Key Insights

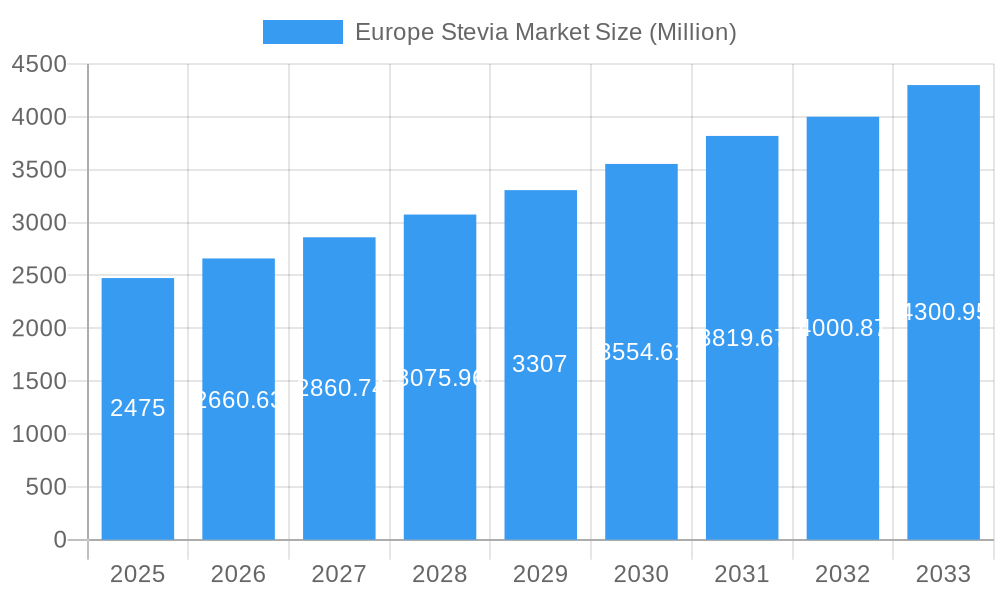

The European Stevia market is projected to experience significant growth, reaching an estimated market size of 143.01 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 10.7 from the base year 2025 through 2033. This expansion is driven by increasing consumer preference for natural, low-calorie sweeteners due to rising health consciousness and the prevalence of lifestyle diseases across Europe. Favorable regulatory approvals and widespread adoption of stevia as a sugar substitute in food and beverage products are further accelerating market penetration. The market is segmented by form into liquid, powder, and leaf, with liquid and powder forms leading due to their formulation versatility. Key application segments include bakery, dairy, beverages, dietary supplements, and confectionery, with beverages and bakery products constituting the largest share.

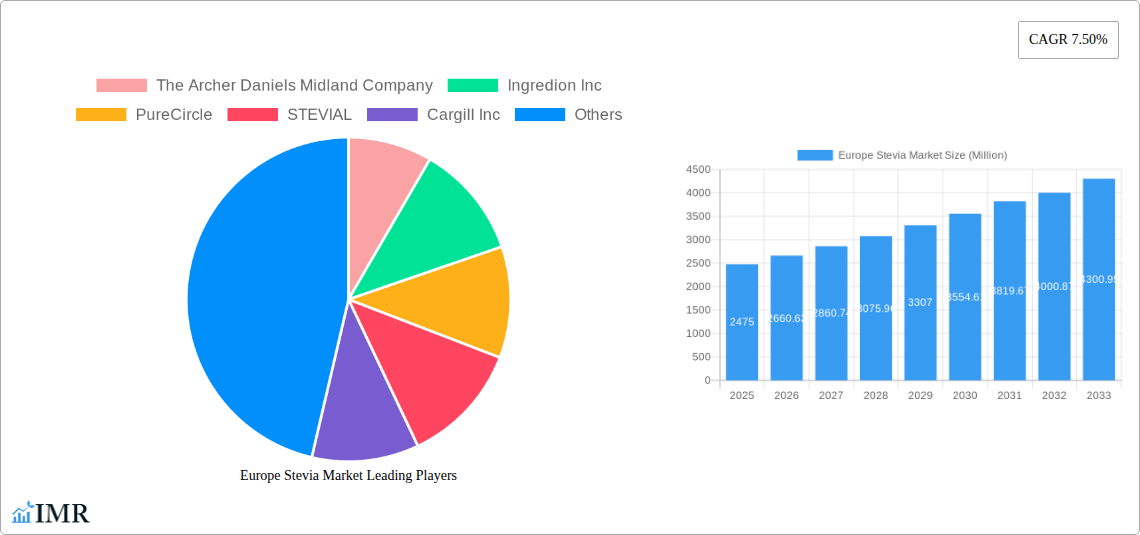

Europe Stevia Market Market Size (In Million)

Primary growth drivers include ongoing global sugar reduction initiatives, encouraging manufacturers to integrate stevia into their product portfolios. Technological advancements in stevia extraction and purification are enhancing taste profiles and reducing bitterness, improving its appeal as an alternative to artificial sweeteners. Increased disposable income in European nations also supports consumer spending on healthier food choices. However, market growth may be constrained by price volatility in stevia cultivation raw materials and potential consumer concerns regarding the naturalness or taste of specific stevia extracts. Leading companies such as The Archer Daniels Midland Company, Ingredion Inc., PureCircle, and Cargill Inc. are actively investing in research and development and production capacity expansion to address growing demand, particularly in major European markets including Germany, France, Spain, and the United Kingdom.

Europe Stevia Market Company Market Share

Europe Stevia Market: Comprehensive Growth Analysis & Future Outlook (2019–2033)

This comprehensive report delves into the dynamic Europe Stevia Market, offering an in-depth analysis of its growth trajectory, key players, and future potential. With a focus on high-traffic keywords like "stevia market Europe," "natural sweeteners," "sugar alternatives," "food and beverage ingredients," and "dietary supplements Europe," this report is optimized for maximum search engine visibility. We explore both the Parent Market: Global Stevia Market and Child Market: Europe Stevia Market to provide a holistic view, presenting all values in Million units.

Europe Stevia Market Market Dynamics & Structure

The Europe Stevia Market is characterized by a moderate market concentration, with key players like Ingredion Inc. (following its significant acquisition of PureCircle), Cargill Inc., and The Archer Daniels Midland Company holding substantial market shares. Technological innovation remains a primary driver, with ongoing research and development focused on enhancing steviol glycoside extraction efficiency and sweetness profiles. Regulatory frameworks, while evolving to embrace natural sweeteners, still present a complex landscape for market entrants. Competitive product substitutes, including other natural sweeteners and artificial sweeteners, exert pressure, necessitating continuous product differentiation and cost-effectiveness. End-user demographics show a growing preference for natural and healthier ingredients, particularly among health-conscious consumers and younger populations. Mergers and Acquisitions (M&A) trends are shaping the competitive landscape, with strategic consolidations aiming to expand market reach and product portfolios.

- Market Concentration: Moderate, with key players holding significant stakes.

- Technological Innovation Drivers: Enhanced extraction, improved taste profiles, and cost reduction.

- Regulatory Frameworks: Evolving to support natural sweeteners, but with regional variations.

- Competitive Product Substitutes: Other natural sweeteners, artificial sweeteners, and sugar itself.

- End-User Demographics: Growing demand from health-conscious consumers and Millennials/Gen Z.

- M&A Trends: Strategic acquisitions and partnerships for market consolidation and portfolio expansion.

Europe Stevia Market Growth Trends & Insights

The Europe Stevia Market has witnessed remarkable evolution, driven by a confluence of factors that are reshaping the food and beverage, and dietary supplement industries. The market size has expanded significantly, reflecting a robust adoption rate of stevia as a preferred sugar alternative. This growth is underpinned by escalating consumer demand for healthier, low-calorie, and natural ingredients, directly impacting product formulations across various applications. Technological disruptions, including advancements in steviol glycoside extraction and purification, have not only improved the taste and functionality of stevia sweeteners but also contributed to cost efficiencies, making them more accessible for broader commercial use. Consumer behavior shifts are particularly evident, with an increasing willingness to pay a premium for products perceived as healthier and more sustainable. This report leverages advanced market intelligence to deliver precise insights into market size evolution, adoption rates, technological breakthroughs, and the nuanced shifts in consumer preferences that are defining the Europe Stevia Market. The compound annual growth rate (CAGR) is projected to remain strong, indicating sustained market penetration and further integration of stevia into mainstream consumer products.

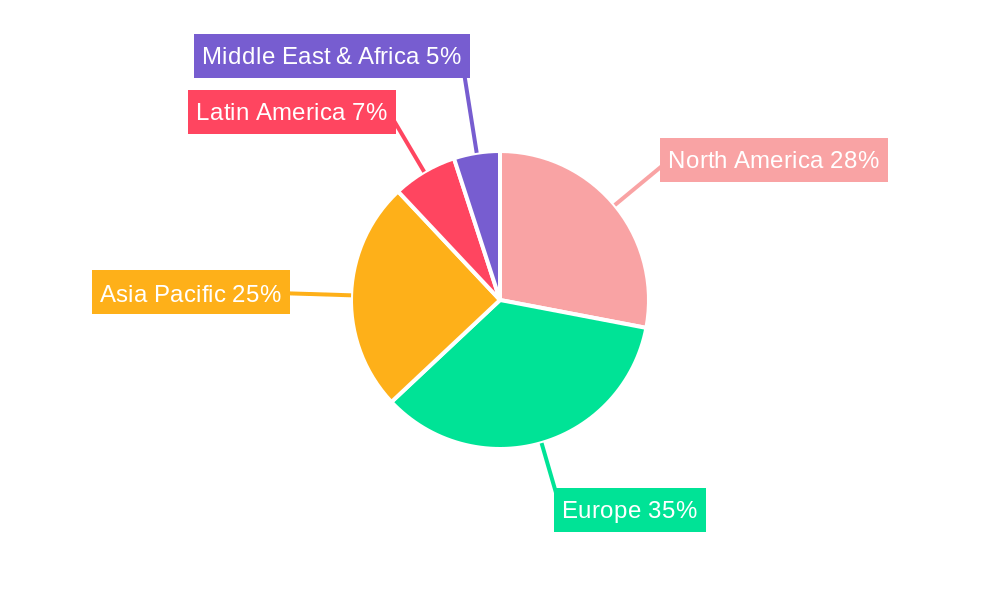

Dominant Regions, Countries, or Segments in Europe Stevia Market

Within the expansive Europe Stevia Market, the Beverages application segment emerges as the dominant growth driver, followed closely by Bakery and Dairy Food Products. This dominance is propelled by the beverage industry's relentless pursuit of sugar reduction without compromising taste, making stevia an ideal ingredient for carbonated drinks, juices, and functional beverages. Economic policies across key European nations, such as those promoting healthier food options and sugar taxes, further incentivize the adoption of stevia. Infrastructure for ingredient sourcing and processing is well-established in regions like Germany, France, and the UK, facilitating the integration of stevia into large-scale production. The Powder form of stevia currently holds a majority market share due to its versatility and ease of incorporation into a wide array of food and beverage products.

- Dominant Application Segment: Beverages, driven by sugar reduction initiatives and consumer demand for healthier drink options.

- Key Contributing Segments: Bakery and Dairy Food Products, benefiting from the trend towards reduced-sugar formulations.

- Leading Forms: Powder, due to its widespread applicability and ease of use in manufacturing processes.

- Regional Catalysts: Favorable economic policies, robust food processing infrastructure, and high consumer awareness of health benefits in Western European countries.

- Growth Potential: Significant opportunities exist in expanding stevia use in confectionery and dietary supplements, driven by evolving consumer preferences for natural ingredients.

Europe Stevia Market Product Landscape

The Europe Stevia Market product landscape is characterized by continuous innovation and a focus on enhancing the sensory experience of steviol glycoside sweeteners. Companies are actively developing next-generation stevia ingredients with improved taste profiles, reduced aftertastes, and optimized sweetness intensity. Product innovations include blends of different steviol glycosides (e.g., Rebaudioside A, M, and D) to achieve a more sugar-like taste and mouthfeel. Applications are expanding beyond traditional sweetened products to include functional foods and beverages, leveraging stevia's natural origin. Performance metrics such as sweetness equivalence, solubility, and stability under various processing conditions are crucial selling points, with leading manufacturers investing heavily in research to meet the stringent demands of the food and beverage industry.

Key Drivers, Barriers & Challenges in Europe Stevia Market

The Europe Stevia Market is propelled by several key drivers, foremost among them being the escalating consumer demand for natural and sugar-free alternatives, driven by growing health consciousness and concerns over obesity and diabetes. Government initiatives promoting sugar reduction and the increasing adoption of stevia by major food and beverage manufacturers further accelerate market growth. Technological advancements in extraction and purification processes are improving taste profiles and reducing production costs, making stevia more competitive.

However, the market faces significant barriers and challenges. The complex regulatory landscape for novel food ingredients, though improving, can still pose hurdles for new entrants. Fluctuations in the supply chain and the potential for crop-related issues can impact raw material availability and price stability. The persistent perception of a lingering aftertaste in some stevia products remains a consumer concern, necessitating ongoing product development. Intense competition from other high-intensity sweeteners, both natural and artificial, also presents a challenge.

Emerging Opportunities in Europe Stevia Market

Emerging opportunities within the Europe Stevia Market are diverse and promising. Untapped markets for stevia in savory food applications, where its flavor-modulating properties can be leveraged, present a significant growth avenue. Innovative applications in the pharmaceutical sector, particularly in sugar-free medications and functional foods for specific dietary needs, are also gaining traction. The evolving consumer preference for transparency and sustainability in food sourcing creates an opportunity for stevia producers who can demonstrate responsible cultivation and ethical supply chains. Furthermore, the increasing demand for clean-label products aligns perfectly with stevia's natural origin, opening doors for wider adoption across the entire food and beverage spectrum.

Growth Accelerators in the Europe Stevia Market Industry

Several key catalysts are accelerating the growth of the Europe Stevia Market. Technological breakthroughs in steviol glycoside research are continuously yielding sweeteners with superior taste profiles and functionality, directly addressing historical consumer objections. Strategic partnerships between stevia ingredient suppliers and major food and beverage manufacturers are facilitating wider product integration and market penetration. Aggressive market expansion strategies by leading companies, focusing on new product development and addressing specific application needs, are further propelling market growth. The increasing awareness and acceptance of stevia as a safe and effective sugar substitute among a broader consumer base also acts as a significant growth accelerator.

Key Players Shaping the Europe Stevia Market Market

- The Archer Daniels Midland Company

- Ingredion Inc

- PureCircle

- STEVIAL

- Cargill Inc

- Tereos S A

- GLG LIFE TECH CORP

- Tate & Lyle

Notable Milestones in Europe Stevia Market Sector

- 2020: Acquisition of PureCircle by Ingredion Inc., significantly consolidating market share and enhancing Ingredion's stevia portfolio.

- 2021: Launch of Tate & Lyle's new stevia-based sweetener, Optimizer Stevia, aimed at improving taste profiles and application versatility.

- 2022: Investment in stevia production facilities by The Archer Daniels Midland Company and Cargill Inc., signaling a commitment to increasing supply and supporting market demand.

In-Depth Europe Stevia Market Market Outlook

The future outlook for the Europe Stevia Market is exceptionally robust, driven by sustained consumer demand for healthier alternatives and ongoing product innovation. Key growth accelerators, including advancements in sweetener technology, strategic industry collaborations, and expanding product applications, are set to fuel significant market expansion. The market's potential is further amplified by evolving consumer preferences towards natural and clean-label ingredients, positioning stevia as a frontrunner in the sugar replacement landscape. Strategic opportunities lie in exploring novel applications in savory foods and pharmaceuticals, alongside a continued focus on optimizing taste profiles and cost-effectiveness to solidify stevia's position as the leading natural sweetener in Europe.

Europe Stevia Market Segmentation

-

1. Form

- 1.1. Liquid

- 1.2. Powder

- 1.3. Leaf

-

2. Application

- 2.1. Bakery

- 2.2. Dairy Food Products

- 2.3. Beverages

- 2.4. Dietary Supplements

- 2.5. Confectionery

- 2.6. Others

Europe Stevia Market Segmentation By Geography

-

1. Europe

- 1.1. Spain

- 1.2. United Kingdom

- 1.3. Germany

- 1.4. France

- 1.5. Italy

- 1.6. Russia

- 1.7. Rest of Europe

Europe Stevia Market Regional Market Share

Geographic Coverage of Europe Stevia Market

Europe Stevia Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Growing Demand For Plant Based Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Stevia Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Liquid

- 5.1.2. Powder

- 5.1.3. Leaf

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Dairy Food Products

- 5.2.3. Beverages

- 5.2.4. Dietary Supplements

- 5.2.5. Confectionery

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Archer Daniels Midland Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ingredion Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PureCircle

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 STEVIAL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cargill Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tereos S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GLG LIFE TECH CORP

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tate & Lyle

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 The Archer Daniels Midland Company

List of Figures

- Figure 1: Europe Stevia Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Stevia Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Stevia Market Revenue million Forecast, by Form 2020 & 2033

- Table 2: Europe Stevia Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Europe Stevia Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Stevia Market Revenue million Forecast, by Form 2020 & 2033

- Table 5: Europe Stevia Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Europe Stevia Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Spain Europe Stevia Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: United Kingdom Europe Stevia Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Germany Europe Stevia Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: France Europe Stevia Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Italy Europe Stevia Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Russia Europe Stevia Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Europe Stevia Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Stevia Market?

The projected CAGR is approximately 10.7%.

2. Which companies are prominent players in the Europe Stevia Market?

Key companies in the market include The Archer Daniels Midland Company, Ingredion Inc, PureCircle, STEVIAL, Cargill Inc, Tereos S A, GLG LIFE TECH CORP, Tate & Lyle.

3. What are the main segments of the Europe Stevia Market?

The market segments include Form, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 143.01 million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Growing Demand For Plant Based Ingredients.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. Acquisition of PureCircle by Ingredion Inc in 2020 2. Launch of Tate & Lyle's new stevia-based sweetener, Optimizer Stevia, in 2021 3. Investment in stevia production facilities by The Archer Daniels Midland Company and Cargill Inc in 2022

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Stevia Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Stevia Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Stevia Market?

To stay informed about further developments, trends, and reports in the Europe Stevia Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence