Key Insights

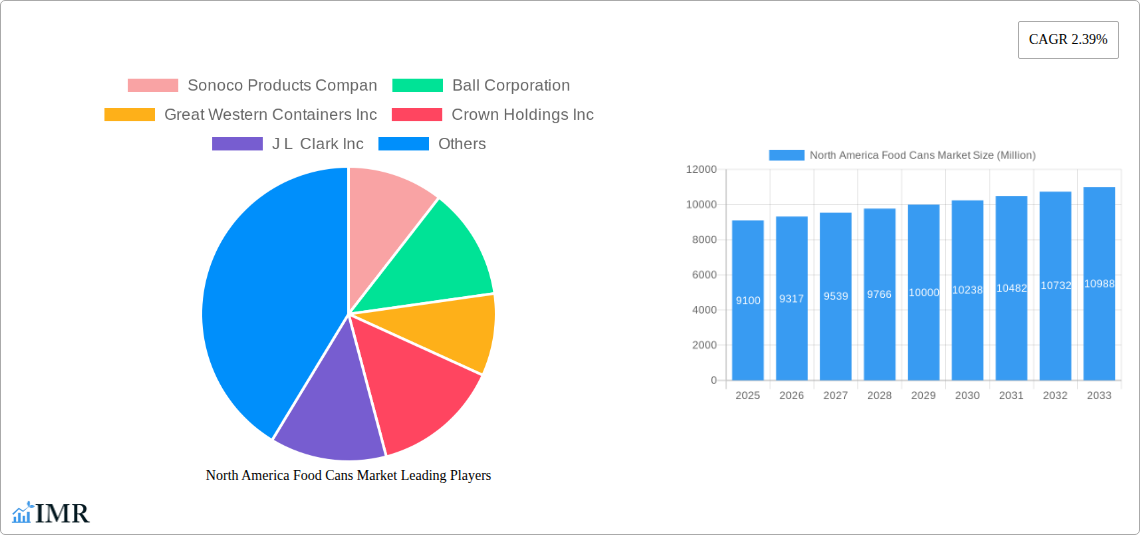

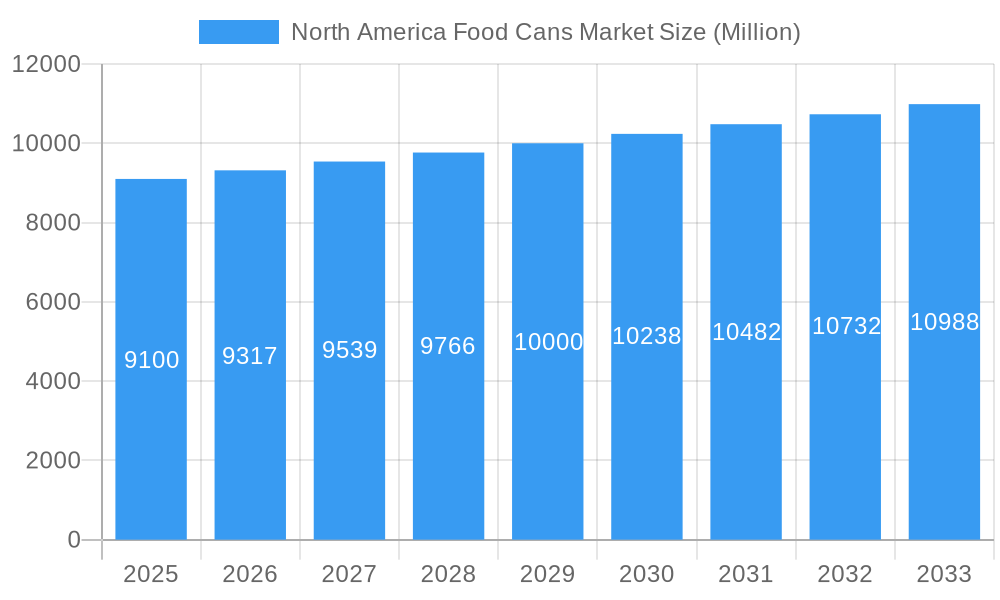

The North American food cans market is projected to reach a substantial valuation of USD 9.10 billion by 2025, demonstrating a consistent growth trajectory. With a Compound Annual Growth Rate (CAGR) of 2.39% anticipated from 2025 to 2033, the market is poised for steady expansion, indicating robust demand for convenient and durable food packaging solutions. This growth is primarily fueled by increasing consumer preference for processed and ready-to-eat meals, driven by busy lifestyles and the demand for longer shelf-life products. The convenience and preservation qualities of food cans make them an indispensable packaging choice across various food segments. Furthermore, the growing awareness regarding the recyclability of metal cans, particularly aluminum and steel, aligns with increasing environmental consciousness among consumers and regulatory pressures promoting sustainable packaging practices. This trend is expected to further bolster the market's appeal and adoption.

North America Food Cans Market Market Size (In Billion)

The market's expansion is further supported by significant investments in manufacturing technologies and innovation by key players such as Ball Corporation, Crown Holdings Inc., and Trivium Packaging. These companies are at the forefront of developing advanced can designs and improving production efficiency to meet the evolving demands of food manufacturers. The segmentation analysis reveals that aluminum cans, prized for their lightweight and recyclability, are likely to witness significant adoption across applications like ready meals, fruits and vegetables, and processed foods. Steel cans also continue to hold a strong position, particularly for products requiring robust protection. Geographically, North America, encompassing the United States, Canada, and Mexico, represents a mature yet expanding market, driven by a well-established food processing industry and a strong consumer base. While the market benefits from drivers like convenience and shelf-life extension, potential restraints could include fluctuations in raw material prices (aluminum and steel) and the increasing competition from alternative packaging materials.

North America Food Cans Market Company Market Share

North America Food Cans Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed examination of the North America food cans market, offering critical insights into its dynamics, growth trajectories, and future potential. With a study period spanning from 2019 to 2033, encompassing a base year of 2025, estimated year of 2025, and a forecast period of 2025-2033, this analysis delivers actionable intelligence for stakeholders. The report delves into the nuances of material types (Aluminum Cans, Steel Cans) and a wide array of applications including Ready Meals, Powder Products, Fish and Seafood, Fruits and Vegetables, Processed Food, Pet Food, and Other Applications, presenting all values in million units.

North America Food Cans Market Market Dynamics & Structure

The North America food cans market exhibits a moderate concentration, with key players like Ball Corporation, Crown Holdings Inc., and Sonoco Products Company holding significant market shares. Technological innovation remains a primary driver, particularly in developing sustainable and advanced packaging solutions. Regulatory frameworks, emphasizing food safety and environmental impact, are increasingly shaping product development and material choices. Competitive product substitutes, such as flexible packaging and glass, present ongoing challenges, necessitating continuous innovation in the metal can sector. End-user demographics, with a growing demand for convenience and shelf-stable products, are influencing product formats and sizes. Mergers and acquisitions (M&A) activity, though not at an extreme level, plays a role in market consolidation and strategic expansion.

- Market Concentration: Moderate, with leading players investing in R&D and capacity expansion.

- Technological Innovation: Focus on lightweighting, advanced coatings, and recyclability to maintain competitiveness.

- Regulatory Frameworks: Stringent food contact regulations and growing emphasis on circular economy principles.

- Competitive Substitutes: Flexible packaging, glass, and novel materials continuously challenge market share.

- End-User Demographics: Rising demand for ready-to-eat meals and single-serving portions.

- M&A Trends: Strategic acquisitions aimed at expanding product portfolios and geographic reach.

North America Food Cans Market Growth Trends & Insights

The North America food cans market is poised for steady growth, driven by evolving consumer preferences and an increasing demand for convenient, safe, and sustainable food packaging solutions. The market size is projected to expand significantly over the forecast period, fueled by rising adoption rates of aluminum cans for their lightweight properties and recyclability, alongside the continued dominance of steel cans for specific applications requiring robust protection. Technological advancements, such as improved can coatings for enhanced product preservation and the development of thinner yet stronger metal alloys, are further accelerating growth. Consumer behavior shifts, including a greater emphasis on health and wellness and a preference for on-the-go consumption, are directly impacting the demand for various food products packaged in cans. The market penetration of metal cans is expected to deepen, especially in emerging food categories and for products targeting busy lifestyles. Specific metrics for market size evolution and adoption rates will be detailed within the full report, providing a comprehensive understanding of the market's trajectory.

Dominant Regions, Countries, or Segments in North America Food Cans Market

Within the North America food cans market, the United States stands as the dominant country, driven by its large consumer base, sophisticated food processing industry, and advanced packaging infrastructure. The Aluminum Cans segment, particularly for applications like ready meals and fruits & vegetables, is a significant growth engine. This dominance is bolstered by the inherent recyclability and lightweight nature of aluminum, aligning with increasing consumer and regulatory demand for sustainable packaging. Key drivers include favorable economic policies supporting manufacturing, substantial investments in recycling infrastructure, and the presence of major food and beverage manufacturers.

- Dominant Country: United States, due to its extensive food processing capabilities and high consumer demand.

- Leading Material Type: Aluminium Cans, favored for its recyclability and lightweight properties.

- Key Application Drivers: Ready Meals and Fruits & Vegetables, reflecting trends in convenience and healthy eating.

- Economic Policies: Government initiatives promoting sustainable manufacturing and recycling programs.

- Infrastructure: Well-developed recycling facilities and efficient supply chains supporting aluminum can production and recovery.

- Market Share & Growth Potential: The US market commands the largest share, with continuous growth potential driven by innovation and consumer preferences.

North America Food Cans Market Product Landscape

The product landscape of the North America food cans market is characterized by continuous innovation focused on enhancing product preservation, sustainability, and consumer convenience. Manufacturers are actively developing lighter-weight aluminum and steel cans with advanced interior coatings to prevent metallic taste and maintain product integrity for extended shelf lives. Innovations include the introduction of easy-open lids and enhanced sealing technologies, catering to the on-the-go consumption trend. Performance metrics such as retortability, durability, and recyclability are key differentiators, with many companies investing in solutions that reduce environmental impact without compromising on functionality or safety.

Key Drivers, Barriers & Challenges in North America Food Cans Market

Key Drivers:

- Growing Demand for Convenience Foods: Increasing consumer preference for ready-to-eat meals and shelf-stable products.

- Sustainability Initiatives: Rising consumer and regulatory pressure for recyclable and eco-friendly packaging.

- Technological Advancements: Innovations in material science and manufacturing processes leading to lighter, stronger, and more efficient cans.

- Brand Loyalty and Shelf Appeal: Cans offer excellent branding opportunities and robust protection for products.

Barriers & Challenges:

- Competition from Flexible Packaging: Flexible pouches and other alternatives offer perceived convenience and lower material costs.

- Raw Material Price Volatility: Fluctuations in aluminum and steel prices can impact production costs and profitability.

- Recycling Infrastructure Gaps: While recyclable, the efficiency of collection and processing varies across regions.

- Consumer Perception: In some instances, consumers may associate canned foods with older preservation methods, requiring education on modern benefits.

Emerging Opportunities in North America Food Cans Market

Emerging opportunities in the North America food cans market lie in the expansion of plant-based and premium food categories, where metal cans offer superior protection and shelf-life. The increasing focus on sustainable packaging is driving demand for cans made from higher recycled content and those with enhanced recyclability. Innovations in smart packaging, incorporating features like temperature indicators, also present untapped potential. Furthermore, the growing demand for single-serving and on-the-go meal solutions creates avenues for smaller format cans and innovative dispensing mechanisms, catering to busy lifestyles and the evolving needs of health-conscious consumers.

Growth Accelerators in the North America Food Cans Market Industry

Several catalysts are accelerating the growth of the North America food cans industry. Technological breakthroughs in lightweighting aluminum and steel, coupled with advancements in coating technologies that enhance product preservation and safety, are key. Strategic partnerships between can manufacturers and food brands, focused on developing bespoke packaging solutions for new product launches, are significant growth drivers. Furthermore, robust government support for recycling infrastructure and the circular economy, alongside growing consumer preference for sustainable options, are creating a favorable market environment for metal cans. The increasing demand for processed foods, pet food, and ready meals further fuels this expansion.

Key Players Shaping the North America Food Cans Market Market

- Sonoco Products Company

- Ball Corporation

- Great Western Containers Inc

- Crown Holdings Inc.

- J L Clark Inc.

- Trivium Packaging

- Wells Can Company

- Independent Can Co

- Can Corporation of America

- Container Supply Co.

- AllState Can Corporation

- CANPACK S A (CANPACK Group)

Notable Milestones in North America Food Cans Market Sector

- May 2024: Ball Corporation partnered with CavinKare to introduce retort two-piece aluminum cans for milkshakes. These cans are designed to withstand the retort process, preserving flavor, nutrients, and freshness, and aligning with on-the-go consumer lifestyles.

- February 2024: Fairfood adopted Sonoco’s GREENCAN packaging solution for its powdered oat drink products. This transition provided a recyclable alternative that effectively maintained product freshness.

In-Depth North America Food Cans Market Market Outlook

The North America food cans market outlook remains exceptionally positive, driven by a confluence of strong consumer demand for convenience, an unwavering commitment to sustainability, and continuous technological advancements. The market is characterized by an increasing shift towards aluminum cans due to their superior recyclability and lightweight properties, while steel cans continue to hold their ground in specific applications. Future growth will be significantly influenced by innovative packaging designs that cater to on-the-go consumption and health-conscious consumers, alongside strategic collaborations that enhance the entire value chain. The industry's ability to adapt to evolving regulatory landscapes and capitalize on the circular economy will be pivotal in its sustained growth and market leadership.

North America Food Cans Market Segmentation

-

1. Material Type

- 1.1. Aluminium Cans

- 1.2. Steel Cans

-

2. Application

- 2.1. Ready Meals

- 2.2. Powder Products

- 2.3. Fish and Seafood

- 2.4. Fruits and Vegetables

- 2.5. Processed Food

- 2.6. Pet Food

- 2.7. Other Applications

North America Food Cans Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Food Cans Market Regional Market Share

Geographic Coverage of North America Food Cans Market

North America Food Cans Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Recyclability of Cans; Convenience and Sustainability Offered by Canned Food

- 3.3. Market Restrains

- 3.3.1. Rising Adoption of Bio-Based Plastic Solutions

- 3.4. Market Trends

- 3.4.1. Steel Cans to Gain Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Food Cans Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Aluminium Cans

- 5.1.2. Steel Cans

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Ready Meals

- 5.2.2. Powder Products

- 5.2.3. Fish and Seafood

- 5.2.4. Fruits and Vegetables

- 5.2.5. Processed Food

- 5.2.6. Pet Food

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sonoco Products Compan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ball Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Great Western Containers Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Crown Holdings Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 J L Clark Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Trivium Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wells Can Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Independent Can Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Can Corporation of America

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Container Supply Co

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 AllState Can Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CANPACK S A (CANPACK Group)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Sonoco Products Compan

List of Figures

- Figure 1: North America Food Cans Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Food Cans Market Share (%) by Company 2025

List of Tables

- Table 1: North America Food Cans Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: North America Food Cans Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: North America Food Cans Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Food Cans Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: North America Food Cans Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: North America Food Cans Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Food Cans Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Food Cans Market?

The projected CAGR is approximately 2.39%.

2. Which companies are prominent players in the North America Food Cans Market?

Key companies in the market include Sonoco Products Compan, Ball Corporation, Great Western Containers Inc, Crown Holdings Inc, J L Clark Inc, Trivium Packaging, Wells Can Company, Independent Can Co, Can Corporation of America, Container Supply Co, AllState Can Corporation, CANPACK S A (CANPACK Group).

3. What are the main segments of the North America Food Cans Market?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Recyclability of Cans; Convenience and Sustainability Offered by Canned Food.

6. What are the notable trends driving market growth?

Steel Cans to Gain Market Growth.

7. Are there any restraints impacting market growth?

Rising Adoption of Bio-Based Plastic Solutions.

8. Can you provide examples of recent developments in the market?

May 2024 - Ball Corporation, has announced its partnership with Cavin kare, a pioneer in the dairy industry. Together, they are set to revolutionize dairy packaging by introducing retort two-piece aluminum cans for CavinKare’s popular milkshakes, where Retort Aluminum cans are carefully designed to withstand the rigorous retort process, ensuring the preservation of flavor, nutrients, and freshness of dairy products. Moreover, these cans align perfectly with the modern consumer’s on-the-go lifestyle.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Food Cans Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Food Cans Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Food Cans Market?

To stay informed about further developments, trends, and reports in the North America Food Cans Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence