Key Insights

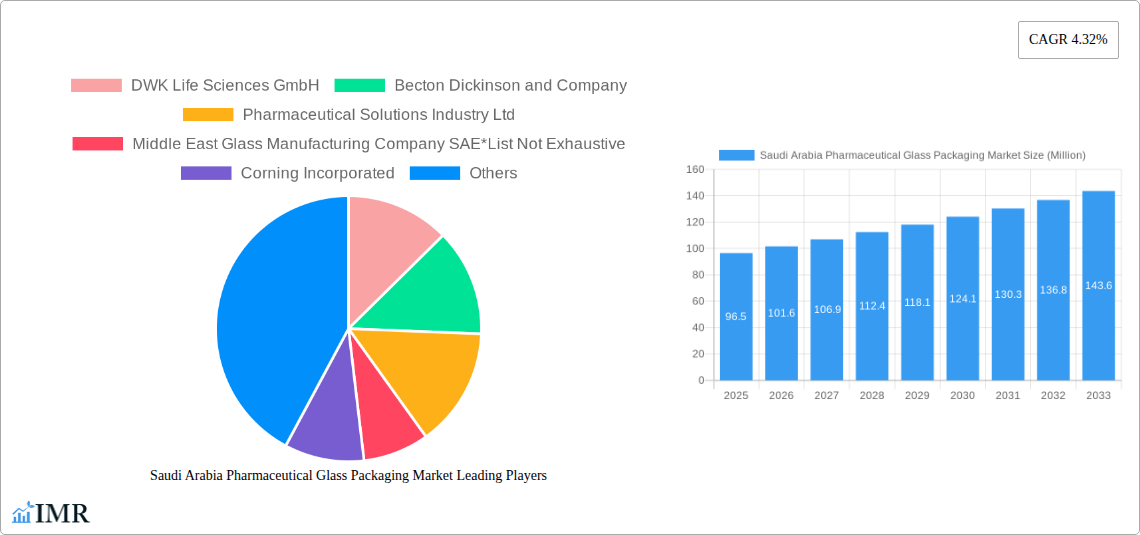

The Saudi Arabia Pharmaceutical Glass Packaging Market is projected for substantial growth, reaching an estimated $96.5 million by 2025 and is expected to grow at a CAGR of 5.24% from 2025 to 2033. This expansion is driven by significant healthcare infrastructure investments, increasing demand for premium pharmaceuticals, and a growing domestic drug manufacturing sector. Saudi Arabia's Vision 2030 initiative, focused on economic diversification and industry localization, is a key catalyst, promoting local production and advanced packaging adoption. Rising chronic disease prevalence, requiring consistent medication supply, and the preference for glass packaging's inertness, barrier properties, and perceived quality for ensuring drug integrity and patient safety further contribute to market growth.

Saudi Arabia Pharmaceutical Glass Packaging Market Market Size (In Million)

Key trends influencing the Saudi Arabian pharmaceutical glass packaging sector include rising demand for Type I borosilicate glass, crucial for sensitive biologicals and parenteral drugs. Vials and bottles are anticipated to lead in product segments, serving diverse pharmaceutical formulations. The increasing emphasis on branded and biological drugs, necessitating superior packaging, will fuel market expansion. Potential challenges include volatile raw material costs and dynamic regulatory environments. Nevertheless, strategic investments in advanced manufacturing and a focus on sustainable packaging are expected to foster innovation and market penetration, positioning Saudi Arabia as a significant regional player in pharmaceutical packaging.

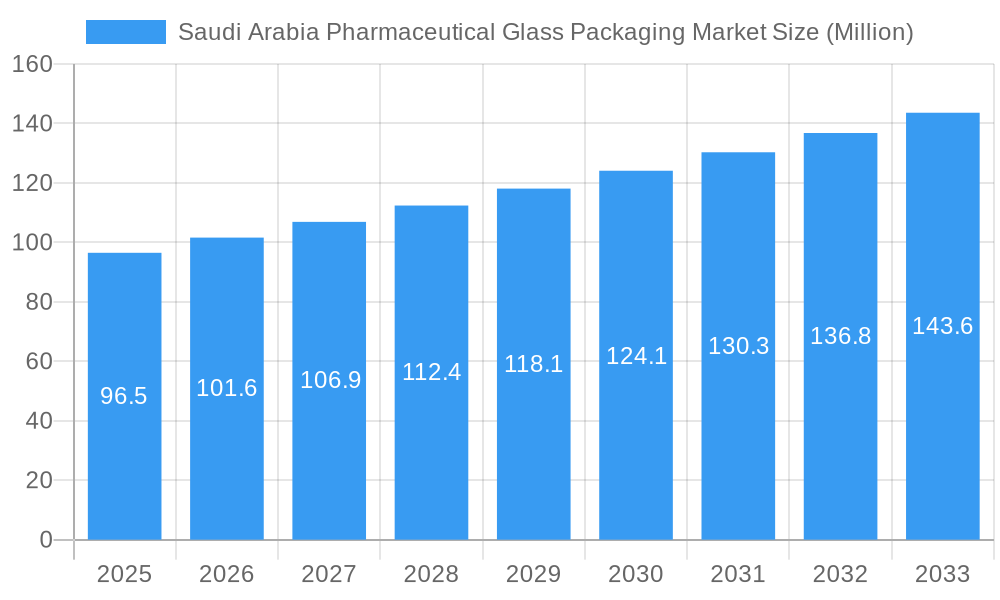

Saudi Arabia Pharmaceutical Glass Packaging Market Company Market Share

Unveiling the Saudi Arabia Pharmaceutical Glass Packaging Market: Growth, Innovations, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the Saudi Arabia Pharmaceutical Glass Packaging Market, a critical sector supporting the Kingdom's burgeoning healthcare industry. With a study period spanning from 2019 to 2033, including a detailed base year of 2025, this report provides invaluable insights into market dynamics, growth trends, dominant segments, and the competitive landscape. We meticulously examine the parent and child market structures, offering a granular understanding of the forces shaping this essential industry. Leveraging high-traffic keywords such as "Saudi Arabia pharmaceutical packaging," "glass vials market," "drug containers Saudi Arabia," and "healthcare packaging trends," this report is optimized for maximum search engine visibility and engagement for industry professionals, investors, and stakeholders. All values are presented in million units for clarity and comparability.

Saudi Arabia Pharmaceutical Glass Packaging Market Market Dynamics & Structure

The Saudi Arabia Pharmaceutical Glass Packaging Market exhibits a moderately concentrated structure, with a few key players holding significant market share, alongside a growing number of specialized manufacturers catering to niche demands. Technological innovation serves as a primary driver, with advancements in glass formulations for enhanced drug stability and safety, and sophisticated manufacturing processes to meet stringent international standards. The regulatory framework, spearheaded by bodies like the Saudi Food and Drug Authority (SFDA), plays a crucial role in dictating quality, safety, and packaging requirements, fostering a demand for high-compliance glass packaging solutions. Competitive product substitutes, such as plastic and other materials, exist but often fall short in providing the inertness and barrier properties essential for sensitive pharmaceutical formulations. End-user demographics, characterized by a growing, aging population and increasing prevalence of chronic diseases, are driving demand for a wider range of pharmaceutical products, consequently boosting the need for specialized glass packaging. Mergers and acquisitions (M&A) trends are expected to shape the market, with larger entities potentially acquiring smaller, innovative firms to expand their product portfolios and market reach.

- Market Concentration: Dominated by established players with a focus on quality and large-scale production.

- Technological Innovation: Driven by demand for enhanced drug protection, sterile packaging, and improved tamper-evident features.

- Regulatory Framework: SFDA compliance is paramount, influencing material selection, manufacturing processes, and product certifications.

- Competitive Landscape: While glass offers superior protection, advancements in alternative materials pose a competitive challenge.

- End-User Demographics: An aging population and rising chronic disease rates fuel demand for diverse pharmaceutical formulations.

- M&A Trends: Potential for consolidation as companies seek to enhance market presence and technological capabilities.

Saudi Arabia Pharmaceutical Glass Packaging Market Growth Trends & Insights

The Saudi Arabia Pharmaceutical Glass Packaging Market is poised for significant expansion, driven by a confluence of factors including robust government initiatives to bolster the domestic pharmaceutical industry, increasing healthcare expenditure, and a growing emphasis on patient safety and drug efficacy. The market size evolution is a testament to the Kingdom's strategic vision for healthcare self-sufficiency, attracting substantial investments in local manufacturing capabilities. Adoption rates for advanced pharmaceutical glass packaging solutions are steadily rising, propelled by the demand for sterile, inert, and chemically resistant containers that preserve the integrity of sensitive medications, including biologics and highly potent drugs. Technological disruptions, such as advancements in barrier coatings and specialized glass compositions like Type I borosilicate glass, are enhancing product performance and enabling the packaging of more complex pharmaceutical formulations. Consumer behavior shifts are also playing a pivotal role; patients and healthcare providers alike are increasingly prioritizing the reliability and safety offered by glass packaging over perceived cost-effectiveness of alternatives for critical medications. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period, reflecting sustained demand and investment. Market penetration of high-quality pharmaceutical glass packaging is projected to reach 85% by 2033, underscoring its indispensable role in the Kingdom's healthcare ecosystem.

Dominant Regions, Countries, or Segments in Saudi Arabia Pharmaceutical Glass Packaging Market

Within the Saudi Arabia Pharmaceutical Glass Packaging Market, Vials emerge as the dominant product type segment, propelled by their ubiquitous use in parenteral drug delivery systems, including vaccines, antibiotics, and critical care medications. The rising demand for biopharmaceuticals and the expanding vaccine manufacturing initiatives in the region further solidify the supremacy of the vials segment. Complementing this, Type I glass, renowned for its exceptional chemical resistance and thermal stability, is the most sought-after glass type, crucial for packaging highly sensitive and potent drugs where drug-product interactions must be minimized.

The Kingdom's strategic push towards Biological applications, driven by significant investments in biotechnology and the production of advanced therapies, significantly fuels the demand for specialized glass packaging, particularly vials and cartridges. This aligns with global trends in personalized medicine and the increasing development of complex biological drugs that require inert and high-purity packaging.

- Dominant Product Type: Vials are the leading segment due to their extensive application in injectable pharmaceuticals, vaccines, and biologics.

- Key Drivers: Increasing demand for parenteral drugs, growth in the biopharmaceutical sector, and vaccine production initiatives.

- Market Share: Estimated to capture over 35% of the overall product type market.

- Dominant Glass Type: Type I glass commands the largest share owing to its superior inertness and resistance to chemical attack.

- Key Drivers: Essential for packaging sensitive drugs, biologics, and highly potent active pharmaceutical ingredients (HPAPIs).

- Market Share: Projected to hold approximately 45% of the glass type market.

- Dominant Application Type: Biological applications are witnessing rapid growth, driven by advancements in biotechnology and the development of novel therapies.

- Key Drivers: Government support for the life sciences sector, increasing R&D investments, and a growing prevalence of chronic and autoimmune diseases requiring biological treatments.

- Market Share: Expected to grow at a CAGR of over 6.5% during the forecast period.

- Geographic Focus: Major metropolitan areas like Riyadh, Jeddah, and Dammam, due to the concentration of pharmaceutical manufacturing facilities and healthcare infrastructure, are the primary consumption hubs.

- Key Drivers: Availability of skilled labor, established logistics networks, and government incentives for industrial development.

Saudi Arabia Pharmaceutical Glass Packaging Market Product Landscape

The product landscape of the Saudi Arabia Pharmaceutical Glass Packaging Market is characterized by a strong emphasis on quality, safety, and compliance. Manufacturers are increasingly focusing on producing vials, bottles, and ampoules made from Type I and Type II borosilicate glass, offering superior chemical inertness and hydrolytic resistance. Innovations include the development of specialized coatings to further enhance barrier properties and reduce drug-leaching, alongside advancements in tamper-evident closures and integrated drug delivery systems like pre-filled syringes and cartridges. Performance metrics are closely scrutinized, with a focus on dimensional accuracy, low particle counts, and sterilization compatibility to meet the stringent demands of injectable and sensitive pharmaceutical formulations. The market is witnessing a rise in customized packaging solutions tailored to specific drug characteristics and patient needs, underscoring a commitment to both efficacy and patient safety.

Key Drivers, Barriers & Challenges in Saudi Arabia Pharmaceutical Glass Packaging Market

Key Drivers:

The Saudi Arabia Pharmaceutical Glass Packaging Market is propelled by several key drivers. Foremost is the Saudi Vision 2030, which prioritizes the localization of pharmaceutical manufacturing, fostering a robust domestic demand for high-quality packaging solutions. Increasing healthcare expenditure and a growing, aging population with a higher incidence of chronic diseases are also significant growth catalysts. Furthermore, the stringent regulatory environment, coupled with a global emphasis on drug safety and efficacy, mandates the use of inert and reliable packaging like pharmaceutical glass. Technological advancements in glass production and sterilization techniques are enabling manufacturers to meet the evolving needs of complex drug formulations, including biologics and biosimilars.

Barriers & Challenges:

Despite the positive growth trajectory, the market faces several barriers and challenges. The cost of raw materials, particularly specialized glass components, can be a significant restraint. Supply chain disruptions, as highlighted by global events, can impact the availability and timely delivery of essential packaging materials, leading to production delays. Intense competition from alternative packaging materials, such as high-barrier plastics, while often perceived as more cost-effective, presents a persistent challenge, particularly for less sensitive drug formulations. Navigating complex and evolving regulatory landscapes, both domestically and internationally, requires continuous investment in compliance and quality control. Fluctuations in foreign exchange rates can also impact the cost of imported raw materials and finished goods, posing economic uncertainties for market players.

Emerging Opportunities in Saudi Arabia Pharmaceutical Glass Packaging Market

Emerging opportunities within the Saudi Arabia Pharmaceutical Glass Packaging Market are diverse and promising. The burgeoning biopharmaceutical sector presents a significant avenue for growth, with an increasing demand for specialized vials and cartridges for advanced therapies and biologics. The push towards generics and biosimilars, driven by government initiatives to reduce healthcare costs, will further fuel the demand for reliable and cost-effective glass packaging. Untapped markets in specialized packaging for sensitive ophthalmic and dermatological preparations also hold considerable potential. Furthermore, the adoption of smart packaging solutions, incorporating features like track-and-trace capabilities and temperature monitoring, represents an innovative application area that can enhance patient safety and supply chain integrity. Evolving consumer preferences for premium, safe, and sustainable packaging options also present an opportunity for manufacturers to differentiate their offerings.

Growth Accelerators in the Saudi Arabia Pharmaceutical Glass Packaging Market Industry

Several catalysts are accelerating the growth of the Saudi Arabia Pharmaceutical Glass Packaging Market. Government support through industrial development programs and incentives for local manufacturing is a significant accelerator, encouraging investment and capacity expansion. The continuous influx of foreign direct investment into the Kingdom's pharmaceutical sector directly translates into increased demand for sophisticated glass packaging. Strategic partnerships between local packaging manufacturers and international pharmaceutical giants facilitate technology transfer and access to global best practices, enhancing product quality and innovation. Market expansion strategies, including the development of new product lines and the exploration of export opportunities within the GCC region, are also contributing to sustained growth. The increasing focus on R&D within the Saudi pharmaceutical industry necessitates the use of advanced packaging materials, thereby driving demand for high-performance glass solutions.

Key Players Shaping the Saudi Arabia Pharmaceutical Glass Packaging Market Market

- DWK Life Sciences GmbH

- Becton Dickinson and Company

- Pharmaceutical Solutions Industry Ltd

- Middle East Glass Manufacturing Company SAE

- Corning Incorporated

- GlaxoSmithKline PLC

Notable Milestones in Saudi Arabia Pharmaceutical Glass Packaging Market Sector

- November 2022: Saudi Pharmaceutical Industries & Medical Appliances Corporation (Spimaco) invested SAR 272 million (USD 73 million) in a new factory in the Qassim region, supported by AstraZeneca. This investment is expected to create opportunities for various glass packaging companies in the country, particularly for the production of hazardous medications.

In-Depth Saudi Arabia Pharmaceutical Glass Packaging Market Market Outlook

The Saudi Arabia Pharmaceutical Glass Packaging Market is projected to experience robust growth, driven by the nation's ambitious healthcare diversification strategy and increasing investments in domestic pharmaceutical production. The growing demand for biologics, vaccines, and generics, coupled with stringent regulatory requirements, will continue to favor high-quality glass packaging solutions. Strategic partnerships, technological advancements in specialty glass manufacturing, and the increasing adoption of sustainable packaging practices are expected to shape the market's future. Opportunities lie in catering to the evolving needs of advanced therapies, developing innovative drug delivery systems, and leveraging digital technologies for enhanced supply chain visibility. The market's outlook is highly positive, indicating sustained expansion and a pivotal role in supporting the Kingdom's evolving healthcare landscape.

Saudi Arabia Pharmaceutical Glass Packaging Market Segmentation

-

1. Glass Type

- 1.1. Type I

- 1.2. Type II

- 1.3. Type III

-

2. Product Type

- 2.1. Bottles and Containers

- 2.2. Vials

- 2.3. Ampoules

- 2.4. Cartridges and Syringes

- 2.5. Other Product Types

-

3. Application Type

- 3.1. Branded

- 3.2. Biological

- 3.3. Generic

Saudi Arabia Pharmaceutical Glass Packaging Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Pharmaceutical Glass Packaging Market Regional Market Share

Geographic Coverage of Saudi Arabia Pharmaceutical Glass Packaging Market

Saudi Arabia Pharmaceutical Glass Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Pharmaceutical Sector in the Country; Recyclability Increasing the Commodity Value of Glass

- 3.3. Market Restrains

- 3.3.1. Presence of Relevant Alternate Material Sources; Concerns Regarding Glass Surface may Restrict the Market Growth

- 3.4. Market Trends

- 3.4.1. Growth of the Pharmaceutical Sector in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Pharmaceutical Glass Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Glass Type

- 5.1.1. Type I

- 5.1.2. Type II

- 5.1.3. Type III

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles and Containers

- 5.2.2. Vials

- 5.2.3. Ampoules

- 5.2.4. Cartridges and Syringes

- 5.2.5. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Branded

- 5.3.2. Biological

- 5.3.3. Generic

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Glass Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DWK Life Sciences GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Becton Dickinson and Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pharmaceutical Solutions Industry Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Middle East Glass Manufacturing Company SAE*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Corning Incorporated

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GlaxoSmithKline PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 DWK Life Sciences GmbH

List of Figures

- Figure 1: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Pharmaceutical Glass Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Glass Type 2020 & 2033

- Table 2: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 4: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Glass Type 2020 & 2033

- Table 6: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 8: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Pharmaceutical Glass Packaging Market?

The projected CAGR is approximately 5.24%.

2. Which companies are prominent players in the Saudi Arabia Pharmaceutical Glass Packaging Market?

Key companies in the market include DWK Life Sciences GmbH, Becton Dickinson and Company, Pharmaceutical Solutions Industry Ltd, Middle East Glass Manufacturing Company SAE*List Not Exhaustive, Corning Incorporated, GlaxoSmithKline PLC.

3. What are the main segments of the Saudi Arabia Pharmaceutical Glass Packaging Market?

The market segments include Glass Type, Product Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 96.5 million as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Pharmaceutical Sector in the Country; Recyclability Increasing the Commodity Value of Glass.

6. What are the notable trends driving market growth?

Growth of the Pharmaceutical Sector in the Country.

7. Are there any restraints impacting market growth?

Presence of Relevant Alternate Material Sources; Concerns Regarding Glass Surface may Restrict the Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: A total of SAR 272 million (USD 73 million) was invested in the construction of the new factory in the Qassim region by Saudi Pharmaceutical Industries & Medical Appliances Corporation (Spimaco), a market player in the Kingdom's pharmaceutical industries sector. AstraZeneca, a prominent worldwide pharmaceutical company, helped establish the new 2,800 square meter plant, producing many hazardous medications. The investment would provide opportunities to various glass packaging companies in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Pharmaceutical Glass Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Pharmaceutical Glass Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Pharmaceutical Glass Packaging Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Pharmaceutical Glass Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence