Key Insights

The Japan Commercial Construction Industry is projected to experience robust expansion, forecasting a market size of 107.06 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 2.91%. Key growth drivers include sustained urban regeneration projects, heightened demand for contemporary retail and hospitality facilities, and significant investment in institutional infrastructure. The nation's ongoing commitment to urban modernization and a flourishing tourism sector are propelling the development and renovation of commercial properties. Furthermore, a growing emphasis on sustainable and technologically advanced construction solutions is opening new avenues. The market is segmented by end-user industries, with Office Building Construction, Retail Construction, and Hospitality Construction anticipated to drive project volume and value.

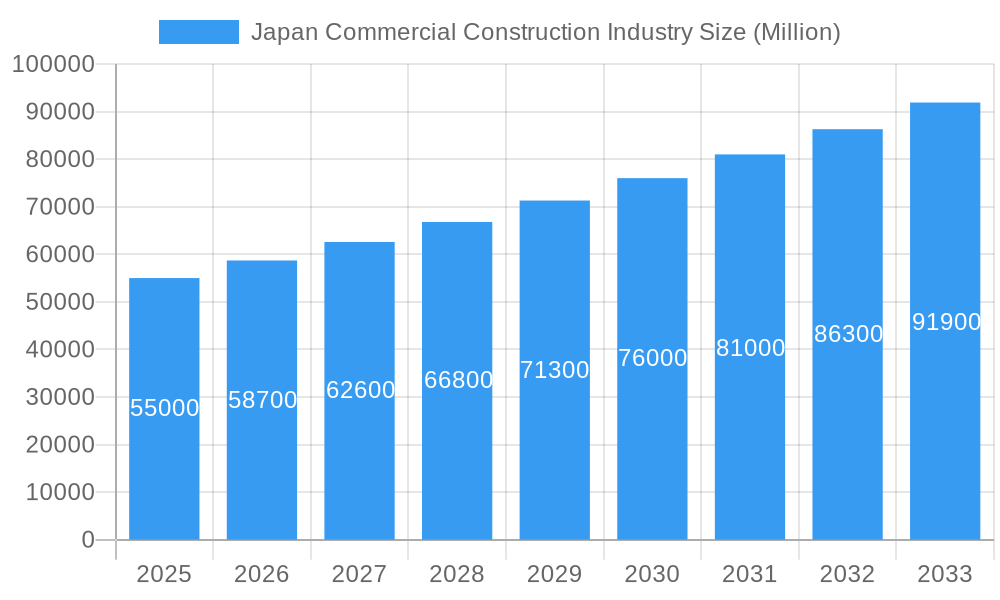

Japan Commercial Construction Industry Market Size (In Billion)

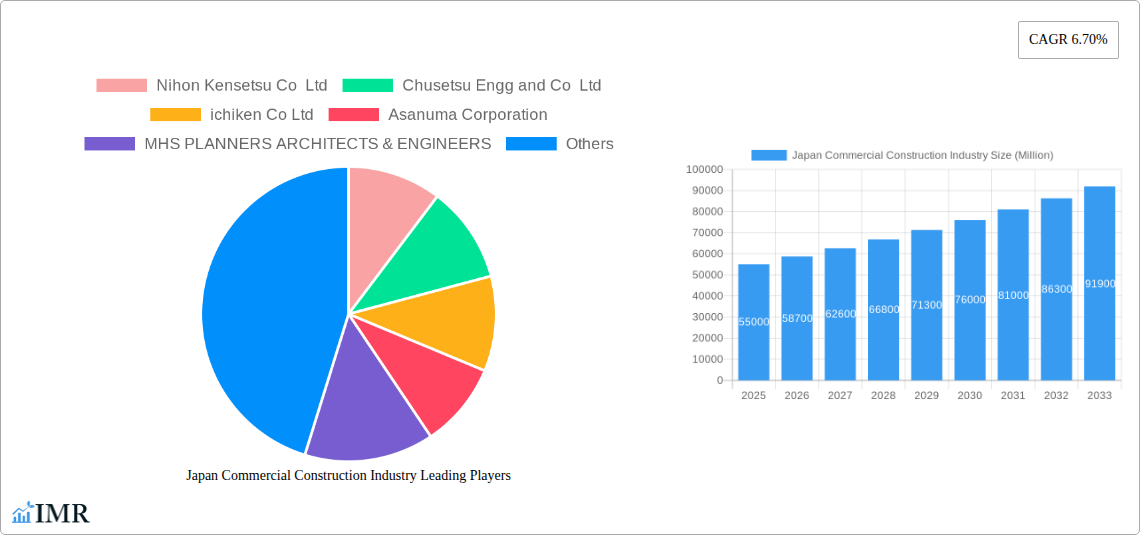

The industry faces challenges including escalating material costs, a scarcity of skilled labor, and rigorous environmental regulations. However, innovative construction technologies, prefabrication, and optimized project management are emerging trends that are mitigating these constraints and improving efficiency. Leading companies such as Nihon Kensetsu Co Ltd, Chusetsu Engg and Co Ltd, and TODA Corp are actively influencing the market through their extensive experience and strategic investments. Adapting to economic shifts, embracing technological progress, and prioritizing sustainability will be crucial for sustained success in this dynamic sector.

Japan Commercial Construction Industry Company Market Share

This comprehensive report offers a definitive analysis of the Japan Commercial Construction Industry, examining its market dynamics, growth forecasts, and future potential from the base year 2025 through to 2033. Gain in-depth insights into the broader Japanese construction market and its key segments, providing valuable intelligence for investors, developers, and stakeholders. Explore the evolving trends in office, retail, hospitality, and institutional construction, alongside niche segments, supported by precise market data.

Japan Commercial Construction Industry Market Dynamics & Structure

The Japan Commercial Construction Industry exhibits a moderately concentrated market, with a blend of established giants and emerging innovators. Technological innovation remains a key driver, fueled by advancements in smart building technologies, sustainable construction materials, and advanced project management software. Regulatory frameworks, particularly those focused on seismic resilience, energy efficiency, and urban development, significantly influence project feasibility and design. Competitive pressures stem from both domestic players and the potential for international firms to enter, alongside the growing threat of digital substitutes for certain construction phases. End-user demographics are shifting, with an increasing demand for flexible office spaces, experiential retail environments, and sustainable hospitality solutions. Mergers and acquisitions (M&A) trends are observed as companies seek to consolidate expertise, expand service offerings, and secure market share, particularly in specialized sectors like retrofitting and smart infrastructure.

- Market Concentration: Moderate, with a few dominant players and a significant number of specialized firms.

- Technological Innovation: Driven by AI, IoT in construction, BIM, prefabrication, and sustainable materials.

- Regulatory Frameworks: Stringent building codes, earthquake resistance standards, and environmental regulations shaping development.

- Competitive Substitutes: Emergence of modular construction and off-site fabrication impacting traditional methods.

- End-User Demographics: Shifting preferences towards sustainable, flexible, and technology-integrated commercial spaces.

- M&A Trends: Focus on acquisitions for technological capabilities and diversification in construction services.

Japan Commercial Construction Industry Growth Trends & Insights

The Japan Commercial Construction Industry is poised for significant growth, driven by a confluence of economic recovery, government initiatives, and evolving societal needs. The market size is projected to experience a robust Compound Annual Growth Rate (CAGR) throughout the forecast period, reflecting increased investment in urban regeneration and infrastructure development. Adoption rates for advanced construction technologies, such as Building Information Modeling (BIM) and prefabrication, are steadily rising, enhancing efficiency and reducing project timelines. Technological disruptions are evident in the integration of smart building systems, AI-powered project management, and the increasing use of robotics in construction. Consumer behavior shifts are a crucial factor, with businesses and end-users demanding more sustainable, adaptable, and technologically advanced commercial spaces. This evolution from traditional brick-and-mortar to dynamic, future-ready environments underpins the sustained expansion of the Japan Commercial Construction Industry.

- Market Size Evolution: Forecasted to expand significantly, indicating robust investment and development activity.

- Adoption Rates: Increasing adoption of BIM, prefabrication, and digital construction tools.

- Technological Disruptions: Integration of smart building solutions, AI for project management, and automation in construction.

- Consumer Behavior Shifts: Growing demand for sustainable, flexible, and technologically integrated commercial spaces.

- CAGR: Projected at xx% for the forecast period (2025–2033).

Dominant Regions, Countries, or Segments in Japan Commercial Construction Industry

Within the Japan Commercial Construction Industry, Office Building Construction stands as a dominant segment, spearheading market growth. This dominance is underpinned by several key drivers. Economically, major urban centers like Tokyo, Osaka, and Nagoya continue to attract significant business investment, necessitating continuous development and modernization of office infrastructure. Government economic policies promoting foreign direct investment and the growth of technology-driven industries further bolster demand for contemporary office spaces. Infrastructure development, including extensive public transportation networks and urban redevelopment projects, enhances the accessibility and appeal of new office buildings.

Market share analysis reveals that office buildings consistently command the largest portion of commercial construction expenditure due to their high value and recurring need for upgrades and new constructions to accommodate evolving work environments. Growth potential remains substantial, particularly in the development of smart offices, co-working spaces, and sustainable, LEED-certified buildings. The increasing trend of companies prioritizing employee well-being and productivity is directly translating into demand for higher-quality, amenity-rich office environments. Furthermore, the decentralization of business hubs and the rise of suburban business districts also contribute to the sustained demand in this segment.

- Leading Segment: Office Building Construction.

- Key Drivers: Economic investment in urban centers, government support for business growth, advanced infrastructure, and evolving corporate workspace demands.

- Market Share: Consistently highest among commercial construction segments.

- Growth Potential: Significant, driven by smart office technology, sustainability mandates, and flexible workspace solutions.

- Dominance Factors: High project values, continuous demand for modernization and upgrades, and adaptation to new work paradigms.

Japan Commercial Construction Industry Product Landscape

The product landscape within the Japan Commercial Construction Industry is characterized by a growing emphasis on sustainable, intelligent, and durable building materials and systems. Innovations range from advanced composite materials offering enhanced structural integrity and reduced weight to smart glass technologies that dynamically control light and temperature, optimizing energy efficiency. The application of these products is diverse, spanning from high-rise office buildings to innovative retail spaces and resilient institutional facilities. Performance metrics are increasingly scrutinized, with a focus on energy consumption reduction, lifecycle cost-effectiveness, and improved occupant comfort and safety. Unique selling propositions often revolve around eco-friendliness, long-term performance, and seamless integration with smart building technologies, driving the adoption of cutting-edge solutions.

Key Drivers, Barriers & Challenges in Japan Commercial Construction Industry

Key Drivers:

- Technological Advancements: Adoption of BIM, AI, robotics, and sustainable materials are accelerating project delivery and efficiency.

- Government Initiatives: Policies supporting urban regeneration, infrastructure development, and defense spending create demand.

- Economic Recovery: A strengthening economy fuels business investment and expansion, necessitating new commercial facilities.

- Sustainability Mandates: Increasing focus on green building standards drives demand for eco-friendly construction.

Barriers & Challenges:

- Skilled Labor Shortage: An aging workforce and difficulty attracting new talent pose a significant constraint.

- Supply Chain Disruptions: Global and domestic supply chain volatility can lead to material shortages and price fluctuations, impacting project timelines and costs.

- Regulatory Hurdles: Complex and evolving building codes and permitting processes can cause delays.

- Competitive Pressures: Intense competition among construction firms can drive down profit margins.

- Capital Investment: High upfront capital requirements for large-scale commercial projects remain a challenge for some developers.

Emerging Opportunities in Japan Commercial Construction Industry

Emerging opportunities in the Japan Commercial Construction Industry lie in the growing demand for sustainable retrofitting and renovation of existing commercial buildings. The drive towards carbon neutrality presents a vast market for energy-efficient upgrades, smart building integrations, and the use of recycled and low-carbon materials. Furthermore, the development of specialized commercial facilities, such as data centers, logistics hubs, and advanced healthcare facilities, is gaining momentum. The increasing focus on resilient infrastructure also opens avenues for earthquake-resistant and climate-adaptive construction solutions. Finally, the exploration of new frontiers, like the development of commercial space stations, signifies a groundbreaking opportunity for futuristic construction technologies and expertise.

Growth Accelerators in the Japan Commercial Construction Industry Industry

Catalysts driving long-term growth in the Japan Commercial Construction Industry are multi-faceted. Strategic partnerships between construction firms, technology providers, and material manufacturers are fostering innovation and the development of integrated solutions. Market expansion strategies are increasingly focusing on niche sectors like specialized industrial facilities and intelligent infrastructure. Technological breakthroughs in areas such as advanced robotics for construction, AI-driven predictive maintenance, and the widespread adoption of digital twin technology will further streamline operations and enhance project outcomes. The government's commitment to modernizing infrastructure and promoting sustainable development will continue to serve as a significant growth accelerator for the industry.

Key Players Shaping the Japan Commercial Construction Industry Market

- Nihon Kensetsu Co Ltd

- Chusetsu Engg and Co Ltd

- ichiken Co Ltd

- Asanuma Corporation

- MHS PLANNERS ARCHITECTS & ENGINEERS

- Bisho Co Ltd

- Renoveru Co Ltd

- Konoike Construction Co Ltd

- TODA Corp

- Kumagui Gumi Co Ltd

Notable Milestones in Japan Commercial Construction Industry Sector

- December 2022: DigitalBlast, Inc. announces plans to launch Japan's first commercial space station module by 2030, signaling innovation in advanced construction.

- December 2022: The Japanese government earmarks approximately 1.6 trillion yen (approx. 11.61 billion USD) through construction bonds for Self-Defense Force facilities, boosting defense infrastructure spending by March 2028.

In-Depth Japan Commercial Construction Industry Market Outlook

The Japan Commercial Construction Industry is set for a robust future, characterized by an increasing focus on sustainability, technological integration, and resilience. Growth accelerators such as government investment in infrastructure and defense, coupled with private sector demand for modern, efficient commercial spaces, will continue to propel the market. Emerging opportunities in retrofitting, smart building solutions, and specialized facilities like data centers offer significant potential for expansion. Strategic partnerships and continuous technological innovation will be crucial in navigating challenges and capitalizing on future market dynamics. The industry's ability to adapt to evolving environmental regulations and embrace advanced construction methodologies will define its long-term success and solidify its position as a vital contributor to Japan's economic development.

Japan Commercial Construction Industry Segmentation

-

1. End-Users

- 1.1. Office Building Construction

- 1.2. Retail Construction

- 1.3. Hospitality Construction

- 1.4. Institutional Construction

- 1.5. Other End-Users

Japan Commercial Construction Industry Segmentation By Geography

- 1. Japan

Japan Commercial Construction Industry Regional Market Share

Geographic Coverage of Japan Commercial Construction Industry

Japan Commercial Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Government Initiatives and Policies

- 3.2.2 such as "Make in India" and "BharatMala"4.; Indian Cities Planning and Implementing Metro Rail Systems to Address Urban Congestion and Improve Public Transportation

- 3.3. Market Restrains

- 3.3.1. 4.; Bureaucratic Delays in Project Approvals4.; Shortage of Skilled Labors Affecting the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Government Mandates Pertaining to Energy Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Commercial Construction Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-Users

- 5.1.1. Office Building Construction

- 5.1.2. Retail Construction

- 5.1.3. Hospitality Construction

- 5.1.4. Institutional Construction

- 5.1.5. Other End-Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by End-Users

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nihon Kensetsu Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chusetsu Engg and Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ichiken Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Asanuma Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MHS PLANNERS ARCHITECTS & ENGINEERS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bisho Co Ltd *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Renoveru Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Konoike Construction Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TODA Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kumagui Gumi Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nihon Kensetsu Co Ltd

List of Figures

- Figure 1: Japan Commercial Construction Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Commercial Construction Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Commercial Construction Industry Revenue billion Forecast, by End-Users 2020 & 2033

- Table 2: Japan Commercial Construction Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Japan Commercial Construction Industry Revenue billion Forecast, by End-Users 2020 & 2033

- Table 4: Japan Commercial Construction Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Commercial Construction Industry?

The projected CAGR is approximately 2.91%.

2. Which companies are prominent players in the Japan Commercial Construction Industry?

Key companies in the market include Nihon Kensetsu Co Ltd, Chusetsu Engg and Co Ltd, ichiken Co Ltd, Asanuma Corporation, MHS PLANNERS ARCHITECTS & ENGINEERS, Bisho Co Ltd *List Not Exhaustive, Renoveru Co Ltd, Konoike Construction Co Ltd, TODA Corp, Kumagui Gumi Co Ltd.

3. What are the main segments of the Japan Commercial Construction Industry?

The market segments include End-Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 107.06 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Initiatives and Policies. such as "Make in India" and "BharatMala"4.; Indian Cities Planning and Implementing Metro Rail Systems to Address Urban Congestion and Improve Public Transportation.

6. What are the notable trends driving market growth?

Government Mandates Pertaining to Energy Projects.

7. Are there any restraints impacting market growth?

4.; Bureaucratic Delays in Project Approvals4.; Shortage of Skilled Labors Affecting the Growth of the Market.

8. Can you provide examples of recent developments in the market?

December 2022: The Yomiuri Shimbun has discovered that a Tokyo-based startup was preparing to launch the country's first commercial space station through this initiative. Several American companies have already talked about building a space station, so DigitalBlast, Inc.'s plan to launch the first module of the station by 2030 is right on schedule.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Commercial Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Commercial Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Commercial Construction Industry?

To stay informed about further developments, trends, and reports in the Japan Commercial Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence