Key Insights

The Indonesian container glass market is poised for substantial growth, projected to reach USD 67.2 billion in 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 5.8% throughout the forecast period of 2025-2033. This expansion is primarily fueled by the burgeoning demand from the beverage sector, encompassing both alcoholic and non-alcoholic segments. The increasing consumer preference for premium packaging in alcoholic beverages like wines and spirits, coupled with the sustained demand for convenient and healthy options in non-alcoholic drinks such as juices and water, significantly bolsters market expansion. Furthermore, the food industry's growing reliance on glass containers for their perceived safety, reusability, and premium aesthetic contributes to this upward trajectory. Emerging applications in the cosmetics and pharmaceutical sectors, where glass packaging offers superior barrier properties and a sophisticated appeal, also present significant growth opportunities.

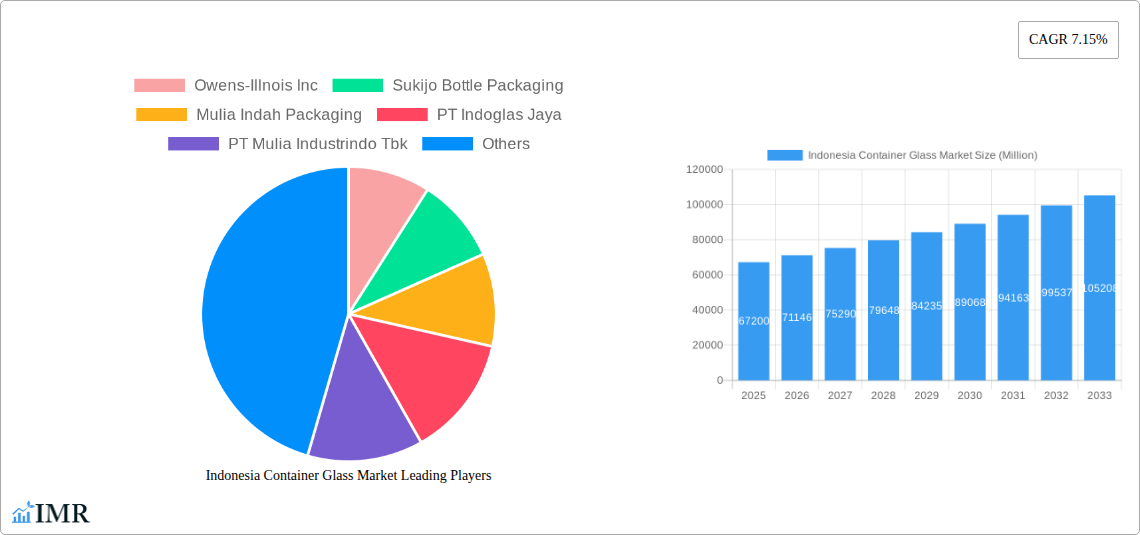

Indonesia Container Glass Market Market Size (In Billion)

The market's growth is further supported by evolving consumer trends towards sustainable and eco-friendly packaging solutions, with glass being a highly recyclable material. This aligns with global sustainability initiatives and growing environmental consciousness among Indonesian consumers. However, challenges such as fluctuating raw material costs, particularly for soda ash and sand, and the energy-intensive nature of glass manufacturing can pose restraining factors. Intense competition among key players, including Owens-Illinois Inc. and local giants like PT Mulia Industrindo Tbk and Sukijo Bottle Packaging, fosters innovation and competitive pricing, which in turn benefits end-users. The continuous development of advanced manufacturing techniques and the exploration of specialized glass formulations are expected to address production efficiencies and cater to diverse packaging needs across various end-user industries, solidifying the market's healthy growth outlook.

Indonesia Container Glass Market Company Market Share

Indonesia Container Glass Market: Comprehensive Report (2019–2033)

Gain unparalleled insights into the dynamic Indonesian container glass market with this in-depth report. Spanning historical analysis (2019–2024), a robust base year (2025), and an extensive forecast period (2025–2033), this report provides critical data and expert analysis for strategic decision-making. Our research leverages the latest industry developments, including the Coca-Cola Co's renewed focus on circular glass packaging and Judydoll's strategic entry into the Indonesian cosmetics scene. Understand the intricate market structure, growth trajectories, dominant segments, product innovations, key drivers, emerging opportunities, and the strategic moves of major players. Essential for manufacturers, suppliers, investors, and industry stakeholders seeking to capitalize on the burgeoning demand for sustainable and high-quality glass packaging solutions in Indonesia.

Indonesia Container Glass Market Market Dynamics & Structure

The Indonesian container glass market is characterized by a moderately concentrated landscape, with a few dominant players holding significant market share, yet ample room for specialized manufacturers. Technological innovation is primarily driven by the demand for enhanced product safety, extended shelf life, and sophisticated aesthetic appeal. Regulatory frameworks, while evolving to support sustainability and product standards, can also present compliance hurdles. Competitive product substitutes, such as plastic and metal packaging, exert continuous pressure, necessitating innovation in glass's inherent advantages like recyclability and inertness. End-user demographics are shifting, with a growing middle class demanding premium and aesthetically pleasing packaging, particularly in the beverage and food sectors. Merger and acquisition trends are observed as companies seek to consolidate market presence, acquire advanced technologies, or expand their product portfolios.

- Market Concentration: Dominated by a few large-scale manufacturers, but with a growing number of niche players.

- Technological Innovation Drivers: Increased demand for lightweighting, enhanced barrier properties, decorative printing, and sustainable manufacturing processes.

- Regulatory Frameworks: Focus on food-grade certifications, environmental regulations for manufacturing, and product safety standards.

- Competitive Product Substitutes: Ongoing competition from PET bottles, aluminum cans, and flexible packaging, driving innovation in glass durability and cost-effectiveness.

- End-User Demographics: Rising disposable incomes and evolving consumer preferences for premium and sustainable packaging are key influencers.

- M&A Trends: Consolidation for economies of scale and strategic acquisition of specialized glass technologies or market access.

Indonesia Container Glass Market Growth Trends & Insights

The Indonesian container glass market is poised for substantial growth, projected to expand from an estimated XX billion units in 2025 to an impressive XX billion units by 2033, reflecting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This expansion is fueled by robust demand from its burgeoning population, increasing urbanization, and a rising middle class with a penchant for premium products. The adoption rate of glass packaging is steadily increasing across various end-user industries, driven by growing consumer awareness regarding health, safety, and environmental sustainability. Technological advancements in glass manufacturing, such as improved energy efficiency, advanced coating techniques for enhanced durability, and innovative design capabilities, are further propelling market penetration. Consumer behavior shifts are significantly impacting the market, with a discernible preference for aesthetically pleasing, reusable, and recyclable packaging options. The "premiumization" trend, especially within the beverage and food sectors, sees consumers associating glass packaging with higher quality and a superior product experience. Furthermore, government initiatives promoting domestic manufacturing and sustainable consumption patterns are acting as significant catalysts. The overall market size evolution indicates a strong and sustained upward trajectory, underscoring the enduring appeal and functional superiority of glass as a packaging material in the Indonesian context.

Dominant Regions, Countries, or Segments in Indonesia Container Glass Market

The Beverage end-user industry stands as the dominant force driving the Indonesian container glass market, with an estimated XX% market share in 2025 and projected to maintain its leadership through the forecast period. Within the beverage segment, Non-Alcoholic Beverages are exhibiting particularly strong growth, driven by the immense popularity of Water, Carbonated Drinks, and Juices. The increasing health consciousness among Indonesian consumers translates into a higher demand for bottled water and natural fruit juices, which are traditionally packaged in glass for perceived purity and freshness. The sheer volume of consumption for these categories ensures a consistent and substantial demand for glass containers.

- Beverage Segment Dominance:

- Non-Alcoholic Beverages:

- Water: Driven by increasing demand for safe and convenient drinking water.

- Carbonated Drinks: Sustained demand from a large youth population and established market presence.

- Juices: Growing popularity of natural and premium fruit juices, favored for glass packaging.

- Dairy-Based and Flavored Drinks: Emerging segments with increasing adoption of glass packaging for perceived freshness and premium appeal.

- Alcoholic Beverages:

- Wines and Spirits: A smaller but high-value segment, with glass packaging being the standard for premium offerings.

- Beer and Cider: While large volumes are packed in other materials, the demand for premium and craft beers in glass bottles is on the rise.

- Non-Alcoholic Beverages:

The Food segment follows as another significant contributor, with glass packaging being favored for its inertness, transparency, and ability to preserve the quality and freshness of various food products, including sauces, jams, preserves, and ready-to-eat meals. The Cosmetics and Pharmaceuticals segments, while smaller in volume, represent high-value applications where the premium perception and inertness of glass are critical. The Other End User Verticals, encompassing a range of specialized applications, also contribute to the market's diversity. Economic policies promoting local production and exports, coupled with robust infrastructure development, further bolster the growth of these dominant segments.

Indonesia Container Glass Market Product Landscape

The product landscape of the Indonesian container glass market is characterized by a growing emphasis on innovation that enhances both functionality and aesthetic appeal. Manufacturers are increasingly focusing on lightweighting techniques to reduce material usage and transportation costs, while simultaneously improving the strength and durability of glass containers through advanced manufacturing processes. Specialized coatings are being developed to offer superior barrier properties, protecting contents from UV light and oxygen, thereby extending shelf life. Furthermore, intricate design capabilities, including custom embossing, debossing, and advanced printing technologies, allow brands to differentiate their products and convey a premium image. The demand for sustainable packaging solutions is also driving the development of recycled glass content integration and energy-efficient production methods. Applications range from the ubiquitous beverage bottles and food jars to specialized pharmaceutical vials and premium cosmetic containers, each demanding specific performance metrics and design considerations.

Key Drivers, Barriers & Challenges in Indonesia Container Glass Market

Key Drivers:

- Growing Demand for Sustainable Packaging: Increasing consumer and regulatory pressure favoring recyclable materials.

- Premiumization of Products: Brands opting for glass to convey quality, luxury, and a superior consumer experience, especially in food and beverages.

- Health and Safety Concerns: Glass's inert nature makes it ideal for preserving food and beverage integrity, free from chemical leaching.

- Expanding Middle Class and Disposable Income: Leading to increased consumption of packaged goods, particularly in premium segments.

- Government Support for Domestic Manufacturing: Policies aimed at boosting local production and reducing import reliance.

Barriers & Challenges:

- Competition from Lighter Alternatives: Plastic bottles and aluminum cans offer cost and weight advantages in certain applications.

- Energy-Intensive Production: High energy consumption during manufacturing contributes to operational costs and environmental impact concerns.

- Logistics and Handling Costs: Glass containers are heavier and more fragile, increasing transportation and handling expenses.

- Recycling Infrastructure Limitations: Inconsistent and underdeveloped recycling collection and processing systems can hinder circularity efforts.

- Price Volatility of Raw Materials: Fluctuations in the cost of raw materials like soda ash and sand can impact profitability.

Emerging Opportunities in Indonesia Container Glass Market

Emerging opportunities in the Indonesian container glass market lie in the growing demand for specialized glass packaging for niche beverage categories like craft beers, artisanal spirits, and functional beverages. The increasing adoption of e-commerce for groceries and beverages presents an opportunity for durable and attractive glass packaging that can withstand shipping. Furthermore, the rising awareness about health and wellness is driving demand for glass packaging for organic food products, premium dairy, and infant nutrition. The cosmetics sector, with brands like Judydoll making strategic entries, offers significant potential for decorative and uniquely shaped glass bottles and jars. Innovations in smart packaging, incorporating features for traceability or temperature indication, could also open new avenues.

Growth Accelerators in the Indonesia Container Glass Market Industry

Long-term growth in the Indonesian container glass market is being accelerated by significant technological breakthroughs in manufacturing efficiency, such as advancements in furnace design and automation, leading to reduced energy consumption and production costs. Strategic partnerships between glass manufacturers and major beverage and food brands are crucial for driving large-scale adoption and co-creating innovative packaging solutions. Market expansion strategies, including diversification into new end-user segments and the development of lightweight yet strong glass formulations, are also playing a pivotal role. The increasing focus on the circular economy and sustainable practices, spurred by global trends and local initiatives, acts as a powerful catalyst for sustained growth, encouraging greater investment in recycling infrastructure and the use of recycled glass content.

Key Players Shaping the Indonesia Container Glass Market Market

- Owens-Illinois Inc

- Sukijo Bottle Packaging

- Mulia Indah Packaging

- PT Indoglas Jaya

- PT Mulia Industrindo Tbk

- FrigoGlas

Notable Milestones in Indonesia Container Glass Market Sector

- October 2024: The Coca-Cola Co. reintroduced its Original Glass bottle in Indonesia, emphasizing circularity and targeting food outlets in Jakarta with a 200ml bottle priced at IDR 3,000 (USD 0.19). This move champions glass's endless recyclability and fosters a closed-loop system.

- June 2024: Judydoll, a prominent makeup brand from Shanghai, officially debuted in Indonesia at Jakarta x Beauty (JxB) 2024, showcasing over 60 SKUs and highlighting its global social media fame, marking a significant entry for a foreign cosmetics brand into the Indonesian market.

In-Depth Indonesia Container Glass Market Market Outlook

The future outlook for the Indonesian container glass market is exceptionally bright, driven by a confluence of sustained consumer demand and evolving industry trends. Growth accelerators, including advancements in sustainable manufacturing and the increasing preference for premium, recyclable packaging, will continue to shape market dynamics. Strategic collaborations between manufacturers and end-users, coupled with an ongoing focus on product innovation that balances cost-effectiveness with superior aesthetics and functionality, will fuel expansion. The market's potential is further amplified by government support for domestic industries and a growing global emphasis on circular economy principles, positioning Indonesia as a key player in the regional container glass landscape.

Indonesia Container Glass Market Segmentation

-

1. End-user Industry

-

1.1. Beverage

-

1.1.1. Alcoholic Beverages

- 1.1.1.1. Wines and Spirits

- 1.1.1.2. Beer and Cider

- 1.1.1.3. Other Alcoholic Beverages

-

1.1.2. Non-Alcoholic Beverages

- 1.1.2.1. Carbonated Drinks

- 1.1.2.2. Juices

- 1.1.2.3. Water

- 1.1.2.4. Dairy-Based

- 1.1.2.5. Flavored Drinks

- 1.1.2.6. Other Non-Alcoholic Beverages

-

1.1.1. Alcoholic Beverages

- 1.2. Food

- 1.3. Cosmetics

- 1.4. Pharmaceuticals

- 1.5. Other End user verticals

-

1.1. Beverage

Indonesia Container Glass Market Segmentation By Geography

- 1. Indonesia

Indonesia Container Glass Market Regional Market Share

Geographic Coverage of Indonesia Container Glass Market

Indonesia Container Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Change in Consumer Preferences and Demand for Eco-friendly Packaging; Surging Demand for Glass in Beverage and Pharmaceutical Sectors

- 3.3. Market Restrains

- 3.3.1. Change in Consumer Preferences and Demand for Eco-friendly Packaging; Surging Demand for Glass in Beverage and Pharmaceutical Sectors

- 3.4. Market Trends

- 3.4.1. Cosmetics Industry to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Container Glass Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Beverage

- 5.1.1.1. Alcoholic Beverages

- 5.1.1.1.1. Wines and Spirits

- 5.1.1.1.2. Beer and Cider

- 5.1.1.1.3. Other Alcoholic Beverages

- 5.1.1.2. Non-Alcoholic Beverages

- 5.1.1.2.1. Carbonated Drinks

- 5.1.1.2.2. Juices

- 5.1.1.2.3. Water

- 5.1.1.2.4. Dairy-Based

- 5.1.1.2.5. Flavored Drinks

- 5.1.1.2.6. Other Non-Alcoholic Beverages

- 5.1.1.1. Alcoholic Beverages

- 5.1.2. Food

- 5.1.3. Cosmetics

- 5.1.4. Pharmaceuticals

- 5.1.5. Other End user verticals

- 5.1.1. Beverage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Owens-Illnois Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sukijo Bottle Packaging

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mulia Indah Packaging

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Indoglas Jaya

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Mulia Industrindo Tbk

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FrigoGlas

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Owens-Illnois Inc

List of Figures

- Figure 1: Indonesia Container Glass Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Indonesia Container Glass Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Container Glass Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 2: Indonesia Container Glass Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Indonesia Container Glass Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Indonesia Container Glass Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Container Glass Market?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Indonesia Container Glass Market?

Key companies in the market include Owens-Illnois Inc, Sukijo Bottle Packaging, Mulia Indah Packaging, PT Indoglas Jaya, PT Mulia Industrindo Tbk, FrigoGlas.

3. What are the main segments of the Indonesia Container Glass Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Change in Consumer Preferences and Demand for Eco-friendly Packaging; Surging Demand for Glass in Beverage and Pharmaceutical Sectors.

6. What are the notable trends driving market growth?

Cosmetics Industry to Witness Growth.

7. Are there any restraints impacting market growth?

Change in Consumer Preferences and Demand for Eco-friendly Packaging; Surging Demand for Glass in Beverage and Pharmaceutical Sectors.

8. Can you provide examples of recent developments in the market?

October 2024: According to data published by Minime Insights to enhance circularity, the Coca-Cola Co has reintroduced its Original Glass bottle in Indonesia. Glass packaging champions circularity, allowing glass to be recycled endlessly without compromising quality, thus fostering a closed-loop system. They are primarily targeting food outlets in Jakarta, the beverage giant is offering drinks in a 200ml glass bottle priced at IDR 3,000 (USD 0.19).June 2024: Judydoll, a prominent makeup brand from Shanghai, officially debuted in Indonesia during the Jakarta x Beauty (JxB) 2024 event. The brand showcased over 60 SKUs across various makeup categories, featuring its trending products like Iron Mascara and an extensive range of over 20 blush shades. Judydoll's offerings have catapulted it to global fame, especially on social media platforms. Judydoll stands out as one of the pioneering brands to launch in Indonesia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Container Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Container Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Container Glass Market?

To stay informed about further developments, trends, and reports in the Indonesia Container Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence