Key Insights

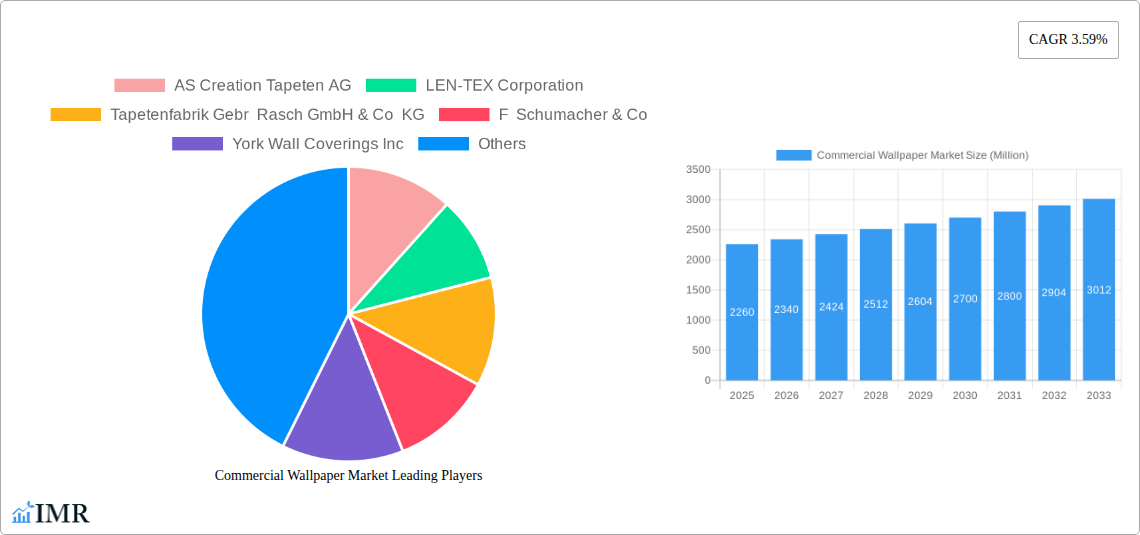

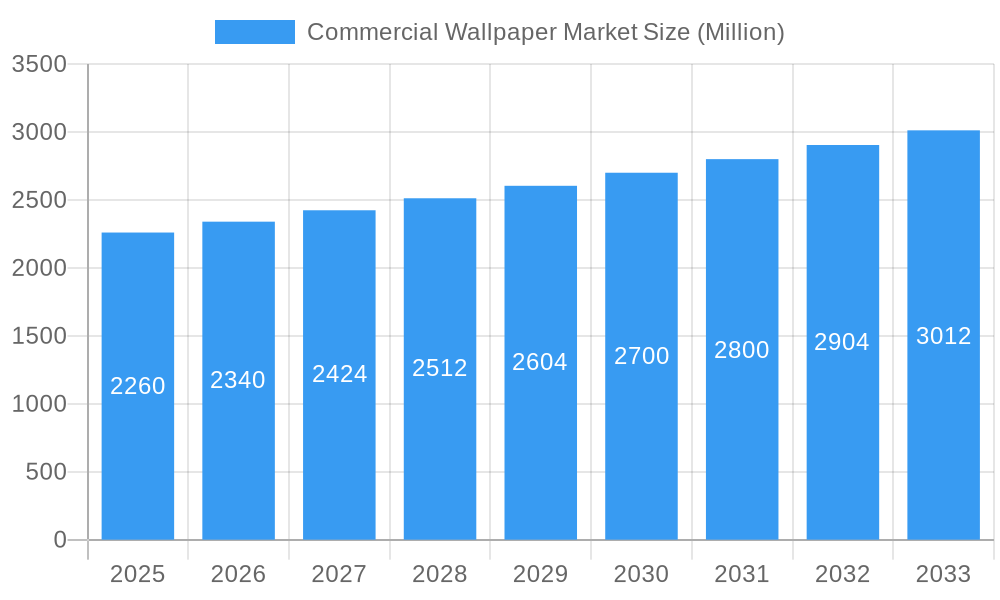

The commercial wallpaper market, valued at approximately $2.26 billion in 2025, is projected to experience steady growth, driven by the increasing demand for aesthetically pleasing and functional spaces in commercial settings. This growth is fueled by several factors. Firstly, the hospitality sector, including hotels and restaurants, consistently invests in renovations and new builds, significantly impacting wallpaper demand. Secondly, the rise of co-working spaces and modern office designs prioritizes visually appealing environments, further stimulating market expansion. Thirdly, technological advancements in wallpaper manufacturing, such as the development of durable, easy-to-clean vinyl and non-woven options, cater to the high-traffic nature of commercial spaces and contribute to market growth. The market segmentation reveals that vinyl and non-woven wallpapers dominate due to their cost-effectiveness and durability, while the commercial application segment holds the largest share due to the factors mentioned above. However, economic downturns and fluctuations in the construction industry could act as potential restraints on market growth. The competition is robust, with key players such as AS Creation Tapeten AG, LEN-TEX Corporation, and others vying for market share through innovation and brand recognition.

Commercial Wallpaper Market Market Size (In Billion)

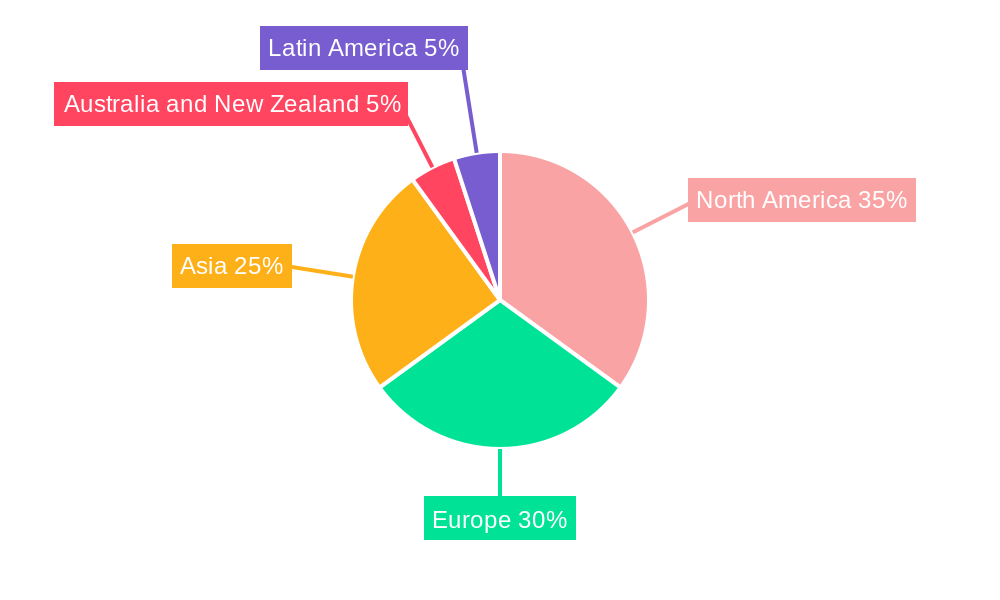

Despite potential restraints, the projected CAGR of 3.59% indicates a positive outlook for the commercial wallpaper market through 2033. Geographic factors also play a significant role, with North America and Europe expected to remain dominant markets due to established commercial real estate sectors and higher disposable incomes. However, emerging economies in Asia are anticipated to witness significant growth due to increasing urbanization and infrastructure development. The market is expected to see continued innovation in terms of design, material, and sustainability, leading to the introduction of eco-friendly options and further segmentation within the market. Companies are likely to focus on building strong distribution networks and partnerships with interior designers and contractors to maintain a competitive edge.

Commercial Wallpaper Market Company Market Share

Commercial Wallpaper Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Commercial Wallpaper Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the period 2019-2033, with 2025 as the base year and forecast period extending to 2033. The study delves into both the parent market (Wall Coverings) and the child market (Commercial Wallpaper), offering invaluable insights for industry professionals, investors, and stakeholders. The market size is presented in million units.

Commercial Wallpaper Market Dynamics & Structure

The Commercial Wallpaper market is characterized by moderate concentration, with several key players holding significant market share. Technological innovation, particularly in sustainable and digitally printed wallpapers, is a key driver. Regulatory frameworks related to VOC emissions and fire safety standards significantly influence product development and market access. The market faces competition from alternative wall coverings like paint, tiles, and murals. End-user demographics, predominantly commercial spaces (offices, hotels, restaurants), shape demand trends. M&A activity has been relatively low in recent years (xx deals in the last 5 years), but strategic partnerships and collaborations are increasingly common.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Innovation Drivers: Sustainable materials, digital printing technology, smart wallpapers.

- Regulatory Landscape: Stringent environmental and safety regulations influence product composition and manufacturing processes.

- Competitive Substitutes: Paint, tiles, murals, textured wall panels.

- End-User Demographics: Predominantly commercial sectors: hospitality, corporate offices, retail spaces.

- M&A Trends: Limited M&A activity; focus on strategic partnerships and collaborations.

Commercial Wallpaper Market Growth Trends & Insights

The Commercial Wallpaper market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of xx million units in 2024. This growth is attributed to factors such as rising construction activity in commercial spaces, increasing demand for aesthetically pleasing and durable wall coverings, and the growing adoption of sustainable and innovative wallpaper products. The market penetration of commercial wallpaper in new construction projects stands at approximately xx% in 2025, with significant potential for growth in renovation projects. Technological disruptions such as 3D-printed wallpapers and smart wallpapers are expected to further drive market expansion. Shifting consumer preferences towards personalized and customizable wall décor also contribute to market growth. The forecast period (2025-2033) projects a CAGR of xx%, reaching xx million units by 2033. The adoption rate of eco-friendly wallpapers is anticipated to increase substantially, driven by rising environmental awareness.

Dominant Regions, Countries, or Segments in Commercial Wallpaper Market

North America and Europe currently dominate the commercial wallpaper market, holding a combined xx% market share in 2025. Within these regions, the United States and Germany stand out as key markets due to robust construction activity, high disposable incomes, and strong demand for premium and designer wallpapers. The fastest-growing segment is Vinyl Wallpaper within the commercial application due to its durability, ease of maintenance, and cost-effectiveness.

- Key Drivers (North America): High disposable incomes, strong construction activity, preference for designer wallpapers.

- Key Drivers (Europe): Focus on sustainability, stringent regulatory frameworks driving innovation, robust tourism sector impacting hospitality segment.

- Segment Dominance: Vinyl Wallpaper dominates by wallpaper type in the commercial sector, followed by non-woven wallpaper.

- Growth Potential: Asia-Pacific region exhibits significant growth potential driven by rising urbanization and increased disposable incomes.

Commercial Wallpaper Market Product Landscape

The commercial wallpaper market offers a diverse range of products, categorized by material (vinyl, non-woven, paper-based, fabric, and others) and application (commercial and non-commercial). Key innovations include the integration of antimicrobial properties, enhanced durability, and improved printability with digital printing methods resulting in custom designs and superior quality. Peel-and-stick wallpapers are gaining popularity for ease of installation and removal, particularly in rental spaces. Products are differentiated by their designs, textures, color palettes, and special features, like sound absorption or moisture resistance, to cater to various commercial requirements.

Key Drivers, Barriers & Challenges in Commercial Wallpaper Market

Key Drivers:

- Rising construction activity in commercial spaces.

- Increasing demand for aesthetically pleasing and durable wall coverings.

- Growing adoption of sustainable and innovative wallpaper products.

- The rise of e-commerce platforms facilitating easy access to a wider selection of products.

Challenges and Restraints:

- Fluctuations in raw material prices impacting profitability.

- Competition from alternative wall coverings.

- Stringent environmental regulations and compliance costs.

- Potential supply chain disruptions. The impact of these factors is estimated to reduce market growth by approximately xx% over the forecast period.

Emerging Opportunities in Commercial Wallpaper Market

Emerging opportunities include the growing demand for personalized and customized wallpapers, the development of smart wallpapers with integrated technology, and the expansion into untapped markets in developing economies. The increasing focus on sustainable and eco-friendly products presents another significant opportunity, with manufacturers adopting recycled materials and reducing their environmental footprint. Collaborations between wallpaper manufacturers and interior designers can unlock new design possibilities and broaden market reach.

Growth Accelerators in the Commercial Wallpaper Market Industry

Technological advancements in digital printing and sustainable material sourcing will drive long-term growth. Strategic partnerships and collaborations between manufacturers and interior design firms will help expand market reach and product diversification. Expansion into new geographical markets with growing construction activity and rising disposable incomes will contribute to market expansion. The development of innovative products with unique functionalities like sound insulation or temperature regulation will further propel market growth.

Key Players Shaping the Commercial Wallpaper Market Market

- AS Creation Tapeten AG

- LEN-TEX Corporation

- Tapetenfabrik Gebr Rasch GmbH & Co KG

- F Schumacher & Co

- York Wall Coverings Inc

- Grandeco Wallfashion Group

- Gratex Industries Ltd

- Laura Ashley Holdings PLC

- Erismann & Cie GmbH

- Sangetsu Corporation

- Asian Paints Ltd

- Sanderson Design Group PLC

- Brewster Home Fashion LLC

Notable Milestones in Commercial Wallpaper Market Sector

- March 2023: Launch of the Erin and Ben Napier Co. Collection by York Wallcoverings, expected to boost demand for peel-and-stick wallpapers.

- September 2022: Schumacher opens its first showroom in Nashville, TN, expanding its reach to interior designers and consumers in the Southern US market.

In-Depth Commercial Wallpaper Market Market Outlook

The Commercial Wallpaper market is poised for sustained growth over the forecast period, driven by ongoing construction activity, growing preference for aesthetically pleasing wall coverings, and the increasing adoption of innovative and eco-friendly products. Strategic partnerships, technological advancements, and expansion into emerging markets will further accelerate market growth. The market offers significant opportunities for companies focusing on sustainability, personalization, and technological integration. The market is expected to experience considerable expansion in the Asia-Pacific region.

Commercial Wallpaper Market Segmentation

-

1. Wallpaper Type

- 1.1. Vinyl

- 1.2. Non-woven

- 1.3. Paper-based

- 1.4. Fabric Wallpaper

- 1.5. Other Wallpaper Types

-

2. Application

- 2.1. Commercial

- 2.2. Non-commercial

Commercial Wallpaper Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Commercial Wallpaper Market Regional Market Share

Geographic Coverage of Commercial Wallpaper Market

Commercial Wallpaper Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trends of Aesthetics; High Demand for Non-woven Wallpapers

- 3.3. Market Restrains

- 3.3.1. Growth of Digital Marketing and the Practice of Online Reading

- 3.4. Market Trends

- 3.4.1. Non-Woven Wallpaper Type Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Wallpaper Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 5.1.1. Vinyl

- 5.1.2. Non-woven

- 5.1.3. Paper-based

- 5.1.4. Fabric Wallpaper

- 5.1.5. Other Wallpaper Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial

- 5.2.2. Non-commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 6. North America Commercial Wallpaper Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 6.1.1. Vinyl

- 6.1.2. Non-woven

- 6.1.3. Paper-based

- 6.1.4. Fabric Wallpaper

- 6.1.5. Other Wallpaper Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial

- 6.2.2. Non-commercial

- 6.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 7. Europe Commercial Wallpaper Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 7.1.1. Vinyl

- 7.1.2. Non-woven

- 7.1.3. Paper-based

- 7.1.4. Fabric Wallpaper

- 7.1.5. Other Wallpaper Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial

- 7.2.2. Non-commercial

- 7.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 8. Asia Pacific Commercial Wallpaper Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 8.1.1. Vinyl

- 8.1.2. Non-woven

- 8.1.3. Paper-based

- 8.1.4. Fabric Wallpaper

- 8.1.5. Other Wallpaper Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial

- 8.2.2. Non-commercial

- 8.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 9. Latin America Commercial Wallpaper Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 9.1.1. Vinyl

- 9.1.2. Non-woven

- 9.1.3. Paper-based

- 9.1.4. Fabric Wallpaper

- 9.1.5. Other Wallpaper Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Commercial

- 9.2.2. Non-commercial

- 9.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 10. Middle East and Africa Commercial Wallpaper Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 10.1.1. Vinyl

- 10.1.2. Non-woven

- 10.1.3. Paper-based

- 10.1.4. Fabric Wallpaper

- 10.1.5. Other Wallpaper Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Commercial

- 10.2.2. Non-commercial

- 10.1. Market Analysis, Insights and Forecast - by Wallpaper Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AS Creation Tapeten AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LEN-TEX Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tapetenfabrik Gebr Rasch GmbH & Co KG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 F Schumacher & Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 York Wall Coverings Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Grandeco Wallfashion Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gratex Industries Ltd*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Laura Ashley Holdings PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Erismann & Cie GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sangetsu Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Asian Paints Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sanderson Design Group PLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Brewster Home Fashion LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 AS Creation Tapeten AG

List of Figures

- Figure 1: Global Commercial Wallpaper Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Commercial Wallpaper Market Revenue (Million), by Wallpaper Type 2025 & 2033

- Figure 3: North America Commercial Wallpaper Market Revenue Share (%), by Wallpaper Type 2025 & 2033

- Figure 4: North America Commercial Wallpaper Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Commercial Wallpaper Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Commercial Wallpaper Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Commercial Wallpaper Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Commercial Wallpaper Market Revenue (Million), by Wallpaper Type 2025 & 2033

- Figure 9: Europe Commercial Wallpaper Market Revenue Share (%), by Wallpaper Type 2025 & 2033

- Figure 10: Europe Commercial Wallpaper Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Commercial Wallpaper Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Commercial Wallpaper Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Commercial Wallpaper Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Commercial Wallpaper Market Revenue (Million), by Wallpaper Type 2025 & 2033

- Figure 15: Asia Pacific Commercial Wallpaper Market Revenue Share (%), by Wallpaper Type 2025 & 2033

- Figure 16: Asia Pacific Commercial Wallpaper Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Commercial Wallpaper Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Commercial Wallpaper Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Commercial Wallpaper Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Commercial Wallpaper Market Revenue (Million), by Wallpaper Type 2025 & 2033

- Figure 21: Latin America Commercial Wallpaper Market Revenue Share (%), by Wallpaper Type 2025 & 2033

- Figure 22: Latin America Commercial Wallpaper Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Latin America Commercial Wallpaper Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Commercial Wallpaper Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Commercial Wallpaper Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Commercial Wallpaper Market Revenue (Million), by Wallpaper Type 2025 & 2033

- Figure 27: Middle East and Africa Commercial Wallpaper Market Revenue Share (%), by Wallpaper Type 2025 & 2033

- Figure 28: Middle East and Africa Commercial Wallpaper Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Commercial Wallpaper Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Commercial Wallpaper Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Commercial Wallpaper Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Wallpaper Market Revenue Million Forecast, by Wallpaper Type 2020 & 2033

- Table 2: Global Commercial Wallpaper Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Commercial Wallpaper Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Commercial Wallpaper Market Revenue Million Forecast, by Wallpaper Type 2020 & 2033

- Table 5: Global Commercial Wallpaper Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Commercial Wallpaper Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Commercial Wallpaper Market Revenue Million Forecast, by Wallpaper Type 2020 & 2033

- Table 8: Global Commercial Wallpaper Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Commercial Wallpaper Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Commercial Wallpaper Market Revenue Million Forecast, by Wallpaper Type 2020 & 2033

- Table 11: Global Commercial Wallpaper Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Commercial Wallpaper Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Commercial Wallpaper Market Revenue Million Forecast, by Wallpaper Type 2020 & 2033

- Table 14: Global Commercial Wallpaper Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Commercial Wallpaper Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Commercial Wallpaper Market Revenue Million Forecast, by Wallpaper Type 2020 & 2033

- Table 17: Global Commercial Wallpaper Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Commercial Wallpaper Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Wallpaper Market?

The projected CAGR is approximately 3.59%.

2. Which companies are prominent players in the Commercial Wallpaper Market?

Key companies in the market include AS Creation Tapeten AG, LEN-TEX Corporation, Tapetenfabrik Gebr Rasch GmbH & Co KG, F Schumacher & Co, York Wall Coverings Inc, Grandeco Wallfashion Group, Gratex Industries Ltd*List Not Exhaustive, Laura Ashley Holdings PLC, Erismann & Cie GmbH, Sangetsu Corporation, Asian Paints Ltd, Sanderson Design Group PLC, Brewster Home Fashion LLC.

3. What are the main segments of the Commercial Wallpaper Market?

The market segments include Wallpaper Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trends of Aesthetics; High Demand for Non-woven Wallpapers.

6. What are the notable trends driving market growth?

Non-Woven Wallpaper Type Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Growth of Digital Marketing and the Practice of Online Reading.

8. Can you provide examples of recent developments in the market?

March 2023: Erin Napier, known for her role in the TV show Hometown, has recently collaborated with the oldest wallpaper manufacturer in the United States, York Wallcoverings, to introduce a new collection. The collection, named the Erin and Ben Napier Co. Collection, offers a variety of peel-and-stick wallpapers featuring whimsical flowers and folk art-inspired designs. This delightful collection is expected to captivate color-loving Southerners, who will undoubtedly be enamored by its charming aesthetics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Wallpaper Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Wallpaper Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Wallpaper Market?

To stay informed about further developments, trends, and reports in the Commercial Wallpaper Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence