Key Insights

The French plastic packaging films market is projected for robust expansion, with an estimated market size of 110.78 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of 5.5% from the 2025 base year. Demand is significantly influenced by the food packaging sector, propelled by the popularity of convenience foods, extended shelf life requirements, and enhanced product safety. Confectionery, dairy, and processed meats are leading segments. The healthcare and personal care industries also contribute to growth through their need for sterile and protective packaging. Technological advancements, including improved barrier properties, printability, and sustainable material development, further stimulate market demand.

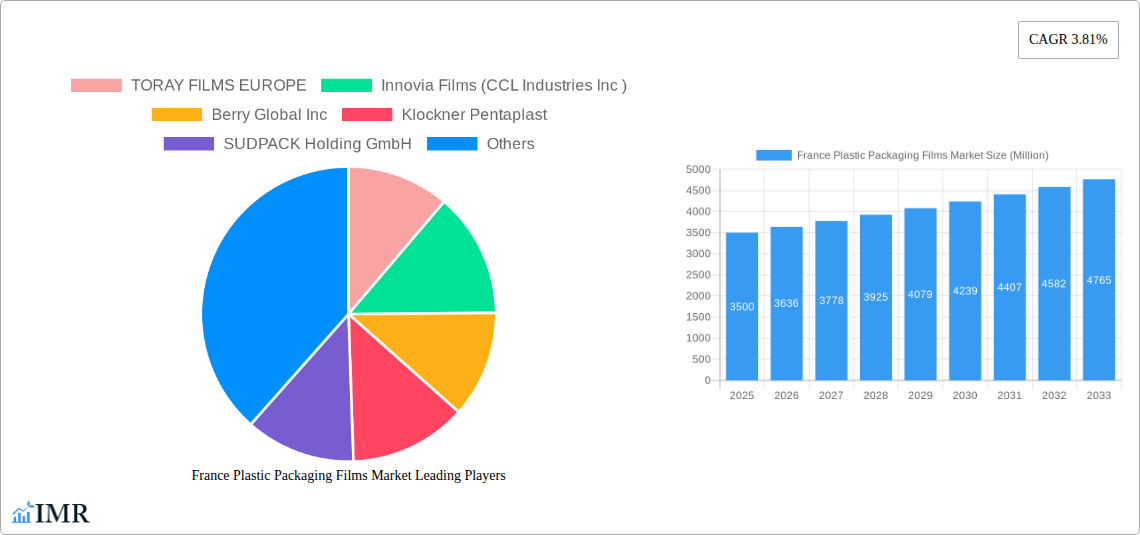

France Plastic Packaging Films Market Market Size (In Billion)

Market dynamics are shaped by regulatory pressures on plastic waste management, encouraging a shift towards recyclable and bio-based alternatives. Fluctuations in petrochemical markets can impact raw material costs. In response, substantial investments are being made in research and development for bio-based and compostable films, alongside improved recycling processes. Key market players are focused on expanding eco-friendly product portfolios and enhancing recyclability. The market anticipates significant growth in demand for Polyethylene (PE) and Polypropylene (PP) films due to their versatility and cost-effectiveness, with a growing niche for Bio-Based and EVOH films.

France Plastic Packaging Films Market Company Market Share

This report offers a comprehensive analysis of the France Plastic Packaging Films Market, detailing market dynamics, growth trajectories, key segments, and leading stakeholders. It explores parent and child market segments, technological innovations, and regulatory impacts, providing essential insights for industry professionals, strategists, and investors. All market size values are presented in billion units.

France Plastic Packaging Films Market Market Dynamics & Structure

The France Plastic Packaging Films Market is characterized by a moderate to high market concentration, driven by the presence of several established global and regional players. Technological innovation is a significant driver, with a continuous focus on developing advanced film properties such as enhanced barrier capabilities, recyclability, and biodegradability. Regulatory frameworks, particularly those related to sustainability and circular economy initiatives, are increasingly shaping market strategies and product development. Competitive product substitutes, including paper-based packaging and rigid plastic alternatives, exert pressure but are often outmatched by the versatility and cost-effectiveness of plastic films. End-user demographics are shifting towards greater demand for convenient, safe, and sustainably produced packaging, influencing the types of films being developed. Mergers and Acquisitions (M&A) activity plays a crucial role in market consolidation and expansion, with recent deals aimed at acquiring new technologies, expanding geographical reach, or strengthening product portfolios. For instance, XX M&A deals were observed in the historical period (2019-2024).

- Market Concentration: Dominated by a few key players, but with room for specialized niche providers.

- Technological Innovation: Driven by sustainability demands, improved functionality, and cost optimization.

- Regulatory Impact: EU Green Deal, Extended Producer Responsibility (EPR) schemes, and plastic reduction targets are significant influences.

- Competitive Landscape: Plastic films compete with alternative materials but maintain a strong position due to performance and cost.

- End-User Preferences: Growing demand for food safety, extended shelf-life, convenience, and eco-friendly packaging solutions.

- M&A Trends: Focus on acquiring sustainable technologies, expanding capacity, and entering new end-user segments.

France Plastic Packaging Films Market Growth Trends & Insights

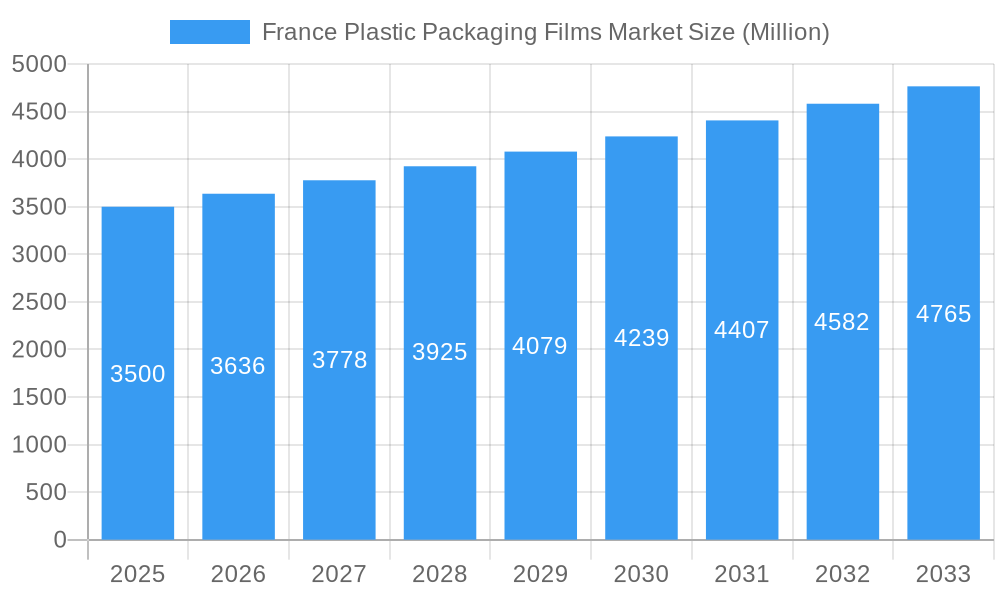

The France Plastic Packaging Films Market is poised for steady growth throughout the study period (2019–2033), with a projected Compound Annual Growth Rate (CAGR) of XX% for the forecast period (2025–2033). This expansion is fueled by escalating demand across various end-user industries, particularly food and healthcare, where the protective and preservative qualities of plastic films are indispensable. The market size is estimated to reach XX Million units by 2033, a significant increase from XX Million units in the base year 2025. Technological disruptions, such as advancements in multilayer film extrusion and the integration of recycled content, are reshaping product offerings and enhancing their sustainability profiles. Consumer behavior shifts are also playing a pivotal role, with an increasing preference for products with longer shelf lives and the growing awareness surrounding the environmental impact of packaging. This has led to a surge in demand for innovative solutions, including bio-based and compostable plastic films, as well as films designed for enhanced recyclability. The adoption rates of these advanced film types are steadily rising, driven by both consumer demand and regulatory incentives aimed at promoting a circular economy.

- Market Size Evolution: Expected to grow from XX Million units (2025) to XX Million units (2033).

- CAGR Projection: Anticipated to be XX% during the forecast period (2025–2033).

- Key Growth Drivers: Rising demand from food, healthcare, and personal care sectors; innovation in sustainable materials.

- Technological Disruptions: Advancements in barrier properties, recyclability, and the use of post-consumer recycled (PCR) content.

- Consumer Behavior Shifts: Growing preference for convenience, food safety, extended shelf-life, and eco-conscious packaging.

- Adoption Rates: Increasing uptake of bio-based, compostable, and high-recycled content films.

- Market Penetration: Deepening penetration in existing end-user segments and exploration of new applications.

Dominant Regions, Countries, or Segments in France Plastic Packaging Films Market

Within the France Plastic Packaging Films Market, the Polyethylene (PE) segment, particularly Polyethylene (PE) films, consistently dominates, driven by its exceptional versatility, cost-effectiveness, and wide range of applications across numerous end-user industries. Its inherent properties, such as flexibility, toughness, and moisture resistance, make it an ideal choice for a vast array of packaging needs. The Food industry stands as the largest end-user segment, consuming a substantial portion of plastic packaging films for its diverse sub-segments including Candy and Confectionery, Frozen Foods, Fresh Produce, Dairy Products, Dry Foods, Meat, Poultry, and Seafood, and Pet Food. The increasing demand for convenience foods, pre-portioned meals, and the need to extend shelf-life for perishable goods directly translate into a robust demand for PE films in this sector. Furthermore, advancements in PE film technology, such as enhanced barrier properties and improved sealability, are critical for maintaining food quality and safety.

- Dominant Film Type: Polyethylene (PE) films – prized for versatility, cost, and performance.

- Sub-segments driving PE demand: High-density polyethylene (HDPE), low-density polyethylene (LDPE), and linear low-density polyethylene (LLDPE) catering to specific application needs.

- Dominant End-User Industry: Food Industry – a primary consumer of plastic packaging films.

- Key sub-segments within Food:

- Candy and Confectionery: Requiring excellent printability and moisture barrier.

- Frozen Foods: Demanding low-temperature flexibility and strong sealing.

- Fresh Produce: Benefiting from controlled atmosphere packaging properties.

- Dairy Products: Needing high barrier to oxygen and light.

- Meat, Poultry, and Seafood: Requiring excellent oxygen barrier and extended shelf-life capabilities.

- Dry Foods: Utilizing films for moisture and aroma protection.

- Pet Food: Benefiting from durability and barrier properties.

- Key sub-segments within Food:

- Key Growth Drivers in Dominant Segments:

- Economic Policies: Government initiatives promoting domestic manufacturing and sustainable packaging solutions.

- Infrastructure: Robust logistics and supply chain networks facilitate efficient distribution of packaging materials.

- Consumer Demand: Growing preference for convenience, ready-to-eat meals, and extended shelf-life products within the food sector.

- Technological Advancements: Continuous innovation in PE film formulations and processing techniques enhancing performance.

- Regulatory Support: Favorable regulations promoting the use of recyclable and food-grade plastic packaging.

France Plastic Packaging Films Market Product Landscape

The France Plastic Packaging Films Market is characterized by a dynamic product landscape with a strong emphasis on innovation and specialization. Manufacturers are continuously introducing advanced films with enhanced barrier properties, superior puncture resistance, and improved seal integrity, crucial for preserving product freshness and extending shelf-life. Polyethylene (PE) films remain a cornerstone, with advancements in LLDPE and HDPE grades offering tailored solutions for demanding applications. Polypropylene (PP) films are gaining traction for their clarity, stiffness, and excellent printability, particularly in food packaging. The growing demand for sustainable alternatives is driving the development and adoption of Bio-Based and Compostable films, derived from renewable resources, catering to eco-conscious brands and consumers. Furthermore, specialized films like EVOH (Ethylene Vinyl Alcohol) and PETG (Polyethylene Terephthalate Glycol) are finding increasing applications in high-barrier packaging for sensitive products in the food and healthcare sectors. The integration of recycled content into virgin polymer streams is also a significant trend, enhancing the circularity of plastic packaging.

Key Drivers, Barriers & Challenges in France Plastic Packaging Films Market

Key Drivers: The France Plastic Packaging Films Market is propelled by the persistent demand for flexible and protective packaging solutions across its burgeoning food, healthcare, and personal care industries. Technological advancements in film properties, such as enhanced barrier capabilities and improved recyclability, are significant growth accelerators. Increasing consumer awareness and regulatory push towards sustainable packaging are fostering the adoption of bio-based and recycled content films. The growing trend of e-commerce also necessitates robust and adaptable packaging for product integrity during transit.

Barriers & Challenges: A primary challenge is the increasing regulatory pressure and public perception concerning plastic waste, leading to stringent environmental policies and a call for reduced single-use plastics. Volatile raw material prices, particularly for petroleum-based feedstocks, can impact production costs and profitability. Competition from alternative packaging materials such as paper, glass, and metal presents another hurdle. Complexities in recycling infrastructure and consumer sorting habits can hinder the effective implementation of circular economy models. Supply chain disruptions, exacerbated by global events, can also pose significant challenges to material availability and timely delivery.

Emerging Opportunities in France Plastic Packaging Films Market

Emerging opportunities lie in the burgeoning demand for sustainable and circular packaging solutions. This includes the expansion of bio-based and compostable plastic films, catering to brands seeking to reduce their environmental footprint. The development of advanced recycling technologies, such as chemical recycling, presents a significant opportunity to enhance the circularity of plastic packaging. Untapped markets within niche healthcare applications, requiring specialized barrier and sterilization properties, also offer considerable growth potential. Evolving consumer preferences for convenience and personalized nutrition are driving demand for innovative flexible packaging formats, including stand-up pouches and single-serving sachets.

Growth Accelerators in the France Plastic Packaging Films Market Industry

The long-term growth of the France Plastic Packaging Films Market is being significantly accelerated by breakthroughs in material science, leading to the development of films with superior performance characteristics, such as enhanced barrier properties and extended shelf-life capabilities. Strategic partnerships and collaborations between film manufacturers, resin producers, and end-users are fostering innovation and enabling the creation of tailored packaging solutions that meet specific market needs. Furthermore, government incentives and policies supporting the adoption of recycled content and the development of a circular economy are acting as powerful catalysts for market expansion and the drive towards more sustainable packaging practices.

Key Players Shaping the France Plastic Packaging Films Market Market

- TORAY FILMS EUROPE

- Innovia Films (CCL Industries Inc)

- Berry Global Inc

- Klockner Pentaplast

- SUDPACK Holding GmbH

- DUO PLAST AG

- SRF LIMITED

- Groupe Barbier

- Surfilm Packaging

- Trioworld Industrier AB

- AEP GROU

Notable Milestones in France Plastic Packaging Films Market Sector

- March 2024: INEOS Olefins & Polymers Europe, PepsiCo, and Amcor collaborated to introduce innovative snack packaging for Sunbites crisps, incorporating 50% recycled plastic. This joint effort involved a diverse set of partners spanning the supply chain. GreenDot oversaw the sourcing and delivery of post-consumer plastic waste, which was then processed into TACOIL (pyrolysis oil) through Plastic Energy’s technology. In a pioneering move, INEOS used this pyrolysis oil to substitute traditional fossil feedstock, crafting recycled propylene. This propylene was further refined into high-quality recycled polypropylene resin at INEOS's facility in Lavera, France. Subsequently, IRPLAST leveraged this resin to revamp existing plastic packaging designs, creating new packaging films infused with 50% post-consumer recycled content, all while meeting stringent food safety standards. Finally, Amcor took these films, imprinting them with designs that maintained the required technical standards for PepsiCo's products.

- December 2023: Specialty plastic packaging materials supplier Pacur LLC, based in Oshkosh, WI, specializing in the medical device sector, finalized an agreement to acquire Carolex SAS. Carolex SAS, headquartered in Longué, France, is known for its expertise in polyethylene terephthalate glycol (PETG) sheet extrusion. Pacur's move is strategic, aiming to bolster its European presence in medical devices and enhance its extrusion capabilities to cater to global demands. Pacur, a key player in the extruded PETG sheet market for medical device packaging, also caters to specialty graphics, pharmaceutical, and food packaging segments.

In-Depth France Plastic Packaging Films Market Market Outlook

The France Plastic Packaging Films Market is characterized by a promising outlook, driven by ongoing innovation and a strong societal push towards sustainability. Growth accelerators, including advancements in high-performance barrier films and the increasing integration of recycled content, will continue to shape market dynamics. Strategic partnerships focused on developing circular economy solutions and expanding the use of bio-based materials will unlock new avenues for growth. The market's future potential is intrinsically linked to its ability to balance performance, cost-effectiveness, and environmental responsibility, presenting significant opportunities for companies that can effectively navigate these evolving demands and contribute to a more sustainable packaging ecosystem.

France Plastic Packaging Films Market Segmentation

-

1. Type

- 1.1. Polyprop

- 1.2. Polyethy

- 1.3. Polyethy

- 1.4. Polystyrene

- 1.5. Bio-Based

- 1.6. PVC, EVOH, PETG, and Other Film Types

-

2. End-user Industry

-

2.1. Food

- 2.1.1. Candy and Confectionery

- 2.1.2. Frozen Foods

- 2.1.3. Fresh Produce

- 2.1.4. Dairy Products

- 2.1.5. Dry Foods

- 2.1.6. Meat, Poultry, andnd Seafood

- 2.1.7. Pet Food

- 2.1.8. Other Fo

- 2.2. Healthcare

- 2.3. Personal Care and Home Care

- 2.4. Industrial Packaging

- 2.5. Other En

-

2.1. Food

France Plastic Packaging Films Market Segmentation By Geography

- 1. France

France Plastic Packaging Films Market Regional Market Share

Geographic Coverage of France Plastic Packaging Films Market

France Plastic Packaging Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Lightweight Packaging Solution; Increasing Demand for Plastic Films Across Various Industries Indicates Growth Potential

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Lightweight Packaging Solution; Increasing Demand for Plastic Films Across Various Industries Indicates Growth Potential

- 3.4. Market Trends

- 3.4.1. Polyethylene Segment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Plastic Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polyprop

- 5.1.2. Polyethy

- 5.1.3. Polyethy

- 5.1.4. Polystyrene

- 5.1.5. Bio-Based

- 5.1.6. PVC, EVOH, PETG, and Other Film Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.1.1. Candy and Confectionery

- 5.2.1.2. Frozen Foods

- 5.2.1.3. Fresh Produce

- 5.2.1.4. Dairy Products

- 5.2.1.5. Dry Foods

- 5.2.1.6. Meat, Poultry, andnd Seafood

- 5.2.1.7. Pet Food

- 5.2.1.8. Other Fo

- 5.2.2. Healthcare

- 5.2.3. Personal Care and Home Care

- 5.2.4. Industrial Packaging

- 5.2.5. Other En

- 5.2.1. Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TORAY FILMS EUROPE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Innovia Films (CCL Industries Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Berry Global Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Klockner Pentaplast

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SUDPACK Holding GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DUO PLAST AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SRF LIMITED

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Groupe Barbier

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Surfilm Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Trioworld Industrier AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 AEP GROU

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 TORAY FILMS EUROPE

List of Figures

- Figure 1: France Plastic Packaging Films Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Plastic Packaging Films Market Share (%) by Company 2025

List of Tables

- Table 1: France Plastic Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: France Plastic Packaging Films Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: France Plastic Packaging Films Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: France Plastic Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: France Plastic Packaging Films Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: France Plastic Packaging Films Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Plastic Packaging Films Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the France Plastic Packaging Films Market?

Key companies in the market include TORAY FILMS EUROPE, Innovia Films (CCL Industries Inc ), Berry Global Inc, Klockner Pentaplast, SUDPACK Holding GmbH, DUO PLAST AG, SRF LIMITED, Groupe Barbier, Surfilm Packaging, Trioworld Industrier AB, AEP GROU.

3. What are the main segments of the France Plastic Packaging Films Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 110.78 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Lightweight Packaging Solution; Increasing Demand for Plastic Films Across Various Industries Indicates Growth Potential.

6. What are the notable trends driving market growth?

Polyethylene Segment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Demand for Lightweight Packaging Solution; Increasing Demand for Plastic Films Across Various Industries Indicates Growth Potential.

8. Can you provide examples of recent developments in the market?

March 2024: INEOS Olefins & Polymers Europe, PepsiCo, and Amcor collaborated to introduce innovative snack packaging for Sunbites crisps, incorporating 50% recycled plastic. This joint effort involved a diverse set of partners spanning the supply chain. GreenDot oversaw the sourcing and delivery of post-consumer plastic waste, which was then processed into TACOIL (pyrolysis oil) through Plastic Energy’s technology. In a pioneering move, INEOS used this pyrolysis oil to substitute traditional fossil feedstock, crafting recycled propylene. This propylene was further refined into high-quality recycled polypropylene resin at INEOS's facility in Lavera, France. Subsequently, IRPLAST leveraged this resin to revamp existing plastic packaging designs, creating new packaging films infused with 50% post-consumer recycled content, all while meeting stringent food safety standards. Finally, Amcor took these films, imprinting them with designs that maintained the required technical standards for PepsiCo's products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Plastic Packaging Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Plastic Packaging Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Plastic Packaging Films Market?

To stay informed about further developments, trends, and reports in the France Plastic Packaging Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence