Key Insights

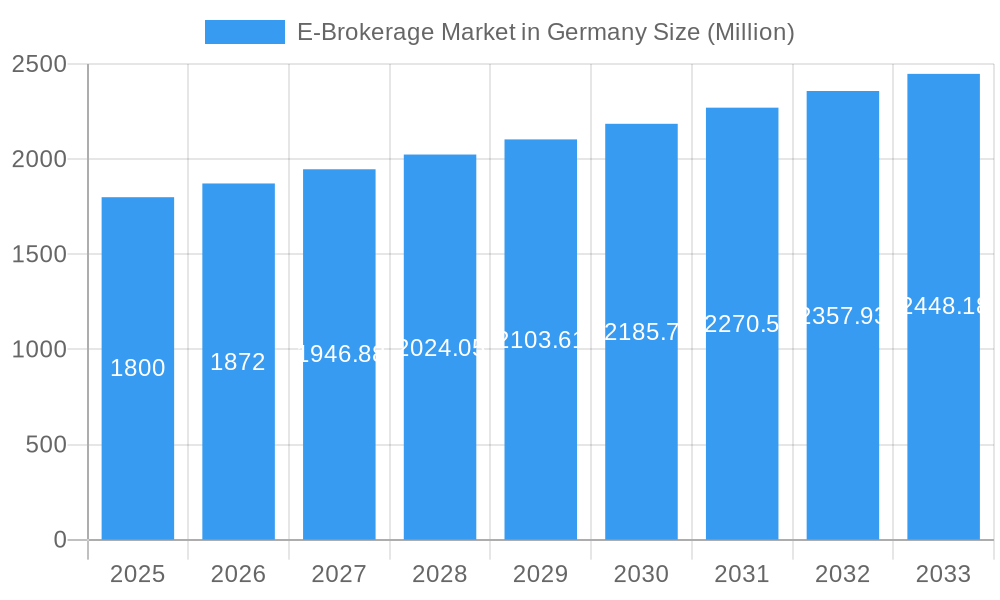

The German e-brokerage market is projected for robust expansion, driven by increasing digitalization and a growing base of digitally native investors comfortable with online platforms. Key growth catalysts include heightened interest in individual investing, portfolio diversification strategies, and advancements in user-friendly trading applications and analytical tools. Despite potential headwinds from evolving regulatory frameworks and cybersecurity concerns, the market is poised for significant growth. Current market size stands at €1.5 billion (2024), with a projected Compound Annual Growth Rate (CAGR) of 6.4% from 2025, reaching an estimated €1 billion by 2025. This trajectory will be further supported by enhanced financial literacy among the German populace and continued technological innovation.

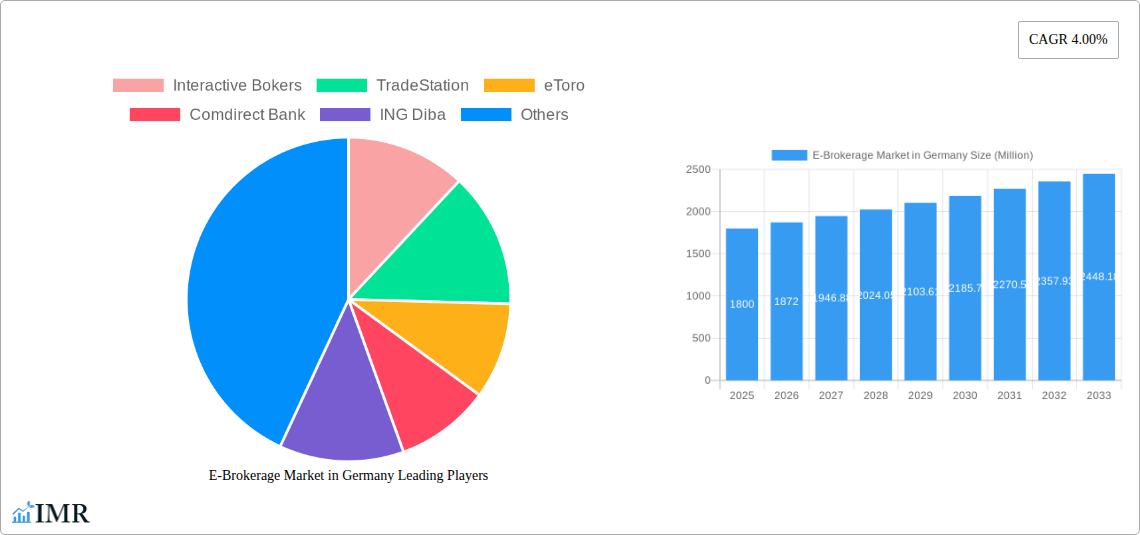

E-Brokerage Market in Germany Market Size (In Billion)

Sustained growth in the German e-brokerage sector will depend on continuous innovation and adaptation to meet evolving investor demands. Prioritizing an exceptional user experience, including intuitive interfaces and comprehensive educational resources, will be paramount for client acquisition and retention. The market is likely to see increased mergers, acquisitions, and consolidation, alongside a greater integration of personalized financial advice into online platforms. Navigating regulatory complexities and robust cybersecurity measures will be critical for fostering investor trust. Expansion into diverse financial instruments, such as cryptocurrencies and alternative investments, will be vital for future market leadership. Strategic regional approaches may also become increasingly important to capture localized market opportunities.

E-Brokerage Market in Germany Company Market Share

E-Brokerage Market in Germany: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the German e-brokerage market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is invaluable for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic market segment. This report analyzes parent markets like the broader German financial services sector and child markets such as mobile trading apps and crypto trading platforms within the e-brokerage space.

E-Brokerage Market in Germany Market Dynamics & Structure

The German e-brokerage market is characterized by a dynamic interplay of factors influencing its structure and growth. Market concentration is moderate, with a few dominant players and numerous smaller firms vying for market share. Technological innovation, particularly in mobile trading platforms and algorithmic trading tools, is a key driver. Stringent regulatory frameworks, including those overseen by BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht), significantly impact market operations. The emergence of robo-advisors and other automated investment platforms presents competitive substitutes, while the increasing digitalization of financial services fuels market expansion. M&A activity, although not exceptionally high in recent years, continues to reshape the competitive landscape.

- Market Concentration: Moderate, with a few large players controlling a significant share.

- Technological Innovation: Mobile trading, AI-powered tools, and robo-advisors are key drivers.

- Regulatory Framework: BaFin regulations significantly influence market structure and operations.

- Competitive Substitutes: Robo-advisors and other automated investment platforms.

- End-User Demographics: Growing adoption amongst younger, tech-savvy investors.

- M&A Trends: Moderate activity, primarily focused on consolidation and expansion. Estimated M&A deal volume in 2024 at €xx million.

E-Brokerage Market in Germany Growth Trends & Insights

The German e-brokerage market experienced significant growth during the historical period (2019-2024), fueled by increasing internet and smartphone penetration, rising retail investor participation, and technological advancements. The market size in 2024 is estimated at €xx million, representing a CAGR of xx% during 2019-2024. The adoption rate of e-brokerage services continues to rise, particularly among younger demographics, driven by ease of use, convenience, and competitive pricing. Technological disruptions, such as the introduction of commission-free trading and sophisticated trading platforms, further accelerate market growth. Consumer behavior is shifting towards greater reliance on digital channels for investment management, presenting both opportunities and challenges for market players. The forecast period (2025-2033) anticipates continued growth, driven by further technological innovation and increasing financial literacy among retail investors. Market penetration is expected to reach xx% by 2033.

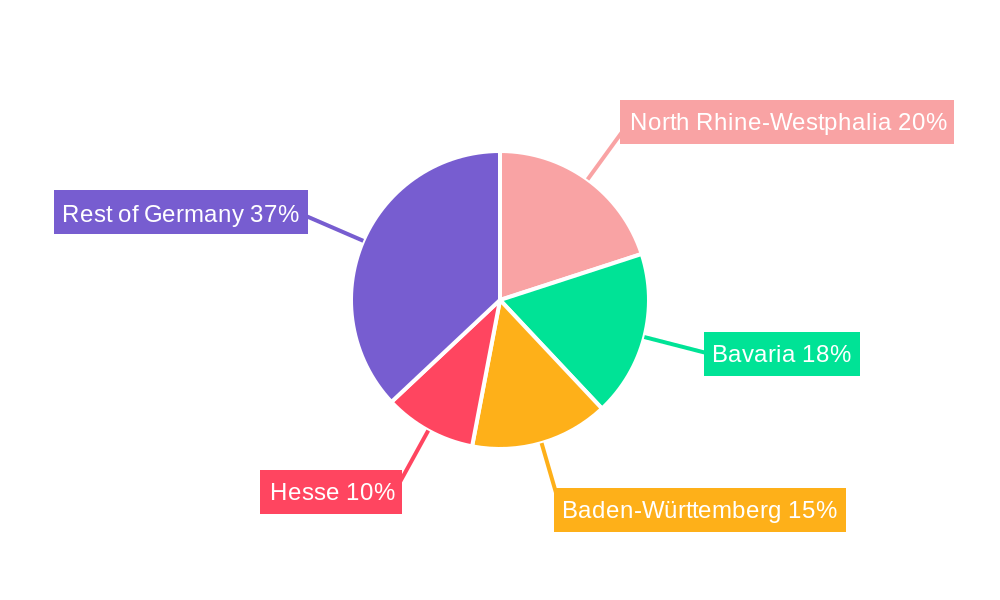

Dominant Regions, Countries, or Segments in E-Brokerage Market in Germany

While the German e-brokerage market is relatively centralized, certain regions exhibit stronger growth than others. Urban centers with higher concentrations of tech-savvy individuals and financial professionals tend to demonstrate higher adoption rates. No single region displays overwhelming dominance; rather, the market is characterized by relatively even distribution across major cities and densely populated areas. The segment focused on active traders and high-net-worth individuals consistently displays the highest growth rate, driven by their demand for sophisticated trading tools and advanced analytics.

- Key Drivers: High internet and smartphone penetration; rising financial literacy; favorable regulatory environment; strong economy in urban centers.

- Dominance Factors: High concentration of retail investors in major cities; strong presence of major e-brokerage players; availability of advanced technology and infrastructure.

- Growth Potential: Continued growth anticipated across all regions; potential for accelerated growth in less developed areas with increasing internet access.

E-Brokerage Market in Germany Product Landscape

The German e-brokerage market offers a diverse range of products and services, including online trading platforms, mobile apps, robo-advisors, and specialized tools for active trading. Key product innovations include commission-free trading, fractional share trading, and AI-powered portfolio management tools. Performance metrics, such as execution speed, order fill rates, and platform uptime, are crucial factors influencing consumer choice. Unique selling propositions often focus on user-friendliness, competitive pricing, advanced charting tools, and personalized customer support. Recent advancements incorporate sophisticated analytics dashboards and integration with other financial management tools.

Key Drivers, Barriers & Challenges in E-Brokerage Market in Germany

Key Drivers:

- Increasing digitalization of financial services.

- Rising retail investor participation.

- Technological advancements, like mobile trading apps and AI-powered tools.

- Government initiatives promoting financial literacy.

Key Challenges:

- Stringent regulatory requirements increase compliance costs. (e.g., BaFin regulations on data privacy and anti-money laundering compliance)

- Intense competition among numerous e-brokerage firms, leading to price wars and reduced profit margins.

- Cybersecurity risks and the need for robust data protection measures. (Potential impact of data breaches could be estimated at a loss of €xx million in customer trust).

Emerging Opportunities in E-Brokerage Market in Germany

- Expansion into niche markets: Catering to specific investor groups (e.g., ESG investing, sustainable finance).

- Development of innovative trading tools: AI-driven sentiment analysis, algorithmic trading strategies.

- Integration with other financial services: Offering bundled services, such as banking, insurance, and wealth management.

- Leveraging blockchain technology: Increased security and efficiency in transactions.

Growth Accelerators in the E-Brokerage Market in Germany Industry

Several factors are poised to accelerate long-term growth in the German e-brokerage market. Strategic partnerships between e-brokerage firms and other financial institutions could lead to expanded product offerings and increased customer reach. Technological breakthroughs, such as the development of more sophisticated AI-powered tools and advanced analytics platforms, will continue to enhance the trading experience. Government initiatives promoting financial literacy and digital inclusion will further fuel market expansion. International expansion by German e-brokerage firms is also a significant potential growth driver.

Key Players Shaping the E-Brokerage Market in Germany Market

- Interactive Brokers

- TradeStation

- eToro

- Comdirect Bank

- ING Diba

- Flatex

- Trade Republic

- Lynx

- Onvista

- Consors Bank

- Geno Broker

- List Not Exhaustive

Notable Milestones in E-Brokerage Market in Germany Sector

- July 2022: Flatex became the Exclusive Online Brokerage Partner of the Police Union ('Gewerkschaft der Polizei, GdP') of North Rhine-Westphalia, significantly expanding its customer base.

- January 2022: Comdirect Bank partnered with ETC Group to offer crypto ETP-based savings plans, indicating growing interest in crypto investments among retail investors.

In-Depth E-Brokerage Market in Germany Market Outlook

The German e-brokerage market is poised for sustained growth throughout the forecast period (2025-2033). Technological innovation, coupled with rising retail investor participation and increasing digitalization of financial services, presents significant opportunities for market players. Strategic partnerships and expansions into niche markets will be key to success. The market is expected to see further consolidation, with larger players potentially acquiring smaller firms to enhance their market share and product offerings. The continued development of sophisticated trading tools and AI-driven analytics will further enhance the user experience and drive market growth.

E-Brokerage Market in Germany Segmentation

-

1. Investor Type

- 1.1. Retail

- 1.2. Institutional

-

2. Broker Ownership Type

- 2.1. Local

- 2.2. Foreign

E-Brokerage Market in Germany Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

E-Brokerage Market in Germany Regional Market Share

Geographic Coverage of E-Brokerage Market in Germany

E-Brokerage Market in Germany REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Investment Culture is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Investment Culture is Driving the Market

- 3.4. Market Trends

- 3.4.1. Increase in Internet and Mobile Penetration in Germany is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investor Type

- 5.1.1. Retail

- 5.1.2. Institutional

- 5.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 5.2.1. Local

- 5.2.2. Foreign

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Investor Type

- 6. North America E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Investor Type

- 6.1.1. Retail

- 6.1.2. Institutional

- 6.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 6.2.1. Local

- 6.2.2. Foreign

- 6.1. Market Analysis, Insights and Forecast - by Investor Type

- 7. South America E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Investor Type

- 7.1.1. Retail

- 7.1.2. Institutional

- 7.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 7.2.1. Local

- 7.2.2. Foreign

- 7.1. Market Analysis, Insights and Forecast - by Investor Type

- 8. Europe E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Investor Type

- 8.1.1. Retail

- 8.1.2. Institutional

- 8.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 8.2.1. Local

- 8.2.2. Foreign

- 8.1. Market Analysis, Insights and Forecast - by Investor Type

- 9. Middle East & Africa E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Investor Type

- 9.1.1. Retail

- 9.1.2. Institutional

- 9.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 9.2.1. Local

- 9.2.2. Foreign

- 9.1. Market Analysis, Insights and Forecast - by Investor Type

- 10. Asia Pacific E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Investor Type

- 10.1.1. Retail

- 10.1.2. Institutional

- 10.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 10.2.1. Local

- 10.2.2. Foreign

- 10.1. Market Analysis, Insights and Forecast - by Investor Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Interactive Bokers

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TradeStation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 eToro

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Comdirect Bank

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ING Diba

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Flatex

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Trade Republic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lynx

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Onvista

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Consors Bank

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Geno Broker**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Interactive Bokers

List of Figures

- Figure 1: Global E-Brokerage Market in Germany Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 3: North America E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 4: North America E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 5: North America E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 6: North America E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 7: North America E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 9: South America E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 10: South America E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 11: South America E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 12: South America E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 13: South America E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 15: Europe E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 16: Europe E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 17: Europe E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 18: Europe E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 21: Middle East & Africa E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 22: Middle East & Africa E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 23: Middle East & Africa E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 24: Middle East & Africa E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 27: Asia Pacific E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 28: Asia Pacific E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 29: Asia Pacific E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 30: Asia Pacific E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 2: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 3: Global E-Brokerage Market in Germany Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 5: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 6: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 11: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 12: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 17: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 18: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 29: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 30: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 38: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 39: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the E-Brokerage Market in Germany?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the E-Brokerage Market in Germany?

Key companies in the market include Interactive Bokers, TradeStation, eToro, Comdirect Bank, ING Diba, Flatex, Trade Republic, Lynx, Onvista, Consors Bank, Geno Broker**List Not Exhaustive.

3. What are the main segments of the E-Brokerage Market in Germany?

The market segments include Investor Type, Broker Ownership Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1 billion as of 2022.

5. What are some drivers contributing to market growth?

Investment Culture is Driving the Market.

6. What are the notable trends driving market growth?

Increase in Internet and Mobile Penetration in Germany is Driving the Market.

7. Are there any restraints impacting market growth?

Investment Culture is Driving the Market.

8. Can you provide examples of recent developments in the market?

July 2022: Flatex, Europe's leading online broker for retail investors, became the Exclusive Online Brokerage Partner of the Police Union ('Gewerkschaft der Polizei, GdP') of North Rhine-Westphalia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "E-Brokerage Market in Germany," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the E-Brokerage Market in Germany report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the E-Brokerage Market in Germany?

To stay informed about further developments, trends, and reports in the E-Brokerage Market in Germany, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence