Key Insights

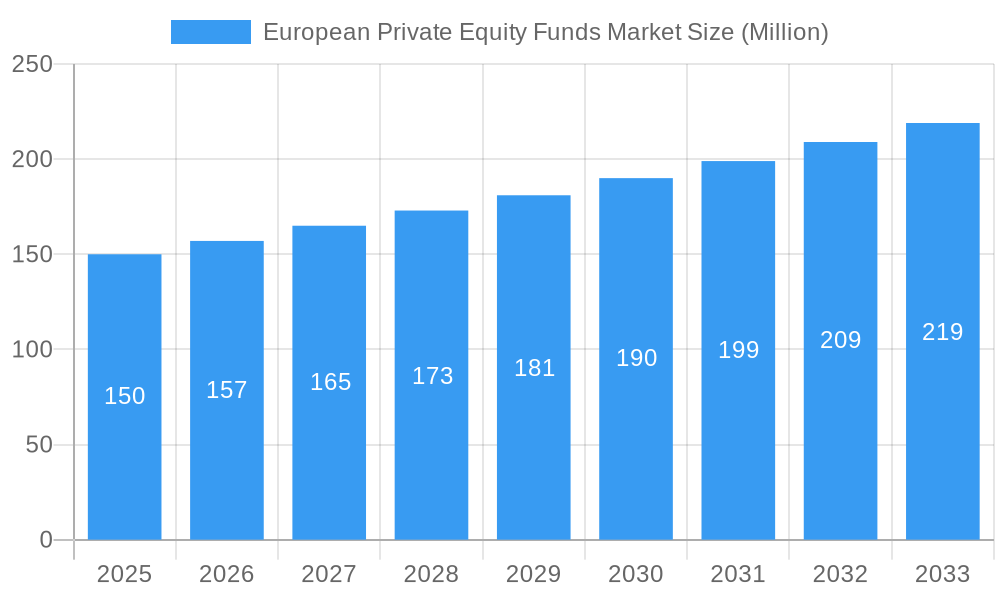

The European Private Equity Funds Market is poised for significant expansion, with a current market size of 150 Million and a projected Compound Annual Growth Rate (CAGR) of 5.12%. This robust growth is fueled by several key drivers. A primary catalyst is the increasing appetite among institutional investors, such as pension funds and sovereign wealth funds, for alternative asset classes offering diversification and potentially higher returns. Furthermore, the ongoing economic recovery across Europe, coupled with a supportive regulatory environment for private equity operations in several key nations, is fostering a favorable investment climate. The market's dynamism is also evident in its segmentation. Large-cap investments continue to dominate, reflecting substantial fund sizes and the pursuit of established, stable companies. However, there's a discernible upward trend in mid-cap and small-cap allocations, driven by a strategic search for untapped growth potential in emerging businesses and sectors. The application landscape is similarly diverse, with early-stage venture capital investments playing a crucial role in nurturing innovation, while private equity and leveraged buyouts remain core strategies for established fund managers looking to acquire and optimize mature businesses.

European Private Equity Funds Market Market Size (In Million)

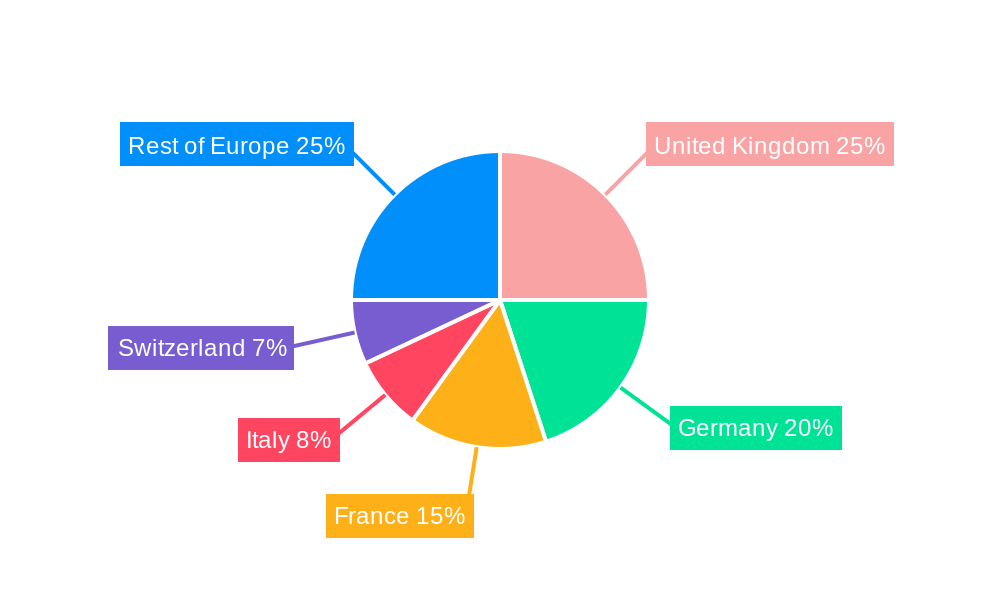

The European Private Equity Funds Market is navigating a landscape shaped by both opportunities and challenges. Emerging trends include a growing focus on Environmental, Social, and Governance (ESG) factors within investment strategies, as investors increasingly demand sustainable and responsible capital deployment. This is leading to a surge in private equity firms specializing in impact investing and renewable energy. Technological advancements are also a significant trend, with private equity actively investing in disruptive technologies and digital transformation across various industries. Conversely, restraints such as heightened regulatory scrutiny in certain regions and concerns around valuation bubbles in specific sectors present headwinds. Intense competition among a growing number of fund managers is also a factor, potentially impacting fundraising success and deal sourcing. Geographically, the United Kingdom, Germany, and France are expected to remain the dominant markets, attracting a substantial share of capital. However, countries like Italy and Switzerland, along with the broader "Rest of Europe" region, are exhibiting promising growth trajectories, indicating a more diversified European investment landscape in the coming years.

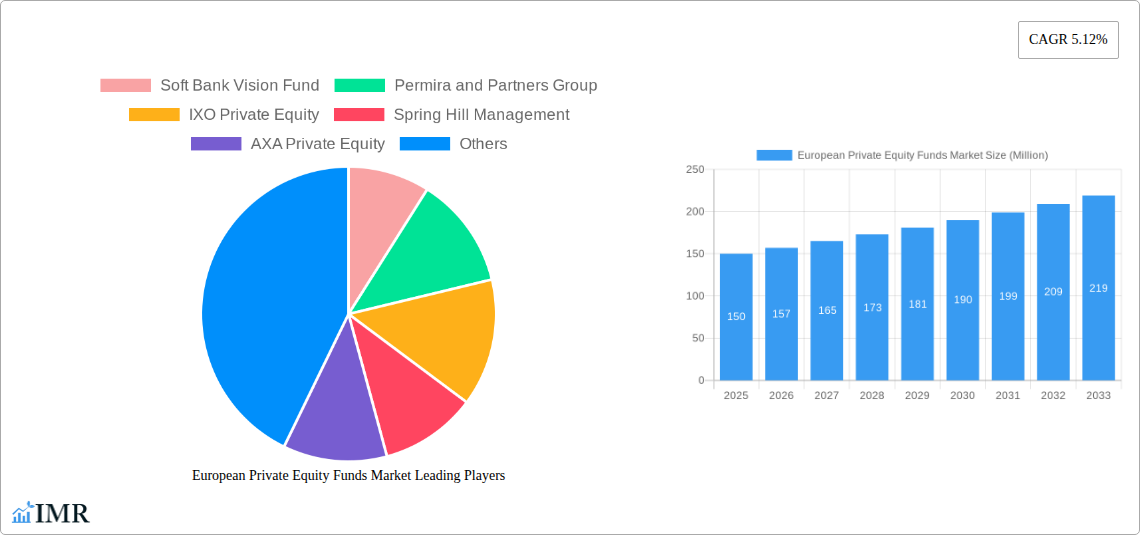

European Private Equity Funds Market Company Market Share

Unlocking Growth: The Definitive European Private Equity Funds Market Report (2019-2033)

This comprehensive report offers an in-depth analysis of the European Private Equity Funds Market, providing critical insights into its dynamics, growth trajectories, and future outlook. Designed for industry professionals, investors, and strategic planners, this report leverages high-traffic keywords and a structured format to deliver actionable intelligence. Explore investment opportunities across Large Cap, Mid Cap, and Small Cap segments, and understand the nuances of Early Stage Venture Capital Investment, Private Equity, and Leverage Buyout applications. With a study period spanning 2019–2033, a base year of 2025, and a forecast period from 2025–2033, this report equips you with the data to navigate this evolving landscape. All financial values are presented in Million units.

European Private Equity Funds Market Market Dynamics & Structure

The European Private Equity Funds Market is characterized by a complex interplay of institutional investors, fund managers, and portfolio companies, driven by evolving economic conditions and a robust regulatory environment. Market concentration is influenced by the increasing dominance of larger, established funds that can deploy substantial capital. Technological innovation, particularly in digital transformation and data analytics, is a key driver, enabling more efficient deal sourcing, due diligence, and portfolio management. Regulatory frameworks, while providing stability, also present compliance challenges, impacting fund structures and investment strategies. Competitive product substitutes, such as direct investments and public market offerings, constantly vie for investor attention, necessitating clear value propositions from private equity. End-user demographics are shifting, with a growing demand for sustainable and impact-focused investments. Mergers and acquisitions (M&A) trends are robust, with significant consolidation and strategic partnerships shaping the competitive landscape. For instance, the sector witnessed xx M&A deal volumes in the historical period, signaling active portfolio rebalancing and strategic growth initiatives. Innovation barriers include the high cost of entry for new fund managers and the need for specialized expertise in niche sectors.

European Private Equity Funds Market Growth Trends & Insights

The European Private Equity Funds Market is poised for significant expansion, with market size evolution projected to reach USD XXX Million by 2033. The adoption rates of private equity as an investment vehicle continue to rise, fueled by attractive risk-adjusted returns compared to traditional asset classes. Technological disruptions are profoundly impacting deal origination and portfolio value creation, with a growing emphasis on data-driven investment decisions and operational enhancements within portfolio companies. Consumer behavior shifts, such as the increasing demand for ESG-compliant investments and sector-specific innovation, are influencing fund mandates and investment theses. The CAGR for the forecast period is estimated at XX%, indicating a strong growth trajectory. Market penetration is expected to deepen across various European economies as institutional investors diversify their portfolios and sophisticated limited partners (LPs) seek alternative investment opportunities. The report delves into the granular evolution of market share across different fund sizes and investment strategies, providing a detailed picture of where growth is concentrated and the underlying drivers.

Dominant Regions, Countries, or Segments in European Private Equity Funds Market

The Large Cap segment within the European Private Equity Funds Market is a significant growth driver, commanding a substantial market share of approximately XX%. This dominance is fueled by the ability of large-cap funds to execute transformative deals, often involving established companies seeking strategic capital for expansion, M&A, or operational restructuring. Economic policies across key European nations, such as stable regulatory environments and tax incentives, play a crucial role in attracting substantial capital to this segment. Infrastructure development, both physical and digital, within these economies also supports the growth of companies operating at this scale.

- Key Drivers in Large Cap:

- Access to significant pools of capital from institutional investors and pension funds.

- Opportunities for operational improvements and value creation through strategic interventions.

- Strong deal pipelines driven by corporate carve-outs and public-to-private transactions.

- Established track records of successful large-scale exits.

Conversely, the Private Equity application, as a broader category encompassing various investment strategies, continues to be the bedrock of the market, representing approximately XX% of the overall activity. This segment benefits from its flexibility in deal structuring and its ability to cater to a wide range of investor needs.

- Dominance Factors in Private Equity:

- Versatility in investment strategies, including growth equity, buyouts, and distressed investments.

- Robust demand from a diverse investor base seeking exposure to private markets.

- Active secondary market, facilitating liquidity and capital recycling.

Within countries, the United Kingdom and Germany consistently emerge as dominant regions, accounting for an estimated XX% and XX% of the market, respectively. This is attributable to their deep capital markets, mature legal and financial infrastructure, and a high concentration of investable companies across various sectors. France and the Nordic countries are also demonstrating robust growth.

European Private Equity Funds Market Product Landscape

The European Private Equity Funds Market is characterized by a dynamic product landscape driven by innovation in fund structures and investment mandates. Emerging products include specialized funds focusing on impact investing, climate technology, and digital infrastructure. Performance metrics are increasingly transparent, with a focus on net IRR, MoIC, and DPI as key indicators of fund success. Unique selling propositions often lie in a fund manager's proprietary deal sourcing capabilities, deep sector expertise, or a proven ability to drive operational improvements in portfolio companies. Technological advancements, such as the use of AI for deal screening and ESG analytics, are becoming integral to the product offering, enhancing efficiency and attracting a new generation of LPs.

Key Drivers, Barriers & Challenges in European Private Equity Funds Market

Key Drivers:

- Attractive Returns: The potential for outsized returns compared to public markets continues to be a primary driver for private equity investments.

- Low Interest Rate Environment (Historical): While shifting, the extended period of low interest rates historically encouraged investors to seek higher yields in alternative assets.

- Investor Diversification: Institutional investors and family offices increasingly allocate capital to private equity to diversify their portfolios and mitigate risk.

- Technological Advancements: Digital transformation and innovation across industries create new investment opportunities and drive portfolio company growth.

Barriers & Challenges:

- Regulatory Scrutiny: Evolving regulations and compliance burdens can increase operational costs and complexity for fund managers.

- Fundraising Competition: The crowded market makes it challenging for newer or smaller funds to attract sufficient capital.

- Valuation Gaps: Discrepancies between buyer and seller expectations can hinder deal execution, particularly in periods of economic uncertainty.

- Talent Acquisition: Attracting and retaining skilled investment professionals with specialized expertise remains a constant challenge. The sector faces an estimated XX% shortage in specialized deal sourcing talent.

Emerging Opportunities in European Private Equity Funds Market

Emerging opportunities in the European Private Equity Funds Market lie in the burgeoning ESG-focused investment themes, catering to a growing demand for sustainable and socially responsible capital deployment. The digitalization of traditional industries presents fertile ground for value creation through technology integration and operational efficiency improvements. Furthermore, the mid-market segment in certain Eastern European economies, with their developing capital markets and entrepreneurial dynamism, offers untapped potential for specialized buyout and growth equity strategies. Innovative applications in sectors like renewable energy, healthcare technology, and cybersecurity are attracting significant investor interest.

Growth Accelerators in the European Private Equity Funds Market Industry

Long-term growth in the European Private Equity Funds Market is significantly propelled by technological breakthroughs, enabling more sophisticated data analysis for deal sourcing and portfolio management. Strategic partnerships between private equity firms and strategic corporate players are fostering co-investment opportunities and unlocking synergistic value. Furthermore, market expansion strategies into new geographies, particularly in emerging European economies, and the increasing institutionalization of alternative asset allocations by pension funds and sovereign wealth funds are critical growth catalysts.

Key Players Shaping the European Private Equity Funds Market Market

- Soft Bank Vision Fund

- Permira

- Partners Group

- IXO Private Equity

- Spring Hill Management

- AXA Private Equity

- Oakley Capital

- Heartland

- CVC Capital Partners

- Accent Equity Partners

- Apax Partners

- Other Key Players* (List Not Exhaustive)

Notable Milestones in European Private Equity Funds Market Sector

- February 2023: Oakley Capital raises a record Euro 2.85 Billion (USD 3.13 Billion) for its fifth flagship fund, signaling strong investor confidence and a continued focus on long-term megatrends like online consumer shifts, cloud migration, and accessible education.

- February 2023: Apax Partners seeks to acquire up to a 40% stake, primarily from existing investors Advent International and Bain Capital, valuing the target at USD 2.1 billion. This strategic move aims to enhance market control and refine investment strategies.

In-Depth European Private Equity Funds Market Market Outlook

The European Private Equity Funds Market is projected for sustained growth, driven by a combination of accelerating factors. Technological innovation, particularly in AI and data analytics, will continue to enhance deal sourcing and portfolio management capabilities, leading to improved returns. Increased investor appetite for ESG-compliant investments presents significant opportunities for specialized funds. Furthermore, the ongoing trend of corporate carve-outs and the search for strategic partners by privately held companies will ensure a robust deal pipeline. The market outlook is highly positive, with strategic opportunities for both established and emerging fund managers to capitalize on evolving economic landscapes and investor preferences.

European Private Equity Funds Market Segmentation

-

1. Investment Type

- 1.1. Large Cap

- 1.2. Mid Cap

- 1.3. Small Cap

-

2. Application

- 2.1. Early Stage Venture Capital Investment

- 2.2. Private Equity

- 2.3. Leverage Buyout

European Private Equity Funds Market Segmentation By Geography

- 1. Italy

- 2. Germany

- 3. France

- 4. Switzerland

- 5. United Kingdom

- 6. Rest of Europe

European Private Equity Funds Market Regional Market Share

Geographic Coverage of European Private Equity Funds Market

European Private Equity Funds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Cost Acts as a Restraint to the Market

- 3.4. Market Trends

- 3.4.1. Family Owned Companies Witnessing Majority Shareholding in Private Equity Industry of Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investment Type

- 5.1.1. Large Cap

- 5.1.2. Mid Cap

- 5.1.3. Small Cap

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Early Stage Venture Capital Investment

- 5.2.2. Private Equity

- 5.2.3. Leverage Buyout

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. Switzerland

- 5.3.5. United Kingdom

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Investment Type

- 6. Italy European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Investment Type

- 6.1.1. Large Cap

- 6.1.2. Mid Cap

- 6.1.3. Small Cap

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Early Stage Venture Capital Investment

- 6.2.2. Private Equity

- 6.2.3. Leverage Buyout

- 6.1. Market Analysis, Insights and Forecast - by Investment Type

- 7. Germany European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Investment Type

- 7.1.1. Large Cap

- 7.1.2. Mid Cap

- 7.1.3. Small Cap

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Early Stage Venture Capital Investment

- 7.2.2. Private Equity

- 7.2.3. Leverage Buyout

- 7.1. Market Analysis, Insights and Forecast - by Investment Type

- 8. France European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Investment Type

- 8.1.1. Large Cap

- 8.1.2. Mid Cap

- 8.1.3. Small Cap

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Early Stage Venture Capital Investment

- 8.2.2. Private Equity

- 8.2.3. Leverage Buyout

- 8.1. Market Analysis, Insights and Forecast - by Investment Type

- 9. Switzerland European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Investment Type

- 9.1.1. Large Cap

- 9.1.2. Mid Cap

- 9.1.3. Small Cap

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Early Stage Venture Capital Investment

- 9.2.2. Private Equity

- 9.2.3. Leverage Buyout

- 9.1. Market Analysis, Insights and Forecast - by Investment Type

- 10. United Kingdom European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Investment Type

- 10.1.1. Large Cap

- 10.1.2. Mid Cap

- 10.1.3. Small Cap

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Early Stage Venture Capital Investment

- 10.2.2. Private Equity

- 10.2.3. Leverage Buyout

- 10.1. Market Analysis, Insights and Forecast - by Investment Type

- 11. Rest of Europe European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Investment Type

- 11.1.1. Large Cap

- 11.1.2. Mid Cap

- 11.1.3. Small Cap

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Early Stage Venture Capital Investment

- 11.2.2. Private Equity

- 11.2.3. Leverage Buyout

- 11.1. Market Analysis, Insights and Forecast - by Investment Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Soft Bank Vision Fund

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Permira and Partners Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IXO Private Equity

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Spring Hill Management

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 AXA Private Equity

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Oakley Capital

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Heartland

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 CVC Capital Partners

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Accent Equity Partners*

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Other Key Players*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Apax Partners

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Soft Bank Vision Fund

List of Figures

- Figure 1: European Private Equity Funds Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Private Equity Funds Market Share (%) by Company 2025

List of Tables

- Table 1: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 2: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: European Private Equity Funds Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 5: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 8: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 11: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 14: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 17: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 20: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Private Equity Funds Market?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the European Private Equity Funds Market?

Key companies in the market include Soft Bank Vision Fund, Permira and Partners Group, IXO Private Equity, Spring Hill Management, AXA Private Equity, Oakley Capital, Heartland, CVC Capital Partners, Accent Equity Partners*, Other Key Players*List Not Exhaustive, Apax Partners.

3. What are the main segments of the European Private Equity Funds Market?

The market segments include Investment Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 150 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market.

6. What are the notable trends driving market growth?

Family Owned Companies Witnessing Majority Shareholding in Private Equity Industry of Europe.

7. Are there any restraints impacting market growth?

Increasing Cost Acts as a Restraint to the Market.

8. Can you provide examples of recent developments in the market?

In February 2023, Oakley Capital raises a record Euro 2.85 Billion (USD 3.13 Billion) for its fifth flagship fund. Oakley will continue to invest behind the long-term megatrends that have underpinned growth and returns across economic cycles, including the consumer shift to online, business migration to the Cloud, and the growing global demand for quality, accessible education.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Private Equity Funds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Private Equity Funds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Private Equity Funds Market?

To stay informed about further developments, trends, and reports in the European Private Equity Funds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence