Key Insights

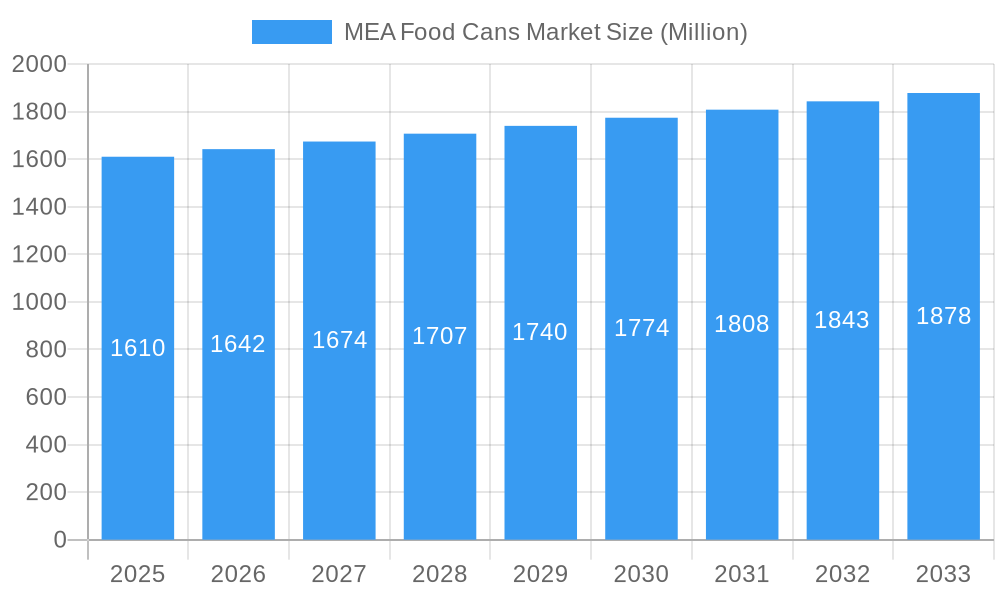

The Middle East and Africa (MEA) food cans market is poised for steady growth, projected to reach a valuation of $1.61 billion by 2025. This growth will be fueled by an anticipated Compound Annual Growth Rate (CAGR) of 1.99% over the forecast period of 2025-2033. This sustained expansion is primarily driven by the increasing demand for convenient and long-shelf-life food products across the region. Growing urbanization, coupled with evolving consumer lifestyles and a rising disposable income in key markets, are significantly contributing to the adoption of processed and ready-to-eat meals, thereby boosting the demand for reliable and safe food packaging solutions like metal cans. Furthermore, the robust food processing industry in countries like Turkey, the UAE, and South Africa, supported by government initiatives promoting food security and domestic production, acts as a significant catalyst for market expansion. Innovations in can manufacturing, focusing on enhanced durability, sustainability, and appealing designs, will also play a crucial role in shaping market dynamics.

MEA Food Cans Market Market Size (In Billion)

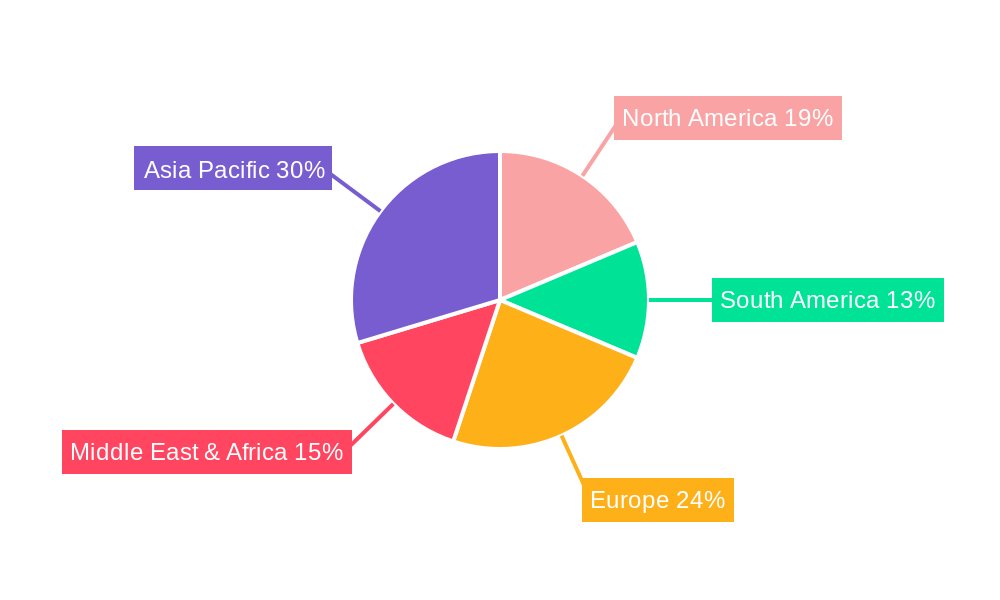

While the market presents a positive outlook, certain factors could influence its trajectory. Increasing consumer preference for alternative packaging materials, such as flexible pouches and glass, poses a potential restraint. However, the inherent advantages of metal cans, including superior barrier properties, recyclability, and cost-effectiveness, are expected to maintain their dominance in specific food segments. The market’s segmentation reveals a diverse landscape, with Aluminium Cans and Steel Cans representing key material types. Applications such as Ready Meals, Powder Products, Fish and Seafood, Fruits and Vegetables, Processed Food, and Pet Food are the primary consumers of these cans. Geographically, Asia Pacific, with its large and growing population, is expected to lead the market, followed by significant contributions from Europe and the Middle East & Africa. Key players like Ball Corporation and Crown Holdings Inc. are actively investing in expanding their manufacturing capacities and product portfolios to cater to the burgeoning demand across these diverse regions.

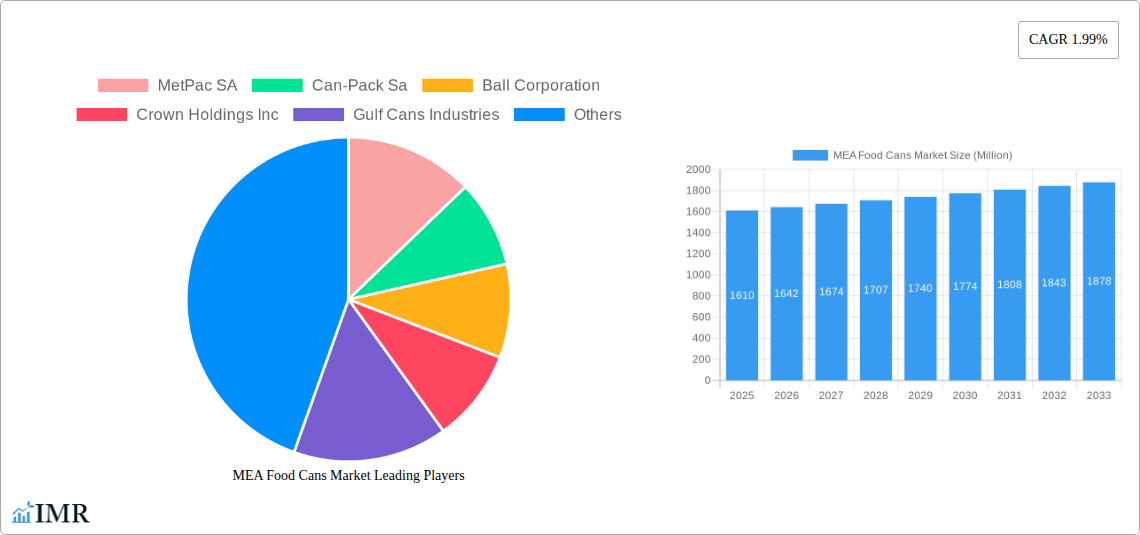

MEA Food Cans Market Company Market Share

This in-depth report provides an exhaustive analysis of the Middle East & Africa (MEA) Food Cans Market, offering critical insights into market dynamics, growth trends, regional dominance, and competitive landscapes. With a study period spanning from 2019 to 2033, the report details historical performance, base year valuations, and future projections, ensuring a robust understanding of this vital sector. Utilizing high-traffic keywords such as "food cans MEA," "aluminum food cans," "steel food cans," "ready meals packaging," "processed food packaging," and "pet food cans," this report is meticulously crafted for optimal SEO visibility and engagement with industry professionals, manufacturers, suppliers, and investors.

The MEA Food Cans Market is experiencing dynamic shifts driven by evolving consumer preferences, advancements in packaging technology, and growing demand for convenient food solutions. This report delves into the intricate structure of both parent and child markets, offering a granular view of market segmentation by material type (Aluminum Cans, Steel Cans) and application (Ready Meals, Powder Products, Fish and Seafood, Fruits and Vegetables, Processed Food, Pet Food, Other Applications). Quantitative data, presented in Million units, and qualitative insights are strategically integrated to provide a comprehensive market overview.

**The report encompasses: **

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

MEA Food Cans Market Market Dynamics & Structure

The MEA Food Cans Market exhibits a moderate to high concentration, with key players like Ball Corporation and Crown Holdings Inc. holding significant market shares. Technological innovation remains a primary driver, focusing on enhanced barrier properties, lightweighting for aluminum cans, and improved recyclability. Regulatory frameworks, particularly concerning food safety and environmental sustainability, are increasingly influencing manufacturing processes and material choices. Competitive product substitutes, such as flexible packaging and glass containers, pose challenges, but the superior shelf-life and durability of metal cans maintain their dominance for various food applications. End-user demographics are shifting towards a younger, urbanized population with a greater demand for convenient, ready-to-eat meals and processed food products. Mergers and acquisitions (M&A) trends are also shaping the landscape, with companies seeking to expand their geographical reach and product portfolios. For instance, the volume of M&A deals in the packaging sector is projected to increase by approximately 15% over the forecast period, driven by the pursuit of economies of scale and market consolidation. Barriers to innovation include the high capital investment required for advanced manufacturing technologies and the need for extensive research and development to meet diverse food preservation requirements.

MEA Food Cans Market Growth Trends & Insights

The MEA Food Cans Market is projected to witness robust growth, fueled by a confluence of economic development, increasing disposable incomes, and a growing consumer preference for processed and convenience foods across the region. The market size is estimated to expand from XX Million units in 2019 to reach over XXX Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 5.2% during the forecast period. Adoption rates for food cans are on an upward trajectory, particularly for ready meals and pet food applications, driven by their extended shelf life and protection against spoilage. Technological disruptions, such as the development of advanced coating technologies for enhanced food compatibility and the introduction of thinner, yet stronger, metal alloys, are further optimizing the performance and sustainability of food cans. Consumer behavior shifts towards urbanization and busier lifestyles are creating a sustained demand for convenient and portable food packaging solutions, directly benefiting the food can sector. Market penetration for canned fruits and vegetables is also anticipated to rise, as consumers seek healthier, readily available options.

Dominant Regions, Countries, or Segments in MEA Food Cans Market

Within the MEA region, the Processed Food segment, particularly within Steel Cans, is a dominant force driving market growth. This dominance is attributed to the widespread consumption of staple processed goods such as canned tomatoes, sauces, and dairy products, which benefit from the robust protection and extended shelf-life offered by steel cans. Countries like Egypt, Saudi Arabia, and South Africa are leading this segment due to their significant food processing industries and large consumer bases.

- Key Drivers for Processed Food Dominance:

- Large Population & Growing Urbanization: Increasing urban populations in countries like Nigeria, Egypt, and the UAE drive demand for conveniently packaged, long-shelf-life processed foods.

- Economic Development & Disposable Income: Rising disposable incomes allow consumers to purchase more processed and packaged food items.

- Established Food Processing Infrastructure: Nations with well-developed food processing capabilities are major consumers of food cans for their products.

- Preference for Shelf-Stable Products: In regions with varying climate conditions and supply chain challenges, shelf-stable canned foods offer reliability.

- Government Initiatives: Support for local food production and processing industries indirectly boosts the demand for food cans.

The Fruits and Vegetables application segment, increasingly utilizing Aluminum Cans for premium offerings, is also experiencing significant growth. This trend is propelled by a growing health consciousness among consumers and the demand for easily accessible, nutritious food options. Market share within this segment is steadily increasing, projected to capture approximately 22% of the total market by 2033. The growth potential for fruits and vegetables in cans remains high, supported by agricultural advancements and evolving consumer dietary habits across the MEA.

MEA Food Cans Market Product Landscape

The MEA Food Cans Market product landscape is characterized by continuous innovation focused on enhancing functionality, sustainability, and consumer appeal. Advancements in aluminum can technology are leading to lighter-weight, yet equally durable, containers, reducing transportation costs and environmental impact. Steel cans continue to be a staple, with ongoing improvements in coating technologies that enhance corrosion resistance and ensure product integrity for a wider range of acidic and sensitive food products. Unique selling propositions revolve around superior barrier properties, extended shelf-life, and high recyclability. Technological advancements are also enabling more sophisticated printing and labeling options, allowing for better brand differentiation and consumer engagement on the shelf.

Key Drivers, Barriers & Challenges in MEA Food Cans Market

Key Drivers:

- Rising Demand for Convenience Foods: Urbanization and evolving lifestyles fuel the need for ready-to-eat and easy-to-prepare food options.

- Growing Food Processing Industry: Expansion of food processing capabilities across the MEA region directly increases the demand for food cans.

- Shelf-Life Extension and Food Safety: Cans provide unparalleled protection against spoilage and contamination, crucial in diverse climatic conditions.

- Technological Advancements: Innovations in material science and manufacturing lead to more efficient, sustainable, and cost-effective can production.

- Government Support for Food Security: Initiatives to boost local food production and reduce reliance on imports drive domestic packaging needs.

Barriers & Challenges:

- Fluctuating Raw Material Prices: Volatility in aluminum and steel prices can impact manufacturing costs and profitability, with price increases of up to 10% observed historically affecting margins.

- Competition from Alternative Packaging: Flexible packaging, glass, and cartons present significant competition, especially for certain product categories.

- Recycling Infrastructure Limitations: In some parts of the MEA, underdeveloped recycling infrastructure can hinder the widespread adoption of highly recyclable materials.

- High Initial Capital Investment: Establishing modern food can manufacturing facilities requires substantial upfront investment, acting as a barrier for new entrants.

- Logistical Challenges: Supply chain complexities and infrastructure gaps in certain regions can impact timely delivery and operational efficiency.

Emerging Opportunities in MEA Food Cans Market

Emerging opportunities in the MEA Food Cans Market lie in catering to niche and growing consumer segments. The burgeoning pet food industry presents a significant untapped market, with increasing pet ownership driving demand for specialized canned pet food. Furthermore, the demand for exotic and specialty fruits and vegetables in cans, catering to diverse culinary preferences, is an avenue for growth. Innovations in smart packaging, incorporating features like QR codes for traceability and enhanced consumer information, also represent a forward-looking opportunity. The increasing focus on sustainable packaging solutions opens doors for manufacturers investing in high-recycled-content aluminum and tinplate cans.

Growth Accelerators in the MEA Food Cans Market Industry

Several catalysts are accelerating the long-term growth of the MEA Food Cans Market. Technological breakthroughs in metal forming and coating are leading to the production of lighter, stronger, and more versatile cans. Strategic partnerships between can manufacturers and food producers are crucial for developing customized packaging solutions that meet specific product needs and market demands. Market expansion strategies, including investing in emerging economies within the MEA and developing localized production facilities, are further fueling growth. The increasing adoption of circular economy principles, emphasizing recyclability and waste reduction, will also act as a significant growth driver as regulations and consumer awareness evolve.

Key Players Shaping the MEA Food Cans Market Market

- MetPac SA

- Can-Pack Sa

- Ball Corporation

- Crown Holdings Inc

- Gulf Cans Industries

- Sapin UAE

- Arabian Can Industry

- Middle East Metal Can LLC (Trinity Holdings)

- Emirates Metallic Industries Company Limited (EMIC)

- Amopack Can Manufacturers

Notable Milestones in MEA Food Cans Market Sector

- June 2023: Ball Corporation showcased its latest aluminum can and bottle portfolio at the BevNET Live Summer 2023, highlighting their "slim" can capabilities and new supply locations for various can sizes (5.5oz, 6.8oz, 8.4oz, and 250mL).

- July 2022: A West African ready meals brand, Oyetty Meals, was launched by Samis Online. This launch, focusing on organic ingredients and authentic African flavors for the UK market, exemplifies the growing demand for ready-meal food launches that directly drive the market for food cans.

In-Depth MEA Food Cans Market Market Outlook

The future outlook for the MEA Food Cans Market is exceptionally promising, with sustained growth anticipated. Key growth accelerators include the escalating demand for convenience and processed foods, driven by rapid urbanization and evolving consumer lifestyles. Strategic investments in advanced manufacturing technologies and the continuous pursuit of sustainable packaging solutions will further bolster market expansion. The increasing focus on the circular economy, coupled with supportive government policies aimed at enhancing food security and local manufacturing, will create a favorable environment for can manufacturers. Emerging opportunities in sectors like pet food and specialty food packaging, alongside geographical market expansion, will contribute significantly to the market's robust trajectory over the forecast period.

MEA Food Cans Market Segmentation

-

1. Material Type

- 1.1. Aluminium Cans

- 1.2. Steel Cans

-

2. Application

- 2.1. Ready Meals

- 2.2. Powder Products

- 2.3. Fish and Seafood

- 2.4. Fruits and Vegetables

- 2.5. Processed Food

- 2.6. Pet Food

- 2.7. Other Applications

MEA Food Cans Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

MEA Food Cans Market Regional Market Share

Geographic Coverage of MEA Food Cans Market

MEA Food Cans Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Disposable Income and Urbanization; Growth in E-commerce Industry is Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lower Costs of Substitute Products Might Affect the Market

- 3.4. Market Trends

- 3.4.1. Aluminum Cans Expected to Gain Largest Market in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Food Cans Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Aluminium Cans

- 5.1.2. Steel Cans

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Ready Meals

- 5.2.2. Powder Products

- 5.2.3. Fish and Seafood

- 5.2.4. Fruits and Vegetables

- 5.2.5. Processed Food

- 5.2.6. Pet Food

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America MEA Food Cans Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Aluminium Cans

- 6.1.2. Steel Cans

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Ready Meals

- 6.2.2. Powder Products

- 6.2.3. Fish and Seafood

- 6.2.4. Fruits and Vegetables

- 6.2.5. Processed Food

- 6.2.6. Pet Food

- 6.2.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. South America MEA Food Cans Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Aluminium Cans

- 7.1.2. Steel Cans

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Ready Meals

- 7.2.2. Powder Products

- 7.2.3. Fish and Seafood

- 7.2.4. Fruits and Vegetables

- 7.2.5. Processed Food

- 7.2.6. Pet Food

- 7.2.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Europe MEA Food Cans Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Aluminium Cans

- 8.1.2. Steel Cans

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Ready Meals

- 8.2.2. Powder Products

- 8.2.3. Fish and Seafood

- 8.2.4. Fruits and Vegetables

- 8.2.5. Processed Food

- 8.2.6. Pet Food

- 8.2.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Middle East & Africa MEA Food Cans Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Aluminium Cans

- 9.1.2. Steel Cans

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Ready Meals

- 9.2.2. Powder Products

- 9.2.3. Fish and Seafood

- 9.2.4. Fruits and Vegetables

- 9.2.5. Processed Food

- 9.2.6. Pet Food

- 9.2.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Asia Pacific MEA Food Cans Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Aluminium Cans

- 10.1.2. Steel Cans

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Ready Meals

- 10.2.2. Powder Products

- 10.2.3. Fish and Seafood

- 10.2.4. Fruits and Vegetables

- 10.2.5. Processed Food

- 10.2.6. Pet Food

- 10.2.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 MetPac SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Can-Pack Sa

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ball Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Crown Holdings Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gulf Cans Industries

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sapin UAE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Arabian Can Industr

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Middle East Metal Can LLC (Trinity Holdings)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Emirates Metallic Industries Company Limited (EMIC)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Amopack Can Manufacturers

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 MetPac SA

List of Figures

- Figure 1: Global MEA Food Cans Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America MEA Food Cans Market Revenue (Million), by Material Type 2025 & 2033

- Figure 3: North America MEA Food Cans Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America MEA Food Cans Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America MEA Food Cans Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America MEA Food Cans Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America MEA Food Cans Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America MEA Food Cans Market Revenue (Million), by Material Type 2025 & 2033

- Figure 9: South America MEA Food Cans Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 10: South America MEA Food Cans Market Revenue (Million), by Application 2025 & 2033

- Figure 11: South America MEA Food Cans Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: South America MEA Food Cans Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America MEA Food Cans Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe MEA Food Cans Market Revenue (Million), by Material Type 2025 & 2033

- Figure 15: Europe MEA Food Cans Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 16: Europe MEA Food Cans Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe MEA Food Cans Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe MEA Food Cans Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe MEA Food Cans Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa MEA Food Cans Market Revenue (Million), by Material Type 2025 & 2033

- Figure 21: Middle East & Africa MEA Food Cans Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Middle East & Africa MEA Food Cans Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Middle East & Africa MEA Food Cans Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East & Africa MEA Food Cans Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa MEA Food Cans Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific MEA Food Cans Market Revenue (Million), by Material Type 2025 & 2033

- Figure 27: Asia Pacific MEA Food Cans Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Asia Pacific MEA Food Cans Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Asia Pacific MEA Food Cans Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific MEA Food Cans Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific MEA Food Cans Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Food Cans Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Global MEA Food Cans Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global MEA Food Cans Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global MEA Food Cans Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: Global MEA Food Cans Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global MEA Food Cans Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global MEA Food Cans Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 11: Global MEA Food Cans Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global MEA Food Cans Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global MEA Food Cans Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 17: Global MEA Food Cans Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global MEA Food Cans Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global MEA Food Cans Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 29: Global MEA Food Cans Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global MEA Food Cans Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global MEA Food Cans Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 38: Global MEA Food Cans Market Revenue Million Forecast, by Application 2020 & 2033

- Table 39: Global MEA Food Cans Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific MEA Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Food Cans Market?

The projected CAGR is approximately 1.99%.

2. Which companies are prominent players in the MEA Food Cans Market?

Key companies in the market include MetPac SA, Can-Pack Sa, Ball Corporation, Crown Holdings Inc, Gulf Cans Industries, Sapin UAE, Arabian Can Industr, Middle East Metal Can LLC (Trinity Holdings), Emirates Metallic Industries Company Limited (EMIC), Amopack Can Manufacturers.

3. What are the main segments of the MEA Food Cans Market?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.61 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Disposable Income and Urbanization; Growth in E-commerce Industry is Expected to Drive the Market.

6. What are the notable trends driving market growth?

Aluminum Cans Expected to Gain Largest Market in the Region.

7. Are there any restraints impacting market growth?

Lower Costs of Substitute Products Might Affect the Market.

8. Can you provide examples of recent developments in the market?

June 2023 - Ball Corporation showcased its latest aluminum can and bottle portfolio at the BevNET Live Summer 2023. Attendees for BevNET Live will learn about Ball's range of "slim" can capabilities, including new supply locations for the 5.5oz, 6.8oz, 8.4oz, and 250mL can sizes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Food Cans Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Food Cans Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Food Cans Market?

To stay informed about further developments, trends, and reports in the MEA Food Cans Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence