Key Insights

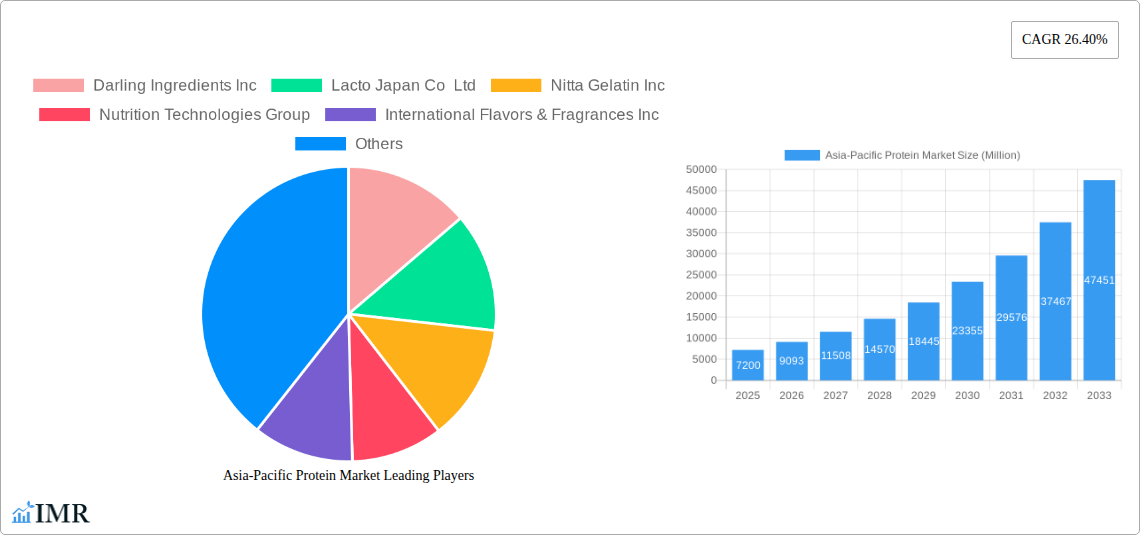

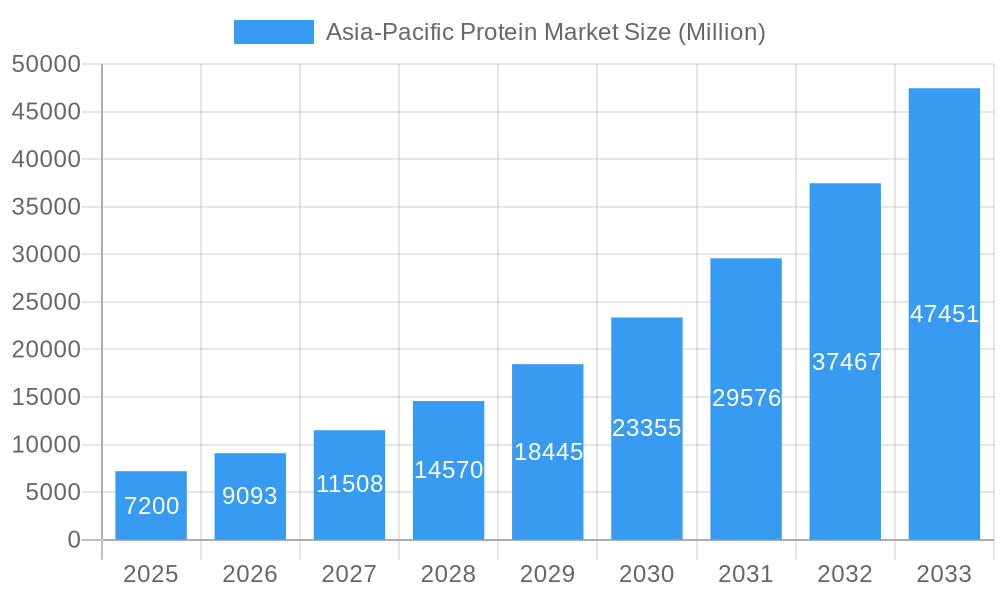

The Asia-Pacific protein market is poised for exceptional growth, projected to reach a substantial market size of USD 7,200 million by 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 26.40%. This surge is primarily fueled by increasing consumer awareness regarding the health benefits of protein consumption, leading to a higher demand across various end-user segments. The food and beverages sector, encompassing bakery, dairy, meat alternatives, and snacks, is a significant contributor to this growth, as manufacturers increasingly incorporate diverse protein sources to cater to evolving dietary preferences and health-conscious consumers. The burgeoning demand for nutritional supplements, including infant formula and sports nutrition, further amplifies market expansion, reflecting a societal shift towards proactive health management and performance enhancement.

Asia-Pacific Protein Market Market Size (In Billion)

The market's dynamism is further shaped by a diverse range of protein sources. While traditional animal proteins like whey and casein continue to hold a strong presence, innovative alternatives are gaining traction. Plant-based proteins, such as pea, soy, and hemp, are experiencing robust growth due to their sustainability, ethical considerations, and allergen-friendly profiles. Similarly, microbial proteins, including algae and mycoprotein, are emerging as key players, offering novel functionalities and appealing to environmentally conscious consumers. Despite this rapid expansion, potential restraints such as fluctuating raw material prices and evolving regulatory landscapes require strategic navigation by market participants. The Asia-Pacific region, with its vast population and growing disposable incomes, presents a fertile ground for both established and emerging protein manufacturers, promising significant investment opportunities and market leadership for agile and innovative companies.

Asia-Pacific Protein Market Company Market Share

Asia-Pacific Protein Market: Comprehensive Market Intelligence Report (2019-2033)

This in-depth report provides a strategic overview of the Asia-Pacific Protein Market, encompassing historical trends, current dynamics, and future projections from 2019 to 2033. Covering a wide array of protein sources including Animal (Casein, Whey, Collagen, Gelatin, Milk Protein, Egg Protein, Insect Protein), Microbial (Algae Protein, Mycoprotein), and Plant (Soy, Pea, Rice, Wheat, Hemp, Potato Proteins), the report delves into its application across diverse end-user industries: Animal Feed, Food and Beverages (Bakery, Confectionery, Dairy, Meat Alternatives, Snacks, RTE/RTC, Breakfast Cereals, Condiments/Sauces), Personal Care and Cosmetics, and Supplements (Baby Food, Sports Nutrition, Elderly/Medical Nutrition). With a base year of 2025 and a forecast period extending to 2033, this analysis is essential for stakeholders seeking to capitalize on the rapidly evolving protein landscape in the Asia-Pacific region.

Asia-Pacific Protein Market Market Dynamics & Structure

The Asia-Pacific protein market is characterized by a dynamic interplay of factors influencing its structure and growth trajectory. Market concentration varies across segments, with established players in animal-derived proteins exhibiting higher market share, while newer entrants are rapidly gaining traction in plant-based and microbial protein sectors. Technological innovation is a key driver, with advancements in extraction, processing, and formulation enabling the development of novel protein ingredients with improved functionality and nutritional profiles. Regulatory frameworks, while evolving, play a crucial role in shaping product development and market access, particularly for novel protein sources. Competitive product substitutes are abundant, ranging from traditional animal proteins to emerging alternatives, forcing manufacturers to differentiate based on sustainability, cost, and specific application benefits. End-user demographics are shifting, with rising disposable incomes, increased health consciousness, and a growing preference for sustainable and ethical food choices fueling demand for diverse protein options. Merger and acquisition (M&A) trends are prominent, with companies strategically acquiring innovative startups and diversifying their portfolios to capture emerging market opportunities. For instance, recent M&A activity highlights consolidation efforts and strategic partnerships aimed at expanding technological capabilities and market reach.

- Market Concentration: Moderate to high in established animal protein segments, increasing in novel protein categories.

- Technological Innovation Drivers: Enhanced bioavailability, improved taste and texture, sustainable production methods, and cost-effective processing.

- Regulatory Frameworks: Focus on food safety, labeling standards, and approval processes for novel ingredients.

- Competitive Product Substitutes: Extensive range from conventional animal proteins to plant-based, insect, and algae alternatives.

- End-User Demographics: Growing middle class, health-conscious consumers, flexitarians, and vegans/vegetarians.

- M&A Trends: Strategic acquisitions of ingredient developers, joint ventures for R&D, and vertical integration.

Asia-Pacific Protein Market Growth Trends & Insights

The Asia-Pacific protein market is poised for significant expansion, driven by a confluence of macro-economic, demographic, and consumer-driven trends. The market size is projected to evolve at a substantial Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. Adoption rates for alternative protein sources, particularly plant-based and insect proteins, are witnessing accelerated growth as consumers become more aware of the environmental and health implications of their dietary choices. Technological disruptions, such as advancements in precision fermentation and cellular agriculture, are poised to unlock new protein sources and improve the sustainability and scalability of existing ones. Consumer behavior shifts are a pivotal force, with a growing demand for convenient, healthy, and ethically sourced protein products. This is evident in the increasing penetration of protein-fortified foods and beverages, as well as the rising popularity of protein supplements for various age groups and fitness goals. The burgeoning middle class across countries like China, India, and Southeast Asian nations contributes significantly to increased per capita protein consumption. Furthermore, government initiatives promoting food security and sustainable agriculture are indirectly bolstering the protein market by encouraging innovation and investment in alternative protein production. The shift from a purely animal-protein-centric diet to a more diversified protein intake is a fundamental change impacting all segments of the market. The increasing prevalence of lifestyle diseases and the demand for functional foods that offer specific health benefits are further propelling the growth of specialized protein ingredients. This sustained growth underscores a fundamental transformation in how protein is perceived, produced, and consumed within the Asia-Pacific region, presenting a fertile ground for investment and innovation.

Dominant Regions, Countries, or Segments in Asia-Pacific Protein Market

Within the Asia-Pacific protein market, several regions, countries, and segments are demonstrating remarkable dominance and contributing significantly to overall growth. Plant Protein stands out as a dominant segment, fueled by strong consumer demand for healthier, sustainable, and ethically sourced alternatives to animal protein. This surge is particularly pronounced in East Asia, led by China and Japan, where a growing vegetarian and vegan population, coupled with increased health consciousness, is driving substantial market penetration.

Dominant Segment: Plant Protein

- Drivers: Rising veganism and vegetarianism, health and wellness trends, environmental concerns, and government support for sustainable agriculture.

- Key Players: Numerous domestic and international ingredient manufacturers are investing heavily in pea protein, soy protein, and rice protein isolate production.

- Market Share: Expected to capture a significant portion of the overall protein market growth in the coming years, driven by innovation and consumer acceptance.

- Growth Potential: High, due to continuous product development and expanding applications across various food and beverage categories.

Dominant Region: East Asia

- Key Countries: China, Japan, South Korea.

- Drivers: Large and growing populations, increasing disposable incomes, a strong focus on health and nutrition, and significant R&D investments in food technology.

- Country-Specific Insights:

- China: The sheer size of its population and its rapid adoption of Western dietary trends, alongside a growing awareness of health and sustainability, make it a powerhouse for all protein categories, especially plant-based alternatives and infant nutrition.

- Japan: A long-standing tradition of soy consumption and a mature market for functional foods and supplements contribute to its leadership, with a growing interest in alternative proteins and high-quality animal proteins.

- Economic Policies: Government initiatives supporting innovation in food technology and sustainable food production are crucial.

- Infrastructure: Well-developed supply chains and distribution networks facilitate market access.

Dominant End User: Food and Beverages

- Sub End Users Driving Growth:

- Dairy and Dairy Alternative Products: The demand for plant-based milk, yogurt, and cheese alternatives is skyrocketing, directly impacting the demand for ingredients like pea protein and soy protein.

- Meat/Poultry/Seafood and Meat Alternative Products: The burgeoning market for plant-based meat alternatives is a significant driver, utilizing soy protein, pea protein, and other novel proteins.

- Supplements (Sport/Performance Nutrition): Athletes and fitness enthusiasts increasingly rely on protein powders and bars, driving demand for whey protein, casein, and plant-based protein isolates.

- Market Share: This segment consistently represents the largest share of the protein market due to the ubiquitous nature of protein in everyday food consumption.

- Growth Potential: Continued innovation in product formulations and consumer preferences for healthier options will sustain robust growth.

- Sub End Users Driving Growth:

Asia-Pacific Protein Market Product Landscape

The Asia-Pacific protein market is witnessing a surge of innovative products catering to diverse consumer needs and preferences. Product innovations are centered around improving taste, texture, nutritional profile, and sustainability. For instance, advancements in processing technologies are yielding plant-based protein isolates with significantly improved solubility and neutral flavor profiles, making them ideal for a wider range of applications in beverages and baked goods. Functional proteins, such as collagen peptides with enhanced bioavailability for skin and joint health, and specialized whey protein hydrolysates for rapid absorption in sports nutrition, are gaining prominence. Insect protein, while nascent, is evolving with refined processing methods to create palatable and functional flours and oils for animal feed and increasingly, for human consumption. Performance metrics are constantly being optimized, with protein efficiency ratios (PER) and digestibility scores becoming critical selling points. Unique selling propositions often revolve around clean labels, non-GMO sourcing, allergen-free formulations, and transparent supply chains, particularly for plant-based and specialty animal proteins. Technological advancements in fermentation and enzyme technology are also enabling the creation of novel proteins with unique functionalities and improved environmental footprints.

Key Drivers, Barriers & Challenges in Asia-Pacific Protein Market

The Asia-Pacific protein market is propelled by several key drivers, including the burgeoning demand for healthier and sustainable food options, a growing middle class with increased disposable income, and rising awareness of the health benefits associated with protein consumption. Technological advancements in protein extraction and processing, coupled with innovative product development, are further fueling market growth. Government initiatives promoting food security and sustainable agriculture also play a significant role.

- Key Drivers:

- Rising health consciousness and demand for functional foods.

- Growing adoption of flexitarian, vegetarian, and vegan diets.

- Increasing disposable incomes and urbanization.

- Technological innovations in protein production and application.

- Focus on sustainable and ethically sourced protein alternatives.

However, the market faces several barriers and challenges. Supply chain complexities, especially for novel protein sources, and the need for robust regulatory approvals can hinder rapid market penetration. Consumer perception and acceptance of certain protein types, such as insect protein, remain a hurdle. High production costs for some alternative proteins compared to conventional sources also pose a challenge. Furthermore, competition from established animal protein producers and the need for significant investment in R&D and infrastructure can impede smaller players.

- Key Barriers & Challenges:

- High production costs of some alternative proteins.

- Consumer acceptance and perception challenges for novel sources.

- Complex supply chains and sourcing difficulties.

- Stringent and evolving regulatory landscapes.

- Competition from established animal protein products.

Emerging Opportunities in Asia-Pacific Protein Market

Emerging opportunities in the Asia-Pacific protein market lie in the untapped potential of novel protein sources and specialized applications. The escalating demand for personalized nutrition presents a significant avenue, with opportunities to develop customized protein blends for specific dietary needs, age groups, and health goals. The integration of protein into functional beverages and snacks beyond traditional bars and powders is another growth area. Furthermore, advancements in insect farming and processing technologies are opening doors for cost-effective and sustainable protein ingredients for both animal feed and potentially, human food applications. The development of advanced plant-based protein ingredients that mimic the taste and texture of animal products more closely will continue to create new product development opportunities in the meat and dairy alternative sectors. Exploring untapped geographic markets within Southeast Asia and the Pacific Islands, where protein demand is rising but supply chains are less developed, also represents a significant growth frontier.

Growth Accelerators in the Asia-Pacific Protein Market Industry

Several catalysts are driving long-term growth in the Asia-Pacific protein market. Technological breakthroughs in precision fermentation and cell-based protein production hold the promise of creating highly sustainable and scalable protein sources, potentially disrupting traditional agriculture. Strategic partnerships between ingredient manufacturers, food and beverage companies, and research institutions are accelerating product innovation and market penetration. Market expansion strategies, including entering emerging economies with tailored product offerings and building robust distribution networks, are crucial for capturing new consumer segments. The increasing investment from venture capital and private equity firms in the alternative protein sector signals strong confidence in the market's future potential, providing vital capital for research, development, and scaling up production. These accelerators are collectively shaping a dynamic and rapidly evolving protein landscape.

Key Players Shaping the Asia-Pacific Protein Market Market

- Darling Ingredients Inc.

- Lacto Japan Co Ltd

- Nitta Gelatin Inc.

- Nutrition Technologies Group

- International Flavors & Fragrances Inc.

- Tereos SCA

- Wilmar International Lt

- Archer Daniels Midland Company

- Glanbia PLC

- Fuji Oil Group

- Corbion Biotech Inc.

- Nagata Group Holdings Ltd

- Fonterra Co-operative Group Limited

- Hilmar Cheese Company Inc.

- Kerry Group plc

Notable Milestones in Asia-Pacific Protein Market Sector

- July 2021: Fuji Oil Holdings Inc.'s Dutch subsidiary invested in UNOVIS NCAP II Fund, a major fund specializing in food technologies. Fuji Oil Group aims to contribute to a sustainable society using its processing technologies of plant-based food materials to tackle the issues faced by customers worldwide.

- May 2021: Darling Ingredients Inc. announced that its Rousselot brand expanded its range of purified, pharmaceutical-grade, modified gelatins with the launch of X-Pure® GelDAT – Gelatin Desaminotyrosine.

- March 2021: Darling Ingredients entered a joint venture with Intrexon Corporation for industrial-scale production of non-pathogenic black soldier fly (BSF) larvae for use as a protein source in animal feed.

In-Depth Asia-Pacific Protein Market Market Outlook

The future outlook for the Asia-Pacific protein market is exceptionally bright, characterized by sustained growth and transformative innovation. Key growth accelerators, including advancements in sustainable protein production technologies, increasing consumer demand for health-conscious and environmentally friendly options, and strategic market expansions by key players, will continue to shape the landscape. The market's potential is further bolstered by the rising middle class across the region, driving higher protein consumption. Strategic partnerships and significant investments are expected to fuel the development of novel protein ingredients and applications, particularly in the plant-based, insect, and microbial protein sectors. Stakeholders can anticipate a dynamic market characterized by diversification, innovation, and an increasing focus on addressing global food security and sustainability challenges through advanced protein solutions.

Asia-Pacific Protein Market Segmentation

-

1. Source

-

1.1. Animal

-

1.1.1. By Protein Type

- 1.1.1.1. Casein and Caseinates

- 1.1.1.2. Collagen

- 1.1.1.3. Egg Protein

- 1.1.1.4. Gelatin

- 1.1.1.5. Insect Protein

- 1.1.1.6. Milk Protein

- 1.1.1.7. Whey Protein

- 1.1.1.8. Other Animal Protein

-

1.1.1. By Protein Type

-

1.2. Microbial

- 1.2.1. Algae Protein

- 1.2.2. Mycoprotein

-

1.3. Plant

- 1.3.1. Hemp Protein

- 1.3.2. Pea Protein

- 1.3.3. Potato Protein

- 1.3.4. Rice Protein

- 1.3.5. Soy Protein

- 1.3.6. Wheat Protein

- 1.3.7. Other Plant Protein

-

1.1. Animal

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Confectionery

- 2.2.1.5. Dairy and Dairy Alternative Products

- 2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.2.1.7. RTE/RTC Food Products

- 2.2.1.8. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Asia-Pacific Protein Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Protein Market Regional Market Share

Geographic Coverage of Asia-Pacific Protein Market

Asia-Pacific Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Animal

- 5.1.1.1. By Protein Type

- 5.1.1.1.1. Casein and Caseinates

- 5.1.1.1.2. Collagen

- 5.1.1.1.3. Egg Protein

- 5.1.1.1.4. Gelatin

- 5.1.1.1.5. Insect Protein

- 5.1.1.1.6. Milk Protein

- 5.1.1.1.7. Whey Protein

- 5.1.1.1.8. Other Animal Protein

- 5.1.1.1. By Protein Type

- 5.1.2. Microbial

- 5.1.2.1. Algae Protein

- 5.1.2.2. Mycoprotein

- 5.1.3. Plant

- 5.1.3.1. Hemp Protein

- 5.1.3.2. Pea Protein

- 5.1.3.3. Potato Protein

- 5.1.3.4. Rice Protein

- 5.1.3.5. Soy Protein

- 5.1.3.6. Wheat Protein

- 5.1.3.7. Other Plant Protein

- 5.1.1. Animal

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Confectionery

- 5.2.2.1.5. Dairy and Dairy Alternative Products

- 5.2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.2.1.7. RTE/RTC Food Products

- 5.2.2.1.8. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Darling Ingredients Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lacto Japan Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nitta Gelatin Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nutrition Technologies Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 International Flavors & Fragrances Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tereos SCA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wilmar International Lt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Archer Daniels Midland Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Glanbia PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fuji Oil Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Corbion Biotech Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Nagata Group Holdings Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Fonterra Co-operative Group Limited

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Hilmar Cheese Company Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Kerry Group plc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Darling Ingredients Inc

List of Figures

- Figure 1: Asia-Pacific Protein Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Protein Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Protein Market Revenue Million Forecast, by Source 2020 & 2033

- Table 2: Asia-Pacific Protein Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Asia-Pacific Protein Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Protein Market Revenue Million Forecast, by Source 2020 & 2033

- Table 5: Asia-Pacific Protein Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Asia-Pacific Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Protein Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the Asia-Pacific Protein Market?

Key companies in the market include Darling Ingredients Inc, Lacto Japan Co Ltd, Nitta Gelatin Inc, Nutrition Technologies Group, International Flavors & Fragrances Inc, Tereos SCA, Wilmar International Lt, Archer Daniels Midland Company, Glanbia PLC, Fuji Oil Group, Corbion Biotech Inc, Nagata Group Holdings Ltd, Fonterra Co-operative Group Limited, Hilmar Cheese Company Inc, Kerry Group plc.

3. What are the main segments of the Asia-Pacific Protein Market?

The market segments include Source, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

July 2021: Fuji Oil Holdings Inc.'s Dutch subsidiary invested in UNOVIS NCAP II Fund, which is a major fund specializing in food technologies. Fuji Oil Group aims to contribute to a sustainable society using its processing technologies of plant-based food materials to tackle the issues faced by customers worldwide.May 2021: Darling Ingredients Inc. announced that its Rousselot brand expanded its range of purified, pharmaceutical-grade, modified gelatins with the launch of X-Pure® GelDAT – Gelatin Desaminotyrosine.March 2021: Darling Ingredients entered a joint venture with Intrexon Corporation for industrial-scale production of non-pathogenic black soldier fly (BSF) larvae for use as a protein source in animal feed.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Protein Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence