Key Insights

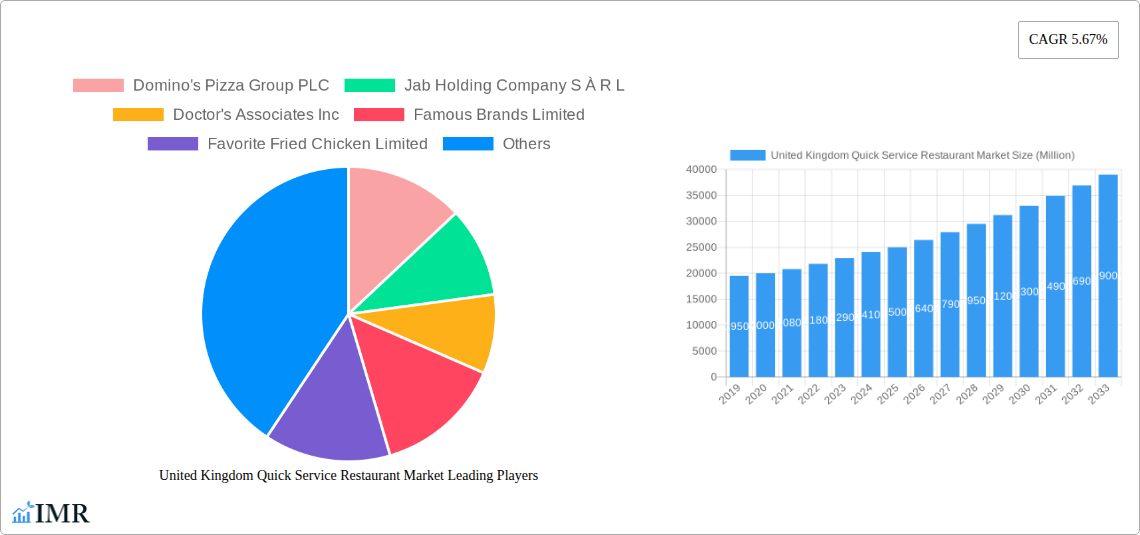

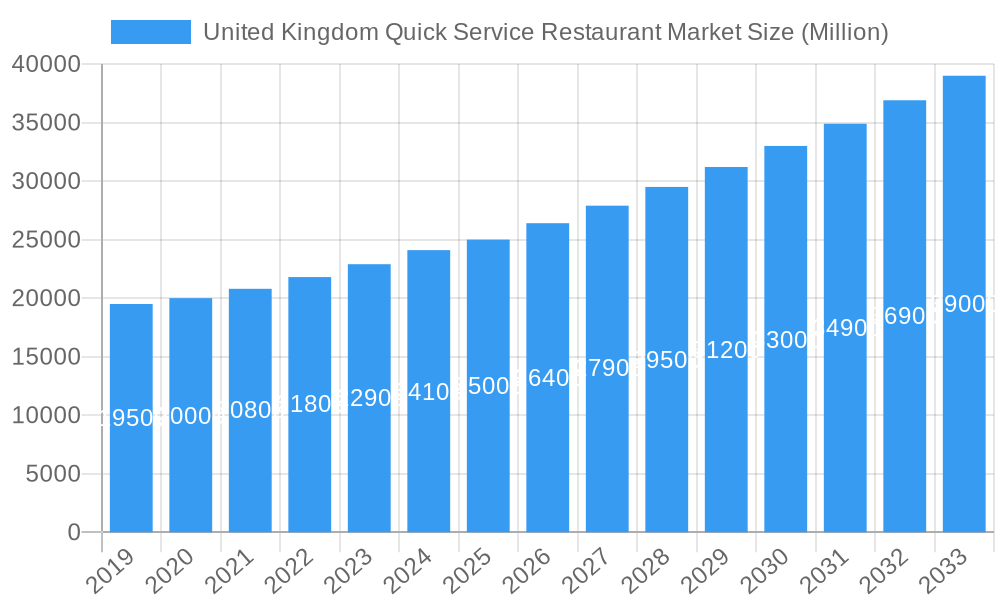

The United Kingdom Quick Service Restaurant (QSR) market is projected to experience substantial growth, reaching an estimated $23.6 billion by 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 5.42% from 2025 to 2033. Key growth factors include rising demand for convenience amidst busy lifestyles, evolving consumer preferences for diverse and international cuisines, and the significant impact of digital ordering platforms and delivery services on accessibility and customer engagement. Investments in operational efficiency through technologies like AI and automation are also contributing to market dynamism.

United Kingdom Quick Service Restaurant Market Market Size (In Billion)

The UK QSR market is segmented by cuisine, outlet type, and location. The "Other QSR Cuisines" segment is anticipated to grow significantly as consumers seek novel dining experiences. Bakeries and coffee-focused QSRs maintain consistent demand. Chained outlets are expected to dominate due to brand recognition and economies of scale, while independent outlets will cater to unique local tastes. Leisure and retail locations offer strong sales potential. However, the market faces challenges such as rising ingredient costs, labor shortages, and competition from meal kit delivery services.

United Kingdom Quick Service Restaurant Market Company Market Share

United Kingdom Quick Service Restaurant Market Analysis: Forecast to 2033

This report provides a comprehensive analysis of the United Kingdom Quick Service Restaurant (QSR) market, with a base year of 2025 and a forecast period extending to 2033. It covers market dynamics, growth trends, key drivers, emerging opportunities, and competitive landscape. Optimized for search engine visibility, this report targets professionals in the fast-food, QSR, hospitality, and retail sectors. Market size is presented in billions.

United Kingdom Quick Service Restaurant Market Market Dynamics & Structure

The United Kingdom's Quick Service Restaurant (QSR) market is characterized by a dynamic and evolving landscape, shaped by increasing consumer demand for convenience, value, and diverse culinary options. Market concentration varies across segments, with some areas dominated by large, established players, while others offer opportunities for independent operators. Technological innovation is a significant driver, with advancements in online ordering platforms, delivery apps, and kitchen automation enhancing operational efficiency and customer experience. Regulatory frameworks, particularly concerning food safety, labor practices, and environmental sustainability, continue to influence business operations and strategic decisions. The competitive landscape is robust, with a constant influx of new entrants and the perpetual threat of substitute products and services, including meal kits and home cooking solutions. End-user demographics are shifting, with a growing demand from younger, tech-savvy consumers and a rising interest in healthier and more ethically sourced food options. Mergers and acquisitions (M&A) remain a key strategy for market consolidation and expansion.

- Market Concentration: Highly competitive, with dominant players in specific cuisines like Pizza and Burger.

- Technological Innovation: Driven by digital ordering, AI-powered customer service, and advanced delivery logistics.

- Regulatory Frameworks: Focus on food hygiene standards, ethical sourcing, and waste reduction policies.

- Competitive Substitutes: Rise of home meal kits, ready-to-eat options from supermarkets, and ghost kitchens.

- End-User Demographics: Increasing demand from Gen Z and Millennials for speed, customization, and transparency.

- M&A Trends: Strategic acquisitions to expand market reach, gain access to new technologies, and diversify offerings.

United Kingdom Quick Service Restaurant Market Growth Trends & Insights

The United Kingdom Quick Service Restaurant (QSR) market is poised for sustained growth, propelled by evolving consumer lifestyles and a continuously expanding array of culinary choices. The market size has witnessed consistent expansion, driven by increasing disposable incomes and a preference for on-the-go dining solutions. Adoption rates for digital ordering and delivery services have surged, transforming how consumers interact with QSR brands and significantly contributing to revenue streams. Technological disruptions are at the forefront, with AI-powered personalization, automated ordering kiosks, and advanced supply chain management optimizing operations and enhancing customer engagement. Consumer behavior is undergoing a marked shift, with a growing emphasis on health-conscious options, plant-based alternatives, and sustainable sourcing practices. This evolving demand necessitates QSR brands to innovate their menus and operational models to remain competitive and relevant. The projected Compound Annual Growth Rate (CAGR) indicates a robust trajectory, underscoring the market's resilience and potential.

The market is experiencing a significant penetration of quick service concepts across various locations, from urban centers to suburban retail parks and travel hubs, reflecting the ubiquity of convenience-driven dining. The integration of advanced analytics is enabling QSR businesses to better understand consumer preferences, leading to more targeted marketing campaigns and personalized offers. This data-driven approach, coupled with a focus on speed of service and value for money, continues to underpin the market's growth momentum. Furthermore, the increasing adoption of cashless payment systems and self-service technologies is streamlining the ordering process, reducing wait times, and improving overall customer satisfaction. The QSR sector is also adapting to changing dietary trends, with a noticeable increase in vegan, vegetarian, and gluten-free options, appealing to a broader customer base and fostering market inclusivity. The ongoing investment in new store openings, particularly by major international and domestic brands, signals strong confidence in the long-term viability and expansion potential of the UK QSR market.

Dominant Regions, Countries, or Segments in United Kingdom Quick Service Restaurant Market

The United Kingdom Quick Service Restaurant (QSR) market is a vibrant and multifaceted sector, with specific segments and locations exhibiting exceptional growth and dominance. Analysis of cuisines reveals that Pizza and Burger segments consistently lead in market share and consumer preference, driven by their established brand recognition, wide availability, and appeal across all age demographics. However, the Bakeries segment is experiencing a notable resurgence, fueled by a demand for premium baked goods and convenient breakfast and snack options. The Meat-based Cuisines segment remains a strong performer, while Ice Cream offers seasonal peaks and niche appeal. Other QSR Cuisines, encompassing a diverse range of international flavors and innovative concepts, are gaining traction as consumer palates become more adventurous.

In terms of outlet type, Chained Outlets dominate the market landscape, leveraging economies of scale, standardized branding, and extensive marketing budgets to capture significant market share. Companies like McDonald's Corporation and Domino's Pizza Group PLC exemplify this dominance. Nevertheless, Independent Outlets continue to play a crucial role, offering unique local flavors and personalized experiences that resonate with specific communities, often carving out successful niches.

Location plays a pivotal role in QSR success. The Retail and Standalone locations are consistently strong performers, benefiting from high foot traffic and accessibility. Leisure locations, including entertainment districts and theme parks, also present significant opportunities due to concentrated consumer spending. Travel locations, such as airports and train stations, continue to be vital for commuter and tourist traffic, though subject to fluctuating travel patterns. The Lodging segment, encompassing hotels and serviced apartments, is also seeing increased demand for in-room dining and accessible QSR options.

Key drivers for dominance in these segments and locations include:

- Economic Policies: Favorable business rates and government support for the hospitality sector.

- Infrastructure Development: Improved transportation networks enhancing accessibility to QSR outlets.

- Consumer Demographics: Understanding and catering to the preferences of urban populations and a younger demographic.

- Brand Recognition and Marketing: Extensive campaigns by major chains to build loyalty and attract new customers.

- Technological Adoption: Seamless integration of online ordering, delivery platforms, and loyalty programs.

- Menu Innovation: Continuous introduction of new products, catering to evolving dietary trends and tastes.

United Kingdom Quick Service Restaurant Market Product Landscape

The product landscape within the United Kingdom Quick Service Restaurant (QSR) market is characterized by a relentless pursuit of innovation, driven by evolving consumer preferences for health, convenience, and variety. Brands are actively differentiating themselves through unique menu offerings, including plant-based alternatives, gourmet burgers, and artisanal baked goods. Applications span across breakfast, lunch, dinner, and snack occasions, with many QSRs extending operating hours to cater to all-day demand. Performance metrics are increasingly focused on perceived value, speed of service, and quality of ingredients. Unique selling propositions often revolve around localized sourcing, allergen-friendly options, and customizable meal deals. Technological advancements in food preparation, such as advanced cooking equipment and sophisticated recipe management systems, are enhancing product consistency and enabling faster service times, further solidifying the market's dynamic product evolution.

Key Drivers, Barriers & Challenges in United Kingdom Quick Service Restaurant Market

The United Kingdom Quick Service Restaurant (QSR) market is propelled by several key drivers. The increasing demand for convenience and time-saving food solutions due to busy lifestyles is paramount. Technological advancements in online ordering, delivery apps, and AI-driven personalization enhance accessibility and customer engagement. Economic factors, including rising disposable incomes and a growing youth population with a preference for informal dining, also contribute significantly. The diversification of culinary offerings, catering to a wider range of tastes and dietary needs, further fuels growth.

However, the market faces notable barriers and challenges. Intense competition from both established brands and emerging players, including ghost kitchens and meal kit services, creates constant pressure. Supply chain disruptions, volatile ingredient costs, and labor shortages, exacerbated by recent economic events, pose significant operational hurdles. Stringent regulatory frameworks concerning food safety, hygiene, and employment standards require continuous adaptation and compliance. Shifting consumer preferences towards healthier and more sustainable options necessitate significant menu and operational overhauls.

Emerging Opportunities in United Kingdom Quick Service Restaurant Market

Emerging opportunities within the United Kingdom Quick Service Restaurant (QSR) market are largely centered around unmet consumer needs and evolving lifestyle trends. The growing demand for sustainable and ethically sourced food presents a significant avenue for brands willing to invest in transparent supply chains and eco-friendly practices. Untapped markets in underserved rural areas or specific demographic segments offer potential for targeted expansion. Innovative applications of technology, such as advanced AI for personalized recommendations or drone delivery in select areas, could redefine customer experience and operational efficiency. Evolving consumer preferences for plant-based and allergen-free options continue to create space for specialized QSR concepts and menu diversification. Furthermore, the rise of hybrid dining models, blending dine-in, takeaway, and delivery seamlessly, presents opportunities for optimizing existing infrastructure and revenue streams.

Growth Accelerators in the United Kingdom Quick Service Restaurant Market Industry

Several catalysts are accelerating the growth of the United Kingdom Quick Service Restaurant (QSR) market. Technological breakthroughs, particularly in artificial intelligence for customer service and data analytics for personalized marketing, are enhancing efficiency and customer engagement. Strategic partnerships between QSR brands and third-party delivery platforms continue to expand reach and accessibility. Market expansion strategies, including the development of new store formats and franchise models, are driving penetration into new territories and demographics. The increasing consumer acceptance of digital ordering and payment systems streamlines transactions and improves overall customer experience. Furthermore, a sustained focus on menu innovation, incorporating healthier options and diverse international cuisines, caters to a broader customer base and encourages repeat business.

Key Players Shaping the United Kingdom Quick Service Restaurant Market Market

- Domino's Pizza Group PLC

- JAB Holding Company S À R L

- Doctor's Associates Inc

- Famous Brands Limited

- Favorite Fried Chicken Limited

- Five Guys Enterprises LLC

- Samworth Brothers Limited

- Deep Blue Restaurants Ltd

- Co-operative Group Limited

- Starbucks Corporation

- Costa Coffee

- Greggs Plc

- McDonald's Corporation

- Ben & Jerry's Homemade Holdings Inc

Notable Milestones in United Kingdom Quick Service Restaurant Market Sector

- August 2023: Subway was acquired by private equity firm Roark Capital for USD 8.95 billion, signaling significant consolidation and investment interest, with earn-out clauses contingent on future cash flow milestones.

- August 2023: Starbucks announced plans to invest USD 32.78 million toward opening 100 new outlets across the United Kingdom in 2023, reflecting strong confidence in continued growth momentum.

- January 2023: Five Guys Enterprises, LLC set to open restaurants in Queensway and Bridgend in 2023, following a successful expansion with 20 new sites opened in 2022.

In-Depth United Kingdom Quick Service Restaurant Market Market Outlook

The United Kingdom Quick Service Restaurant (QSR) market is projected to experience robust future growth, fueled by an ongoing evolution in consumer preferences and operational efficiencies. Future market potential is significantly enhanced by the increasing adoption of sustainable practices and the expansion of plant-based menu offerings, aligning with growing environmental consciousness. Strategic opportunities lie in leveraging advanced data analytics to deliver hyper-personalized customer experiences and optimizing delivery logistics through innovative technology. The continued investment in digital transformation and the development of hybrid dining models are expected to further solidify market penetration and revenue streams. Adapting to demographic shifts and catering to the demand for healthier, convenient, and value-driven food options will be crucial for sustained success in this dynamic sector.

United Kingdom Quick Service Restaurant Market Segmentation

-

1. Cuisine

- 1.1. Bakeries

- 1.2. Burger

- 1.3. Ice Cream

- 1.4. Meat-based Cuisines

- 1.5. Pizza

- 1.6. Other QSR Cuisines

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United Kingdom Quick Service Restaurant Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Quick Service Restaurant Market Regional Market Share

Geographic Coverage of United Kingdom Quick Service Restaurant Market

United Kingdom Quick Service Restaurant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Beauty Supplements Products

- 3.4. Market Trends

- 3.4.1. Consumers inclination towards fast food consumption led to an increasing number of fast food outlets in the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Quick Service Restaurant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Bakeries

- 5.1.2. Burger

- 5.1.3. Ice Cream

- 5.1.4. Meat-based Cuisines

- 5.1.5. Pizza

- 5.1.6. Other QSR Cuisines

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Domino's Pizza Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jab Holding Company S À R L

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Doctor's Associates Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Famous Brands Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Favorite Fried Chicken Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Five Guys Enterprises LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Samworth Brothers Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Deep Blue Restaurants Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Co-operative Group Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Starbucks Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Costa Coffee

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Greggs Plc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 McDonald's Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Ben & Jerry's Homemade Holdings Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Domino's Pizza Group PLC

List of Figures

- Figure 1: United Kingdom Quick Service Restaurant Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Quick Service Restaurant Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Quick Service Restaurant Market Revenue billion Forecast, by Cuisine 2020 & 2033

- Table 2: United Kingdom Quick Service Restaurant Market Revenue billion Forecast, by Outlet 2020 & 2033

- Table 3: United Kingdom Quick Service Restaurant Market Revenue billion Forecast, by Location 2020 & 2033

- Table 4: United Kingdom Quick Service Restaurant Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Quick Service Restaurant Market Revenue billion Forecast, by Cuisine 2020 & 2033

- Table 6: United Kingdom Quick Service Restaurant Market Revenue billion Forecast, by Outlet 2020 & 2033

- Table 7: United Kingdom Quick Service Restaurant Market Revenue billion Forecast, by Location 2020 & 2033

- Table 8: United Kingdom Quick Service Restaurant Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Quick Service Restaurant Market?

The projected CAGR is approximately 5.42%.

2. Which companies are prominent players in the United Kingdom Quick Service Restaurant Market?

Key companies in the market include Domino's Pizza Group PLC, Jab Holding Company S À R L, Doctor's Associates Inc, Famous Brands Limited, Favorite Fried Chicken Limited, Five Guys Enterprises LLC, Samworth Brothers Limited, Deep Blue Restaurants Ltd, Co-operative Group Limited, Starbucks Corporatio, Costa Coffee, Greggs Plc, McDonald's Corporation, Ben & Jerry's Homemade Holdings Inc.

3. What are the main segments of the United Kingdom Quick Service Restaurant Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products.

6. What are the notable trends driving market growth?

Consumers inclination towards fast food consumption led to an increasing number of fast food outlets in the country.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Beauty Supplements Products.

8. Can you provide examples of recent developments in the market?

August 2023: Subway was acquired by private equity firm Roark Capital for USD 8.95 billion. To fully receive the amount, Subway needs to achieve certain cash flow milestones within a period of two or more years after the deal is completed.August 2023: Coffee shop chain Starbucks announced plans to invest USD 32.78 million toward opening 100 new outlets across the United Kingdom in 2023, as it expects its growth momentum to continue.January 2023: Five Guys Enterprises, LLC set to open restaurants in Queensway and Bridgend in 2023 after 20 new sites were opened in 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Quick Service Restaurant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Quick Service Restaurant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Quick Service Restaurant Market?

To stay informed about further developments, trends, and reports in the United Kingdom Quick Service Restaurant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence