Key Insights

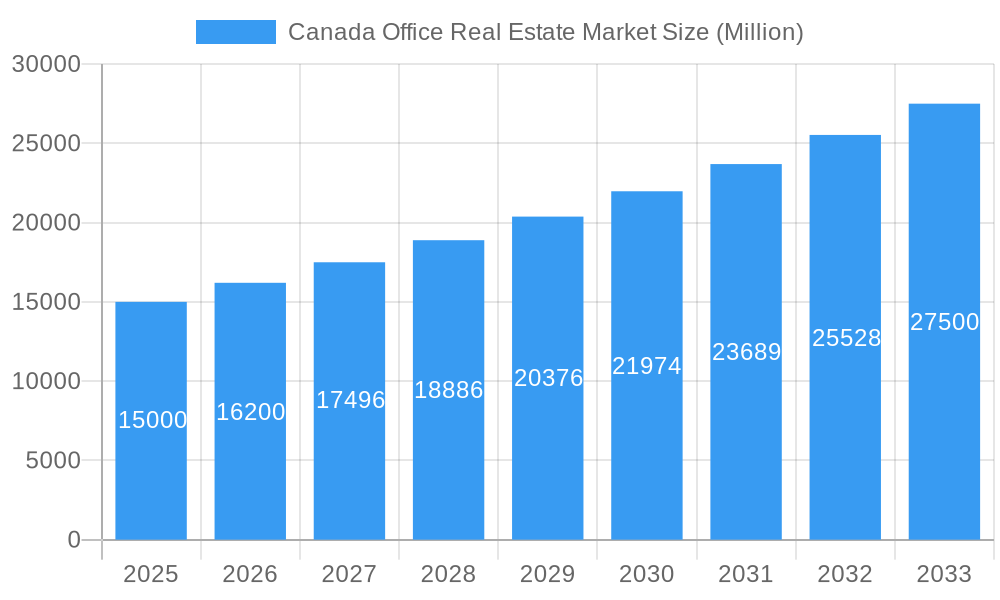

The Canadian office real estate market, valued at approximately $XX million in 2025, exhibits robust growth potential, projected to expand at a CAGR exceeding 8.0% from 2025 to 2033. This expansion is driven by several key factors. Firstly, a growing Canadian economy, particularly in major urban centers like Toronto, Montreal, and Ottawa, fuels increasing demand for office space from diverse sectors, including technology, finance, and professional services. Secondly, ongoing urban development and infrastructure improvements in these cities enhance the attractiveness of office properties, stimulating both new construction and renovations. Finally, the post-pandemic shift towards hybrid work models, while initially impacting demand, is now showing signs of stabilization, with many businesses recognizing the continued need for physical office space to foster collaboration and company culture. However, challenges persist. Rising interest rates and construction costs pose significant headwinds, potentially impacting new development and investment activity. Furthermore, the evolving preferences of the modern workforce, including a desire for flexible and amenity-rich workspaces, present opportunities for landlords to adapt and renovate their properties to remain competitive.

Canada Office Real Estate Market Market Size (In Billion)

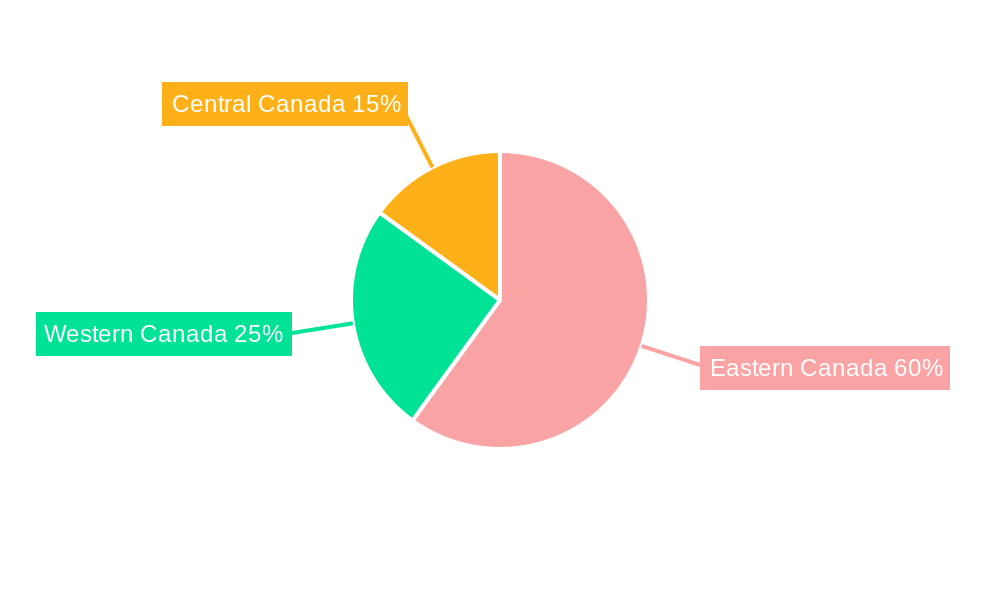

The market is segmented geographically, with Eastern Canada, encompassing major cities like Toronto, Montreal, and Ottawa, expected to dominate the market share due to its higher population density and robust economic activity. Western and Central Canada will also witness growth, albeit at potentially slower rates, driven by regional economic factors and development activity. Key players in this market include established international firms like CBRE Canada, JLL, and Brookfield Asset Management, alongside prominent domestic companies like Colliers, Avison Young, and QuadReal. The competitive landscape is dynamic, with established players and emerging firms vying for market share through strategic acquisitions, portfolio expansion, and innovative service offerings. The long-term outlook remains positive, predicated on continued economic growth and adaptation to evolving market trends. The market’s response to economic fluctuations and the lasting impact of hybrid work arrangements will be key determinants of future performance.

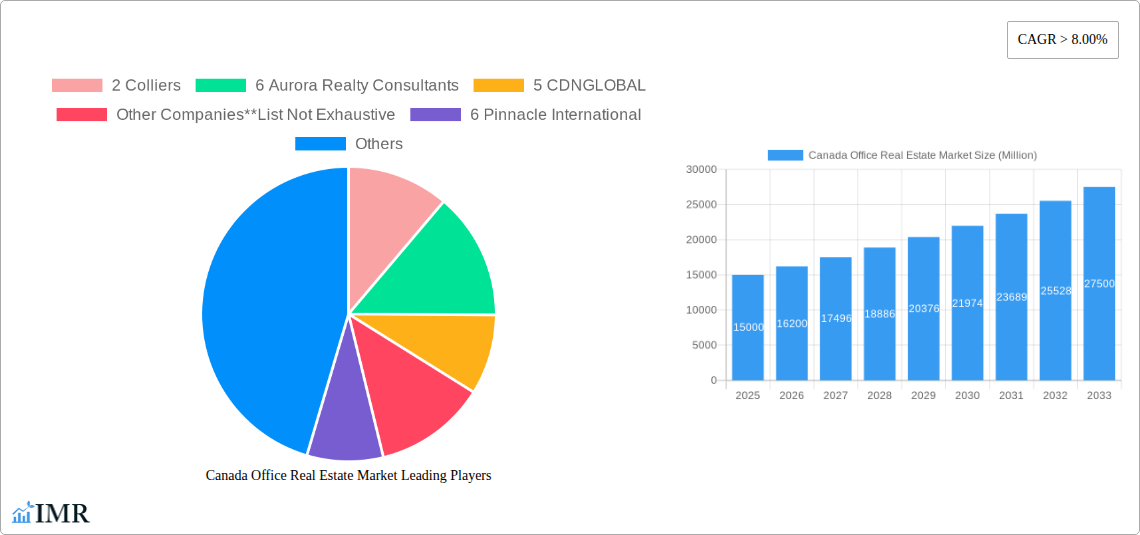

Canada Office Real Estate Market Company Market Share

Canada Office Real Estate Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Canadian office real estate market, covering historical data (2019-2024), the base year (2025), and a detailed forecast from 2025 to 2033. It examines market dynamics, growth trends, dominant regions, key players, and emerging opportunities, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report utilizes a robust methodology, incorporating both quantitative and qualitative data to provide a holistic view of this dynamic sector.

Canada Office Real Estate Market Dynamics & Structure

This section analyzes the structure and dynamics of the Canadian office real estate market, focusing on market concentration, technological disruptions, regulatory frameworks, competitive forces, and M&A activity. The study period spans 2019-2033, providing a long-term perspective on market evolution.

- Market Concentration: The Canadian office real estate market exhibits a moderately concentrated structure with major players like CBRE Canada, Colliers, and JLL holding significant market share. However, a substantial portion of the market is also occupied by smaller, regional players and independent firms (estimated at xx%).

- Technological Innovation: Technological advancements like smart building technologies, proptech solutions for property management, and data analytics are transforming the sector, boosting efficiency and creating new revenue streams. However, adoption rates vary among companies, with smaller firms facing challenges in integrating new technologies.

- Regulatory Framework: Federal and provincial regulations, zoning laws, and building codes significantly impact development, investment, and operations. Changes in these regulations (e.g., environmental standards) can accelerate or hinder market growth.

- Competitive Landscape: The market faces competition from alternative workspace solutions (co-working spaces, flexible offices) which are impacting demand for traditional office spaces, particularly in major urban centers.

- M&A Activity: The market has witnessed significant M&A activity in recent years, driven by consolidation and expansion strategies of major players. The total deal volume from 2019 to 2024 is estimated at $xx Million, with an average deal size of $xx Million. (Further detailed breakdown available in the full report).

- End-User Demographics: The changing needs of office tenants, including a shift towards flexible work arrangements and a focus on employee well-being, are influencing office design and functionality, further shaping market dynamics.

Canada Office Real Estate Market Growth Trends & Insights

This section provides a comprehensive analysis of market size evolution, adoption rates, technological disruptions, and consumer behavior shifts using proprietary data and industry benchmarks. The report projects a CAGR of xx% for the forecast period (2025-2033). Key factors influencing market growth include:

The Canadian office real estate market, fueled by economic growth, urbanization, and technological advancements, exhibited significant growth during the historical period (2019-2024). This growth trend is expected to continue, although at a potentially moderated pace in the forecast period (2025-2033). Market penetration of smart building technologies is expected to reach xx% by 2033, driven by increased adoption among larger corporations and developers. Further, changing work preferences and the rise of hybrid work models are affecting demand and leading to a growing need for flexible and adaptable office spaces. A detailed analysis of these factors and their impact on growth trajectories is presented in the full report. The report also explores the evolving demographics of office tenants and their preferences, influencing the design, amenities, and location of office buildings. Market size is projected to reach $xx Million by 2033.

Dominant Regions, Countries, or Segments in Canada Office Real Estate Market

Toronto, Montreal, and Ottawa are the dominant markets for office real estate in Canada.

- Toronto: Toronto's robust economy, large corporate presence, and thriving financial sector drive significant demand for office space, making it the leading market. Key drivers include a strong influx of skilled labor, significant infrastructure investment, and favorable government policies.

- Montreal: Montreal's growing tech sector and established presence in various industries contribute to substantial demand. Factors influencing growth include comparatively lower real estate costs than Toronto, a skilled workforce, and government incentives promoting innovation and economic development.

- Ottawa: Ottawa's government sector and growing tech scene fuel demand for office space, especially in the high-tech and government service sectors. Government investments in infrastructure and a strategic geographical location contribute to this city's attractiveness as an office market.

The report provides a granular analysis of the market share and growth potential of each major city, outlining the key factors driving their dominance.

Canada Office Real Estate Market Product Landscape

The Canadian office real estate market offers a variety of products, ranging from traditional Class A office buildings in downtown cores to suburban office parks and flex spaces. Innovation is focused on creating sustainable, smart buildings with enhanced amenities to cater to the evolving needs of tenants. This includes integrating technology for better energy efficiency, security, and tenant experience. The emphasis is on creating flexible workspaces adaptable to hybrid work models.

Key Drivers, Barriers & Challenges in Canada Office Real Estate Market

Key Drivers:

- Strong economic growth in major cities.

- Increasing demand from technology and financial sectors.

- Government investments in infrastructure.

- Growing adoption of sustainable building practices.

Challenges:

- Rising construction costs and material shortages (estimated impact on development costs: xx%).

- Increasing interest rates impacting financing options.

- Competition from alternative workspace solutions (e.g., co-working spaces).

- Regulatory complexities and permitting processes.

Emerging Opportunities in Canada Office Real Estate Market

Emerging opportunities include the expansion of flexible office spaces, the growing demand for sustainable buildings, and the integration of technology into property management and tenant experience. Untapped markets in secondary cities present potential for growth, and strategic partnerships between developers and technology companies are creating innovative solutions to address the evolving needs of office tenants.

Growth Accelerators in the Canada Office Real Estate Market Industry

Technological advancements, strategic partnerships between developers and technology companies, and expansion into new markets will accelerate growth. The focus on creating sustainable and smart buildings equipped with modern amenities will be key to attracting tenants and maximizing value. Government initiatives to support sustainable development will further propel market growth.

Key Players Shaping the Canada Office Real Estate Market Market

- Colliers

- Aurora Realty Consultants

- CDNGLOBAL

- Other Companies (List Not Exhaustive)

- Pinnacle International

- Avison Young (Canada) Inc

- CBRE Canada

- Brookfield Asset Management

- QUADREAL

- EllisDon Inc

- BROCCOLINI

- Amacon

- Hines

- JLL

Notable Milestones in Canada Office Real Estate Market Sector

- April 2022: Canadian Net Real Estate Investment Trust's purchase of four properties in Quebec and Nova Scotia for USD 18,800,000, reflecting a 6.5% capitalization rate, signifies investor confidence in specific regional markets.

- February 2022: Crown Realty Partners' acquisition of the Park of Commerce property in Ottawa highlights the growing interest in value-add opportunities and sustainable investments.

In-Depth Canada Office Real Estate Market Market Outlook

The Canadian office real estate market is poised for continued growth, driven by technological advancements, evolving tenant demands, and strategic investments. The focus on sustainable development and the creation of flexible workspaces will be pivotal for future success. Strategic partnerships and expansion into secondary markets will unlock further growth potential, creating a dynamic and evolving landscape for years to come.

Canada Office Real Estate Market Segmentation

-

1. Major Cities

- 1.1. Toronto

- 1.2. Ottawa

- 1.3. Montreal

Canada Office Real Estate Market Segmentation By Geography

- 1. Canada

Canada Office Real Estate Market Regional Market Share

Geographic Coverage of Canada Office Real Estate Market

Canada Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing new construction activity as well as expansion of new startups and small enterprises; Increasing demand for affordable housing units

- 3.3. Market Restrains

- 3.3.1. Lack of housing spaces and mortgage regulation

- 3.4. Market Trends

- 3.4.1. Office spaces in Toronto and Vancouver are increasing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Major Cities

- 5.1.1. Toronto

- 5.1.2. Ottawa

- 5.1.3. Montreal

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Major Cities

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 2 Colliers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 6 Aurora Realty Consultants

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 5 CDNGLOBAL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Other Companies**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 6 Pinnacle International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 4 Avison Young (Canada) Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 3 CBRE Canada

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 1 Brookfield Asset Management

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 5 QUADREAL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 2 EllisDon Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 4 BROCCOLINI

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 7 Amacon

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 3 Hines

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 1 JLL

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 2 Colliers

List of Figures

- Figure 1: Canada Office Real Estate Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Canada Office Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Office Real Estate Market Revenue undefined Forecast, by Major Cities 2020 & 2033

- Table 2: Canada Office Real Estate Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Canada Office Real Estate Market Revenue undefined Forecast, by Major Cities 2020 & 2033

- Table 4: Canada Office Real Estate Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Office Real Estate Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Canada Office Real Estate Market?

Key companies in the market include 2 Colliers, 6 Aurora Realty Consultants, 5 CDNGLOBAL, Other Companies**List Not Exhaustive, 6 Pinnacle International, 4 Avison Young (Canada) Inc, 3 CBRE Canada, 1 Brookfield Asset Management, 5 QUADREAL, 2 EllisDon Inc, 4 BROCCOLINI, 7 Amacon, 3 Hines, 1 JLL.

3. What are the main segments of the Canada Office Real Estate Market?

The market segments include Major Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing new construction activity as well as expansion of new startups and small enterprises; Increasing demand for affordable housing units.

6. What are the notable trends driving market growth?

Office spaces in Toronto and Vancouver are increasing.

7. Are there any restraints impacting market growth?

Lack of housing spaces and mortgage regulation.

8. Can you provide examples of recent developments in the market?

April 2022: Canadian Net Real Estate Investment Trust announced the purchase of four properties in Quebec and Nova Scotia. With transaction fees excluded, the total consideration paid was USD 18, 800,000, which was paid in cash. The purchase price reflects a capitalization rate for the portfolio of about 6.5%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Canada Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence