Key Insights

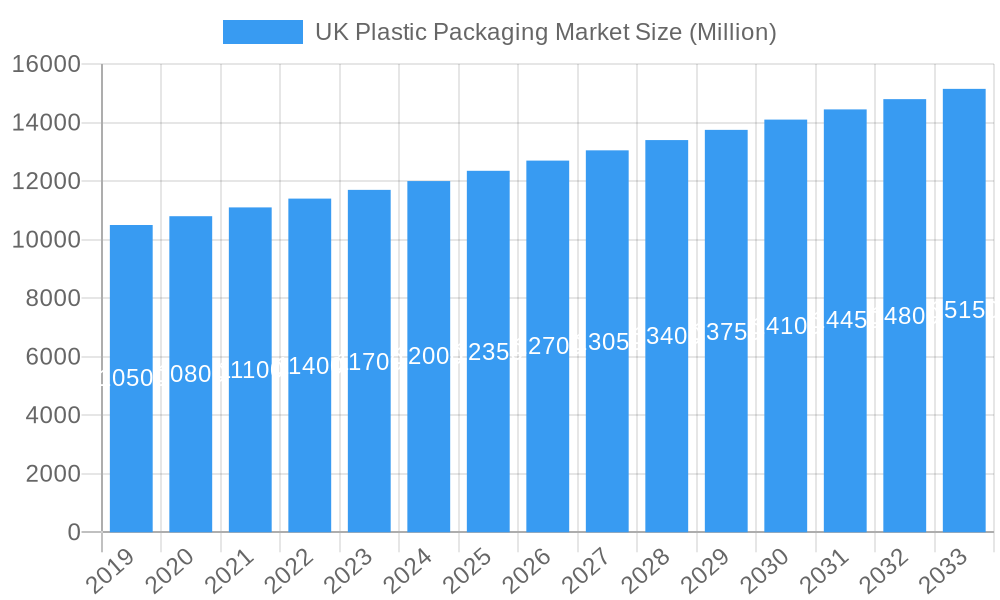

The UK plastic packaging market is poised for steady growth, driven by its indispensable role across various consumer and industrial sectors. With a projected market size of approximately £12,000 million and a Compound Annual Growth Rate (CAGR) of 2.87%, the market is expected to reach an estimated value of £13,500 million by 2025. This expansion is largely fueled by the increasing demand for convenience and product preservation in sectors like food and beverage, which represent a significant portion of the end-user industry. The versatility and cost-effectiveness of plastic packaging continue to make it a preferred choice for manufacturers seeking to protect and present their products efficiently. Innovations in material science, focusing on enhanced barrier properties and lightweighting, further contribute to its adoption. Additionally, the healthcare and personal care industries are significant contributors, driven by stringent packaging requirements for safety, hygiene, and extended shelf life.

UK Plastic Packaging Market Market Size (In Billion)

Despite the overall positive trajectory, the market faces considerable headwinds. Growing environmental concerns and stringent government regulations aimed at reducing plastic waste and promoting recycling are significant restraining factors. The push towards a circular economy and the increasing consumer preference for sustainable alternatives are compelling companies to invest in and adopt eco-friendly packaging solutions. This necessitates a strategic shift towards recycled plastics, biodegradable materials, and innovative packaging designs that minimize material usage. Key trends include the rise of flexible plastic packaging, particularly pouches and films, due to their superior material efficiency and adaptability. Rigid plastic packaging, especially bottles and jars, remains dominant, yet faces pressure from alternative materials. Companies are actively navigating these challenges by investing in R&D for sustainable solutions, enhancing recyclability, and exploring new business models that support a more circular approach to plastic packaging.

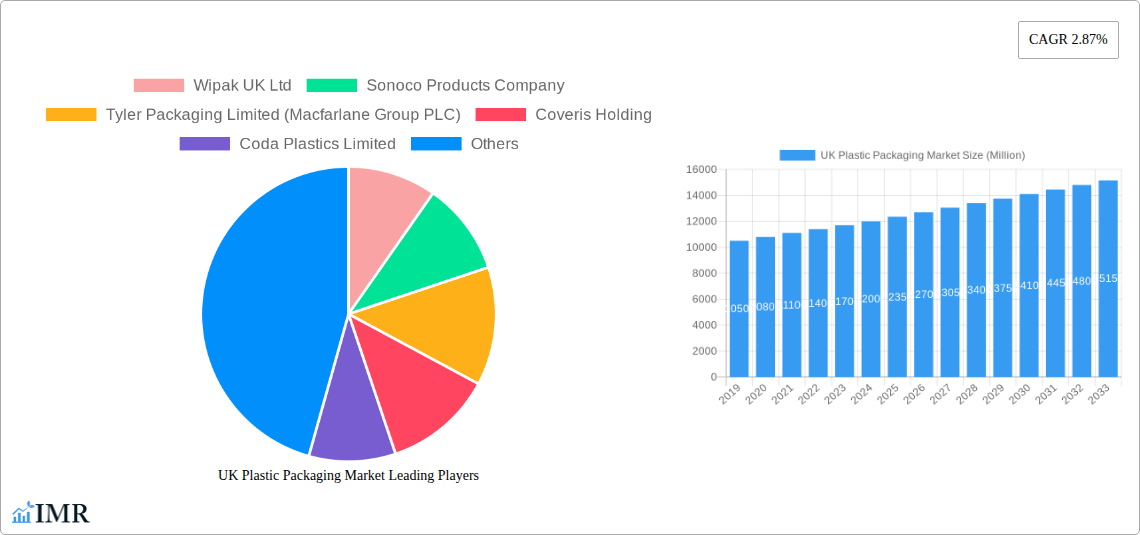

UK Plastic Packaging Market Company Market Share

Unlock crucial insights into the dynamic UK plastic packaging market. This report delves into flexible plastic packaging and rigid plastic packaging segments, analyzing trends across key product types like pouches, bags, films and wraps, bottles and jars, and trays and containers. We explore the pervasive influence of plastic packaging across the food, beverage, healthcare, personal care and household industries, providing an indispensable resource for stakeholders seeking to navigate this evolving landscape. Our analysis spans the historical period of 2019-2024, the base and estimated year of 2025, and forecasts growth through to 2033, offering a complete view of market evolution.

UK Plastic Packaging Market Market Dynamics & Structure

The UK plastic packaging market exhibits a moderately concentrated structure, characterized by the presence of global giants and specialized domestic players. Technological innovation is a significant driver, with continuous advancements in material science, barrier properties, and lightweighting solutions shaping product development. Regulatory frameworks, particularly those focused on sustainability and recyclability, are increasingly influencing market dynamics. Competitive product substitutes, including paper-based and bio-plastic alternatives, present a growing challenge, necessitating constant innovation in plastic packaging solutions. End-user demographics, driven by increasing consumer awareness and demand for convenience and sustainability, are also shaping product demand. Mergers and acquisitions (M&A) remain a key strategy for market consolidation and expansion.

- Market Concentration: Dominated by a mix of multinational corporations and a substantial number of SMEs.

- Technological Innovation Drivers: Focus on enhanced recyclability, biodegradability, and barrier performance.

- Regulatory Frameworks: Growing influence of Extended Producer Responsibility (EPR) schemes and plastic tax.

- Competitive Product Substitutes: Rise of sustainable alternatives impacting market share.

- End-User Demographics: Shifting preferences towards eco-friendly and convenient packaging solutions.

- M&A Trends: Strategic acquisitions to expand product portfolios and market reach.

UK Plastic Packaging Market Growth Trends & Insights

The UK plastic packaging market is poised for substantial growth, projected to reach xx million units by 2033. This expansion is driven by sustained demand from core end-user industries and the increasing adoption of innovative packaging solutions. The market size evolution will be marked by a steady Compound Annual Growth Rate (CAGR) of approximately x.x% during the forecast period. Technological disruptions, including advancements in high-barrier films and mono-material packaging designed for enhanced recyclability, are significantly influencing adoption rates. Consumer behavior shifts, such as a growing preference for single-serve portions and the demand for extended shelf life, are further propelling the market forward. The penetration of advanced plastic packaging solutions is expected to increase, particularly in sectors prioritizing product safety and convenience.

- Market Size Evolution: Projected to reach xx million units by 2033.

- CAGR: Expected to witness a CAGR of x.x% from 2025 to 2033.

- Adoption Rates: Increasing uptake of sustainable and high-performance plastic packaging solutions.

- Technological Disruptions: Innovations in recyclability and barrier properties driving market penetration.

- Consumer Behavior Shifts: Demand for convenience, extended shelf life, and sustainable packaging.

Dominant Regions, Countries, or Segments in UK Plastic Packaging Market

Within the UK plastic packaging market, flexible plastic packaging is emerging as a dominant segment, driven by its versatility and cost-effectiveness. The food and beverage end-user industries continue to be the largest consumers, accounting for a significant portion of the market share.

- Dominant Packaging Type: Flexible Plastic Packaging:

- Key Drivers: Lightweight, cost-efficient, excellent barrier properties, wide range of applications.

- Market Share: Estimated to hold xx% of the total UK plastic packaging market in 2025.

- Growth Potential: High demand for pouches and bags in the convenience food sector.

- Dominant Product Type: Pouches and Bags:

- Drivers: Increasing popularity of stand-up pouches, doypacks, and resealable bags for snacks, pet food, and ready meals.

- Market Share: Expected to constitute xx% of the flexible plastic packaging segment.

- Dominant End-user Industry: Food:

- Drivers: Growing demand for convenient, safe, and extended-shelf-life food products.

- Market Share: Accounts for an estimated xx% of the overall UK plastic packaging market.

- Growth Factors: E-commerce growth in food delivery and online grocery shopping.

- Leading Country/Region within UK: The South East of England continues to lead in terms of consumption and manufacturing due to its strong economic base and proximity to major distribution networks.

UK Plastic Packaging Market Product Landscape

The UK plastic packaging market is characterized by a diverse product landscape featuring innovations focused on sustainability and enhanced functionality. Key developments include the increasing use of mono-material structures for improved recyclability, advanced barrier technologies extending product shelf life, and lightweighting solutions reducing material consumption. Applications span from protecting sensitive pharmaceuticals and fresh produce to providing robust containment for household chemicals. Performance metrics such as puncture resistance, seal integrity, and gas barrier properties are continually being optimized to meet stringent industry demands.

Key Drivers, Barriers & Challenges in UK Plastic Packaging Market

Key Drivers:

- Growing Demand for Convenience: Increased consumption of ready-to-eat meals and on-the-go products fuels demand for flexible and rigid packaging solutions.

- E-commerce Growth: The surge in online shopping necessitates robust and protective packaging for various consumer goods.

- Technological Advancements: Innovations in material science and manufacturing processes enable the creation of more sustainable and functional packaging.

- Government Initiatives for Recycling: Policies encouraging the use of recycled content and improved recyclability are driving innovation.

Barriers & Challenges:

- Environmental Concerns & Regulations: Public scrutiny and stringent regulations surrounding plastic waste and pollution pose significant challenges.

- Fluctuating Raw Material Prices: Volatility in the prices of virgin plastic resins impacts production costs and market stability.

- Infrastructure for Recycling: Inadequate collection and processing infrastructure for certain types of plastic packaging hinders circular economy initiatives.

- Competition from Alternative Materials: Increasing adoption of paper, glass, and bioplastics presents a competitive threat.

Emerging Opportunities in UK Plastic Packaging Market

Emerging opportunities lie in the development of advanced recycling technologies, particularly for multi-layer flexible packaging, which currently presents collection and recycling challenges. The growing demand for bio-based and compostable plastic alternatives, especially in food service and single-use applications, offers significant untapped market potential. Furthermore, the expansion of reusable packaging systems and smart packaging solutions that incorporate features like temperature monitoring and authentication presents avenues for future growth.

Growth Accelerators in the UK Plastic Packaging Market Industry

Catalysts driving long-term growth include significant investments in R&D for developing truly circular plastic packaging solutions. Strategic partnerships between material manufacturers, converters, and waste management companies are crucial for building robust recycling ecosystems. Market expansion strategies focusing on underserved niche applications within the healthcare and personal care sectors, coupled with the adoption of advanced automation in manufacturing, will further accelerate growth.

Key Players Shaping the UK Plastic Packaging Market Market

- Wipak UK Ltd

- Sonoco Products Company

- Tyler Packaging Limited (Macfarlane Group PLC)

- Coveris Holding

- Coda Plastics Limited

- Polystar Plastics Ltd

- Amcor PLC

- Clifton Packaging Group Limited

- National Flexible

- Constantia Flexibles

- Charpak Ltd

- Berry Global

- Sealed Air Corporation

Notable Milestones in UK Plastic Packaging Market Sector

- September 2022: Coca-Cola Great Britain (CCGB) expanded the use of its attached caps to 500 ml bottles to increase recycling rates and reduce waste, simplifying the recycling of the complete package.

- May 2022: FlexCollect, the UK's largest collaborative effort to support the collection and recycling of flexible plastic packaging, debuted with backing from UK Research and Innovation (UKRI), aiming to significantly boost recovery and recycling rates through residential pickups.

In-Depth UK Plastic Packaging Market Market Outlook

The future outlook for the UK plastic packaging market is characterized by a strong imperative towards sustainability and circularity. Growth will be significantly influenced by continued innovation in recyclable materials, the successful implementation of advanced recycling technologies, and robust government policies supporting a circular economy. Strategic investments in infrastructure for collection and processing, alongside evolving consumer preferences for eco-conscious products, will shape market dynamics. Stakeholders that proactively embrace these shifts, focusing on collaboration and innovative solutions, are best positioned to capitalize on the evolving opportunities within this vital industry.

UK Plastic Packaging Market Segmentation

-

1. Packaging Type

- 1.1. Flexible Plastic Packaging

- 1.2. Rigid Plastic Packaging

-

2. Product Type

-

2.1. Rigid Plastic Packaging

- 2.1.1. Bottles and Jars

- 2.1.2. Trays and containers

- 2.1.3. Other Product Types (Caps and Closures, etc.)

-

2.2. Flexible Plastic Packaging

- 2.2.1. Pouches

- 2.2.2. Bags

- 2.2.3. Films and Wraps

-

2.1. Rigid Plastic Packaging

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare

- 3.4. Personal Care and Household

- 3.5. Other End-user Industries

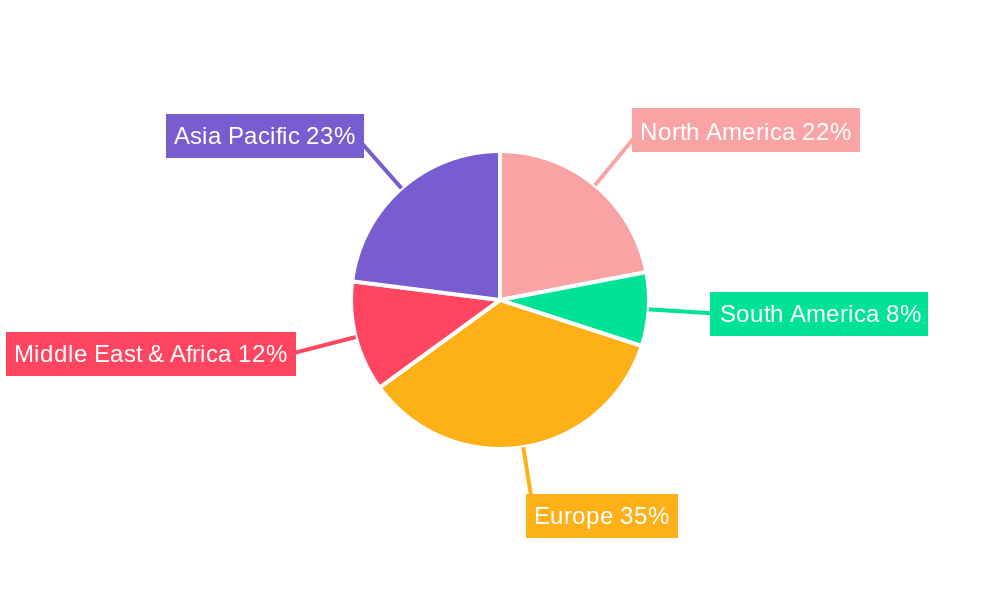

UK Plastic Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Plastic Packaging Market Regional Market Share

Geographic Coverage of UK Plastic Packaging Market

UK Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Lightweight-packaging Methods; Increased Eco-friendly Packaging and Recycled Plastics

- 3.3. Market Restrains

- 3.3.1. High Price of Raw Material (Plastic Resin); Government Regulations and Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Food Industry Driving Prominent Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Flexible Plastic Packaging

- 5.1.2. Rigid Plastic Packaging

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Rigid Plastic Packaging

- 5.2.1.1. Bottles and Jars

- 5.2.1.2. Trays and containers

- 5.2.1.3. Other Product Types (Caps and Closures, etc.)

- 5.2.2. Flexible Plastic Packaging

- 5.2.2.1. Pouches

- 5.2.2.2. Bags

- 5.2.2.3. Films and Wraps

- 5.2.1. Rigid Plastic Packaging

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare

- 5.3.4. Personal Care and Household

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. North America UK Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6.1.1. Flexible Plastic Packaging

- 6.1.2. Rigid Plastic Packaging

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Rigid Plastic Packaging

- 6.2.1.1. Bottles and Jars

- 6.2.1.2. Trays and containers

- 6.2.1.3. Other Product Types (Caps and Closures, etc.)

- 6.2.2. Flexible Plastic Packaging

- 6.2.2.1. Pouches

- 6.2.2.2. Bags

- 6.2.2.3. Films and Wraps

- 6.2.1. Rigid Plastic Packaging

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Healthcare

- 6.3.4. Personal Care and Household

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Packaging Type

- 7. South America UK Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Packaging Type

- 7.1.1. Flexible Plastic Packaging

- 7.1.2. Rigid Plastic Packaging

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Rigid Plastic Packaging

- 7.2.1.1. Bottles and Jars

- 7.2.1.2. Trays and containers

- 7.2.1.3. Other Product Types (Caps and Closures, etc.)

- 7.2.2. Flexible Plastic Packaging

- 7.2.2.1. Pouches

- 7.2.2.2. Bags

- 7.2.2.3. Films and Wraps

- 7.2.1. Rigid Plastic Packaging

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Healthcare

- 7.3.4. Personal Care and Household

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Packaging Type

- 8. Europe UK Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Packaging Type

- 8.1.1. Flexible Plastic Packaging

- 8.1.2. Rigid Plastic Packaging

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Rigid Plastic Packaging

- 8.2.1.1. Bottles and Jars

- 8.2.1.2. Trays and containers

- 8.2.1.3. Other Product Types (Caps and Closures, etc.)

- 8.2.2. Flexible Plastic Packaging

- 8.2.2.1. Pouches

- 8.2.2.2. Bags

- 8.2.2.3. Films and Wraps

- 8.2.1. Rigid Plastic Packaging

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Healthcare

- 8.3.4. Personal Care and Household

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Packaging Type

- 9. Middle East & Africa UK Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Packaging Type

- 9.1.1. Flexible Plastic Packaging

- 9.1.2. Rigid Plastic Packaging

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Rigid Plastic Packaging

- 9.2.1.1. Bottles and Jars

- 9.2.1.2. Trays and containers

- 9.2.1.3. Other Product Types (Caps and Closures, etc.)

- 9.2.2. Flexible Plastic Packaging

- 9.2.2.1. Pouches

- 9.2.2.2. Bags

- 9.2.2.3. Films and Wraps

- 9.2.1. Rigid Plastic Packaging

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Healthcare

- 9.3.4. Personal Care and Household

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Packaging Type

- 10. Asia Pacific UK Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Packaging Type

- 10.1.1. Flexible Plastic Packaging

- 10.1.2. Rigid Plastic Packaging

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Rigid Plastic Packaging

- 10.2.1.1. Bottles and Jars

- 10.2.1.2. Trays and containers

- 10.2.1.3. Other Product Types (Caps and Closures, etc.)

- 10.2.2. Flexible Plastic Packaging

- 10.2.2.1. Pouches

- 10.2.2.2. Bags

- 10.2.2.3. Films and Wraps

- 10.2.1. Rigid Plastic Packaging

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Healthcare

- 10.3.4. Personal Care and Household

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Packaging Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Wipak UK Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sonoco Products Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tyler Packaging Limited (Macfarlane Group PLC)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Coveris Holding

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Coda Plastics Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Polystar Plastics Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amcor PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Clifton Packaging Group Limited*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 National Flexible

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Constantia Flexibles

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Charpak Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Berry Global

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sealed Air Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Wipak UK Ltd

List of Figures

- Figure 1: Global UK Plastic Packaging Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America UK Plastic Packaging Market Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 3: North America UK Plastic Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 4: North America UK Plastic Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 5: North America UK Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America UK Plastic Packaging Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: North America UK Plastic Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America UK Plastic Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America UK Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UK Plastic Packaging Market Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 11: South America UK Plastic Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 12: South America UK Plastic Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 13: South America UK Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: South America UK Plastic Packaging Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: South America UK Plastic Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America UK Plastic Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America UK Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UK Plastic Packaging Market Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 19: Europe UK Plastic Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 20: Europe UK Plastic Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: Europe UK Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe UK Plastic Packaging Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Europe UK Plastic Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe UK Plastic Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe UK Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UK Plastic Packaging Market Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 27: Middle East & Africa UK Plastic Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 28: Middle East & Africa UK Plastic Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 29: Middle East & Africa UK Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East & Africa UK Plastic Packaging Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa UK Plastic Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa UK Plastic Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa UK Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UK Plastic Packaging Market Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 35: Asia Pacific UK Plastic Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 36: Asia Pacific UK Plastic Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 37: Asia Pacific UK Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific UK Plastic Packaging Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific UK Plastic Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific UK Plastic Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific UK Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Plastic Packaging Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 2: Global UK Plastic Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 3: Global UK Plastic Packaging Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global UK Plastic Packaging Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global UK Plastic Packaging Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 6: Global UK Plastic Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Global UK Plastic Packaging Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Global UK Plastic Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global UK Plastic Packaging Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 13: Global UK Plastic Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: Global UK Plastic Packaging Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global UK Plastic Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global UK Plastic Packaging Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 20: Global UK Plastic Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 21: Global UK Plastic Packaging Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 22: Global UK Plastic Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global UK Plastic Packaging Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 33: Global UK Plastic Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 34: Global UK Plastic Packaging Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 35: Global UK Plastic Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global UK Plastic Packaging Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 43: Global UK Plastic Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 44: Global UK Plastic Packaging Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 45: Global UK Plastic Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Plastic Packaging Market?

The projected CAGR is approximately 7.56%.

2. Which companies are prominent players in the UK Plastic Packaging Market?

Key companies in the market include Wipak UK Ltd, Sonoco Products Company, Tyler Packaging Limited (Macfarlane Group PLC), Coveris Holding, Coda Plastics Limited, Polystar Plastics Ltd, Amcor PLC, Clifton Packaging Group Limited*List Not Exhaustive, National Flexible, Constantia Flexibles, Charpak Ltd, Berry Global, Sealed Air Corporation.

3. What are the main segments of the UK Plastic Packaging Market?

The market segments include Packaging Type, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Lightweight-packaging Methods; Increased Eco-friendly Packaging and Recycled Plastics.

6. What are the notable trends driving market growth?

Food Industry Driving Prominent Growth.

7. Are there any restraints impacting market growth?

High Price of Raw Material (Plastic Resin); Government Regulations and Environmental Concerns.

8. Can you provide examples of recent developments in the market?

September 2022: In an effort to increase recycling rates and reduce waste, Coca-Cola Great Britain (CCGB) expanded the use of its attached caps to 500 ml bottles. This move was a part of a packaging evolution across the company's complete portfolio. The bottle cap can now remain attached to the bottle even after it has been opened, making it simpler to recycle the complete package and guaranteeing that no cap is ever left behind, even when traveling.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the UK Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence