Key Insights

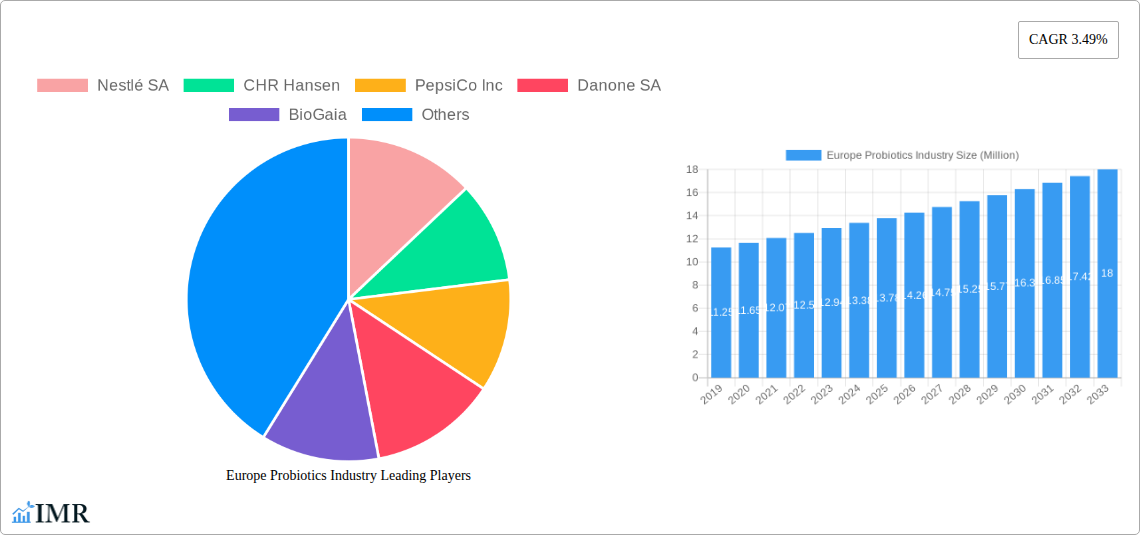

The European probiotics market is poised for significant expansion, projected to reach USD 13.78 billion by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 3.49% through 2033. This robust growth is primarily propelled by increasing consumer awareness regarding the health benefits of probiotics, particularly their positive impact on gut health, immunity, and overall well-being. The rising prevalence of lifestyle-related diseases and a proactive approach to preventative healthcare are further fueling demand for probiotic-rich functional foods and beverages, alongside dietary supplements. Furthermore, the evolving understanding of the microbiome's crucial role in health is driving innovation and product development across various segments.

Europe Probiotics Industry Market Size (In Million)

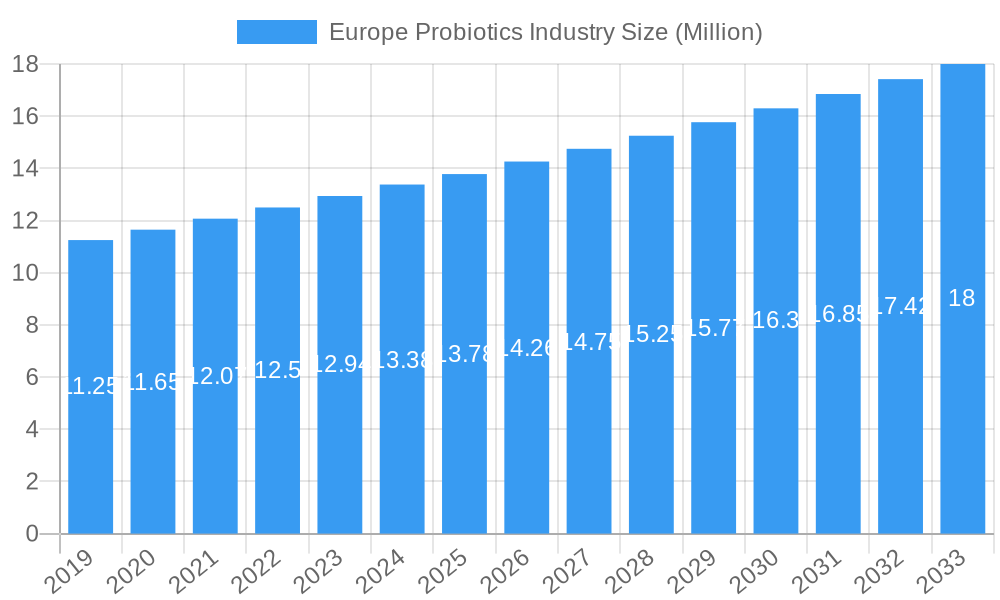

The market dynamics are characterized by evolving consumer preferences and distribution strategies. Functional foods and beverages are expected to maintain their dominance, offering convenient and palatable ways for consumers to incorporate probiotics into their daily routines. Dietary supplements, however, are witnessing rapid growth due to their targeted formulations and perceived efficacy. The distribution landscape is diversifying, with supermarkets and hypermarkets serving as primary channels, complemented by a growing presence in pharmacies, health stores, and even convenience stores, catering to a broader consumer base. Key players like Nestlé SA, Danone SA, and PepsiCo Inc. are heavily investing in research and development, strategic acquisitions, and marketing initiatives to capture market share in this dynamic and competitive European landscape, with countries like the United Kingdom, Germany, and France leading consumption.

Europe Probiotics Industry Company Market Share

Europe Probiotics Industry: Comprehensive Market Analysis & Forecast 2019–2033

This in-depth report provides an indispensable analysis of the Europe probiotics market, dissecting intricate dynamics, growth trajectories, and competitive landscapes. Essential for functional food and beverage manufacturers, dietary supplement brands, animal feed producers, and pharmacy/health store distributors, this report offers strategic insights into a rapidly expanding sector driven by rising consumer demand for health and wellness solutions. Leverage critical data for informed decision-making regarding product development, market entry, and investment. This report covers functional food and beverages, dietary supplements, and animal feed as key product segments, and analyzes distribution through supermarkets/hypermarkets, pharmacies/health stores, convenience stores, and other distribution channels. The study period spans 2019–2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, based on historical data from 2019–2024. All values are presented in million units.

Europe Probiotics Industry Market Dynamics & Structure

The Europe probiotics market is characterized by a moderately concentrated structure, with a few key global players and numerous smaller, specialized companies vying for market share. Technological innovation is a significant driver, fueled by ongoing research into novel strains and their efficacy for various health benefits, from gut health to immunity and mental well-being. Regulatory frameworks, while evolving, generally support the growth of well-researched probiotic products, particularly within the food and supplement categories. Competitive product substitutes, such as prebiotics and synbiotics, also influence market dynamics, prompting innovation in probiotic formulations. End-user demographics are shifting towards a health-conscious population, particularly millennials and Gen Z, who actively seek preventative health solutions. Mergers and acquisitions (M&A) trends are evident as larger corporations aim to consolidate their market position and acquire innovative technologies or specialized portfolios.

- Market Concentration: Dominated by a mix of multinational corporations and niche players, leading to both intense competition and strategic collaborations.

- Technological Innovation: Driven by R&D in strain discovery, fermentation processes, and targeted delivery systems to enhance efficacy and expand applications.

- Regulatory Frameworks: Generally favorable for scientifically validated products, with ongoing discussions around clear labeling and health claims.

- Competitive Landscape: Probiotics compete with prebiotics, synbiotics, and general health supplements, necessitating clear differentiation.

- End-User Demographics: Growing demand from a health-conscious population, including a significant uptake in the younger demographic segments.

- M&A Trends: Strategic acquisitions are common as companies seek to expand their product offerings, geographical reach, and R&D capabilities.

Europe Probiotics Industry Growth Trends & Insights

The Europe probiotics market is projected for robust expansion, driven by an escalating awareness of the profound link between gut health and overall well-being. Probiotics are no longer confined to niche digestive health supplements; they are increasingly integrated into functional foods and beverages, catering to a broader consumer base seeking convenient health-enhancing options. This shift is reflected in the market size evolution, which has witnessed a steady upward trajectory over the historical period and is expected to accelerate through the forecast period. Adoption rates for probiotic-fortified products are increasing across various age groups, spurred by extensive marketing campaigns and positive word-of-mouth. Technological disruptions, including advancements in strain identification, encapsulation technologies for enhanced survival, and personalized probiotic formulations, are further fueling market penetration. Consumer behavior is demonstrably shifting towards preventative healthcare, with a greater willingness to invest in products that promise long-term health benefits. The CAGR for the Europe probiotics market is estimated at 9.2% during the forecast period, projecting the market size to reach XX Million Units by 2033. Market penetration in functional food and beverage segments is expected to reach XX% by 2030.

Dominant Regions, Countries, or Segments in Europe Probiotics Industry

The Functional Food and Beverage segment is emerging as the dominant force within the Europe probiotics industry, driven by consumer preference for integrated health solutions. This segment, valued at XX Million Units in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of XX% through 2033, reaching an estimated XX Million Units. The increasing demand for yogurts, fermented drinks, and fortified snacks containing live and active cultures underscores this dominance. Key drivers include the convenience factor, appealing to busy lifestyles, and the growing understanding of how probiotics can positively impact gut health, immunity, and even mood when consumed as part of a regular diet.

- Functional Food and Beverage:

- Dominance Factors: Consumer preference for convenient health solutions, integration into daily diets, growing research linking gut health to overall well-being, and innovative product development.

- Market Share: Expected to hold over XX% of the total Europe probiotics market by 2033.

- Growth Potential: High, driven by new product launches and expanding applications in various food categories.

- Dietary Supplements:

- Dominance Factors: Established market, wide range of formulations targeting specific health concerns (digestive, immune, mental health), and trusted by consumers seeking targeted therapeutic benefits.

- Market Share: Significant, projected to account for XX% of the market by 2033.

- Growth Potential: Steady, with continued innovation in strain combinations and targeted delivery.

- Animal Feed:

- Dominance Factors: Growing awareness of animal welfare and performance enhancement in livestock and aquaculture, driven by the need for sustainable farming practices and reduced antibiotic use.

- Market Share: A growing segment, anticipated to reach XX% by 2033.

- Growth Potential: Strong, influenced by regulatory pressures to limit antibiotic use in animal agriculture.

The Pharmacies/Health Stores distribution channel remains a critical nexus for probiotic sales, commanding a significant market share of XX% in 2025, projected to reach XX Million Units by 2033. These channels provide expert advice and a curated selection of scientifically backed products, fostering consumer trust and facilitating the uptake of more advanced or specialized probiotic formulations.

Europe Probiotics Industry Product Landscape

The Europe probiotics product landscape is characterized by rapid innovation and diversification. Beyond traditional yogurts and capsules, the market is seeing a surge in probiotic-fortified beverages, baked goods, and even confectionery, catering to evolving consumer preferences for palatable and accessible health solutions. Unique selling propositions increasingly revolve around specific, clinically validated probiotic strains known for distinct health benefits, such as Lactobacillus rhamnosus GG for digestive health or Bifidobacterium animalis for immune support. Technological advancements in encapsulation techniques are enhancing the survivability of probiotics through the digestive tract, ensuring greater efficacy and a more compelling consumer experience. Performance metrics are increasingly tied to scientific validation and demonstrable health outcomes.

Key Drivers, Barriers & Challenges in Europe Probiotics Industry

The Europe probiotics industry is propelled by several key drivers, including the escalating consumer demand for preventative healthcare solutions and a growing scientific understanding of the gut microbiome's impact on overall health. Technological advancements in strain discovery and formulation are also critical, enabling the development of more targeted and effective products. Economic factors, such as rising disposable incomes, allow for greater consumer investment in premium health products.

- Key Drivers:

- Growing Health Consciousness: Increased consumer focus on gut health, immunity, and personalized wellness.

- Scientific Advancements: Ongoing research revealing new probiotic benefits and strain efficacies.

- Product Innovation: Development of diverse product formats and targeted formulations.

- Supportive Regulatory Environment: Generally favorable regulations for well-researched probiotic products.

Key barriers and challenges, however, include stringent and sometimes fragmented regulatory approval processes for health claims across different European countries, which can hinder market entry and product differentiation. Supply chain complexities for live microbial products, requiring specific handling and storage conditions, can also pose logistical hurdles. Furthermore, consumer confusion arising from unsubstantiated claims by some market players necessitates clear communication and scientific backing for credible products. Competitive pressures from both established brands and emerging players demand continuous innovation and marketing effectiveness.

- Key Barriers & Challenges:

- Regulatory Hurdles: Complex and varied regulations for health claims across Europe.

- Supply Chain Management: Ensuring the viability and efficacy of live cultures from production to consumption.

- Consumer Education: Differentiating scientifically supported probiotics from less credible products.

- Intense Competition: Pressure from numerous domestic and international players.

- Cost of R&D: Significant investment required for strain research and clinical validation.

Emerging Opportunities in Europe Probiotics Industry

Emerging opportunities in the Europe probiotics industry lie in the untapped potential of personalized nutrition, leveraging genetic data and microbiome profiling to offer highly tailored probiotic recommendations. The expansion of probiotics into new application areas, such as pet care and specialized infant nutrition, presents significant growth avenues. Evolving consumer preferences for natural and sustainable products also create an opening for probiotics derived from novel, ethically sourced ingredients.

Growth Accelerators in the Europe Probiotics Industry Industry

Long-term growth in the Europe probiotics industry will be significantly accelerated by ongoing technological breakthroughs in genetic sequencing and bioinformatics, enabling the discovery of novel probiotic strains with unprecedented health benefits. Strategic partnerships between research institutions and probiotic manufacturers will foster innovation and expedite the translation of scientific findings into market-ready products. Furthermore, aggressive market expansion strategies by leading players into underpenetrated Eastern European markets and an increased focus on B2B applications, such as probiotics for industrial fermentation or agriculture, will act as potent growth catalysts.

Key Players Shaping the Europe Probiotics Industry Market

- Nestlé SA

- CHR Hansen

- PepsiCo Inc

- Danone SA

- BioGaia

- Lifeway Foods Inc

- Archer Daniels Midland

- Yakult Honsha

- Daflorn MLM5 Ltd

- Bio-K Plus International Inc

Notable Milestones in Europe Probiotics Industry Sector

- September 2022: BioGaia announced its partnership with Skinome to research and develop a probiotic concentrate with living bacteria that will support the skin microbiome and improve skin health.

- August 2022: BioGaia announced expanding its product line with fresh bacterial strains created in collaboration with wholly-owned subsidiary MetaboGen. The two businesses will jointly open a fermentation pilot plant in Eslöv to advance new strains through clinical development and toward a potential launch.

- February 2021: Perrigo and Probi signed an extensive pan-European agreement to launch and expand premium probiotic digestive and immune health concepts in 14 European countries. The products offer validated probiotic strains and have documented positive effects clinically. Furthermore, the partnership is bound to strengthen the company's foothold in many European countries in probiotics.

In-Depth Europe Probiotics Industry Market Outlook

The outlook for the Europe probiotics industry remains exceptionally bright, characterized by sustained growth driven by an ever-increasing consumer focus on proactive health management and the burgeoning scientific understanding of the microbiome. Future market potential is amplified by advancements in personalized nutrition and the development of probiotics for novel applications beyond human consumption, such as advanced animal health solutions and environmental remediation. Strategic opportunities abound for companies that can navigate the evolving regulatory landscape, invest in robust clinical validation, and effectively communicate the scientifically proven benefits of their products to a discerning European consumer base.

Europe Probiotics Industry Segmentation

-

1. Product Type

- 1.1. Functional Food and Beverage

- 1.2. Dietary Supplements

- 1.3. Animal Feed

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Pharmacies/Health Stores

- 2.3. Convenience Stores

- 2.4. Other Distribution Channels

Europe Probiotics Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Probiotics Industry Regional Market Share

Geographic Coverage of Europe Probiotics Industry

Europe Probiotics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Specialty

- 3.2.2 Organic

- 3.2.3 and Green Coffee; Growing In-House Production of Coffee in the Country

- 3.3. Market Restrains

- 3.3.1. Change in Climatic Conditions Impacting Coffee Plantations

- 3.4. Market Trends

- 3.4.1. Growing Demand for Functional Food and Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Probiotics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food and Beverage

- 5.1.2. Dietary Supplements

- 5.1.3. Animal Feed

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Pharmacies/Health Stores

- 5.2.3. Convenience Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nestlé SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CHR Hansen

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PepsiCo Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Danone SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BioGaia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lifeway Foods Inc *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Archer Daniels Midland

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yakult Honsha

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Daflorn MLM5 Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bio-K Plus International Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nestlé SA

List of Figures

- Figure 1: Europe Probiotics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Probiotics Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Probiotics Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Probiotics Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Probiotics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Probiotics Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Europe Probiotics Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Probiotics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Probiotics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Probiotics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Probiotics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Probiotics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Probiotics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Probiotics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Probiotics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Probiotics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Probiotics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Probiotics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Probiotics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Probiotics Industry?

The projected CAGR is approximately 3.49%.

2. Which companies are prominent players in the Europe Probiotics Industry?

Key companies in the market include Nestlé SA, CHR Hansen, PepsiCo Inc, Danone SA, BioGaia, Lifeway Foods Inc *List Not Exhaustive, Archer Daniels Midland, Yakult Honsha, Daflorn MLM5 Ltd, Bio-K Plus International Inc.

3. What are the main segments of the Europe Probiotics Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Specialty. Organic. and Green Coffee; Growing In-House Production of Coffee in the Country.

6. What are the notable trends driving market growth?

Growing Demand for Functional Food and Beverages.

7. Are there any restraints impacting market growth?

Change in Climatic Conditions Impacting Coffee Plantations.

8. Can you provide examples of recent developments in the market?

September 2022: BioGaia announced its partnership with Skinome to research and develop a probiotic concentrate with living bacteria that will support the skin microbiome and improve skin health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Probiotics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Probiotics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Probiotics Industry?

To stay informed about further developments, trends, and reports in the Europe Probiotics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence