Key Insights

The French rigid plastic packaging market is set for sustained growth, with an estimated market size of 220.2 billion by 2025, reflecting a compound annual growth rate (CAGR) of 3.6. Key sectors driving this expansion include food & beverage, healthcare, and cosmetics. The food industry, particularly dairy, frozen foods, and fresh produce, heavily utilizes bottles, jars, trays, and containers. The beverage sector's demand for PET bottles for soft drinks, juices, and water further fuels market growth. The healthcare industry's need for sterile pharmaceutical and medical device packaging, coupled with the cosmetic sector's requirement for attractive and functional solutions, are also significant growth drivers. Innovations in material science, leading to lighter, more sustainable, and higher-performance rigid plastic packaging, also support market expansion.

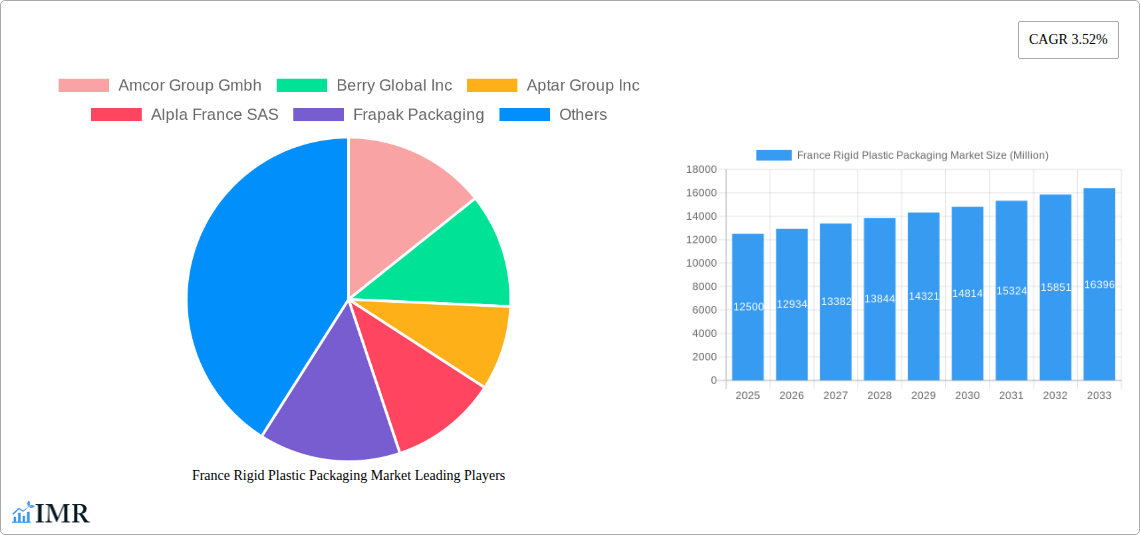

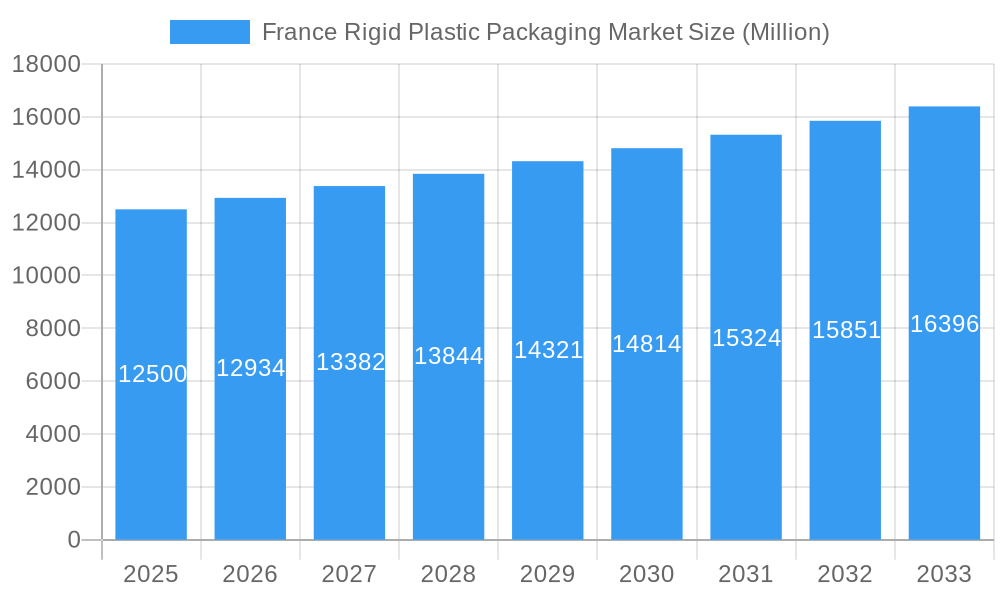

France Rigid Plastic Packaging Market Market Size (In Billion)

Several factors influence the French rigid plastic packaging market. Growing consumer demand for convenience and portability in food and beverages favors rigid packaging formats like single-serving containers and ready-to-drink bottles. Increased e-commerce penetration across industries necessitates secure and durable packaging, with Intermediate Bulk Containers (IBCs) and drums playing a crucial role in logistics. However, the market faces challenges, including stringent environmental regulations and heightened consumer awareness of plastic waste, driving the adoption of sustainable practices such as recycled content and the development of recyclable or biodegradable alternatives. Fluctuations in raw material prices for Polyethylene (PE) and Polypropylene (PP) can affect production costs. Despite these restraints, product design innovation, material technology advancements, and strategic collaborations among industry leaders are expected to maintain the market's positive trajectory.

France Rigid Plastic Packaging Market Company Market Share

France Rigid Plastic Packaging Market: Comprehensive Analysis, Growth Trends, and Future Outlook (2019–2033)

This in-depth report provides a comprehensive analysis of the France Rigid Plastic Packaging Market, offering critical insights into market dynamics, growth trends, regional dominance, and the competitive landscape. Leveraging extensive data from 2019 to 2033, with a base year of 2025, this report serves as an indispensable resource for industry professionals, investors, and stakeholders seeking to understand the evolving dynamics of rigid plastic packaging solutions in France. We delve into key segments including rigid plastic bottles and jars, trays and containers, caps and closures, intermediate bulk containers (IBCs), drums, pallets, and other rigid plastic packaging products. The report meticulously examines market penetration across polyethylene (PE) (LDPE and LLDPE, HDPE), polyethylene terephthalate (PET), polypropylene (PP), polystyrene (PS) and expanded polystyrene (EPS), polyvinyl chloride (PVC), and other rigid plastic materials. Furthermore, it provides granular analysis across critical end-use industries such as Food (Candy and Confectionery, Frozen Foods, Fresh Produce, Dairy Products, Dry Foods, Meat, Poultry, and Seafood, Pet Food, Other Food), Foodservice (Quick Service Restaurants (QSRs), Full-Service Restaurants (FSRs), Coffee and Snack Outlets, Retail Establishments, Institutional, Hospitality, Other Foodservice End-uses), Beverage, Healthcare, Cosmetics and Personal Care, Industrial, Building and Construction, Automotive, and Other End-use Industries. With a forecast period extending to 2033, this report is your definitive guide to navigating the opportunities and challenges within the French rigid plastic packaging sector. All values are presented in Million units.

France Rigid Plastic Packaging Market Market Dynamics & Structure

The France Rigid Plastic Packaging Market is characterized by a moderate to high level of concentration, driven by the presence of several large, established players and a growing number of specialized manufacturers. Technological innovation plays a pivotal role, with a significant focus on sustainability, lightweighting, and enhanced barrier properties for diverse applications. Regulatory frameworks, particularly those concerning circular economy initiatives, plastic waste reduction, and recycled content mandates, are increasingly shaping market strategies and product development. Competitive product substitutes, such as glass, metal, and paperboard packaging, exert pressure, especially in niche segments, driving the need for continuous improvement in plastic packaging performance and cost-effectiveness. End-user demographics are shifting towards greater demand for convenience, safety, and eco-friendly solutions, influencing product design and material choices. Merger and acquisition (M&A) trends are observed as companies seek to expand their product portfolios, gain market share, and enhance their sustainability credentials. The market is influenced by factors such as the increasing adoption of rigid plastic bottles and jars in the beverage and personal care sectors, and the rising demand for trays and containers in the food industry.

- Market Concentration: Dominated by global and regional players, with opportunities for specialized manufacturers.

- Innovation Drivers: Focus on bio-based plastics, recycled content integration, and advanced barrier technologies.

- Regulatory Impact: Stringent EU and French regulations promoting recyclability and reduced virgin plastic use.

- Competitive Landscape: Competition from alternative packaging materials and evolving consumer preferences.

- M&A Activity: Strategic acquisitions to bolster product offerings and sustainability initiatives.

France Rigid Plastic Packaging Market Growth Trends & Insights

The France Rigid Plastic Packaging Market has witnessed a steady evolution, driven by a confluence of technological advancements, shifting consumer behaviors, and evolving regulatory landscapes. The market size has expanded consistently, fueled by the sustained demand from key end-use industries like food, beverage, and healthcare. Adoption rates for innovative packaging solutions, particularly those incorporating recycled content and lightweighting technologies, have accelerated. Technological disruptions are primarily centered around the development of advanced polymers, improved recycling processes, and the integration of smart packaging features. Consumer behavior is increasingly leaning towards sustainability, convenience, and product safety, prompting manufacturers to prioritize eco-friendly materials and designs. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 3.5% over the forecast period. This growth is underpinned by the continued reliance on rigid plastic packaging for product protection, shelf-life extension, and efficient logistics. Specific metrics indicate a growing preference for polyethylene terephthalate (PET) for beverage bottles due to its recyclability and transparency, and polypropylene (PP) for food containers owing to its heat resistance and durability. The demand for caps and closures remains robust, driven by the vast array of packaged goods.

Dominant Regions, Countries, or Segments in France Rigid Plastic Packaging Market

The Food end-use industry stands out as the dominant segment within the France Rigid Plastic Packaging Market, significantly driving growth and innovation. This dominance is attributed to several interconnected factors, including the sheer volume of food products requiring protective and convenient packaging, evolving consumer lifestyles, and stringent food safety regulations. Within the broader food category, specific sub-segments like Frozen Foods and Fresh Produce are showcasing particularly strong growth, necessitating specialized rigid plastic packaging solutions that ensure product integrity and extend shelf life. The increasing popularity of convenience foods and ready-to-eat meals further bolsters the demand for sophisticated trays and containers. The Beverage sector also represents a substantial contributor, with rigid plastic bottles and jars (primarily PET) being the preferred choice for a wide range of beverages due to their lightweight, shatterproof nature, and excellent recyclability.

- Food End-use Industry:

- Key Drivers: High consumption volume, demand for extended shelf life, food safety compliance, and consumer preference for convenience.

- Sub-segments Driving Growth: Frozen Foods, Fresh Produce, Dairy Products, and Dry Foods.

- Packaging Solutions: Dominance of Trays and Containers, Bottles and Jars, and Caps and Closures.

- Beverage End-use Industry:

- Key Drivers: Growing demand for bottled water, soft drinks, and juices; focus on lightweight and sustainable packaging.

- Packaging Solutions: Predominance of Bottles and Jars made from PET.

- Material Dominance:

- Polyethylene Terephthalate (PET): Leading material for beverage bottles and certain food containers due to its transparency and recyclability.

- Polypropylene (PP): Gaining traction for food containers and trays due to its heat resistance and chemical inertness.

- Polyethylene (PE): Widely used for various applications, including bottles, drums, and other containers, with HDPE and LLDPE offering distinct properties.

- Product Segment Impact:

- Bottles and Jars: Essential for beverages, food, and personal care products, exhibiting sustained demand.

- Trays and Containers: Crucial for food packaging, particularly for ready-to-eat meals, fresh produce, and frozen foods.

France Rigid Plastic Packaging Market Product Landscape

The product landscape of the France Rigid Plastic Packaging Market is characterized by a strong emphasis on innovative designs, functional enhancements, and sustainability. Bottles and Jars remain a cornerstone, with advancements in lightweighting and barrier technologies to preserve product freshness and extend shelf life, particularly in the beverage and cosmetics sectors. Trays and Containers are evolving with improved sealing capabilities and aesthetically pleasing designs for ready-to-eat meals and premium food products. Caps and Closures are witnessing innovations in child-resistance, tamper-evidence, and tamper-evident features, alongside the integration of sustainable materials. Intermediate Bulk Containers (IBCs) and Drums are seeing advancements in durability, ease of handling, and improved safety features for industrial and chemical applications. The overarching trend is towards solutions that offer enhanced performance, reduced material usage, and improved end-of-life recyclability, aligning with stringent environmental regulations and growing consumer demand for eco-conscious packaging.

Key Drivers, Barriers & Challenges in France Rigid Plastic Packaging Market

Key Drivers:

The France Rigid Plastic Packaging Market is propelled by several significant drivers. The growing demand for convenience and extended shelf life across the food and beverage industries is a primary catalyst. Increasing consumer awareness and preference for products packaged in safe, hygienic, and durable materials further fuels demand. Regulatory push towards increased recyclability and the integration of recycled content in packaging solutions acts as a major innovation driver. The lightweight nature of rigid plastics contributes to reduced transportation costs and a lower carbon footprint, making them attractive for various applications. Furthermore, the cost-effectiveness and versatility of rigid plastic packaging materials like PET and PP continue to make them a preferred choice for manufacturers across diverse sectors.

Barriers & Challenges:

Despite robust growth, the market faces significant barriers and challenges. Negative public perception and environmental concerns surrounding plastic waste and pollution pose a considerable hurdle. Stringent regulations, while driving innovation, also present compliance challenges and can increase production costs. Fluctuations in raw material prices, particularly for crude oil derivatives, can impact profitability. The need for significant investment in advanced recycling infrastructure and technologies to achieve circular economy goals remains a challenge. Competition from alternative packaging materials, such as glass and paper, particularly in segments with strong sustainability mandates, also presents a restraint. Supply chain disruptions and geopolitical uncertainties can further impact the availability and cost of raw materials and finished products.

Emerging Opportunities in France Rigid Plastic Packaging Market

Emerging opportunities within the France Rigid Plastic Packaging Market are largely driven by the burgeoning demand for sustainable and innovative packaging solutions. The increasing adoption of bio-based and compostable rigid plastics presents a significant avenue for growth, catering to the conscious consumer and stringent environmental regulations. The development of advanced recycling technologies, enabling higher percentages of post-consumer recycled (PCR) content in rigid plastic packaging, offers a pathway to a more circular economy and enhanced market appeal. Innovations in smart packaging, incorporating features like traceability, authentication, and interactive elements, are opening new possibilities, especially within the food and healthcare sectors. Furthermore, the expansion of e-commerce necessitates robust and protective rigid plastic packaging that can withstand the rigors of shipping, creating demand for specialized solutions. The growing trend of premiumization in the cosmetics and personal care market is also driving the need for aesthetically appealing and functional rigid plastic packaging.

Growth Accelerators in the France Rigid Plastic Packaging Market Industry

Several key factors are accelerating growth within the France Rigid Plastic Packaging Market. The continuous innovation in material science, leading to the development of enhanced performance plastics with improved barrier properties, lighter weight, and greater recyclability, is a significant accelerator. Strategic partnerships between packaging manufacturers, material suppliers, and end-users are fostering collaborative efforts to develop bespoke and sustainable solutions, driving market penetration. The increasing investment in research and development by major players to create next-generation packaging technologies, including advanced recycling and bioplastic integration, is paving the way for future growth. Furthermore, supportive government policies and incentives aimed at promoting a circular economy and reducing plastic waste are encouraging market expansion and adoption of sustainable practices. The growing global focus on reducing food waste also translates to increased demand for rigid plastic packaging that offers superior product protection and extended shelf life.

Key Players Shaping the France Rigid Plastic Packaging Market Market

- Amcor Group Gmbh

- Berry Global Inc

- Aptar Group Inc

- Alpla France SAS

- Frapak Packaging

- Axium Packaging

- Retal Group

- PDG Plastiques

- ActiPack SAS

- Pinard Beauty Pack

- SCHUTZ France SAS

- Caps Packaging

- Greif France SAS

Notable Milestones in France Rigid Plastic Packaging Market Sector

- July 2024: Coverpla, in collaboration with Terre d’Oc, a natural beauty and lifestyle brand hailing from the French Provence, unveiled a refillable bottle and a cap crafted from bio-based resin. Following this, Coverpla broadened its eco-design initiative by introducing a range of caps that boast a diminished carbon footprint. Terre d’Oc selected the Lord cap, molded from PHA. Derived from rapeseed oil, PHAs are biopolymers that not only mirror the mechanical properties of PE but also offer compostability.

- June 2024: Carbios developed a biologically recycled plastic bottle for L’Occitane en Provence. The French technology firm crafted a transparent PET container specifically for L’Occitane's Amande shower oil. The production process commenced with sourcing local PET waste, including multi-layer trays, which were sent to Carbios' industrial demonstrator in Clermont-Ferrand. These resins were subsequently blow-molded into bottles by Pinard Beauty Pack in Oyonnax, adhering to L’Occitane’s precise specifications.

In-Depth France Rigid Plastic Packaging Market Market Outlook

The future outlook for the France Rigid Plastic Packaging Market is characterized by robust growth and transformative innovation. The market is set to be driven by an accelerated shift towards sustainable packaging solutions, with bio-based materials, advanced recycling, and the incorporation of high percentages of post-consumer recycled content becoming standard. Technological breakthroughs in material science will continue to enhance the performance and versatility of rigid plastics, enabling their application in new and demanding sectors. Strategic collaborations between industry players, research institutions, and regulatory bodies will be crucial in navigating the complexities of the circular economy. Emerging opportunities lie in smart packaging, personalized packaging solutions, and the development of lightweight yet highly durable packaging for the burgeoning e-commerce sector. The market's ability to adapt to evolving consumer preferences for convenience, safety, and environmental responsibility will ultimately shape its trajectory towards a more sustainable and innovative future.

France Rigid Plastic Packaging Market Segmentation

-

1. Product

- 1.1. Bottles and Jars

- 1.2. Trays and Containers

- 1.3. Caps and Closures

- 1.4. Intermediate Bulk Containers (IBCs)

- 1.5. Drums

- 1.6. Pallets

- 1.7. Other Pr

-

2. Material

-

2.1. Polyethylene (PE)

- 2.1.1. LDPE and LLDPE

- 2.1.2. HDPE

- 2.2. Polyethylene Terephthalate (PET)

- 2.3. Polypropylene (PP)

- 2.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 2.5. Polyvinyl Chloride (PVC)

- 2.6. Other Ri

-

2.1. Polyethylene (PE)

-

3. End-use Industry

-

3.1. Food

- 3.1.1. Candy and Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, and Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

-

3.2. Foodservice

- 3.2.1. Quick Service Restaurants (QSRs)

- 3.2.2. Full-Service Restaurants (FSRs)

- 3.2.3. Coffee and Snack Outlets

- 3.2.4. Retail Establishments

- 3.2.5. Institutional

- 3.2.6. Hospitality

- 3.2.7. Other Foodservice End-uses

- 3.3. Beverage

- 3.4. Healthcare

- 3.5. Cosmetics and Personal Care

- 3.6. Industri

- 3.7. Building and Construction

- 3.8. Automotive

- 3.9. Other En

-

3.1. Food

France Rigid Plastic Packaging Market Segmentation By Geography

- 1. France

France Rigid Plastic Packaging Market Regional Market Share

Geographic Coverage of France Rigid Plastic Packaging Market

France Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector

- 3.3. Market Restrains

- 3.3.1. Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector

- 3.4. Market Trends

- 3.4.1. Beverage Sector Is Set to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Bottles and Jars

- 5.1.2. Trays and Containers

- 5.1.3. Caps and Closures

- 5.1.4. Intermediate Bulk Containers (IBCs)

- 5.1.5. Drums

- 5.1.6. Pallets

- 5.1.7. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyethylene (PE)

- 5.2.1.1. LDPE and LLDPE

- 5.2.1.2. HDPE

- 5.2.2. Polyethylene Terephthalate (PET)

- 5.2.3. Polypropylene (PP)

- 5.2.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 5.2.5. Polyvinyl Chloride (PVC)

- 5.2.6. Other Ri

- 5.2.1. Polyethylene (PE)

- 5.3. Market Analysis, Insights and Forecast - by End-use Industry

- 5.3.1. Food

- 5.3.1.1. Candy and Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, and Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Foodservice

- 5.3.2.1. Quick Service Restaurants (QSRs)

- 5.3.2.2. Full-Service Restaurants (FSRs)

- 5.3.2.3. Coffee and Snack Outlets

- 5.3.2.4. Retail Establishments

- 5.3.2.5. Institutional

- 5.3.2.6. Hospitality

- 5.3.2.7. Other Foodservice End-uses

- 5.3.3. Beverage

- 5.3.4. Healthcare

- 5.3.5. Cosmetics and Personal Care

- 5.3.6. Industri

- 5.3.7. Building and Construction

- 5.3.8. Automotive

- 5.3.9. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor Group Gmbh

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Global Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aptar Group Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alpla France SAS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frapak Packaging

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Axium Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Retal Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PDG Plastiques

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ActiPack SAS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pinard Beauty Pack

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SCHUTZ France SAS

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Caps Packaging

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Greif France SAS7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Amcor Group Gmbh

List of Figures

- Figure 1: France Rigid Plastic Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Rigid Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: France Rigid Plastic Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: France Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: France Rigid Plastic Packaging Market Revenue billion Forecast, by End-use Industry 2020 & 2033

- Table 4: France Rigid Plastic Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: France Rigid Plastic Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: France Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: France Rigid Plastic Packaging Market Revenue billion Forecast, by End-use Industry 2020 & 2033

- Table 8: France Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Rigid Plastic Packaging Market?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the France Rigid Plastic Packaging Market?

Key companies in the market include Amcor Group Gmbh, Berry Global Inc, Aptar Group Inc, Alpla France SAS, Frapak Packaging, Axium Packaging, Retal Group, PDG Plastiques, ActiPack SAS, Pinard Beauty Pack, SCHUTZ France SAS, Caps Packaging, Greif France SAS7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the France Rigid Plastic Packaging Market?

The market segments include Product, Material, End-use Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 220.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector.

6. What are the notable trends driving market growth?

Beverage Sector Is Set to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector.

8. Can you provide examples of recent developments in the market?

July 2024: Coverpla, in collaboration with Terre d’Oc, a natural beauty and lifestyle brand hailing from the French Provence, unveiled a refillable bottle and a cap crafted from bio-based resin. Following this, Coverpla broadened its eco-design initiative by introducing a range of caps that boast a diminished carbon footprint. Terre d’Oc selected the Lord cap, molded from PHA. Derived from rapeseed oil, PHAs are biopolymers that not only mirror the mechanical properties of PE but also offer compostability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the France Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence