Key Insights

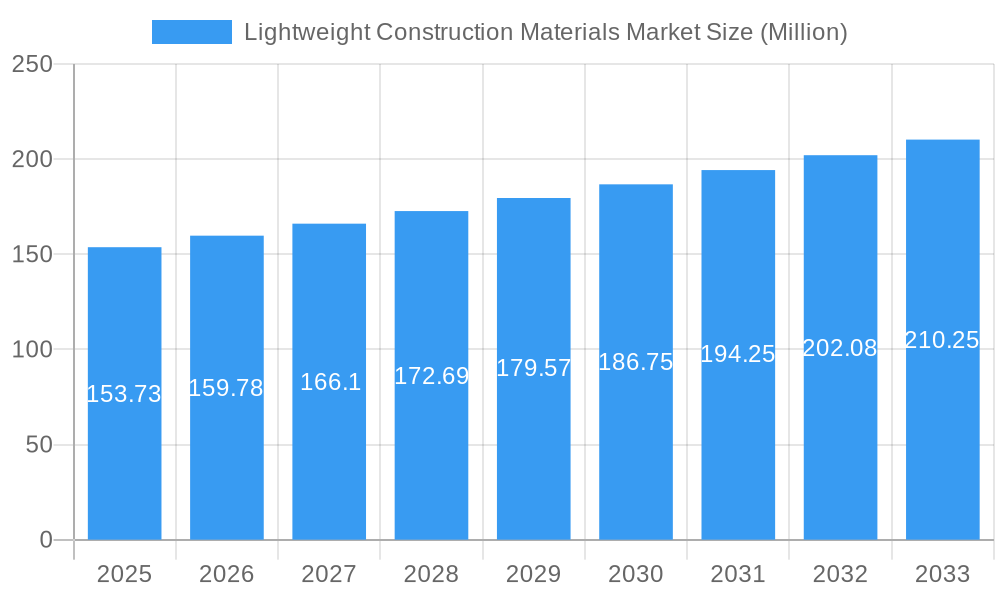

The global Lightweight Construction Materials Market is poised for steady growth, estimated at 153.73 Million units, and is projected to expand at a Compound Annual Growth Rate (CAGR) of 3.97% over the forecast period of 2025-2033. This expansion is fueled by a confluence of increasing urbanization, a growing demand for sustainable and energy-efficient building solutions, and the inherent advantages of lightweight materials such as reduced transportation costs and enhanced structural performance. The market's trajectory is significantly influenced by the construction industry's increasing adoption of innovative materials in residential, commercial, and infrastructure projects. Key drivers include stringent environmental regulations, a push towards green building certifications, and the rising need for faster construction timelines, all of which favor the implementation of lightweight alternatives. The market is segmented across various product types, including wood, bricks, concrete, and other innovative materials, catering to diverse construction needs.

Lightweight Construction Materials Market Market Size (In Million)

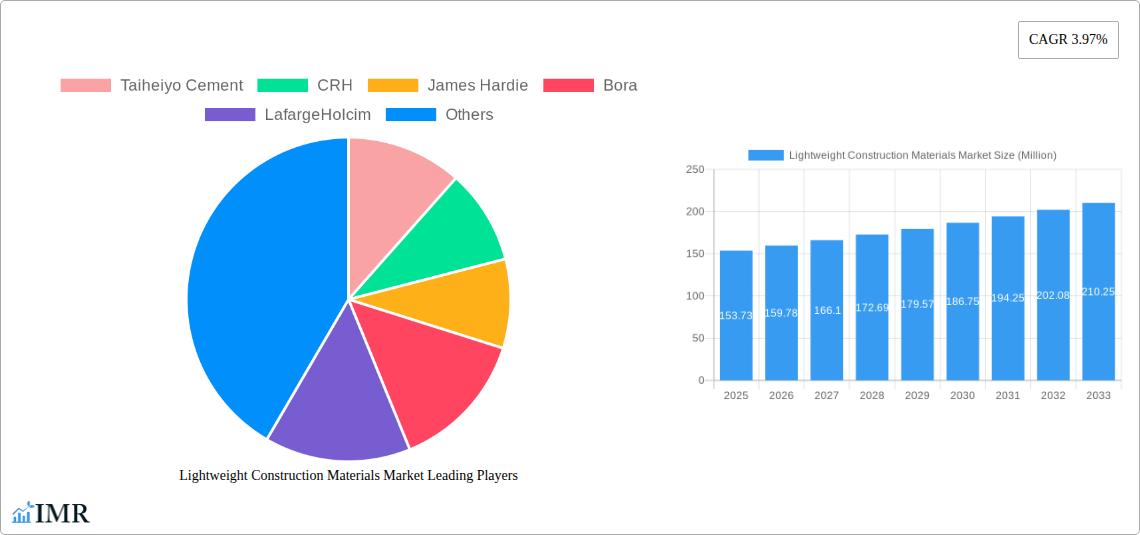

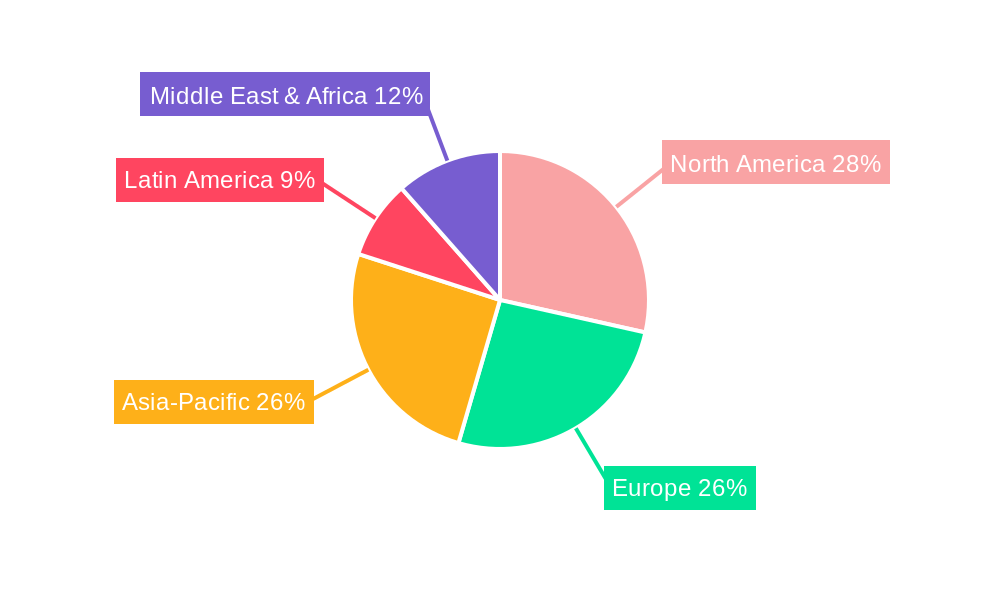

The market is characterized by a dynamic competitive landscape featuring major players like Taiheiyo Cement, CRH, James Hardie, and LafargeHolcim, who are actively investing in research and development to introduce advanced lightweight solutions. Geographic segmentation reveals North America and Europe as leading markets, driven by established construction sectors and a strong emphasis on sustainable development. However, the Asia-Pacific region presents significant growth potential, propelled by rapid industrialization and infrastructure development. Despite the positive outlook, the market faces certain restraints, including the initial cost perception of some lightweight materials compared to traditional options and the need for specialized installation techniques. Nevertheless, the long-term benefits, including reduced operational costs, improved seismic resistance, and enhanced thermal insulation, are increasingly outweighing these challenges, signaling a robust future for the lightweight construction materials sector.

Lightweight Construction Materials Market Company Market Share

This comprehensive report delivers an in-depth analysis of the global Lightweight Construction Materials market, projecting a significant USD 155,600 Million market size by 2033. Driven by increasing demand for energy-efficient buildings, reduced construction time, and sustainable building practices, this market is poised for robust growth. The report examines the intricate dynamics, key trends, dominant regions, product landscape, and competitive strategies shaping this evolving sector. We meticulously analyze parent and child markets, providing actionable insights for stakeholders seeking to capitalize on the burgeoning opportunities in sustainable construction materials.

This report is structured to provide immediate value, with all data presented in Million units.

Lightweight Construction Materials Market Dynamics & Structure

The Lightweight Construction Materials market exhibits a moderately consolidated structure, with key players like Taiheiyo Cement, CRH, James Hardie, Bora, LafargeHolcim, Granite, HeidelbergCement, Italcementi, Dyckerhoff, Trinity, Hanson, and Vulcan Materials holding significant market share. Technological innovation is a primary driver, with continuous research and development focused on enhancing material performance, reducing environmental impact, and improving cost-effectiveness. Regulatory frameworks, particularly those promoting green building certifications and energy efficiency standards, are increasingly influencing material selection and adoption. Competitive product substitutes, while present, often fall short in offering the unique combination of reduced weight, improved insulation, and structural integrity that lightweight materials provide. End-user demographics are shifting towards environmentally conscious consumers and developers prioritizing long-term operational savings. Mergers and acquisitions (M&A) activity is moderate, with companies strategically acquiring or partnering to expand their product portfolios, technological capabilities, and geographical reach. For instance, the recent USD 500 Million M&A activity in the fiber cement segment underscores this trend. Innovation barriers include the initial cost of advanced manufacturing processes and the need for widespread adoption of new building codes to fully accommodate novel materials.

- Market Concentration: Moderately consolidated.

- Technological Innovation Drivers: Energy efficiency, reduced environmental impact, faster construction.

- Regulatory Frameworks: Green building standards, energy codes, carbon footprint regulations.

- Competitive Product Substitutes: Traditional heavy materials (steel, dense concrete) where weight is not a primary concern.

- End-User Demographics: Environmentally conscious consumers, developers seeking cost savings, regulatory compliance.

- M&A Trends: Strategic acquisitions to enhance product offerings and market presence.

- Innovation Barriers: Initial investment in advanced manufacturing, code adoption challenges.

Lightweight Construction Materials Market Growth Trends & Insights

The Lightweight Construction Materials market is experiencing a transformative growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of 8.5% from 2025 to 2033. The market size, estimated at USD 70,500 Million in 2025, is anticipated to reach USD 155,600 Million by 2033. This expansion is fueled by escalating global urbanization and the resultant demand for efficient and sustainable construction solutions. Adoption rates of lightweight materials are significantly increasing across all construction types, driven by their inherent advantages in reducing structural loads, thereby lowering foundation requirements and overall building costs. Technological disruptions, such as the development of advanced composites, aerogels, and recycled materials, are pushing the boundaries of performance and sustainability. Consumer behavior is shifting towards a greater preference for buildings that offer superior thermal insulation, reduced energy consumption, and a smaller environmental footprint. The increasing awareness of climate change and the need for resource conservation are compelling architects, builders, and end-users to opt for lighter, greener alternatives. Furthermore, government incentives and subsidies supporting sustainable construction practices are playing a pivotal role in accelerating market penetration. The shift from traditional, heavy materials to lightweight alternatives is a fundamental change in construction paradigms, influencing everything from logistics and labor requirements to the final lifecycle cost of a building. The perceived higher initial cost of some lightweight materials is being offset by significant long-term savings in energy, maintenance, and structural components. This growing understanding is creating a virtuous cycle of demand and innovation, further propelling market growth. The integration of smart building technologies further enhances the appeal of lightweight materials, enabling better performance monitoring and energy management.

Dominant Regions, Countries, or Segments in Lightweight Construction Materials Market

The Asia-Pacific region is the undisputed leader in the Lightweight Construction Materials market, driven by rapid industrialization, massive infrastructure development projects, and a burgeoning population in countries like China, Japan, and India. This region is projected to contribute over 40% of the global market revenue by 2033. Within the Product Type segment, Concrete remains a dominant force, particularly lightweight concrete variants, due to its versatility, cost-effectiveness, and increasing innovation in reducing density while maintaining strength. However, Wood and Other Product Types (including fiber cement, composites, and engineered wood) are witnessing exceptionally high growth rates, fueled by sustainability initiatives and demand for prefabricated construction solutions.

In terms of Construction Type, the Residential sector is the primary driver of demand, with governments and developers prioritizing affordable and energy-efficient housing. The Commercial sector also represents a significant market share, with an increasing focus on sustainable building design and reduced operational costs.

North America and Europe follow closely, with strong market penetration driven by stringent environmental regulations, advanced construction technologies, and a mature market for green building certifications. The United States and Germany are key contributors within their respective regions, owing to extensive renovation and new construction activities.

- Dominant Region: Asia-Pacific (China, Japan, India)

- Key Drivers: Rapid industrialization, infrastructure development, growing population, government support for green buildings.

- Market Share Contribution: Expected to exceed 40% by 2033.

- Dominant Product Type: Concrete (lightweight variants), Wood, Other Product Types (fiber cement, composites)

- Growth Potential: High growth for Wood and Other Product Types due to sustainability focus.

- Dominant Construction Type: Residential, Commercial

- Market Share: Residential leads due to housing demand, followed by commercial with a focus on sustainability.

- Key Contributor Countries (North America): United States

- Drivers: Advanced construction technologies, stringent environmental regulations, green building initiatives.

- Key Contributor Countries (Europe): Germany, United Kingdom

- Drivers: Energy efficiency standards, renovation market, sustainable construction policies.

Lightweight Construction Materials Market Product Landscape

The Lightweight Construction Materials market is characterized by a dynamic product landscape driven by continuous innovation. Key product categories include lightweight concrete (e.g., aerated autoclaved concrete, expanded polystyrene concrete), engineered wood products (e.g., cross-laminated timber, glulam), fiber cement boards, insulation materials (e.g., mineral wool, foam boards), and advanced composite materials. Product innovations are focused on enhancing thermal and acoustic insulation properties, improving fire resistance, increasing structural strength with reduced density, and incorporating recycled or bio-based content for enhanced sustainability. Applications span across a wide range of construction elements, including walls, roofs, floors, facades, and interior fittings. Performance metrics such as R-value (thermal resistance), U-value (thermal transmittance), acoustic insulation ratings, and compressive strength are critical differentiators. Unique selling propositions revolve around reduced transportation costs, faster installation times, lower embodied energy, and improved occupant comfort. For example, the development of self-healing lightweight concrete and advanced, high-strength engineered wood represents significant technological advancements.

Key Drivers, Barriers & Challenges in Lightweight Construction Materials Market

Key Drivers:

- Environmental Concerns & Sustainability: Growing awareness of climate change and the need for reduced carbon footprints are paramount drivers. Lightweight materials often have lower embodied energy and contribute to energy-efficient buildings.

- Energy Efficiency Demands: Stringent building codes and consumer demand for reduced energy consumption in buildings directly fuel the adoption of materials with superior insulation properties.

- Cost Reduction in Construction: Reduced weight translates to lower transportation costs, less complex foundation requirements, and faster installation, leading to overall project cost savings.

- Technological Advancements: Continuous innovation in material science is leading to higher performance, greater durability, and more sustainable lightweight material options.

- Government Policies & Incentives: Favorable regulations, green building certifications, and subsidies for sustainable construction practices are significant growth catalysts.

Key Barriers & Challenges:

- Initial Cost Perceptions: While long-term savings are evident, the upfront cost of some advanced lightweight materials can be higher than traditional options, posing a barrier to adoption for budget-conscious projects. The estimated USD 1,500 Million higher initial investment for a typical sustainable home can deter some buyers.

- Lack of Standardization & Building Code Integration: The slow pace of updating building codes to fully accommodate newer lightweight materials can hinder widespread acceptance and implementation.

- Durability & Longevity Concerns: In some applications, the perceived long-term durability and resistance to extreme weather conditions of certain lightweight materials can be a concern for specifiers and end-users.

- Supply Chain & Availability: Establishing robust and widespread supply chains for specialized lightweight materials can be challenging, especially in developing regions.

- Skilled Labor Requirements: Installation of certain advanced lightweight materials may require specialized training and skilled labor, which might not be readily available everywhere.

Emerging Opportunities in Lightweight Construction Materials Market

Emerging opportunities in the Lightweight Construction Materials market are abundant, driven by evolving construction practices and consumer preferences. The increasing popularity of modular and prefabricated construction presents a significant avenue for growth, as lightweight materials are ideal for off-site manufacturing and transportation. Furthermore, the retrofitting and renovation market offers substantial potential, with lightweight materials providing an efficient solution for improving the energy performance of existing buildings. The development of bio-based and recycled lightweight materials is gaining traction, aligning with the circular economy principles and appealing to environmentally conscious developers and consumers. The integration of smart materials and self-healing capabilities within lightweight construction products represents a futuristic frontier, promising enhanced durability and reduced maintenance over the building's lifecycle. Untapped markets in developing economies, particularly in areas experiencing rapid urbanization and a growing middle class, represent significant growth potential.

Growth Accelerators in the Lightweight Construction Materials Market Industry

Several catalysts are accelerating the long-term growth of the Lightweight Construction Materials industry. Technological breakthroughs in material science, leading to lighter, stronger, and more sustainable options, are fundamental. Strategic partnerships between material manufacturers, construction companies, and research institutions are fostering innovation and facilitating market penetration. For instance, collaborations focusing on developing novel insulation composites are proving highly effective. Market expansion strategies, including the development of localized production facilities and tailored product offerings for specific regional needs, are crucial for sustained growth. The increasing adoption of Building Information Modeling (BIM) and other digital construction tools is also streamlining the design and implementation of lightweight construction solutions, further accelerating their uptake.

Key Players Shaping the Lightweight Construction Materials Market Market

- Taiheiyo Cement

- CRH

- James Hardie

- Bora

- LafargeHolcim

- Granite

- HeidelbergCement

- Italcementi

- Dyckerhoff

- Trinity

- Hanson

- Vulcan Materials

Notable Milestones in Lightweight Construction Materials Market Sector

- August 2023: James Hardie Building Products Inc. announced a significant national agreement with D.R. Horton, Inc., the largest homebuilder in the United States, making James Hardie the exclusive national supplier for hard siding and trim through December 2026. This partnership is expected to bolster the adoption of fiber cement siding by USD 200 Million annually.

- June 2023: Boral Limited actively participated in Australia's largest crumbed rubber asphalt demonstration project, contributing 2000 tonnes of sustainable pavement material. This initiative, incorporating recycled rubber, aims to enhance road sustainability and longevity.

In-Depth Lightweight Construction Materials Market Market Outlook

The Lightweight Construction Materials market is set for an optimistic future, driven by ongoing global trends and strategic advancements. The increasing emphasis on sustainable development, coupled with the inherent benefits of lightweight materials in terms of cost and performance, will continue to fuel demand. Opportunities in prefabricated construction, building retrofitting, and the development of bio-based materials are expected to be significant growth engines. Strategic collaborations and continued investment in R&D will be crucial for market leaders to maintain their competitive edge and capitalize on emerging applications. The overall outlook suggests a robust and expanding market, with lightweight construction materials playing a pivotal role in shaping the future of the built environment.

Lightweight Construction Materials Market Segmentation

-

1. Product Type

- 1.1. Wood

- 1.2. Brics

- 1.3. Concrete

- 1.4. Other Product Types

-

2. Constrution Type

- 2.1. Resdential

- 2.2. Commercial

- 2.3. Industrial

- 2.4. Infrastructure

-

3. Goegraphy

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Mexico

-

3.2. Europe

- 3.2.1. Germany

- 3.2.2. France

- 3.2.3. United Kingdom

- 3.2.4. Italy

- 3.2.5. Spain

- 3.2.6. Rest of Europe

-

3.3. Asia-Pacific

- 3.3.1. China

- 3.3.2. Japan

- 3.3.3. India

- 3.3.4. ASEAN

- 3.3.5. Rest of APAC

-

3.4. Latin America

- 3.4.1. Brazil

-

3.5. Middle East & Africa

- 3.5.1. GCC

- 3.5.2. South Africa

- 3.5.3. Rest of Middle East & Africa

-

3.1. North America

Lightweight Construction Materials Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Lightweight Construction Materials Market Regional Market Share

Geographic Coverage of Lightweight Construction Materials Market

Lightweight Construction Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Adoption of Lightweight Materials and Increase in the production of aircraft in developing countries; Growth of the Aerospace and Defence Sector in countries; Rise in investments in application-oriented research and development

- 3.3. Market Restrains

- 3.3.1. Economic slowdown and contraction of the automotive sector in developing regions; High cost of Construction Materials

- 3.4. Market Trends

- 3.4.1. Building & Construction segment Holds the prominent share of Global Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lightweight Construction Materials Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Wood

- 5.1.2. Brics

- 5.1.3. Concrete

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Constrution Type

- 5.2.1. Resdential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.2.4. Infrastructure

- 5.3. Market Analysis, Insights and Forecast - by Goegraphy

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.2. Europe

- 5.3.2.1. Germany

- 5.3.2.2. France

- 5.3.2.3. United Kingdom

- 5.3.2.4. Italy

- 5.3.2.5. Spain

- 5.3.2.6. Rest of Europe

- 5.3.3. Asia-Pacific

- 5.3.3.1. China

- 5.3.3.2. Japan

- 5.3.3.3. India

- 5.3.3.4. ASEAN

- 5.3.3.5. Rest of APAC

- 5.3.4. Latin America

- 5.3.4.1. Brazil

- 5.3.5. Middle East & Africa

- 5.3.5.1. GCC

- 5.3.5.2. South Africa

- 5.3.5.3. Rest of Middle East & Africa

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Lightweight Construction Materials Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Wood

- 6.1.2. Brics

- 6.1.3. Concrete

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Constrution Type

- 6.2.1. Resdential

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.2.4. Infrastructure

- 6.3. Market Analysis, Insights and Forecast - by Goegraphy

- 6.3.1. North America

- 6.3.1.1. United States

- 6.3.1.2. Canada

- 6.3.1.3. Mexico

- 6.3.2. Europe

- 6.3.2.1. Germany

- 6.3.2.2. France

- 6.3.2.3. United Kingdom

- 6.3.2.4. Italy

- 6.3.2.5. Spain

- 6.3.2.6. Rest of Europe

- 6.3.3. Asia-Pacific

- 6.3.3.1. China

- 6.3.3.2. Japan

- 6.3.3.3. India

- 6.3.3.4. ASEAN

- 6.3.3.5. Rest of APAC

- 6.3.4. Latin America

- 6.3.4.1. Brazil

- 6.3.5. Middle East & Africa

- 6.3.5.1. GCC

- 6.3.5.2. South Africa

- 6.3.5.3. Rest of Middle East & Africa

- 6.3.1. North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Lightweight Construction Materials Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Wood

- 7.1.2. Brics

- 7.1.3. Concrete

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Constrution Type

- 7.2.1. Resdential

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.2.4. Infrastructure

- 7.3. Market Analysis, Insights and Forecast - by Goegraphy

- 7.3.1. North America

- 7.3.1.1. United States

- 7.3.1.2. Canada

- 7.3.1.3. Mexico

- 7.3.2. Europe

- 7.3.2.1. Germany

- 7.3.2.2. France

- 7.3.2.3. United Kingdom

- 7.3.2.4. Italy

- 7.3.2.5. Spain

- 7.3.2.6. Rest of Europe

- 7.3.3. Asia-Pacific

- 7.3.3.1. China

- 7.3.3.2. Japan

- 7.3.3.3. India

- 7.3.3.4. ASEAN

- 7.3.3.5. Rest of APAC

- 7.3.4. Latin America

- 7.3.4.1. Brazil

- 7.3.5. Middle East & Africa

- 7.3.5.1. GCC

- 7.3.5.2. South Africa

- 7.3.5.3. Rest of Middle East & Africa

- 7.3.1. North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Lightweight Construction Materials Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Wood

- 8.1.2. Brics

- 8.1.3. Concrete

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Constrution Type

- 8.2.1. Resdential

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.2.4. Infrastructure

- 8.3. Market Analysis, Insights and Forecast - by Goegraphy

- 8.3.1. North America

- 8.3.1.1. United States

- 8.3.1.2. Canada

- 8.3.1.3. Mexico

- 8.3.2. Europe

- 8.3.2.1. Germany

- 8.3.2.2. France

- 8.3.2.3. United Kingdom

- 8.3.2.4. Italy

- 8.3.2.5. Spain

- 8.3.2.6. Rest of Europe

- 8.3.3. Asia-Pacific

- 8.3.3.1. China

- 8.3.3.2. Japan

- 8.3.3.3. India

- 8.3.3.4. ASEAN

- 8.3.3.5. Rest of APAC

- 8.3.4. Latin America

- 8.3.4.1. Brazil

- 8.3.5. Middle East & Africa

- 8.3.5.1. GCC

- 8.3.5.2. South Africa

- 8.3.5.3. Rest of Middle East & Africa

- 8.3.1. North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Lightweight Construction Materials Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Wood

- 9.1.2. Brics

- 9.1.3. Concrete

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Constrution Type

- 9.2.1. Resdential

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.2.4. Infrastructure

- 9.3. Market Analysis, Insights and Forecast - by Goegraphy

- 9.3.1. North America

- 9.3.1.1. United States

- 9.3.1.2. Canada

- 9.3.1.3. Mexico

- 9.3.2. Europe

- 9.3.2.1. Germany

- 9.3.2.2. France

- 9.3.2.3. United Kingdom

- 9.3.2.4. Italy

- 9.3.2.5. Spain

- 9.3.2.6. Rest of Europe

- 9.3.3. Asia-Pacific

- 9.3.3.1. China

- 9.3.3.2. Japan

- 9.3.3.3. India

- 9.3.3.4. ASEAN

- 9.3.3.5. Rest of APAC

- 9.3.4. Latin America

- 9.3.4.1. Brazil

- 9.3.5. Middle East & Africa

- 9.3.5.1. GCC

- 9.3.5.2. South Africa

- 9.3.5.3. Rest of Middle East & Africa

- 9.3.1. North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Lightweight Construction Materials Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Wood

- 10.1.2. Brics

- 10.1.3. Concrete

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Constrution Type

- 10.2.1. Resdential

- 10.2.2. Commercial

- 10.2.3. Industrial

- 10.2.4. Infrastructure

- 10.3. Market Analysis, Insights and Forecast - by Goegraphy

- 10.3.1. North America

- 10.3.1.1. United States

- 10.3.1.2. Canada

- 10.3.1.3. Mexico

- 10.3.2. Europe

- 10.3.2.1. Germany

- 10.3.2.2. France

- 10.3.2.3. United Kingdom

- 10.3.2.4. Italy

- 10.3.2.5. Spain

- 10.3.2.6. Rest of Europe

- 10.3.3. Asia-Pacific

- 10.3.3.1. China

- 10.3.3.2. Japan

- 10.3.3.3. India

- 10.3.3.4. ASEAN

- 10.3.3.5. Rest of APAC

- 10.3.4. Latin America

- 10.3.4.1. Brazil

- 10.3.5. Middle East & Africa

- 10.3.5.1. GCC

- 10.3.5.2. South Africa

- 10.3.5.3. Rest of Middle East & Africa

- 10.3.1. North America

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Taiheiyo Cement

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CRH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 James Hardie

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bora

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LafargeHolcim

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Granite

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 HeidelbergCement

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Italcementi

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dyckerhoff

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Trinity

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hanson

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Vulcan Materials

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Taiheiyo Cement

List of Figures

- Figure 1: Global Lightweight Construction Materials Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Lightweight Construction Materials Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Lightweight Construction Materials Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Lightweight Construction Materials Market Revenue (Million), by Constrution Type 2025 & 2033

- Figure 5: North America Lightweight Construction Materials Market Revenue Share (%), by Constrution Type 2025 & 2033

- Figure 6: North America Lightweight Construction Materials Market Revenue (Million), by Goegraphy 2025 & 2033

- Figure 7: North America Lightweight Construction Materials Market Revenue Share (%), by Goegraphy 2025 & 2033

- Figure 8: North America Lightweight Construction Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Lightweight Construction Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Lightweight Construction Materials Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: South America Lightweight Construction Materials Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America Lightweight Construction Materials Market Revenue (Million), by Constrution Type 2025 & 2033

- Figure 13: South America Lightweight Construction Materials Market Revenue Share (%), by Constrution Type 2025 & 2033

- Figure 14: South America Lightweight Construction Materials Market Revenue (Million), by Goegraphy 2025 & 2033

- Figure 15: South America Lightweight Construction Materials Market Revenue Share (%), by Goegraphy 2025 & 2033

- Figure 16: South America Lightweight Construction Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Lightweight Construction Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Lightweight Construction Materials Market Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Europe Lightweight Construction Materials Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe Lightweight Construction Materials Market Revenue (Million), by Constrution Type 2025 & 2033

- Figure 21: Europe Lightweight Construction Materials Market Revenue Share (%), by Constrution Type 2025 & 2033

- Figure 22: Europe Lightweight Construction Materials Market Revenue (Million), by Goegraphy 2025 & 2033

- Figure 23: Europe Lightweight Construction Materials Market Revenue Share (%), by Goegraphy 2025 & 2033

- Figure 24: Europe Lightweight Construction Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Lightweight Construction Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Lightweight Construction Materials Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa Lightweight Construction Materials Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa Lightweight Construction Materials Market Revenue (Million), by Constrution Type 2025 & 2033

- Figure 29: Middle East & Africa Lightweight Construction Materials Market Revenue Share (%), by Constrution Type 2025 & 2033

- Figure 30: Middle East & Africa Lightweight Construction Materials Market Revenue (Million), by Goegraphy 2025 & 2033

- Figure 31: Middle East & Africa Lightweight Construction Materials Market Revenue Share (%), by Goegraphy 2025 & 2033

- Figure 32: Middle East & Africa Lightweight Construction Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Lightweight Construction Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Lightweight Construction Materials Market Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Asia Pacific Lightweight Construction Materials Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Lightweight Construction Materials Market Revenue (Million), by Constrution Type 2025 & 2033

- Figure 37: Asia Pacific Lightweight Construction Materials Market Revenue Share (%), by Constrution Type 2025 & 2033

- Figure 38: Asia Pacific Lightweight Construction Materials Market Revenue (Million), by Goegraphy 2025 & 2033

- Figure 39: Asia Pacific Lightweight Construction Materials Market Revenue Share (%), by Goegraphy 2025 & 2033

- Figure 40: Asia Pacific Lightweight Construction Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Lightweight Construction Materials Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Lightweight Construction Materials Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Lightweight Construction Materials Market Revenue Million Forecast, by Constrution Type 2020 & 2033

- Table 3: Global Lightweight Construction Materials Market Revenue Million Forecast, by Goegraphy 2020 & 2033

- Table 4: Global Lightweight Construction Materials Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Lightweight Construction Materials Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Lightweight Construction Materials Market Revenue Million Forecast, by Constrution Type 2020 & 2033

- Table 7: Global Lightweight Construction Materials Market Revenue Million Forecast, by Goegraphy 2020 & 2033

- Table 8: Global Lightweight Construction Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Lightweight Construction Materials Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 13: Global Lightweight Construction Materials Market Revenue Million Forecast, by Constrution Type 2020 & 2033

- Table 14: Global Lightweight Construction Materials Market Revenue Million Forecast, by Goegraphy 2020 & 2033

- Table 15: Global Lightweight Construction Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Lightweight Construction Materials Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Lightweight Construction Materials Market Revenue Million Forecast, by Constrution Type 2020 & 2033

- Table 21: Global Lightweight Construction Materials Market Revenue Million Forecast, by Goegraphy 2020 & 2033

- Table 22: Global Lightweight Construction Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Lightweight Construction Materials Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global Lightweight Construction Materials Market Revenue Million Forecast, by Constrution Type 2020 & 2033

- Table 34: Global Lightweight Construction Materials Market Revenue Million Forecast, by Goegraphy 2020 & 2033

- Table 35: Global Lightweight Construction Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Lightweight Construction Materials Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 43: Global Lightweight Construction Materials Market Revenue Million Forecast, by Constrution Type 2020 & 2033

- Table 44: Global Lightweight Construction Materials Market Revenue Million Forecast, by Goegraphy 2020 & 2033

- Table 45: Global Lightweight Construction Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Lightweight Construction Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lightweight Construction Materials Market?

The projected CAGR is approximately 3.97%.

2. Which companies are prominent players in the Lightweight Construction Materials Market?

Key companies in the market include Taiheiyo Cement, CRH, James Hardie, Bora, LafargeHolcim, Granite, HeidelbergCement, Italcementi, Dyckerhoff, Trinity, Hanson, Vulcan Materials.

3. What are the main segments of the Lightweight Construction Materials Market?

The market segments include Product Type, Constrution Type, Goegraphy.

4. Can you provide details about the market size?

The market size is estimated to be USD 153.73 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Adoption of Lightweight Materials and Increase in the production of aircraft in developing countries; Growth of the Aerospace and Defence Sector in countries; Rise in investments in application-oriented research and development.

6. What are the notable trends driving market growth?

Building & Construction segment Holds the prominent share of Global Market.

7. Are there any restraints impacting market growth?

Economic slowdown and contraction of the automotive sector in developing regions; High cost of Construction Materials.

8. Can you provide examples of recent developments in the market?

August 2023: James Hardie Building Products Inc., a subsidiary of James Hardie Industries plc and the North American leader in fiber cement home siding and exterior design solutions, announced a significant national agreement with D.R. Horton, Inc., the largest homebuilder in the United States. In this landmark partnership, James Hardie becomes D.R. Horton's exclusive national supplier for the hard siding and trim category, extending through December 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lightweight Construction Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lightweight Construction Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lightweight Construction Materials Market?

To stay informed about further developments, trends, and reports in the Lightweight Construction Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence