Key Insights

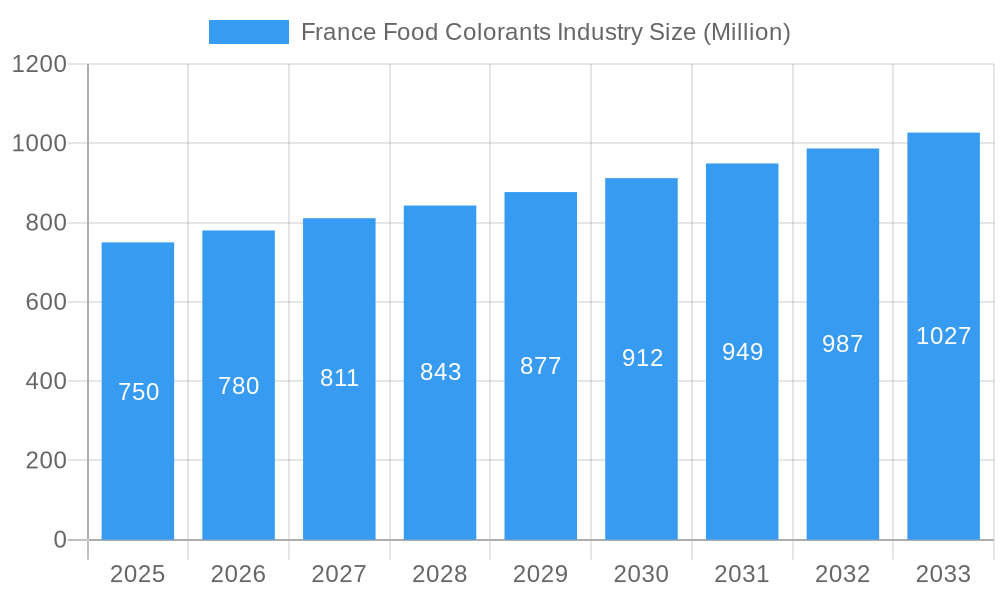

The French food colorants market is projected for robust expansion, anticipating a Compound Annual Growth Rate (CAGR) of 4.00% from 2025 to 2033. This growth trajectory is fueled by escalating consumer demand for visually appealing food and beverages, with the market size expected to reach a substantial valuation by 2033. A key driver is the increasing preference for natural colorants, propelled by heightened health awareness and the demand for "clean label" products, which is stimulating innovation and product development. The beverage and confectionery sectors are anticipated to spearhead this growth due to their strong reliance on vibrant aesthetics. Moreover, innovations in coloring technologies and the creation of stable, novel natural colorants are further enhancing market potential.

France Food Colorants Industry Market Size (In Billion)

While the outlook is positive, the French food colorants market encounters certain challenges. Volatile raw material costs, especially for natural colorants, may affect manufacturer profit margins and pricing. Navigating complex regulatory frameworks for food additives, particularly for new ingredients, presents compliance hurdles. Nevertheless, strong market drivers are expected to outweigh these restraints. Leading companies like Kalsec Inc., FMC Corporation, Sensient Technologies, and Chr. Hansen AS are prioritizing R&D to expand their offerings of natural and synthetic colorants, meeting diverse application needs in beverages, dairy, bakery, and meat products. As a significant contributor to the European market, France is poised to play a crucial role in the regional market's overall share.

France Food Colorants Industry Company Market Share

France Food Colorants Industry Report: Market Analysis, Growth Drivers, and Future Outlook (2019-2033)

This comprehensive report delivers an in-depth analysis of the France Food Colorants Industry, providing critical insights for stakeholders. It meticulously examines market dynamics, growth trends, product landscape, key players, and future opportunities. Leveraging high-traffic keywords and a detailed market segmentation approach, this report is optimized for maximum search engine visibility and delivers actionable intelligence to industry professionals seeking to navigate and capitalize on the evolving French food colorant market.

France Food Colorants Industry Market Dynamics & Structure

The France food colorants industry is characterized by a moderate market concentration, with several leading food colorant manufacturers holding significant market shares, particularly in the natural food colorants segment. Technological innovation is a key driver, with ongoing advancements in extraction and stabilization techniques for natural colorants, driven by increasing consumer demand for clean-label products. Regulatory frameworks, primarily dictated by the European Union and national French food safety agencies, play a crucial role in shaping market access and product development. Stricter regulations on synthetic food colors continue to favor the adoption of their natural counterparts. Competitive product substitutes, such as ingredients offering color naturally through processing (e.g., caramelization in bakery), present a growing challenge, especially in cost-sensitive applications. End-user demographics are shifting towards health-conscious consumers, influencing purchasing decisions towards food colorants perceived as natural and safe. Mergers and acquisitions (M&A) trends indicate strategic consolidation among key players aiming to expand product portfolios and geographical reach. For instance, recent M&A activity has focused on acquiring companies with expertise in specialized natural colorant technologies.

- Market Concentration: Moderate to High, with key players dominating specific segments.

- Technological Innovation Drivers: Clean-label demands, improved extraction, and stabilization of natural colorants.

- Regulatory Frameworks: EU and French food safety regulations (e.g., EFSA guidelines) significantly influence ingredient approval and usage.

- Competitive Product Substitutes: Natural color development through processing, ingredient blends.

- End-User Demographics: Growing demand for natural, plant-based, and transparently sourced colorants.

- M&A Trends: Strategic acquisitions to broaden natural colorant offerings and enhance R&D capabilities. Estimated M&A deal volume in the broader European food ingredients sector averaged XX per year between 2021-2023.

France Food Colorants Industry Growth Trends & Insights

The France food colorants industry is poised for robust expansion driven by a confluence of evolving consumer preferences, technological advancements, and evolving market dynamics. Over the study period of 2019–2033, the market size is projected to witness a significant upward trajectory. The natural food colorants segment, currently a dominant force and estimated at XXX million units in 2025, is expected to continue its lead, propelled by the persistent consumer demand for clean-label products and a growing aversion to artificial additives. This trend is directly linked to increasing consumer awareness regarding the perceived health benefits and safety profiles of naturally derived ingredients. The adoption rates for natural food colorants are steadily increasing across various applications, particularly in the beverage and bakery sectors, which represent substantial market segments. Technological disruptions are playing a pivotal role in enhancing the efficacy, stability, and cost-effectiveness of natural colorants, thereby bridging the gap with their synthetic counterparts. Innovations in microencapsulation, advanced extraction techniques, and the identification of novel natural color sources are actively contributing to this evolution.

Consumer behavior shifts are profoundly impacting the food colorants market. French consumers, more than ever, are scrutinizing ingredient lists, seeking transparent sourcing and fewer artificial components. This has led to a significant market penetration for products explicitly marketed as "natural color." The forecasted CAGR of XX% for the natural food colorants segment between 2025 and 2033 underscores this dominance. While synthetic food colors, with an estimated market size of XX million units in 2025, still hold a significant share, their growth is projected to be more modest, influenced by ongoing regulatory scrutiny and consumer preference away from them. The overall market size for food colorants in France, encompassing both natural and synthetic, is anticipated to grow from an estimated XX million units in 2025 to XX million units by 2033, reflecting a healthy overall market expansion. Understanding these evolving dynamics is crucial for businesses aiming to thrive in this competitive landscape.

Dominant Regions, Countries, or Segments in France Food Colorants Industry

Within the France food colorants industry, the Natural Color segment emerges as the dominant force, significantly outperforming its synthetic counterpart. In 2025, the market value for natural food colorants is estimated at XXX million units, whereas synthetic food colorants are projected to be valued at XX million units. This ascendancy is propelled by a multifaceted interplay of consumer preferences, regulatory landscapes, and product innovation.

Key Drivers of Natural Color Dominance:

- Unwavering Consumer Demand for Clean Labels: French consumers are increasingly health-conscious and prioritize transparency in food ingredients. The perception of natural colorants as safer and healthier is a primary driver, leading to a preference for products with fewer artificial additives. This is particularly evident in the beverage and bakery sectors, where vibrant natural hues are highly sought after.

- Evolving Regulatory Frameworks: While stringent regulations exist for both natural and synthetic colors, there's a continuous push towards limiting the use of certain synthetic dyes due to potential health concerns. This regulatory environment naturally favors the adoption and research into natural alternatives.

- Technological Advancements in Natural Color Extraction and Stabilization: Innovations in extraction techniques, such as supercritical fluid extraction and enzyme-assisted extraction, have improved the yield, purity, and stability of natural colorants. Furthermore, advancements in encapsulation technologies have addressed challenges related to color degradation and limited shelf-life, making them more viable for a wider range of applications.

- Growth in Application Sectors: The beverage industry, a substantial consumer of food colorants, shows a pronounced shift towards natural colors for juices, dairy drinks, and soft drinks. Similarly, the bakery sector, driven by artisanal trends and a demand for visually appealing products, is increasingly adopting natural colorants for cakes, pastries, and confectionery items. The dairy and frozen products segment, along with confectionery, also contributes significantly to the demand for natural hues.

- Brand Differentiation and Premiumization: Food manufacturers are leveraging natural colorants as a key differentiator in their product offerings, allowing for premium pricing and enhanced brand perception associated with healthier and more natural products.

Market Share and Growth Potential:

The Natural Color segment is projected to capture over XX% of the total food colorants market in France by 2025, with an estimated compound annual growth rate (CAGR) of XX% during the forecast period (2025–2033). This growth is significantly higher than that of synthetic colors, which are expected to grow at a CAGR of XX%. The Beverage application segment is anticipated to remain the largest end-user, accounting for approximately XX% of the natural food colorants market in 2025, followed by Bakery (XX%) and Confectionery (XX%).

- Dominant Segment: Natural Color

- Key Application Sectors: Beverage, Bakery, Dairy and Frozen Products, Confectionery, Meat, Poultry, and Seafood.

- Growth Drivers: Consumer demand for clean labels, regulatory shifts favoring natural ingredients, technological innovation in extraction and stabilization, and brand premiumization strategies.

- Market Share (2025 Estimate): Natural Color (XX%), Synthetic Color (XX%).

- Projected CAGR (2025-2033): Natural Color (XX%), Synthetic Color (XX%).

France Food Colorants Industry Product Landscape

The product landscape of the France food colorants industry is increasingly defined by innovation, focusing on natural sourcing, enhanced stability, and broader application suitability. Natural colorants derived from sources like anthocyanins (from berries and purple vegetables), carotenoids (from annatto, paprika, and turmeric), and chlorophyll (from green plants) are at the forefront of product development. Manufacturers are focusing on improving the heat and light stability of these natural pigments through advanced processing and encapsulation techniques, expanding their usability in challenging food matrices and processing conditions. For instance, microencapsulated paprika oleoresin now offers superior heat resistance for savory snacks. Unique selling propositions often revolve around vibrant and consistent hues, traceability of natural ingredients, and clean-label compliance. Technological advancements in enzyme-assisted extraction are yielding higher concentrations of active color compounds with improved purity, reducing the need for extensive purification steps. The performance metrics being optimized include color intensity, shelf-life, migration resistance, and pH stability, ensuring that natural alternatives can effectively replace synthetic colors without compromising product aesthetics or quality.

Key Drivers, Barriers & Challenges in France Food Colorants Industry

Key Drivers:

The France food colorants industry is primarily propelled by the escalating consumer demand for natural and clean-label ingredients, fueled by a growing awareness of health and wellness. This trend directly supports the growth of natural food colorants derived from fruits, vegetables, and other botanical sources. Technological innovation in extraction and stabilization techniques for natural colors is a significant driver, making them more competitive against synthetic alternatives in terms of performance and cost-effectiveness. Furthermore, stringent regulatory frameworks in France and the EU that favor safer ingredients indirectly promote the shift towards natural options. Favorable government policies encouraging sustainable agriculture and food production also contribute to the adoption of plant-based colorants.

- Consumer Demand for Natural Ingredients: Driving the market for plant-based and clean-label colorants.

- Technological Advancements: Improving stability, efficacy, and cost of natural colorants.

- Regulatory Landscape: Favorable regulations for natural ingredients and restrictions on certain synthetic dyes.

- Sustainability Initiatives: Growing emphasis on eco-friendly sourcing and production.

Barriers & Challenges:

Despite the positive outlook, the industry faces several challenges. The higher cost of natural food colorants compared to synthetic alternatives remains a significant barrier, particularly for mass-produced food items and private label brands. Variability in the availability and consistency of raw materials for natural colorants, influenced by agricultural yields and climate conditions, can lead to supply chain disruptions and price fluctuations. Achieving comparable color intensity and stability of certain natural colors to their synthetic counterparts in specific applications, especially under extreme processing conditions like high heat or prolonged light exposure, presents a technical challenge. Intense competition from both established players and emerging niche manufacturers also poses a challenge, requiring continuous innovation and strategic marketing. Supply chain complexities and the need for specialized logistics for sensitive natural colorants add to operational hurdles.

- Cost Competitiveness: Natural colorants are often more expensive than synthetic options.

- Raw Material Variability: Supply chain disruptions due to agricultural factors affecting consistency and price.

- Performance Limitations: Challenges in matching synthetic color stability and intensity in all applications.

- Intense Competition: Pressure from both large corporations and smaller, specialized producers.

- Supply Chain Complexity: Ensuring consistent sourcing and specialized logistics for natural ingredients.

Emerging Opportunities in France Food Colorants Industry

Emerging opportunities in the France food colorants industry are centered around the burgeoning demand for plant-based food alternatives, functional food colorants that offer additional health benefits, and personalized nutrition. The growing popularity of vegan and vegetarian diets necessitates a wider palette of natural colors to mimic traditional food appearances. Innovations in the extraction of colors from underutilized agricultural by-products present a sustainable and cost-effective avenue for new product development. Furthermore, the exploration of natural colorants with antioxidant or anti-inflammatory properties can lead to the creation of value-added ingredients that appeal to health-conscious consumers. The "free-from" claims (e.g., free from artificial colors, allergens) continue to drive innovation, creating niches for specialized colorant solutions. Finally, advancements in digital color matching and formulation software are enabling more precise and efficient color application, opening doors for customized solutions for food manufacturers.

Growth Accelerators in the France Food Colorants Industry Industry

Several key catalysts are accelerating the growth of the France food colorants industry. Strategic partnerships and collaborations between food ingredient suppliers, research institutions, and food manufacturers are crucial for faster product development and market penetration of innovative natural color solutions. Investment in cutting-edge R&D, particularly in areas like biotechnology for color production and nanotechnology for enhanced color delivery, promises to unlock new possibilities. Market expansion strategies focusing on emerging applications within the food and beverage sector, such as ready-to-eat meals, plant-based dairy alternatives, and functional beverages, will broaden the demand base. Furthermore, proactive engagement with regulatory bodies to ensure a clear and supportive regulatory pathway for novel natural colorants can significantly de-risk innovation and encourage investment. Consumer education campaigns that highlight the benefits and safety of natural colorants can also accelerate adoption rates.

Key Players Shaping the France Food Colorants Industry Market

- Kalsec Inc

- FMC Corp

- Sensient Technologies

- Dohler Group

- BASF SE

- Chr Hansen AS

- DD Williamson & Co

- Koninklijke DSM NV

Notable Milestones in France Food Colorants Industry Sector

- 2023: Launch of a new range of heat-stable anthocyanins for bakery applications by Sensient Technologies, addressing a long-standing challenge in natural color stability.

- 2022: Chr Hansen AS announced significant investment in expanding its natural color production capacity in Europe to meet growing demand from the beverage and confectionery sectors.

- 2021: Dohler Group acquired a specialized ingredient supplier with expertise in fruit and vegetable extracts, bolstering its natural colorant portfolio.

- 2020: Kalsec Inc. introduced a novel line of natural colorants derived from ancient grains, catering to the trend for unique and heritage ingredients.

- 2019: The European Food Safety Authority (EFSA) published updated guidelines on the use of natural food colorants, further clarifying regulations and encouraging their adoption.

In-Depth France Food Colorants Industry Market Outlook

The France food colorants industry is on an upward trajectory, driven by an unyielding consumer preference for natural ingredients and continuous technological innovation. Growth accelerators such as strategic collaborations for R&D, targeted investments in biotechnology for color production, and expansion into burgeoning application sectors like plant-based foods and functional beverages will solidify this growth. Proactive engagement with regulatory bodies to foster a supportive environment for novel natural colorants and effective consumer education are crucial for sustained market expansion. The future of the market lies in delivering natural color solutions that offer not only vibrant aesthetics but also functional benefits, further appealing to health-conscious consumers and enabling food manufacturers to create differentiated and premium products. The outlook is highly positive, with significant opportunities for players who can innovate, adapt to evolving consumer demands, and navigate the regulatory landscape effectively.

France Food Colorants Industry Segmentation

-

1. Product Type

- 1.1. Natural Color

- 1.2. Synthetic Color

-

2. Application

- 2.1. Beverage

- 2.2. Dairy and Frozen Products

- 2.3. Bakery

- 2.4. Meat, Poultry, and Seafood

- 2.5. Confectionery

- 2.6. Other Applications

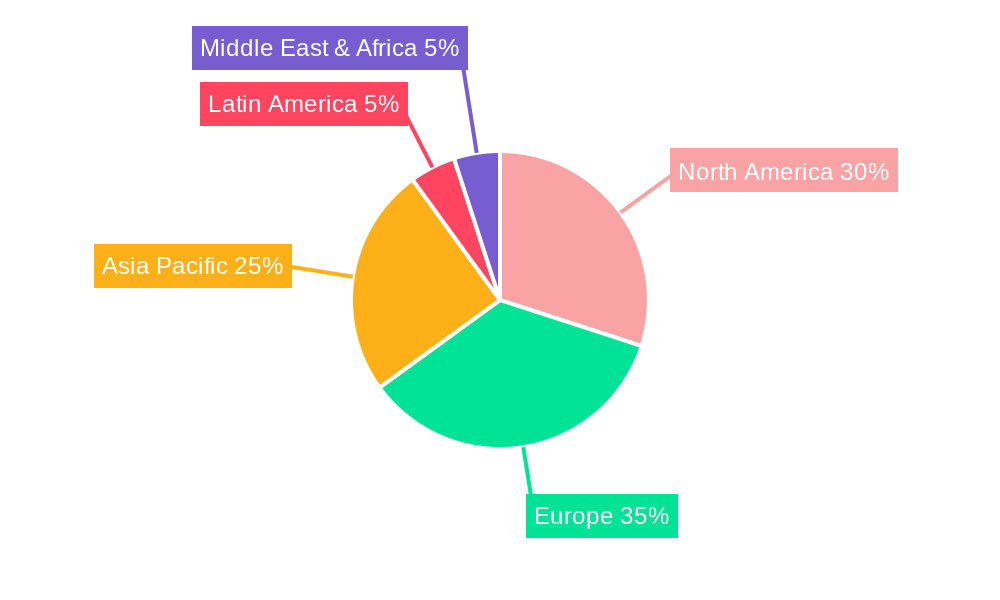

France Food Colorants Industry Segmentation By Geography

- 1. France

France Food Colorants Industry Regional Market Share

Geographic Coverage of France Food Colorants Industry

France Food Colorants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth

- 3.4. Market Trends

- 3.4.1. Natural Food Colorants Dominates the Overall Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Food Colorants Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Natural Color

- 5.1.2. Synthetic Color

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverage

- 5.2.2. Dairy and Frozen Products

- 5.2.3. Bakery

- 5.2.4. Meat, Poultry, and Seafood

- 5.2.5. Confectionery

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kalsec Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FMC Cor

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sensient Technologies

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dohler Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BASF SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chr Hansen AS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 D D Williamson & Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Koninklijke DSM NV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Kalsec Inc

List of Figures

- Figure 1: France Food Colorants Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Food Colorants Industry Share (%) by Company 2025

List of Tables

- Table 1: France Food Colorants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: France Food Colorants Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: France Food Colorants Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: France Food Colorants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: France Food Colorants Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: France Food Colorants Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Food Colorants Industry?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the France Food Colorants Industry?

Key companies in the market include Kalsec Inc, FMC Cor, Sensient Technologies, Dohler Group, BASF SE, Chr Hansen AS, D D Williamson & Co, Koninklijke DSM NV.

3. What are the main segments of the France Food Colorants Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.75 billion as of 2022.

5. What are some drivers contributing to market growth?

The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth.

6. What are the notable trends driving market growth?

Natural Food Colorants Dominates the Overall Market.

7. Are there any restraints impacting market growth?

Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Food Colorants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Food Colorants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Food Colorants Industry?

To stay informed about further developments, trends, and reports in the France Food Colorants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence