Key Insights

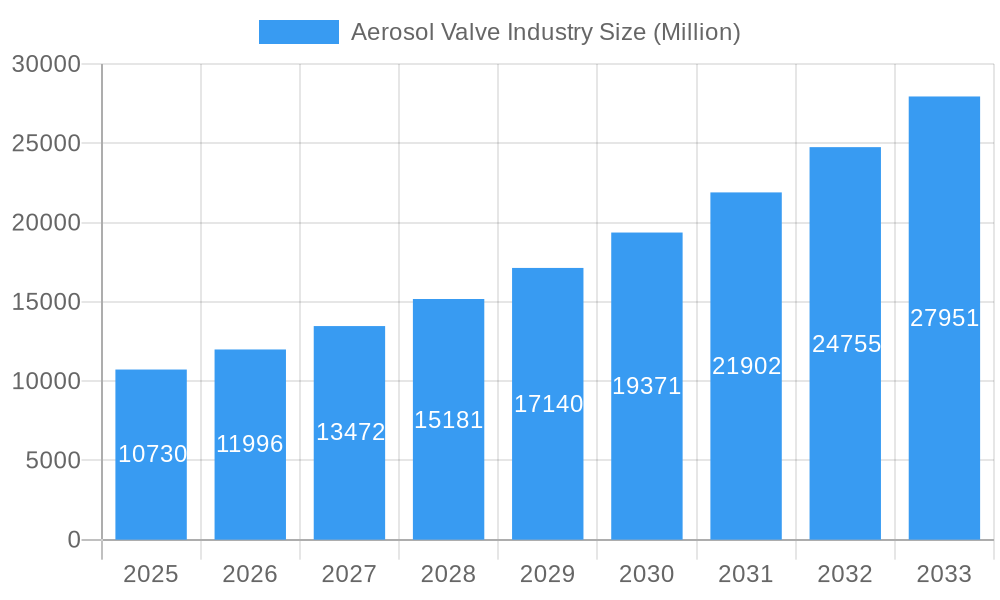

The global Aerosol Valve market is poised for robust expansion, projected to reach an estimated $10.73 billion in 2025, exhibiting a compelling Compound Annual Growth Rate (CAGR) of 11.88% through 2033. This significant growth trajectory is underpinned by a confluence of powerful market drivers, primarily the escalating demand for convenient and user-friendly packaging solutions across a multitude of consumer and industrial sectors. The Personal Care and Home Care segments, in particular, are anticipated to be major beneficiaries, driven by consumer preference for spray-based formulations in cosmetics, deodorants, air fresheners, and cleaning products. Furthermore, the growing adoption of aerosol technology in the Healthcare sector for metered-dose inhalers and topical treatments, coupled with its increasing application in the Automotive industry for products like lubricants and paints, are substantial growth catalysts. The market is also benefiting from continuous innovation in valve technology, focusing on enhanced safety, precision dispensing, and eco-friendly propellants, catering to evolving consumer and regulatory demands.

Aerosol Valve Industry Market Size (In Billion)

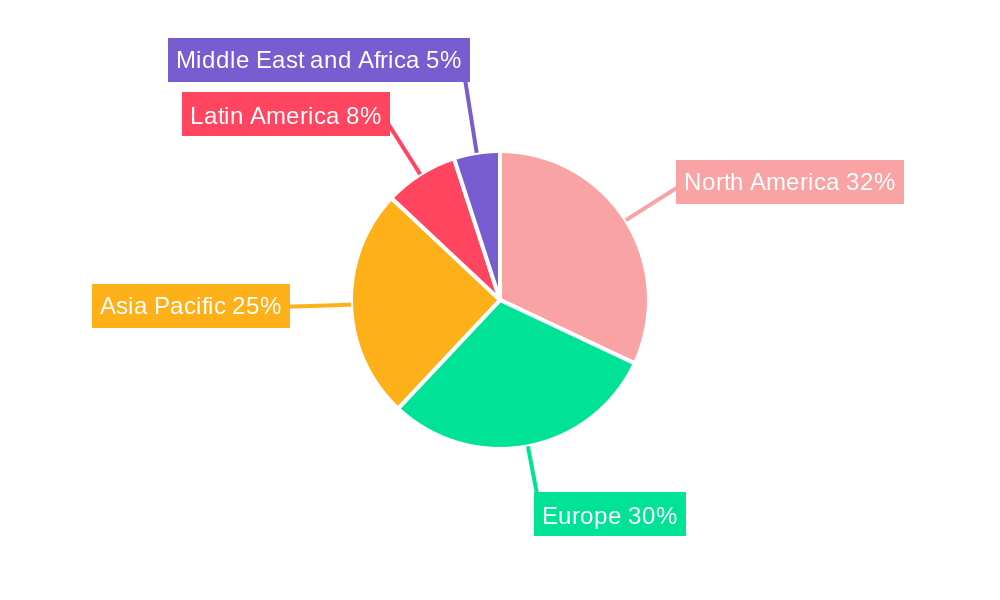

Despite the optimistic outlook, certain restraints could influence the pace of growth. Stringent environmental regulations regarding the use of certain propellants and a growing consumer preference for sustainable packaging alternatives, such as pump sprays and refillable systems, present challenges. However, the industry is actively responding through research and development into greener propellants and more recyclable materials. The market’s segmentation reveals a dynamic landscape, with Continuous and Metered valve types serving diverse end-user needs. Geographically, while North America and Europe have historically dominated, the Asia Pacific region is emerging as a significant growth engine, fueled by increasing disposable incomes and a burgeoning middle class driving consumption of aerosolized products. Companies like AptarGroup, Lindal Group Holding GmbH, and Coster Tecnologie Speciali are at the forefront, driving innovation and capturing market share through strategic investments and product development. The market is characterized by a mix of established global players and emerging regional manufacturers, fostering a competitive yet collaborative environment.

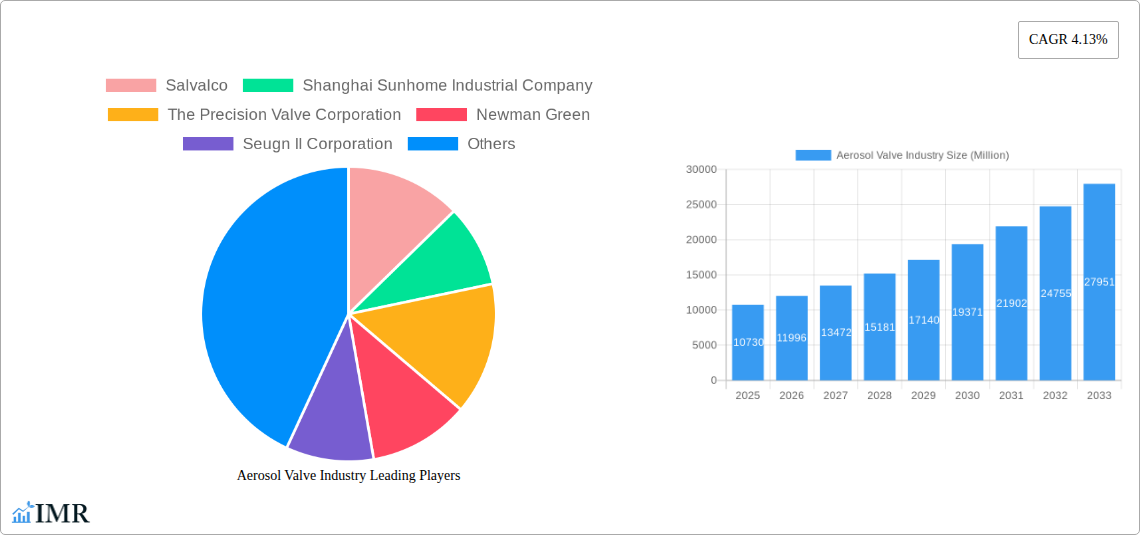

Aerosol Valve Industry Company Market Share

Aerosol Valve Industry Report: Comprehensive Market Analysis & Growth Forecast (2019-2033)

Unlock critical insights into the dynamic Aerosol Valve Industry, a sector poised for significant expansion driven by innovation and evolving consumer demands. This in-depth report, covering the period from 2019 to 2033 with a base year of 2025, delivers a comprehensive analysis of market dynamics, growth trends, regional dominance, product landscape, key players, and emerging opportunities. Navigate the complexities of the global aerosol valve market and its interconnected parent and child markets with expert analysis and quantitative data.

Maximize your understanding of the aerosol valve market with high-traffic keywords including: aerosol valve market size, aerosol valve manufacturers, continuous aerosol valves, metered aerosol valves, personal care aerosol valves, home care aerosol valves, healthcare aerosol valves, automotive aerosol valves, aerosol valve technology, aerosol packaging, dispensing systems, spray technology, and specialized valve solutions.

Aerosol Valve Industry Market Dynamics & Structure

The Aerosol Valve Industry is characterized by a moderately consolidated market structure, with a blend of large multinational corporations and specialized niche players. Technological innovation remains a paramount driver, pushing the development of more efficient, sustainable, and precise dispensing mechanisms. Regulatory frameworks, particularly concerning environmental impact and product safety, significantly shape manufacturing processes and material choices. While direct competitive product substitutes for aerosol valves are limited, alternative dispensing methods within end-user industries pose an indirect challenge. End-user demographics, heavily influenced by the growing demand for convenience and efficacy in personal care and home care segments, are a key factor. Mergers and acquisitions (M&A) trends, while not as frequent as in broader packaging sectors, indicate a strategic consolidation aimed at expanding product portfolios and market reach.

- Market Concentration: A mix of established global leaders and agile regional manufacturers.

- Technological Innovation Drivers: Demand for enhanced product delivery, improved user experience, and sustainable materials.

- Regulatory Frameworks: Strict adherence to environmental regulations (e.g., VOC emissions) and product safety standards.

- Competitive Product Substitutes: While direct substitutes are scarce, innovation in alternative delivery systems (e.g., pumps, sticks) influences the market.

- End-User Demographics: A rising middle class, increased urbanization, and a preference for user-friendly products.

- M&A Trends: Strategic acquisitions focused on technology integration and market expansion.

Aerosol Valve Industry Growth Trends & Insights

The Aerosol Valve Industry is projected to witness robust growth over the forecast period, driven by a confluence of factors that underscore its vital role in diverse consumer and industrial applications. The market size evolution reflects an increasing adoption rate across key end-user segments, propelled by technological disruptions that enhance performance and sustainability. Consumer behavior shifts, such as a growing preference for convenience, hygiene, and aesthetically pleasing packaging, further fuel demand for aerosol products equipped with advanced valve technology. This evolution is supported by ongoing R&D efforts aimed at miniaturization, improved spray patterns, and the development of valves compatible with a wider range of formulations, including eco-friendly propellants. The market penetration of specialized aerosol valves, particularly in the healthcare and automotive sectors, is also on an upward trajectory.

The CAGR for the aerosol valve industry is estimated to be approximately XX% during the forecast period. This growth trajectory is underpinned by the increasing per capita consumption of personal care and home care products globally, where aerosol packaging offers distinct advantages in terms of application ease and product preservation. Furthermore, the healthcare segment is experiencing a surge in demand for metered-dose inhalers and topical sprays, directly boosting the need for precise and reliable aerosol valves. Innovations in materials science are enabling the production of lighter, more durable, and recyclable aerosol valves, aligning with global sustainability initiatives and appealing to environmentally conscious consumers. The automotive sector is also a significant contributor, with aerosol valves finding application in lubricants, cleaners, and cosmetic products. The base year, 2025, is anticipated to see a market size of approximately XX billion units, with significant expansion expected by 2033. This growth is not merely quantitative but also qualitative, with manufacturers focusing on delivering enhanced user experience through ergonomic designs and controlled dispensing. The estimated year of 2025 highlights a stable yet growing market poised for accelerated advancement in the subsequent years.

Dominant Regions, Countries, or Segments in Aerosol Valve Industry

The Asia Pacific region is emerging as the dominant force in the Aerosol Valve Industry, driven by a confluence of rapidly industrializing economies, a burgeoning middle class with increasing disposable income, and a strong manufacturing base. Countries like China and India are at the forefront, owing to their vast populations and expanding consumer markets for personal care, home care, and healthcare products. Government initiatives promoting manufacturing and exports further bolster the region's dominance. Infrastructure development, including advanced logistics and supply chain networks, facilitates efficient production and distribution of aerosol valves. The Personal Care segment, within the broader end-user industries, is a significant growth driver across all regions, but its sheer scale and continuous innovation in cosmetic and hygiene products make it a primary influencer.

- Asia Pacific Dominance: Fueled by rapid industrialization, large consumer bases, and cost-effective manufacturing capabilities.

- China: A major hub for aerosol valve production and consumption.

- India: Rapidly growing demand for personal and home care products.

- Leading Segment: Personal Care

- High demand for deodorants, hairsprays, shaving foams, and cosmetics.

- Continuous innovation in product formulations requiring specialized valve solutions.

- Key Growth Drivers:

- Economic Policies: Favorable policies supporting manufacturing and trade.

- Infrastructure Development: Robust logistics and supply chain networks.

- Consumer Demographics: Growing middle class and increasing urbanization.

- Technological Adoption: Increased investment in advanced manufacturing processes.

- Market Share & Growth Potential: Asia Pacific holds the largest market share and is projected to exhibit the highest growth rate due to expanding end-user industries and increasing export opportunities.

Aerosol Valve Industry Product Landscape

The Aerosol Valve Industry boasts a diverse and innovative product landscape, with continuous advancements focused on precision, safety, and sustainability. Continuous valves, essential for applications requiring a steady stream of product like cleaning agents and lubricants, are seeing enhancements in flow rate control and propellant compatibility. Metered valves, crucial for precise dosage applications in personal care and pharmaceuticals, are becoming more sophisticated with improved actuation mechanisms and reduced variance in dispensed volume, ensuring efficacy and optimal usage. Innovations include valves with reduced dead space for pharmaceutical applications, tamper-evident features for enhanced security, and designs optimized for a wider range of formulations, including water-based and sensitive products. The trend towards eco-friendly propellants and recyclable materials is also driving the development of new valve materials and sealing technologies.

Key Drivers, Barriers & Challenges in Aerosol Valve Industry

Key Drivers:

- Growing Demand for Convenience Products: The preference for easy-to-use and efficient delivery systems across personal care and home care segments.

- Technological Advancements: Development of specialized valves for precise dosing, improved spray patterns, and enhanced user experience.

- Expanding Healthcare Applications: Increased use of metered-dose inhalers and topical sprays for medical treatments.

- Sustainability Initiatives: Growing demand for valves compatible with eco-friendly propellants and recyclable materials.

- Emerging Markets: Rapid industrialization and rising consumerism in developing economies.

Barriers & Challenges:

- Regulatory Hurdles: Stringent environmental regulations regarding propellants and emissions can increase manufacturing complexity and costs.

- Supply Chain Volatility: Disruptions in raw material availability and logistics can impact production and lead times.

- Cost Pressures: Intense competition leads to price sensitivity among end-users, requiring manufacturers to optimize production efficiency.

- Competition from Alternative Dispensing Technologies: Innovations in pumps, sticks, and other delivery systems pose an indirect competitive threat.

- Investment in R&D: The need for continuous innovation requires significant investment in research and development to stay ahead of market trends.

Emerging Opportunities in Aerosol Valve Industry

Emerging opportunities within the Aerosol Valve Industry lie in the development of highly specialized valves for niche applications and the integration of smart technologies. The increasing demand for sustainable packaging presents a significant avenue for innovation in recyclable materials and valves designed for propellants with lower environmental impact. Furthermore, the growth of personalized medicine and cosmetic formulations opens doors for valves offering unparalleled precision and customization in dispensing. The expansion of aerosol applications into new sectors, such as advanced materials and electronics, also represents untapped potential. The focus on enhancing consumer safety and product integrity through features like child-resistant mechanisms and tamper-evident seals will continue to drive product development.

Growth Accelerators in the Aerosol Valve Industry Industry

The long-term growth of the Aerosol Valve Industry is significantly accelerated by continuous technological breakthroughs and strategic partnerships. Innovations in materials science, enabling the creation of lighter, more durable, and environmentally friendly valves, are critical. The ongoing development of sophisticated dispensing technologies, offering enhanced precision, controlled spray patterns, and improved user experience, directly fuels market expansion. Strategic collaborations between valve manufacturers, formulation companies, and brand owners foster innovation and accelerate the adoption of new products. Furthermore, market expansion strategies targeting underdeveloped regions and exploring novel applications beyond traditional sectors will act as powerful catalysts for sustained growth.

Key Players Shaping the Aerosol Valve Industry Market

- Salvalco

- Shanghai Sunhome Industrial Company

- The Precision Valve Corporation

- Newman Green

- Seugn Il Corporation

- Clayton Corp

- C Ehrensperger Ag

- Lindal Group Holding GmbH

- Aroma Industries

- Mitani Valve

- Coster Tecnologie Speciali

- Koh-I-Noor Mlada Vozice A S

- Majesty Packaging Systems Limited

- Maruichi Co Ltd

- Yingbo Aerosol Valve (Zhongshan) Co Ltd

- Summit Packaging Systems

- EC Pack Industrial Limited

- Guangzhou Zhongpin Aerosol Valves Co Ltd

- Aptargroup

Notable Milestones in Aerosol Valve Industry Sector

- April 2022: Salvalco secures Euro 2.5 million funding to expand manufacturing capacity in Thailand, invest in R&D, and further develop its patent portfolio, underscoring a focus on technological advancement and global expansion.

In-Depth Aerosol Valve Industry Market Outlook

The future outlook for the Aerosol Valve Industry is exceptionally promising, driven by a synergistic interplay of innovation and market demand. Growth accelerators, including breakthroughs in sustainable materials and advanced dispensing mechanisms, will continue to propel the industry forward. Strategic partnerships between key players are expected to foster cross-pollination of ideas and accelerate product development cycles. The industry is well-positioned to capitalize on the increasing global demand for convenient, safe, and effective dispensing solutions across personal care, home care, and healthcare sectors. Emerging opportunities in smart packaging and niche applications offer significant potential for market diversification and revenue growth. The overall market trajectory points towards sustained expansion and increased technological sophistication in the coming years.

Aerosol Valve Industry Segmentation

-

1. Type

- 1.1. Continuous

- 1.2. Metered

-

2. End-user Industry

- 2.1. Personal Care

- 2.2. Home Care

- 2.3. Healthcare

- 2.4. Automotive

- 2.5. Other End-user Industries

Aerosol Valve Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Aerosol Valve Industry Regional Market Share

Geographic Coverage of Aerosol Valve Industry

Aerosol Valve Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Demand From the Cosmetic & Personal Care Industry; Shift Towards Easy-To-Handle and Convenient Packaging

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations

- 3.4. Market Trends

- 3.4.1. Personal Care Segment is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aerosol Valve Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Continuous

- 5.1.2. Metered

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Personal Care

- 5.2.2. Home Care

- 5.2.3. Healthcare

- 5.2.4. Automotive

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Aerosol Valve Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Continuous

- 6.1.2. Metered

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Personal Care

- 6.2.2. Home Care

- 6.2.3. Healthcare

- 6.2.4. Automotive

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Aerosol Valve Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Continuous

- 7.1.2. Metered

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Personal Care

- 7.2.2. Home Care

- 7.2.3. Healthcare

- 7.2.4. Automotive

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Aerosol Valve Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Continuous

- 8.1.2. Metered

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Personal Care

- 8.2.2. Home Care

- 8.2.3. Healthcare

- 8.2.4. Automotive

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Aerosol Valve Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Continuous

- 9.1.2. Metered

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Personal Care

- 9.2.2. Home Care

- 9.2.3. Healthcare

- 9.2.4. Automotive

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Aerosol Valve Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Continuous

- 10.1.2. Metered

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Personal Care

- 10.2.2. Home Care

- 10.2.3. Healthcare

- 10.2.4. Automotive

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Salvalco

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shanghai Sunhome Industrial Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Precision Valve Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Newman Green

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Seugn Il Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Clayton Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 C Ehrensperger Ag

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lindal Group Holding GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aroma Industries

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mitani Valve

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Coster Tecnologie Speciali

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Koh-I-Noor Mlada Vozice A S

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Majesty Packaging Systems Limited

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Maruichi Co Ltd*List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Yingbo Aerosol Valve (Zhongshan) Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Summit Packaging Systems

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 EC Pack Industrial Limited

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Guangzhou Zhongpin Aerosol Valves Co Ltd

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Aptargroup

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Salvalco

List of Figures

- Figure 1: Global Aerosol Valve Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Aerosol Valve Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Aerosol Valve Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Aerosol Valve Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: North America Aerosol Valve Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Aerosol Valve Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Aerosol Valve Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Aerosol Valve Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Aerosol Valve Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Aerosol Valve Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Europe Aerosol Valve Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Aerosol Valve Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Aerosol Valve Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Aerosol Valve Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Aerosol Valve Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Aerosol Valve Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Aerosol Valve Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Aerosol Valve Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Aerosol Valve Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Aerosol Valve Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: Latin America Aerosol Valve Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Aerosol Valve Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Latin America Aerosol Valve Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Aerosol Valve Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Aerosol Valve Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Aerosol Valve Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Aerosol Valve Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Aerosol Valve Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Aerosol Valve Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Aerosol Valve Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Aerosol Valve Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aerosol Valve Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Aerosol Valve Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Aerosol Valve Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Aerosol Valve Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Aerosol Valve Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Aerosol Valve Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Aerosol Valve Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Aerosol Valve Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Aerosol Valve Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Aerosol Valve Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Aerosol Valve Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Aerosol Valve Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Aerosol Valve Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Aerosol Valve Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Aerosol Valve Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Aerosol Valve Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global Aerosol Valve Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Aerosol Valve Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aerosol Valve Industry?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Aerosol Valve Industry?

Key companies in the market include Salvalco, Shanghai Sunhome Industrial Company, The Precision Valve Corporation, Newman Green, Seugn Il Corporation, Clayton Corp, C Ehrensperger Ag, Lindal Group Holding GmbH, Aroma Industries, Mitani Valve, Coster Tecnologie Speciali, Koh-I-Noor Mlada Vozice A S, Majesty Packaging Systems Limited, Maruichi Co Ltd*List Not Exhaustive, Yingbo Aerosol Valve (Zhongshan) Co Ltd, Summit Packaging Systems, EC Pack Industrial Limited, Guangzhou Zhongpin Aerosol Valves Co Ltd, Aptargroup.

3. What are the main segments of the Aerosol Valve Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Strong Demand From the Cosmetic & Personal Care Industry; Shift Towards Easy-To-Handle and Convenient Packaging.

6. What are the notable trends driving market growth?

Personal Care Segment is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Stringent Government Regulations.

8. Can you provide examples of recent developments in the market?

April 2022 - Salvalco, a Yorkshire manufacturer of specialist aerosol technology, has secured Euro 2.5 million funding from a consortium of six companies: Green Angel Syndicate, Beiersdorf, Foresight Williams Technology, AWI Ltd, Fin.Essa and Growthdeck Ltd. to support expansion. The new funding will be used to expand manufacturing capacity at Salvalco's plant in Thailand and will also be invested in R&D operations and to further develop the patent portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aerosol Valve Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aerosol Valve Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aerosol Valve Industry?

To stay informed about further developments, trends, and reports in the Aerosol Valve Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence