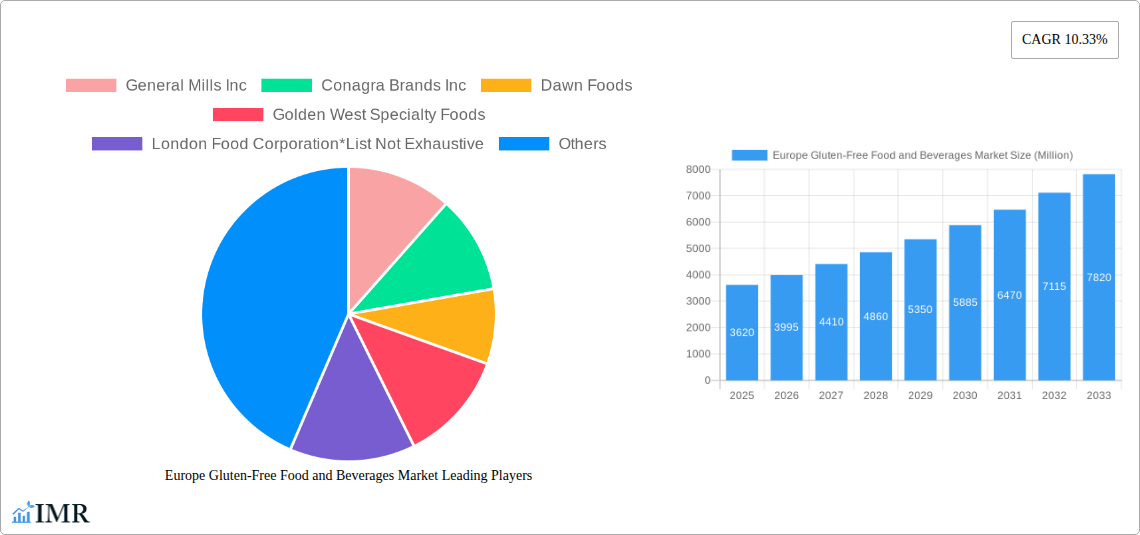

The market's trajectory is further shaped by emerging trends like the innovation in gluten-free product formulations, offering improved taste and texture, and the expansion of specialty stores catering specifically to dietary needs. While the market is experiencing strong growth, certain factors like the higher cost of gluten-free ingredients and potential consumer skepticism regarding taste and quality can act as restraints. However, the proactive efforts by leading companies such as General Mills Inc., Conagra Brands Inc., and Kraft Heinz Company in developing and marketing a wide array of gluten-free offerings, alongside specialized players like Dr. Schär AG / SPA and Amy's Kitchen Inc., are mitigating these challenges. The European region, with its established healthcare systems and informed consumer base, particularly in countries like the United Kingdom, Germany, and France, is a crucial hub for this market's development, indicating sustained opportunities for both established and new entrants.

Europe Gluten-Free Food and Beverages Market Company Market Share

Europe Gluten-Free Food and Beverages Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the Europe Gluten-Free Food and Beverages Market, encompassing a comprehensive study from 2019 to 2033. With the base year set for 2025, the report offers critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and the strategic moves of leading industry players. Analyzing the market by product type and distribution channel, this report is an essential resource for manufacturers, suppliers, distributors, investors, and industry stakeholders seeking to navigate and capitalize on the burgeoning European gluten-free sector.

Key Highlights:

- Study Period: 2019–2033

- Base Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

- Values Presented in: Million Units

Europe Gluten-Free Food and Beverages Market Market Dynamics & Structure

The Europe gluten-free food and beverages market is characterized by a moderate to high degree of market concentration, with established players holding significant shares. Technological innovation is a primary driver, focusing on improving taste, texture, and nutritional value to rival conventional products. Regulatory frameworks, particularly those concerning food labeling and allergen declarations, play a crucial role in shaping market entry and consumer trust. Competitive product substitutes are evolving, with a growing array of naturally gluten-free options and advancements in alternative grain research. End-user demographics are increasingly diverse, encompassing not only individuals with celiac disease but also those opting for gluten-free diets for perceived health benefits or lifestyle choices. Mergers and acquisitions (M&A) trends indicate strategic consolidation, with larger companies acquiring smaller, innovative brands to expand their product portfolios and market reach.

- Market Concentration: Moderate to High, with key players like Dr. Schär AG / SPA and General Mills Inc. leading the segment.

- Technological Innovation Drivers: Development of novel gluten-free flours, advanced processing techniques for improved texture, and fortification with essential nutrients.

- Regulatory Frameworks: Strict EU regulations on gluten-free labeling and allergen management are crucial for market compliance.

- Competitive Product Substitutes: Increasing availability of naturally gluten-free staples (rice, corn, quinoa) and expansion of plant-based protein alternatives.

- End-User Demographics: Growing demand from health-conscious consumers, individuals with non-celiac gluten sensitivity, and those with celiac disease.

- M&A Trends: Strategic acquisitions aimed at portfolio expansion and market consolidation are on the rise. For instance, Dawn Foods' acquisition of JABEX in March 2021 signals strategic supply chain strengthening.

Europe Gluten-Free Food and Beverages Market Growth Trends & Insights

The Europe gluten-free food and beverages market is experiencing robust growth, fueled by a confluence of factors including rising celiac disease diagnoses, increasing consumer awareness regarding gluten intolerance, and a broader trend towards healthier eating habits. The market size is projected to expand significantly throughout the forecast period, driven by innovative product development and wider availability across diverse retail channels. Adoption rates for gluten-free products are escalating, moving beyond niche markets to become mainstream consumer choices. Technological disruptions are continuously improving the palatability and functionality of gluten-free alternatives, addressing historical concerns about taste and texture. Consumer behavior shifts are evident, with a growing segment actively seeking gluten-free options even without a diagnosed condition, influenced by perceived health benefits, dietary trends, and increasing availability of appealing products. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. Market penetration is expected to deepen, with gluten-free products becoming a staple in households across the continent.

Dominant Regions, Countries, or Segments in Europe Gluten-Free Food and Beverages Market

The Bakery Products segment within the Europe Gluten-Free Food and Beverages Market is a dominant force, exhibiting substantial growth and market share. This dominance is attributed to the widespread consumer preference for traditional bakery items and the increasing demand for gluten-free alternatives that can replicate the taste and texture of conventional bread, cakes, and pastries. Several key drivers contribute to this segment's leadership.

- Consumer Preferences: Bakery products represent a significant portion of daily diets across Europe. The availability of palatable gluten-free versions directly addresses a vast consumer base seeking to avoid gluten without compromising on their dietary habits.

- Innovation in Gluten-Free Baking: Significant advancements in gluten-free flour blends, emulsifiers, and leavening agents have led to improved product quality. Companies are investing heavily in R&D to enhance the crumb structure, shelf life, and overall sensory experience of gluten-free baked goods.

- Product Variety: The gluten-free bakery segment offers an extensive range of products, from everyday bread loaves and rolls to artisanal cakes, cookies, and pizza bases, catering to diverse consumer needs and occasions.

- Distribution Channel Accessibility: Gluten-free bakery products are widely available across various distribution channels, including supermarkets/hypermarkets, speciality stores, and online retail, ensuring broad consumer access.

- Economic Policies and Support: Government initiatives promoting healthy food choices and awareness campaigns about celiac disease indirectly support the growth of the gluten-free bakery sector.

Leading countries within Europe, such as Germany and the United Kingdom, are at the forefront of this trend, driven by high disposable incomes, a strong awareness of celiac disease, and a well-developed retail infrastructure supporting the availability of specialized food products. For instance, Germany’s proactive approach to health and wellness, coupled with a significant diagnosed celiac population, makes it a prime market for gluten-free bakery items. The market share for gluten-free bakery products is estimated to be around 35% of the total Europe Gluten-Free Food and Beverages Market.

Europe Gluten-Free Food and Beverages Market Product Landscape

The Europe gluten-free food and beverages market is witnessing a vibrant product innovation landscape, driven by the need to offer diverse, palatable, and nutritious alternatives. Key advancements focus on improving the sensory attributes of gluten-free products, particularly in bakery and dairy substitute categories, to closely mimic their conventional counterparts. The development of novel ingredients and processing techniques enhances texture, taste, and shelf-life. Applications are expanding beyond traditional staples to include ready-to-eat meals, snacks, and beverages with added nutritional benefits, such as probiotics and prebiotics. Performance metrics like taste panels and consumer acceptance studies are crucial for product success, with a growing emphasis on clean labels and minimal processing. Unique selling propositions often revolve around allergen-free claims, natural ingredients, and plant-based formulations.

Key Drivers, Barriers & Challenges in Europe Gluten-Free Food and Beverages Market

Key Drivers:

- Increasing Prevalence of Celiac Disease and Gluten Sensitivity: This remains the primary driver, pushing demand for certified gluten-free products.

- Growing Health and Wellness Trends: Consumers are increasingly adopting gluten-free diets for perceived health benefits, weight management, and improved digestion, even without a medical diagnosis.

- Product Innovation and Variety: Manufacturers are investing in R&D to create gluten-free products with improved taste, texture, and nutritional profiles, expanding consumer choice.

- Retailer Expansion and Availability: A wider presence of gluten-free options in supermarkets and online channels makes these products more accessible to consumers.

- Awareness Campaigns and Education: Public health initiatives and media coverage raise awareness about gluten-related disorders and dietary choices.

Barriers & Challenges:

- Higher Production Costs: Sourcing alternative flours and specialized ingredients often leads to higher manufacturing costs, resulting in premium pricing for gluten-free products.

- Taste and Texture Limitations: Despite advancements, achieving the exact taste and texture of gluten-containing products can still be a challenge for some categories, leading to consumer dissatisfaction.

- Cross-Contamination Risks: For individuals with severe celiac disease, ensuring strict avoidance of cross-contamination during manufacturing and preparation remains a significant concern.

- Complex Regulatory Landscape: Navigating varying national regulations for gluten-free labeling and certification across different European countries can be complex for manufacturers.

- Consumer Misconceptions: Misinformation surrounding the benefits of gluten-free diets for the general population can create market noise and potentially dilute the message for those with genuine medical needs. Supply chain disruptions, as seen in ingredient sourcing and logistics, can also impact availability and pricing.

Emerging Opportunities in Europe Gluten-Free Food and Beverages Market

Emerging opportunities in the Europe gluten-free food and beverages market lie in catering to niche dietary needs and expanding product applications. The rise of plant-based and vegan gluten-free options presents a significant growth area, appealing to a broader health-conscious demographic. Innovations in gluten-free alternative grains, such as lupin and ancient grains, offer new textural and nutritional possibilities. The market also presents opportunities in developing functional gluten-free foods fortified with vitamins, minerals, and probiotics, aligning with consumer demand for health-enhancing products. Untapped markets in specific regions within Eastern Europe are beginning to show increased demand. Furthermore, the growth of the foodservice sector embracing gluten-free options, from restaurants to catering services, opens new avenues for product development and distribution.

Growth Accelerators in the Europe Gluten-Free Food and Beverages Market Industry

Several catalysts are accelerating the growth of the Europe gluten-free food and beverages market. Technological breakthroughs in ingredient formulation, particularly the development of advanced gluten-free flour blends and natural binders, are crucial in overcoming historical taste and texture limitations. Strategic partnerships between ingredient suppliers, manufacturers, and retailers are streamlining supply chains and expanding product reach. Furthermore, market expansion strategies focusing on new product categories and innovative packaging solutions are capturing consumer attention. The increasing integration of e-commerce platforms provides direct access to consumers and facilitates targeted marketing campaigns.

Key Players Shaping the Europe Gluten-Free Food and Beverages Market Market

- General Mills Inc

- Conagra Brands Inc

- Dawn Foods

- Golden West Specialty Foods

- London Food Corporation

- Dr Schär AG / SPA

- Bob's Red Mill Natural Foods

- Amy's Kitchen Inc

- Genius Foods

- Kraft Heinz Company

Notable Milestones in Europe Gluten-Free Food and Beverages Market Sector

- September 2022: LikeMeat introduced Like Bacon, a gluten-free and soy-based bacon variant, specifically for the breakfast market in Germany, enhancing meat substitute options.

- March 2021: Dawn Foods acquired JABEX, a specialized manufacturer of high-quality fruit products. This acquisition is expected to bolster Dawn Foods' operational capabilities and supply chain management in Central and Eastern Europe.

- March 2021: Arctic Blue Beverages, based in Finland, launched "Arctic Blue Oat," a vegan and gluten-free liqueur made from organic Finnish oats. This innovation expands the gluten-free beverage category with a unique gin-based oat liqueur.

In-Depth Europe Gluten-Free Food and Beverages Market Market Outlook

The outlook for the Europe gluten-free food and beverages market remains exceptionally strong, driven by sustained consumer demand and continuous innovation. Growth accelerators, including advanced ingredient technology and strategic market expansion by key players, will propel the sector forward. Future market potential is significant, particularly in the development of more affordable and accessible gluten-free alternatives. Strategic opportunities lie in leveraging e-commerce for direct-to-consumer sales, expanding into emerging European markets, and catering to the growing demand for functional and plant-based gluten-free products. Manufacturers that focus on product quality, transparency, and diverse dietary needs are poised for substantial success.

Europe Gluten-Free Food and Beverages Market Segmentation

-

1. Product Type

- 1.1. Bakery Products

- 1.2. Meats/Meat Substitutes

- 1.3. Dairy/Dairy Substitutes

- 1.4. Sauces, Dressing, and Seasonings

- 1.5. Frozen Desserts

- 1.6. Beverages

- 1.7. Other Product Types

-

2. Distribution Channel

- 2.1. Online Retail

- 2.2. Speciality Stores

- 2.3. Supermarkets/Hypermarkets

- 2.4. Other Retailers

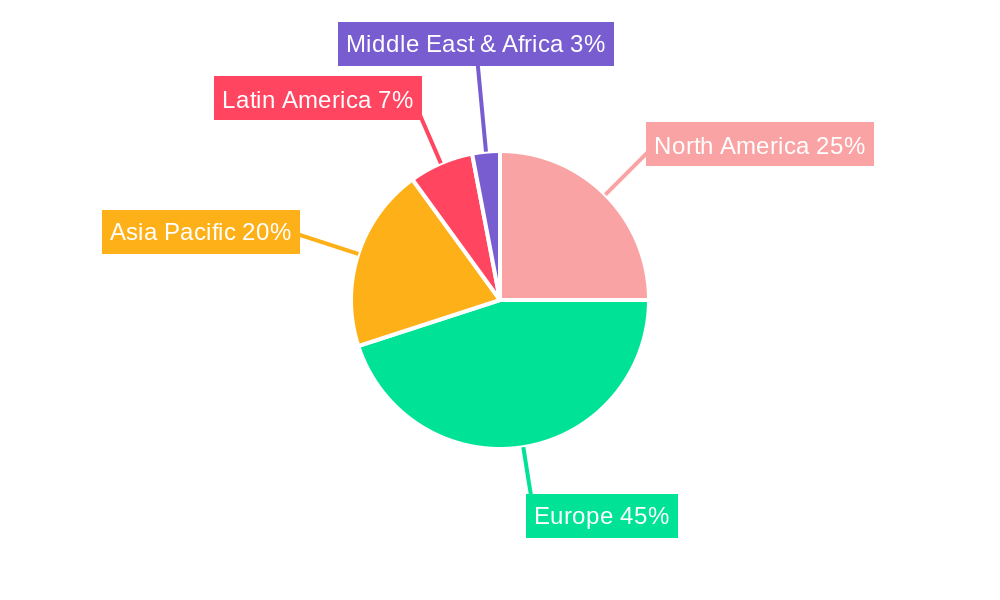

Europe Gluten-Free Food and Beverages Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Gluten-Free Food and Beverages Market Regional Market Share

Geographic Coverage of Europe Gluten-Free Food and Beverages Market

Europe Gluten-Free Food and Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. Increasing Prevalence of Celiac Disease

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Gluten-Free Food and Beverages Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bakery Products

- 5.1.2. Meats/Meat Substitutes

- 5.1.3. Dairy/Dairy Substitutes

- 5.1.4. Sauces, Dressing, and Seasonings

- 5.1.5. Frozen Desserts

- 5.1.6. Beverages

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online Retail

- 5.2.2. Speciality Stores

- 5.2.3. Supermarkets/Hypermarkets

- 5.2.4. Other Retailers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 General Mills Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Conagra Brands Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dawn Foods

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Golden West Specialty Foods

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 London Food Corporation*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dr Schär AG / SPA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bob's Red Mill Natural Foods

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amy's Kitchen Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Genius Foods

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kraft Heinz Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 General Mills Inc

List of Figures

- Figure 1: Europe Gluten-Free Food and Beverages Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Gluten-Free Food and Beverages Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Gluten-Free Food and Beverages Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Gluten-Free Food and Beverages Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Europe Gluten-Free Food and Beverages Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Gluten-Free Food and Beverages Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: Europe Gluten-Free Food and Beverages Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Gluten-Free Food and Beverages Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Europe Gluten-Free Food and Beverages Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Europe Gluten-Free Food and Beverages Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 9: Europe Gluten-Free Food and Beverages Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Europe Gluten-Free Food and Beverages Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 11: Europe Gluten-Free Food and Beverages Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Gluten-Free Food and Beverages Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Gluten-Free Food and Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Gluten-Free Food and Beverages Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Gluten-Free Food and Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Gluten-Free Food and Beverages Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: France Europe Gluten-Free Food and Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Gluten-Free Food and Beverages Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Gluten-Free Food and Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Gluten-Free Food and Beverages Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Gluten-Free Food and Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Gluten-Free Food and Beverages Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Gluten-Free Food and Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Gluten-Free Food and Beverages Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Gluten-Free Food and Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Gluten-Free Food and Beverages Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Gluten-Free Food and Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Gluten-Free Food and Beverages Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Gluten-Free Food and Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Gluten-Free Food and Beverages Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Gluten-Free Food and Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Gluten-Free Food and Beverages Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Gluten-Free Food and Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Gluten-Free Food and Beverages Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Gluten-Free Food and Beverages Market?

The projected CAGR is approximately 10.33%.

2. Which companies are prominent players in the Europe Gluten-Free Food and Beverages Market?

Key companies in the market include General Mills Inc, Conagra Brands Inc, Dawn Foods, Golden West Specialty Foods, London Food Corporation*List Not Exhaustive, Dr Schär AG / SPA, Bob's Red Mill Natural Foods, Amy's Kitchen Inc, Genius Foods, Kraft Heinz Company.

3. What are the main segments of the Europe Gluten-Free Food and Beverages Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

Increasing Prevalence of Celiac Disease.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

September 2022: LikeMeat presented its new product, Like Bacon, a gluten-free and soy-based bacon variant, and it is offered as a breakfast product in Germany.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Gluten-Free Food and Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Gluten-Free Food and Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Gluten-Free Food and Beverages Market?

To stay informed about further developments, trends, and reports in the Europe Gluten-Free Food and Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence