Key Insights

The European Noodles and Pasta Market is projected for substantial growth, forecasting a market size of 13701.4 million by 2032, with a Compound Annual Growth Rate (CAGR) of 4.8% from the base year 2024. This expansion is driven by evolving consumer preferences for convenient, versatile, and diverse culinary options. The increasing demand for ready-to-eat meals and convenient noodle and pasta dishes reflects Europe's fast-paced lifestyles. Growing awareness of the nutritional benefits and versatility of these staples also supports sustained demand. The market is witnessing a trend towards premium and artisanal products, with consumers seeking high-quality ingredients and unique flavor profiles, further fueling growth.

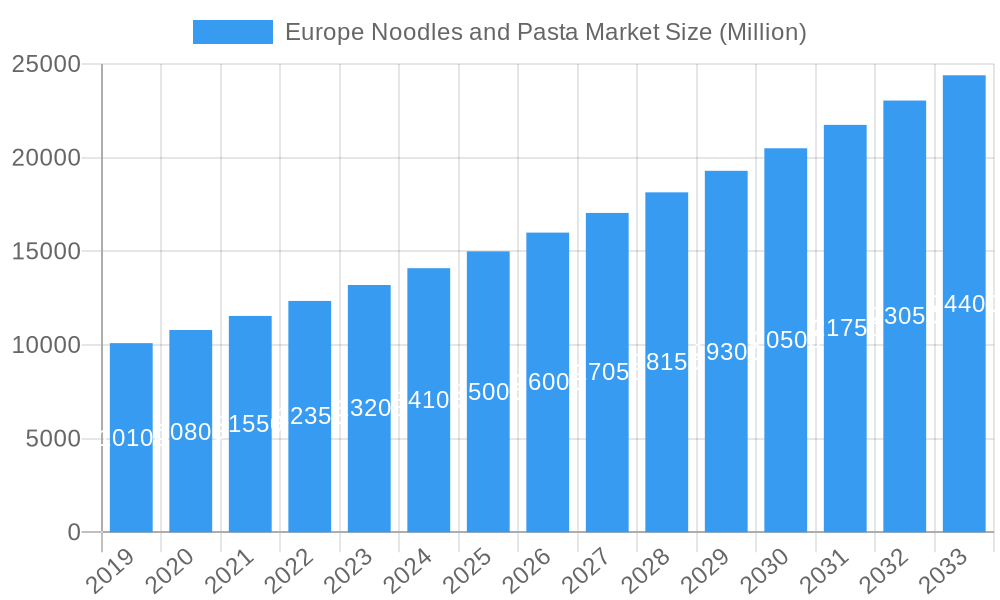

Europe Noodles and Pasta Market Market Size (In Billion)

Key trends shaping the European Noodles and Pasta Market include a significant surge in online sales, driven by the convenience and extensive product selection offered by e-commerce platforms. While supermarkets and hypermarkets retain a substantial market share, online retailers are increasingly challenging their dominance through agility and direct consumer engagement. Ambient and canned options remain popular for their shelf-life and convenience, while chilled/frozen variants are gaining traction for their perceived freshness and quality. The market is also observing a rise in demand for healthier alternatives, such as whole wheat, gluten-free, and plant-based pasta and noodle products, aligning with growing health consciousness. Challenges include raw material price volatility and competition from substitute food products. However, overall market sentiment is optimistic, presenting significant opportunities for innovation and market penetration.

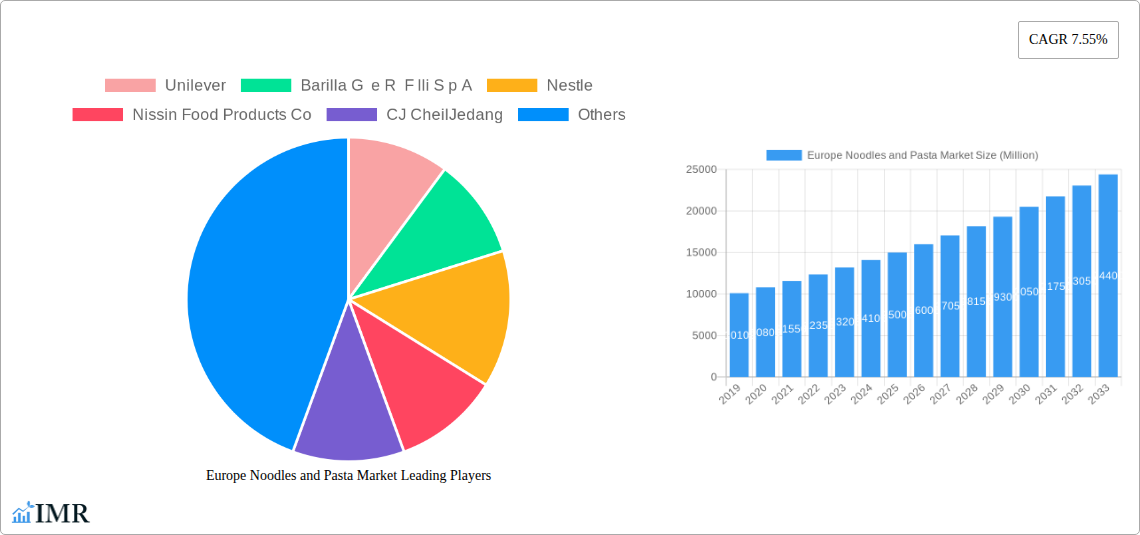

Europe Noodles and Pasta Market Company Market Share

Europe Noodles and Pasta Market: Comprehensive Analysis and Forecast (2019–2033)

Unlock strategic insights into the dynamic Europe noodles and pasta market. This in-depth report provides a 360-degree view of market trends, growth drivers, competitive landscapes, and future projections, essential for manufacturers, suppliers, distributors, and investors navigating this robust sector. Covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report equips you with the knowledge to capitalize on emerging opportunities and mitigate challenges.

Europe Noodles and Pasta Market Market Dynamics & Structure

The Europe noodles and pasta market exhibits a moderate to high market concentration, with leading global players like Unilever, Barilla G e R Flli S p A, and Nestle dominating market share. Technological innovation is a significant driver, focusing on developing healthier options, convenient formats, and novel flavors to cater to evolving consumer preferences. Regulatory frameworks primarily revolve around food safety standards, labeling requirements, and import/export regulations, ensuring product quality and consumer trust. Competitive product substitutes include ready-to-eat meals and other convenient food options, necessitating continuous product development and marketing to maintain market share. End-user demographics are increasingly influenced by health-conscious consumers seeking whole-wheat, gluten-free, and plant-based alternatives, as well as busy professionals and families opting for quick and easy meal solutions. Mergers and acquisitions (M&A) trends indicate strategic consolidation and market expansion, as seen in recent acquisitions aimed at broadening product portfolios and geographical reach.

- Market Concentration: Dominated by a few key players, with a growing presence of niche and private-label brands.

- Technological Innovation: Focus on functional ingredients, sustainable packaging, and enhanced shelf-life technologies.

- Regulatory Frameworks: Strict adherence to EFSA guidelines and national food safety laws.

- Competitive Landscape: Intense competition from other convenient food categories and an increasing number of artisanal pasta producers.

- End-User Demographics: Growing demand from young adults, urban dwellers, and health-conscious consumers.

- M&A Trends: Strategic acquisitions to gain market share, diversify product offerings, and expand into new European regions. Example: Newlat's acquisition of Symington's, bolstering its private-label capabilities.

Europe Noodles and Pasta Market Growth Trends & Insights

The Europe noodles and pasta market has demonstrated robust growth over the historical period (2019–2024) and is projected to continue this upward trajectory through the forecast period (2025–2033). This expansion is driven by several key trends, including the escalating demand for convenience food products, an increasing awareness of pasta and noodle-based meals as a versatile and cost-effective dietary staple, and a growing preference for healthier and plant-based options. The market size evolution has been consistently positive, with consistent year-over-year increases. Adoption rates for premium and specialty pasta products, such as artisan pasta and organic noodles, are on the rise, signaling a consumer shift towards higher-value offerings. Technological disruptions, while less revolutionary than in some other food sectors, are subtly influencing the market through advancements in processing, packaging, and the development of innovative ingredients that enhance nutritional profiles and extend shelf life. Consumer behavior shifts are clearly evident, with a growing emphasis on health and wellness leading to a surge in demand for whole-wheat, lentil, chickpea, and gluten-free pasta and noodle varieties. Furthermore, the convenience factor associated with these products, coupled with their affordability, continues to attract a broad demographic base, from students and young professionals to families seeking quick and satisfying meal solutions. The CAGR for the Europe noodles and pasta market is estimated to be in the range of 4.5% to 5.8% from 2025 to 2033. Market penetration for various product categories, particularly dried pasta, remains high across the continent, while chilled and frozen segments are experiencing faster growth due to convenience and premiumization. The online retail channel's increasing prominence is also facilitating greater market reach and accessibility for a wider array of products.

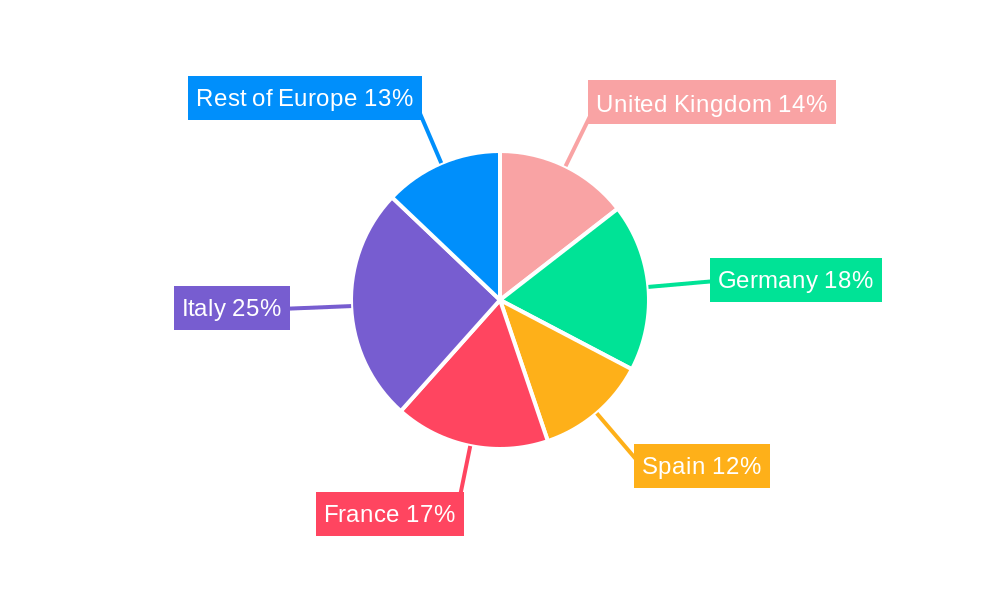

Dominant Regions, Countries, or Segments in Europe Noodles and Pasta Market

The Dried segment within the Form category is currently the dominant force driving growth in the Europe noodles and pasta market. This segment's dominance is attributable to its widespread availability, affordability, long shelf life, and versatility in culinary applications across numerous European cuisines. The Supermarkets/Hypermarkets distribution channel also plays a pivotal role, offering consumers a convenient and comprehensive shopping experience for a wide variety of noodle and pasta products, from everyday staples to specialty items.

Dominant Segment (Form): Dried

- Market Share: Estimated to hold over 60% of the total market value due to its established consumer base and cost-effectiveness.

- Key Drivers:

- Affordability: A cost-effective staple for households across all income levels.

- Shelf-Life: Extended shelf life reduces spoilage and inventory management challenges for retailers.

- Versatility: Can be used in a vast array of dishes, from simple weeknight meals to elaborate culinary creations.

- Consumer Familiarity: Deeply ingrained in traditional European diets.

- Innovation in Variety: Continuous introduction of new shapes, flours (e.g., whole wheat, legume-based), and flavor infusions catering to evolving tastes.

Dominant Distribution Channel: Supermarkets/Hypermarkets

- Market Share: Represents a significant portion of sales, estimated at over 50% of the total market value.

- Key Drivers:

- Convenience: One-stop shopping destination for consumers.

- Product Variety: Offer a broad selection of brands, forms, and price points.

- Promotional Activities: Frequent discounts and multi-buy offers drive sales volume.

- Brand Visibility: Prime shelf placement ensures high product visibility and consumer engagement.

- Geographical Reach: Extensive network of stores across urban and suburban areas.

While Dried pasta and Supermarkets/Hypermarkets currently lead, the Online Stores distribution channel is experiencing rapid growth. This surge is fueled by the convenience of home delivery, a wider selection of niche and international products, and increasingly sophisticated e-commerce platforms. Countries like the United Kingdom, Germany, and Italy consistently represent significant markets due to their large populations, established culinary traditions, and strong retail infrastructure. However, emerging markets in Eastern Europe are showing promising growth potential. The Chilled/Frozen segment is also gaining traction, particularly in urban centers, driven by demand for convenient, ready-to-cook or heat-and-eat pasta and noodle solutions.

Europe Noodles and Pasta Market Product Landscape

The product landscape of the Europe noodles and pasta market is characterized by a blend of traditional offerings and innovative developments. Core products include a vast array of pasta shapes, from spaghetti and penne to more regional varieties, alongside various noodle types like instant noodles, ramen, and udon. Product innovations are increasingly focusing on health and wellness, with a surge in demand for whole-wheat, gluten-free, legume-based (e.g., lentil, chickpea), and low-carbohydrate options. Manufacturers are also exploring novel flavors and ingredient combinations, such as infused pastas with herbs and vegetables, and the integration of superfoods. Packaging innovation is another key area, with a focus on sustainability, convenience (e.g., resealable pouches, single-serving packs), and enhanced shelf-life without compromising product quality. Performance metrics are evaluated based on taste, texture, nutritional value, ease of preparation, and value for money.

Key Drivers, Barriers & Challenges in Europe Noodles and Pasta Market

Key Drivers:

- Growing Demand for Convenience: Busy lifestyles and a preference for quick meal solutions fuel the demand for instant and ready-to-cook noodles and pasta.

- Health and Wellness Trends: Increasing consumer focus on healthy eating drives demand for whole-wheat, gluten-free, and plant-based alternatives.

- Affordability and Versatility: Pasta and noodles remain cost-effective and adaptable staple foods for a broad consumer base.

- Growing Disposable Income: In many European regions, increased disposable income allows consumers to opt for premium and specialty products.

- E-commerce Growth: The expansion of online grocery shopping makes a wider range of products accessible to consumers, boosting sales.

Barriers & Challenges:

- Intense Competition: The market is highly competitive with numerous domestic and international players, as well as private-label brands, leading to price pressures.

- Raw Material Price Volatility: Fluctuations in the prices of wheat, flour, and other key ingredients can impact production costs and profit margins.

- Supply Chain Disruptions: Geopolitical events, trade disputes, and logistical challenges can affect the availability and cost of raw materials and finished goods.

- Consumer Perception of Unhealthy Options: Some traditional instant noodles are perceived as unhealthy due to high sodium and fat content, requiring manufacturers to reformulate products.

- Regulatory Compliance: Adhering to evolving food safety standards and labeling regulations across different European countries can be complex and costly.

Emerging Opportunities in Europe Noodles and Pasta Market

Emerging opportunities in the Europe noodles and pasta market lie in the continuous innovation of plant-based and alternative-ingredient pasta and noodles, catering to the growing vegan and vegetarian populations and those with dietary restrictions. The demand for functional foods, enriched with vitamins, minerals, and protein, presents a significant avenue for growth. Furthermore, the expansion of the "food-to-go" and meal-kit sectors offers new applications for specialized pasta and noodle products. Untapped regional markets within Eastern Europe, with their growing economies and evolving consumer preferences, also represent significant expansion potential.

Growth Accelerators in the Europe Noodles and Pasta Market Industry

Growth accelerators in the Europe noodles and pasta market are primarily driven by ongoing technological breakthroughs in food processing that allow for the development of healthier and more nutritious products with extended shelf lives. Strategic partnerships between manufacturers and ingredient suppliers are crucial for sourcing innovative and sustainable raw materials. Market expansion strategies, including targeted marketing campaigns highlighting the health benefits and versatility of pasta and noodles, alongside a focus on expanding distribution networks, particularly into underserved regions and through e-commerce channels, will further accelerate growth. The increasing consumer willingness to experiment with global cuisines also presents an opportunity for the introduction of diverse noodle varieties.

Key Players Shaping the Europe Noodles and Pasta Market Market

- Unilever

- Barilla G e R Flli S p A

- Nestle

- Nissin Food Products Co

- CJ CheilJedang

- Unilever PLC

- Ebro Foods S A

- The Kraft Heinz Company

- ITC Limited

- F lli De Cecco di Filippo SpA

Notable Milestones in Europe Noodles and Pasta Market Sector

- Oct 2021: CG Foods, makers of Wai Wai noodles, announced the acquisition of GB Foods' business in the Russia/CIS markets, aiming to enhance their European presence and diversify into culinary products and pasta.

- Aug 2021: Newlat, an Italy-based food manufacturer, acquired United Kingdom's peer Symington's, gaining ownership of private-label brands like Mug Shot pasta and Naked noodles.

- May 2020: Italian pasta brand, Le Stagioni d'Italia, launched in the United Kingdom with Big Partnership, capitalizing on the shortage of dried pasta products during the Covid-19 pandemic and aiming to establish its brand in the UK market.

In-Depth Europe Noodles and Pasta Market Market Outlook

The future outlook for the Europe noodles and pasta market remains exceptionally positive, driven by sustained consumer demand for convenient, affordable, and increasingly health-conscious food options. Growth accelerators such as the continuous development of innovative plant-based and gluten-free varieties, coupled with the expanding reach of e-commerce, will further propel market expansion. Strategic investments in product diversification, sustainability, and penetration into emerging European markets will be key to capturing future growth. The market is poised for continued innovation, with manufacturers focusing on enhancing nutritional profiles, exploring novel flavor combinations, and adopting eco-friendly packaging solutions, ensuring its resilience and attractiveness for stakeholders.

Europe Noodles and Pasta Market Segmentation

-

1. Form

- 1.1. Ambient/Canned

- 1.2. Dried

- 1.3. Chilled/ Frozen

-

2. Distibution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Europe Noodles and Pasta Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Spain

- 4. France

- 5. Italy

- 6. Rest of Europe

Europe Noodles and Pasta Market Regional Market Share

Geographic Coverage of Europe Noodles and Pasta Market

Europe Noodles and Pasta Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased interest in international cuisines and diverse flavor profiles.

- 3.3. Market Restrains

- 3.3.1. Rising awareness about health issues related to high carbohydrate intake and gluten may impact traditional pasta consumption

- 3.4. Market Trends

- 3.4.1. Increasing demand for gluten-free pasta and noodles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Noodles and Pasta Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Ambient/Canned

- 5.1.2. Dried

- 5.1.3. Chilled/ Frozen

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. Spain

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. United Kingdom Europe Noodles and Pasta Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Ambient/Canned

- 6.1.2. Dried

- 6.1.3. Chilled/ Frozen

- 6.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. Germany Europe Noodles and Pasta Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Ambient/Canned

- 7.1.2. Dried

- 7.1.3. Chilled/ Frozen

- 7.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Spain Europe Noodles and Pasta Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Ambient/Canned

- 8.1.2. Dried

- 8.1.3. Chilled/ Frozen

- 8.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. France Europe Noodles and Pasta Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. Ambient/Canned

- 9.1.2. Dried

- 9.1.3. Chilled/ Frozen

- 9.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. Italy Europe Noodles and Pasta Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Form

- 10.1.1. Ambient/Canned

- 10.1.2. Dried

- 10.1.3. Chilled/ Frozen

- 10.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Form

- 11. Rest of Europe Europe Noodles and Pasta Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Form

- 11.1.1. Ambient/Canned

- 11.1.2. Dried

- 11.1.3. Chilled/ Frozen

- 11.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 11.2.1. Supermarkets/Hypermarkets

- 11.2.2. Convenience Stores

- 11.2.3. Online Stores

- 11.2.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Form

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Unilever

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Barilla G e R F lli S p A

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Nestle

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nissin Food Products Co

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 CJ CheilJedang

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Unilever PLC

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Ebro Foods S A

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 The Kraft Heinz Company

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 ITC Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 F lli De Cecco di Filippo SpA

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Unilever

List of Figures

- Figure 1: Europe Noodles and Pasta Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Noodles and Pasta Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Noodles and Pasta Market Revenue million Forecast, by Form 2020 & 2033

- Table 2: Europe Noodles and Pasta Market Revenue million Forecast, by Distibution Channel 2020 & 2033

- Table 3: Europe Noodles and Pasta Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Noodles and Pasta Market Revenue million Forecast, by Form 2020 & 2033

- Table 5: Europe Noodles and Pasta Market Revenue million Forecast, by Distibution Channel 2020 & 2033

- Table 6: Europe Noodles and Pasta Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Europe Noodles and Pasta Market Revenue million Forecast, by Form 2020 & 2033

- Table 8: Europe Noodles and Pasta Market Revenue million Forecast, by Distibution Channel 2020 & 2033

- Table 9: Europe Noodles and Pasta Market Revenue million Forecast, by Country 2020 & 2033

- Table 10: Europe Noodles and Pasta Market Revenue million Forecast, by Form 2020 & 2033

- Table 11: Europe Noodles and Pasta Market Revenue million Forecast, by Distibution Channel 2020 & 2033

- Table 12: Europe Noodles and Pasta Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Europe Noodles and Pasta Market Revenue million Forecast, by Form 2020 & 2033

- Table 14: Europe Noodles and Pasta Market Revenue million Forecast, by Distibution Channel 2020 & 2033

- Table 15: Europe Noodles and Pasta Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Europe Noodles and Pasta Market Revenue million Forecast, by Form 2020 & 2033

- Table 17: Europe Noodles and Pasta Market Revenue million Forecast, by Distibution Channel 2020 & 2033

- Table 18: Europe Noodles and Pasta Market Revenue million Forecast, by Country 2020 & 2033

- Table 19: Europe Noodles and Pasta Market Revenue million Forecast, by Form 2020 & 2033

- Table 20: Europe Noodles and Pasta Market Revenue million Forecast, by Distibution Channel 2020 & 2033

- Table 21: Europe Noodles and Pasta Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Noodles and Pasta Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Europe Noodles and Pasta Market?

Key companies in the market include Unilever, Barilla G e R F lli S p A, Nestle, Nissin Food Products Co, CJ CheilJedang, Unilever PLC, Ebro Foods S A, The Kraft Heinz Company, ITC Limited, F lli De Cecco di Filippo SpA .

3. What are the main segments of the Europe Noodles and Pasta Market?

The market segments include Form, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 13701.4 million as of 2022.

5. What are some drivers contributing to market growth?

Increased interest in international cuisines and diverse flavor profiles..

6. What are the notable trends driving market growth?

Increasing demand for gluten-free pasta and noodles.

7. Are there any restraints impacting market growth?

Rising awareness about health issues related to high carbohydrate intake and gluten may impact traditional pasta consumption.

8. Can you provide examples of recent developments in the market?

In Oct 2021, CG Foods, which makes Wai Wai noodles, announced to acquire GB Foods' business in the Russia/CIS markets. The acquisition aims to improve CG Foods' presence in Europe and CIS markets, besides diversifying into culinary products and pasta.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Noodles and Pasta Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Noodles and Pasta Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Noodles and Pasta Market?

To stay informed about further developments, trends, and reports in the Europe Noodles and Pasta Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence