Key Insights

The Nigerian plastic packaging films market is set for substantial growth, projected to reach USD 116.7 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.2%. This expansion is primarily driven by increased demand in the food and beverage sector, fueled by growing urbanization and evolving consumer lifestyles leading to higher consumption of packaged goods. The healthcare sector's need for sterile packaging and the rising demand for personal and home care products also contribute significantly. The adoption of advanced films like Polyethylene (PE) and Polypropylene (PP) for enhanced barrier properties and durability, alongside growing interest in bio-based films for sustainability, are key market trends.

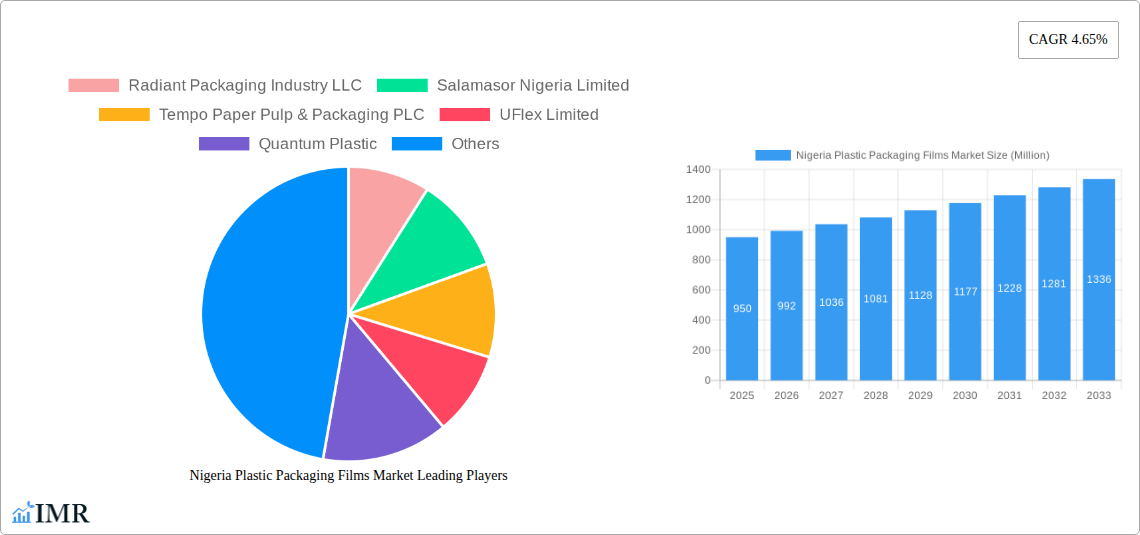

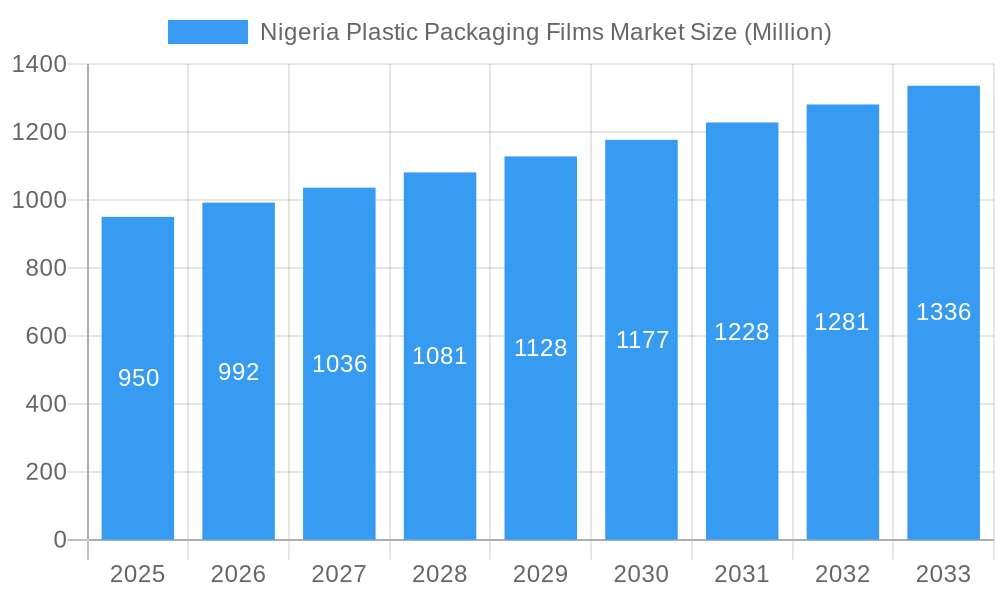

Nigeria Plastic Packaging Films Market Market Size (In Billion)

Key drivers for market growth include Nigeria's expanding middle class, leading to increased per capita consumption of packaged goods. Government initiatives promoting food security and agricultural development also necessitate improved packaging solutions. Industrial packaging for manufacturing and export sectors provides stable demand. Potential restraints include raw material price volatility and evolving environmental regulations. However, the overall market outlook remains positive, driven by strong demographic and economic trends.

Nigeria Plastic Packaging Films Market Company Market Share

Nigeria Plastic Packaging Films Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a meticulous analysis of the Nigeria Plastic Packaging Films Market, encompassing a historical overview from 2019-2024, a base year of 2025, and a detailed forecast period from 2025-2033. It delves into market dynamics, growth trends, dominant segments, product landscapes, key drivers, barriers, opportunities, growth accelerators, and the influential players shaping this vital sector. With a focus on high-traffic keywords such as "Nigeria plastic films," "packaging solutions Nigeria," "polyethylene films," "polypropylene packaging," "flexible packaging Nigeria," and "sustainable packaging Nigeria," this report is optimized for maximum search engine visibility and industry professional engagement. The analysis includes parent and child market perspectives to offer a holistic view, with all values presented in Million units.

Nigeria Plastic Packaging Films Market Market Dynamics & Structure

The Nigeria Plastic Packaging Films Market exhibits a moderately concentrated structure, characterized by the presence of both established multinational corporations and agile local manufacturers. Technological innovation is a key driver, with an increasing focus on developing advanced film formulations that offer enhanced barrier properties, extended shelf life for food products, and improved sustainability profiles. Regulatory frameworks, while evolving, are gradually shaping the market towards more responsible plastic management and recycling initiatives. Competitive product substitutes, including paper-based and biodegradable alternatives, are gaining traction, necessitating continuous innovation and cost-efficiency from plastic packaging film producers. End-user demographics are diverse, with a rapidly growing middle class and an expanding food and beverage industry fueling demand. Mergers and acquisitions (M&A) are observed as key players seek to consolidate market share, expand their product portfolios, and integrate backward into raw material supply chains or forward into specialized converting operations.

- Market Concentration: Dominated by a few key players, with significant room for emerging local businesses.

- Technological Innovation: Driven by demand for high-barrier films, lightweight solutions, and eco-friendly materials.

- Regulatory Landscape: Influenced by governmental policies on plastic waste management and import regulations.

- Competitive Landscape: Facing pressure from alternative packaging materials and the increasing adoption of recycled content.

- End-User Trends: Strong demand from the food & beverage, healthcare, and personal care sectors.

- M&A Activity: Strategic acquisitions to enhance production capacity, market reach, and technological capabilities.

Nigeria Plastic Packaging Films Market Growth Trends & Insights

The Nigeria Plastic Packaging Films Market is poised for robust growth, driven by a confluence of economic development, demographic expansion, and shifting consumer preferences. The market size is projected to witness a significant upward trajectory, fueled by increasing disposable incomes and a burgeoning middle-class population that demands convenient and well-packaged consumer goods. Adoption rates for advanced plastic packaging films are accelerating, particularly within the food and beverage sector, where consumers prioritize hygiene, freshness, and extended shelf life. Technological disruptions are playing a pivotal role, with advancements in extrusion technologies and material science enabling the production of thinner, stronger, and more sustainable packaging films. Consumer behavior shifts are also evident, with a growing awareness of environmental issues influencing purchasing decisions, leading to a higher demand for recyclable and bio-based packaging solutions. The CAGR for the forecast period is estimated to be xx%, indicating substantial market expansion. Market penetration of specialized films, such as those with enhanced oxygen and moisture barriers, is also on the rise, reflecting the increasing sophistication of Nigerian manufacturing and retail sectors.

Dominant Regions, Countries, or Segments in Nigeria Plastic Packaging Films Market

Within the Nigeria Plastic Packaging Films Market, the Food End-user Industry segment is the undisputed leader, exhibiting the strongest growth and commanding the largest market share. This dominance is primarily driven by Nigeria's large and expanding population, coupled with the rapid growth of its food processing and retail sectors. The sheer volume of food products requiring effective, safe, and shelf-life-extending packaging propels demand for various plastic films.

- Food (Candy and Confectionery): This sub-segment is a significant contributor, with impulse purchases and the need for attractive, tamper-evident packaging driving the use of specialized films.

- Food (Frozen Foods): The growing adoption of frozen food products due to convenience and longer storage capabilities necessitates high-barrier films that prevent freezer burn and maintain product quality.

- Food (Fresh Produce): Modified Atmosphere Packaging (MAP) films are increasingly being utilized to extend the shelf life of fruits and vegetables, reducing spoilage and waste.

- Food (Dairy Products): Demand for high-barrier films for milk, yogurt, cheese, and other dairy items is consistent, driven by hygiene requirements and shelf-life considerations.

- Food (Dry Foods): Films offering excellent moisture barrier properties are crucial for packaging grains, pasta, snacks, and other dry goods, preventing spoilage and maintaining freshness.

- Food (Meat, Poultry, and Seafood): The demand for vacuum-sealed and modified atmosphere packaging films is high, ensuring product safety and extending shelf life for these perishable items.

- Food (Pet Food): As pet ownership grows, the demand for durable and barrier-effective packaging for pet food is also on the rise.

- Food (Other Foods): This broad category encompasses various processed and convenience food items, all contributing to the overall demand for plastic packaging films.

The dominance of the food sector is further amplified by supportive economic policies aimed at boosting local food production and processing, coupled with improving retail infrastructure, including supermarkets and modern trade outlets, which rely heavily on effective packaging. The accessibility of raw materials and the presence of key manufacturers catering to this segment also contribute to its leading position.

Nigeria Plastic Packaging Films Market Product Landscape

The product landscape of the Nigeria Plastic Packaging Films Market is characterized by continuous innovation aimed at meeting diverse packaging needs. Leading manufacturers are focusing on developing high-performance films such as advanced polyethylene (PE) and polypropylene (PP) films that offer superior strength, flexibility, and barrier properties. Innovations include multi-layer co-extruded films designed for specific applications, like those providing enhanced oxygen and moisture resistance for perishable foods, or UV protection for sensitive products. The introduction of bio-based and biodegradable film alternatives is also gaining momentum, responding to growing environmental consciousness. Applications range from flexible pouches and bags for snacks and dry goods to shrink films for industrial packaging and specialized films for medical devices and pharmaceutical products. Unique selling propositions often lie in cost-effectiveness, recyclability, and the ability to customize film properties to client specifications, ensuring optimal product protection and extended shelf life.

Key Drivers, Barriers & Challenges in Nigeria Plastic Packaging Films Market

Key Drivers:

The Nigeria Plastic Packaging Films Market is propelled by several key drivers. A rapidly growing population and an expanding middle class are fueling increased demand for packaged consumer goods, particularly food and beverages. The growth of the food processing industry, with its need for effective preservation and extended shelf life, is a significant catalyst. Furthermore, government initiatives promoting local manufacturing and industrialization, alongside increasing investment in the retail sector, are creating a more favorable environment for packaging solutions. Technological advancements enabling the production of lighter, stronger, and more functional films also contribute to market expansion.

Barriers & Challenges:

Despite the growth potential, the market faces significant barriers and challenges. Volatile raw material prices, often linked to global oil markets, can impact manufacturing costs and profitability. Inadequate waste management infrastructure and limited recycling facilities pose a substantial hurdle, leading to environmental concerns and regulatory scrutiny. The availability of imported, lower-cost packaging films can also present competitive pressure for local manufacturers. Additionally, the need for consistent power supply and skilled labor can affect operational efficiency and scalability. Supply chain disruptions, due to logistical complexities and infrastructure limitations, can further impede growth.

Emerging Opportunities in Nigeria Plastic Packaging Films Market

Emerging opportunities in the Nigeria Plastic Packaging Films Market lie in the burgeoning demand for sustainable packaging solutions and innovative applications. The increasing consumer and regulatory pressure for eco-friendly alternatives presents a significant avenue for the growth of bio-based and biodegradable films. Advancements in recycling technologies are creating opportunities for manufacturers to incorporate higher percentages of recycled content into their products, aligning with circular economy principles. The expansion of e-commerce in Nigeria also creates a niche for specialized, durable, and tamper-evident packaging films designed to protect goods during transit. Furthermore, exploring untapped markets within the pharmaceutical and healthcare sectors, where stringent packaging standards are required, offers considerable potential for growth and diversification.

Growth Accelerators in the Nigeria Plastic Packaging Films Market Industry

Several catalysts are accelerating growth within the Nigeria Plastic Packaging Films Market. Technological breakthroughs in extrusion and material science are enabling the development of highly specialized films with enhanced barrier properties, contributing to reduced food spoilage and extended product shelf life. Strategic partnerships between raw material suppliers, film manufacturers, and end-users are fostering innovation and ensuring the development of tailored packaging solutions that meet specific market needs. The growing adoption of automation and advanced manufacturing techniques by key players is enhancing production efficiency and cost-competitiveness. Moreover, market expansion strategies, including the exploration of export opportunities within the wider West African region, are further contributing to the industry's robust growth trajectory.

Key Players Shaping the Nigeria Plastic Packaging Films Market

- Radiant Packaging Industry LLC

- Salamasor Nigeria Limited

- Tempo Paper Pulp & Packaging PLC

- UFlex Limited

- Quantum Plastic

- Luban Packing LL

Notable Milestones in Nigeria Plastic Packaging Films Market Sector

- July 2024: Nigeria initiated a plastic recycling project in collaboration with researchers and university organizations, aiming to establish two recycling micro-factories within university campuses. This project seeks to tailor recycling processes to local demands, bolstering the plastic recycling sector and potentially providing a sustainable supply chain for recycled plastic materials for packaging film manufacturing.

- May 2024: The collaboration between USAID and the Coca-Cola Foundation in Nigeria, through the NPSA (Nigeria Plastic Sustainability Alliance) initiative, aims to recover approximately 49,000 tons of plastic waste. This initiative is expected to significantly increase the availability of recycled plastics in Nigeria, offering a sustainable and cost-effective source of raw materials for plastic packaging film manufacturers, thereby reducing dependency on virgin plastics and supporting environmental sustainability goals.

In-Depth Nigeria Plastic Packaging Films Market Market Outlook

The Nigeria Plastic Packaging Films Market is set for sustained growth, driven by a combination of fundamental economic expansion and a proactive embrace of sustainable practices. The increasing consumer demand for convenient, safe, and well-preserved goods, particularly within the food and beverage sector, forms the bedrock of this market’s potential. As Nigeria continues to develop its industrial base and retail infrastructure, the need for advanced and reliable packaging solutions will only intensify. Emerging opportunities in bio-based materials and the increased integration of recycled content are poised to transform the market, aligning it with global environmental standards and consumer preferences. Strategic investments in localized recycling initiatives and technological advancements will further solidify Nigeria's position as a significant player in the African plastic packaging films landscape, promising a dynamic and opportunity-rich future.

Nigeria Plastic Packaging Films Market Segmentation

-

1. Type

- 1.1. Polyprop

- 1.2. Polyethy

- 1.3. Polyethy

- 1.4. Polystyrene

- 1.5. Bio-Based

- 1.6. PVC, EVOH, PETG, and Other Film Types

-

2. End-user Industry

-

2.1. Food

- 2.1.1. Candy and Confectionery

- 2.1.2. Frozen Foods

- 2.1.3. Fresh Produce

- 2.1.4. Dairy Products

- 2.1.5. Dry Foods

- 2.1.6. Meat, Poultry, and Seafood

- 2.1.7. Pet Food

- 2.1.8. Other Fo

- 2.2. Healthcare

- 2.3. Personal Care and Home Care

- 2.4. Industrial Packaging

- 2.5. Other En

-

2.1. Food

Nigeria Plastic Packaging Films Market Segmentation By Geography

- 1. Niger

Nigeria Plastic Packaging Films Market Regional Market Share

Geographic Coverage of Nigeria Plastic Packaging Films Market

Nigeria Plastic Packaging Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Impact of Rising Adoption of Online Shopping on Market; Capitalizing on Increasing Demand from the Food Industry

- 3.3. Market Restrains

- 3.3.1. Impact of Rising Adoption of Online Shopping on Market; Capitalizing on Increasing Demand from the Food Industry

- 3.4. Market Trends

- 3.4.1. Polyethylene is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Plastic Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polyprop

- 5.1.2. Polyethy

- 5.1.3. Polyethy

- 5.1.4. Polystyrene

- 5.1.5. Bio-Based

- 5.1.6. PVC, EVOH, PETG, and Other Film Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.1.1. Candy and Confectionery

- 5.2.1.2. Frozen Foods

- 5.2.1.3. Fresh Produce

- 5.2.1.4. Dairy Products

- 5.2.1.5. Dry Foods

- 5.2.1.6. Meat, Poultry, and Seafood

- 5.2.1.7. Pet Food

- 5.2.1.8. Other Fo

- 5.2.2. Healthcare

- 5.2.3. Personal Care and Home Care

- 5.2.4. Industrial Packaging

- 5.2.5. Other En

- 5.2.1. Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Radiant Packaging Industry LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Salamasor Nigeria Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tempo Paper Pulp & Packaging PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UFlex Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Quantum Plastic

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Luban Packing LL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Radiant Packaging Industry LLC

List of Figures

- Figure 1: Nigeria Plastic Packaging Films Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Nigeria Plastic Packaging Films Market Share (%) by Company 2025

List of Tables

- Table 1: Nigeria Plastic Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Nigeria Plastic Packaging Films Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Nigeria Plastic Packaging Films Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Nigeria Plastic Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Nigeria Plastic Packaging Films Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Nigeria Plastic Packaging Films Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Plastic Packaging Films Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Nigeria Plastic Packaging Films Market?

Key companies in the market include Radiant Packaging Industry LLC, Salamasor Nigeria Limited, Tempo Paper Pulp & Packaging PLC, UFlex Limited, Quantum Plastic, Luban Packing LL.

3. What are the main segments of the Nigeria Plastic Packaging Films Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 116.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Impact of Rising Adoption of Online Shopping on Market; Capitalizing on Increasing Demand from the Food Industry.

6. What are the notable trends driving market growth?

Polyethylene is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Impact of Rising Adoption of Online Shopping on Market; Capitalizing on Increasing Demand from the Food Industry.

8. Can you provide examples of recent developments in the market?

July 2024: Nigeria has initiated a plastic recycling project in collaboration with researchers and university organizations. The project's primary goal is to establish two recycling micro-factories within university campuses. The overarching objective is to tailor a recycling process to meet local demands, ultimately bolstering Nigeria's plastic recycling sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Plastic Packaging Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Plastic Packaging Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Plastic Packaging Films Market?

To stay informed about further developments, trends, and reports in the Nigeria Plastic Packaging Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence