Key Insights

The Indian food enzyme market is projected for substantial expansion, driven by a burgeoning processed food sector, heightened consumer preference for healthier and convenient options, and growing awareness of enzyme benefits in food production. With a current market size of 210.2 million, expected to reach $650 million by the base year 2025, the market is forecast to grow at a Compound Annual Growth Rate (CAGR) of 7.22% from 2025 to 2033. This robust growth underscores a dynamic market. Key drivers include increased enzyme adoption for product quality enhancement, processing efficiency improvements, and extended shelf life across food categories. Rising disposable incomes and evolving dietary habits in India are fueling demand for processed and value-added foods, directly benefiting the food enzyme sector.

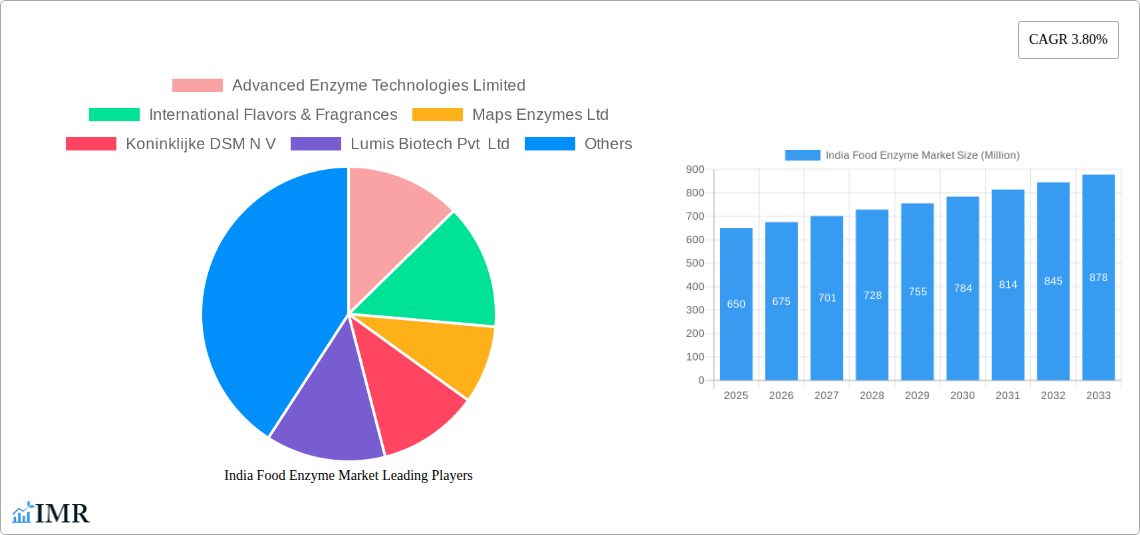

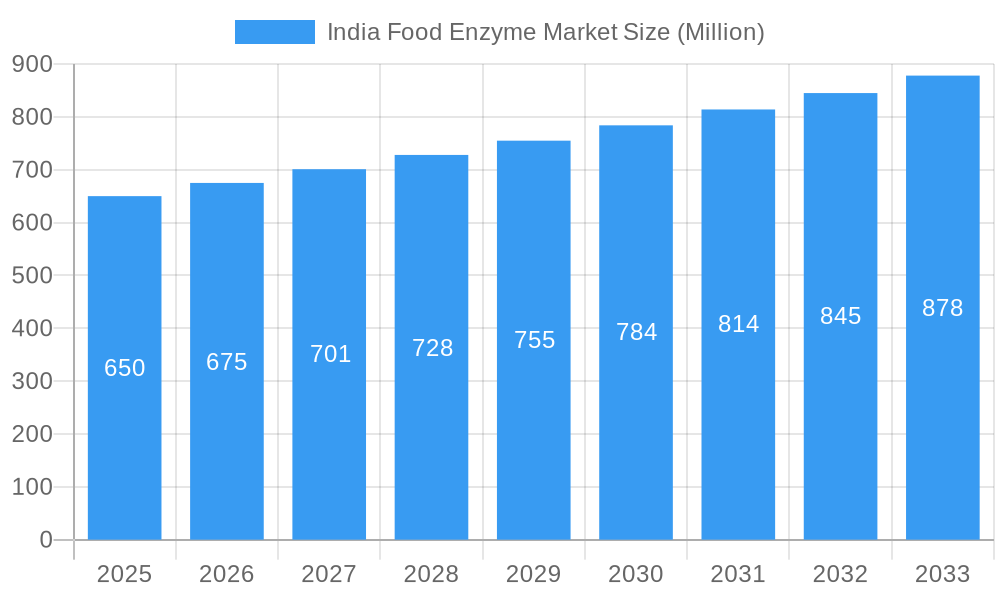

India Food Enzyme Market Market Size (In Million)

Dominant segments within the Indian food enzyme market include carbohydrases and proteases, utilized extensively in baking, confectionery, and meat processing, respectively. The dairy and frozen dessert sector also presents significant opportunities, with enzymes crucial for texture and flavor development. Emerging trends such as the demand for clean-label products and natural ingredients are spurring innovation in specialized and sustainable enzyme solutions. Potential restraints, such as the cost of advanced enzyme formulations and the need for broader industry and consumer education on benefits and safety, are outweighed by positive growth prospects and ample scope for innovation.

India Food Enzyme Market Company Market Share

This comprehensive report delivers a meticulously researched analysis of the India Food Enzyme Market, offering critical insights into its growth trajectory, segmentation, competitive landscape, and future potential. Optimized for search engines with high-traffic keywords including "India food enzymes," "food processing enzymes," "enzyme market India," "carbohydrases," "proteases," "lipases," "bakery enzymes," "dairy enzymes," and "beverage enzymes," this report targets industry professionals. It examines the intricate dynamics, prevailing trends, and emerging opportunities shaping this rapidly evolving sector.

Key Report Features:

- Study Period: 2019–2033

- Base Year: 2025

- Forecast Period: 2025–2033

India Food Enzyme Market Market Dynamics & Structure

The India Food Enzyme Market exhibits a moderately concentrated structure, characterized by the strategic presence of both global giants and emerging domestic players. Technological innovation is a primary driver, with continuous research and development focused on enhancing enzyme efficiency, specificity, and sustainability for diverse food applications. Regulatory frameworks, while evolving, aim to ensure food safety and quality standards, influencing product development and market entry. Competitive product substitutes, such as chemical additives, are present but are increasingly being displaced by the superior functionality and consumer appeal of enzymes. End-user demographics are shifting towards a greater demand for processed and convenience foods, creating a fertile ground for enzyme adoption. Mergers and acquisitions (M&A) are significant, as evidenced by recent industry consolidation, aimed at expanding product portfolios and market reach.

- Market Concentration: Moderate, with key global players and growing domestic presence.

- Technological Innovation: Focus on enzyme efficiency, specificity, and sustainable production methods.

- Regulatory Frameworks: Evolving standards to ensure food safety and quality.

- Competitive Product Substitutes: Chemical additives are being increasingly replaced by enzymes.

- End-User Demographics: Growing demand for processed and convenience foods.

- M&A Trends: Strategic consolidations to enhance market position and product offerings.

- Estimated Market Share of Top 5 Players: xx% in 2025.

- Volume of M&A Deals (2020-2024): xx deals.

India Food Enzyme Market Growth Trends & Insights

The India Food Enzyme Market is poised for robust growth, driven by a confluence of factors that are reshaping the food processing landscape. The increasing adoption of advanced processing techniques, coupled with a rising consumer preference for healthier, more natural, and convenient food options, is significantly augmenting the demand for a diverse range of food enzymes. The market's evolution is marked by escalating adoption rates across various food and beverage segments, with manufacturers increasingly recognizing the multifaceted benefits enzymes offer, including improved texture, enhanced flavor profiles, extended shelf life, and optimized nutritional value.

Technological disruptions, such as the development of novel enzyme immobilization techniques and the exploration of genetically modified enzymes for specific functionalities, are further propelling the market forward. These advancements not only improve enzyme performance but also contribute to cost-effectiveness and sustainability in food production. Consumer behavior shifts, including a growing awareness of the health benefits associated with enzyme-rich foods and a demand for clean-label products, are creating new avenues for enzyme applications. The penetration of food enzymes in smaller food processing units and home kitchens, though nascent, represents a significant untapped potential.

The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033, reaching an estimated value of XXX Million units by 2033. This growth will be fueled by innovations in enzyme technology, including the development of enzymes tailored for specific functional properties like enhanced protein hydrolysis and improved starch conversion. The increasing investments by key players in research and development are expected to yield innovative enzyme solutions that address complex food formulation challenges. Furthermore, the growing middle-class population in India and their rising disposable incomes are leading to higher consumption of packaged and processed foods, thereby driving the demand for food enzymes in their production. The integration of enzymes in fermentation processes for various food products, such as dairy and baked goods, is also a significant growth catalyst. The market is witnessing a paradigm shift towards enzymes that offer superior efficiency, reduced processing times, and lower energy consumption, aligning with the global trend towards sustainable food production. The focus on functional foods and nutraceuticals is also expected to boost the demand for specific enzymes that can enhance the bioavailability of nutrients or contribute to the production of health-benefiting compounds.

- Market Size Evolution: Projected to reach XXX Million units by 2033.

- CAGR (2025-2033): XX%

- Adoption Rates: Steadily increasing across bakery, dairy, beverage, and meat processing sectors.

- Technological Disruptions: Innovations in enzyme immobilization and GM enzymes.

- Consumer Behavior Shifts: Demand for healthier, natural, and clean-label food products.

- Market Penetration: Expanding beyond large-scale industries into smaller processing units.

- Drivers: Rising disposable incomes, urbanization, and increasing awareness of food processing benefits.

Dominant Regions, Countries, or Segments in India Food Enzyme Market

Within the India Food Enzyme Market, specific segments and regions are emerging as significant growth drivers. The Type segment of Carbohydrases is currently dominating the market due to its widespread application in the baking industry for dough conditioning and improving texture, and in the beverage sector for starch conversion and sugar production. Proteases are also witnessing substantial growth, driven by their utility in tenderizing meat products, improving dairy processing (e.g., cheese ripening), and enhancing the production of protein hydrolysates for functional foods and beverages.

Geographically, the Northern and Western regions of India are leading the market. This dominance can be attributed to several factors:

- Economic Policies: Favorable government initiatives supporting the food processing industry, including tax incentives and infrastructure development, are concentrated in these regions.

- Infrastructure: Well-established food processing hubs with advanced manufacturing facilities and robust supply chain networks are prevalent in these areas, facilitating easier access to and adoption of food enzymes.

- Consumer Demand: These regions exhibit higher per capita consumption of processed foods, dairy products, and bakery items, directly translating into a greater demand for food enzymes.

- Presence of Key Manufacturers and R&D Centers: A significant concentration of food processing companies and research institutions, actively involved in enzyme development and application, is located here.

- Technological Adoption: Early adoption of advanced food processing technologies and a greater awareness of the benefits of enzyme applications are observed in these economically advanced regions.

In terms of Application, the Bakery segment holds a significant share, owing to the extensive use of carbohydrases for improved dough handling, crumb structure, and shelf life. The Dairy and Frozen Desserts segment is a close contender, with proteases and lipases playing crucial roles in cheese production, yogurt fermentation, and improving the texture of frozen desserts. The Beverages sector is also a rapidly expanding application area, driven by the use of enzymes in juice clarification, wine production, and the manufacturing of high-protein beverages. The increasing focus on natural ingredients and cleaner labels is further accelerating enzyme adoption across all these applications, as they offer a sustainable and efficient alternative to traditional chemical additives. The "Other Applications" segment, encompassing areas like fruit and vegetable processing, and the production of infant food, is also demonstrating considerable growth potential.

- Dominant Type Segment: Carbohydrases, followed by Proteases.

- Leading Regions: Northern and Western India.

- Key Application Segments: Bakery, Dairy and Frozen Desserts, and Beverages.

- Drivers in Leading Regions: Favorable economic policies, advanced infrastructure, high consumer demand for processed foods.

- Growth Potential in Dairy & Beverages: Driven by innovation in protein-rich products and functional beverages.

- Market Share in Bakery Segment: Estimated at XX% in 2025.

- Projected Growth in Beverage Enzymes: XX% CAGR during the forecast period.

India Food Enzyme Market Product Landscape

The India Food Enzyme Market product landscape is characterized by continuous innovation and diversification. Leading players are focused on developing enzymes with enhanced specificity, higher activity, and improved stability under varying processing conditions. This includes the development of novel carbohydrases for optimized starch breakdown in baking and brewing, proteases for precise protein modification in dairy and meat processing, and lipases for targeted fat modification in confectionery and dairy products. Unique selling propositions often revolve around tailored enzyme formulations for specific applications, such as enzymes designed for gluten-free baking, lactose-free dairy products, and the production of specialty protein hydrolysates for infant nutrition and sports supplements. Technological advancements are enabling the production of enzymes through sustainable fermentation processes, reducing the environmental footprint and offering a cleaner label solution for food manufacturers.

- Product Innovations: Enzymes with enhanced specificity, higher activity, and improved stability.

- Application-Specific Formulations: Tailored solutions for baking, dairy, meat, and beverage industries.

- Unique Selling Propositions: Gluten-free baking enzymes, lactose-free dairy enzymes, specialty protein hydrolysates.

- Technological Advancements: Sustainable fermentation processes and enzyme engineering.

Key Drivers, Barriers & Challenges in India Food Enzyme Market

Key Drivers:

The India Food Enzyme Market is propelled by several key drivers, including the increasing demand for processed and convenience foods, a growing consumer preference for natural and healthy ingredients, and the rising awareness of the functional benefits of enzymes in food production. Technological advancements in enzyme production and application, coupled with favorable government initiatives promoting the food processing sector, are also significant growth catalysts. The expanding middle-class population and their increasing disposable incomes further fuel the demand for enzyme-enhanced food products.

Barriers & Challenges:

Despite the robust growth prospects, the market faces certain barriers and challenges. High initial investment costs for enzyme production and adoption can be a deterrent for smaller food manufacturers. Stringent regulatory approvals and evolving compliance standards can pose hurdles for new product launches. Supply chain complexities and the need for specialized storage and handling of enzymes can also present logistical challenges. Furthermore, competition from conventional chemical additives, though diminishing, remains a factor. Ensuring consistent quality and availability of enzymes across a diverse geographical landscape like India is an ongoing challenge. The limited awareness about specific enzyme applications among some segments of the food industry also needs to be addressed.

- Drivers: Processed food demand, natural ingredients trend, technological advancements, government support.

- Barriers: High initial investment, regulatory hurdles, supply chain complexities.

- Challenges: Competition from chemical additives, quality consistency, limited awareness in certain segments.

- Quantifiable Impact of Regulatory Hurdles: Potential delay in market entry by xx months.

- Supply Chain Cost Impact: xx% increase in operational costs for enzyme logistics.

Emerging Opportunities in India Food Enzyme Market

Emerging opportunities in the India Food Enzyme Market lie in the burgeoning demand for plant-based protein alternatives, where enzymes play a crucial role in texturization and flavor development. The functional foods and nutraceuticals segment presents a significant untapped market, with enzymes being used to enhance the bioavailability of nutrients and produce bioactive compounds. The expanding e-commerce platforms for food ingredients offer a direct channel to reach a wider customer base, including smaller businesses and home-based food producers. Furthermore, the development of enzymes for upcycling food waste into valuable ingredients and the increasing adoption of enzymes in animal feed for improved digestibility represent promising avenues for future growth.

- Plant-based protein alternatives: Enzyme applications in texturization and flavor enhancement.

- Functional foods & Nutraceuticals: Enhancing nutrient bioavailability and producing bioactive compounds.

- E-commerce platforms: Direct market access for wider customer reach.

- Food waste upcycling: Enzymes for converting waste into valuable ingredients.

- Animal feed applications: Improving digestibility and nutrient absorption.

Growth Accelerators in the India Food Enzyme Market Industry

Long-term growth in the India Food Enzyme Market will be significantly accelerated by continued technological breakthroughs in enzyme discovery and engineering, leading to more efficient, cost-effective, and sustainable enzyme solutions. Strategic partnerships between enzyme manufacturers and food processing companies will foster collaborative innovation and accelerate market penetration. Government initiatives focused on promoting food processing, R&D, and sustainable agriculture will create a conducive ecosystem for growth. Market expansion strategies, including increased focus on untapped rural markets and the development of application-specific training programs for food industry professionals, will further bolster the industry's expansion. The growing emphasis on a circular economy and sustainable food systems will also drive the demand for bio-based enzyme solutions.

- Technological Breakthroughs: Enzyme discovery, engineering, and production efficiency.

- Strategic Partnerships: Collaborations between enzyme producers and food manufacturers.

- Government Support: Policies promoting food processing, R&D, and sustainability.

- Market Expansion: Reaching rural markets and developing specialized training.

Key Players Shaping the India Food Enzyme Market Market

- Advanced Enzyme Technologies Limited

- International Flavors & Fragrances

- Maps Enzymes Ltd

- Koninklijke DSM N V

- Lumis Biotech Pvt Ltd

- Nature BioScience Pvt Ltd

- Kerry Group PLC

- Noor Enzymes

- Novozymes A/S

- Infinita Biotech Private Limited

Notable Milestones in India Food Enzyme Market Sector

- December 2022: Danish food ingredient and enzyme makers Novozymes and Chr. Hansen agreed to merge. Chr. Hansen focuses on enzymes and microbials for the food industry, and Novozymes' major business areas include enzymes for household products, food and beverages, and biofuels. This merger signifies a consolidation of expertise in the enzyme sector.

- February 2021: International Flavors & Fragrances merged with DuPont's Nutrition and Biosciences Business, continuing operations under the name IFF. This merger significantly strengthened IFF's position as a major player in the global ingredients market, including food enzymes.

- January 2021: Novozymes globally launched "Formea Prime," a new enzyme developed for high-protein beverages. Formea Prime was designed to assist beverage manufacturers in overcoming formulation challenges associated with whey protein hydrolysates, particularly in ready-to-drink (RTD) protein beverages.

In-Depth India Food Enzyme Market Market Outlook

The India Food Enzyme Market is projected for sustained and robust growth, driven by a confluence of evolving consumer preferences, technological advancements, and supportive industry trends. The increasing demand for healthier, cleaner-label food products, coupled with the expanding processed food industry, will continue to be primary growth accelerators. Innovations in enzyme technology, leading to more efficient and sustainable solutions, will further propel market expansion. Strategic collaborations and expansions by key players are expected to enhance market reach and product offerings. The market is well-positioned to capitalize on emerging opportunities in functional foods, plant-based alternatives, and sustainable food production practices, promising a dynamic and prosperous future.

- Future Market Potential: Strong growth driven by consumer demand and innovation.

- Strategic Opportunities: Functional foods, plant-based alternatives, sustainable solutions.

- Projected Market Value (2033): XXX Million units.

- Key Factors for Future Growth: Technological advancements, government support, and evolving consumer consciousness.

India Food Enzyme Market Segmentation

-

1. Type

- 1.1. Carbohydrases

- 1.2. Proteases

- 1.3. Lipases

- 1.4. Other Types

-

2. Application

- 2.1. Bakery

- 2.2. Confectionery

- 2.3. Dairy and Frozen Desserts

- 2.4. Meat Poultry and Sea Food Products

- 2.5. Beverages

- 2.6. Other Applications

India Food Enzyme Market Segmentation By Geography

- 1. India

India Food Enzyme Market Regional Market Share

Geographic Coverage of India Food Enzyme Market

India Food Enzyme Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Clean Label Bakery Products; Increasing Popularity of Specialty Ingredients

- 3.3. Market Restrains

- 3.3.1. Risk of Allergies

- 3.4. Market Trends

- 3.4.1. Rising Demand for Processed Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Food Enzyme Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carbohydrases

- 5.1.2. Proteases

- 5.1.3. Lipases

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Confectionery

- 5.2.3. Dairy and Frozen Desserts

- 5.2.4. Meat Poultry and Sea Food Products

- 5.2.5. Beverages

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Advanced Enzyme Technologies Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 International Flavors & Fragrances

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Maps Enzymes Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Koninklijke DSM N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lumis Biotech Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nature BioScience Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kerry Group PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Noor Enzymes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Novozymes A/S

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Infinita Biotech Private Limited*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Advanced Enzyme Technologies Limited

List of Figures

- Figure 1: India Food Enzyme Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Food Enzyme Market Share (%) by Company 2025

List of Tables

- Table 1: India Food Enzyme Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: India Food Enzyme Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: India Food Enzyme Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: India Food Enzyme Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: India Food Enzyme Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: India Food Enzyme Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Food Enzyme Market?

The projected CAGR is approximately 7.22%.

2. Which companies are prominent players in the India Food Enzyme Market?

Key companies in the market include Advanced Enzyme Technologies Limited, International Flavors & Fragrances, Maps Enzymes Ltd, Koninklijke DSM N V, Lumis Biotech Pvt Ltd, Nature BioScience Pvt Ltd, Kerry Group PLC, Noor Enzymes, Novozymes A/S, Infinita Biotech Private Limited*List Not Exhaustive.

3. What are the main segments of the India Food Enzyme Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 210.2 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Clean Label Bakery Products; Increasing Popularity of Specialty Ingredients.

6. What are the notable trends driving market growth?

Rising Demand for Processed Food.

7. Are there any restraints impacting market growth?

Risk of Allergies.

8. Can you provide examples of recent developments in the market?

December 2022: Danish food ingredient and enzyme makers Novozymes and Chr. Hansen agreed to merge. In comparison, both firms produce enzymes, Chr. Hansen focuses on enzymes and microbials for the food industry, and Novozymes' major business areas include enzymes for household products, food and beverages, and biofuels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Food Enzyme Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Food Enzyme Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Food Enzyme Market?

To stay informed about further developments, trends, and reports in the India Food Enzyme Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence