Key Insights

The Egyptian food sweetener market is poised for significant expansion, projected to reach a market size of approximately USD 650 million by 2025, growing at a Compound Annual Growth Rate (CAGR) of 5.22%. This robust growth is primarily driven by evolving consumer preferences towards healthier alternatives, a burgeoning processed food industry, and increasing disposable incomes within Egypt. The demand for sucrose (common sugar) remains substantial, but the market is witnessing a notable shift towards sugar alcohols and high-intensity sweeteners (HIS) due to growing health consciousness around sugar consumption and its associated health risks. This trend is particularly evident in applications like beverages, confectionery, and dairy, where manufacturers are actively reformulating products to reduce sugar content. The increasing prevalence of diabetes and obesity in Egypt further fuels the demand for low-calorie and natural sweeteners, creating a fertile ground for HIS like stevia and sucralose.

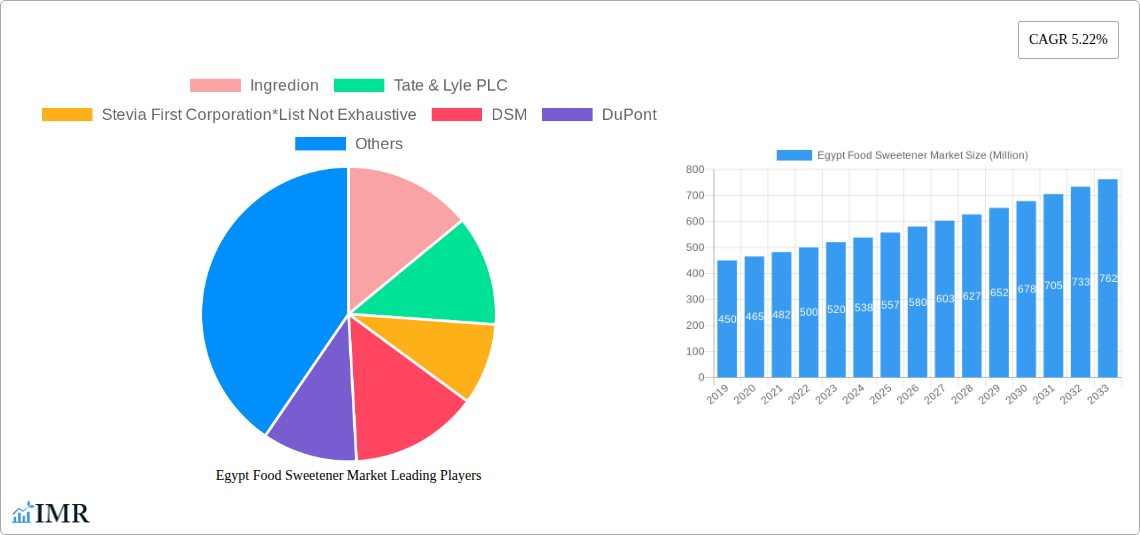

Egypt Food Sweetener Market Market Size (In Million)

The competitive landscape is characterized by a mix of global players and local manufacturers catering to diverse application needs. Key product segments include sucrose, starch sweeteners, sugar alcohols, and high-intensity sweeteners, with HIS expected to exhibit the fastest growth rate. Applications span across dairy, bakery, soups, sauces, dressings, confectionery, beverages, and other food products. While the overall market outlook for Egypt is highly positive, potential restraints could include fluctuations in raw material prices and stringent regulatory frameworks that might impact the adoption of novel sweeteners. However, the overarching demand for healthier food options and the sustained growth of the food processing sector are expected to outweigh these challenges, making the Egyptian food sweetener market an attractive investment and growth opportunity.

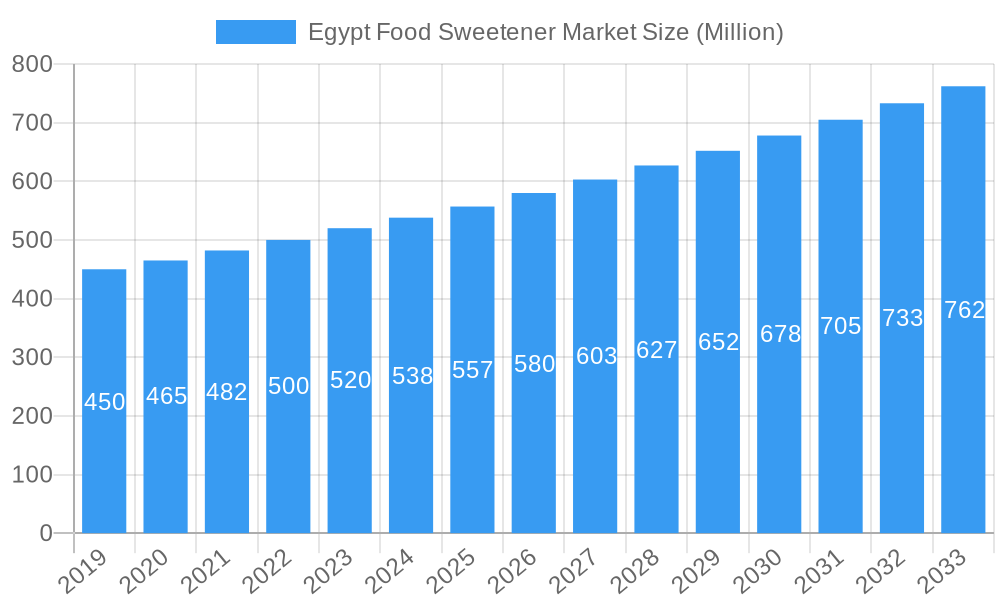

Egypt Food Sweetener Market Company Market Share

Unlocking Sweet Opportunities: The Comprehensive Egypt Food Sweetener Market Report 2024-2033

This in-depth market report provides an exhaustive analysis of the Egypt food sweetener market, forecasting its trajectory from 2024 to 2033. Delve into the intricate dynamics of this burgeoning sector, driven by evolving consumer preferences for healthier alternatives and the robust growth of the Egyptian food and beverage industry. We dissect the market by product type, including Sucrose (Common Sugar), Starch Sweeteners and Sugar Alcohols, and High-intensity Sweeteners (HIS), and by application, spanning Dairy, Bakery, Soups, Sauces, and Dressings, Confectionery, Beverages, and Other Applications. This report is an indispensable resource for manufacturers, ingredient suppliers, R&D professionals, and investors seeking to capitalize on the significant growth potential within the Egyptian sweetener landscape.

Egypt Food Sweetener Market Market Dynamics & Structure

The Egypt food sweetener market is characterized by a moderate to high market concentration, with a few key global players holding significant market share, alongside a growing number of local and regional suppliers. Technological innovation is a primary driver, fueled by the demand for low-calorie sweeteners, natural sweeteners, and ingredients that enhance texture and shelf-life in food products. Regulatory frameworks, primarily concerning food safety and labeling, play a crucial role in shaping market entry and product development. Competitive product substitutes are abundant, ranging from traditional sucrose to a wide array of artificial and natural high-intensity sweeteners. End-user demographics are shifting towards health-conscious consumers, particularly younger generations seeking sugar-free and reduced-sugar options, which is directly impacting demand for healthier sweetener alternatives. Mergers and acquisitions (M&A) trends are on the rise, with larger corporations acquiring innovative smaller players to expand their product portfolios and market reach. For instance, the acquisition of Stevia First Corporation by Ingredion in 2023 signifies this trend. The market is projected to see an increasing number of strategic alliances and partnerships aimed at addressing supply chain efficiencies and product innovation.

Egypt Food Sweetener Market Growth Trends & Insights

The Egypt food sweetener market is poised for substantial growth, driven by a confluence of factors including a growing population, increasing disposable incomes, and a heightened awareness of health and wellness among consumers. The base year of 2025 sets the stage for an estimated market value of approximately USD 550 Million units, with a projected Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period of 2025–2033. This robust growth trajectory is underpinned by the increasing adoption of low-calorie and high-intensity sweeteners across various food and beverage applications. Consumers are actively seeking alternatives to traditional sugar, spurred by concerns over rising obesity rates and related health issues like diabetes. This shift in consumer behavior is creating significant demand for innovative sweetener solutions that do not compromise on taste or product quality. Technological advancements in sweetener production, such as improved extraction processes for natural sweeteners and the development of novel sweetening compounds, are further fueling market expansion. For example, the launch of new low-calorie sweeteners by Tate & Lyle in 2022 reflects the industry's commitment to innovation in this space. Furthermore, the expansion of the food processing industry in Egypt, supported by government initiatives aimed at boosting domestic production and exports, provides a fertile ground for sweetener consumption. The confectionery and beverage sectors, in particular, are witnessing a surge in demand for sugar-reduced and sugar-free products, directly translating into increased uptake of alternative sweeteners. The Egypt food sweetener market is thus characterized by a dynamic interplay between evolving consumer needs, technological innovation, and a supportive industrial environment.

Dominant Regions, Countries, or Segments in Egypt Food Sweetener Market

Within the Egypt food sweetener market, the Beverages segment, particularly within the High-intensity Sweeteners (HIS) product type, is emerging as the dominant force driving market growth. This dominance is attributed to several interconnected factors, including strong consumer preference for sugar-free and diet beverages, coupled with aggressive product innovation by major beverage manufacturers. The Greater Cairo region is a primary economic hub, concentrating a significant portion of the food and beverage manufacturing facilities and consumer base, thus leading regional demand.

Product Type Dominance: High-intensity Sweeteners (HIS) are witnessing unprecedented demand due to their calorie-free nature and superior sweetening power. This segment is projected to account for over 40% of the total market value by 2025, driven by the extensive use of sweeteners like aspartame, sucralose, and stevia-based compounds in beverages and diet foods. Starch Sweeteners and Sugar Alcohols, while significant, are expected to experience moderate growth due to their calorie content and specific functional properties. Sucrose (Common Sugar) remains a staple but its growth is tempered by health concerns.

Application Dominance: The Beverages application segment is the largest consumer of food sweeteners, estimated to reach approximately USD 220 Million units in 2025. This is followed closely by Confectionery and Bakery, which are actively reformulating products to cater to the health-conscious demographic. The demand for HIS in beverages is particularly high due to the need for zero-calorie sweetness without affecting taste profile.

Regional Influence: The Greater Cairo region stands out as the leading market due to its dense population, higher disposable incomes, and a concentration of multinational and local food and beverage companies. Infrastructure development and established distribution networks in this region facilitate faster market penetration and adoption of new sweetener technologies. Economic policies that encourage investment in the food processing sector further bolster the demand for various sweetener types in this prime locale. The expansion of Cargill's sweetener production facility in Alexandria in 2021 is a testament to the strategic importance of Egypt's industrial zones for sweetener supply chain enhancement.

Egypt Food Sweetener Market Product Landscape

The Egypt food sweetener market product landscape is characterized by a dynamic interplay of traditional and innovative offerings. Sucrose, while a legacy product, continues to hold its ground due to its affordability and versatile functionality in bakery and confectionery. However, the real growth is in High-intensity Sweeteners (HIS), with sucralose and stevia-based sweeteners leading the charge. Ingredion's acquisition of Stevia First Corporation in 2023 underscores the strategic importance of natural, zero-calorie HIS. Tate & Lyle's recent launch of new low-calorie sweeteners in 2022 demonstrates ongoing innovation to meet consumer demand for healthier options in beverages and dairy. Starch sweeteners, such as high-fructose corn syrup, remain relevant in processed foods but face scrutiny due to health concerns. The performance metrics of these sweeteners are evaluated based on sweetness intensity, calorie content, taste profile, solubility, and thermal stability, with HIS increasingly scoring higher on consumer-preferred attributes.

Key Drivers, Barriers & Challenges in Egypt Food Sweetener Market

Key Drivers:

- Growing Health Consciousness: A significant surge in consumer awareness regarding health and wellness, particularly concerning sugar intake and its association with obesity and diabetes, is a primary driver. This is fueling demand for low-calorie and natural sweeteners in beverages, dairy, and bakery products.

- Government Initiatives & Food Industry Growth: Supportive government policies aimed at boosting the food processing sector and increasing domestic production are creating a favorable environment for sweetener consumption. The expansion of Cargill's sweetener production facility in Alexandria in 2021 exemplifies this industrial growth.

- Innovation in Food & Beverage Products: Continuous product development by food and beverage manufacturers, especially in the diet and functional food segments, necessitates the use of diverse and advanced sweetener solutions.

Barriers & Challenges:

- Price Sensitivity: While demand for healthier options is rising, price remains a significant consideration for a large segment of the Egyptian population, making premium sweeteners less accessible.

- Regulatory Hurdles: Evolving food safety regulations and labeling requirements can pose challenges for new market entrants and product approvals.

- Supply Chain Volatility: Reliance on imported raw materials for certain sweeteners can expose the market to global price fluctuations and supply chain disruptions. For example, a projected 3% increase in the cost of key HIS ingredients due to geopolitical factors could impact market pricing.

- Consumer Perception & Education: Despite growing awareness, some consumers still harbor misconceptions about the safety and taste of artificial and natural high-intensity sweeteners, requiring ongoing educational efforts.

Emerging Opportunities in Egypt Food Sweetener Market

Emerging opportunities in the Egypt food sweetener market lie in the burgeoning demand for natural and clean-label sweeteners, particularly those derived from plant sources like stevia and monk fruit. The expansion of the "free-from" product category, including sugar-free and gluten-free options, presents a significant growth avenue. Untapped potential exists within the baby food and nutrition segment, where parents are increasingly seeking healthier alternatives to traditional sugars. Furthermore, the development of sweetener blends that offer a more sugar-like taste profile and texture, while maintaining a low-calorie count, represents an innovative application. The increasing adoption of these sweeteners in soups, sauces, and dressings is also a promising area for growth, driven by the desire for healthier convenience foods.

Growth Accelerators in the Egypt Food Sweetener Market Industry

Several catalysts are accelerating the growth of the Egypt food sweetener market. Technological breakthroughs in sweetener extraction and purification are leading to more cost-effective and higher-quality ingredients. Strategic partnerships between sweetener manufacturers and food & beverage companies are fostering product innovation and market penetration. For instance, ongoing collaborations between global ingredient giants and local Egyptian manufacturers are crucial. Market expansion strategies, including targeted marketing campaigns emphasizing the health benefits of reduced-sugar diets and the availability of diverse sweetener options, are playing a pivotal role. Government support for investment in food processing infrastructure and the promotion of healthy eating habits further act as significant growth accelerators for the Egypt food sweetener market. The projected CAGR of 5.8% is a direct reflection of these combined efforts.

Key Players Shaping the Egypt Food Sweetener Market Market

- Ingredion

- Tate & Lyle PLC

- Stevia First Corporation

- DSM

- DuPont

- Cargill Inc

- JK Sucralose Inc

Notable Milestones in Egypt Food Sweetener Market Sector

- 2023: Acquisition of Stevia First Corporation by Ingredion, a move that significantly bolsters Ingredion's position in the natural sweetener market and expands its product offerings for the Egypt food sweetener market.

- 2022: Launch of a new low-calorie sweetener by Tate & Lyle, offering enhanced taste and functionality for the Egyptian beverage and food industries, directly responding to consumer demand for healthier options.

- 2021: Expansion of Cargill's sweetener production facility in Alexandria, Egypt, increasing local supply capabilities and potentially reducing import dependency for starch-based sweeteners and other products, a critical step for market stability.

In-Depth Egypt Food Sweetener Market Market Outlook

The future outlook for the Egypt food sweetener market is exceptionally bright, propelled by strong growth accelerators. The continued emphasis on health and wellness will drive sustained demand for high-intensity sweeteners and sugar alcohols. Strategic alliances between global players like Ingredion and local Egyptian food manufacturers will unlock new market opportunities and facilitate the introduction of innovative products. Government initiatives aimed at promoting a healthier lifestyle and supporting the food processing industry will further fuel market expansion. The market is projected to witness robust growth, with an estimated market value reaching USD 890 Million units by 2033. Key strategic opportunities lie in catering to the growing demand for clean-label and natural sweeteners, expanding product applications in less penetrated segments like savory products, and leveraging technological advancements to offer cost-effective and high-performing sweetener solutions.

Egypt Food Sweetener Market Segmentation

-

1. Product Type

- 1.1. Sucrose (Common Sugar)

- 1.2. Starch Sweeteners and Sugar Alcohols

- 1.3. High-intensity Sweeteners (HIS)

-

2. Application

- 2.1. Dairy

- 2.2. Bakery

- 2.3. Soups, Sauces, and Dressings

- 2.4. Confectionery

- 2.5. Beverages

- 2.6. Other Applications

Egypt Food Sweetener Market Segmentation By Geography

- 1. Egypt

Egypt Food Sweetener Market Regional Market Share

Geographic Coverage of Egypt Food Sweetener Market

Egypt Food Sweetener Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia

- 3.3. Market Restrains

- 3.3.1. Side Effects and Challenges with Stevia

- 3.4. Market Trends

- 3.4.1. Increasing Demand for High-intensity Sweeteners (HIS) in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Food Sweetener Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sucrose (Common Sugar)

- 5.1.2. Starch Sweeteners and Sugar Alcohols

- 5.1.3. High-intensity Sweeteners (HIS)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy

- 5.2.2. Bakery

- 5.2.3. Soups, Sauces, and Dressings

- 5.2.4. Confectionery

- 5.2.5. Beverages

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ingredion

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tate & Lyle PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Stevia First Corporation*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DSM

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DuPont

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cargill Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JK Sucralose Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Ingredion

List of Figures

- Figure 1: Egypt Food Sweetener Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Egypt Food Sweetener Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Food Sweetener Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Egypt Food Sweetener Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Egypt Food Sweetener Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Egypt Food Sweetener Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Egypt Food Sweetener Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Egypt Food Sweetener Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Food Sweetener Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Egypt Food Sweetener Market?

Key companies in the market include Ingredion, Tate & Lyle PLC, Stevia First Corporation*List Not Exhaustive, DSM, DuPont, Cargill Inc, JK Sucralose Inc.

3. What are the main segments of the Egypt Food Sweetener Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia.

6. What are the notable trends driving market growth?

Increasing Demand for High-intensity Sweeteners (HIS) in the Country.

7. Are there any restraints impacting market growth?

Side Effects and Challenges with Stevia.

8. Can you provide examples of recent developments in the market?

1. Acquisition of Stevia First Corporation by Ingredion in 2023 2. Launch of new low-calorie sweetener by Tate & Lyle in 2022 3. Expansion of Cargill's sweetener production facility in Alexandria in 2021

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Food Sweetener Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Food Sweetener Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Food Sweetener Market?

To stay informed about further developments, trends, and reports in the Egypt Food Sweetener Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence