Key Insights

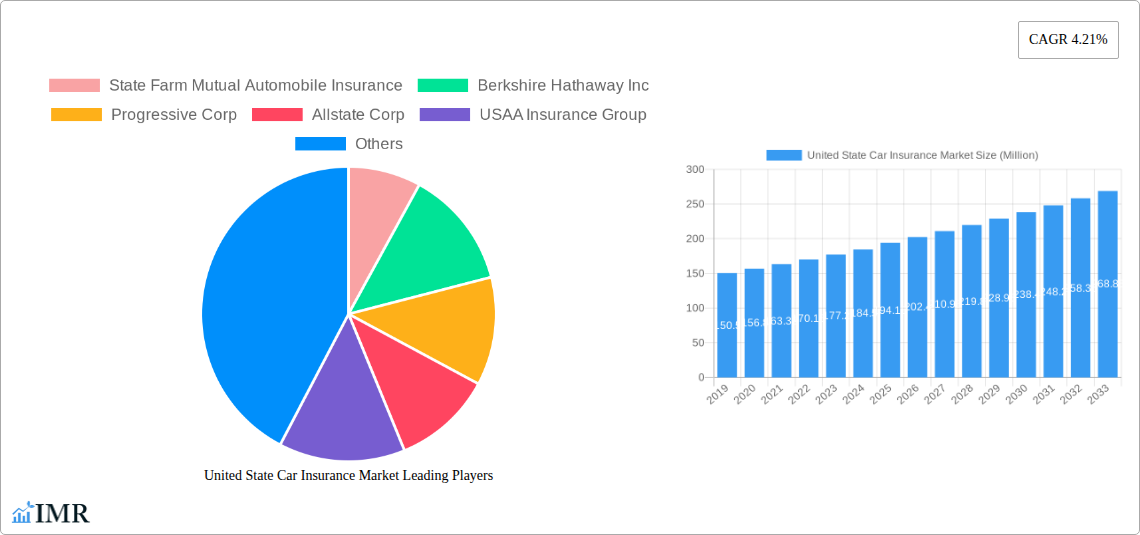

The United States car insurance market is a robust and continuously evolving sector, projected to reach a substantial market size of approximately $194.15 million by 2025. This growth is underpinned by a steady Compound Annual Growth Rate (CAGR) of 4.21% anticipated through 2033. A primary driver of this expansion is the increasing vehicle parc, which includes a growing number of both personal and commercial vehicles on American roads. Furthermore, evolving regulatory landscapes and a heightened consumer awareness regarding the importance of comprehensive protection contribute significantly to market demand. Technological advancements in vehicle safety features and the increasing adoption of telematics-based insurance policies are also shaping the market, offering personalized risk assessment and potential cost savings for policyholders. The expanding adoption of digital platforms for policy purchase and management is further streamlining access and enhancing customer experience.

United State Car Insurance Market Market Size (In Million)

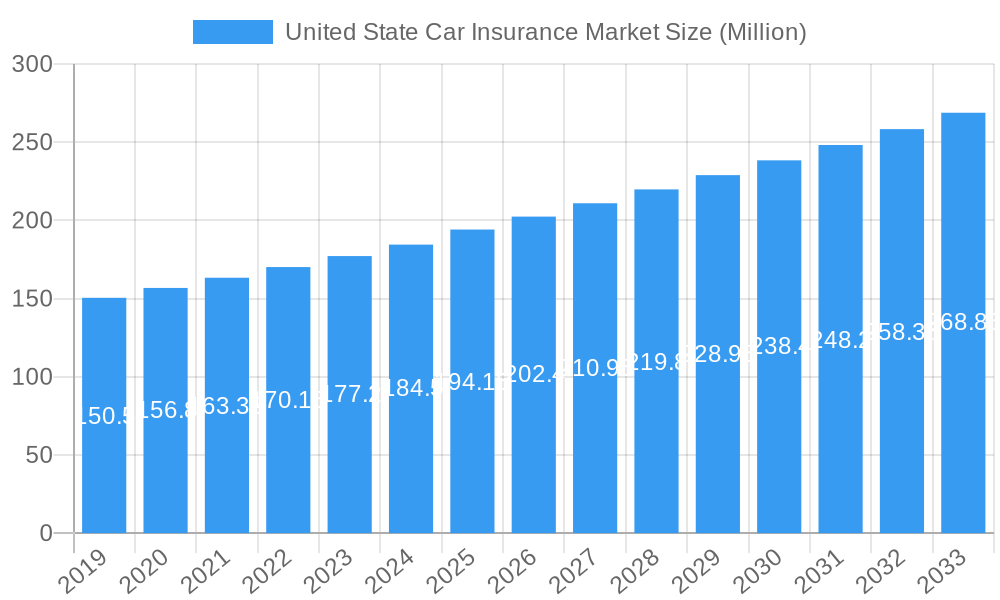

The market is characterized by a diverse range of coverage options, with third-party liability coverage remaining a fundamental component, while collision, comprehensive, and other optional coverages are increasingly sought after by consumers seeking enhanced protection. Distribution channels are multifaceted, with traditional agents and brokers playing a vital role, complemented by growing influence from banks and other alternative distribution channels that offer convenience and integrated financial solutions. Key industry players like State Farm Mutual Automobile Insurance, Berkshire Hathaway Inc., and Progressive Corp. are actively competing, innovating product offerings, and leveraging digital strategies to capture market share. The market also faces certain restraints, including intense price competition and potential economic downturns that could affect consumer spending on insurance premiums. However, the underlying necessity of car insurance, coupled with ongoing innovation and a strong demand for vehicular transport, ensures a resilient and growing market trajectory.

United State Car Insurance Market Company Market Share

Comprehensive Report: United States Car Insurance Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Car Insurance Market, covering historical trends, current dynamics, and future projections through 2033. With a base year of 2025 and a forecast period extending from 2025 to 2033, this study delves into market size evolution, growth drivers, segmentation, competitive landscape, and emerging opportunities. We analyze key segments including Third-Party Liability Coverage and Collision/Comprehensive/Other Optional Coverage, alongside applications for Personal Vehicles and Commercial Vehicles. The report also examines various distribution channels, including Agents, Banks, Brokers, and Other Distribution Channel. Valuable insights into market dynamics, technological disruptions, and evolving consumer behavior are presented in a clear, structured format, utilizing data in millions of units.

United State Car Insurance Market Market Dynamics & Structure

The United States car insurance market exhibits a moderately concentrated structure, with a few dominant players alongside a fragmented segment of smaller insurers. Market concentration is influenced by regulatory requirements and the capital intensity of underwriting. Technological innovation is a significant driver, with insurers increasingly adopting AI, telematics, and digital platforms to enhance underwriting accuracy, streamline claims processing, and personalize customer experiences. Regulatory frameworks, including state-specific mandates on coverage requirements and pricing, significantly shape market operations and product offerings. Competitive product substitutes, while limited in core insurance functions, emerge through alternative risk transfer mechanisms and usage-based insurance models. End-user demographics, including age, driving habits, and vehicle ownership, directly impact demand for various coverage types and pricing strategies. Mergers and acquisitions (M&A) are sporadic but significant, often aimed at achieving economies of scale, expanding market reach, or acquiring technological capabilities.

- Market Concentration: While top-tier companies hold substantial market share, the market is not entirely consolidated, allowing for competitive pricing and innovation from mid-sized and smaller insurers.

- Technological Innovation Drivers: AI for fraud detection and claims assessment, telematics for personalized premiums, and digital platforms for customer engagement are key innovation frontiers.

- Regulatory Frameworks: State-specific insurance laws, solvency requirements, and consumer protection regulations are critical operational parameters.

- Competitive Product Substitutes: Usage-based insurance and micro-insurance products offer alternative pricing and coverage structures.

- End-User Demographics: Younger drivers often face higher premiums due to perceived higher risk, while factors like location and vehicle type significantly influence insurance costs.

- M&A Trends: Acquisitions are often strategic, focusing on technological integration or market expansion into specific regions or customer segments.

United State Car Insurance Market Growth Trends & Insights

The United States car insurance market is poised for steady growth, driven by an increasing vehicle parc, evolving consumer expectations, and ongoing technological advancements. The market size is projected to expand significantly from $xxx million in 2019 to an estimated $xxx million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Adoption rates for usage-based insurance (UBI) and telematics-driven policies are accelerating as consumers become more aware of potential cost savings and personalized coverage. Technological disruptions, such as the integration of AI in claims processing and the development of autonomous driving features, are reshaping the risk landscape and insurance product design. Consumer behavior shifts are evident, with a growing demand for seamless digital experiences, transparent pricing, and flexible policy options. The historical period (2019-2024) saw a robust expansion driven by economic recovery and an increase in vehicle sales. The base year of 2025 serves as a critical benchmark for understanding current market conditions and future trajectory. The estimated year of 2025 indicates a market size of $xxx million.

The market's trajectory is further influenced by factors such as evolving driving patterns, the increasing complexity of vehicle technology, and the persistent need for financial protection against accidents and damage. Insurers are responding by developing more sophisticated risk assessment models and introducing innovative products that cater to diverse consumer needs. The penetration of car insurance remains high, as it is legally mandated in most states, ensuring a consistent demand for core coverage. However, the market is also witnessing a rise in demand for ancillary services, such as roadside assistance and accident forgiveness, which are being integrated into comprehensive insurance packages.

The ongoing digital transformation within the insurance sector is a key growth accelerator. Online comparison platforms, mobile application-based policy management, and AI-powered customer service chatbots are enhancing accessibility and customer satisfaction. This digital shift is particularly impacting younger demographics, who are more comfortable with technology-driven interactions. Furthermore, the increasing adoption of electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs) is creating new underwriting challenges and opportunities, as these vehicles often have different repair costs and safety features. Insurers are adapting by developing specialized EV insurance policies and investing in training for repair networks.

The competitive landscape is characterized by a drive for efficiency and customer-centricity. Companies that can effectively leverage data analytics to personalize pricing, improve claims handling, and offer a superior digital experience are likely to gain a competitive edge. The market is also seeing a growing emphasis on environmental, social, and governance (ESG) factors, with some insurers developing programs that incentivize eco-friendly driving habits. The long-term outlook for the United States car insurance market remains positive, underpinned by the fundamental necessity of vehicle insurance and the industry's capacity to adapt to technological advancements and changing consumer preferences. The projected market size by 2033 underscores the sustained growth potential driven by these dynamic forces.

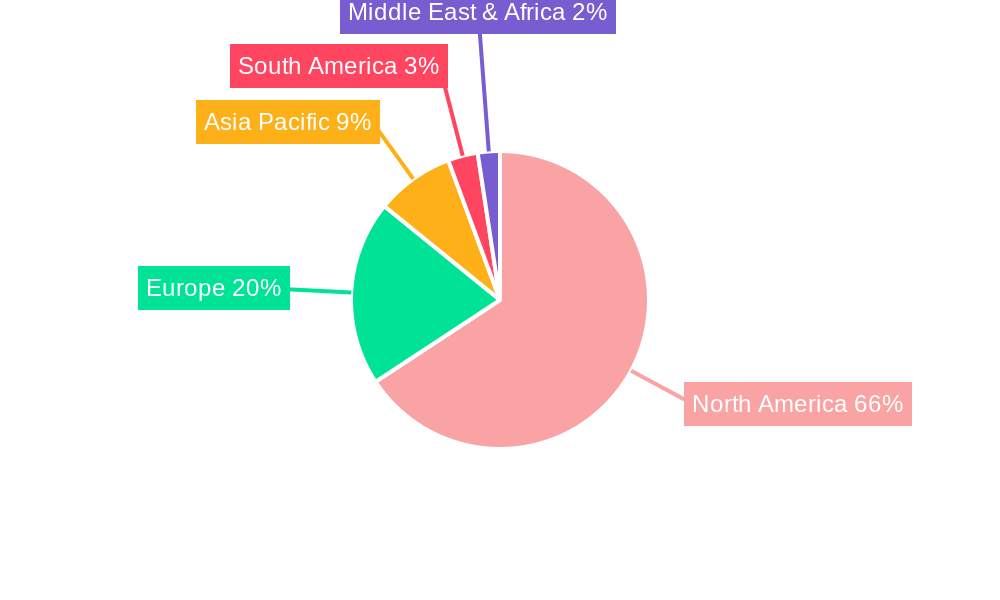

Dominant Regions, Countries, or Segments in United State Car Insurance Market

The United States Car Insurance Market is dominated by several key segments, with Personal Vehicles application holding the largest market share, followed closely by Third-Party Liability Coverage. This dominance is driven by the sheer volume of personal car ownership across the nation and the legal mandate for basic liability protection. The market size for Personal Vehicles is estimated to be $xxx million in 2025, while Third-Party Liability Coverage is projected to be $xxx million. Collision/Comprehensive/Other Optional Coverage represents a significant portion of the market as well, reflecting drivers' desire for greater protection against damage and theft. The Commercial Vehicles segment, while smaller, is experiencing steady growth due to the expansion of e-commerce and the gig economy, leading to an increased number of commercial vehicles on the road.

The Agents distribution channel continues to be a significant player, offering personalized advice and tailored solutions, particularly for complex insurance needs. However, Other Distribution Channel, which encompasses direct online sales and digital platforms, is rapidly gaining traction, especially among tech-savvy consumers seeking convenience and competitive pricing. Banks are also playing an increasing role through partnerships and bundled offerings, providing an integrated financial service experience. Brokers, while serving a niche, remain crucial for commercial insurance and specialized risks.

Key drivers of dominance in the Personal Vehicles segment include the high rate of car ownership, urban and suburban lifestyles necessitating private transportation, and the legal requirement for minimum liability coverage in all states. The economic policies promoting vehicle sales and consumer spending directly influence this segment. For Third-Party Liability Coverage, its dominance is cemented by its foundational role in all auto insurance policies and its mandatory nature, ensuring a consistent demand. The growth potential in this segment is substantial, driven by an increasing number of insured vehicles and evolving regulatory requirements that may mandate higher liability limits.

The market share for Personal Vehicles is estimated at xx% in 2025, while Third-Party Liability Coverage accounts for approximately xx%. Collision/Comprehensive/Other Optional Coverage holds a significant xx% share. The Other Distribution Channel is experiencing the highest growth rate, projected at xx% CAGR during the forecast period, indicating a significant shift in consumer purchasing behavior. Factors like economic stability, growing disposable incomes, and the availability of diverse vehicle models all contribute to the sustained demand for car insurance across these segments. Infrastructure development, particularly road networks, indirectly supports the car insurance market by facilitating vehicle usage. The increasing complexity of vehicle technology, leading to higher repair costs, also fuels demand for comprehensive coverage options, further solidifying the dominance of these segments.

United State Car Insurance Market Product Landscape

The United States car insurance market is characterized by a dynamic product landscape, with insurers continuously innovating to meet evolving consumer needs and technological advancements. Beyond traditional policies, there is a growing emphasis on usage-based insurance (UBI) leveraging telematics to offer personalized premiums based on driving behavior, promoting safer driving and potentially lower costs. Digital claims solutions, such as AXA S.A.'s STeP, are simplifying the claims process, reducing turnaround times and improving customer satisfaction. AI-powered damage assessment tools, exemplified by GEICO's partnership with Tractable, are enhancing efficiency and accuracy in claims handling. Product offerings now increasingly incorporate bundled services like roadside assistance and accident forgiveness, providing a more holistic value proposition. The performance metrics for these products are evaluated based on customer acquisition cost, retention rates, claims severity, and customer satisfaction scores.

Key Drivers, Barriers & Challenges in United State Car Insurance Market

Key Drivers:

- Mandatory Coverage Requirements: Legal mandates for liability insurance in most states ensure a consistent baseline demand.

- Increasing Vehicle Parc: A growing number of vehicles on the road directly translates to a larger insurable market.

- Technological Advancements: Telematics, AI, and digital platforms are driving innovation in underwriting, pricing, and claims, leading to more efficient and personalized offerings.

- Economic Growth and Consumer Spending: A healthy economy boosts vehicle sales and consumer confidence, encouraging insurance purchases.

Key Barriers & Challenges:

- Regulatory Complexity: Navigating diverse state-specific regulations can be costly and time-consuming for insurers.

- Increasing Claims Costs: Rising repair costs for advanced vehicle technologies, as well as increased frequency of certain types of accidents, put pressure on profitability.

- Fraudulent Claims: The persistent challenge of insurance fraud leads to higher premiums for honest policyholders and requires significant investment in detection and prevention.

- Intense Competition: The market is highly competitive, leading to price pressures and a constant need for differentiation through product innovation and customer service.

- Supply Chain Disruptions: Shortages of parts and skilled labor can prolong repair times, impacting claims resolution and customer satisfaction, with an estimated impact on claims handling times by xx% during periods of severe disruption.

Emerging Opportunities in United State Car Insurance Market

Emerging opportunities lie in the continued expansion of usage-based insurance (UBI) and pay-how-you-drive (PHYD) models, catering to a growing segment of cost-conscious and tech-savvy consumers. The increasing adoption of electric vehicles (EVs) presents a nascent market for specialized insurance products that address unique risks and repair considerations. Furthermore, the development of embedded insurance solutions, where car insurance is seamlessly integrated into the vehicle purchase or financing process, offers significant potential for capturing new customers. Insurtech startups are also fostering innovation, introducing novel approaches to risk assessment, customer engagement, and claims management, creating potential for partnerships and acquisitions by established players.

Growth Accelerators in the United State Car Insurance Market Industry

Long-term growth in the United States car insurance market will be significantly accelerated by the widespread adoption of AI and machine learning in underwriting and claims, leading to more accurate risk assessment and faster settlement processes. Strategic partnerships between traditional insurers and insurtech companies will foster rapid innovation and the development of agile, customer-centric products. The ongoing expansion of digital distribution channels and the enhancement of online customer experience will make insurance more accessible and convenient, driving higher conversion rates and retention. Furthermore, the increasing integration of telematics data into policy pricing and risk management strategies will create a more personalized and equitable insurance environment, encouraging safer driving behaviors and reducing overall risk exposure for insurers.

Key Players Shaping the United State Car Insurance Market Market

- State Farm Mutual Automobile Insurance

- Berkshire Hathaway Inc

- Progressive Corp

- Allstate Corp

- USAA Insurance Group

- Liberty Mutual

- Farmers Insurance Group of Companies

- Nationwide Mutual Group

- American Family Insurance Group

- Travelers Companies Inc

Notable Milestones in United State Car Insurance Market Sector

- August 2023: AXA S.A. introduced its latest digital claims solution, STeP, which simplifies the car insurance process, aiming to reduce claim settlement times and enhance customer satisfaction.

- May 2022: GEICO partnered with Tractable, an AI technology company, to accelerate its car claim and repair process. The AI is used to assess car damage, improving efficiency and accuracy in the claims handling lifecycle.

In-Depth United State Car Insurance Market Market Outlook

The United States car insurance market is set for sustained growth, driven by the accelerating adoption of advanced technologies like AI and telematics, which are revolutionizing risk assessment and customer engagement. Strategic alliances between established insurers and agile insurtech firms will be crucial for fostering innovation and delivering enhanced value propositions. The continued shift towards digital platforms and a focus on superior online customer experiences will further democratize access to insurance and improve retention rates. The integration of telematics data into core insurance operations promises a more personalized and performance-based pricing model, incentivizing safer driving and ultimately contributing to a more efficient and equitable market. The market's outlook remains robust, with significant opportunities in specialized coverage for emerging vehicle technologies and evolving consumer preferences.

United State Car Insurance Market Segmentation

-

1. Coverage

- 1.1. Third-Party Liability Coverage

- 1.2. Collision/Comprehensive/Other Optional Coverage

-

2. Application

- 2.1. Personal Vehicles

- 2.2. Commercial Vehicles

-

3. Distribution Channel

- 3.1. Agents

- 3.2. Banks

- 3.3. Brokers

- 3.4. Other Distribution Channel

United State Car Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

United State Car Insurance Market Regional Market Share

Geographic Coverage of United State Car Insurance Market

United State Car Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Number of Accidents Drives The Market; An increase in Road Traffic Accidents Drives The Market

- 3.3. Market Restrains

- 3.3.1. Rising Number of Accidents Drives The Market; An increase in Road Traffic Accidents Drives The Market

- 3.4. Market Trends

- 3.4.1. Rise In Number Of Traffic Accidents

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global United State Car Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Third-Party Liability Coverage

- 5.1.2. Collision/Comprehensive/Other Optional Coverage

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal Vehicles

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Agents

- 5.3.2. Banks

- 5.3.3. Brokers

- 5.3.4. Other Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. North America United State Car Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Coverage

- 6.1.1. Third-Party Liability Coverage

- 6.1.2. Collision/Comprehensive/Other Optional Coverage

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Personal Vehicles

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Agents

- 6.3.2. Banks

- 6.3.3. Brokers

- 6.3.4. Other Distribution Channel

- 6.1. Market Analysis, Insights and Forecast - by Coverage

- 7. South America United State Car Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Coverage

- 7.1.1. Third-Party Liability Coverage

- 7.1.2. Collision/Comprehensive/Other Optional Coverage

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Personal Vehicles

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Agents

- 7.3.2. Banks

- 7.3.3. Brokers

- 7.3.4. Other Distribution Channel

- 7.1. Market Analysis, Insights and Forecast - by Coverage

- 8. Europe United State Car Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Coverage

- 8.1.1. Third-Party Liability Coverage

- 8.1.2. Collision/Comprehensive/Other Optional Coverage

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Personal Vehicles

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Agents

- 8.3.2. Banks

- 8.3.3. Brokers

- 8.3.4. Other Distribution Channel

- 8.1. Market Analysis, Insights and Forecast - by Coverage

- 9. Middle East & Africa United State Car Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Coverage

- 9.1.1. Third-Party Liability Coverage

- 9.1.2. Collision/Comprehensive/Other Optional Coverage

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Personal Vehicles

- 9.2.2. Commercial Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Agents

- 9.3.2. Banks

- 9.3.3. Brokers

- 9.3.4. Other Distribution Channel

- 9.1. Market Analysis, Insights and Forecast - by Coverage

- 10. Asia Pacific United State Car Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Coverage

- 10.1.1. Third-Party Liability Coverage

- 10.1.2. Collision/Comprehensive/Other Optional Coverage

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Personal Vehicles

- 10.2.2. Commercial Vehicles

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Agents

- 10.3.2. Banks

- 10.3.3. Brokers

- 10.3.4. Other Distribution Channel

- 10.1. Market Analysis, Insights and Forecast - by Coverage

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 State Farm Mutual Automobile Insurance

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Berkshire Hathaway Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Progressive Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Allstate Corp

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 USAA Insurance Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Liberty Mutual

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Farmers Insurance Group of Companies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nationwide Mutual Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 American Family Insurance Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Travelers Companies Inc **List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 State Farm Mutual Automobile Insurance

List of Figures

- Figure 1: Global United State Car Insurance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global United State Car Insurance Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America United State Car Insurance Market Revenue (Million), by Coverage 2025 & 2033

- Figure 4: North America United State Car Insurance Market Volume (Billion), by Coverage 2025 & 2033

- Figure 5: North America United State Car Insurance Market Revenue Share (%), by Coverage 2025 & 2033

- Figure 6: North America United State Car Insurance Market Volume Share (%), by Coverage 2025 & 2033

- Figure 7: North America United State Car Insurance Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America United State Car Insurance Market Volume (Billion), by Application 2025 & 2033

- Figure 9: North America United State Car Insurance Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America United State Car Insurance Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America United State Car Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 12: North America United State Car Insurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 13: North America United State Car Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: North America United State Car Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: North America United State Car Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America United State Car Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America United State Car Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America United State Car Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 19: South America United State Car Insurance Market Revenue (Million), by Coverage 2025 & 2033

- Figure 20: South America United State Car Insurance Market Volume (Billion), by Coverage 2025 & 2033

- Figure 21: South America United State Car Insurance Market Revenue Share (%), by Coverage 2025 & 2033

- Figure 22: South America United State Car Insurance Market Volume Share (%), by Coverage 2025 & 2033

- Figure 23: South America United State Car Insurance Market Revenue (Million), by Application 2025 & 2033

- Figure 24: South America United State Car Insurance Market Volume (Billion), by Application 2025 & 2033

- Figure 25: South America United State Car Insurance Market Revenue Share (%), by Application 2025 & 2033

- Figure 26: South America United State Car Insurance Market Volume Share (%), by Application 2025 & 2033

- Figure 27: South America United State Car Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 28: South America United State Car Insurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 29: South America United State Car Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: South America United State Car Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: South America United State Car Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America United State Car Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 33: South America United State Car Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America United State Car Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe United State Car Insurance Market Revenue (Million), by Coverage 2025 & 2033

- Figure 36: Europe United State Car Insurance Market Volume (Billion), by Coverage 2025 & 2033

- Figure 37: Europe United State Car Insurance Market Revenue Share (%), by Coverage 2025 & 2033

- Figure 38: Europe United State Car Insurance Market Volume Share (%), by Coverage 2025 & 2033

- Figure 39: Europe United State Car Insurance Market Revenue (Million), by Application 2025 & 2033

- Figure 40: Europe United State Car Insurance Market Volume (Billion), by Application 2025 & 2033

- Figure 41: Europe United State Car Insurance Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: Europe United State Car Insurance Market Volume Share (%), by Application 2025 & 2033

- Figure 43: Europe United State Car Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Europe United State Car Insurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 45: Europe United State Car Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Europe United State Car Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Europe United State Car Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe United State Car Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Europe United State Car Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe United State Car Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa United State Car Insurance Market Revenue (Million), by Coverage 2025 & 2033

- Figure 52: Middle East & Africa United State Car Insurance Market Volume (Billion), by Coverage 2025 & 2033

- Figure 53: Middle East & Africa United State Car Insurance Market Revenue Share (%), by Coverage 2025 & 2033

- Figure 54: Middle East & Africa United State Car Insurance Market Volume Share (%), by Coverage 2025 & 2033

- Figure 55: Middle East & Africa United State Car Insurance Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East & Africa United State Car Insurance Market Volume (Billion), by Application 2025 & 2033

- Figure 57: Middle East & Africa United State Car Insurance Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East & Africa United State Car Insurance Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East & Africa United State Car Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 60: Middle East & Africa United State Car Insurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 61: Middle East & Africa United State Car Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 62: Middle East & Africa United State Car Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 63: Middle East & Africa United State Car Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East & Africa United State Car Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Middle East & Africa United State Car Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa United State Car Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific United State Car Insurance Market Revenue (Million), by Coverage 2025 & 2033

- Figure 68: Asia Pacific United State Car Insurance Market Volume (Billion), by Coverage 2025 & 2033

- Figure 69: Asia Pacific United State Car Insurance Market Revenue Share (%), by Coverage 2025 & 2033

- Figure 70: Asia Pacific United State Car Insurance Market Volume Share (%), by Coverage 2025 & 2033

- Figure 71: Asia Pacific United State Car Insurance Market Revenue (Million), by Application 2025 & 2033

- Figure 72: Asia Pacific United State Car Insurance Market Volume (Billion), by Application 2025 & 2033

- Figure 73: Asia Pacific United State Car Insurance Market Revenue Share (%), by Application 2025 & 2033

- Figure 74: Asia Pacific United State Car Insurance Market Volume Share (%), by Application 2025 & 2033

- Figure 75: Asia Pacific United State Car Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 76: Asia Pacific United State Car Insurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 77: Asia Pacific United State Car Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 78: Asia Pacific United State Car Insurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 79: Asia Pacific United State Car Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Asia Pacific United State Car Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Asia Pacific United State Car Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific United State Car Insurance Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global United State Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 2: Global United State Car Insurance Market Volume Billion Forecast, by Coverage 2020 & 2033

- Table 3: Global United State Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global United State Car Insurance Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global United State Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global United State Car Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global United State Car Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global United State Car Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global United State Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 10: Global United State Car Insurance Market Volume Billion Forecast, by Coverage 2020 & 2033

- Table 11: Global United State Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global United State Car Insurance Market Volume Billion Forecast, by Application 2020 & 2033

- Table 13: Global United State Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global United State Car Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global United State Car Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global United State Car Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Global United State Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 24: Global United State Car Insurance Market Volume Billion Forecast, by Coverage 2020 & 2033

- Table 25: Global United State Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global United State Car Insurance Market Volume Billion Forecast, by Application 2020 & 2033

- Table 27: Global United State Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global United State Car Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global United State Car Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global United State Car Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Brazil United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Brazil United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Global United State Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 38: Global United State Car Insurance Market Volume Billion Forecast, by Coverage 2020 & 2033

- Table 39: Global United State Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global United State Car Insurance Market Volume Billion Forecast, by Application 2020 & 2033

- Table 41: Global United State Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global United State Car Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global United State Car Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global United State Car Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 45: United Kingdom United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Germany United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Germany United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: France United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Italy United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Italy United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Spain United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Spain United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Russia United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Russia United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Benelux United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Benelux United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Nordics United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Nordics United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Global United State Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 64: Global United State Car Insurance Market Volume Billion Forecast, by Coverage 2020 & 2033

- Table 65: Global United State Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 66: Global United State Car Insurance Market Volume Billion Forecast, by Application 2020 & 2033

- Table 67: Global United State Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 68: Global United State Car Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 69: Global United State Car Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global United State Car Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 71: Turkey United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Turkey United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Israel United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Israel United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: GCC United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: GCC United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: North Africa United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: North Africa United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 79: South Africa United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South Africa United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Global United State Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 84: Global United State Car Insurance Market Volume Billion Forecast, by Coverage 2020 & 2033

- Table 85: Global United State Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 86: Global United State Car Insurance Market Volume Billion Forecast, by Application 2020 & 2033

- Table 87: Global United State Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 88: Global United State Car Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 89: Global United State Car Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 90: Global United State Car Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 91: China United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: China United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 93: India United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: India United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 95: Japan United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Japan United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 97: South Korea United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Korea United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 99: ASEAN United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: ASEAN United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 101: Oceania United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Oceania United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific United State Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific United State Car Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United State Car Insurance Market?

The projected CAGR is approximately 4.21%.

2. Which companies are prominent players in the United State Car Insurance Market?

Key companies in the market include State Farm Mutual Automobile Insurance, Berkshire Hathaway Inc, Progressive Corp, Allstate Corp, USAA Insurance Group, Liberty Mutual, Farmers Insurance Group of Companies, Nationwide Mutual Group, American Family Insurance Group, Travelers Companies Inc **List Not Exhaustive.

3. What are the main segments of the United State Car Insurance Market?

The market segments include Coverage, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 194.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Number of Accidents Drives The Market; An increase in Road Traffic Accidents Drives The Market.

6. What are the notable trends driving market growth?

Rise In Number Of Traffic Accidents.

7. Are there any restraints impacting market growth?

Rising Number of Accidents Drives The Market; An increase in Road Traffic Accidents Drives The Market.

8. Can you provide examples of recent developments in the market?

August 2023: AXA S.A. introduced its latest digital claims solution, STeP, which simplifies the car insurance process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United State Car Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United State Car Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United State Car Insurance Market?

To stay informed about further developments, trends, and reports in the United State Car Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence