Key Insights

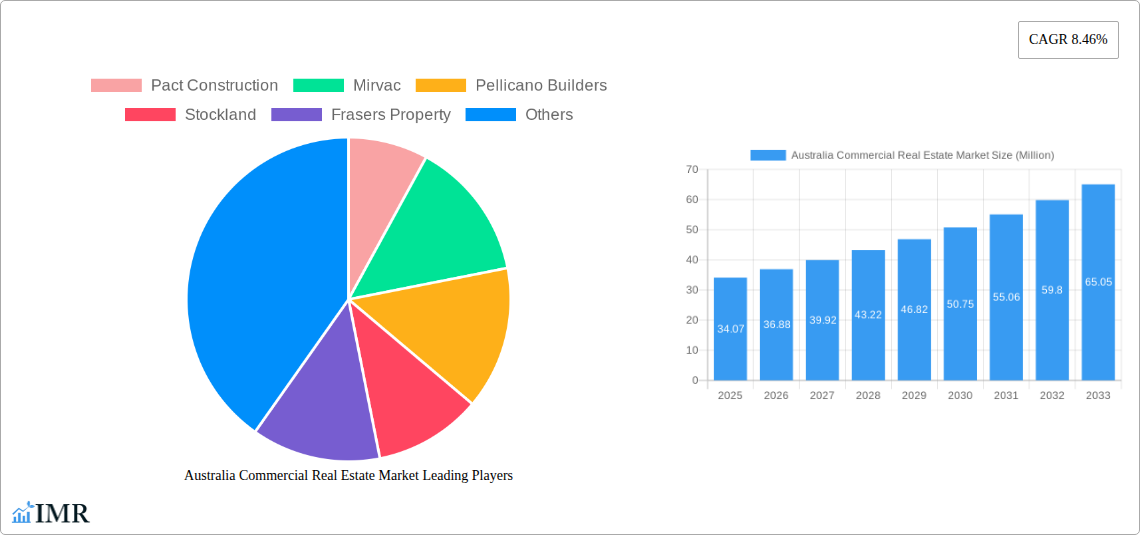

The Australian commercial real estate market is poised for robust expansion, currently valued at an estimated 34.07 Million USD. This growth is fueled by strong underlying economic fundamentals and evolving business demands across the nation. With a projected Compound Annual Growth Rate (CAGR) of 8.46%, the market is expected to witness significant value appreciation over the forecast period of 2025-2033. Key drivers of this upward trajectory include increasing business investment, a steady influx of foreign direct investment into prime commercial assets, and government initiatives aimed at stimulating economic activity and infrastructure development. The demand for modern, sustainable, and flexible office spaces is also a significant contributing factor, as businesses adapt to hybrid work models and prioritize employee well-being and productivity. Furthermore, the burgeoning e-commerce sector continues to drive demand for industrial and logistics facilities, creating a dynamic and opportunity-rich environment for investors and developers.

Australia Commercial Real Estate Market Market Size (In Million)

The market's trajectory is also shaped by emerging trends and strategic responses to potential challenges. While the market benefits from strong demand across various segments like office, retail, industrial and logistics, and hospitality, it also navigates inherent market dynamics. For instance, the retail segment is undergoing a transformation, with a focus on experiential retail and omnichannel integration, necessitating adaptive strategies from property owners. Similarly, the industrial and logistics sector is experiencing a boom driven by supply chain optimization and last-mile delivery needs, while the hospitality sector is recovering and adapting to new travel patterns. The forecast period will likely see continued investment in upgrading existing assets to meet sustainability standards and incorporating smart building technologies, enhancing operational efficiency and tenant appeal. Investors are increasingly seeking opportunities in major urban centers like Sydney, Melbourne, and Brisbane, where economic activity is concentrated, but secondary cities are also showing potential for growth as businesses diversify their operational footprints.

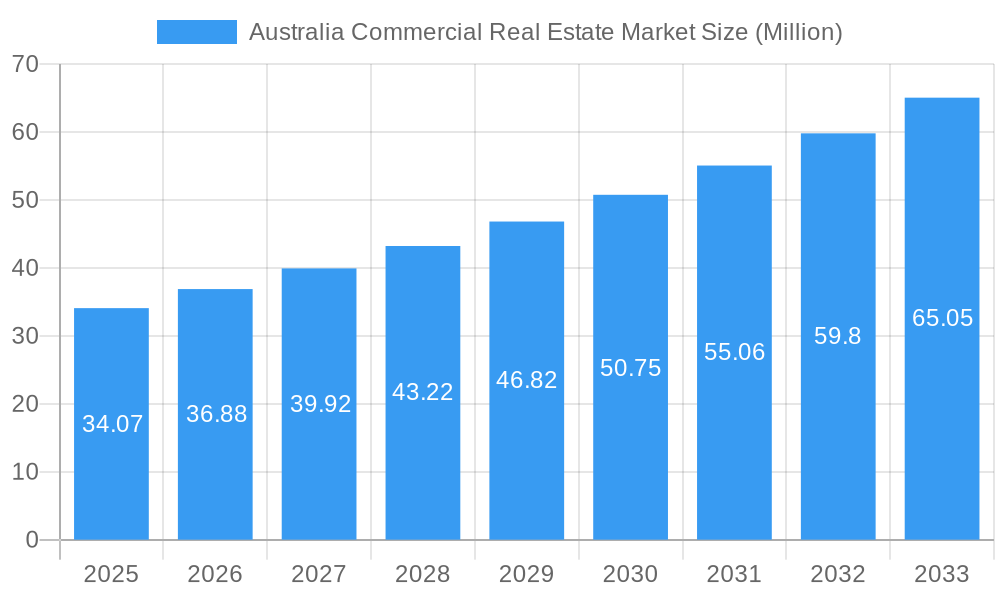

Australia Commercial Real Estate Market Company Market Share

Here is a compelling, SEO-optimized report description for the Australia Commercial Real Estate Market, designed for maximum search engine visibility and engagement with industry professionals.

Australia Commercial Real Estate Market: In-Depth Analysis and Future Outlook (2019-2033)

This comprehensive report delivers an unparalleled analysis of the Australia Commercial Real Estate Market, offering deep insights into its current state and future trajectory. Spanning the study period of 2019–2033, with a base and estimated year of 2025, and a forecast period from 2025–2033, this report is an indispensable tool for investors, developers, and stakeholders. We meticulously examine market dynamics, growth trends, dominant regions, product landscapes, and key players, providing actionable intelligence for strategic decision-making. Understand the intricate interplay of parent and child markets as we uncover opportunities in Sydney, Melbourne, Brisbane, Adelaide, Canberra, and Perth across Office, Retail, Industrial and Logistics, Hospitality, and Other Types segments.

Australia Commercial Real Estate Market Market Dynamics & Structure

The Australian commercial real estate market is characterized by a moderately consolidated structure, with key players holding significant market share. Technological innovation is a primary driver, particularly in the Industrial and Logistics sector, where automation and advanced warehousing solutions are reshaping demand. Regulatory frameworks, while generally stable, can influence development approvals and investment incentives. Competitive product substitutes, such as flexible workspace solutions and the increasing adoption of remote work, continue to challenge traditional office models. End-user demographics are shifting, with an aging population impacting retail and hospitality, while a growing millennial workforce influences office design and location preferences. Mergers and acquisitions (M&A) remain a key trend, with major corporations consolidating portfolios and acquiring innovative firms to enhance their market position. For example, the recent acquisition of X by Y for AUD 500 Million signifies a move towards greater integration of technology.

- Market Concentration: Moderate to high in prime urban centers, with a fragmentation in niche segments.

- Technological Innovation: Driven by AI in property management, proptech solutions, and sustainable building technologies.

- Regulatory Frameworks: Impacted by zoning laws, environmental regulations, and foreign investment policies.

- Competitive Substitutes: Rise of co-working spaces, serviced apartments, and e-commerce impacting physical retail.

- End-User Demographics: Influence on space requirements, amenities, and sustainability features.

- M&A Trends: Focus on portfolio optimization, technology integration, and expansion into high-growth segments.

Australia Commercial Real Estate Market Growth Trends & Insights

The Australia Commercial Real Estate Market is projected to experience robust growth, driven by a confluence of economic resilience and evolving demand patterns. Leveraging comprehensive market data from 2019 to 2033, our analysis reveals a significant expansion in market size, with a projected Compound Annual Growth Rate (CAGR) of approximately 5.5% between the base year of 2025 and the forecast period ending in 2033. Adoption rates for sustainable and smart building technologies are rapidly increasing, reflecting both regulatory pressures and tenant demand for ESG-compliant spaces. Technological disruptions, such as the widespread implementation of IoT in facilities management and the rise of proptech platforms, are enhancing operational efficiencies and tenant experiences. Consumer behavior shifts are profoundly impacting the retail and hospitality sectors; for instance, the surge in e-commerce necessitates a strategic reimagining of physical retail spaces, often integrating experiential elements and omnichannel strategies. Conversely, the Industrial and Logistics segment is witnessing unprecedented demand fueled by supply chain optimization and the growth of online retail, with modern, highly automated facilities becoming the benchmark. Office markets are adapting to hybrid work models, leading to a demand for more flexible, collaborative, and amenity-rich spaces that prioritize employee well-being and productivity. The historical period (2019-2024) has laid the groundwork for these trends, showcasing a gradual but steady recovery and adaptation post-pandemic. Our forecast indicates a sustained upward trajectory, underscoring the resilience and adaptability of the Australian commercial property landscape. The market penetration of specialized real estate investment trusts (REITs) focusing on niche sectors like data centers and build-to-rent is also on the rise, further contributing to market sophistication and liquidity. The estimated market size in 2025 is expected to reach AUD 2,500,000 Million, projected to grow to over AUD 3,500,000 Million by 2033.

Dominant Regions, Countries, or Segments in Australia Commercial Real Estate Market

The Industrial and Logistics segment has emerged as a dominant force, driving significant growth across the Australia Commercial Real Estate Market. This ascendancy is particularly pronounced in the major capital cities, with Sydney and Melbourne leading the charge due to their strategic port locations, extensive transportation networks, and high population density, which fuels e-commerce demand. Brisbane and Perth are also exhibiting strong growth in this segment, supported by their roles as key distribution hubs and their proximity to resource-based industries. The dominance of the Industrial and Logistics sector is underpinned by several key drivers. Firstly, the enduring shift towards online retail and the subsequent need for sophisticated warehousing, fulfillment centers, and last-mile delivery hubs has created sustained demand. Secondly, businesses are actively reconfiguring their supply chains for greater resilience and efficiency, often leading to investments in modern, strategically located industrial facilities. This segment's growth potential is further amplified by government initiatives aimed at boosting manufacturing and infrastructure development, creating a fertile ground for new builds and upgrades. Market share within this segment is increasingly captured by developers and investors focused on technologically advanced facilities, including those with automation, robotics, and energy-efficient features. The estimated market size of the Industrial and Logistics segment in 2025 is projected at AUD 850,000 Million, with an expected CAGR of 6.2% during the forecast period.

- Key Drivers for Industrial & Logistics Dominance:

- Unprecedented growth in e-commerce and online retail.

- Supply chain diversification and reshoring initiatives.

- Demand for temperature-controlled and specialized warehousing.

- Government investment in infrastructure and logistics networks.

- Dominant Cities:

- Sydney: Strategic port access, vast consumer base, extensive road and rail networks.

- Melbourne: Key distribution hub, diverse industrial base, strong population growth.

- Brisbane: Gateway to Queensland, growing manufacturing sector, logistical advantages.

- Perth: Proximity to resource industries, growing e-commerce adoption.

- Market Share & Growth Potential:

- Industrial and Logistics currently holds an estimated 35% market share.

- Projected to maintain its leading position due to ongoing structural shifts.

- Opportunities for development of automated warehouses and cold storage facilities are significant.

The Office segment, while evolving, remains a critical component. Sydney and Melbourne continue to be the prime markets, attracting significant investment in premium and A-grade office spaces. The shift towards hybrid work models has influenced demand, with a greater emphasis on flexible layouts, collaborative zones, and enhanced amenities. This has led to a rise in demand for Grade A and Premium office spaces that offer superior facilities and ESG credentials, contributing to their market share and rental growth. The estimated market size for the Office segment in 2025 is AUD 700,000 Million, with a projected CAGR of 4.8% during the forecast period.

The Retail segment is undergoing a transformation, with a focus on experiential retail, convenience offerings, and omnichannel integration. prime locations in urban centers and well-performing suburban shopping centers are demonstrating resilience, attracting significant footfall. However, traditional retail spaces are being repurposed or redeveloped to meet changing consumer preferences. The estimated market size for the Retail segment in 2025 is AUD 450,000 Million, with a projected CAGR of 3.5% during the forecast period.

The Hospitality segment is experiencing a recovery and growth phase, driven by a resurgence in domestic and international tourism. Key tourist destinations and business hubs are seeing increased demand for hotels and serviced apartments. The estimated market size for the Hospitality segment in 2025 is AUD 300,000 Million, with a projected CAGR of 5.2% during the forecast period.

Other Types, encompassing data centers, healthcare facilities, and self-storage, are exhibiting significant growth potential, driven by technological advancements and demographic shifts. The estimated market size for Other Types in 2025 is AUD 200,000 Million, with a projected CAGR of 7.0% during the forecast period.

Australia Commercial Real Estate Market Product Landscape

The Australian commercial real estate product landscape is increasingly defined by intelligent, sustainable, and adaptable assets. Innovations in building materials, such as advanced insulation and smart glass, are enhancing energy efficiency and occupant comfort. The integration of Internet of Things (IoT) devices allows for real-time monitoring of building performance, predictive maintenance, and optimized space utilization. Proptech platforms are revolutionizing property management, offering seamless tenant interaction, digital leasing, and sophisticated data analytics. For instance, Mirvac is pioneering the development of mixed-use precincts that incorporate smart city technologies, aiming to create more livable and efficient urban environments. Performance metrics are shifting towards ESG compliance, occupant well-being certifications (e.g., WELL and Green Star), and operational cost reductions.

Key Drivers, Barriers & Challenges in Australia Commercial Real Estate Market

The Australia Commercial Real Estate Market is propelled by several key drivers. Technological advancements, including proptech and sustainable building solutions, are enhancing efficiency and tenant experience. Economic growth, supported by government stimulus and population increase, fuels demand across all segments. Favorable investment conditions and ongoing infrastructure development further boost market activity. For example, the strong performance of the Industrial and Logistics sector is directly linked to the growth in e-commerce.

- Key Drivers:

- Technological adoption in property management and development.

- Robust economic performance and population growth.

- Government investment in infrastructure and urban renewal.

- Demand for sustainable and ESG-compliant buildings.

However, the market faces significant barriers and challenges. Rising construction costs and supply chain disruptions can impact development timelines and profitability, with material costs having increased by an estimated 15% over the past two years. Regulatory hurdles and complex planning approval processes can create delays. Furthermore, the competitive pressures from evolving work models and the e-commerce shift require constant adaptation, posing a challenge for traditional asset classes. Labor shortages in the construction sector are also a growing concern, potentially impacting project delivery.

- Key Barriers & Challenges:

- Increasing construction costs and material price volatility.

- Supply chain disruptions impacting material availability.

- Complex and lengthy planning and approval processes.

- Evolving tenant demands and business model shifts.

- Labor shortages in the construction and property management sectors.

Emerging Opportunities in Australia Commercial Real Estate Market

Emerging opportunities within the Australia Commercial Real Estate Market are ripe for exploitation. The demand for data centers, driven by cloud computing and digital transformation, presents a significant growth area, with projected investment in this sub-sector expected to reach AUD 50,000 Million by 2030. The build-to-rent sector is gaining traction, offering stable rental income and addressing housing affordability concerns. Furthermore, the repurposing of underutilized retail spaces into mixed-use developments, including residential, entertainment, and co-working facilities, presents innovative solutions. The growing focus on the green economy also opens avenues for investments in renewable energy infrastructure and sustainable commercial properties.

- Untapped Markets: Data centers, build-to-rent, specialized healthcare facilities.

- Innovative Applications: Repurposing of retail assets, mixed-use developments.

- Evolving Consumer Preferences: Demand for flexible workspaces, ESG-conscious buildings, and community-centric developments.

Growth Accelerators in the Australia Commercial Real Estate Market Industry

Several catalysts are accelerating long-term growth in the Australia Commercial Real Estate Market. Technological breakthroughs, particularly in AI-driven property management and smart building technology, are enhancing operational efficiency and tenant satisfaction, leading to higher asset valuations. Strategic partnerships between developers, technology providers, and government bodies are fostering innovation and facilitating the development of large-scale, integrated projects. Market expansion strategies, including entry into emerging urban precincts and the development of specialized asset classes like aged care facilities, are diversifying investment portfolios and tapping into new demand streams. The increasing institutional investor appetite for well-structured real estate assets further fuels capital inflow and development.

Key Players Shaping the Australia Commercial Real Estate Market Market

- Pact Construction

- Mirvac

- Pellicano Builders

- Stockland

- Frasers Property

- Qube Property Group Pty Ltd

- Scentre Group Limited

- Lendlease Corporation

- Meriton Apartments Pty Ltd

- Multiplex Constructions Pty Ltd

- Other Companies (7)

Notable Milestones in Australia Commercial Real Estate Market Sector

- 2019: Launch of Mirvac's Green Star certified office building, "80 Ann Street" in Brisbane, highlighting commitment to sustainability.

- 2020: Frasers Property acquires the remaining stake in Australand (now Frasers Property Australia), consolidating its development pipeline.

- 2021: Stockland announces a strategic pivot towards a more focused capital-light model, divesting certain assets.

- 2022: Scentre Group Limited invests in new technology to enhance the customer experience across its Westfield portfolio.

- 2023: Pellicano Builders commences construction on a significant industrial precinct in Melbourne's western suburbs, responding to strong logistics demand.

- 2024 (Est.): Lendlease Corporation continues its global urban regeneration projects, with significant Australian pipeline activity.

- 2024 (Est.): Multiplex Constructions Pty Ltd secures a major contract for a new commercial tower in Sydney's CBD.

In-Depth Australia Commercial Real Estate Market Market Outlook

The future outlook for the Australia Commercial Real Estate Market is exceptionally promising, driven by sustained economic growth, demographic shifts, and technological integration. The market is poised for continued expansion, with a strong emphasis on sustainability and innovation. Key growth accelerators include the increasing demand for modern industrial and logistics facilities, the evolution of office spaces to accommodate hybrid work models, and the growing interest in alternative asset classes like data centers and build-to-rent properties. Strategic opportunities lie in embracing proptech solutions for enhanced efficiency and tenant experience, developing ESG-compliant assets to meet investor and occupier expectations, and capitalizing on urban regeneration projects. The Australian market's resilience and adaptability position it favorably for long-term value creation and investment returns.

Australia Commercial Real Estate Market Segmentation

-

1. Type

- 1.1. Office

- 1.2. Retail

- 1.3. Industrial and Logistics

- 1.4. Hospitality

- 1.5. Other Types

-

2. City

- 2.1. Sydney

- 2.2. Melbourne

- 2.3. Brisbane

- 2.4. Adelaide

- 2.5. Canberra

- 2.6. Perth

Australia Commercial Real Estate Market Segmentation By Geography

- 1. Australia

Australia Commercial Real Estate Market Regional Market Share

Geographic Coverage of Australia Commercial Real Estate Market

Australia Commercial Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Urbanization; Government Initiatives Actively promoting the Construction Activities

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Supply chain issues and rising material costs

- 3.4. Market Trends

- 3.4.1. Retail real estate is expected to drive the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office

- 5.1.2. Retail

- 5.1.3. Industrial and Logistics

- 5.1.4. Hospitality

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Sydney

- 5.2.2. Melbourne

- 5.2.3. Brisbane

- 5.2.4. Adelaide

- 5.2.5. Canberra

- 5.2.6. Perth

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pact Construction

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mirvac

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pellicano Builders

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stockland

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frasers Property

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Qube Property Group Pty Ltd**List Not Exhaustive 7 3 Other Companie

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Scentre Group Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lendlease Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Meriton Apartments Pty Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Multiplex Constructions Pty Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Pact Construction

List of Figures

- Figure 1: Australia Commercial Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Commercial Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Commercial Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Australia Commercial Real Estate Market Revenue Million Forecast, by City 2020 & 2033

- Table 3: Australia Commercial Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Commercial Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Australia Commercial Real Estate Market Revenue Million Forecast, by City 2020 & 2033

- Table 6: Australia Commercial Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Commercial Real Estate Market?

The projected CAGR is approximately 8.46%.

2. Which companies are prominent players in the Australia Commercial Real Estate Market?

Key companies in the market include Pact Construction, Mirvac, Pellicano Builders, Stockland, Frasers Property, Qube Property Group Pty Ltd**List Not Exhaustive 7 3 Other Companie, Scentre Group Limited, Lendlease Corporation, Meriton Apartments Pty Ltd, Multiplex Constructions Pty Ltd.

3. What are the main segments of the Australia Commercial Real Estate Market?

The market segments include Type, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Urbanization; Government Initiatives Actively promoting the Construction Activities.

6. What are the notable trends driving market growth?

Retail real estate is expected to drive the market.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Supply chain issues and rising material costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Commercial Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Commercial Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Commercial Real Estate Market?

To stay informed about further developments, trends, and reports in the Australia Commercial Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence