Key Insights

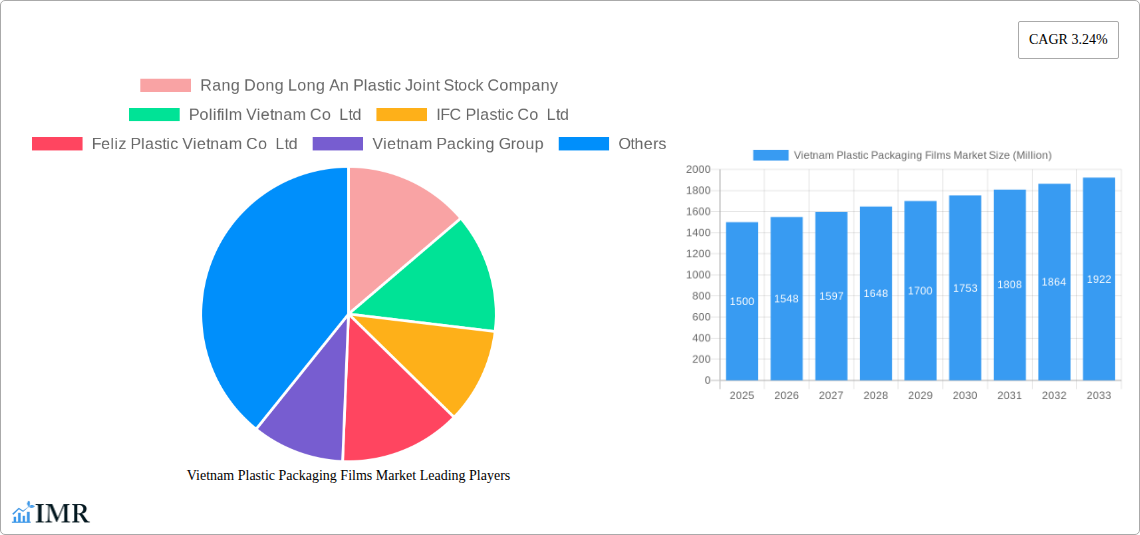

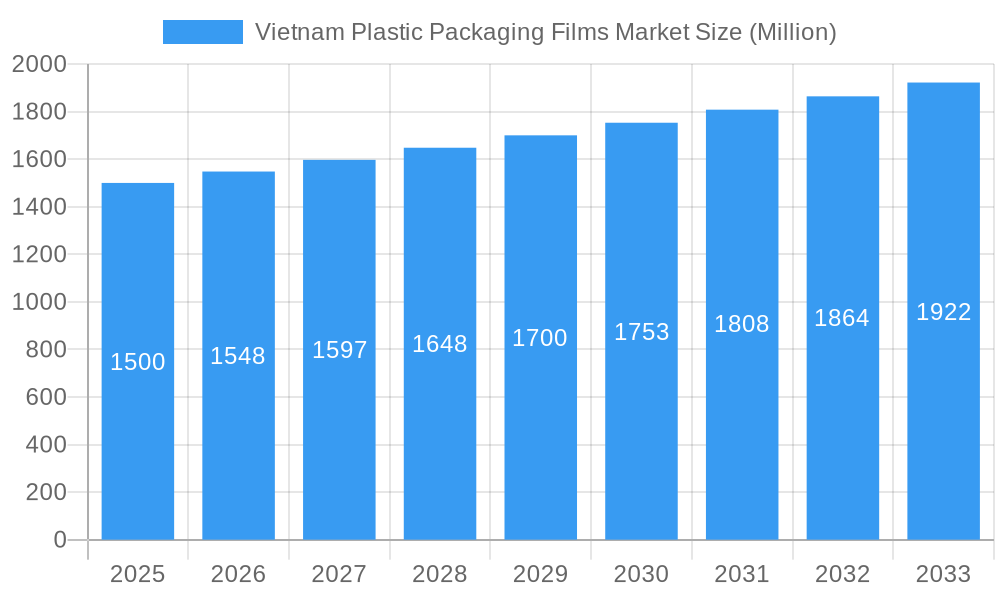

The Vietnam Plastic Packaging Films Market is poised for robust growth, driven by increasing consumer demand and expanding industrial sectors. With an estimated market size of approximately \$1,500 million in 2025, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of 3.24% through 2033. This sustained growth is fueled by significant market drivers, including the burgeoning food and beverage industry, a rising middle class with increased disposable income, and the growing demand for sophisticated healthcare and personal care products. The convenience and protective qualities of plastic packaging films make them indispensable across these sectors. Furthermore, the evolving retail landscape and the increasing adoption of e-commerce are creating new avenues for plastic packaging films, particularly in flexible and multi-layer formats that offer superior product preservation and shelf appeal.

Vietnam Plastic Packaging Films Market Market Size (In Billion)

The market is characterized by a dynamic segmentation, with Polyethylene (PE) and Polypropylene (PP) films holding substantial shares due to their versatility, cost-effectiveness, and wide range of applications. However, there's a notable upward trend in the adoption of specialized films like EVOH and PETG for their enhanced barrier properties, catering to the stringent requirements of the food and healthcare industries. The "Bio-Based" segment, though currently smaller, is anticipated to gain traction as environmental consciousness grows and regulatory pressures for sustainable packaging solutions intensify. Key restraints include fluctuating raw material prices, environmental concerns associated with plastic waste, and increasing competition from alternative packaging materials. Nevertheless, the proactive engagement of leading companies like Rang Dong Long An Plastic Joint Stock Company, Polifilm Vietnam Co Ltd, and Nan Ya Plastics Corporation in innovation and capacity expansion suggests a resilient market poised to overcome these challenges.

Vietnam Plastic Packaging Films Market Company Market Share

Here's a compelling, SEO-optimized report description for the Vietnam Plastic Packaging Films Market, incorporating high-traffic keywords and detailed structure as requested:

Vietnam Plastic Packaging Films Market Report: Forecast to 2033 | Industry Insights, Growth Trends, and Key Players

Unlock critical insights into the dynamic Vietnam Plastic Packaging Films Market with this comprehensive report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis delves into market size, growth trajectories, technological advancements, and the competitive landscape. Essential for stakeholders seeking to understand the evolving needs of segments like Food Packaging, Healthcare, and Industrial Applications, this report provides a detailed breakdown of product types including Polypropylene, Polyethylene, Polystyrene, Bio-Based films, PVC, EVOH, PETG, and other film types. The report quantifies market evolution with data in million units, offering precise market share percentages, CAGR, and market penetration figures to guide strategic decision-making.

Vietnam Plastic Packaging Films Market Market Dynamics & Structure

The Vietnam Plastic Packaging Films Market is characterized by a moderately concentrated structure, with key players actively engaging in strategic maneuvers to capture market share. Technological innovation is a significant driver, fueled by the increasing demand for advanced barrier properties, enhanced shelf-life, and sustainable packaging solutions. Regulatory frameworks, while evolving, are increasingly focusing on waste management and the promotion of recyclable and biodegradable materials, influencing product development and market entry strategies. Competitive product substitutes, primarily from alternative materials and imported films, exert pressure on domestic manufacturers. End-user demographics play a crucial role, with a growing middle class driving demand for packaged goods across various categories. Mergers and acquisitions (M&A) are becoming more prevalent as companies seek to consolidate their market position, expand their product portfolios, and gain access to new technologies.

- Market Concentration: Dominated by a mix of large domestic manufacturers and multinational corporations, with a trend towards consolidation.

- Technological Innovation Drivers: Demand for improved barrier properties, lightweighting, and sustainable film solutions.

- Regulatory Frameworks: Growing emphasis on plastic waste reduction, recycling initiatives, and Extended Producer Responsibility (EPR) schemes.

- Competitive Product Substitutes: Growing penetration of paper-based packaging and advanced material alternatives.

- End-User Demographics: Rising disposable incomes, urbanization, and a preference for convenience packaging.

- M&A Trends: Strategic acquisitions aimed at expanding production capacity, technological capabilities, and market reach.

Vietnam Plastic Packaging Films Market Growth Trends & Insights

The Vietnam Plastic Packaging Films Market is poised for robust growth, driven by a confluence of economic development, evolving consumer preferences, and advancements in material science. The market size evolution is projected to witness a steady upward trajectory, fueled by the expanding food and beverage industry, the burgeoning healthcare sector, and increasing demand for personal care and home care products. Adoption rates for advanced packaging films are accelerating, as manufacturers recognize the benefits of enhanced product protection, extended shelf life, and improved visual appeal. Technological disruptions, including the development of high-performance multilayer films and innovations in bio-based and biodegradable packaging, are reshaping the market landscape. Consumer behavior shifts are also playing a significant role, with a growing awareness of sustainability and a preference for packaged goods that offer convenience and hygiene. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033, with an estimated market penetration of xx% by the forecast period's end. The increasing reliance on flexible packaging solutions across diverse industries further underpins this growth.

Dominant Regions, Countries, or Segments in Vietnam Plastic Packaging Films Market

Within the Vietnam Plastic Packaging Films Market, Polyethylene (PE) films stand out as the dominant segment, driven by their versatility, cost-effectiveness, and wide range of applications across multiple end-user industries. The Food Packaging end-user industry, particularly segments such as Dry Foods, Frozen Foods, and Meat, Poultry, and Seafood, represent the largest and fastest-growing application areas for plastic packaging films in Vietnam. The economic policies promoting industrial growth and foreign direct investment (FDI) have significantly bolstered the manufacturing sector, consequently increasing the demand for packaging materials. Furthermore, the expanding retail infrastructure and the growing middle class have amplified consumer spending on packaged food items, directly translating to higher consumption of PE films. Vietnam's strategic geographical location and its integration into global supply chains further contribute to the dominance of these segments. The infrastructure development, including advancements in logistics and cold chain facilities, supports the efficient distribution and preservation of perishable goods, thus sustaining the demand for high-quality packaging films.

- Dominant Segment (Type): Polyethylene (PE) films, including HDPE, LDPE, and LLDPE, owing to their broad applicability and cost-efficiency.

- Dominant Segment (End-user Industry): Food Packaging, specifically Dry Foods, Frozen Foods, Meat, Poultry, and Seafood, driven by population growth and dietary shifts.

- Key Drivers for Dominance:

- Economic Policies: Government initiatives supporting manufacturing and export-oriented industries.

- Infrastructure Development: Investments in transportation networks and cold chain facilities.

- Consumer Demand: Growing middle class with increased purchasing power and preference for convenience.

- Versatility of PE Films: Suitability for a wide array of food preservation and packaging needs.

- Market Share: PE films are estimated to hold xx% of the Vietnam plastic packaging films market.

Vietnam Plastic Packaging Films Market Product Landscape

The product landscape of the Vietnam Plastic Packaging Films Market is marked by innovation aimed at enhancing functionality and sustainability. Leading manufacturers are developing advanced multilayer films that offer superior barrier properties against oxygen, moisture, and light, thereby extending product shelf life for sensitive goods like food and pharmaceuticals. Applications are rapidly diversifying, from flexible food pouches and shrink films to medical device packaging and agricultural films. Performance metrics are continually being improved, with a focus on increased tensile strength, puncture resistance, and seal integrity. Unique selling propositions often lie in tailored solutions that meet specific industry requirements, such as high-clarity films for consumer appeal or specialized films with antimicrobial properties. Technological advancements in extrusion and co-extrusion processes are enabling the creation of thinner yet stronger films, contributing to material reduction and cost efficiencies.

Key Drivers, Barriers & Challenges in Vietnam Plastic Packaging Films Market

Key Drivers:

- Economic Growth and Urbanization: A rising middle class and increasing urbanization are fueling demand for packaged goods across various sectors.

- Growth of Food & Beverage Industry: The expanding food processing and retail sectors are the primary consumers of plastic packaging films.

- Technological Advancements: Innovations in film extrusion and material science are leading to enhanced performance and specialized applications.

- Demand for Convenience and Shelf Stability: Consumers' preference for ready-to-eat meals and longer shelf-life products.

- E-commerce Growth: The surge in online retail necessitates robust and protective packaging solutions.

Key Barriers & Challenges:

- Environmental Concerns and Regulations: Increasing scrutiny over plastic waste and the push towards sustainable alternatives pose regulatory and market challenges.

- Volatile Raw Material Prices: Fluctuations in crude oil prices directly impact the cost of plastic resins.

- Competition from Substitutes: Growing adoption of paper, glass, and compostable materials as alternatives.

- Infrastructure Gaps: In certain regions, underdeveloped logistics and waste management infrastructure can hinder adoption and recycling efforts.

- Supply Chain Disruptions: Global supply chain issues can affect the availability and cost of raw materials and finished products.

Emerging Opportunities in Vietnam Plastic Packaging Films Market

Emerging opportunities in the Vietnam Plastic Packaging Films Market are largely centered around sustainable packaging solutions. The rising consumer and regulatory pressure for eco-friendly alternatives is creating a strong demand for bio-based and biodegradable films, as well as solutions facilitating enhanced mechanical and advanced recycling. The growth of e-commerce presents an untapped market for specialized protective and tamper-evident packaging films. Furthermore, the increasing adoption of flexible packaging in niche sectors like medical devices and specialized industrial applications offers significant potential. Innovations in smart packaging, incorporating features like spoilage indicators or authentication technologies, are also poised for growth as they enhance consumer trust and product safety.

Growth Accelerators in the Vietnam Plastic Packaging Films Market Industry

Several catalysts are accelerating long-term growth in the Vietnam Plastic Packaging Films Market. Technological breakthroughs in developing high-barrier, lightweight, and fully recyclable mono-material films are expanding their application scope. Strategic partnerships between resin manufacturers, film converters, and end-users are fostering innovation and tailored solutions. The Vietnamese government's commitment to sustainable development and its focus on attracting FDI in advanced manufacturing sectors are creating a conducive environment for market expansion. Furthermore, the increasing penetration of sophisticated food processing and preservation technologies directly drives the demand for advanced packaging films that can maintain product integrity and extend shelf life.

Key Players Shaping the Vietnam Plastic Packaging Films Market Market

- Rang Dong Long An Plastic Joint Stock Company

- Polifilm Vietnam Co Ltd

- IFC Plastic Co Ltd

- Feliz Plastic Vietnam Co Ltd

- Vietnam Packing Group

- Bao Ma Production & Trading Co Ltd

- Nan Ya Plastics Corporation

- A J Plast (Vietnam) Co Lt

Notable Milestones in Vietnam Plastic Packaging Films Market Sector

- May 2024: Dow and SCG Chemicals (SCGC) signed an MOU in the Asia-Pacific region to convert 200,000 KTA of plastic waste into circular products by 2030. This collaboration aims to fast-track technology advancements across the value chain, facilitating both mechanical recycling (MR) and advanced recycling (AR).

- September 2023: SKC Co., a South Korean materials manufacturer, announced its intention to construct a manufacturing facility in Vietnam focused on producing materials for biodegradable plastics, signaling a strategic move to strengthen its presence in the eco-friendly materials sector.

In-Depth Vietnam Plastic Packaging Films Market Market Outlook

The future outlook for the Vietnam Plastic Packaging Films Market is exceptionally promising, driven by sustained economic expansion, evolving consumer preferences towards convenience and sustainability, and ongoing technological advancements. Growth accelerators include the increasing integration of circular economy principles, the development of high-performance biodegradable and recyclable films, and the expansion of applications into niche sectors. Strategic opportunities lie in tapping into the growing demand for flexible packaging in the e-commerce and healthcare industries, while also addressing the environmental concerns through innovative material solutions and robust recycling initiatives. The market is well-positioned for continued growth, offering substantial potential for stakeholders who can adapt to these dynamic trends.

Vietnam Plastic Packaging Films Market Segmentation

-

1. Type

- 1.1. Polyprop

- 1.2. Polyethy

- 1.3. Polyethy

- 1.4. Polystyrene

- 1.5. Bio-Based

- 1.6. PVC, EVOH, PETG, and Other Film Types

-

2. End-user Industry

-

2.1. Food

- 2.1.1. Candy and Confectionery

- 2.1.2. Frozen Foods

- 2.1.3. Fresh Produce

- 2.1.4. Dairy Products

- 2.1.5. Dry Foods

- 2.1.6. Meat, Poultry, and Seafood

- 2.1.7. Pet Food

- 2.1.8. Other Fo

- 2.2. Healthcare

- 2.3. Personal Care and Home Care

- 2.4. Industrial Packaging

- 2.5. Other En

-

2.1. Food

Vietnam Plastic Packaging Films Market Segmentation By Geography

- 1. Vietnam

Vietnam Plastic Packaging Films Market Regional Market Share

Geographic Coverage of Vietnam Plastic Packaging Films Market

Vietnam Plastic Packaging Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Environmental Consciousness Fuels Embrace of Extended Producer Responsibility (EPR)

- 3.3. Market Restrains

- 3.3.1. Rising Environmental Consciousness Fuels Embrace of Extended Producer Responsibility (EPR)

- 3.4. Market Trends

- 3.4.1. Polyethylene Segment Is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Plastic Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polyprop

- 5.1.2. Polyethy

- 5.1.3. Polyethy

- 5.1.4. Polystyrene

- 5.1.5. Bio-Based

- 5.1.6. PVC, EVOH, PETG, and Other Film Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.1.1. Candy and Confectionery

- 5.2.1.2. Frozen Foods

- 5.2.1.3. Fresh Produce

- 5.2.1.4. Dairy Products

- 5.2.1.5. Dry Foods

- 5.2.1.6. Meat, Poultry, and Seafood

- 5.2.1.7. Pet Food

- 5.2.1.8. Other Fo

- 5.2.2. Healthcare

- 5.2.3. Personal Care and Home Care

- 5.2.4. Industrial Packaging

- 5.2.5. Other En

- 5.2.1. Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rang Dong Long An Plastic Joint Stock Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Polifilm Vietnam Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IFC Plastic Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Feliz Plastic Vietnam Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vietnam Packing Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bao Ma Production & Trading Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nan Ya Plastics Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 A J Plast (Vietnam) Co Lt

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Rang Dong Long An Plastic Joint Stock Company

List of Figures

- Figure 1: Vietnam Plastic Packaging Films Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Vietnam Plastic Packaging Films Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Plastic Packaging Films Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Vietnam Plastic Packaging Films Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Vietnam Plastic Packaging Films Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Vietnam Plastic Packaging Films Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Vietnam Plastic Packaging Films Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Vietnam Plastic Packaging Films Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Plastic Packaging Films Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Vietnam Plastic Packaging Films Market?

Key companies in the market include Rang Dong Long An Plastic Joint Stock Company, Polifilm Vietnam Co Ltd, IFC Plastic Co Ltd, Feliz Plastic Vietnam Co Ltd, Vietnam Packing Group, Bao Ma Production & Trading Co Ltd, Nan Ya Plastics Corporation, A J Plast (Vietnam) Co Lt.

3. What are the main segments of the Vietnam Plastic Packaging Films Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Environmental Consciousness Fuels Embrace of Extended Producer Responsibility (EPR).

6. What are the notable trends driving market growth?

Polyethylene Segment Is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Rising Environmental Consciousness Fuels Embrace of Extended Producer Responsibility (EPR).

8. Can you provide examples of recent developments in the market?

May 2024: Dow and SCG Chemicals, also known as SCGC, signed a memorandum of understanding (MOU) in the Asia-Pacific region. Their goal is to convert 200KTA of plastic waste into circular products by 2030. The collaboration aims to fast-track technology advancements across the value chain. This will facilitate recycling via both mechanical recycling (MR) and advanced recycling (AR), broadening the spectrum of plastic waste that can be transformed into high-value applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Plastic Packaging Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Plastic Packaging Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Plastic Packaging Films Market?

To stay informed about further developments, trends, and reports in the Vietnam Plastic Packaging Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence