Key Insights

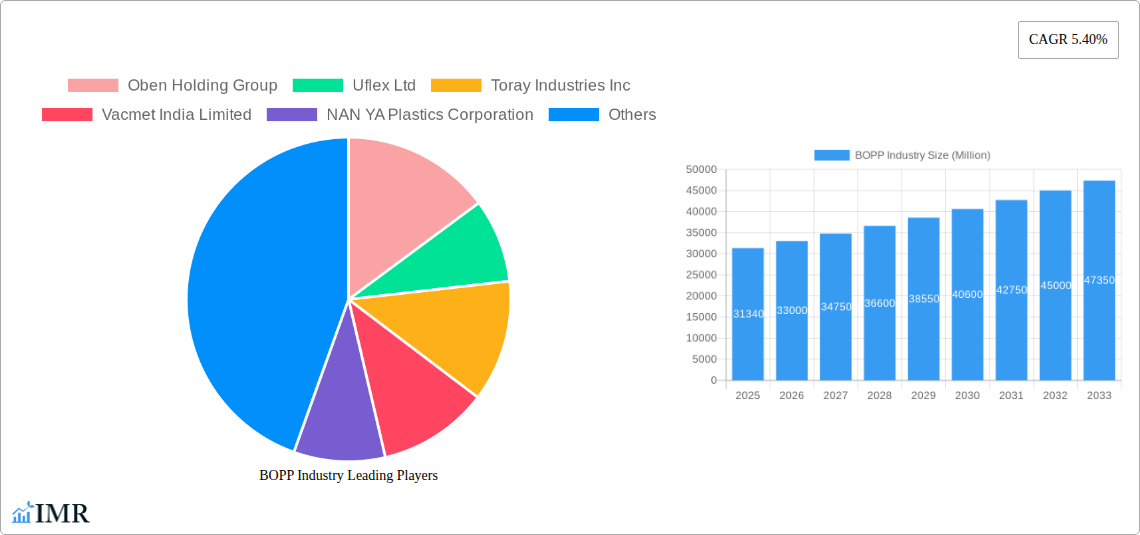

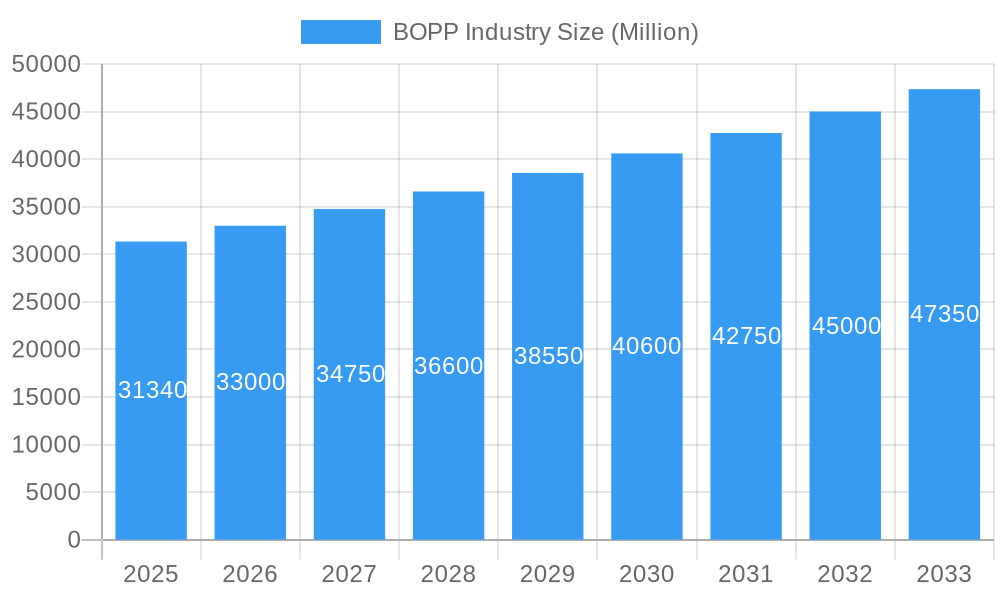

The global BOPP (Biaxially Oriented Polypropylene) film market is poised for robust expansion, estimated to reach $29.74 million with a projected Compound Annual Growth Rate (CAGR) of 5.40% from 2019 to 2033. This significant growth is propelled by a confluence of factors, notably the escalating demand from the food and beverage sector, where BOPP films are indispensable for packaging due to their superior barrier properties, printability, and durability. The pharmaceutical and medical industries are also contributing to this upward trajectory, driven by the need for sterile, tamper-evident packaging. Furthermore, the increasing adoption of advanced packaging solutions across various industrial applications, including textiles, adhesives, and electrical insulation, is fueling market penetration. The market's dynamism is further underscored by emerging trends such as the development of specialized BOPP films with enhanced properties like high clarity, anti-fog, and metallization, catering to niche applications and premium product segments. Innovations in sustainable BOPP production and the increasing focus on recyclable packaging materials are also shaping market dynamics, aligning with global environmental concerns and regulatory pressures.

BOPP Industry Market Size (In Billion)

Despite the optimistic outlook, the BOPP film market encounters certain restraints that could influence its growth trajectory. Volatility in polypropylene resin prices, a key raw material, poses a significant challenge, directly impacting production costs and profit margins for manufacturers. Fluctuations in crude oil prices, the primary source of polypropylene, can lead to unpredictable cost structures. Moreover, the increasing competition from alternative packaging materials, such as polyethylene terephthalate (PET) and biodegradable films, requires continuous innovation and cost-competitiveness from BOPP film producers. The stringent environmental regulations in certain regions concerning plastic waste management and the push towards a circular economy also necessitate significant investment in research and development for more sustainable BOPP solutions. However, the inherent advantages of BOPP films in terms of cost-effectiveness and performance in many applications are expected to mitigate these restraints, ensuring continued market dominance. Key players like Uflex Ltd, Toray Industries Inc, and SRF Limited are actively investing in capacity expansion and product diversification to capitalize on these growth opportunities and navigate market challenges effectively.

BOPP Industry Company Market Share

BOPP Industry Report: Market Dynamics, Growth Trends, and Key Player Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the global Biaxially Oriented Polypropylene (BOPP) film industry, offering critical insights into market dynamics, growth trajectories, technological advancements, and competitive landscapes. Covering the period from 2019 to 2033, with a base year of 2025, this report is an indispensable resource for industry stakeholders, investors, and strategists seeking to navigate and capitalize on the evolving BOPP market.

BOPP Industry Market Dynamics & Structure

The BOPP industry exhibits a moderately concentrated market structure, characterized by the presence of several global leaders alongside a significant number of regional players. Technological innovation is a primary driver, with continuous advancements in film properties, such as enhanced barrier capabilities, improved printability, and specialized functionalities like heat sealability and anti-fogging. Regulatory frameworks, particularly concerning food safety, environmental sustainability, and recycling initiatives, significantly influence product development and market entry. Competitive product substitutes, including PET, CPP, and other flexible packaging materials, exert pressure on BOPP's market share, necessitating ongoing innovation and cost optimization. End-user demographics are shifting, with a growing demand for convenience, shelf-life extension, and aesthetically appealing packaging across various sectors. Mergers and acquisitions (M&A) are observed as a strategic approach for companies to expand their geographical reach, enhance their product portfolios, and achieve economies of scale. For instance, recent M&A activities indicate a trend towards consolidation to gain a competitive edge in the burgeoning flexible packaging market.

- Market Concentration: Moderate to high, with key players holding substantial market shares.

- Technological Innovation Drivers: Development of high-performance films, sustainable solutions, and specialty grades.

- Regulatory Frameworks: Stringent regulations on food contact materials and increasing emphasis on recyclability.

- Competitive Product Substitutes: PET films, CPP films, and other flexible packaging materials.

- End-User Demographics: Growing demand from food & beverage, pharmaceutical, and industrial sectors.

- M&A Trends: Consolidation to gain market share and expand product offerings.

BOPP Industry Growth Trends & Insights

The global BOPP industry is projected to witness robust growth over the forecast period (2025–2033), driven by escalating demand from key end-user verticals and expanding applications. The market size is expected to evolve from approximately 23,500 Million units in the base year 2025 to an estimated 31,200 Million units by 2033, showcasing a Compound Annual Growth Rate (CAGR) of approximately 3.7%. Adoption rates are steadily increasing, particularly in developing economies, where the rise of organized retail and the demand for packaged goods are creating significant opportunities. Technological disruptions are playing a crucial role, with the development of thinner, stronger, and more sustainable BOPP films that cater to evolving consumer preferences and environmental concerns. For example, advancements in metallization techniques and coating technologies are enhancing the barrier properties of BOPP, thereby extending product shelf life and reducing food waste. Consumer behavior shifts towards convenience, on-the-go consumption, and enhanced product visibility are further fueling the demand for flexible packaging solutions that BOPP films excel in providing. The increasing penetration of e-commerce also contributes to this growth, as BOPP films are widely used in protective packaging for shipped goods. Furthermore, the growing awareness and adoption of sustainable packaging solutions are pushing manufacturers to develop recyclable and compostable BOPP alternatives, which is creating a new wave of innovation and market expansion. The interplay between these factors – market size evolution, adoption rates, technological disruptions, and consumer behavior shifts – paints a promising picture for the BOPP industry's sustained expansion.

Dominant Regions, Countries, or Segments in BOPP Industry

The Food segment stands out as the dominant end-user vertical within the BOPP industry, consistently driving market growth and innovation. This dominance is attributed to several key factors, including the vast global demand for packaged food products, the critical need for extended shelf life, and the requirement for visually appealing packaging that attracts consumers. The food industry's reliance on BOPP films for applications such as snack packaging, confectionery wrapping, frozen food pouches, and fresh produce bags is immense. The inherent properties of BOPP films – their excellent moisture and aroma barrier, printability, and cost-effectiveness – make them an ideal choice for preserving food quality and extending shelf life, thereby reducing food spoilage and waste.

- Key Drivers for Food Segment Dominance:

- Growing Global Population and Food Consumption: A continuously expanding population necessitates increased production and packaging of food items.

- Rise of Organized Retail and Supermarkets: These channels require pre-packaged goods with enhanced shelf appeal and tamper-evident features.

- Demand for Convenience and Ready-to-Eat Meals: BOPP films are crucial for the packaging of single-serve and convenience food products.

- Extended Shelf Life Requirements: BOPP's barrier properties are vital for maintaining food freshness and reducing spoilage.

- Cost-Effectiveness: BOPP offers a favorable cost-to-performance ratio compared to many alternatives.

- Aesthetic Appeal and Printability: High-quality printing capabilities on BOPP films enhance brand visibility and consumer attraction.

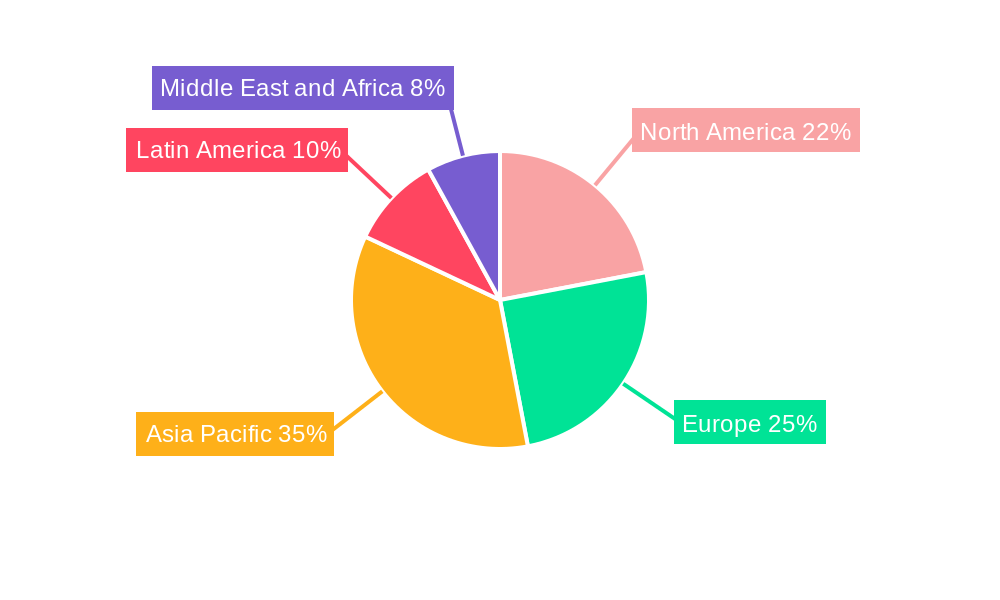

Geographically, Asia Pacific emerges as the leading region for BOPP market growth. This prominence is fueled by rapid industrialization, a burgeoning middle class with increasing disposable income, and a significant expansion in the food and beverage sector. Countries like China and India are major contributors, with their vast populations and growing demand for packaged goods. Government initiatives promoting manufacturing and foreign investment further bolster the growth in this region. The infrastructure development in these countries also supports the efficient distribution of packaged products.

BOPP Industry Product Landscape

The BOPP industry is characterized by a diverse and evolving product landscape, driven by continuous innovation to meet varied end-use demands. Key product categories include plain BOPP films, metallized BOPP films, and coated BOPP films. Plain BOPP films offer excellent clarity, stiffness, and printability, making them suitable for general packaging applications. Metallized BOPP films provide enhanced barrier properties against light, moisture, and oxygen, crucial for extending the shelf life of food products and for applications like snack packaging. Coated BOPP films incorporate various coatings (e.g., acrylic, PVDC) to impart specific properties such as improved heat sealability, enhanced barrier performance, or anti-static characteristics. Recent product innovations have focused on developing thinner, stronger films to reduce material usage and improve sustainability, as well as specialized films for electrical applications, such as the metalized electrical grade BOPP films for capacitor manufacturing launched by Cosmo Films. These advancements underscore the industry's commitment to high-performance materials and niche market development.

Key Drivers, Barriers & Challenges in BOPP Industry

Key Drivers:

- Growing Demand for Flexible Packaging: The inherent advantages of BOPP, such as its lightweight nature, durability, and excellent barrier properties, continue to drive demand across various sectors.

- Expansion of Food & Beverage Industry: The increasing global consumption of packaged foods and beverages directly fuels the need for BOPP films.

- Technological Advancements: Innovations in film properties, such as enhanced barrier, printability, and sustainability features, create new application opportunities.

- Growth in E-commerce: The rise of online retail necessitates robust and protective packaging solutions, where BOPP plays a significant role.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in polypropylene prices, a key feedstock, can impact production costs and profitability.

- Environmental Concerns and Sustainability Pressure: Increasing scrutiny over plastic waste and demand for recyclable or biodegradable alternatives pose a significant challenge, requiring substantial investment in R&D for sustainable solutions.

- Intense Competition: The presence of numerous global and regional players leads to price pressures and the need for continuous product differentiation.

- Regulatory Hurdles: Evolving regulations concerning food contact materials, recycling mandates, and environmental impact can necessitate product reformulation and process adjustments.

Emerging Opportunities in BOPP Industry

Emerging opportunities in the BOPP industry lie in the growing demand for sustainable and recyclable packaging solutions. The development of advanced recycling technologies and the creation of mono-material BOPP films that can be easily integrated into existing recycling streams present a significant avenue for growth. Furthermore, the expansion of BOPP applications in niche sectors like medical packaging, where stringent barrier and sterilization properties are required, offers untapped potential. The increasing adoption of electric vehicles and renewable energy systems is also creating demand for specialized electrical grade BOPP films for capacitor manufacturing, a segment seeing significant innovation. The growing middle class in emerging economies, with their rising disposable incomes and preference for convenience and branded goods, presents a vast untapped market for flexible packaging.

Growth Accelerators in the BOPP Industry Industry

Several factors are acting as accelerators for sustained growth in the BOPP industry. Technological breakthroughs in film extrusion, metallization, and coating technologies are enabling the production of high-performance BOPP films with superior barrier properties and enhanced functionality, opening doors to new and demanding applications. Strategic partnerships between BOPP manufacturers and converters, as well as with end-users, are fostering collaborative innovation and faster market penetration of new products. Market expansion into developing economies, driven by increasing consumer demand for packaged goods and improving retail infrastructure, is a significant growth catalyst. Furthermore, the increasing focus on circular economy principles and the development of truly recyclable BOPP solutions are not only addressing environmental concerns but also creating a competitive advantage for proactive companies.

Key Players Shaping the BOPP Industry Market

- Oben Holding Group

- Uflex Ltd

- Toray Industries Inc

- Vacmet India Limited

- NAN YA Plastics Corporation

- Biofilm SA

- Altopro SA de C

- SRF Limited

- Trefan Group

- Polyplex Corporation Ltd

- Tatrafan SRO

- Taghleef Industries LLC

- Jindal Poly Film

Notable Milestones in BOPP Industry Sector

- December 2023: Cosmo Films launched Metalised Electrical grade BOPP films for Capacitor applications, catering to diverse electronic and industrial needs.

- August 2022: SRF Limited announced a project to establish a second BOPP film line and metallizer in Indore, India, to meet growing domestic and international demand.

In-Depth BOPP Industry Market Outlook

The BOPP industry is poised for continued expansion, driven by innovation and evolving market demands. The report forecasts a positive outlook, with growth accelerators including the development of high-performance, sustainable films, and the expansion of applications in specialized sectors. Strategic partnerships and the increasing adoption of circular economy principles will further fuel this growth. The increasing disposable incomes and urbanization in emerging markets will continue to boost demand for flexible packaging. Investment in advanced manufacturing technologies and R&D for eco-friendly alternatives will be crucial for companies to maintain a competitive edge. The industry is expected to witness a sustained CAGR of around 3.7% from 2025 to 2033, indicating a healthy and growing market for BOPP solutions.

BOPP Industry Segmentation

-

1. End-user Vertical

- 1.1. Food

- 1.2. Beverage

- 1.3. Pharmaceutical and Medical

- 1.4. Industrial

- 1.5. Other End-user Verticals

BOPP Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Mexico

- 4.4. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Egypt

- 5.4. Rest of Middle East and Africa

BOPP Industry Regional Market Share

Geographic Coverage of BOPP Industry

BOPP Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand For Packaged Food; Environmental Regulation Paving Way for Flexible Packaging Requirements (over Rigid Packaging Materials); Steady Rise in Demand from Emerging Regions

- 3.3. Market Restrains

- 3.3.1. Fluctuations in the Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Beverage Vertical is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global BOPP Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.1.1. Food

- 5.1.2. Beverage

- 5.1.3. Pharmaceutical and Medical

- 5.1.4. Industrial

- 5.1.5. Other End-user Verticals

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6. North America BOPP Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.1.1. Food

- 6.1.2. Beverage

- 6.1.3. Pharmaceutical and Medical

- 6.1.4. Industrial

- 6.1.5. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 7. Europe BOPP Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.1.1. Food

- 7.1.2. Beverage

- 7.1.3. Pharmaceutical and Medical

- 7.1.4. Industrial

- 7.1.5. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 8. Asia Pacific BOPP Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.1.1. Food

- 8.1.2. Beverage

- 8.1.3. Pharmaceutical and Medical

- 8.1.4. Industrial

- 8.1.5. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 9. Latin America BOPP Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.1.1. Food

- 9.1.2. Beverage

- 9.1.3. Pharmaceutical and Medical

- 9.1.4. Industrial

- 9.1.5. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 10. Middle East and Africa BOPP Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.1.1. Food

- 10.1.2. Beverage

- 10.1.3. Pharmaceutical and Medical

- 10.1.4. Industrial

- 10.1.5. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Oben Holding Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Uflex Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Toray Industries Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Vacmet India Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NAN YA Plastics Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Biofilm SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Altopro SA de C

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SRF Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Trefan Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Polyplex Corporation Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tatrafan SRO

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Taghleef Industries LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Jindal Poly Film

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Oben Holding Group

List of Figures

- Figure 1: Global BOPP Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America BOPP Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 3: North America BOPP Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 4: North America BOPP Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America BOPP Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe BOPP Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 7: Europe BOPP Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: Europe BOPP Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe BOPP Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific BOPP Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 11: Asia Pacific BOPP Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 12: Asia Pacific BOPP Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific BOPP Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America BOPP Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 15: Latin America BOPP Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Latin America BOPP Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America BOPP Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa BOPP Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 19: Middle East and Africa BOPP Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 20: Middle East and Africa BOPP Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa BOPP Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global BOPP Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 2: Global BOPP Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global BOPP Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global BOPP Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global BOPP Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global BOPP Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global BOPP Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 16: Global BOPP Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: China BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: India BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Australia BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global BOPP Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 23: Global BOPP Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Brazil BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Argentina BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Latin America BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global BOPP Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 29: Global BOPP Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Saudi Arabia BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: South Africa BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Egypt BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa BOPP Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the BOPP Industry?

The projected CAGR is approximately 5.40%.

2. Which companies are prominent players in the BOPP Industry?

Key companies in the market include Oben Holding Group, Uflex Ltd, Toray Industries Inc, Vacmet India Limited, NAN YA Plastics Corporation, Biofilm SA, Altopro SA de C, SRF Limited, Trefan Group, Polyplex Corporation Ltd, Tatrafan SRO, Taghleef Industries LLC, Jindal Poly Film.

3. What are the main segments of the BOPP Industry?

The market segments include End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand For Packaged Food; Environmental Regulation Paving Way for Flexible Packaging Requirements (over Rigid Packaging Materials); Steady Rise in Demand from Emerging Regions.

6. What are the notable trends driving market growth?

Beverage Vertical is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Fluctuations in the Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

December 2023 - Cosmo Films, one of the global leaders in specialty films for packaging, labeling, synthetic paper, and lamination applications, launched Metalised Electrical grade BOPP films for Capacitor application. These Films are used for Capacitor manufacturing of various types of AC and DC Capacitors. These Capacitors have diverse applications ranging from Electronics appliances, Industrial applications, Power Electronics, Automobile, Electric Vehicles, Renewable Power systems, etc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "BOPP Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the BOPP Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the BOPP Industry?

To stay informed about further developments, trends, and reports in the BOPP Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence