Key Insights

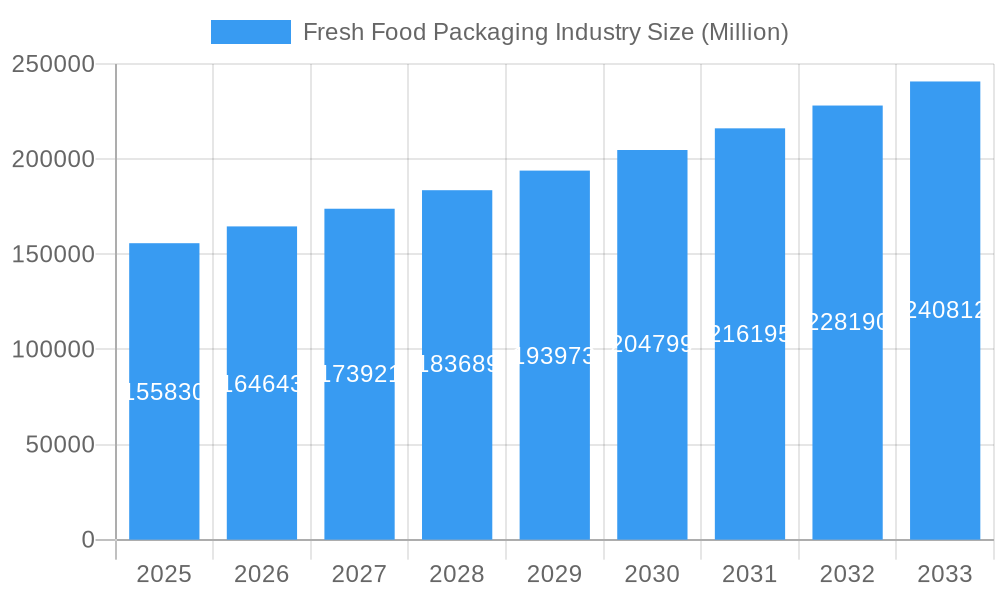

The global fresh food packaging market is poised for robust expansion, projected to reach USD 155.83 billion in 2025 and grow at a Compound Annual Growth Rate (CAGR) of 5.6% through 2033. This significant market growth is propelled by a confluence of factors, primarily driven by the escalating global demand for fresh and minimally processed food products. Consumers are increasingly prioritizing health and convenience, leading to a higher consumption of fresh fruits, vegetables, meats, and dairy, all of which necessitate specialized packaging solutions. Furthermore, advancements in packaging materials and technologies are enhancing food preservation, extending shelf life, and reducing spoilage, thereby directly contributing to market expansion. The rising disposable incomes in emerging economies also play a crucial role, enabling consumers to purchase a wider variety of fresh food items.

Fresh Food Packaging Industry Market Size (In Billion)

Key trends shaping the fresh food packaging landscape include a strong emphasis on sustainable and eco-friendly packaging solutions, driven by environmental concerns and regulatory pressures. This translates to a growing preference for recyclable, biodegradable, and compostable materials such as paper and paperboard, and an increasing adoption of mono-material packaging designs. Innovations in active and intelligent packaging, which aim to further preserve food quality and provide consumers with enhanced information, are also gaining traction. While the market benefits from these drivers and trends, potential restraints such as the fluctuating raw material costs, stringent food safety regulations, and the capital-intensive nature of advanced packaging technologies could pose challenges. However, the overarching demand for safe, fresh, and conveniently packaged food products, coupled with continuous innovation, ensures a dynamic and growing market.

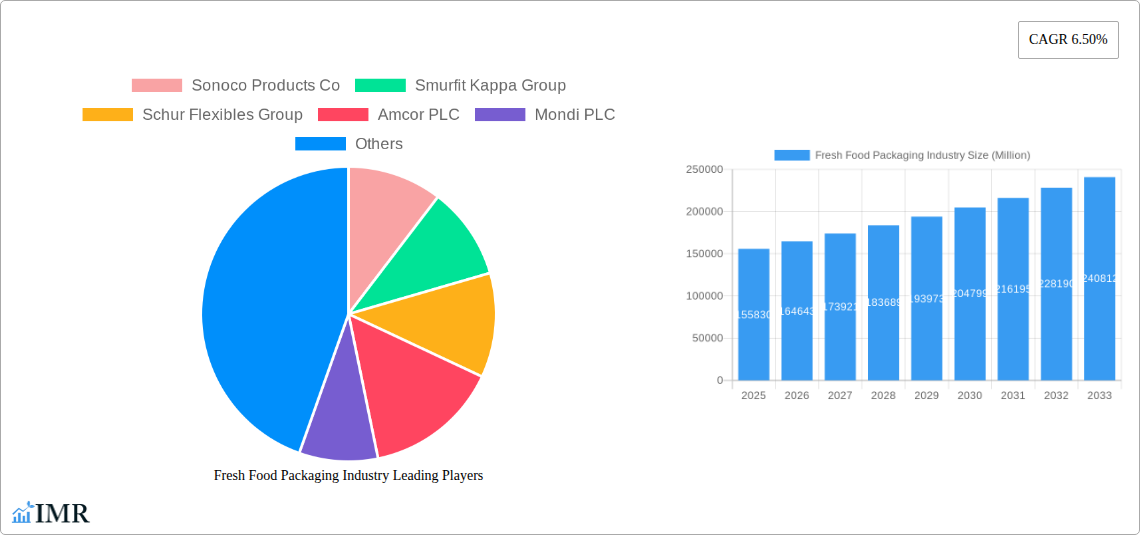

Fresh Food Packaging Industry Company Market Share

This in-depth report provides a critical analysis of the global Fresh Food Packaging Industry, offering detailed insights into market dynamics, growth trajectories, regional dominance, product landscape, key players, and emerging opportunities. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this research is designed to equip industry professionals, investors, and stakeholders with actionable intelligence to navigate this dynamic and expanding market. The report meticulously examines various segments, including Type of Material (Plastic, Metal, Glass, Paper and Paperboard), Packaging Type (Cans, Converted Roll Stock, Gusseted Box, Corrugated Box, Boxboard, Other Packaging Types), and Application (Poultry and Meat Products, Dairy Products, Vegetables and Fruits, Sea Food, Other Applications). We delve into the parent and child market structures to provide a holistic view of the industry's value chain and growth drivers.

Fresh Food Packaging Industry Market Dynamics & Structure

The Fresh Food Packaging Industry is characterized by a moderately concentrated market, with a few dominant players holding significant market share, alongside a robust presence of regional and specialized manufacturers. Technological innovation is a primary driver, fueled by the increasing demand for extended shelf life, enhanced product visibility, and sustainable packaging solutions. Regulatory frameworks, focusing on food safety, hygiene standards, and environmental impact, significantly shape market strategies and product development. Competitive product substitutes, such as alternative materials and packaging formats, continually challenge existing market positions, pushing for greater efficiency and consumer appeal. End-user demographics play a crucial role, with a growing emphasis on convenience, health consciousness, and eco-friendly options influencing packaging design and material choices. Mergers and acquisitions (M&A) are prevalent, as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, the historical period saw an estimated volume of xx billion units in M&A deals, indicating a strong consolidation trend.

- Market Concentration: Dominated by key global players alongside a fragmented landscape of smaller, specialized companies.

- Technological Innovation Drivers: Focus on barrier properties, active and intelligent packaging, lightweighting, and advanced printing technologies.

- Regulatory Frameworks: Strict adherence to FDA, EFSA, and local food safety regulations, as well as evolving sustainability mandates.

- Competitive Product Substitutes: Innovations in bioplastics, compostable materials, and reusable packaging solutions.

- End-User Demographics: Growing demand from urbanized populations, health-conscious consumers, and e-commerce channels.

- M&A Trends: Strategic acquisitions to gain market share, access new technologies, and expand product offerings.

Fresh Food Packaging Industry Growth Trends & Insights

The global Fresh Food Packaging Industry is poised for substantial expansion, driven by an escalating global population, increasing disposable incomes, and a growing consumer preference for convenient and safely packaged food products. The market size evolution is particularly noteworthy, with projections indicating a significant upward trend in volume and value throughout the forecast period. By 2025, the market is estimated to reach approximately $xxx billion, with a projected Compound Annual Growth Rate (CAGR) of x.x% from 2025 to 2033. Adoption rates for innovative packaging solutions, such as those offering enhanced shelf-life extension and improved food safety, are steadily increasing. Technological disruptions, including advancements in material science, automation in packaging lines, and the integration of smart technologies for traceability and spoilage detection, are reshaping the industry landscape. Consumer behavior shifts, such as a heightened awareness of health and wellness, a demand for transparency in food sourcing, and a growing concern for environmental sustainability, are profoundly influencing packaging choices. The surge in online grocery shopping also necessitates robust and protective packaging to ensure product integrity during transit. The parent market, encompassing all food packaging, sees the fresh food segment contributing significantly to overall growth, with its specific demands for preservation and presentation driving specialized innovations.

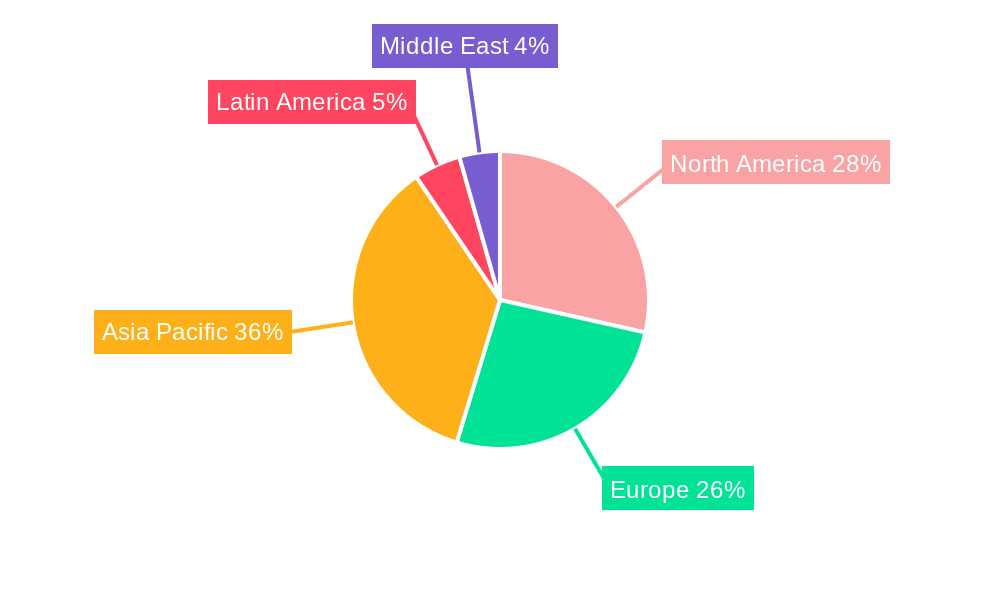

Dominant Regions, Countries, or Segments in Fresh Food Packaging Industry

North America and Europe currently represent the dominant regions in the Fresh Food Packaging Industry, owing to mature economies, high consumer spending on fresh produce, and stringent food safety regulations that drive demand for advanced packaging solutions. Within these regions, the Paper and Paperboard segment, particularly for Corrugated Boxes and Boxboard used in the packaging of fruits, vegetables, and dairy products, is experiencing robust growth. This is driven by a strong consumer preference for sustainable and recyclable materials. In terms of applications, Poultry and Meat Products and Dairy Products continue to be major revenue generators, necessitating specialized packaging that ensures hygiene, extends shelf life, and prevents contamination.

Dominant Region: North America.

- Key Drivers: High disposable incomes, well-established retail infrastructure, stringent food safety regulations, and strong consumer demand for convenience.

- Market Share: Estimated to hold approximately xx% of the global market share.

- Growth Potential: Steady growth driven by innovation in sustainable packaging and demand for premium, safely packaged products.

Dominant Segment (Type of Material): Paper and Paperboard.

- Key Drivers: Growing environmental consciousness, government initiatives promoting sustainable packaging, and the versatility of paper-based solutions for various fresh food types.

- Market Share: Significant contribution to the overall market, especially in packaging for produce and dry goods.

- Growth Potential: High, as consumers and manufacturers increasingly seek alternatives to single-use plastics.

Dominant Segment (Packaging Type): Corrugated Box and Boxboard.

- Key Drivers: Cost-effectiveness, recyclability, and suitability for bulk transportation and retail display of fresh produce and other perishable items.

- Market Share: Dominant in the logistics and secondary packaging of fresh foods.

- Growth Potential: Steady growth aligned with the expansion of the e-commerce food delivery sector.

Fresh Food Packaging Industry Product Landscape

The Fresh Food Packaging Industry is witnessing a surge in innovative product developments focused on extending shelf life, enhancing food safety, and improving consumer appeal. This includes the development of active packaging with oxygen scavengers or ethylene absorbers, intelligent packaging with time-temperature indicators, and antimicrobial coatings. Lightweighting of materials, such as thinner plastic films and more efficient paperboard structures, is also a key trend, contributing to cost savings and reduced environmental impact. The performance metrics are increasingly scrutinized, with a focus on barrier properties against moisture and oxygen, puncture resistance, and recyclability. Unique selling propositions often revolve around the ability to preserve freshness for longer periods, reduce food waste, and provide clear product visibility.

Key Drivers, Barriers & Challenges in Fresh Food Packaging Industry

Key Drivers:

- Growing Global Population and Urbanization: Increased demand for conveniently packaged and preserved food.

- Rising Disposable Incomes: Consumers are willing to pay for higher quality, safer, and more appealing packaged food.

- Focus on Food Safety and Shelf-Life Extension: Driving adoption of advanced packaging technologies.

- Sustainability Initiatives: Consumer and regulatory pressure for eco-friendly packaging solutions.

- E-commerce Growth: Increased need for protective and efficient packaging for food delivery.

Barriers & Challenges:

- Volatile Raw Material Prices: Fluctuations in the cost of plastics, paper, and other packaging materials.

- Stringent Regulatory Compliance: Navigating diverse and evolving food safety and environmental regulations globally.

- Supply Chain Disruptions: Geopolitical factors, transportation issues, and natural disasters impacting material availability and delivery.

- Consumer Resistance to Certain Materials: Concerns about the environmental impact of plastics, even with advancements in recyclability.

- High Investment Costs for New Technologies: Implementing advanced packaging solutions requires significant capital expenditure.

Emerging Opportunities in Fresh Food Packaging Industry

Emerging opportunities in the Fresh Food Packaging Industry lie in the development of fully compostable and biodegradable packaging solutions derived from renewable resources. The expansion of the plant-based food market presents a unique opportunity for specialized packaging that caters to the specific preservation needs of these products. The integration of smart technologies, such as QR codes and NFC tags for enhanced traceability and consumer engagement, is another rapidly growing area. Untapped markets in developing economies, with their burgeoning middle classes and increasing urbanization, offer significant growth potential for packaged fresh foods. Innovative applications in personalized and on-demand food packaging also present promising avenues.

Growth Accelerators in the Fresh Food Packaging Industry Industry

Technological breakthroughs in sustainable material science, including the development of advanced bioplastics and recyclable composites, are key growth accelerators. Strategic partnerships between packaging manufacturers, food producers, and technology providers are fostering innovation and market penetration. Market expansion strategies, particularly in emerging economies, are unlocking new consumer bases and driving demand. The increasing adoption of circular economy principles within the packaging sector, focusing on reusability and advanced recycling technologies, is also poised to accelerate sustainable growth.

Key Players Shaping the Fresh Food Packaging Industry Market

- Sonoco Products Co

- Smurfit Kappa Group

- Schur Flexibles Group

- Amcor PLC

- Mondi PLC

- ITC Limited

- International Paper Company

- Anchor Packaging Inc

- E I du Pont de Nemours and Company

Notable Milestones in Fresh Food Packaging Industry Sector

- 2021/Q3: Amcor PLC launches a new line of recyclable flexible packaging solutions for fresh produce, enhancing sustainability credentials.

- 2022/Q1: Mondi PLC acquires a flexible packaging producer in Eastern Europe, expanding its market reach and product offerings.

- 2022/Q4: Schur Flexibles Group introduces innovative active packaging films that significantly extend the shelf life of dairy products.

- 2023/Q2: Sonoco Products Co announces significant investment in new recycling technologies for flexible packaging materials.

- 2023/Q3: Smurfit Kappa Group develops advanced corrugated packaging solutions for the booming e-commerce grocery sector, focusing on durability and insulation.

In-Depth Fresh Food Packaging Industry Market Outlook

The Fresh Food Packaging Industry is set for a period of sustained and robust growth, driven by a confluence of evolving consumer preferences, technological advancements, and increasing global demand for safe and sustainable food options. The forecast period is expected to witness a significant shift towards environmentally friendly packaging materials, with a strong emphasis on recyclability and biodegradability. Innovations in active and intelligent packaging will play a crucial role in reducing food waste and enhancing consumer trust. Strategic collaborations and continuous investment in research and development will be vital for market players to maintain a competitive edge and capitalize on emerging opportunities, particularly in the rapidly expanding fresh food e-commerce sector.

Fresh Food Packaging Industry Segmentation

-

1. Type of Material

- 1.1. Plastic

- 1.2. Metal

- 1.3. Glass

- 1.4. Paper and Paperboard

-

2. Packaging Type

- 2.1. Cans

- 2.2. Converted Roll Stock

- 2.3. Gusseted Box

- 2.4. Corrugated Box

- 2.5. Boxboard

- 2.6. Other Packaging Types

-

3. Application

- 3.1. Poultry and Meat Products

- 3.2. Dairy Products

- 3.3. Vegetables and Fruits

- 3.4. Sea Food

- 3.5. Other Applications

Fresh Food Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Fresh Food Packaging Industry Regional Market Share

Geographic Coverage of Fresh Food Packaging Industry

Fresh Food Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Extended Shelf Life of the Products; Increasing Demand for Convenience Food

- 3.3. Market Restrains

- 3.3.1. ; Increasing Prices of Raw Materials; Stringent Government Regulations

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Extended Shelf Life of Products is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fresh Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Material

- 5.1.1. Plastic

- 5.1.2. Metal

- 5.1.3. Glass

- 5.1.4. Paper and Paperboard

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Cans

- 5.2.2. Converted Roll Stock

- 5.2.3. Gusseted Box

- 5.2.4. Corrugated Box

- 5.2.5. Boxboard

- 5.2.6. Other Packaging Types

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Poultry and Meat Products

- 5.3.2. Dairy Products

- 5.3.3. Vegetables and Fruits

- 5.3.4. Sea Food

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type of Material

- 6. North America Fresh Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Material

- 6.1.1. Plastic

- 6.1.2. Metal

- 6.1.3. Glass

- 6.1.4. Paper and Paperboard

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Cans

- 6.2.2. Converted Roll Stock

- 6.2.3. Gusseted Box

- 6.2.4. Corrugated Box

- 6.2.5. Boxboard

- 6.2.6. Other Packaging Types

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Poultry and Meat Products

- 6.3.2. Dairy Products

- 6.3.3. Vegetables and Fruits

- 6.3.4. Sea Food

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type of Material

- 7. Europe Fresh Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Material

- 7.1.1. Plastic

- 7.1.2. Metal

- 7.1.3. Glass

- 7.1.4. Paper and Paperboard

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Cans

- 7.2.2. Converted Roll Stock

- 7.2.3. Gusseted Box

- 7.2.4. Corrugated Box

- 7.2.5. Boxboard

- 7.2.6. Other Packaging Types

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Poultry and Meat Products

- 7.3.2. Dairy Products

- 7.3.3. Vegetables and Fruits

- 7.3.4. Sea Food

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type of Material

- 8. Asia Pacific Fresh Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Material

- 8.1.1. Plastic

- 8.1.2. Metal

- 8.1.3. Glass

- 8.1.4. Paper and Paperboard

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Cans

- 8.2.2. Converted Roll Stock

- 8.2.3. Gusseted Box

- 8.2.4. Corrugated Box

- 8.2.5. Boxboard

- 8.2.6. Other Packaging Types

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Poultry and Meat Products

- 8.3.2. Dairy Products

- 8.3.3. Vegetables and Fruits

- 8.3.4. Sea Food

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type of Material

- 9. Latin America Fresh Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Material

- 9.1.1. Plastic

- 9.1.2. Metal

- 9.1.3. Glass

- 9.1.4. Paper and Paperboard

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Cans

- 9.2.2. Converted Roll Stock

- 9.2.3. Gusseted Box

- 9.2.4. Corrugated Box

- 9.2.5. Boxboard

- 9.2.6. Other Packaging Types

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Poultry and Meat Products

- 9.3.2. Dairy Products

- 9.3.3. Vegetables and Fruits

- 9.3.4. Sea Food

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type of Material

- 10. Middle East Fresh Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Material

- 10.1.1. Plastic

- 10.1.2. Metal

- 10.1.3. Glass

- 10.1.4. Paper and Paperboard

- 10.2. Market Analysis, Insights and Forecast - by Packaging Type

- 10.2.1. Cans

- 10.2.2. Converted Roll Stock

- 10.2.3. Gusseted Box

- 10.2.4. Corrugated Box

- 10.2.5. Boxboard

- 10.2.6. Other Packaging Types

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Poultry and Meat Products

- 10.3.2. Dairy Products

- 10.3.3. Vegetables and Fruits

- 10.3.4. Sea Food

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type of Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sonoco Products Co

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Smurfit Kappa Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Schur Flexibles Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amcor PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mondi PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ITC Limited*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 International Paper Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Anchor Packaging Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 E I du Pont de Nemours and Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Sonoco Products Co

List of Figures

- Figure 1: Global Fresh Food Packaging Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Fresh Food Packaging Industry Revenue (undefined), by Type of Material 2025 & 2033

- Figure 3: North America Fresh Food Packaging Industry Revenue Share (%), by Type of Material 2025 & 2033

- Figure 4: North America Fresh Food Packaging Industry Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 5: North America Fresh Food Packaging Industry Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 6: North America Fresh Food Packaging Industry Revenue (undefined), by Application 2025 & 2033

- Figure 7: North America Fresh Food Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Fresh Food Packaging Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Fresh Food Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Fresh Food Packaging Industry Revenue (undefined), by Type of Material 2025 & 2033

- Figure 11: Europe Fresh Food Packaging Industry Revenue Share (%), by Type of Material 2025 & 2033

- Figure 12: Europe Fresh Food Packaging Industry Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 13: Europe Fresh Food Packaging Industry Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 14: Europe Fresh Food Packaging Industry Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Fresh Food Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Fresh Food Packaging Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Fresh Food Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Fresh Food Packaging Industry Revenue (undefined), by Type of Material 2025 & 2033

- Figure 19: Asia Pacific Fresh Food Packaging Industry Revenue Share (%), by Type of Material 2025 & 2033

- Figure 20: Asia Pacific Fresh Food Packaging Industry Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 21: Asia Pacific Fresh Food Packaging Industry Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 22: Asia Pacific Fresh Food Packaging Industry Revenue (undefined), by Application 2025 & 2033

- Figure 23: Asia Pacific Fresh Food Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Fresh Food Packaging Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Fresh Food Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Fresh Food Packaging Industry Revenue (undefined), by Type of Material 2025 & 2033

- Figure 27: Latin America Fresh Food Packaging Industry Revenue Share (%), by Type of Material 2025 & 2033

- Figure 28: Latin America Fresh Food Packaging Industry Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 29: Latin America Fresh Food Packaging Industry Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 30: Latin America Fresh Food Packaging Industry Revenue (undefined), by Application 2025 & 2033

- Figure 31: Latin America Fresh Food Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Latin America Fresh Food Packaging Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Latin America Fresh Food Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Fresh Food Packaging Industry Revenue (undefined), by Type of Material 2025 & 2033

- Figure 35: Middle East Fresh Food Packaging Industry Revenue Share (%), by Type of Material 2025 & 2033

- Figure 36: Middle East Fresh Food Packaging Industry Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 37: Middle East Fresh Food Packaging Industry Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 38: Middle East Fresh Food Packaging Industry Revenue (undefined), by Application 2025 & 2033

- Figure 39: Middle East Fresh Food Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East Fresh Food Packaging Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East Fresh Food Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Type of Material 2020 & 2033

- Table 2: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 3: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Type of Material 2020 & 2033

- Table 6: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 7: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Type of Material 2020 & 2033

- Table 10: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 11: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Type of Material 2020 & 2033

- Table 14: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 15: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Type of Material 2020 & 2033

- Table 18: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 19: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Type of Material 2020 & 2033

- Table 22: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 23: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: Global Fresh Food Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fresh Food Packaging Industry?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Fresh Food Packaging Industry?

Key companies in the market include Sonoco Products Co, Smurfit Kappa Group, Schur Flexibles Group, Amcor PLC, Mondi PLC, ITC Limited*List Not Exhaustive, International Paper Company, Anchor Packaging Inc, E I du Pont de Nemours and Company.

3. What are the main segments of the Fresh Food Packaging Industry?

The market segments include Type of Material, Packaging Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Extended Shelf Life of the Products; Increasing Demand for Convenience Food.

6. What are the notable trends driving market growth?

Increasing Demand for Extended Shelf Life of Products is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; Increasing Prices of Raw Materials; Stringent Government Regulations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fresh Food Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fresh Food Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fresh Food Packaging Industry?

To stay informed about further developments, trends, and reports in the Fresh Food Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence