Key Insights

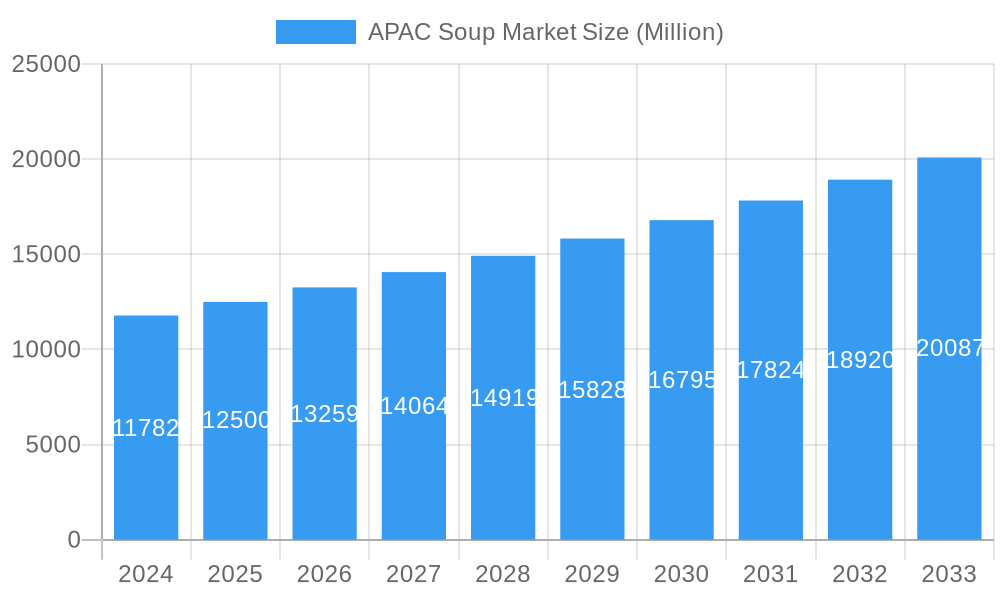

The APAC Soup Market is poised for significant expansion, projected to reach a substantial market size of approximately $12,500 million by 2025 and continue its robust growth trajectory. This expansion is fueled by a confluence of factors, including increasing disposable incomes across the region, a growing demand for convenient and ready-to-eat food options, and a rising awareness of the health benefits associated with certain soup varieties. The market's Compound Annual Growth Rate (CAGR) of 6.10% underscores its dynamism and attractiveness for stakeholders. Key drivers include the burgeoning middle class in countries like China and India, who are increasingly adopting Western dietary habits and seeking convenient meal solutions. Furthermore, the growing popularity of vegetarian and plant-based diets is significantly boosting the demand for vegetarian soup options, aligning with evolving consumer preferences towards healthier and more sustainable food choices.

APAC Soup Market Market Size (In Billion)

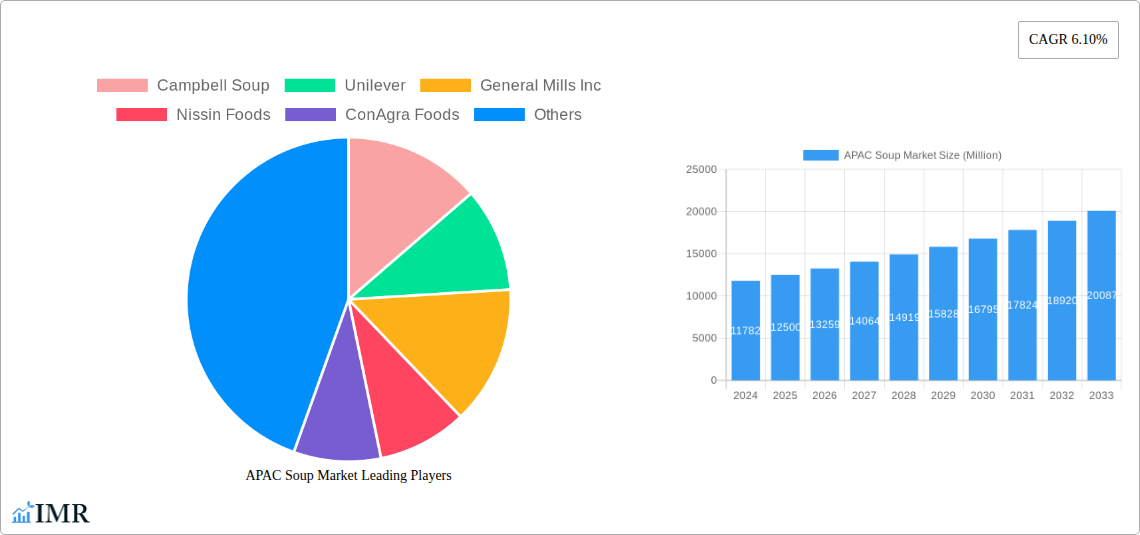

The market segmentation paints a clear picture of consumer preferences and market opportunities. Vegetarian soups are a dominant force, catering to the region's large vegetarian population and growing health consciousness. Canned/preserved soups, owing to their long shelf life and convenience, are widely adopted, while chilled soups are gaining traction for their freshness and perceived health benefits. The distribution landscape is evolving, with online retail channels experiencing rapid growth alongside traditional supermarkets and hypermarkets, reflecting the digital transformation impacting consumer purchasing behavior. Key players such as Campbell Soup, Unilever, General Mills Inc., and Nestlé S.A. are actively innovating and expanding their product portfolios to capture market share. The Asia Pacific region, with China, India, and Japan leading the charge, represents the primary battleground for market dominance, exhibiting distinct consumer tastes and preferences that manufacturers must adeptly address to succeed.

APAC Soup Market Company Market Share

APAC Soup Market: Comprehensive Industry Analysis and Future Outlook (2019–2033)

This detailed report provides an in-depth analysis of the APAC Soup Market, offering critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, and the strategic initiatives of leading players. Leveraging extensive data from the study period 2019–2033, with 2025 as the base and estimated year, and a forecast period extending to 2033, this report is an indispensable resource for industry professionals seeking to understand and capitalize on the evolving soup market in the Asia Pacific region. All quantitative values are presented in Million units for clarity and ease of comparison.

APAC Soup Market Market Dynamics & Structure

The APAC soup market exhibits a moderately concentrated structure, with a few key global players like Campbell Soup, Unilever, and Nestlé S.A. holding significant market share. However, the presence of robust regional and local manufacturers, particularly in emerging economies, introduces a dynamic competitive landscape. Technological innovation is a significant driver, with advancements in packaging, preservation techniques, and flavor profiles enhancing consumer appeal. Regulatory frameworks, while generally supportive of food safety, can vary across countries, impacting product formulations and market entry strategies. Competitive product substitutes, such as instant noodles and ready-to-eat meals, pose a constant challenge, necessitating continuous product differentiation. End-user demographics are shifting, with a growing middle class, increasing urbanization, and a greater demand for convenient, healthy, and diverse food options. Mergers and acquisitions (M&A) trends indicate a strategic consolidation and expansion by larger players to gain market access and enhance product portfolios.

- Market Concentration: Dominated by a mix of multinational corporations and strong local players.

- Technological Innovation: Focus on convenience, shelf-life extension, and health-conscious options.

- Regulatory Landscape: Varied across APAC nations, influencing product approvals and market access.

- Competitive Substitutes: Instant noodles, ready-to-eat meals, and fresh food alternatives.

- End-User Demographics: Growing demand from urbanizing populations and health-conscious consumers.

- M&A Trends: Strategic acquisitions for market expansion and portfolio diversification.

APAC Soup Market Growth Trends & Insights

The APAC soup market is projected to experience robust growth, driven by a confluence of evolving consumer preferences, rising disposable incomes, and increasing demand for convenient and healthy food options. Market size is expected to witness a steady expansion throughout the forecast period, fueled by the growing penetration of processed and packaged foods across the region. Technological advancements in production and preservation techniques are enhancing product quality, extending shelf life, and enabling greater product variety, which directly contributes to higher adoption rates. Consumer behavior is shifting towards healthier eating habits, leading to an increased demand for soups with natural ingredients, lower sodium content, and functional benefits. The digital transformation of retail channels is also playing a crucial role, with online platforms providing wider accessibility and convenience to consumers. The CAGR is predicted to be around 7.5% for the forecast period.

- Market Size Evolution: Significant growth anticipated driven by increasing per capita consumption.

- Adoption Rates: Steadily increasing due to urbanization and changing lifestyles.

- Technological Disruptions: Innovations in packaging and processing to meet evolving consumer needs.

- Consumer Behavior Shifts: Growing preference for healthy, convenient, and diverse soup options.

- Market Penetration: Expected to rise as awareness and accessibility increase across all demographics.

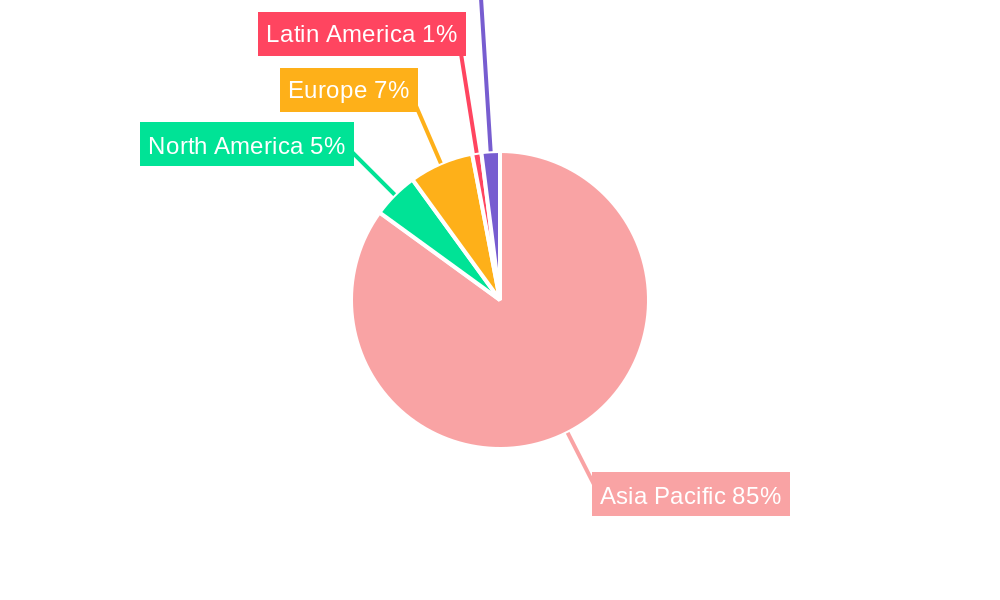

Dominant Regions, Countries, or Segments in APAC Soup Market

Within the expansive APAC region, China and India are poised to be the dominant countries shaping the soup market's trajectory. China's massive population, coupled with its rapidly expanding middle class and high disposable incomes, creates an enormous consumer base for a wide range of soup products. The country's advanced retail infrastructure, encompassing both traditional supermarkets/hypermarkets and a burgeoning online retail sector, ensures widespread availability. Moreover, Chinese culinary traditions often incorporate soups, providing a strong cultural foundation for market acceptance. India, with its young demographic and increasing urbanization, presents significant growth potential. The rising awareness of health and convenience, coupled with the expansion of organized retail, is driving demand for packaged soups.

Among the product segments, Vegetarian Soup is expected to maintain its dominance, catering to the dietary preferences of a significant portion of the APAC population. Within the Type segment, Canned/Preserved soup is likely to lead due to its long shelf life and convenience, though Chilled soup is gaining traction with its perceived freshness and quick preparation times. In terms of Distribution Channels, Supermarkets/Hypermarkets will continue to be the primary channel, offering a wide selection and accessibility, while Online Retail is anticipated to exhibit the fastest growth rate, driven by e-commerce penetration and changing shopping habits.

- Dominant Countries: China and India, driven by large populations and growing economies.

- Segment Dominance (Category): Vegetarian Soup, catering to cultural and dietary preferences.

- Segment Dominance (Type): Canned/Preserved soup for its shelf-stability and convenience.

- Distribution Channel Dominance: Supermarkets/Hypermarkets for broad reach, with Online Retail as the fastest-growing.

- Key Drivers for Dominance: Economic policies, rising disposable incomes, urbanization, and evolving consumer lifestyles.

APAC Soup Market Product Landscape

The APAC soup market is characterized by a dynamic product landscape driven by continuous innovation aimed at meeting diverse consumer needs and preferences. Manufacturers are focusing on developing soups with enhanced nutritional profiles, incorporating ingredients rich in vitamins, minerals, and protein. There is a significant trend towards offering healthier options, including low-sodium, organic, and plant-based soups, appealing to the health-conscious segment. Product formats are also evolving, with advancements in retort pouch technology and aseptic packaging extending shelf life while preserving freshness and flavor. Unique selling propositions include the introduction of regional flavors, catering to local tastes, and the development of ready-to-eat and ready-to-cook variants for enhanced convenience. Technological advancements in flavor encapsulation and ingredient sourcing are crucial in delivering authentic and appealing taste experiences.

Key Drivers, Barriers & Challenges in APAC Soup Market

The APAC soup market is propelled by several key drivers, including the growing demand for convenient and ready-to-eat food solutions driven by busy lifestyles and increasing urbanization. The rising disposable incomes across the region allow consumers to spend more on processed and packaged food items. Furthermore, an increasing health consciousness among consumers is driving the demand for soups perceived as nutritious and wholesome.

However, the market also faces significant barriers and challenges. Supply chain complexities, particularly in vast and diverse regions like the APAC, can lead to logistical hurdles and increased costs. Stringent regulatory requirements regarding food safety and labeling in different countries can pose compliance challenges for manufacturers. Intense competition from established brands, local players, and substitute products like instant noodles also presents a formidable restraint. Fluctuations in raw material prices can impact profitability and necessitate price adjustments, potentially affecting consumer demand.

Emerging Opportunities in APAC Soup Market

Emerging opportunities within the APAC soup market lie in the growing demand for premium and gourmet soup varieties that cater to discerning palates. The increasing adoption of plant-based diets presents a significant opportunity for the development and marketing of innovative vegan and vegetarian soup options. Furthermore, the expansion of e-commerce platforms offers untapped potential for reaching a wider customer base, particularly in tier-2 and tier-3 cities. The development of functional soups, enriched with ingredients that offer specific health benefits such as immunity support or digestive health, is another avenue for growth. Leveraging localized flavors and traditional recipes in modern, convenient formats will also resonate strongly with consumers.

Growth Accelerators in the APAC Soup Market Industry

Several catalysts are accelerating growth in the APAC soup market. Technological breakthroughs in food processing and preservation are enabling the creation of soups with better taste, texture, and nutritional value while extending shelf life. Strategic partnerships between ingredient suppliers, manufacturers, and retailers are streamlining the supply chain and enhancing product distribution. Market expansion strategies, including the introduction of new product lines and entry into underserved geographies, are further fueling growth. The increasing focus on sustainability and ethical sourcing by consumers and companies alike is also becoming a significant growth accelerator, driving innovation in eco-friendly packaging and responsible ingredient procurement.

Key Players Shaping the APAC Soup Market Market

- Campbell Soup

- Unilever

- General Mills Inc

- Nissin Foods

- ConAgra Foods

- Kraft Heinz

- Bambino

- Nestlé S A

Notable Milestones in APAC Soup Market Sector

- 2019/Q1: Campbell Soup announces expansion of its Asia Pacific product offerings, focusing on local flavor adaptations.

- 2020/Q2: Unilever launches a new range of chilled soups in Southeast Asian markets, emphasizing fresh ingredients.

- 2021/Q4: Nissin Foods introduces innovative dehydrated soup formulations for convenient on-the-go consumption.

- 2022/Q3: General Mills Inc. increases its investment in research and development for healthy and functional soup ingredients in the APAC region.

- 2023/Q1: Kraft Heinz explores strategic partnerships to strengthen its distribution network for soup products in emerging APAC economies.

- 2023/Q4: Nestlé S.A. expands its portfolio of plant-based soup options, aligning with growing consumer demand for sustainable food choices.

In-Depth APAC Soup Market Market Outlook

The future outlook for the APAC soup market is exceptionally positive, driven by sustained economic growth, evolving consumer lifestyles, and a strong demand for convenient, healthy, and diverse food options. Key growth accelerators such as technological innovations in product development and packaging, coupled with strategic market expansion initiatives by leading players, will continue to propel the market forward. The increasing adoption of online retail channels offers significant potential for market penetration into new demographics and geographies. Emerging opportunities in plant-based and functional soups, alongside the continued demand for localized flavors, present ample avenues for innovation and market leadership. Industry players are strategically positioned to capitalize on these trends, ensuring a dynamic and expanding soup market in the Asia Pacific region for years to come.

APAC Soup Market Segmentation

-

1. Category

- 1.1. Vegetarian Soup

- 1.2. Non-Vegetarian Soup

-

2. Type

- 2.1. Canned/Preserved soup

- 2.2. Chilled soup

- 2.3. Dehydrated soup

- 2.4. Others

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience Stores

- 3.3. Online Retail

- 3.4. Others

-

4. Geography

-

4.1. Asia Pacific

- 4.1.1. China

- 4.1.2. Japan

- 4.1.3. India

- 4.1.4. Australia

- 4.1.5. Rest of Asia-Pacific

-

4.1. Asia Pacific

APAC Soup Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. Australia

- 1.5. Rest of Asia Pacific

APAC Soup Market Regional Market Share

Geographic Coverage of APAC Soup Market

APAC Soup Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Convenience Foods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Soup Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Vegetarian Soup

- 5.1.2. Non-Vegetarian Soup

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Canned/Preserved soup

- 5.2.2. Chilled soup

- 5.2.3. Dehydrated soup

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Online Retail

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Asia Pacific

- 5.4.1.1. China

- 5.4.1.2. Japan

- 5.4.1.3. India

- 5.4.1.4. Australia

- 5.4.1.5. Rest of Asia-Pacific

- 5.4.1. Asia Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Campbell Soup

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Unilever

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Mills Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nissin Foods

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ConAgra Foods

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kraft Heinz*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bambino

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nestlé S A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Campbell Soup

List of Figures

- Figure 1: Global APAC Soup Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific APAC Soup Market Revenue (Million), by Category 2025 & 2033

- Figure 3: Asia Pacific APAC Soup Market Revenue Share (%), by Category 2025 & 2033

- Figure 4: Asia Pacific APAC Soup Market Revenue (Million), by Type 2025 & 2033

- Figure 5: Asia Pacific APAC Soup Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific APAC Soup Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: Asia Pacific APAC Soup Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: Asia Pacific APAC Soup Market Revenue (Million), by Geography 2025 & 2033

- Figure 9: Asia Pacific APAC Soup Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Asia Pacific APAC Soup Market Revenue (Million), by Country 2025 & 2033

- Figure 11: Asia Pacific APAC Soup Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Soup Market Revenue Million Forecast, by Category 2020 & 2033

- Table 2: Global APAC Soup Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global APAC Soup Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global APAC Soup Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Global APAC Soup Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global APAC Soup Market Revenue Million Forecast, by Category 2020 & 2033

- Table 7: Global APAC Soup Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global APAC Soup Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Global APAC Soup Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global APAC Soup Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: China APAC Soup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Japan APAC Soup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: India APAC Soup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Australia APAC Soup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific APAC Soup Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Soup Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the APAC Soup Market?

Key companies in the market include Campbell Soup, Unilever, General Mills Inc, Nissin Foods, ConAgra Foods, Kraft Heinz*List Not Exhaustive, Bambino, Nestlé S A.

3. What are the main segments of the APAC Soup Market?

The market segments include Category, Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

Increasing Demand for Convenience Foods.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Soup Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Soup Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Soup Market?

To stay informed about further developments, trends, and reports in the APAC Soup Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence