Key Insights

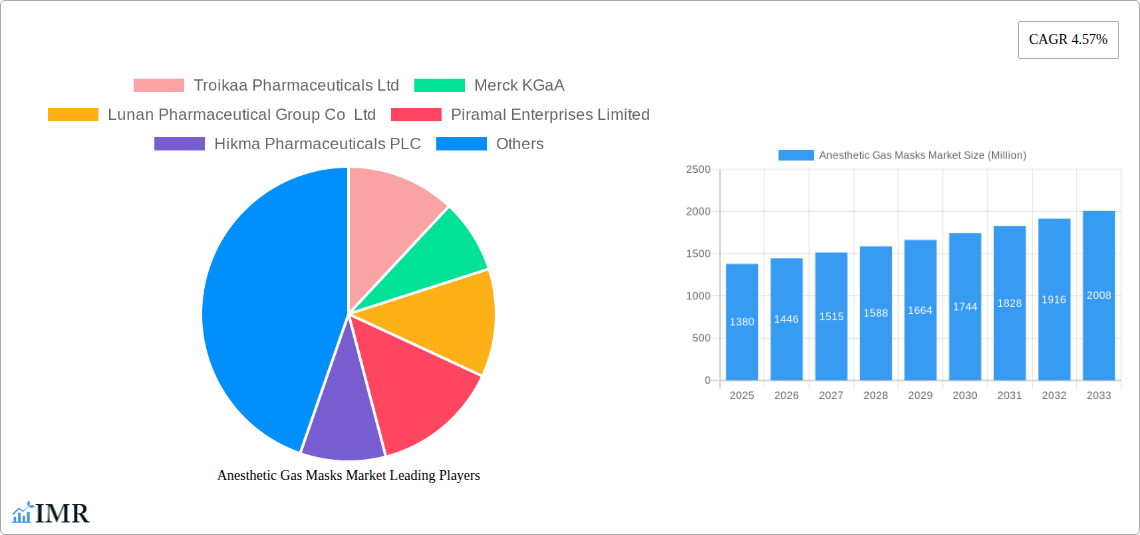

The global Anesthetic Gas Masks Market is projected to reach an estimated USD 2.5 billion in 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 4.00% through 2033. This expansion is primarily fueled by an increasing demand for advanced anesthesia delivery systems, a rising incidence of surgical procedures globally, and significant technological advancements in anesthetic gas masks and vaporizers. Key drivers include the growing preference for inhalation anesthesia, driven by its perceived safety and efficacy, and the expanding healthcare infrastructure in emerging economies, leading to greater access to surgical interventions. Furthermore, the development of novel anesthetic agents and sophisticated vaporizer devices designed for precise and controlled delivery of anesthetic gases are bolstering market growth. The market is segmented by product type, with Anesthesia Gases, including Desflurane, Sevoflurane, Isoflurane, and Nitrous Oxide, holding a substantial share due to their widespread use. Vaporizer Devices also represent a significant segment, critical for the accurate administration of these gases. End-user segments are dominated by Hospitals and Ambulatory Surgery Centers, reflecting the concentration of surgical activities in these settings.

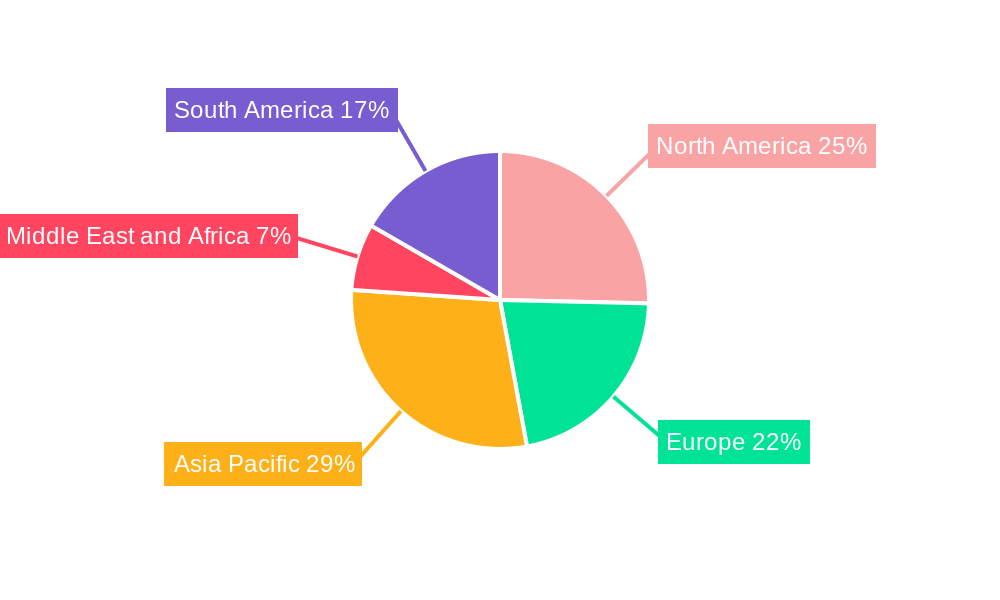

The market dynamics are further shaped by a complex interplay of trends and restraints. Key trends include the increasing adoption of low-flow anesthesia techniques, which improve cost-effectiveness and reduce environmental impact, and the integration of smart technologies in anesthesia delivery systems for enhanced patient monitoring and safety. The development of more environmentally friendly anesthetic agents also presents a significant growth opportunity. However, certain restraints, such as the high cost of advanced anesthesia equipment and the stringent regulatory approvals required for new anesthetic agents and devices, could temper growth in specific regions. The competitive landscape is characterized by the presence of established global players such as GE Healthcare, Dragerwerk AG & Co KGaA, and AbbVie Inc., alongside emerging companies, all vying for market share through product innovation, strategic partnerships, and geographic expansion. The study encompasses a comprehensive analysis of major regions including North America, Europe, Asia Pacific, Middle East and Africa, and South America, with North America currently leading the market due to advanced healthcare infrastructure and high adoption rates of sophisticated medical technologies.

This in-depth report provides a holistic view of the global Anesthetic Gas Masks Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, and future opportunities. With a study period spanning from 2019 to 2033, and a detailed analysis of the base year 2025 and forecast period 2025-2033, this report leverages high-traffic keywords and granular data to offer unparalleled insights for industry professionals. We delve into parent and child market segments, exploring critical areas like Anesthesia Gases (Desflurane, Sevoflurane, Isoflurane, Nitrous Oxide, Other Anesthesia Gases) and Vaporizer Devices, alongside end-user segments such as Hospitals, Ambulatory Surgery Centers, and Others. All values are presented in Million units.

Anesthetic Gas Masks Market Dynamics & Structure

The Anesthetic Gas Masks Market exhibits a moderately concentrated structure, with key players like GE Healthcare, Dragerwerk AG & Co KGaA, and Mindray Medical International Limited holding significant market share. Technological innovation is a primary driver, particularly advancements in vaporizer technology and the development of more environmentally friendly anesthetic agents. Stringent regulatory frameworks, overseen by bodies like the FDA and EMA, ensure product safety and efficacy, influencing product development cycles. Competitive product substitutes, including alternative anesthetic delivery systems and regional anesthetic techniques, present a moderate challenge. End-user demographics are shifting, with an increasing demand from ambulatory surgery centers and a growing focus on patient safety and sustainability in hospitals. Mergers and Acquisitions (M&A) trends are observed, aimed at expanding product portfolios and geographic reach, though the volume of such deals remains moderate.

- Market Concentration: Moderately concentrated, with a few key players dominating.

- Technological Innovation: Driven by advanced vaporizer design and greener anesthetic agent development.

- Regulatory Frameworks: Strict regulations ensure product quality and patient safety.

- Competitive Landscape: Moderate competition from alternative anesthetic methods.

- End-User Focus: Growing demand from ASCs and emphasis on patient-centric solutions.

- M&A Activity: Strategic acquisitions for portfolio enhancement and market penetration.

Anesthetic Gas Masks Market Growth Trends & Insights

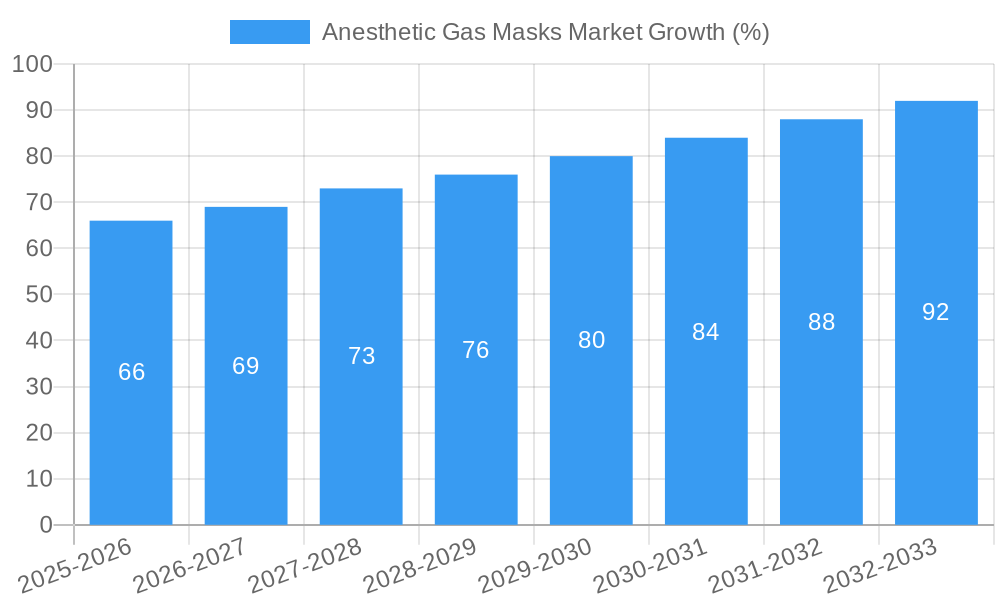

The Anesthetic Gas Masks Market is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This expansion is underpinned by the increasing prevalence of surgical procedures globally, driven by an aging population and the rising incidence of chronic diseases. The adoption rate of advanced anesthesia delivery systems is accelerating, as healthcare providers prioritize improved patient outcomes, reduced recovery times, and enhanced operational efficiency. Technological disruptions, such as the integration of smart monitoring capabilities into anesthesia machines and the development of biodegradable mask materials, are further shaping market dynamics. Consumer behavior shifts are also evident, with a growing emphasis on patient comfort, minimal side effects, and cost-effectiveness in anesthetic gas selection. The market size evolution indicates a steady upward trajectory, with the global market valued at approximately $XXXX million in 2025 and projected to reach $YYYY million by 2033. Market penetration of advanced anesthetic gas masks is expected to increase significantly as awareness and accessibility improve.

Dominant Regions, Countries, or Segments in Anesthetic Gas Masks Market

North America currently dominates the Anesthetic Gas Masks Market, driven by a well-established healthcare infrastructure, high disposable incomes, and a proactive approach to adopting cutting-edge medical technologies. The United States, in particular, accounts for a substantial market share due to its extensive network of hospitals and ambulatory surgery centers performing a high volume of surgical interventions. The Anesthesia Gases segment, with Sevoflurane and Desflurane leading in demand due to their favorable pharmacokinetic profiles and efficacy, is a significant growth driver. Within the Product Type segment, Vaporizer Devices are experiencing substantial demand, fueled by the need for precise and safe administration of anesthetic agents. The End User segment of Hospitals remains the largest contributor, although Ambulatory Surgery Centers (ASCs) are exhibiting rapid growth, reflecting the trend towards outpatient procedures. Economic policies that support healthcare spending and infrastructure development in countries like Canada and Mexico further bolster the North American market's dominance.

- Regional Dominance: North America leads due to advanced healthcare systems and high procedural volumes.

- Key Country: United States commands a significant market share.

- Dominant Product Type: Anesthesia Gases (Sevoflurane, Desflurane) and Vaporizer Devices are key growth areas.

- Leading End User: Hospitals are the largest consumers, with Ambulatory Surgery Centers showing strong growth.

- Growth Drivers: Favorable economic policies, advanced infrastructure, and high surgical rates.

Anesthetic Gas Masks Market Product Landscape

The Anesthetic Gas Masks Market product landscape is characterized by continuous innovation focused on enhancing patient safety, improving gas delivery efficiency, and minimizing environmental impact. Innovations include the development of low-flow anesthesia systems, advanced scavenging technologies to reduce waste anesthetic gas emissions, and masks with improved ergonomic designs for enhanced patient comfort and better seal. Performance metrics such as gas leakage rates, dead space volume, and material biocompatibility are crucial differentiators. Unique selling propositions often revolve around features like integrated monitoring capabilities, disposability for infection control, and compatibility with various anesthesia machines. Technological advancements are also paving the way for the development of reusable and sterilizable mask options, addressing sustainability concerns.

Key Drivers, Barriers & Challenges in Anesthetic Gas Masks Market

Key Drivers:

- Rising Incidence of Surgical Procedures: An increasing global patient population and the prevalence of chronic diseases necessitate more surgeries, directly driving demand for anesthetic gas masks.

- Technological Advancements: Innovations in vaporizer technology, mask design, and anesthetic agent formulations offer improved efficacy and safety, encouraging adoption.

- Government Initiatives & Healthcare Reforms: Policies promoting access to surgical care and investing in healthcare infrastructure create a favorable market environment.

- Focus on Patient Safety & Comfort: Growing awareness and demand for enhanced patient experiences during anesthesia procedures.

Barriers & Challenges:

- High Cost of Advanced Equipment: The initial investment in sophisticated anesthesia delivery systems and masks can be a deterrent for some healthcare facilities, especially in developing economies.

- Stringent Regulatory Approvals: The lengthy and complex process for obtaining regulatory clearance for new products can hinder market entry and slow down innovation.

- Availability of Trained Personnel: A shortage of skilled anesthesiologists and technicians in certain regions can limit the adoption of advanced anesthesia techniques and equipment.

- Environmental Concerns: The impact of volatile anesthetic gases on the environment is a growing concern, driving research into greener alternatives and stricter emission controls.

- Supply Chain Disruptions: Geopolitical factors and global events can lead to interruptions in the supply of raw materials and finished products.

Emerging Opportunities in Anesthetic Gas Masks Market

Emerging opportunities in the Anesthetic Gas Masks Market lie in the development of cost-effective, reusable anesthesia delivery systems for low-resource settings and the creation of biodegradable or recyclable mask materials to address environmental concerns. The increasing demand for minimally invasive surgeries, particularly in outpatient settings, presents a significant opportunity for specialized anesthetic gas masks designed for these environments. Furthermore, the integration of artificial intelligence and machine learning into anesthesia monitoring systems, offering predictive analytics for patient status and anesthetic gas management, represents a nascent but promising area of innovation. Untapped markets in developing economies with expanding healthcare sectors also offer substantial growth potential.

Growth Accelerators in the Anesthetic Gas Masks Market Industry

Long-term growth in the Anesthetic Gas Masks Market will be significantly accelerated by continued technological breakthroughs, such as the development of ultra-low flow anesthesia systems that drastically reduce anesthetic gas consumption and environmental impact. Strategic partnerships between anesthesia equipment manufacturers and pharmaceutical companies developing novel anesthetic agents will foster synergistic innovation and market penetration. Furthermore, strategic market expansion initiatives targeting underserved regions and a growing emphasis on specialized anesthesia care for complex surgical procedures will act as key catalysts for sustained growth. The increasing adoption of telehealth and remote patient monitoring in anesthesia can also indirectly boost the demand for advanced, connected anesthesia gas delivery solutions.

Key Players Shaping the Anesthetic Gas Masks Market Market

- MSS International Ltd

- OES Medical

- GE Healthcare

- BPL Group (Penlon)

- Mindray Medical International Limited

- Piramal Enterprise Ltd

- Fresenius SE & Co KGaA

- AbbVie Inc

- Dragerwerk AG & Co KGaA

- Baxter International Inc

Notable Milestones in Anesthetic Gas Masks Market Sector

- Sept 2022: The Government of Zimbabwe (GoZ) launched its first National Surgical, Obstetric, and Anesthesia Strategy (NSOAS) 2022-2025, aiming to improve surgical and anesthesia care access at the district level.

- Jun 2022: Kootenay Lake Hospital of Canada significantly reduced its greenhouse gas footprint by transitioning to Sevoflurane for 99% of anesthetic procedures, recognizing its 13-times lower environmental impact compared to Desflurane.

In-Depth Anesthetic Gas Masks Market Market Outlook

- Sept 2022: The Government of Zimbabwe (GoZ) launched its first National Surgical, Obstetric, and Anesthesia Strategy (NSOAS) 2022-2025, aiming to improve surgical and anesthesia care access at the district level.

- Jun 2022: Kootenay Lake Hospital of Canada significantly reduced its greenhouse gas footprint by transitioning to Sevoflurane for 99% of anesthetic procedures, recognizing its 13-times lower environmental impact compared to Desflurane.

In-Depth Anesthetic Gas Masks Market Market Outlook

The future outlook for the Anesthetic Gas Masks Market is highly promising, driven by a confluence of factors including an ever-increasing global demand for surgical interventions and a relentless pursuit of enhanced patient safety and comfort. Growth accelerators such as the development of environmentally sustainable anesthetic agents and delivery systems, coupled with the widespread adoption of advanced anesthesia technologies in emerging economies, will propel the market forward. Strategic collaborations between key industry players will foster innovation and expand market reach, while a growing emphasis on personalized anesthesia approaches will create niche opportunities. The market is set for substantial expansion, offering significant strategic opportunities for stakeholders who can adapt to evolving healthcare landscapes and technological advancements.

Anesthetic Gas Masks Market Segmentation

-

1. Product Type

-

1.1. Anesthesia Gases

- 1.1.1. Desflurane

- 1.1.2. Sevoflurane

- 1.1.3. Isoflurane

- 1.1.4. Nitrous Oxide

- 1.1.5. Other Anesthesia Gases

- 1.2. Vaporizer Devices

-

1.1. Anesthesia Gases

-

2. End User

- 2.1. Hospitals

- 2.2. Ambulatory Surgery Centers

- 2.3. Others

Anesthetic Gas Masks Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Anesthetic Gas Masks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Geriatric Population Prone To Chronic Diseases; Increasing Number of Emergency Cases

- 3.3. Market Restrains

- 3.3.1. Increasing Generic Anesthesia Usage; Side Effects of Anesthesia Gases

- 3.4. Market Trends

- 3.4.1. Isoflurane Gas is Expected to Witness Significant Growth Over The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Anesthetic Gas Masks Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Anesthesia Gases

- 5.1.1.1. Desflurane

- 5.1.1.2. Sevoflurane

- 5.1.1.3. Isoflurane

- 5.1.1.4. Nitrous Oxide

- 5.1.1.5. Other Anesthesia Gases

- 5.1.2. Vaporizer Devices

- 5.1.1. Anesthesia Gases

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Ambulatory Surgery Centers

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Anesthetic Gas Masks Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Anesthesia Gases

- 6.1.1.1. Desflurane

- 6.1.1.2. Sevoflurane

- 6.1.1.3. Isoflurane

- 6.1.1.4. Nitrous Oxide

- 6.1.1.5. Other Anesthesia Gases

- 6.1.2. Vaporizer Devices

- 6.1.1. Anesthesia Gases

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Ambulatory Surgery Centers

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Anesthetic Gas Masks Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Anesthesia Gases

- 7.1.1.1. Desflurane

- 7.1.1.2. Sevoflurane

- 7.1.1.3. Isoflurane

- 7.1.1.4. Nitrous Oxide

- 7.1.1.5. Other Anesthesia Gases

- 7.1.2. Vaporizer Devices

- 7.1.1. Anesthesia Gases

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Ambulatory Surgery Centers

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Anesthetic Gas Masks Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Anesthesia Gases

- 8.1.1.1. Desflurane

- 8.1.1.2. Sevoflurane

- 8.1.1.3. Isoflurane

- 8.1.1.4. Nitrous Oxide

- 8.1.1.5. Other Anesthesia Gases

- 8.1.2. Vaporizer Devices

- 8.1.1. Anesthesia Gases

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Ambulatory Surgery Centers

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Anesthetic Gas Masks Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Anesthesia Gases

- 9.1.1.1. Desflurane

- 9.1.1.2. Sevoflurane

- 9.1.1.3. Isoflurane

- 9.1.1.4. Nitrous Oxide

- 9.1.1.5. Other Anesthesia Gases

- 9.1.2. Vaporizer Devices

- 9.1.1. Anesthesia Gases

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Ambulatory Surgery Centers

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Anesthetic Gas Masks Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Anesthesia Gases

- 10.1.1.1. Desflurane

- 10.1.1.2. Sevoflurane

- 10.1.1.3. Isoflurane

- 10.1.1.4. Nitrous Oxide

- 10.1.1.5. Other Anesthesia Gases

- 10.1.2. Vaporizer Devices

- 10.1.1. Anesthesia Gases

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals

- 10.2.2. Ambulatory Surgery Centers

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Anesthetic Gas Masks Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Anesthetic Gas Masks Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Anesthetic Gas Masks Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Anesthetic Gas Masks Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Anesthetic Gas Masks Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 MSS International Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 OES Medical

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 GE Healthcare

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 BPL Group (Penlon)

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Mindray Medical International Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Piramal Enterprise Ltd*List Not Exhaustive

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Fresenius SE & Co KGaA

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 AbbVie Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Dragerwerk AG & Co KGaA

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Baxter International Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 MSS International Ltd

List of Figures

- Figure 1: Global Anesthetic Gas Masks Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Anesthetic Gas Masks Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Anesthetic Gas Masks Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Anesthetic Gas Masks Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Anesthetic Gas Masks Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Anesthetic Gas Masks Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Anesthetic Gas Masks Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Anesthetic Gas Masks Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Anesthetic Gas Masks Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Anesthetic Gas Masks Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Anesthetic Gas Masks Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Anesthetic Gas Masks Market Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Anesthetic Gas Masks Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Anesthetic Gas Masks Market Revenue (Million), by End User 2024 & 2032

- Figure 15: North America Anesthetic Gas Masks Market Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Anesthetic Gas Masks Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Anesthetic Gas Masks Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Anesthetic Gas Masks Market Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Europe Anesthetic Gas Masks Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Europe Anesthetic Gas Masks Market Revenue (Million), by End User 2024 & 2032

- Figure 21: Europe Anesthetic Gas Masks Market Revenue Share (%), by End User 2024 & 2032

- Figure 22: Europe Anesthetic Gas Masks Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Anesthetic Gas Masks Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Anesthetic Gas Masks Market Revenue (Million), by Product Type 2024 & 2032

- Figure 25: Asia Pacific Anesthetic Gas Masks Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Asia Pacific Anesthetic Gas Masks Market Revenue (Million), by End User 2024 & 2032

- Figure 27: Asia Pacific Anesthetic Gas Masks Market Revenue Share (%), by End User 2024 & 2032

- Figure 28: Asia Pacific Anesthetic Gas Masks Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Anesthetic Gas Masks Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Anesthetic Gas Masks Market Revenue (Million), by Product Type 2024 & 2032

- Figure 31: Middle East and Africa Anesthetic Gas Masks Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: Middle East and Africa Anesthetic Gas Masks Market Revenue (Million), by End User 2024 & 2032

- Figure 33: Middle East and Africa Anesthetic Gas Masks Market Revenue Share (%), by End User 2024 & 2032

- Figure 34: Middle East and Africa Anesthetic Gas Masks Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Anesthetic Gas Masks Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Anesthetic Gas Masks Market Revenue (Million), by Product Type 2024 & 2032

- Figure 37: South America Anesthetic Gas Masks Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: South America Anesthetic Gas Masks Market Revenue (Million), by End User 2024 & 2032

- Figure 39: South America Anesthetic Gas Masks Market Revenue Share (%), by End User 2024 & 2032

- Figure 40: South America Anesthetic Gas Masks Market Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Anesthetic Gas Masks Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Anesthetic Gas Masks Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 32: Global Anesthetic Gas Masks Market Revenue Million Forecast, by End User 2019 & 2032

- Table 33: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 38: Global Anesthetic Gas Masks Market Revenue Million Forecast, by End User 2019 & 2032

- Table 39: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 47: Global Anesthetic Gas Masks Market Revenue Million Forecast, by End User 2019 & 2032

- Table 48: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: India Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 56: Global Anesthetic Gas Masks Market Revenue Million Forecast, by End User 2019 & 2032

- Table 57: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: GCC Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 62: Global Anesthetic Gas Masks Market Revenue Million Forecast, by End User 2019 & 2032

- Table 63: Global Anesthetic Gas Masks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Brazil Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Argentina Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of South America Anesthetic Gas Masks Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anesthetic Gas Masks Market?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Anesthetic Gas Masks Market?

Key companies in the market include MSS International Ltd, OES Medical, GE Healthcare, BPL Group (Penlon), Mindray Medical International Limited, Piramal Enterprise Ltd*List Not Exhaustive, Fresenius SE & Co KGaA, AbbVie Inc, Dragerwerk AG & Co KGaA, Baxter International Inc.

3. What are the main segments of the Anesthetic Gas Masks Market?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Geriatric Population Prone To Chronic Diseases; Increasing Number of Emergency Cases.

6. What are the notable trends driving market growth?

Isoflurane Gas is Expected to Witness Significant Growth Over The Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Generic Anesthesia Usage; Side Effects of Anesthesia Gases.

8. Can you provide examples of recent developments in the market?

Sept 2022: The Government of Zimbabwe (GoZ) launched its first National Surgical, Obstetric, and Anesthesia Strategy (NSOAS) 2022-2025. This strategy will promote access to surgical services from the district level, and it will play a central role in surgery and anesthesia care in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Anesthetic Gas Masks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Anesthetic Gas Masks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Anesthetic Gas Masks Market?

To stay informed about further developments, trends, and reports in the Anesthetic Gas Masks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence