Key Insights

Spain's Diagnostic Imaging Equipment market is projected for substantial growth, expected to reach $26.51 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.4%. This expansion is driven by increased healthcare spending, the rising incidence of chronic conditions like cardiology and oncology, and an aging demographic requiring advanced diagnostic tools. Key growth catalysts include technological advancements in high-resolution MRI and CT scanners, alongside the expanding application of ultrasound and X-ray. The integration of AI and machine learning in imaging systems enhances diagnostic accuracy and workflow efficiency, further accelerating market adoption. Heightened public awareness of early disease detection and the subsequent demand for advanced imaging services also contribute significantly.

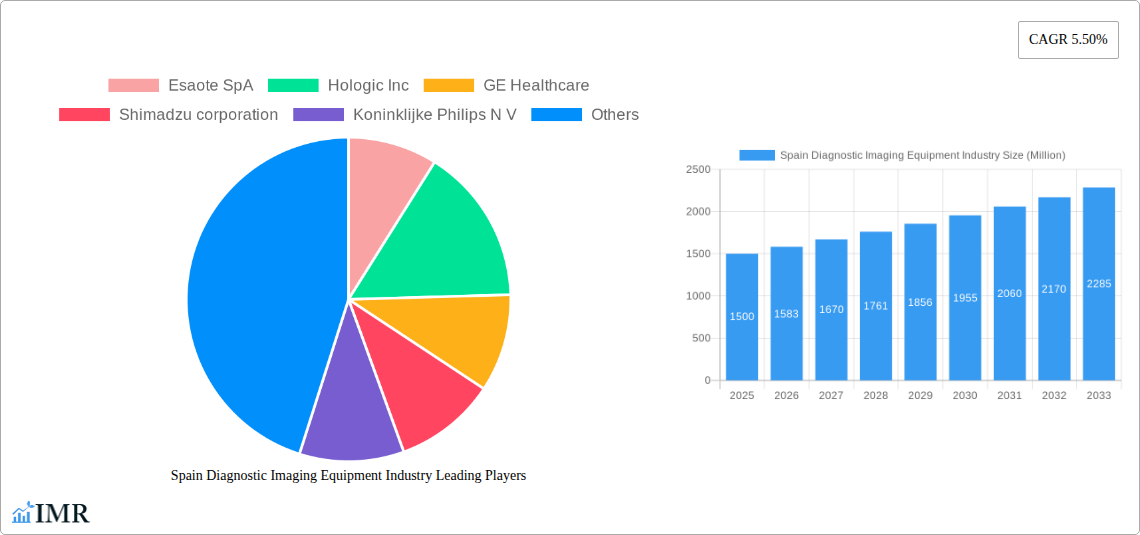

Spain Diagnostic Imaging Equipment Industry Market Size (In Billion)

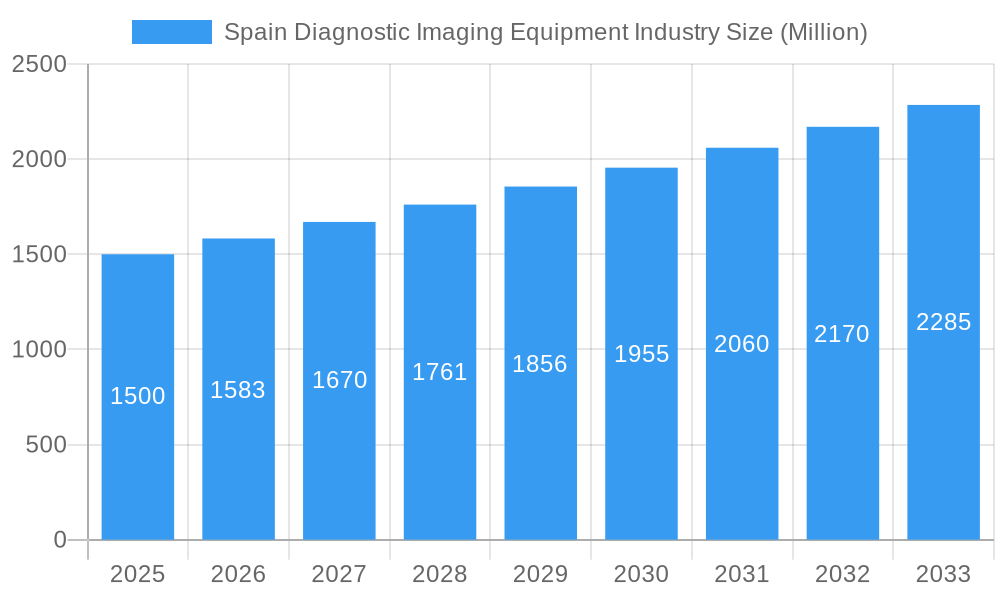

The competitive landscape features major global players such as GE Healthcare, Siemens AG, and Koninklijke Philips N.V., alongside specialized firms like Hologic Inc. and Fujifilm Holdings Corporation. A trend towards portable and cost-effective imaging devices, especially in ultrasound, is emerging to serve a broader spectrum of healthcare providers, including smaller clinics and remote regions. However, significant initial capital investment for advanced equipment and the requirement for skilled operators present market restraints. Stringent regulatory approvals and reimbursement policies also pose challenges. Despite these factors, the market's segmentation by modality (MRI, CT, Ultrasound) and application (Cardiology, Oncology, Neurology) indicates sustained demand and ongoing innovation in Spain's Diagnostic Imaging Equipment sector.

Spain Diagnostic Imaging Equipment Industry Company Market Share

Spain Diagnostic Imaging Equipment Industry Report: Market Dynamics, Growth, and Key Players (2019-2033)

This comprehensive report delves into the intricate landscape of the Spain Diagnostic Imaging Equipment Industry, offering an in-depth analysis of market dynamics, growth trajectories, and the competitive ecosystem. With a focus on high-traffic keywords such as "diagnostic imaging Spain," "medical imaging equipment market," "MRI systems Spain," "CT scanners Spain," and "ultrasound devices Spain," this report is optimized for maximum search engine visibility and aims to be an indispensable resource for industry professionals. We explore both the parent market and crucial child markets, providing granular insights into trends across modalities like MRI, Computed Tomography, Ultrasound, X-Ray, Nuclear Imaging, Fluoroscopy, and Mammography, and applications in Cardiology, Oncology, Neurology, Orthopedics, Gastroenterology, Gynecology, and more. The analysis also segments by end-users, including Hospitals, Diagnostic Centers, and Other End Users. This report covers the study period of 2019–2033, with a base year of 2025 and a forecast period from 2025–2033, building upon historical data from 2019–2024.

Spain Diagnostic Imaging Equipment Industry Market Dynamics & Structure

The Spain Diagnostic Imaging Equipment Industry is characterized by a moderately consolidated market, with leading global players holding significant influence. Technological innovation remains a primary driver, pushing the demand for advanced imaging solutions that offer higher resolution, faster scan times, and improved diagnostic accuracy. Regulatory frameworks, particularly those focused on patient safety and data privacy, play a crucial role in shaping market entry and product development.

- Market Concentration: The market features a mix of large multinational corporations and specialized domestic providers, leading to a competitive yet structured environment.

- Technological Innovation: Key drivers include advancements in AI-powered image analysis, portable and point-of-care imaging devices, and the integration of multi-modal imaging solutions.

- Regulatory Frameworks: Strict adherence to EU medical device regulations (MDR) and national health guidelines influences product approvals and market access.

- Competitive Product Substitutes: While direct substitutions are limited for core imaging modalities, advancements in non-invasive diagnostic techniques and data analytics present indirect competition.

- End-User Demographics: An aging population, coupled with increasing prevalence of chronic diseases, fuels the demand for sophisticated diagnostic imaging services across hospitals and specialized diagnostic centers.

- M&A Trends: Strategic acquisitions and partnerships are observed as companies aim to expand their product portfolios, enhance technological capabilities, and gain market share in key application areas like oncology and cardiology. For example, recent M&A activities in the broader European market suggest a trend towards consolidation for enhanced R&D and market reach.

Spain Diagnostic Imaging Equipment Industry Growth Trends & Insights

The Spain Diagnostic Imaging Equipment Industry is poised for robust growth, driven by a confluence of factors including increasing healthcare expenditure, a growing aging population, and the escalating burden of chronic diseases. This expansion is further fueled by technological advancements that enhance diagnostic accuracy, reduce examination times, and improve patient comfort. The adoption of advanced imaging modalities is accelerating, with a noticeable shift towards digital and AI-integrated systems.

The market size evolution is projected to be significant, with a steady increase in the installed base of advanced imaging equipment. This growth is underpinned by the rising prevalence of conditions such as cancer, cardiovascular diseases, and neurological disorders, all of which rely heavily on diagnostic imaging for early detection and effective management. The adoption rates for sophisticated technologies like PET/CT scanners and advanced MRI systems are increasing, particularly within larger hospital networks and dedicated diagnostic centers.

Technological disruptions are reshaping the industry. The integration of Artificial Intelligence (AI) into diagnostic imaging is a pivotal trend, enabling automated image analysis, lesion detection, and workflow optimization. This not only improves diagnostic efficiency but also empowers clinicians with more accurate insights. Furthermore, the development of portable and point-of-care ultrasound devices is expanding access to diagnostic imaging in remote areas and primary care settings.

Consumer behavior shifts are also playing a crucial role. Patients are increasingly becoming more informed and proactive about their health, leading to a higher demand for comprehensive diagnostic assessments. This, in turn, incentivizes healthcare providers to invest in state-of-the-art imaging equipment. The emphasis on preventative healthcare and early disease detection further bolsters the market.

Specific metrics indicate a healthy compound annual growth rate (CAGR) for the Spain Diagnostic Imaging Equipment Market. Market penetration of advanced imaging techniques is expected to rise, as healthcare facilities invest in upgrading their existing infrastructure to meet the growing demands of a population with complex medical needs. The demand for high-resolution imaging, real-time diagnostics, and integrated data management solutions will continue to shape purchasing decisions, driving innovation and market expansion.

Dominant Regions, Countries, or Segments in Spain Diagnostic Imaging Equipment Industry

The Spain Diagnostic Imaging Equipment Industry is experiencing significant growth across various segments, with specific modalities, applications, and end-user categories emerging as key drivers. Understanding these dominant forces is crucial for strategic market navigation.

Dominant Modalities:

- Computed Tomography (CT): CT remains a cornerstone of diagnostic imaging in Spain, driven by its versatility in diagnosing a wide range of conditions, from trauma and stroke to oncology. The demand for advanced CT scanners with lower radiation doses and higher spatial resolution, particularly for cardiac and lung imaging, is consistently high. Its widespread adoption in both hospitals and diagnostic centers makes it a leading segment.

- Magnetic Resonance Imaging (MRI): MRI continues its upward trajectory, propelled by its superior soft-tissue contrast and its critical role in neurological, orthopedic, and oncological diagnostics. The increasing demand for high-field MRI systems (e.g., 3T and above) for detailed anatomical and functional imaging, as well as the growing interest in functional MRI (fMRI) for research and complex neurological conditions, are significant growth catalysts.

- Ultrasound: Ultrasound technology is experiencing substantial growth, particularly due to its affordability, portability, and non-invasiveness. Its applications span across cardiology, obstetrics & gynecology, gastroenterology, and emergency medicine. The development of advanced ultrasound systems with AI-driven features and high-resolution imaging capabilities is further solidifying its market position, especially in diagnostic centers and smaller clinics.

Dominant Applications:

- Oncology: The fight against cancer continues to be a primary driver for advanced diagnostic imaging. Modalities like PET/CT, MRI, and advanced CT scanners are indispensable for cancer detection, staging, treatment planning, and monitoring response to therapy. Investments in cancer care infrastructure and research directly translate into increased demand for these imaging solutions.

- Cardiology: The high prevalence of cardiovascular diseases in Spain fuels the demand for specialized cardiac imaging solutions. Advanced CT angiography, cardiac MRI, and sophisticated ultrasound systems are crucial for diagnosing coronary artery disease, structural heart abnormalities, and monitoring heart function, making cardiology a vital application segment.

- Neurology: With an aging population and increasing awareness of neurological disorders, the demand for neurological imaging is on the rise. MRI is the preferred modality for diagnosing conditions like stroke, multiple sclerosis, tumors, and degenerative diseases. Advanced imaging techniques within MRI, such as diffusion tensor imaging (DTI), are gaining traction for detailed brain analysis.

Dominant End-Users:

- Hospitals: Hospitals, particularly large university hospitals and specialized medical centers, remain the largest consumers of diagnostic imaging equipment. Their comprehensive service offerings, high patient volumes, and commitment to adopting cutting-edge technologies make them central to market growth. Public and private investment in upgrading hospital infrastructure directly impacts the demand for a wide array of imaging modalities.

- Diagnostic Centers: The proliferation of independent diagnostic centers in Spain is a significant growth accelerator. These centers focus on specific imaging services, catering to both referring physicians and self-referring patients, thereby driving demand for versatile and cost-effective imaging solutions.

The dominance of these segments is driven by factors such as economic policies that favor healthcare investment, a well-established healthcare infrastructure with a network of hospitals and clinics, and growing public awareness regarding the importance of early disease detection. The market share for advanced modalities like PET/CT and high-field MRI is steadily increasing within these dominant segments, indicating a clear trend towards higher-value diagnostic solutions.

Spain Diagnostic Imaging Equipment Industry Product Landscape

The Spain Diagnostic Imaging Equipment Industry is characterized by a diverse and rapidly evolving product landscape. Innovations are focused on enhancing image quality, reducing scan times, improving patient comfort, and integrating artificial intelligence for enhanced diagnostic capabilities. Products range from high-end, multi-functional systems for complex diagnoses to more portable and accessible devices for point-of-care applications.

Key product advancements include the development of ultra-high field MRI scanners offering unparalleled resolution, AI-powered CT reconstruction algorithms that reduce radiation dose while maintaining image clarity, and advanced ultrasound systems with quantitative imaging features. The integration of digital radiography and PACS (Picture Archiving and Communication Systems) is standard, with a growing emphasis on cloud-based solutions for seamless data management and remote access.

Key Drivers, Barriers & Challenges in Spain Diagnostic Imaging Equipment Industry

Key Drivers:

- Technological Advancements: The continuous development of AI-powered diagnostics, higher resolution imaging, and portable devices are significant growth catalysts.

- Aging Population & Chronic Diseases: Spain's demographic shift towards an older population, coupled with a rising incidence of chronic diseases like cancer and cardiovascular conditions, directly fuels demand for advanced diagnostic imaging.

- Increased Healthcare Expenditure: Growing government and private investments in healthcare infrastructure and services enhance the purchasing power for sophisticated medical equipment.

- Focus on Preventative Healthcare: The shift towards early detection and preventative medicine necessitates more frequent and accurate diagnostic imaging.

Barriers & Challenges:

- High Initial Investment Costs: Advanced diagnostic imaging equipment represents a substantial capital expenditure, which can be a barrier for smaller healthcare providers.

- Regulatory Compliance: Navigating complex and evolving regulatory frameworks for medical devices can be time-consuming and resource-intensive.

- Reimbursement Policies: Evolving reimbursement structures for diagnostic imaging procedures can impact revenue streams and investment decisions.

- Skilled Workforce Shortage: A demand for highly trained radiographers and radiologists to operate and interpret advanced imaging technologies can pose a challenge.

- Supply Chain Disruptions: Global supply chain issues can affect the availability and timely delivery of essential components and finished equipment.

- Competitive Pressures: Intense competition among global and local manufacturers can lead to price pressures and necessitate continuous innovation.

Emerging Opportunities in Spain Diagnostic Imaging Equipment Industry

Emerging opportunities within the Spain Diagnostic Imaging Equipment Industry lie in the expanding application of AI in radiology, the development of point-of-care imaging solutions, and the increasing demand for hybrid imaging systems. The growing focus on personalized medicine is also creating a niche for advanced imaging techniques that can provide more specific diagnostic information.

- AI Integration: Further development and adoption of AI algorithms for image analysis, workflow optimization, and predictive diagnostics present a significant growth avenue.

- Point-of-Care Ultrasound (POCUS): Expansion of POCUS in emergency medicine, primary care, and remote settings offers a substantial untapped market.

- Hybrid Imaging: The increasing demand for PET/MRI and other hybrid systems, which combine anatomical and functional information, is an area of significant potential.

- Home Healthcare Imaging: As home healthcare services expand, there is an emerging opportunity for portable and user-friendly imaging devices.

Growth Accelerators in the Spain Diagnostic Imaging Equipment Industry Industry

Long-term growth in the Spain Diagnostic Imaging Equipment Industry will be significantly accelerated by continued technological breakthroughs, strategic partnerships, and proactive market expansion strategies. The increasing integration of digital health platforms and the expansion of telehealth services will further drive the adoption of connected imaging solutions.

- Technological Breakthroughs: Innovations in detector technology, artificial intelligence, and miniaturization of equipment will continue to push the boundaries of diagnostic imaging.

- Strategic Partnerships: Collaborations between equipment manufacturers, software providers, and healthcare institutions will foster the development of integrated solutions and streamline adoption.

- Market Expansion: Targeting underserved regions and expanding services within existing healthcare networks will unlock new growth avenues.

- Data Analytics and AI: Leveraging big data and AI for predictive diagnostics and personalized treatment plans will create new service models and drive demand for advanced imaging.

Key Players Shaping the Spain Diagnostic Imaging Equipment Industry Market

- Esaote SpA

- Hologic Inc

- GE Healthcare

- Shimadzu Corporation

- Koninklijke Philips N V

- Siemens AG

- AURELIUS (Agfa-Gevaert Group)

- Canon

- Fujifilm Holdings Corporation

- Carestream Health

Notable Milestones in Spain Diagnostic Imaging Equipment Industry Sector

- October 2022: GE Healthcare launched the Omni PET/CT platform and Omni Legend system at the annual meeting of the European Association of Nuclear Medicine (EANM) in Barcelona, Spain.

- August 2022: The Nuclear Medicine-PET Service at Bellvitge University Hospital (HUB) incorporated a gamma camera, enhancing advancements in oncology care and research, as well as in non-oncological pathologies.

In-Depth Spain Diagnostic Imaging Equipment Industry Market Outlook

The Spain Diagnostic Imaging Equipment Industry is on a robust growth trajectory, underpinned by a sustained demand for advanced diagnostic capabilities. Future market potential is immense, driven by the ongoing integration of AI, the expansion of hybrid imaging technologies, and the increasing need for efficient and accurate disease diagnosis across all medical specialties. Strategic opportunities lie in developing solutions that address the growing demand for personalized medicine, preventative healthcare, and accessible diagnostic services in both urban and remote areas. The industry is set to witness a significant transformation driven by innovation and a proactive approach to meeting evolving healthcare needs.

Spain Diagnostic Imaging Equipment Industry Segmentation

-

1. Modality

- 1.1. MRI

- 1.2. Computed Tomography

- 1.3. Ultrasound

- 1.4. X-Ray

- 1.5. Nuclear Imaging

- 1.6. Fluoroscopy

- 1.7. Mammography

-

2. Application

- 2.1. Cardiology

- 2.2. Oncology

- 2.3. Neurology

- 2.4. Orthopedics

- 2.5. Gastroenterology

- 2.6. Gynecology

- 2.7. Other Applications

-

3. End User

- 3.1. Hospital

- 3.2. Diagnostic Centers

- 3.3. Other End Users

Spain Diagnostic Imaging Equipment Industry Segmentation By Geography

- 1. Spain

Spain Diagnostic Imaging Equipment Industry Regional Market Share

Geographic Coverage of Spain Diagnostic Imaging Equipment Industry

Spain Diagnostic Imaging Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Prevalence of Chronic Diseases and Growing Geriatric Population; Technological Advancements and Rapid Innovation

- 3.3. Market Restrains

- 3.3.1. High Cost of Diagnostic Imaging Procedures and Equipment

- 3.4. Market Trends

- 3.4.1. Oncology Segment is Expected to Show Better Growth in the Forecast Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Diagnostic Imaging Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Modality

- 5.1.1. MRI

- 5.1.2. Computed Tomography

- 5.1.3. Ultrasound

- 5.1.4. X-Ray

- 5.1.5. Nuclear Imaging

- 5.1.6. Fluoroscopy

- 5.1.7. Mammography

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Oncology

- 5.2.3. Neurology

- 5.2.4. Orthopedics

- 5.2.5. Gastroenterology

- 5.2.6. Gynecology

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospital

- 5.3.2. Diagnostic Centers

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Modality

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Esaote SpA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hologic Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GE Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shimadzu corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Koninklijke Philips N V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AURELIUS (Agfa-Gevaert Group)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Carestream Health

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Canon*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fujifilm Holdings Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Esaote SpA

List of Figures

- Figure 1: Spain Diagnostic Imaging Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Spain Diagnostic Imaging Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Spain Diagnostic Imaging Equipment Industry Revenue billion Forecast, by Modality 2020 & 2033

- Table 2: Spain Diagnostic Imaging Equipment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Spain Diagnostic Imaging Equipment Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Spain Diagnostic Imaging Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Spain Diagnostic Imaging Equipment Industry Revenue billion Forecast, by Modality 2020 & 2033

- Table 6: Spain Diagnostic Imaging Equipment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Spain Diagnostic Imaging Equipment Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Spain Diagnostic Imaging Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Diagnostic Imaging Equipment Industry?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the Spain Diagnostic Imaging Equipment Industry?

Key companies in the market include Esaote SpA, Hologic Inc, GE Healthcare, Shimadzu corporation, Koninklijke Philips N V, Siemens AG, AURELIUS (Agfa-Gevaert Group), Carestream Health, Canon*List Not Exhaustive, Fujifilm Holdings Corporation.

3. What are the main segments of the Spain Diagnostic Imaging Equipment Industry?

The market segments include Modality, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Prevalence of Chronic Diseases and Growing Geriatric Population; Technological Advancements and Rapid Innovation.

6. What are the notable trends driving market growth?

Oncology Segment is Expected to Show Better Growth in the Forecast Years.

7. Are there any restraints impacting market growth?

High Cost of Diagnostic Imaging Procedures and Equipment.

8. Can you provide examples of recent developments in the market?

In October 2022, GE Healthcare launched the Omni PET/CT platform and Omni Legend system at the annual meeting of the European Association of Nuclear Medicine (EANM) in Barcelona, Spain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Diagnostic Imaging Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Diagnostic Imaging Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Diagnostic Imaging Equipment Industry?

To stay informed about further developments, trends, and reports in the Spain Diagnostic Imaging Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence