Key Insights

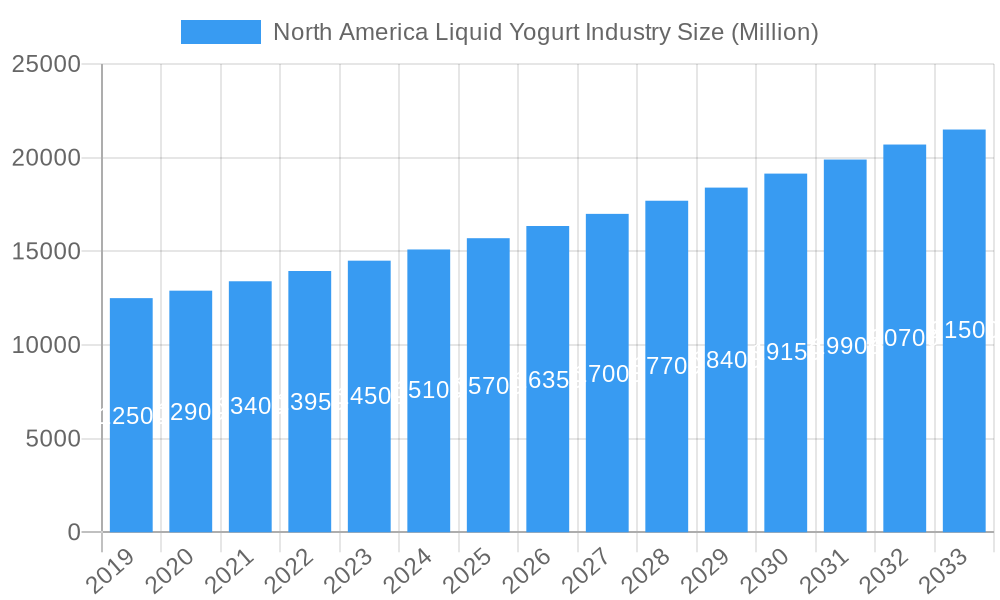

The North American liquid yogurt market is poised for significant expansion, projected to reach a substantial XX million by 2033. This growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 4.20%, indicating a robust and sustained upward trajectory for the industry. The market's dynamism is fueled by evolving consumer preferences, with a pronounced shift towards healthier, convenient, and on-the-go food options. This trend is particularly evident in the rising popularity of flavored yogurts, which cater to a broader consumer base seeking enjoyable taste experiences alongside nutritional benefits. Furthermore, the increasing awareness of gut health and the probiotic advantages associated with yogurt consumption is a key driver, pushing demand for both dairy-based and innovative non-dairy alternatives. The expanding distribution channels, including a growing online retail presence, are making liquid yogurt more accessible than ever, further contributing to its market penetration across North America.

North America Liquid Yogurt Industry Market Size (In Billion)

The North American liquid yogurt market is characterized by distinct segmentation, with dairy-based yogurts currently holding a dominant position, though non-dairy alternatives are rapidly gaining traction due to rising veganism and lactose intolerance. Within types, flavored yogurts are outperforming plain varieties, driven by product innovation and diverse flavor profiles catering to a wider audience. Supermarkets/hypermarkets remain the primary distribution channel, but online retailers are experiencing exponential growth, reflecting changing consumer shopping habits. Key players such as Chobani LLC, Yoplait USA Inc., and Groupe Lactalis are actively innovating with new product formulations and marketing strategies to capture market share. The region's market is dominated by the United States, followed by Canada and Mexico, with each country exhibiting unique consumption patterns and growth potentials influenced by local economic conditions and consumer trends. Despite the positive outlook, potential restraints such as fluctuating raw material prices and intense competition could pose challenges, necessitating strategic adaptation from market participants.

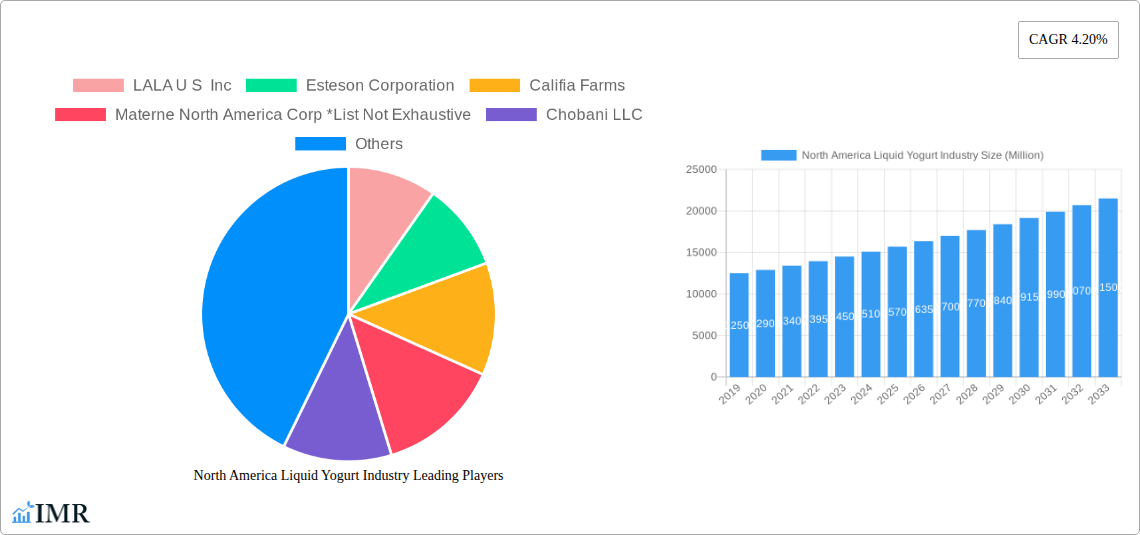

North America Liquid Yogurt Industry Company Market Share

North America Liquid Yogurt Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the North America Liquid Yogurt Industry, covering market dynamics, growth trajectories, regional dominance, product innovations, key drivers, challenges, emerging opportunities, growth accelerators, and the competitive landscape. With a detailed forecast period of 2025-2033 and a base year of 2025, this report provides critical insights for stakeholders seeking to navigate and capitalize on this evolving market. High-traffic keywords such as "liquid yogurt market," "dairy-based yogurt," "non-dairy yogurt," "yogurt market trends," "North America food industry," and "yogurt market analysis" are integrated to ensure maximum search engine visibility and engagement with industry professionals.

North America Liquid Yogurt Industry Market Dynamics & Structure

The North America liquid yogurt market is characterized by a moderate to high level of concentration, with key players like LALA U.S. Inc., Esteson Corporation, Califia Farms, Materne North America Corp (List Not Exhaustive), Chobani LLC, Cie Gervais Danone, Groupe Lactalis, and Yoplait USA Inc. actively shaping the competitive landscape. Technological innovation, particularly in product formulation and processing, acts as a significant driver, enabling the development of enhanced nutritional profiles (e.g., added protein and fiber) and novel flavor combinations. Regulatory frameworks governing food safety and labeling are well-established, influencing product development and market entry strategies. Competitive product substitutes, including other dairy and non-dairy beverages, pose a constant challenge, necessitating continuous product differentiation. End-user demographics are shifting, with growing demand from health-conscious consumers, millennials seeking convenience, and individuals with dietary restrictions embracing non-dairy alternatives. Mergers and acquisitions (M&A) are a notable trend, with companies strategically acquiring smaller players or complementary brands to expand their product portfolios and market reach. For instance, the recent acquisition of Kite Hill by Chobani signifies a strategic move to bolster its non-dairy offerings.

- Market Concentration: Dominated by a few major players, but with increasing fragmentation due to niche brands and private labels.

- Technological Innovation: Focus on improved texture, shelf-life extension, functional ingredients (probiotics, prebiotics), and sustainable packaging.

- Regulatory Frameworks: Stringent guidelines from agencies like the FDA influence product claims and manufacturing practices.

- Competitive Product Substitutes: Other cultured dairy products, plant-based beverages, and functional drinks.

- End-User Demographics: Growing appeal among health-conscious individuals, busy professionals, and plant-based consumers.

- M&A Trends: Strategic acquisitions for portfolio expansion, market share consolidation, and access to innovative technologies.

North America Liquid Yogurt Industry Growth Trends & Insights

The North America liquid yogurt market has witnessed robust growth over the historical period (2019-2024), a trend projected to continue through the forecast period (2025-2033). The market size is expected to expand significantly, driven by increasing consumer awareness regarding the health benefits associated with yogurt consumption, including improved digestive health and nutrient intake. Adoption rates for both traditional dairy-based liquid yogurts and their burgeoning non-dairy counterparts are on an upward trajectory. Technological disruptions are playing a pivotal role, with advancements in processing technologies enabling longer shelf lives and the incorporation of diverse functional ingredients. These innovations cater to the evolving consumer behavior, which increasingly prioritizes convenience, health, and functional benefits in their food choices.

The base year (2025) estimates indicate a healthy market volume, with projections showing a compound annual growth rate (CAGR) that will further propel the market's expansion. Market penetration is deepening across various consumer segments, as manufacturers actively target a wider demographic through diverse product offerings and marketing campaigns. The shift towards healthier lifestyles and a growing preference for plant-based diets are key factors contributing to the substantial growth of the non-dairy liquid yogurt segment. Furthermore, the convenience factor of liquid yogurt, being easy to consume on-the-go, resonates well with the fast-paced lifestyles prevalent in North America. This sustained demand, coupled with continuous product innovation and strategic market expansions, paints a promising picture for the future of the North America liquid yogurt industry.

Dominant Regions, Countries, or Segments in North America Liquid Yogurt Industry

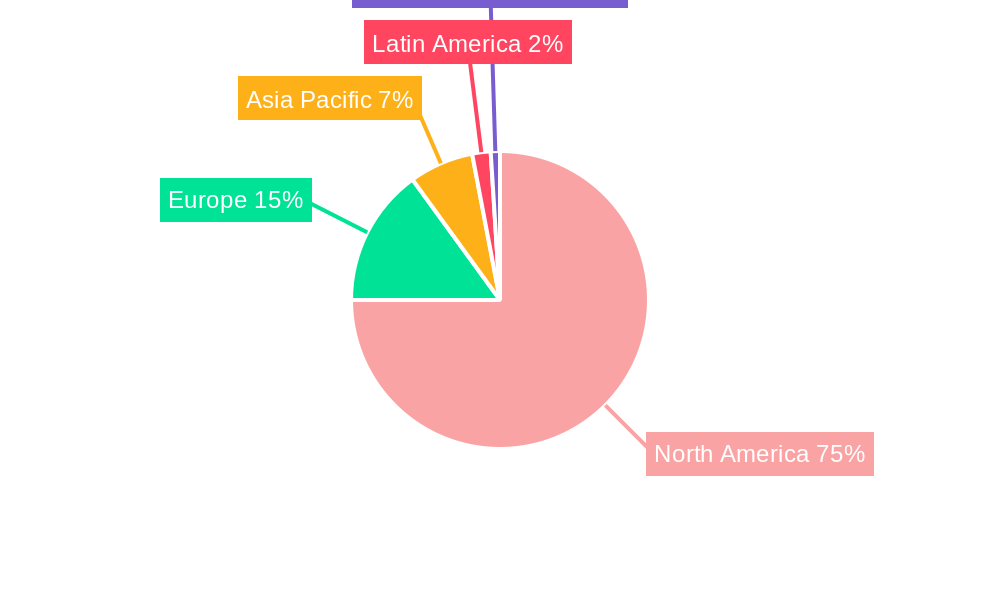

The Dairy-based yogurt segment, particularly within the Supermarkets/Hypermarkets distribution channel, is currently the most dominant force driving growth in the North America liquid yogurt industry. The United States stands out as the leading country, accounting for a significant share of the market volume due to its large consumer base and established dairy processing infrastructure.

Dominance Factors in the Dairy-based Yogurt Segment:

- Consumer Preference and Habit: Dairy-based yogurt has a long-standing history and is deeply ingrained in the North American diet, making it a preferred choice for a majority of consumers. The familiarity with taste and texture further solidifies its position.

- Nutritional Value and Fortification: Dairy-based liquid yogurts are often perceived as a superior source of protein, calcium, and essential vitamins. Manufacturers are increasingly fortifying these products with additional nutrients like Vitamin D and probiotics, enhancing their appeal to health-conscious consumers.

- Established Distribution Networks: Supermarkets and hypermarkets boast extensive reach and visibility, ensuring widespread availability of dairy-based liquid yogurts. Their large shelf space allocation and promotional activities further bolster sales.

- Price Competitiveness: Historically, dairy-based yogurts have often been more competitively priced compared to their non-dairy alternatives, making them accessible to a broader economic spectrum of consumers.

- Innovation in Flavors and Formats: While a traditional segment, dairy-based liquid yogurts continue to see innovation in terms of new flavor profiles, reduced sugar options, and convenient single-serving formats, keeping them relevant and attractive.

Growth Potential and Market Share: While the dairy-based segment currently leads, the Non-dairy based yogurt segment is exhibiting a significantly higher growth rate. This surge is primarily driven by evolving dietary trends, including the rise in veganism, lactose intolerance, and general health consciousness. The expansion of plant-based alternatives, such as almond, soy, oat, and coconut-based yogurts, is catering to these specific consumer needs.

- Key Drivers for Non-dairy Growth: Growing consumer awareness of the environmental impact of dairy farming, ethical considerations, and the increasing availability of diverse and palatable non-dairy options.

- Emerging Distribution Channels: Online retailers and specialty stores are playing a crucial role in the accessibility and growth of non-dairy liquid yogurts, reaching niche markets effectively.

- Innovation in Ingredients and Taste: Continuous efforts are being made to improve the taste and texture of non-dairy yogurts to better mimic their dairy counterparts, thereby attracting a wider audience.

The Flavored yogurt type also contributes significantly to the overall market volume due to its broad appeal across age groups, particularly children and adolescents. However, the demand for Plain yogurt is steadily increasing among health-conscious adults seeking to control sugar intake and customize their consumption with added fruits or granola.

North America Liquid Yogurt Industry Product Landscape

The North America liquid yogurt industry is witnessing a dynamic product landscape characterized by continuous innovation. Key advancements include the development of plant-based liquid yogurts with improved textures and richer flavors, catering to the growing vegan and lactose-intolerant populations. Dairy-based liquid yogurts are being enhanced with functional ingredients such as added protein for satiety and muscle support, probiotics for gut health, and prebiotics for digestive wellness. Unique selling propositions often revolve around natural ingredients, reduced sugar content, and innovative flavor fusions like tropical fruits with herbs, or coffee-infused varieties. Technological advancements in UHT processing and aseptic packaging are contributing to extended shelf lives without compromising nutritional value or taste, making these products more convenient for consumers.

Key Drivers, Barriers & Challenges in North America Liquid Yogurt Industry

The North America liquid yogurt market is propelled by several key drivers including a growing emphasis on health and wellness, driving demand for nutrient-rich and functional food options. The increasing prevalence of lactose intolerance and the rising popularity of plant-based diets are significant catalysts for the non-dairy liquid yogurt segment. Convenience and on-the-go consumption trends further fuel the demand for easily accessible and portable yogurt products.

However, the industry faces considerable barriers and challenges. Fluctuations in the cost of raw materials, particularly dairy and alternative plant-based ingredients, can impact profitability. Intense competition from other beverage categories and a crowded dairy aisle requires continuous product differentiation and marketing efforts. Strict regulatory compliance for labeling and food safety adds to operational complexities and costs. Supply chain disruptions, as evidenced by recent global events, can affect ingredient availability and distribution efficiency.

Emerging Opportunities in North America Liquid Yogurt Industry

Emerging opportunities in the North America liquid yogurt industry lie in the continued innovation within the non-dairy segment, exploring novel plant-based sources like fava bean or pea protein to offer unique nutritional profiles and cater to evolving dietary needs. The demand for functional ingredients presents a significant avenue, with opportunities to develop products enriched with adaptogens, specific vitamins, or personalized probiotic strains. Untapped markets, particularly among aging populations seeking easy-to-digest and nutrient-dense options, and the expansion of product offerings for children with cleaner ingredient labels, represent promising growth areas. Furthermore, the integration of sustainable packaging solutions and transparent sourcing practices can resonate with environmentally conscious consumers, creating a competitive edge.

Growth Accelerators in the North America Liquid Yogurt Industry Industry

Several factors are acting as growth accelerators for the North America liquid yogurt industry. The relentless pursuit of healthier food options by consumers is a primary driver, pushing manufacturers to develop products with enhanced nutritional benefits like higher protein content, lower sugar, and added probiotics. Technological breakthroughs in fermentation processes and ingredient technology are enabling the creation of more diverse and appealing liquid yogurt formulations, including improved textures and flavors for non-dairy alternatives. Strategic partnerships and collaborations between ingredient suppliers and yogurt manufacturers are fostering innovation and accelerating the development of new product lines. Moreover, aggressive marketing campaigns and increased availability through e-commerce platforms are expanding market reach and accessibility to a broader consumer base.

Key Players Shaping the North America Liquid Yogurt Industry Market

- LALA U. S. Inc.

- Esteson Corporation

- Califia Farms

- Materne North America Corp

- Chobani LLC

- Cie Gervais Danone

- Groupe Lactalis

- Yoplait USA Inc

Notable Milestones in North America Liquid Yogurt Industry Sector

- 2023, Q4: Yoplait launches its new dairy-based liquid yogurt, fortified with added protein and fiber, targeting health-conscious consumers.

- 2024, Q1: Califia Farms enters into a strategic partnership with Whole Foods to significantly expand the distribution of its popular non-dairy based liquid yogurt range across the retailer's extensive network.

- 2024, Q2: Chobani acquires the well-regarded Greek yogurt brand Kite Hill, a move aimed at strengthening its non-dairy product portfolio and enhancing its competitive standing in the plant-based yogurt market.

In-Depth North America Liquid Yogurt Industry Market Outlook

The outlook for the North America liquid yogurt industry remains exceptionally positive, fueled by sustained consumer demand for convenient, healthy, and diversified beverage options. Growth accelerators, including ongoing innovation in both dairy and non-dairy formulations, coupled with strategic market expansions, are poised to drive significant market expansion. The increasing consumer focus on gut health and personalized nutrition presents a fertile ground for functional ingredient integration, creating new product categories and revenue streams. Furthermore, the industry's ability to adapt to evolving dietary preferences and embrace sustainable practices will be crucial in capitalizing on emerging opportunities and solidifying its long-term growth trajectory.

North America Liquid Yogurt Industry Segmentation

-

1. Category

- 1.1. Dairy-based yogurt

- 1.2. Non-dairy based yogurt

-

2. Type

- 2.1. Plain yogurt

- 2.2. Flavored yogurt

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience Stores

- 3.3. Specialty Stores

- 3.4. Online Retailers

- 3.5. Others

North America Liquid Yogurt Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Liquid Yogurt Industry Regional Market Share

Geographic Coverage of North America Liquid Yogurt Industry

North America Liquid Yogurt Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Application and Benefits of Collagen Across End-User Industry; Implementation of Business Strategies by Market Players

- 3.3. Market Restrains

- 3.3.1. Intolerance of Vegetarian/Vegan Population Towards Animal Sourced Protein

- 3.4. Market Trends

- 3.4.1. Growing Digestive Heath Concerns Heating Up Demand For Probiotic Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Liquid Yogurt Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Dairy-based yogurt

- 5.1.2. Non-dairy based yogurt

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Plain yogurt

- 5.2.2. Flavored yogurt

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online Retailers

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LALA U S Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Esteson Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Califia Farms

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Materne North America Corp *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chobani LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cie Gervais Danone

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Groupe Lactalis

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yoplait USA Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 LALA U S Inc

List of Figures

- Figure 1: North America Liquid Yogurt Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Liquid Yogurt Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Liquid Yogurt Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 2: North America Liquid Yogurt Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: North America Liquid Yogurt Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Liquid Yogurt Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Liquid Yogurt Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 6: North America Liquid Yogurt Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 7: North America Liquid Yogurt Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: North America Liquid Yogurt Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Liquid Yogurt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Liquid Yogurt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Liquid Yogurt Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Liquid Yogurt Industry?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the North America Liquid Yogurt Industry?

Key companies in the market include LALA U S Inc, Esteson Corporation, Califia Farms, Materne North America Corp *List Not Exhaustive, Chobani LLC, Cie Gervais Danone, Groupe Lactalis, Yoplait USA Inc.

3. What are the main segments of the North America Liquid Yogurt Industry?

The market segments include Category, Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Application and Benefits of Collagen Across End-User Industry; Implementation of Business Strategies by Market Players.

6. What are the notable trends driving market growth?

Growing Digestive Heath Concerns Heating Up Demand For Probiotic Products.

7. Are there any restraints impacting market growth?

Intolerance of Vegetarian/Vegan Population Towards Animal Sourced Protein.

8. Can you provide examples of recent developments in the market?

1. Yoplait launches new dairy-based liquid yogurt with added protein and fiber 2. Califia Farms enters into partnership with Whole Foods to expand distribution of its non-dairy based liquid yogurt 3. Chobani acquires Greek yogurt brand Kite Hill to strengthen its non-dairy product portfolio

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Liquid Yogurt Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Liquid Yogurt Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Liquid Yogurt Industry?

To stay informed about further developments, trends, and reports in the North America Liquid Yogurt Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence