Key Insights

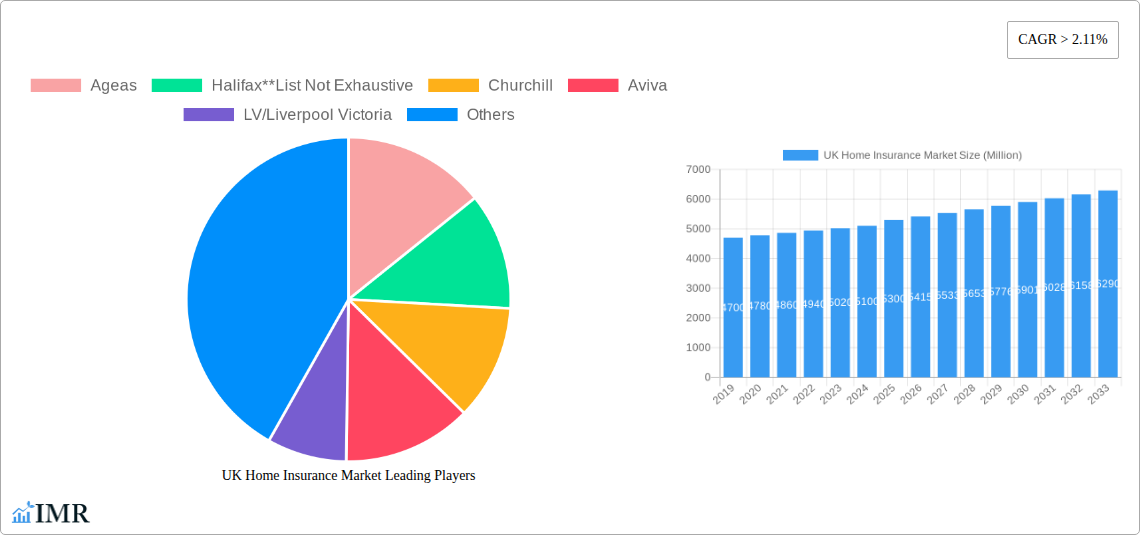

The UK Home Insurance Market is a substantial and evolving sector, projected to reach approximately £5.30 billion by 2025. This market is characterized by a steady growth rate, with a Compound Annual Growth Rate (CAGR) estimated to be over 2.11% during the forecast period of 2025-2033. Several key drivers are fueling this expansion, including increasing homeownership rates, a growing awareness of the importance of property protection against a range of risks such as natural disasters and theft, and the continuous innovation in insurance products to meet diverse consumer needs. The market is witnessing a significant trend towards personalized policies and digital offerings, with insurers leveraging technology to enhance customer experience, streamline claims processing, and offer more flexible coverage options. The rise of smart home technology also presents new opportunities for insurers to develop policies that integrate with these devices for enhanced security and risk mitigation.

UK Home Insurance Market Market Size (In Billion)

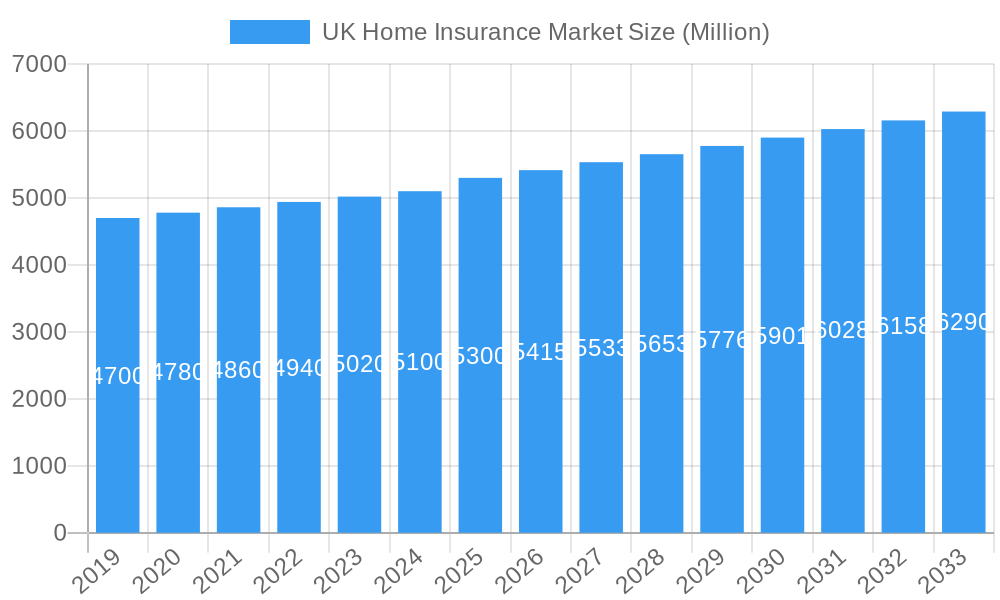

Despite the positive growth trajectory, the UK Home Insurance Market faces certain restraints. Economic uncertainties, such as fluctuating inflation rates and the cost of living crisis, can impact consumer disposable income and, consequently, their willingness to invest in comprehensive insurance coverage. Intense competition among a multitude of providers, including established players like Ageas, Aviva, and Direct Line Group, as well as new entrants focusing on digital-first approaches, puts pressure on pricing and profit margins. Moreover, evolving regulatory landscapes and the increasing frequency and severity of extreme weather events, necessitating higher reinsurance costs, also present challenges. The market segmentation reveals a broad spectrum of offerings, from Building/Property Insurance to Contents Insurance, and various distribution channels, with a notable shift towards online platforms and direct sales.

UK Home Insurance Market Company Market Share

This in-depth report provides a crucial overview of the UK Home Insurance Market, offering detailed insights into market dynamics, growth trends, dominant segments, product innovations, and key players. With a study period spanning from 2019 to 2033, including a base and estimated year of 2025, this analysis is essential for industry professionals seeking to understand current landscapes and forecast future trajectories. Discover market concentration, technological drivers, regulatory influences, competitive landscapes, and the evolving needs of UK households. This report meticulously unpacks the parent and child market segments, providing a granular view of opportunities and challenges within the £XX,XXX million (estimated 2025 value) UK Home Insurance sector.

UK Home Insurance Market Market Dynamics & Structure

The UK Home Insurance Market exhibits a dynamic and moderately concentrated structure, with a few major players commanding significant market share. Technological innovation is a key driver, with insurers increasingly leveraging data analytics, AI, and InsurTech solutions to enhance underwriting accuracy, personalize customer experiences, and streamline claims processing. The regulatory framework, overseen by bodies like the Financial Conduct Authority (FCA), plays a crucial role in ensuring consumer protection and market stability. Competitive product substitutes, while present in the broader financial services sector, are largely confined to alternative risk management strategies rather than direct replacements for home insurance. End-user demographics are diverse, encompassing a wide range of homeowners and renters with varying risk profiles and financial capacities. Mergers and acquisitions (M&A) trends continue to shape the market, with strategic consolidations aimed at achieving economies of scale and expanding market reach.

- Market Concentration: Dominated by a few key insurers, but with increasing presence of InsurTech startups.

- Technological Innovation: Focus on AI for underwriting, digital claims, and personalized pricing.

- Regulatory Framework: Emphasis on consumer protection, data privacy, and fair pricing.

- Competitive Substitutes: Limited direct substitutes, but increasing interest in parametric insurance for specific risks.

- End-User Demographics: Diverse, with evolving needs driven by life stages, property types, and risk appetites.

- M&A Trends: Ongoing consolidation for market share and operational efficiency.

UK Home Insurance Market Growth Trends & Insights

The UK Home Insurance Market is poised for robust growth, driven by an increasing awareness of risk, evolving consumer preferences, and ongoing technological advancements. The market size has demonstrated a steady upward trajectory, with projected expansion fueled by factors such as an aging housing stock, a growing population, and the increasing value of insured assets. Adoption rates for home insurance are high among homeowners, with a growing segment of the renter population also recognizing the necessity of contents insurance. Technological disruptions are revolutionizing the industry, with the proliferation of smart home devices enabling insurers to offer proactive risk mitigation and incentivize safer living. This shift is also impacting consumer behavior, leading to a demand for more flexible, personalized, and digitally accessible insurance products. The CAGR for the forecast period is estimated at XX.XX%, underscoring the market's sustained expansion. Market penetration is expected to rise, particularly among younger demographics and within the rental market.

Dominant Regions, Countries, or Segments in UK Home Insurance Market

Within the UK Home Insurance Market, Building/ Property Insurance stands out as the dominant segment, driven by regulatory requirements for mortgages and the inherent need to protect substantial physical assets. This segment consistently commands the largest market share due to the fundamental value of safeguarding residential properties against a wide array of perils. The Direct distribution channel is also a significant growth driver, leveraging online platforms and insurer-owned websites to reach consumers directly, offering convenience and competitive pricing. The increasing adoption of digital technologies has propelled online channels to the forefront, enabling seamless policy acquisition and management.

- Dominant Segment (Type): Building/ Property Insurance, accounting for an estimated XX% of the market in 2025, due to its essential nature for property ownership.

- Key Drivers for Building/ Property Insurance: Mortgage requirements, increasing property values, and a growing awareness of catastrophic risks.

- Dominant Distribution Channel: Direct channels, including online platforms and insurer websites, are crucial for accessibility and cost-effectiveness.

- Growth Drivers for Direct Channels: Convenience, transparency, competitive pricing, and the rise of digital consumers.

- Emerging Trends in Distribution: Increasing importance of comparison websites and affinity partnerships.

- Market Share in Building/ Property Insurance: Leading players like Aviva and Direct Line Group hold substantial portions of this segment.

- Growth Potential in Direct Channels: Significant, as consumers increasingly prefer self-service options.

- Other Key Segments: Contents Insurance and Building & Content Insurance are also substantial, catering to different consumer needs.

UK Home Insurance Market Product Landscape

The UK Home Insurance Market is characterized by a continuous stream of product innovations aimed at meeting evolving consumer needs and leveraging technological advancements. Insurers are increasingly offering tailored policies that go beyond basic coverage, incorporating features like accidental damage, flood excess waivers, and new-for-old replacement of contents. Applications of IoT devices are emerging, with smart home technology integrated into policies to provide proactive risk alerts for issues like water leaks or fire detection, leading to reduced claims and enhanced customer safety. Performance metrics are being redefined by improved claims processing times, customer satisfaction scores, and the ability to offer personalized pricing based on risk data. Unique selling propositions often revolve around exceptional customer service, flexible policy options, and competitive pricing, further differentiating insurers in a crowded market.

Key Drivers, Barriers & Challenges in UK Home Insurance Market

Key Drivers: The UK Home Insurance Market is propelled by several significant factors. Increasing homeownership rates, coupled with a growing awareness of the financial implications of property damage, are primary drivers. Technological advancements, such as AI-powered underwriting and digital claims management, are enhancing efficiency and customer experience. Favorable economic conditions, including stable property markets, also contribute to growth. Furthermore, evolving consumer expectations for seamless digital interactions and personalized coverage are pushing insurers to innovate.

Barriers & Challenges: Despite growth, the market faces several hurdles. Intense price competition and the commoditization of basic policies can compress margins. The increasing frequency and severity of extreme weather events pose a significant challenge, leading to higher claims costs and potential uninsurability in certain areas. Regulatory changes and compliance requirements can also add to operational costs and complexity. Supply chain issues, particularly for home repairs and rebuilding, can impact claims fulfillment times and overall customer satisfaction. The challenge of effectively communicating the value proposition of insurance beyond price remains a persistent concern.

Emerging Opportunities in UK Home Insurance Market

Emerging opportunities in the UK Home Insurance Market lie in catering to the growing renter population with specialized tenant insurance products that cover contents and personal liability. The burgeoning market for short-term lets and holiday homes presents a niche for specialized strata or holiday home insurance. Furthermore, the integration of InsurTech solutions offers avenues for innovative product development, such as parametric insurance for specific, verifiable events like significant rainfall impacting properties. Evolving consumer preferences for bundled services and holistic home management solutions also present opportunities for insurers to expand their offerings beyond traditional policies.

Growth Accelerators in the UK Home Insurance Market Industry

Several catalysts are accelerating growth within the UK Home Insurance Market. Technological breakthroughs, including the widespread adoption of data analytics and artificial intelligence, are enabling more accurate risk assessment and personalized pricing. Strategic partnerships, such as the one between Amazon and leading UK insurers, are streamlining the customer journey and expanding reach. Market expansion strategies, including targeted marketing campaigns and the development of flexible policy options, are helping insurers attract new customer segments. The continuous drive for digital transformation, focusing on seamless online interactions and efficient claims handling, is also a significant growth accelerator.

Key Players Shaping the UK Home Insurance Market Market

- Ageas

- Halifax

- Churchill

- Aviva

- LV/Liverpool Victoria

- AA Home Insurance

- Zurich

- Axa Insurance UK

- Direct Line Group

- Admiral Group

Notable Milestones in UK Home Insurance Market Sector

- July 2023: Aviva, the leading home insurer in the United Kingdom, signed a contract with Barclays United Kingdom to purchase its home insurance portfolio comprising 350,000 customers. This acquisition will further support the insurer’s ambitions to grow its retail insurance business in the United Kingdom.

- May 2023: Amazon, the international e-commerce giant, partnered with prominent United Kingdom insurance providers, Ageas, Co-op, LV, and Policy Expert to streamline the home insurance purchase process.

In-Depth UK Home Insurance Market Market Outlook

The future outlook for the UK Home Insurance Market is exceptionally positive, driven by a confluence of growth accelerators. The continued integration of InsurTech and AI will not only enhance operational efficiency but also foster greater personalization and customer engagement. Strategic alliances and acquisitions are expected to further consolidate the market, leading to more robust and diversified offerings. Emerging opportunities in niche segments, such as landlord insurance and specialized property coverage, coupled with an increasing consumer demand for digital-first solutions, will fuel sustained expansion. The market is well-positioned to adapt to evolving risks and consumer needs, ensuring continued relevance and growth throughout the forecast period.

UK Home Insurance Market Segmentation

-

1. Type

- 1.1. Building/ Property Insurance

- 1.2. Contents Insurance

- 1.3. Building & Content Insurance

- 1.4. Renter's or Tenant's Insuarance

- 1.5. Landlord's Insurance

- 1.6. Strata/ Holiday Home Insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Independent Advisers

- 2.3. Banks/Building societies

- 2.4. Utilities/Retailers/Affinity Groups

- 2.5. Company Agents

- 2.6. Online Channels

UK Home Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

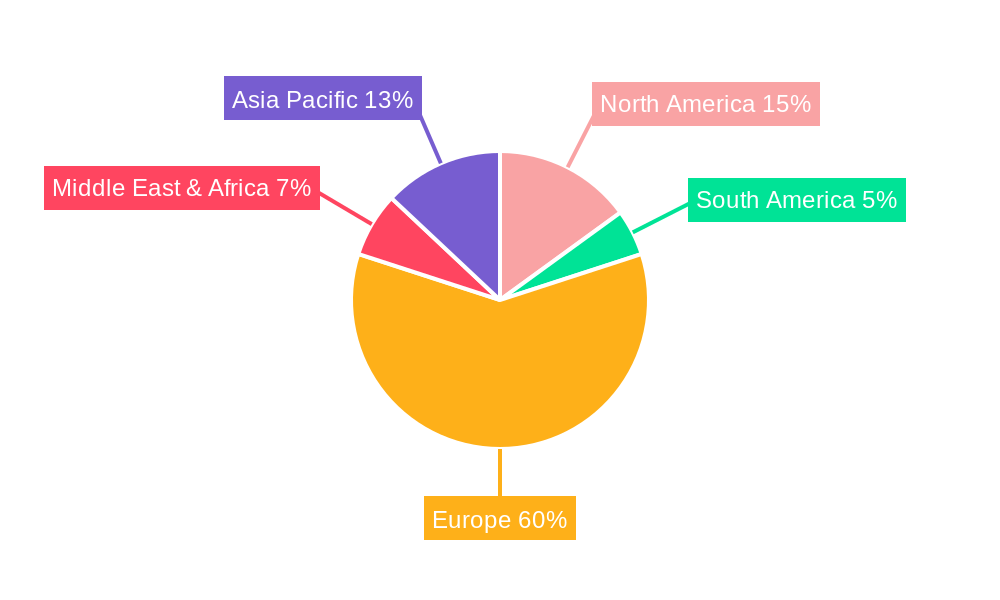

UK Home Insurance Market Regional Market Share

Geographic Coverage of UK Home Insurance Market

UK Home Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 2.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Number of Households is Driving the Market; Wide Range Of Offers Provided By Insurers is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Policies Excluding Coverage for Natural Disasters is Restraining the Market; Rising Claims Costs Impacting Insurer's Profitability

- 3.4. Market Trends

- 3.4.1. Building/Property Insurance is Dominating the United Kingdom Home Insurance Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Home Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Building/ Property Insurance

- 5.1.2. Contents Insurance

- 5.1.3. Building & Content Insurance

- 5.1.4. Renter's or Tenant's Insuarance

- 5.1.5. Landlord's Insurance

- 5.1.6. Strata/ Holiday Home Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Independent Advisers

- 5.2.3. Banks/Building societies

- 5.2.4. Utilities/Retailers/Affinity Groups

- 5.2.5. Company Agents

- 5.2.6. Online Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UK Home Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Building/ Property Insurance

- 6.1.2. Contents Insurance

- 6.1.3. Building & Content Insurance

- 6.1.4. Renter's or Tenant's Insuarance

- 6.1.5. Landlord's Insurance

- 6.1.6. Strata/ Holiday Home Insurance

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Direct

- 6.2.2. Independent Advisers

- 6.2.3. Banks/Building societies

- 6.2.4. Utilities/Retailers/Affinity Groups

- 6.2.5. Company Agents

- 6.2.6. Online Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UK Home Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Building/ Property Insurance

- 7.1.2. Contents Insurance

- 7.1.3. Building & Content Insurance

- 7.1.4. Renter's or Tenant's Insuarance

- 7.1.5. Landlord's Insurance

- 7.1.6. Strata/ Holiday Home Insurance

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Direct

- 7.2.2. Independent Advisers

- 7.2.3. Banks/Building societies

- 7.2.4. Utilities/Retailers/Affinity Groups

- 7.2.5. Company Agents

- 7.2.6. Online Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UK Home Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Building/ Property Insurance

- 8.1.2. Contents Insurance

- 8.1.3. Building & Content Insurance

- 8.1.4. Renter's or Tenant's Insuarance

- 8.1.5. Landlord's Insurance

- 8.1.6. Strata/ Holiday Home Insurance

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Direct

- 8.2.2. Independent Advisers

- 8.2.3. Banks/Building societies

- 8.2.4. Utilities/Retailers/Affinity Groups

- 8.2.5. Company Agents

- 8.2.6. Online Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UK Home Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Building/ Property Insurance

- 9.1.2. Contents Insurance

- 9.1.3. Building & Content Insurance

- 9.1.4. Renter's or Tenant's Insuarance

- 9.1.5. Landlord's Insurance

- 9.1.6. Strata/ Holiday Home Insurance

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Direct

- 9.2.2. Independent Advisers

- 9.2.3. Banks/Building societies

- 9.2.4. Utilities/Retailers/Affinity Groups

- 9.2.5. Company Agents

- 9.2.6. Online Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UK Home Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Building/ Property Insurance

- 10.1.2. Contents Insurance

- 10.1.3. Building & Content Insurance

- 10.1.4. Renter's or Tenant's Insuarance

- 10.1.5. Landlord's Insurance

- 10.1.6. Strata/ Holiday Home Insurance

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Direct

- 10.2.2. Independent Advisers

- 10.2.3. Banks/Building societies

- 10.2.4. Utilities/Retailers/Affinity Groups

- 10.2.5. Company Agents

- 10.2.6. Online Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ageas

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Halifax**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Churchill

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aviva

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LV/Liverpool Victoria

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AA Home Insurance

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zurich

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Axa Insurance UK

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Direct Line Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Admiral Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ageas

List of Figures

- Figure 1: Global UK Home Insurance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UK Home Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America UK Home Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America UK Home Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America UK Home Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America UK Home Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America UK Home Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UK Home Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 9: South America UK Home Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America UK Home Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: South America UK Home Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America UK Home Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America UK Home Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UK Home Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe UK Home Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe UK Home Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Europe UK Home Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe UK Home Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe UK Home Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UK Home Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa UK Home Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa UK Home Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa UK Home Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa UK Home Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa UK Home Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UK Home Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific UK Home Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific UK Home Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific UK Home Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific UK Home Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific UK Home Insurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Home Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global UK Home Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global UK Home Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UK Home Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global UK Home Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global UK Home Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global UK Home Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global UK Home Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global UK Home Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global UK Home Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global UK Home Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global UK Home Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global UK Home Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global UK Home Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global UK Home Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global UK Home Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global UK Home Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global UK Home Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UK Home Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Home Insurance Market?

The projected CAGR is approximately > 2.11%.

2. Which companies are prominent players in the UK Home Insurance Market?

Key companies in the market include Ageas, Halifax**List Not Exhaustive, Churchill, Aviva, LV/Liverpool Victoria, AA Home Insurance, Zurich, Axa Insurance UK, Direct Line Group, Admiral Group.

3. What are the main segments of the UK Home Insurance Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Number of Households is Driving the Market; Wide Range Of Offers Provided By Insurers is Driving the Market.

6. What are the notable trends driving market growth?

Building/Property Insurance is Dominating the United Kingdom Home Insurance Market.

7. Are there any restraints impacting market growth?

Policies Excluding Coverage for Natural Disasters is Restraining the Market; Rising Claims Costs Impacting Insurer's Profitability.

8. Can you provide examples of recent developments in the market?

In July 2023: Aviva, the leading home insurer in the United Kingdom, signed a contract with Barclays United Kingdom to purchase its home insurance portfolio comprising 350,000 customers. This acquisition will further support the insurer’s ambitions to grow its retail insurance business in the United Kingdom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Home Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Home Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Home Insurance Market?

To stay informed about further developments, trends, and reports in the UK Home Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence