Key Insights

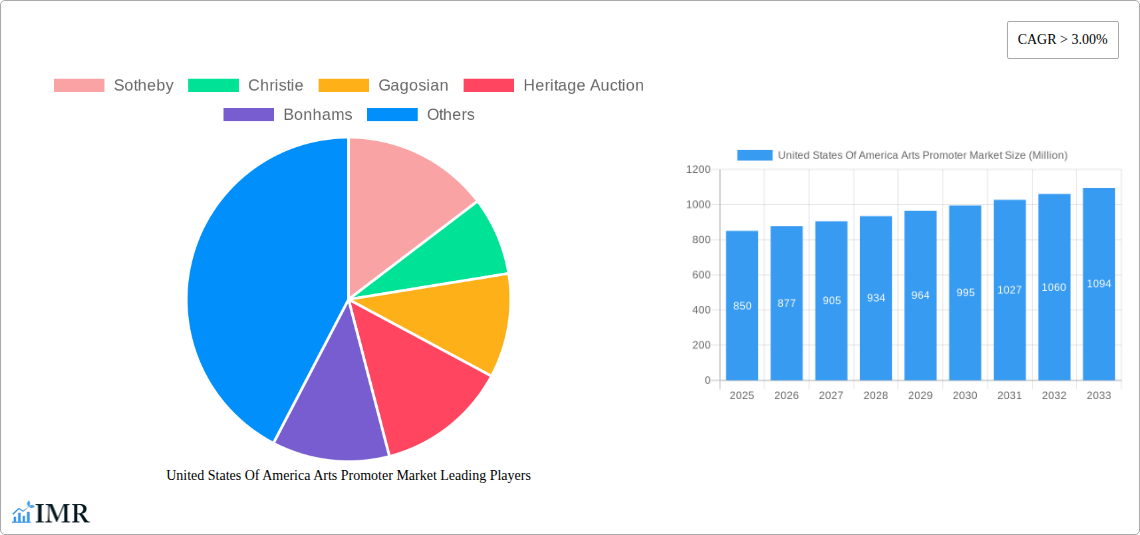

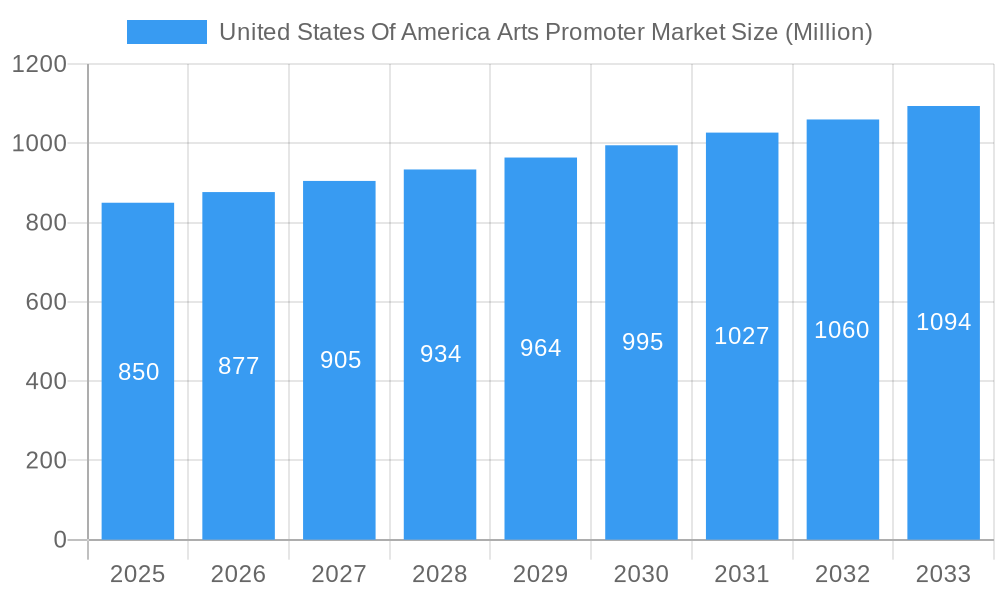

The United States Arts Promoter Market is poised for robust growth, projected to reach a significant market size of approximately $850 million by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 3.00% through 2033. This expansion is fueled by a confluence of powerful drivers, most notably the increasing consumer demand for unique and immersive cultural experiences. As disposable incomes rise and a greater appreciation for artistic expression takes hold, individuals and corporations alike are investing more in art, whether through direct purchases, event attendance, or corporate sponsorships. The digital art revolution also presents a substantial growth avenue, with new platforms and collector bases emerging, further diversifying revenue streams beyond traditional media rights and merchandising. This dynamic environment fosters innovation, encouraging promoters to explore novel engagement models and expand their reach.

United States Of America Arts Promoter Market Market Size (In Million)

Several key trends are shaping the trajectory of the US arts promotion landscape. The burgeoning online segment is a critical growth engine, democratizing access to art and connecting artists with a global audience. E-commerce platforms, virtual galleries, and digital art marketplaces are witnessing unprecedented traction. Concurrently, traditional offline channels, such as prestigious art fairs and exclusive auctions, continue to hold their allure for high-net-worth individuals and established collectors, especially for fine arts and antiques. This dual approach, blending digital innovation with established offline prestige, is essential for comprehensive market penetration. While the market is experiencing a healthy upward trend, potential restraints such as economic downturns and evolving regulatory landscapes for digital assets warrant careful consideration by market players. Nonetheless, the inherent value placed on cultural enrichment and artistic heritage in the US ensures a resilient and expanding market for arts promoters.

United States Of America Arts Promoter Market Company Market Share

United States Arts Promoter Market: Comprehensive Industry Analysis and Future Outlook (2019-2033)

Unlock unparalleled insights into the dynamic United States Arts Promoter Market. This definitive report delivers a deep dive into market size, growth trajectories, competitive landscapes, and emerging opportunities, covering the period from 2019 to 2033, with a base and estimated year of 2025. This analysis is meticulously crafted for industry professionals, investors, and stakeholders seeking to navigate the complexities of art promotion, sales, and audience engagement. Discover the key drivers, pivotal players, and future trends shaping the US fine arts market, US collectibles market, and the burgeoning US digital art market.

United States Of America Arts Promoter Market Market Dynamics & Structure

The United States Arts Promoter Market exhibits a moderately concentrated structure, with a few dominant players like Sotheby's and Christie's orchestrating major auction events, while a vibrant ecosystem of galleries, online platforms, and specialized promoters caters to diverse market segments. Technological innovation, particularly in digital art and online auction platforms, is a significant driver, democratizing access and expanding collector bases. Regulatory frameworks primarily govern auction practices and authenticity, with varying state-level regulations influencing operations. Competitive product substitutes include direct sales, private commissions, and alternative investment avenues. End-user demographics are broad, encompassing high-net-worth individuals, corporations seeking cultural investments, and a growing segment of younger collectors interested in digital art and contemporary pieces. Mergers and acquisitions (M&A) trends are observed as larger entities consolidate their market presence or acquire innovative technologies. For instance, the acquisition of smaller online art platforms by established auction houses aims to expand their digital footprint. Barriers to innovation include the inherent subjectivity of art valuation and the significant capital required for large-scale exhibitions and auctions.

- Market Concentration: Dominated by a few major auction houses, but with a fragmented secondary market.

- Technological Innovation: Driven by online auction platforms, blockchain for provenance, and digital art promotion.

- Regulatory Frameworks: Focus on fair auction practices, anti-money laundering, and tax implications.

- Competitive Substitutes: Private sales, art funds, and other luxury asset investments.

- End-User Demographics: High-net-worth individuals, institutional buyers, and a growing base of digital-native collectors.

- M&A Trends: Consolidation of online art marketplaces and acquisition of technology startups.

United States Of America Arts Promoter Market Growth Trends & Insights

The United States Arts Promoter Market is poised for substantial growth, fueled by evolving consumer behaviors and technological advancements. The market size is projected to experience a Compound Annual Growth Rate (CAGR) of xx% over the forecast period. This expansion is driven by increasing disposable incomes, a growing appreciation for cultural heritage, and the proliferation of online platforms that enhance accessibility and global reach. The adoption rate for digital art and NFTs has seen a significant surge, transforming traditional collecting paradigms and attracting new demographics. Technological disruptions, such as AI-powered art generation and virtual reality exhibition spaces, are further redefining how art is created, promoted, and consumed. Consumer behavior shifts indicate a growing preference for personalized art experiences, curated collections, and investments in emerging artists. The market penetration of online art sales channels has steadily increased, indicating a long-term trend towards digital acquisition. The market's resilience, demonstrated even through economic fluctuations, highlights its intrinsic value as a cultural and investment asset. Insights from the US fine arts market indicate a sustained demand for established masters, while the US collectibles market shows diversification beyond traditional categories. The forecast period will witness further integration of virtual and augmented reality into the art promotion landscape.

- Market Size Evolution: Expected to grow at a significant CAGR of xx% from 2025 to 2033.

- Adoption Rates: Rapid adoption of digital art and NFT platforms, increasing market penetration.

- Technological Disruptions: AI in art creation, VR/AR for exhibitions, and blockchain for provenance are reshaping the industry.

- Consumer Behavior Shifts: Demand for personalized experiences, curated art, and investment in emerging artists.

- Market Penetration: Increasing reliance on online sales channels for art acquisition.

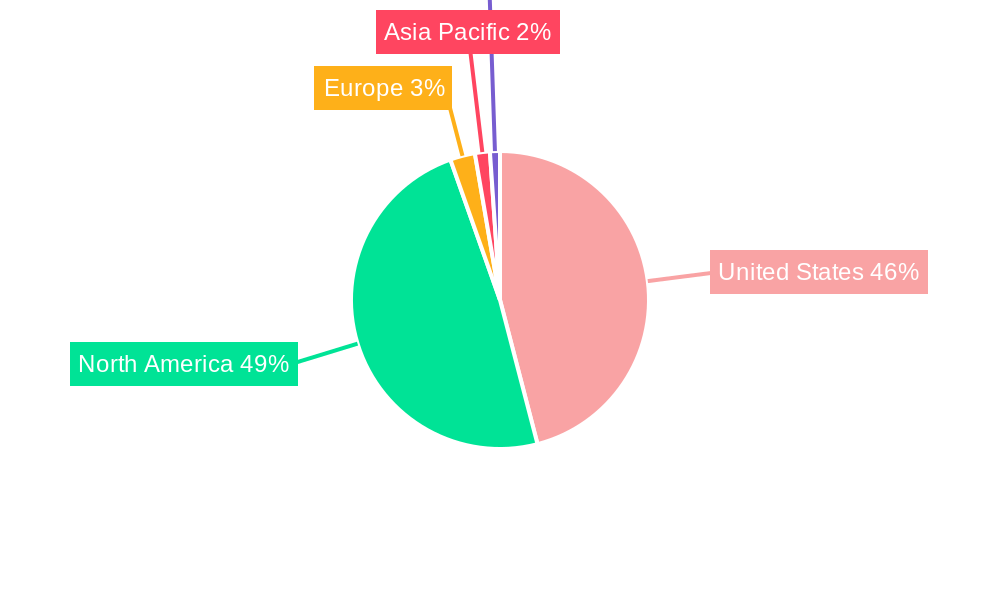

Dominant Regions, Countries, or Segments in United States Of America Arts Promoter Market

Within the United States Arts Promoter Market, Fine Arts emerge as the dominant segment, consistently driving significant revenue and collector interest. This dominance is underpinned by a rich history, established valuation mechanisms, and a robust ecosystem of galleries, museums, and auction houses dedicated to promoting these works. New York stands out as the most influential region, serving as a global hub for art trading, exhibitions, and artist representation. Its unparalleled concentration of leading galleries, auction houses, and cultural institutions, coupled with a strong investor base, solidifies its preeminent position.

The fine arts segment's growth is propelled by several key drivers: sustained economic policies that encourage cultural investment, a well-developed infrastructure for art logistics and security, and a deeply ingrained cultural appreciation for established artistic legacies. Market share within fine arts is substantial, with traditional mediums like painting and sculpture continuing to command high prices. The growth potential remains robust, driven by a constant influx of new masterpieces and the enduring appeal of art as both an aesthetic and financial asset.

Furthermore, the Sponsorship revenue source plays a crucial role, with corporations and foundations increasingly investing in arts organizations to enhance brand image and fulfill corporate social responsibility mandates. This financial support underpins many large-scale exhibitions and public art initiatives, thereby boosting the overall market. Companies as end-users also contribute significantly, acquiring art for corporate collections, office spaces, and brand marketing, further solidifying the dominance of fine arts. The Offline channel, encompassing physical galleries and auction houses, continues to hold sway for high-value transactions, leveraging the tactile and visual experience of engaging with art in person, although online channels are steadily gaining traction.

- Dominant Segment (Type): Fine Arts, encompassing paintings, sculptures, and historical artworks.

- Dominant Region: New York, as a global nexus for art commerce and cultural institutions.

- Key Drivers for Fine Arts Dominance: Favorable economic policies, robust art infrastructure, and cultural appreciation for established art.

- Significant Revenue Source: Sponsorship, enabling large-scale exhibitions and public art projects.

- Key End-User: Companies, for corporate collections and brand building.

- Primary Channel: Offline, for high-value transactions and tangible art experiences.

United States Of America Arts Promoter Market Product Landscape

The United States Arts Promoter Market product landscape is characterized by a diverse range of offerings, from traditional Fine Arts and Antiques to the rapidly evolving Digital Art sector. Promoters showcase a spectrum of artistic creations, each with unique applications and performance metrics. Fine arts, including paintings and sculptures, continue to command premium prices based on artist reputation, provenance, and historical significance. Antiques, valued for their age and rarity, appeal to collectors seeking tangible links to the past. The advent of Digital Art, including NFTs, has introduced new performance metrics based on digital scarcity, community engagement, and technological innovation, with artworks like Cherniak's "Ringers#879" fetching millions. Services offered by promoters range from auctioning and gallery representation to online sales platforms and art advisory. Unique selling propositions often revolve around exclusivity, curated collections, and access to renowned artists.

Key Drivers, Barriers & Challenges in United States Of America Arts Promoter Market

Key Drivers: The United States Arts Promoter Market is propelled by several robust drivers. Technological advancements, particularly in online sales platforms and blockchain technology for provenance and authenticity, are significantly expanding market reach and accessibility. A growing global interest in art as an investment asset class, coupled with increasing disposable incomes among affluent demographics, fuels demand. Furthermore, government initiatives supporting cultural institutions and the arts, alongside a strong tradition of patronage, create a conducive environment. The rise of Digital Art and NFTs has unlocked new revenue streams and attracted a younger, tech-savvy collector base.

Barriers & Challenges: Despite its growth, the market faces several challenges. The inherent subjectivity of art valuation poses a significant barrier, making price discovery and risk assessment complex. High operational costs associated with insurance, security, and transportation for valuable artworks present a considerable hurdle. Regulatory complexities, including varying tax laws and import/export restrictions, can also impede smooth transactions. Moreover, the market is susceptible to economic downturns, where discretionary spending on luxury items like art may decline. Ensuring authenticity and combating forgeries remain persistent concerns, requiring robust verification processes. Supply chain disruptions can impact the timely delivery of artworks.

Emerging Opportunities in United States Of America Arts Promoter Market

Emerging opportunities in the United States Arts Promoter Market lie in the continued expansion of the Digital Art market, particularly exploring new utility and accessibility models for NFTs beyond speculative trading. The increasing demand for art in corporate and hospitality sectors presents significant untapped potential for promoters specializing in commercial art placement. Furthermore, leveraging augmented reality (AR) for virtual exhibitions and at-home art previews offers an innovative way to enhance the buyer experience and reach a wider audience. Focusing on underrepresented artists and diverse cultural narratives can tap into growing collector interest and promote greater inclusivity within the art world. The development of more accessible fractional ownership models for high-value artworks could democratize art investment further.

Growth Accelerators in the United States Of America Arts Promoter Market Industry

Several catalysts are accelerating growth in the United States Arts Promoter Market. Technological breakthroughs in blockchain and AI are enhancing transparency, provenance tracking, and the creation of novel digital art forms. Strategic partnerships between traditional auction houses and digital art platforms are bridging the gap between established and emerging markets, creating hybrid sale models. Market expansion strategies, including global outreach and the development of specialized sub-markets (e.g., urban art, generative art), are broadening the collector base. The increasing institutionalization of the art market, with more corporations and investment funds allocating capital to art acquisitions, provides significant impetus. Educational initiatives and the growing influence of art media further stimulate interest and demand.

Key Players Shaping the United States Of America Arts Promoter Market Market

- Sotheby

- Christie

- Gagosian

- Heritage Auction

- Bonhams

- Artsy

- Artnet

- Art Basel

- MTArt Agency

- ColorWheel Art

Notable Milestones in United States Of America Arts Promoter Market Sector

- June 2023: Sotheby's conducted its second part of the "Grails" sale, focusing on artworks owned by 3AC, featuring 40 digital artworks. The highlight was Cherniak's "Ringers#879" ("The Goose"), sold for USD 6.2 million to the 6529 NFT Fund, demonstrating the significant market value and collector interest in high-profile digital art.

- March 2023: The Metropolitan Museum of Art in New York partnered with the Korean beauty brand Sulwhaso for a year-long initiative aimed at supporting museum programs and redefining audience engagement with global heritage, showcasing a growing trend of cross-industry collaborations to promote arts and culture.

In-Depth United States Of America Arts Promoter Market Market Outlook

The United States Arts Promoter Market is poised for sustained expansion, driven by an interwoven tapestry of technological innovation, evolving consumer preferences, and a burgeoning appreciation for art as a cultural and financial asset. Growth accelerators, including the continued mainstreaming of digital art and NFTs, alongside strategic collaborations between traditional and digital art entities, will redefine market accessibility and engagement. Future market potential lies in leveraging AI for personalized art curation and recommendation engines, as well as expanding the reach of fine arts and collectibles through immersive virtual experiences. Strategic opportunities include catering to the growing demand for investment-grade art from new collector demographics and developing innovative financing models for art acquisition. The market's forward trajectory is marked by increased digitalization, a greater emphasis on inclusivity, and the enduring allure of artistic expression.

United States Of America Arts Promoter Market Segmentation

-

1. Type

- 1.1. Fine Arts

- 1.2. Antiques

- 1.3. Collectables

- 1.4. Abstract Arts

- 1.5. Digital Art

- 1.6. Other Types

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Tickets

- 2.4. Sponsorship

-

3. End-User

- 3.1. Individual

- 3.2. Companies

-

4. Channel

- 4.1. Online

- 4.2. Offline

United States Of America Arts Promoter Market Segmentation By Geography

- 1. United States

United States Of America Arts Promoter Market Regional Market Share

Geographic Coverage of United States Of America Arts Promoter Market

United States Of America Arts Promoter Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Digital Art Products driving the Market; Increasing partnership with global market driving artwork sales

- 3.3. Market Restrains

- 3.3.1. Rise in Digital Art Products driving the Market; Increasing partnership with global market driving artwork sales

- 3.4. Market Trends

- 3.4.1. Digital Art Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Of America Arts Promoter Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fine Arts

- 5.1.2. Antiques

- 5.1.3. Collectables

- 5.1.4. Abstract Arts

- 5.1.5. Digital Art

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Tickets

- 5.2.4. Sponsorship

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Individual

- 5.3.2. Companies

- 5.4. Market Analysis, Insights and Forecast - by Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sotheby

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Christie

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gagosian

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Heritage Auction

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bonhams

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Artsy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Artnet

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Art Basel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MTArt Agency

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ColorWheel Art**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sotheby

List of Figures

- Figure 1: United States Of America Arts Promoter Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Of America Arts Promoter Market Share (%) by Company 2025

List of Tables

- Table 1: United States Of America Arts Promoter Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: United States Of America Arts Promoter Market Revenue undefined Forecast, by Revenue Source 2020 & 2033

- Table 3: United States Of America Arts Promoter Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 4: United States Of America Arts Promoter Market Revenue undefined Forecast, by Channel 2020 & 2033

- Table 5: United States Of America Arts Promoter Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: United States Of America Arts Promoter Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: United States Of America Arts Promoter Market Revenue undefined Forecast, by Revenue Source 2020 & 2033

- Table 8: United States Of America Arts Promoter Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 9: United States Of America Arts Promoter Market Revenue undefined Forecast, by Channel 2020 & 2033

- Table 10: United States Of America Arts Promoter Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Of America Arts Promoter Market?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the United States Of America Arts Promoter Market?

Key companies in the market include Sotheby, Christie, Gagosian, Heritage Auction, Bonhams, Artsy, Artnet, Art Basel, MTArt Agency, ColorWheel Art**List Not Exhaustive.

3. What are the main segments of the United States Of America Arts Promoter Market?

The market segments include Type, Revenue Source, End-User, Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in Digital Art Products driving the Market; Increasing partnership with global market driving artwork sales.

6. What are the notable trends driving market growth?

Digital Art Driving The Market.

7. Are there any restraints impacting market growth?

Rise in Digital Art Products driving the Market; Increasing partnership with global market driving artwork sales.

8. Can you provide examples of recent developments in the market?

June 2023: Sotheby's conducted its second part of the "Grails" sale, focusing on artworks owned by 3AC, featuring 40 digital artworks. The highlight of the auction was Cherniak's highly coveted piece, "Ringers#879," affectionately known as "The Goose" due to its uncanny resemblance to a bird, which appeared to defy the algorithm's randomized logic. This remarkable artwork was sold for a staggering USD 6.2 million to the 6529 NFT Fund.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Of America Arts Promoter Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Of America Arts Promoter Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Of America Arts Promoter Market?

To stay informed about further developments, trends, and reports in the United States Of America Arts Promoter Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence