Key Insights

The North American Starch Sweetener Market is projected to experience robust growth, estimated to reach a market size of $22.49 billion by 2025. This expansion is anticipated to occur at a Compound Annual Growth Rate (CAGR) of 5.54% between the base year and 2033. The primary growth drivers include the escalating demand for cost-effective and versatile sweeteners in the food and beverage industry. Glucose syrups and high-fructose corn syrup are key product segments benefiting from their widespread application in processed foods, beverages, and bakery products. The expanding processed food sector in North America, coupled with a rising consumer preference for convenient food options, significantly fuels market expansion. Additionally, the increasing use of sugar alcohols like sorbitol and xylitol in dietary supplements, owing to their low-calorie properties and functional benefits, contributes to market momentum. Manufacturers are prioritizing product innovation and portfolio expansion to align with evolving consumer preferences and health consciousness.

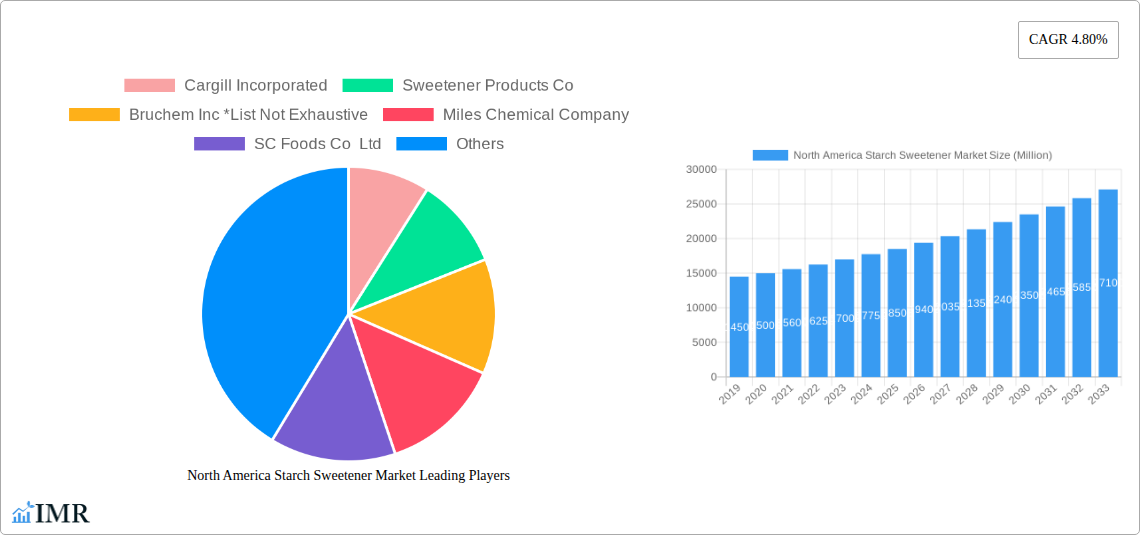

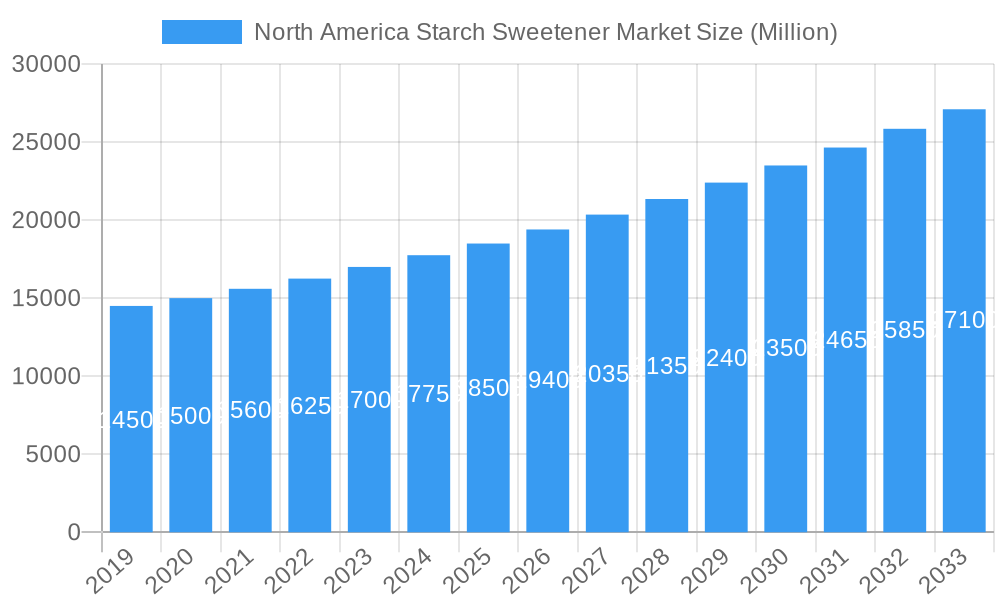

North America Starch Sweetener Market Market Size (In Billion)

Challenges for the market include price volatility of raw materials, particularly corn, a key feedstock for starch sweeteners. Regulatory oversight and shifting consumer perceptions concerning the health implications of certain starch sweeteners, such as high-fructose corn syrup, may also pose market constraints. Nevertheless, advancements in processing technologies that improve sweetener quality and functionality are expected to create significant market opportunities. Innovations in specialty starch sweeteners with unique attributes are also poised to unlock new growth avenues. The competitive environment features prominent players like Cargill Incorporated and Ingredion Incorporated, actively pursuing strategic collaborations, mergers, and acquisitions to enhance market presence and expand their North American reach. The growing adoption of starch sweeteners in meat processing and confectionery sectors further supports a positive market outlook.

North America Starch Sweetener Market Company Market Share

North America Starch Sweetener Market Report: Unlocking Growth and Innovation (2019-2033)

This comprehensive report delves into the dynamic North America starch sweetener market, providing in-depth analysis and actionable insights for industry stakeholders. With a study period spanning 2019-2033 and a base year of 2025, our analysis offers a robust understanding of current trends, historical performance, and future projections. The report is meticulously structured to offer clarity, covering market dynamics, growth trends, regional dominance, product landscapes, key drivers, barriers, challenges, emerging opportunities, growth accelerators, and a detailed overview of key players and notable milestones. All values are presented in Million units for your convenience.

North America Starch Sweetener Market Dynamics & Structure

The North America starch sweetener market is characterized by a moderately consolidated structure, with key players like Cargill Incorporated, Ingredion Incorporated, and Corn Refiners Association holding significant market shares. Technological innovation is a primary driver, with continuous advancements in enzymatic processing and modification techniques leading to novel starch-based sweeteners with enhanced functionalities. Regulatory frameworks, particularly concerning food labeling and health claims, influence product development and market entry strategies. The competitive landscape features a growing number of regional and specialized players, alongside established global entities. Substitutability from other caloric and non-caloric sweeteners, such as cane sugar and artificial sweeteners, presents a constant challenge, necessitating product differentiation and cost-effectiveness. End-user demographics, particularly the growing health-conscious consumer base and the food and beverage industry's demand for cost-effective and functional ingredients, are shaping market demand. Merger and acquisition (M&A) activity, while moderate, indicates a strategic consolidation trend aimed at expanding product portfolios and market reach. For instance, approximately 5-7 M&A deals are anticipated annually within the broader food ingredients sector, with starch sweeteners being a frequent target. Innovation barriers include high R&D costs and the need for extensive regulatory approvals for new product formulations.

- Market Concentration: Moderately consolidated with a few dominant players.

- Technological Innovation: Driven by enzymatic processing, modification techniques, and functional ingredient development.

- Regulatory Frameworks: Influenced by food labeling laws, health claims regulations, and safety standards.

- Competitive Substitutes: Cane sugar, beet sugar, artificial sweeteners, and other natural sweeteners.

- End-User Demographics: Growing demand from health-conscious consumers and the food & beverage industry.

- M&A Trends: Strategic consolidation to gain market share and expand product offerings.

North America Starch Sweetener Market Growth Trends & Insights

The North America starch sweetener market is poised for steady growth, propelled by a confluence of evolving consumer preferences, technological advancements, and the inherent versatility of starch-based ingredients. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 3.5% over the forecast period (2025-2033). Adoption rates for specialized starch sweeteners, particularly those derived from corn and wheat, are on an upward trajectory, driven by their functional benefits and cost-effectiveness compared to traditional sugar. Technological disruptions, such as the development of cleaner label starch sweeteners and innovative processing methods that enhance solubility and stability, are significantly impacting product formulations across various applications. Consumer behavior shifts are a pivotal force, with a growing demand for reduced sugar content in products, leading to increased utilization of high-intensity sweeteners and sugar alcohols derived from starch. The "natural" appeal of starch-derived sweeteners, when positioned correctly, is also contributing to their market penetration. For example, the demand for glucose syrups in bakery applications continues to be robust due to their humectant properties and ability to improve texture. Similarly, high-fructose corn syrup (HFCS) remains a dominant sweetener in the beverage industry due to its cost-effectiveness and taste profile, although faced with increasing scrutiny. The increasing prevalence of chronic diseases like diabetes and obesity is indirectly fueling interest in sugar substitutes, including sugar alcohols like sorbitol and maltitol, which have lower caloric values and glycemic indices. The report forecasts a market size of approximately $22,500 million units in the base year of 2025, with projections reaching $29,800 million units by 2033. The market penetration of starch sweeteners across various food and beverage categories is expected to deepen, especially in emerging applications like plant-based products and functional foods.

Dominant Regions, Countries, or Segments in North America Starch Sweetener Market

Within the North America starch sweetener market, the United States stands out as the dominant region, driven by its large consumer base, robust food and beverage manufacturing sector, and advanced agricultural infrastructure for corn production. The country’s significant consumption of processed foods and beverages, coupled with ongoing innovation in food technology, solidifies its leading position. The Beverages segment, particularly carbonated soft drinks, juices, and other ready-to-drink beverages, represents the largest application, consuming substantial volumes of high-fructose corn syrup and glucose syrups. This dominance is further amplified by the cost-effectiveness and functional properties of these sweeteners in large-scale beverage production.

United States:

- Economic Policies: Supportive agricultural policies for corn production influence raw material availability and cost.

- Infrastructure: Well-developed logistics and supply chains facilitate efficient distribution of starch sweeteners.

- Consumer Demand: High per capita consumption of processed foods and beverages drives demand.

Dominant Product Segments:

- High-Fructose Corn Syrup (HFCS): Remains a cornerstone in the beverage industry and various processed foods due to its economic viability and functional attributes.

- Glucose Syrups: Widely used across bakery, confectionery, and dairy products for their humectant properties, texture enhancement, and controlled sweetness.

Dominant Application Segments:

- Beverages: The largest consumer of starch sweeteners, particularly HFCS and glucose syrups, owing to cost-effectiveness and volume requirements.

- Bakery: Glucose syrups and dextrins are crucial for texture, shelf-life extension, and browning in a wide array of baked goods.

- Confectionery: Glucose syrups play a vital role in preventing crystallization and providing a smooth texture in candies and chocolates.

The market share of High-Fructose Corn Syrup in the U.S. beverage sector is estimated to be around 55-60% of the caloric sweetener market. Glucose syrups hold a significant share in the bakery segment, estimated at 40-45% of the total sweetener usage. The growth potential in these dominant segments is linked to population growth, evolving dietary habits, and the continuous innovation by food manufacturers to cater to diverse consumer needs.

North America Starch Sweetener Market Product Landscape

The North America starch sweetener market showcases a diverse product landscape driven by continuous innovation and a focus on functional benefits. Glucose syrups, in their various DE (Dextrose Equivalent) levels, are fundamental ingredients, offering controlled sweetness, viscosity, and browning properties essential for bakery, confectionery, and dairy applications. High-fructose corn syrup (HFCS), primarily HFCS-42 and HFCS-55, remains a dominant sweetener in beverages and processed foods due to its cost-effectiveness and sugar-like taste. Dextrins find application as binders and texturizers, particularly in food coatings and confectionery. Sugar alcohols, including sorbitol, maltitol, and xylitol, are gaining traction due to their lower caloric value and use in sugar-free and diabetic-friendly products. Recent advancements include the development of specialized maltodextrins with improved solubility and lower viscosity, catering to the growing demand for sports nutrition and dietary supplements. The performance metrics, such as sweetness intensity, viscosity, and hygroscopicity, are continuously optimized to meet specific application requirements.

Key Drivers, Barriers & Challenges in North America Starch Sweetener Market

Key Drivers:

- Cost-Effectiveness: Starch sweeteners, particularly HFCS and glucose syrups, offer a more economical alternative to sucrose for large-scale food and beverage production.

- Versatility and Functionality: Their diverse properties like humectancy, viscosity control, browning, and shelf-life extension make them indispensable in numerous food formulations.

- Growing Demand for Processed Foods: The increasing consumption of convenience foods, snacks, and beverages directly fuels the demand for starch sweeteners.

- Innovation in Sugar Reduction: The development of specialized starch derivatives and sugar alcohols supports manufacturers in meeting consumer demand for lower-sugar options.

Key Barriers & Challenges:

- Health Concerns and Consumer Perception: Negative perceptions surrounding HFCS and concerns about excessive sugar intake create headwinds, driving demand for alternatives.

- Regulatory Scrutiny and Labeling Requirements: Evolving regulations on sugar content and ingredient labeling can impact product formulation and market acceptance.

- Competition from Other Sweeteners: Intense competition from natural sweeteners like stevia and erythritol, as well as artificial sweeteners, poses a challenge.

- Raw Material Price Volatility: Fluctuations in the prices of agricultural commodities like corn can impact production costs and profitability.

- Supply Chain Disruptions: Global and regional supply chain issues can affect the availability and timely delivery of raw materials and finished products. For example, weather events impacting corn harvests can lead to price hikes and supply shortages, potentially impacting market growth by an estimated 1-2% in affected periods.

Emerging Opportunities in North America Starch Sweetener Market

Emerging opportunities within the North America starch sweetener market are predominantly driven by evolving consumer trends and technological advancements. The burgeoning market for plant-based foods and beverages presents a significant avenue for starch sweeteners, offering functional benefits in texture and mouthfeel. The growing demand for functional foods and beverages, such as those fortified with probiotics or vitamins, can leverage starch sweeteners for improved palatability and delivery systems. Furthermore, the increasing focus on clean-label ingredients is spurring the development and adoption of starch sweeteners derived from non-GMO sources and produced through more natural processing methods. The "sugar-free" and "low-calorie" trend continues to create demand for sugar alcohols and novel starch derivatives with reduced caloric impact. Innovations in encapsulating starch sweeteners to control release and enhance stability also open new application possibilities.

Growth Accelerators in the North America Starch Sweetener Market Industry

Long-term growth in the North America starch sweetener market is being propelled by several key catalysts. Technological breakthroughs in enzymatic conversion and fermentation processes are enabling the production of highly specialized starch sweeteners with tailored functionalities and improved nutritional profiles. Strategic partnerships between starch producers and food manufacturers are accelerating the co-development of innovative products that meet specific market demands, such as low-glycemic index sweeteners or those with enhanced prebiotic properties. Market expansion strategies, including the development of novel applications in emerging food categories like alternative proteins and functional snacks, are crucial growth accelerators. Furthermore, ongoing research into the health benefits of certain starch derivatives, such as resistant starches, could unlock new market segments and drive demand.

Key Players Shaping the North America Starch Sweetener Market Market

- Cargill Incorporated

- Sweetener Products Co

- Bruchem Inc

- Miles Chemical Company

- SC Foods Co Ltd

- Corn Refiners Association

- Ingredion Incorporated

- Sweet Additions LLC

Notable Milestones in North America Starch Sweetener Market Sector

- 2020: Launch of new non-GMO glucose syrups with improved viscosity profiles by Ingredion Incorporated, catering to the clean-label trend.

- 2021: Cargill Incorporated expands its portfolio of sugar alcohols to meet growing demand for sugar-free confectionery.

- 2022: Corn Refiners Association advocates for clear labeling policies regarding corn-derived sweeteners, addressing consumer concerns.

- 2023: Sweet Additions LLC introduces a new line of functional dextrins for the bakery and snack industries.

- 2024: Introduction of advanced enzymatic technologies for higher yields and purity in fructose production by key manufacturers.

In-Depth North America Starch Sweetener Market Market Outlook

The outlook for the North America starch sweetener market remains positive, driven by continuous innovation and adaptation to evolving consumer demands. Growth accelerators, such as advancements in biotechnology for creating novel starch derivatives and strategic collaborations between ingredient suppliers and food manufacturers, will be instrumental. The market is expected to witness increasing adoption of specialized starch sweeteners that offer functionalities beyond simple sweetening, including texturizing, stabilizing, and prebiotic benefits. Furthermore, the persistent trend towards sugar reduction, coupled with consumer interest in naturally derived ingredients, will continue to fuel the demand for sugar alcohols and clean-label starch sweeteners. Strategic opportunities lie in tapping into the expanding plant-based food sector and developing customized solutions for functional foods and beverages, ensuring sustained growth and market leadership in the coming years.

North America Starch Sweetener Market Segmentation

-

1. Product Type

- 1.1. Dextrin

- 1.2. Fructose

- 1.3. High-fructose Corn Syrup

- 1.4. Glucose Syrups

-

1.5. Sugar Alcohols

- 1.5.1. Sorbitol

- 1.5.2. Maltitol

- 1.5.3. Xylitol

- 1.5.4. Other Sugar Alcohols

-

2. Application

- 2.1. Bakery

- 2.2. Dairy and Desserts

- 2.3. Beverages

- 2.4. Meat and Meat Products

- 2.5. Soups, Sauces, and Dressings

- 2.6. Confectionery

- 2.7. Dietary Supplements

- 2.8. Other Applications

North America Starch Sweetener Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

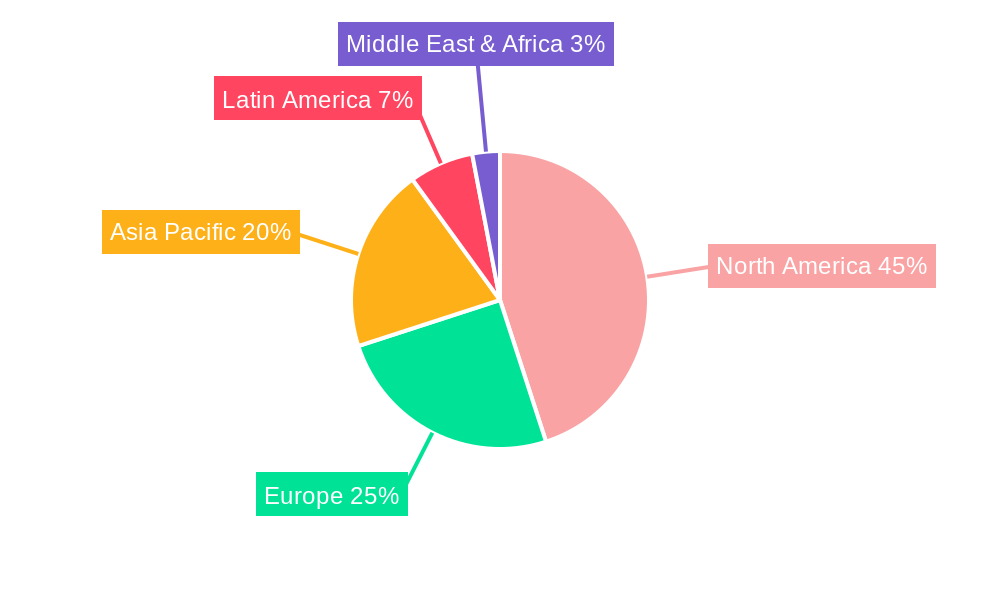

North America Starch Sweetener Market Regional Market Share

Geographic Coverage of North America Starch Sweetener Market

North America Starch Sweetener Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health Benefits Promoting Apple Cider Vinegar Demand; Unfiltered Apple Cider Vinegar Being Popular

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Other Vinegar Types

- 3.4. Market Trends

- 3.4.1. Rising Demand for Xylitol

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Starch Sweetener Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Dextrin

- 5.1.2. Fructose

- 5.1.3. High-fructose Corn Syrup

- 5.1.4. Glucose Syrups

- 5.1.5. Sugar Alcohols

- 5.1.5.1. Sorbitol

- 5.1.5.2. Maltitol

- 5.1.5.3. Xylitol

- 5.1.5.4. Other Sugar Alcohols

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Dairy and Desserts

- 5.2.3. Beverages

- 5.2.4. Meat and Meat Products

- 5.2.5. Soups, Sauces, and Dressings

- 5.2.6. Confectionery

- 5.2.7. Dietary Supplements

- 5.2.8. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sweetener Products Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bruchem Inc *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Miles Chemical Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SC Foods Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Corn Refiners Association

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ingredion Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sweet Additions LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: North America Starch Sweetener Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Starch Sweetener Market Share (%) by Company 2025

List of Tables

- Table 1: North America Starch Sweetener Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Starch Sweetener Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Starch Sweetener Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Starch Sweetener Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: North America Starch Sweetener Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: North America Starch Sweetener Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Starch Sweetener Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Starch Sweetener Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Starch Sweetener Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Starch Sweetener Market?

The projected CAGR is approximately 5.54%.

2. Which companies are prominent players in the North America Starch Sweetener Market?

Key companies in the market include Cargill Incorporated, Sweetener Products Co, Bruchem Inc *List Not Exhaustive, Miles Chemical Company, SC Foods Co Ltd, Corn Refiners Association, Ingredion Incorporated, Sweet Additions LLC.

3. What are the main segments of the North America Starch Sweetener Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.49 billion as of 2022.

5. What are some drivers contributing to market growth?

Health Benefits Promoting Apple Cider Vinegar Demand; Unfiltered Apple Cider Vinegar Being Popular.

6. What are the notable trends driving market growth?

Rising Demand for Xylitol.

7. Are there any restraints impacting market growth?

Rising Demand for Other Vinegar Types.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Starch Sweetener Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Starch Sweetener Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Starch Sweetener Market?

To stay informed about further developments, trends, and reports in the North America Starch Sweetener Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence