Key Insights

The Polish container glass market is projected for substantial expansion, expected to reach approximately $106.36 billion by 2025. This growth is driven by a Compound Annual Growth Rate (CAGR) of 8.6% between 2025 and 2033. Key demand drivers include the rapidly expanding beverage sector, encompassing both alcoholic and non-alcoholic products, and the food industry's increasing adoption of premium and sustainable packaging. The cosmetics and pharmaceuticals sectors are also contributing due to glass's inert, aesthetic, and hygienic properties. Growing middle-class populations and emerging economies further fuel demand for packaged goods, while glass's inherent recyclability and environmental appeal solidify its market position.

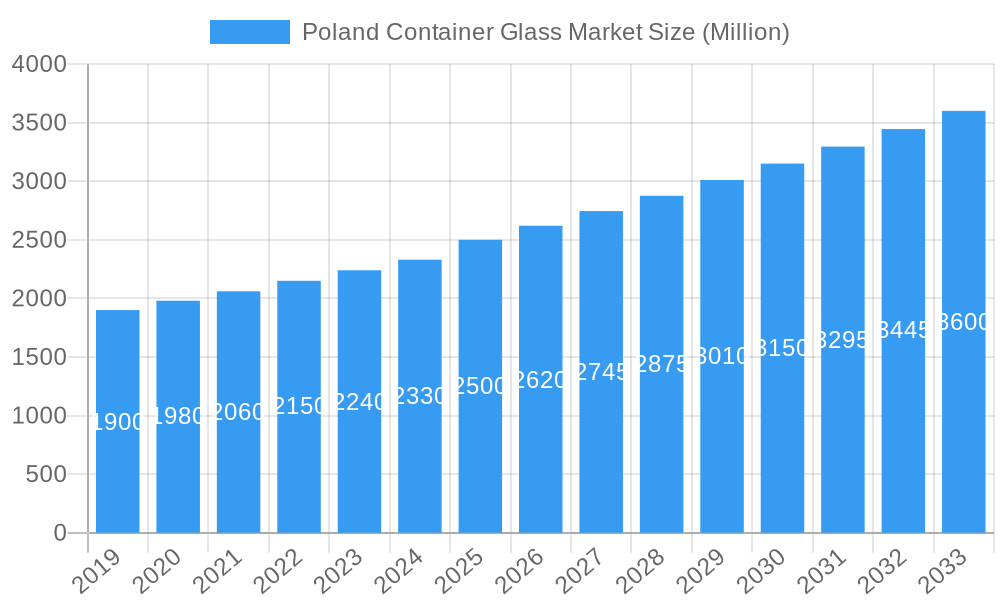

Poland Container Glass Market Market Size (In Billion)

Potential market restraints include the volatility of raw material costs, such as soda ash and silica sand, and fluctuations in energy prices. Intense competition from established players like HEINZ GLAS DZIALDOWO SP Z O O and Ardagh Glass S.A., as well as emerging entrants, requires ongoing innovation and operational efficiency. However, advancements in glass manufacturing, including enhanced energy efficiency and lightweight designs, are expected to offset these challenges. Poland's robust industrial base and strategic European location offer significant advantages for both domestic sales and exports, further supported by the increasing consumer preference for eco-friendly packaging.

Poland Container Glass Market Company Market Share

Poland Container Glass Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report delivers a thorough examination of the Poland container glass market, providing critical insights into market dynamics, growth trends, regional dominance, product landscape, key players, and future opportunities. With a detailed forecast period from 2025 to 2033 and historical analysis from 2019 to 2024, this study leverages base year data from 2025 to offer robust projections and strategic guidance. The report is meticulously structured to assist industry professionals, investors, and stakeholders in understanding the evolving glass packaging market in Poland, with a focus on food and beverage glass bottles, cosmetic glass packaging, and pharmaceutical glass containers. All values are presented in million units.

Poland Container Glass Market Dynamics & Structure

The Poland container glass market is characterized by a moderately concentrated structure, with a few major players holding significant market share. Technological innovation, particularly in areas like lightweighting, enhanced barrier properties, and decorative finishing, is a key driver shaping product development and consumer preferences. The regulatory framework in Poland, aligned with EU directives on packaging and waste, influences manufacturing processes and sustainability initiatives, pushing for increased recycled content and reduced environmental impact. Competitive product substitutes, such as PET bottles and aluminum cans, present a constant challenge, necessitating continuous innovation in glass's inherent advantages like inertness, premium appeal, and recyclability. End-user demographics, with a growing middle class and an increasing demand for premium products, are positively impacting the glass container market. Merger and acquisition (M&A) trends are observed, aiming to consolidate market presence, expand product portfolios, and achieve economies of scale.

- Market Concentration: Dominated by a few large-scale manufacturers, but with a growing number of specialized and regional players.

- Technological Innovation: Focus on lightweighting, improved strength, and advanced surface treatments for enhanced aesthetics and functionality.

- Regulatory Framework: Stringent adherence to EU environmental and packaging directives, promoting sustainable production and recycling.

- Competitive Landscape: Competition from PET, aluminum, and cartons necessitates continuous value proposition enhancement for glass.

- End-User Demographics: Rising disposable incomes and a preference for premium packaging in food and beverage sectors.

- M&A Activity: Strategic acquisitions aimed at market expansion and portfolio diversification.

Poland Container Glass Market Growth Trends & Insights

The Poland container glass market is poised for sustained growth driven by evolving consumer preferences and expanding end-user industries. The market size evolution is expected to reflect an upward trajectory, fueled by the inherent premium appeal of glass packaging in sectors like alcoholic beverages and cosmetics. Adoption rates of glass packaging are projected to rise, particularly as manufacturers prioritize sustainability and brand differentiation. Technological disruptions are anticipated to include advancements in energy-efficient manufacturing processes, smart glass technologies, and innovative designs that cater to niche market demands. Consumer behavior shifts are playing a crucial role, with a growing emphasis on health and wellness driving demand for glass packaging in the food and beverage segments, especially for products perceived as natural and high-quality. The CAGR (Compound Annual Growth Rate) of the Poland container glass market is estimated to be robust, indicating significant expansion potential over the forecast period. Market penetration of specialized glass solutions for sectors like pharmaceuticals is also expected to increase, owing to stringent quality and safety requirements. The increasing trend of e-commerce also presents opportunities, with advancements in protective packaging and bottle designs suitable for online distribution. The demand for eco-friendly and recyclable packaging solutions is a significant catalyst for the growth of the glass packaging solutions in Poland.

Dominant Regions, Countries, or Segments in Poland Container Glass Market

The Beverage segment, encompassing both Alcoholic Beverages and Non-Alcoholic Beverages, is the dominant force driving growth within the Poland container glass market. This segment's supremacy is attributed to several interconnected factors, including a strong Polish tradition of beer and spirits consumption, a burgeoning craft beverage industry, and increasing demand for premium and aesthetically pleasing packaging. The alcoholic beverage market, in particular, benefits from the cultural significance of certain drinks and the consumer's perception of glass as the material that best preserves quality and flavor.

Alcoholic Beverages:

- Key Drivers: High consumption rates of beer, vodka, and wine; increasing popularity of craft breweries and distilleries; demand for premium and gift-able packaging.

- Market Share: Constitutes a significant portion of the overall container glass demand in Poland.

- Growth Potential: Continued expansion of the craft beverage sector and a steady demand for traditional spirits.

Non-Alcoholic Beverages:

- Key Drivers: Growing health consciousness leading to demand for juices and functional beverages; increased consumption of premium bottled water; innovation in soft drink packaging.

- Market Share: A substantial and growing contributor to the market.

- Growth Potential: Increasing consumer preference for natural and healthy drinks, driving demand for glass bottles.

While the Food segment also represents a significant market share, and the Cosmetics and Pharmaceuticals segments offer high-value niche opportunities, the sheer volume and consistent demand from the beverage sector firmly establish its leadership. Economic policies supporting the food and beverage industry, coupled with robust infrastructure for distribution, further amplify the dominance of this segment. The ability of glass to convey quality, preserve freshness, and offer a superior unboxing experience makes it the preferred choice for many beverage brands seeking to differentiate themselves in a competitive marketplace. The continuous innovation in bottle design and functionality within the beverage industry ensures sustained demand and growth for container glass manufacturers in Poland.

Poland Container Glass Market Product Landscape

The Poland container glass market product landscape is characterized by a wide array of innovative and application-specific solutions. Manufacturers are focusing on developing lightweight glass bottles and jars that reduce transportation costs and environmental impact without compromising strength. Advanced barrier coatings and treatments are being implemented to enhance product shelf life and protect sensitive contents, particularly in the food and beverage and pharmaceutical sectors. Decorative capabilities are also a key focus, with techniques such as embossing, debossing, and advanced printing allowing brands to create visually appealing and premium packaging that enhances brand recognition. The performance metrics for container glass are constantly being optimized for durability, thermal resistance, and chemical inertness. Unique selling propositions include the inherent recyclability of glass, its inertness ensuring no chemical leaching into contents, and its premium tactile and visual appeal, making it ideal for high-value products. Technological advancements are leading to more complex shapes and functionalities, catering to specialized market needs.

Key Drivers, Barriers & Challenges in Poland Container Glass Market

Key Drivers:

- Growing Demand for Premium Packaging: Consumers associate glass with quality, luxury, and health, particularly in the food and beverage and cosmetics industries.

- Sustainability and Recyclability: The increasing global focus on environmental responsibility drives demand for infinitely recyclable materials like glass.

- Brand Differentiation: Unique bottle designs and aesthetic appeal offered by glass packaging allow brands to stand out.

- Food and Beverage Industry Growth: Expansion of the Polish food and beverage sector, including a thriving craft beer and spirits market, fuels demand.

Barriers & Challenges:

- Competition from Alternative Packaging: PET bottles and aluminum cans offer lighter weight and lower cost, posing a significant competitive threat.

- Energy Costs: The glass manufacturing process is energy-intensive, making it susceptible to fluctuations in energy prices.

- Logistics and Transportation Costs: The weight of glass packaging can increase shipping expenses compared to lighter alternatives.

- Breakage and Damage: Fragility remains a concern, requiring robust packaging and careful handling throughout the supply chain.

- Recycling Infrastructure Limitations: While glass is recyclable, efficient collection and processing infrastructure can sometimes be a bottleneck.

Emerging Opportunities in Poland Container Glass Market

Emerging opportunities in the Poland container glass market lie in the growing demand for sustainable and aesthetically pleasing packaging solutions. The expansion of the e-commerce sector presents a significant avenue, with the development of specialized, impact-resistant glass packaging designed for safe online delivery. Innovations in smart glass technologies, such as those offering extended shelf-life indicators or tamper-evident features, are also creating new market niches. Furthermore, the increasing consumer interest in artisanal and local products, particularly in the food and beverage and cosmetics sectors, provides an opportunity for customized and premium glass packaging that emphasizes heritage and quality. The potential for increased use of recycled glass content (cullet) in manufacturing also aligns with environmental regulations and consumer preferences, presenting a cost-saving and eco-friendly opportunity.

Growth Accelerators in the Poland Container Glass Market Industry

Several catalysts are accelerating the growth of the Poland container glass market. Technological breakthroughs in manufacturing efficiency, such as advancements in furnace design and automation, are reducing production costs and enhancing output. Strategic partnerships between glass manufacturers and brands, focused on co-development of innovative packaging solutions, are driving market penetration and consumer appeal. Market expansion strategies, including targeting emerging export markets for Polish-produced glass containers and developing specialized packaging for niche product categories within the food, beverage, cosmetics, and pharmaceutical sectors, are also contributing significantly. The increasing investment in research and development to create lighter, stronger, and more sustainable glass packaging further propels the industry forward, ensuring its continued relevance and growth in a competitive packaging landscape.

Key Players Shaping the Poland Container Glass Market Market

- HEINZ GLAS DZIALDOWO SP Z O O

- Ardagh Glass S A

- CAN-PACK S A

- TREND GLASS SP Z O O

- EUROVERLUX SP Z O O

- HUTA SZKLA CZECHY S A

- Stoelzle Cz?stochowa Sp z o o

- BA GLASS POLAND Sp z o o

- C P Glass S A

- O-I Produkction Polska S A (O-I Glass Inc)

Notable Milestones in Poland Container Glass Market Sector

- June 2022: Łomża Brewery launched its Łomża Jasne beer in a premium new glass bottle design, featuring modern, sleek aesthetics and embossed branding. This product innovation, developed in collaboration with Ardagh Group in Poland, highlights the growing emphasis on premium packaging within the alcoholic beverage sector.

In-Depth Poland Container Glass Market Market Outlook

The Poland container glass market is projected for significant future potential, driven by a confluence of factors including robust demand from the food and beverage industries, increasing consumer preference for sustainable and premium packaging, and ongoing technological advancements. Strategic opportunities lie in capitalizing on the growing e-commerce market with specialized protective glass packaging, and in further developing smart glass solutions. The drive towards higher recycled content in manufacturing presents both an environmental and economic advantage. Continued investment in innovation and capacity expansion by key players will be crucial in navigating competitive pressures and solidifying Poland's position as a key player in the European container glass landscape.

Poland Container Glass Market Segmentation

-

1. End-user Industry

-

1.1. Beverage

- 1.1.1. Alcoholic Beverages

- 1.1.2. Non-Alcoholic Beverages

- 1.2. Food

- 1.3. Cosmetics

- 1.4. Pharmaceuticals

- 1.5. Other End user Industries

-

1.1. Beverage

Poland Container Glass Market Segmentation By Geography

- 1. Poland

Poland Container Glass Market Regional Market Share

Geographic Coverage of Poland Container Glass Market

Poland Container Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing wine production in Poland; Increasing Adoption of Glass Container Packaging in Personal Care

- 3.3. Market Restrains

- 3.3.1. High Carbon Footprint due to Glass Manufacturing; Operation and Logistical Concerns

- 3.4. Market Trends

- 3.4.1. Emergence of White Wine and Innovative Wine Drinks to Boost the Studied Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Container Glass Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Beverage

- 5.1.1.1. Alcoholic Beverages

- 5.1.1.2. Non-Alcoholic Beverages

- 5.1.2. Food

- 5.1.3. Cosmetics

- 5.1.4. Pharmaceuticals

- 5.1.5. Other End user Industries

- 5.1.1. Beverage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 HEINZ GLAS DZIALDOWO SP Z O O

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ardagh Glass S A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CAN-PACK S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TREND GLASS SP Z O O*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 EUROVERLUX SP Z O O

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HUTA SZKLA CZECHY S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Stoelzle Cz?stochowa Sp z o o

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BA GLASS POLAND Sp z o o

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 C P Glass S A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 O-I Produkction Polska S A (O-I Glass Inc )

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 HEINZ GLAS DZIALDOWO SP Z O O

List of Figures

- Figure 1: Poland Container Glass Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Poland Container Glass Market Share (%) by Company 2025

List of Tables

- Table 1: Poland Container Glass Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: Poland Container Glass Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Poland Container Glass Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Poland Container Glass Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Container Glass Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the Poland Container Glass Market?

Key companies in the market include HEINZ GLAS DZIALDOWO SP Z O O, Ardagh Glass S A, CAN-PACK S A, TREND GLASS SP Z O O*List Not Exhaustive, EUROVERLUX SP Z O O, HUTA SZKLA CZECHY S A, Stoelzle Cz?stochowa Sp z o o, BA GLASS POLAND Sp z o o, C P Glass S A, O-I Produkction Polska S A (O-I Glass Inc ).

3. What are the main segments of the Poland Container Glass Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 106.36 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing wine production in Poland; Increasing Adoption of Glass Container Packaging in Personal Care.

6. What are the notable trends driving market growth?

Emergence of White Wine and Innovative Wine Drinks to Boost the Studied Market Growth.

7. Are there any restraints impacting market growth?

High Carbon Footprint due to Glass Manufacturing; Operation and Logistical Concerns.

8. Can you provide examples of recent developments in the market?

June 2022 - Łomża Brewery has launched the Łomża Jasne beer in a premium new glass bottle design, introducing modern features to the sleek bottle.The new design emphasizes the slim shape, and the neck of the bottle has been embossed with the brewery's logo, reflecting the Łomża brand's history. In collaboration with Ardagh Group in Poland, in-house designers used their creativity and technical expertise to develop a range of different bottle designs to meet the brief, from which the final shape was selected.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Container Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Container Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Container Glass Market?

To stay informed about further developments, trends, and reports in the Poland Container Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence