Key Insights

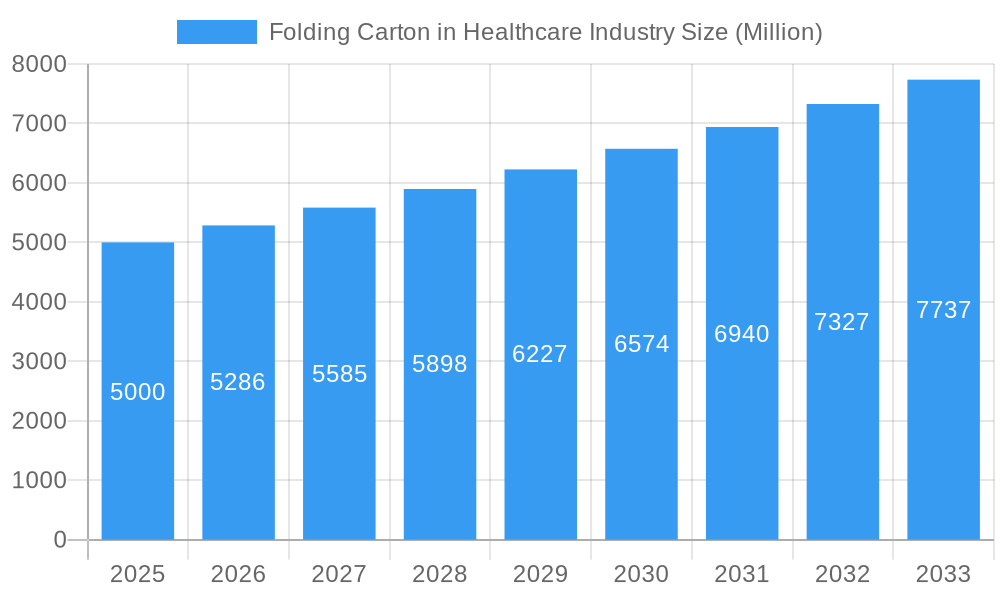

The global folding carton market within the healthcare industry is poised for significant expansion, projected to reach a market size of approximately $5,000 million by 2025 and sustain a Compound Annual Growth Rate (CAGR) of 5.72% through 2033. This robust growth is primarily fueled by the escalating demand for pharmaceutical products, coupled with an increasing emphasis on patient safety and product integrity. The rising prevalence of chronic diseases and an aging global population are directly contributing to the increased production of medications and healthcare products, consequently driving the need for reliable and protective packaging solutions like folding cartons. Furthermore, stringent regulatory requirements for pharmaceutical packaging, which necessitate clear labeling, tamper-evidence, and child-resistance features, are compelling manufacturers to invest in advanced folding carton designs and materials. The trend towards smaller, more convenient dosage forms, alongside the growth of over-the-counter (OTC) medications and nutraceuticals, further bolsters the demand for these versatile packaging solutions.

Folding Carton in Healthcare Industry Market Size (In Billion)

Key drivers shaping the folding carton market in healthcare include the continuous innovation in printing and finishing technologies, enabling enhanced visual appeal and anti-counterfeiting measures. The integration of smart packaging solutions, incorporating features like QR codes for drug traceability and patient information access, is also gaining traction. Despite the optimistic outlook, the market faces certain restraints, such as fluctuating raw material costs, particularly for paperboard, and the growing environmental concerns that are pushing for sustainable packaging alternatives. However, the industry is actively responding to these challenges by embracing eco-friendly materials and optimizing production processes. The market is segmented across various product types, with Blisters, Vials & Ampoules, and Injectables representing key applications, and a strong focus on specialized labeling techniques like pressure-sensitive and glue-applied labels to meet intricate regulatory and branding needs. Major players like LGR Packaging, DS Smith, and CCL Industries are actively investing in research and development to offer innovative and sustainable folding carton solutions.

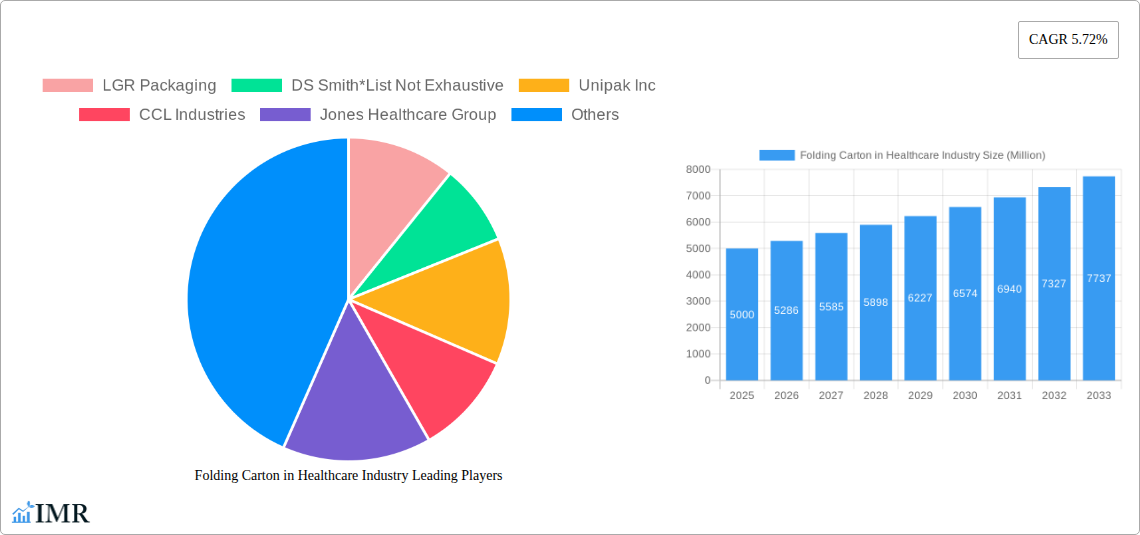

Folding Carton in Healthcare Industry Company Market Share

Folding Carton in Healthcare Industry: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the global folding carton market within the healthcare industry. Covering the period from 2019 to 2033, with a base year of 2025, this report delivers crucial insights into market dynamics, growth drivers, regional dominance, product landscape, competitive intelligence, and future opportunities. Essential for pharmaceutical manufacturers, packaging suppliers, healthcare providers, and investors, this report equips you with actionable data and strategic foresight to navigate this rapidly evolving sector.

Folding Carton in Healthcare Industry Market Dynamics & Structure

The folding carton market in the healthcare industry is characterized by a dynamic interplay of forces, driven by increasing demand for secure, compliant, and sustainable packaging solutions. Market concentration varies by region and product sub-segment, with leading players investing heavily in advanced printing technologies and tamper-evident features to meet stringent regulatory requirements. Technological innovation is primarily focused on enhanced security, child-resistance, and serialization capabilities, crucial for combating counterfeiting and ensuring patient safety. Regulatory frameworks, such as those from the FDA and EMA, significantly shape product design and material choices, promoting the adoption of high-barrier materials and precise labeling. Competitive product substitutes, including rigid boxes and specialized plastic containers, present a moderate challenge, though folding cartons offer a cost-effective and versatile alternative. End-user demographics, with a growing aging population and increased chronic disease prevalence, are fueling demand for pharmaceuticals and, consequently, their packaging. Mergers and acquisitions (M&A) activity remains a key trend, with larger entities acquiring smaller, specialized manufacturers to expand their product portfolios and geographical reach.

- Market Concentration: Moderate to high in developed regions, with consolidation driving market share shifts.

- Technological Innovation Drivers: Serialization, track-and-trace, anti-counterfeiting features, sustainable materials, and enhanced shelf-life preservation.

- Regulatory Frameworks: Strict adherence to cGMP, FDA, EMA, and country-specific pharmaceutical packaging regulations is paramount.

- Competitive Product Substitutes: Rigid boxes, plastic containers, and specialized pouching systems.

- End-User Demographics: Growing elderly population, rising prevalence of chronic diseases, and increasing demand for home healthcare.

- M&A Trends: Strategic acquisitions to gain market share, technological expertise, and product diversification.

Folding Carton in Healthcare Industry Growth Trends & Insights

The global folding carton market in the healthcare industry is poised for robust expansion, projected to reach substantial market value driven by an escalating demand for effective and safe pharmaceutical packaging. The market size evolution is a direct reflection of the burgeoning pharmaceutical sector, influenced by global health trends, increased R&D investments, and the continuous development of new drugs and therapies. Adoption rates for advanced folding carton solutions are steadily increasing, propelled by the imperative for product integrity, patient safety, and regulatory compliance. Technological disruptions, such as the integration of smart packaging features and advanced printing techniques, are reshaping the market, offering enhanced traceability and authentication capabilities. Consumer behavior shifts, including a growing preference for convenience and self-medication, are indirectly contributing to the demand for smaller, unit-dose packaging often facilitated by folding cartons. The overall CAGR for the forecast period is expected to be healthy, indicating sustained market growth.

Market penetration of specialized folding cartons, particularly those designed for sensitive medications and injectables, is on the rise. The increasing emphasis on sustainability is also driving the adoption of eco-friendly paperboard materials and innovative designs that minimize material usage. The development of high-barrier coatings and laminations within folding cartons is crucial for protecting pharmaceuticals from environmental factors, thereby extending their shelf life and efficacy. The evolving landscape of drug delivery systems, from traditional pills to advanced biologics and gene therapies, necessitates packaging solutions that can accommodate diverse product forms and maintain sterile conditions. The report will delve into detailed market size projections and CAGR for the historical and forecast periods, providing a clear picture of market growth trajectories.

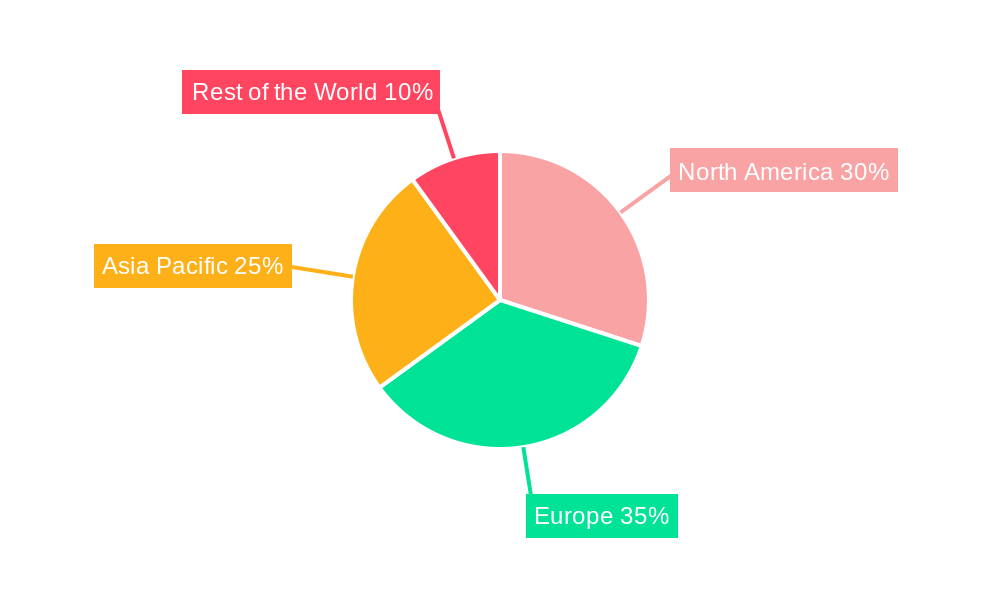

Dominant Regions, Countries, or Segments in Folding Carton in Healthcare Industry

North America, led by the United States, and Europe, with significant contributions from Germany, the UK, and France, currently dominate the global folding carton market in the healthcare industry. This dominance is attributed to the presence of a robust pharmaceutical manufacturing base, advanced healthcare infrastructure, and stringent regulatory landscapes that mandate high-quality packaging. The Injectables segment within Product Type is a significant growth driver, fueled by the increasing demand for biologics, vaccines, and complex therapeutic agents that require sterile, precise, and secure packaging. In terms of Labelling, Pressure Sensitive labelling remains a dominant type due to its versatility, cost-effectiveness, and ease of application in high-volume production environments. However, the demand for advanced labelling solutions like Shrink-Sleeve and custom die-cut labels for unique product shapes and enhanced anti-counterfeiting features is on a steady ascent.

Key drivers for regional dominance include strong economic policies supporting the pharmaceutical industry, substantial investments in research and development, and the presence of a skilled workforce. The established infrastructure for pharmaceutical distribution and healthcare delivery further solidifies the position of these regions. Market share within these leading regions is largely held by established players with strong manufacturing capabilities and a deep understanding of regulatory compliance. Growth potential in these markets remains high, driven by continuous innovation in drug development and increasing healthcare expenditure. The report will provide a granular analysis of market share and growth potential for key regions and countries, offering a nuanced understanding of market leadership. The Other Product Types (Medical Devices, etc.) segment is also experiencing considerable growth, driven by innovation in wearable devices, diagnostic kits, and other medical equipment requiring specialized packaging.

Folding Carton in Healthcare Industry Product Landscape

The product landscape of folding cartons in the healthcare industry is defined by continuous innovation aimed at enhancing patient safety, product integrity, and regulatory compliance. Key product innovations include the integration of advanced barrier coatings to protect sensitive pharmaceuticals from moisture, oxygen, and light, thereby extending shelf life. Tamper-evident features, such as specialized seals and die-cut designs, are crucial for ensuring product authenticity and preventing counterfeiting. Serialization capabilities, often achieved through advanced printing technologies on the carton surface, are becoming standard for enhanced traceability throughout the supply chain. The performance metrics are rigorously evaluated against industry standards, focusing on strength, print quality, and suitability for various sterilization methods. Unique selling propositions often revolve around customizability, sustainable material options, and integrated security features that address specific pharmaceutical product needs. Technological advancements are also enabling faster production cycles and improved cost-efficiency for manufacturers.

Key Drivers, Barriers & Challenges in Folding Carton in Healthcare Industry

The folding carton market in the healthcare industry is propelled by several key drivers. The ever-increasing global demand for pharmaceuticals, driven by an aging population and the rise of chronic diseases, directly fuels the need for reliable packaging solutions. Stringent regulatory requirements for drug safety and authenticity are pushing manufacturers towards high-security and traceable packaging. Technological advancements in printing and material science enable the creation of more sophisticated and functional cartons. Furthermore, the growing emphasis on sustainability is driving the adoption of eco-friendly paperboard materials.

However, the market also faces significant barriers and challenges. Supply chain disruptions, including raw material availability and fluctuating costs, can impact production efficiency and pricing. The complex and evolving regulatory landscape requires continuous investment in compliance and product development. Intense competition from alternative packaging materials and the need for significant capital investment in advanced machinery also present hurdles. Moreover, the pressure to reduce packaging costs while maintaining high quality and security adds another layer of complexity for manufacturers.

Emerging Opportunities in Folding Carton in Healthcare Industry

Emerging opportunities in the folding carton sector for the healthcare industry are predominantly centered around innovation and niche market penetration. The growing demand for personalized medicine and biologics presents a significant opportunity for highly specialized, secure, and temperature-controlled folding carton solutions. The increasing adoption of smart packaging technologies, such as embedded NFC tags or QR codes for enhanced patient engagement and medication adherence, offers a new frontier. Untapped markets in emerging economies, with their rapidly developing healthcare infrastructure and expanding pharmaceutical sectors, represent substantial growth potential. Furthermore, the development of novel, sustainable packaging materials with enhanced barrier properties and biodegradability will cater to evolving consumer and regulatory preferences.

Growth Accelerators in the Folding Carton in Healthcare Industry Industry

Several catalysts are accelerating long-term growth in the folding carton industry within the healthcare sector. Technological breakthroughs in areas like advanced printing (e.g., digital printing for variable data) and material science are enabling the creation of more functional and secure packaging. Strategic partnerships between packaging manufacturers and pharmaceutical companies, focusing on co-development of innovative solutions, are becoming increasingly common. Market expansion strategies, particularly targeting emerging economies with growing healthcare needs, are proving effective. The continuous innovation in drug delivery systems also necessitates new packaging formats, creating ongoing demand for specialized folding cartons.

Key Players Shaping the Folding Carton in Healthcare Industry Market

- LGR Packaging

- DS Smith

- Unipak Inc

- CCL Industries

- Jones Healthcare Group

- August Faller GmbH & co KG

- Nosco Inc

- Edelmann Group

- AR Packaging

- Stora Enso Group

- Big Valley Packaging

- Essentra PLC

- Keystone Folding Box Company

- Multi Packaging Solutions (WestRock)

Notable Milestones in Folding Carton in Healthcare Industry Sector

- 2020: Increased focus on anti-counterfeiting features and serialization solutions due to global supply chain vulnerabilities.

- 2021: Greater adoption of sustainable paperboard and eco-friendly inks driven by regulatory pressure and consumer demand.

- 2022: Advancements in smart packaging integration, including IoT-enabled features for enhanced track-and-trace capabilities.

- 2023: Significant M&A activities as larger players sought to consolidate market share and expand technological offerings.

- 2024: Enhanced focus on child-resistant and tamper-evident carton designs for over-the-counter (OTC) and prescription medications.

In-Depth Folding Carton in Healthcare Industry Market Outlook

The future outlook for the folding carton market in the healthcare industry remains exceptionally strong, fueled by persistent global healthcare demand and ongoing innovation. Key growth accelerators include the continued development of biologics and complex therapies requiring specialized packaging, the integration of advanced digital printing for serialization and brand protection, and the expansion into underserved emerging markets. Strategic partnerships and the development of sustainable, high-performance materials will further solidify market growth. The industry is well-positioned to capitalize on evolving patient needs and stringent regulatory mandates, ensuring continued demand for sophisticated folding carton solutions.

Folding Carton in Healthcare Industry Segmentation

-

1. Product Type

- 1.1. Blisters

- 1.2. Vials & Ampoules

- 1.3. Injectables

- 1.4. Other Product Types (Medical Devices, etc)

-

2. Labelling

-

2.1. Labelling Type

- 2.1.1. Pressure Sensitive

- 2.1.2. In-Mold

- 2.1.3. Shrink-Sleeve

- 2.1.4. Glue-Applied

- 2.1.5. Others (Custom Die-cut, etc.)

- 2.2. Advancem

- 2.3. Key regu

-

2.4. Key specific manufacturers in Labelling

- 2.4.1. WS Packaging

- 2.4.2. Schreiner Group

- 2.4.3. Faubel & Co

- 2.4.4. OPM Group

-

2.1. Labelling Type

Folding Carton in Healthcare Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Folding Carton in Healthcare Industry Regional Market Share

Geographic Coverage of Folding Carton in Healthcare Industry

Folding Carton in Healthcare Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Stringent regulations related to discerning key product related information in the field of medical devices; Growing emphasis of monitoring & assisting patient medication; Focus on traceability & anti-counterfeiting in the healthcare sector; Product & Material-based innovations driven by major packaging manufacturers to drive demand

- 3.3. Market Restrains

- 3.3.1. ; High Inventory Costs and Premium Pricing

- 3.4. Market Trends

- 3.4.1. Growing Emphasis of Monitoring and Assisting Patient Medication

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Blisters

- 5.1.2. Vials & Ampoules

- 5.1.3. Injectables

- 5.1.4. Other Product Types (Medical Devices, etc)

- 5.2. Market Analysis, Insights and Forecast - by Labelling

- 5.2.1. Labelling Type

- 5.2.1.1. Pressure Sensitive

- 5.2.1.2. In-Mold

- 5.2.1.3. Shrink-Sleeve

- 5.2.1.4. Glue-Applied

- 5.2.1.5. Others (Custom Die-cut, etc.)

- 5.2.2. Advancem

- 5.2.3. Key regu

- 5.2.4. Key specific manufacturers in Labelling

- 5.2.4.1. WS Packaging

- 5.2.4.2. Schreiner Group

- 5.2.4.3. Faubel & Co

- 5.2.4.4. OPM Group

- 5.2.1. Labelling Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Blisters

- 6.1.2. Vials & Ampoules

- 6.1.3. Injectables

- 6.1.4. Other Product Types (Medical Devices, etc)

- 6.2. Market Analysis, Insights and Forecast - by Labelling

- 6.2.1. Labelling Type

- 6.2.1.1. Pressure Sensitive

- 6.2.1.2. In-Mold

- 6.2.1.3. Shrink-Sleeve

- 6.2.1.4. Glue-Applied

- 6.2.1.5. Others (Custom Die-cut, etc.)

- 6.2.2. Advancem

- 6.2.3. Key regu

- 6.2.4. Key specific manufacturers in Labelling

- 6.2.4.1. WS Packaging

- 6.2.4.2. Schreiner Group

- 6.2.4.3. Faubel & Co

- 6.2.4.4. OPM Group

- 6.2.1. Labelling Type

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Blisters

- 7.1.2. Vials & Ampoules

- 7.1.3. Injectables

- 7.1.4. Other Product Types (Medical Devices, etc)

- 7.2. Market Analysis, Insights and Forecast - by Labelling

- 7.2.1. Labelling Type

- 7.2.1.1. Pressure Sensitive

- 7.2.1.2. In-Mold

- 7.2.1.3. Shrink-Sleeve

- 7.2.1.4. Glue-Applied

- 7.2.1.5. Others (Custom Die-cut, etc.)

- 7.2.2. Advancem

- 7.2.3. Key regu

- 7.2.4. Key specific manufacturers in Labelling

- 7.2.4.1. WS Packaging

- 7.2.4.2. Schreiner Group

- 7.2.4.3. Faubel & Co

- 7.2.4.4. OPM Group

- 7.2.1. Labelling Type

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Blisters

- 8.1.2. Vials & Ampoules

- 8.1.3. Injectables

- 8.1.4. Other Product Types (Medical Devices, etc)

- 8.2. Market Analysis, Insights and Forecast - by Labelling

- 8.2.1. Labelling Type

- 8.2.1.1. Pressure Sensitive

- 8.2.1.2. In-Mold

- 8.2.1.3. Shrink-Sleeve

- 8.2.1.4. Glue-Applied

- 8.2.1.5. Others (Custom Die-cut, etc.)

- 8.2.2. Advancem

- 8.2.3. Key regu

- 8.2.4. Key specific manufacturers in Labelling

- 8.2.4.1. WS Packaging

- 8.2.4.2. Schreiner Group

- 8.2.4.3. Faubel & Co

- 8.2.4.4. OPM Group

- 8.2.1. Labelling Type

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Folding Carton in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Blisters

- 9.1.2. Vials & Ampoules

- 9.1.3. Injectables

- 9.1.4. Other Product Types (Medical Devices, etc)

- 9.2. Market Analysis, Insights and Forecast - by Labelling

- 9.2.1. Labelling Type

- 9.2.1.1. Pressure Sensitive

- 9.2.1.2. In-Mold

- 9.2.1.3. Shrink-Sleeve

- 9.2.1.4. Glue-Applied

- 9.2.1.5. Others (Custom Die-cut, etc.)

- 9.2.2. Advancem

- 9.2.3. Key regu

- 9.2.4. Key specific manufacturers in Labelling

- 9.2.4.1. WS Packaging

- 9.2.4.2. Schreiner Group

- 9.2.4.3. Faubel & Co

- 9.2.4.4. OPM Group

- 9.2.1. Labelling Type

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 LGR Packaging

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 DS Smith*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Unipak Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 CCL Industries

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Jones Healthcare Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 August Faller GmbH & co KG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 8 COMPETITIVE LANDSCAPE 8 1 COMPANY PROFILES

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nosco Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Edelmann Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 AR Packaging

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Stora Enso Group

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Big Valley Packaging

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Essentra PLC Keystone Folding Box Company

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Multi Packaging Solutions (WestRock)

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 LGR Packaging

List of Figures

- Figure 1: Global Folding Carton in Healthcare Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Folding Carton in Healthcare Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Folding Carton in Healthcare Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Folding Carton in Healthcare Industry Revenue (Million), by Labelling 2025 & 2033

- Figure 5: North America Folding Carton in Healthcare Industry Revenue Share (%), by Labelling 2025 & 2033

- Figure 6: North America Folding Carton in Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Folding Carton in Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Folding Carton in Healthcare Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Folding Carton in Healthcare Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Folding Carton in Healthcare Industry Revenue (Million), by Labelling 2025 & 2033

- Figure 11: Europe Folding Carton in Healthcare Industry Revenue Share (%), by Labelling 2025 & 2033

- Figure 12: Europe Folding Carton in Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Folding Carton in Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Folding Carton in Healthcare Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Folding Carton in Healthcare Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Folding Carton in Healthcare Industry Revenue (Million), by Labelling 2025 & 2033

- Figure 17: Asia Pacific Folding Carton in Healthcare Industry Revenue Share (%), by Labelling 2025 & 2033

- Figure 18: Asia Pacific Folding Carton in Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Folding Carton in Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Folding Carton in Healthcare Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Rest of the World Folding Carton in Healthcare Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Rest of the World Folding Carton in Healthcare Industry Revenue (Million), by Labelling 2025 & 2033

- Figure 23: Rest of the World Folding Carton in Healthcare Industry Revenue Share (%), by Labelling 2025 & 2033

- Figure 24: Rest of the World Folding Carton in Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Folding Carton in Healthcare Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Labelling 2020 & 2033

- Table 3: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Labelling 2020 & 2033

- Table 6: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Labelling 2020 & 2033

- Table 9: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Labelling 2020 & 2033

- Table 12: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Labelling 2020 & 2033

- Table 15: Global Folding Carton in Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Folding Carton in Healthcare Industry?

The projected CAGR is approximately 5.72%.

2. Which companies are prominent players in the Folding Carton in Healthcare Industry?

Key companies in the market include LGR Packaging, DS Smith*List Not Exhaustive, Unipak Inc, CCL Industries, Jones Healthcare Group, August Faller GmbH & co KG, 8 COMPETITIVE LANDSCAPE 8 1 COMPANY PROFILES, Nosco Inc, Edelmann Group, AR Packaging, Stora Enso Group, Big Valley Packaging, Essentra PLC Keystone Folding Box Company, Multi Packaging Solutions (WestRock).

3. What are the main segments of the Folding Carton in Healthcare Industry?

The market segments include Product Type, Labelling.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Stringent regulations related to discerning key product related information in the field of medical devices; Growing emphasis of monitoring & assisting patient medication; Focus on traceability & anti-counterfeiting in the healthcare sector; Product & Material-based innovations driven by major packaging manufacturers to drive demand.

6. What are the notable trends driving market growth?

Growing Emphasis of Monitoring and Assisting Patient Medication.

7. Are there any restraints impacting market growth?

; High Inventory Costs and Premium Pricing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Folding Carton in Healthcare Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Folding Carton in Healthcare Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Folding Carton in Healthcare Industry?

To stay informed about further developments, trends, and reports in the Folding Carton in Healthcare Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence