Key Insights

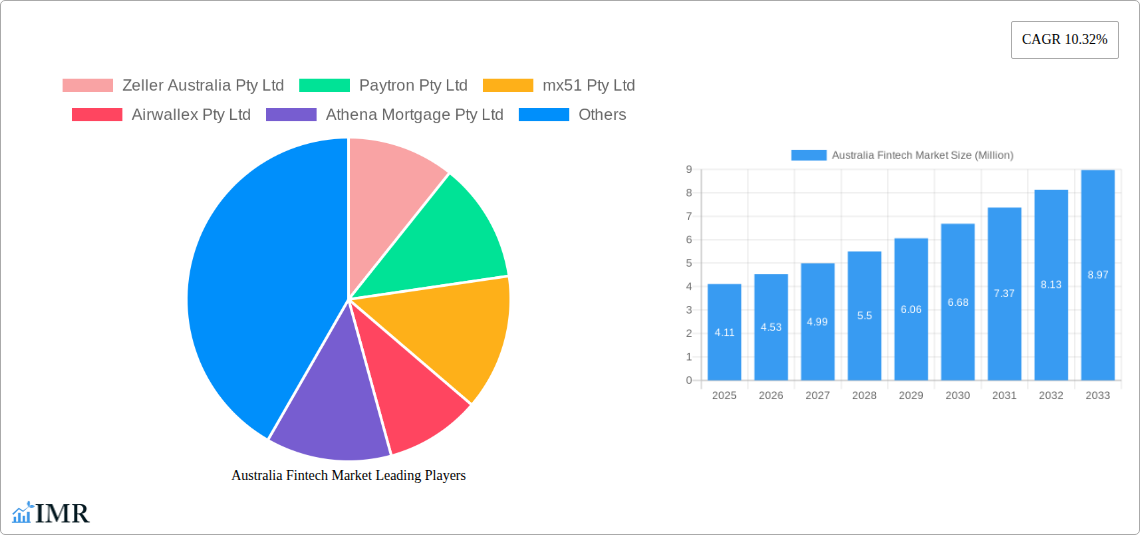

The Australian fintech market is poised for significant expansion, projecting a robust market size of USD 4.11 million in 2025 and a remarkable CAGR of 10.32% during the 2025-2033 forecast period. This growth is fueled by a confluence of factors, primarily driven by increasing consumer adoption of digital financial services, a supportive regulatory environment that encourages innovation, and the continuous emergence of new technologies. The shift towards seamless digital payments, the growing demand for personalized savings and investment solutions, and the burgeoning online insurance sector are key growth catalysts. Furthermore, the digital lending and lending marketplace segment is experiencing a surge as businesses and individuals seek faster, more accessible financing options. Leading companies such as Zeller Australia Pty Ltd, Paytron Pty Ltd, Airwallex Pty Ltd, and Wise are actively shaping this dynamic landscape through their innovative product offerings and strategic expansions.

Australia Fintech Market Market Size (In Million)

Despite the promising outlook, certain restraints could temper growth, including evolving regulatory compliance burdens, the need for enhanced cybersecurity measures to protect sensitive financial data, and the challenge of fostering widespread digital literacy among all demographics. However, the overarching trend indicates a continued migration from traditional banking to agile fintech solutions. The market is segmenting further, with specialized offerings in money transfer, payments, savings, investments, and lending gaining traction. As competition intensifies, companies are focusing on user experience, cost-effectiveness, and the integration of advanced technologies like AI and blockchain to maintain a competitive edge. The Australian fintech ecosystem, encompassing a diverse range of players from established institutions venturing into digital innovation to agile startups, is well-positioned to capitalize on these evolving market dynamics and deliver enhanced financial services to a wider audience.

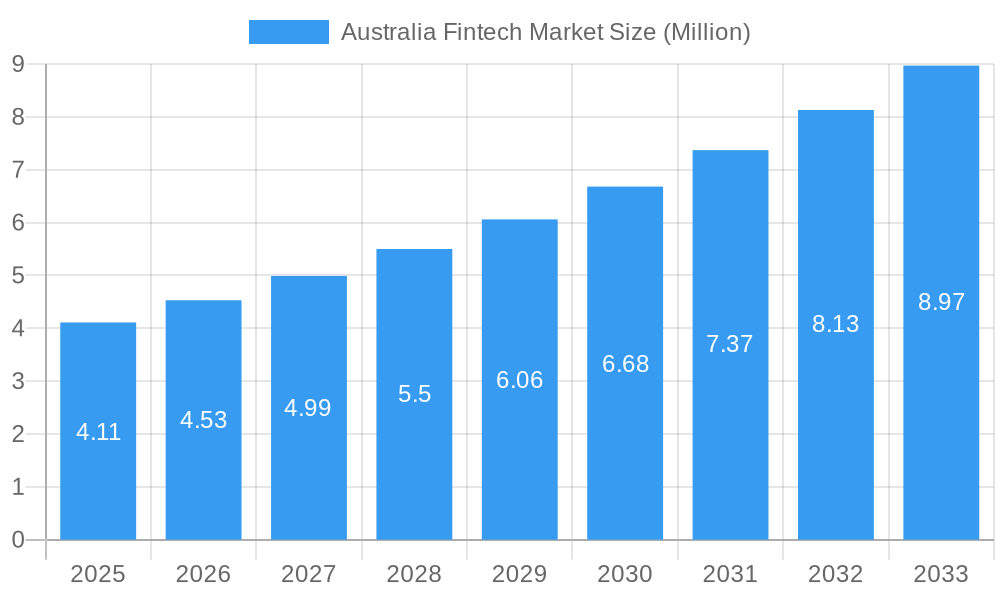

Australia Fintech Market Company Market Share

Australia Fintech Market: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth report offers a complete analysis of the Australian Fintech market, covering key segments like Money Transfer and Payments, Savings and Investments, Digital Lending & Lending Marketplaces, and Online Insurance & Insurance Marketplaces. We delve into market dynamics, growth trends, regional dominance, product landscape, drivers, barriers, and emerging opportunities. Leveraging extensive data and expert insights, this report provides a 15-year outlook (2019-2033), with a base year of 2025, and a forecast period extending to 2033. Essential for industry professionals, investors, and policymakers, this report is your definitive guide to the rapidly evolving Australian fintech ecosystem.

Australia Fintech Market Market Dynamics & Structure

The Australian fintech market is characterized by a dynamic and evolving structure, marked by increasing competition and technological innovation. Market concentration varies across segments, with established players and emerging startups vying for market share. Technological advancements, particularly in AI, blockchain, and cloud computing, are key drivers of innovation, enabling the development of new financial products and services. Regulatory frameworks, while evolving to accommodate fintech, also present a crucial aspect of market structure, influencing operational strategies and market entry. Competitive product substitutes are rapidly emerging, forcing traditional financial institutions to adapt. End-user demographics are increasingly tech-savvy, demanding seamless, digital-first financial solutions. Mergers and acquisitions (M&A) activity is a significant trend, indicating consolidation and strategic expansion within the sector.

- Market Concentration: Moderately concentrated, with a mix of large incumbents and a growing number of agile fintech startups.

- Technological Innovation Drivers: AI for personalized financial advice, blockchain for secure transactions, open banking APIs for data sharing, and mobile-first platforms for enhanced accessibility.

- Regulatory Frameworks: Evolving regulations supporting open banking, consumer data rights, and digital identity are shaping competitive landscapes.

- Competitive Product Substitutes: Digital wallets, peer-to-peer lending platforms, robo-advisors, and insurtech solutions are increasingly challenging traditional offerings.

- End-User Demographics: A growing segment of digitally native millennials and Gen Z, alongside a broader adoption by small to medium-sized enterprises (SMEs) seeking efficient financial tools.

- M&A Trends: Increasing M&A activity to acquire innovative technologies, expand customer bases, and gain market share. Expect a CAGR of approximately 15-20% in M&A deal volume over the forecast period.

Australia Fintech Market Growth Trends & Insights

The Australian fintech market is poised for substantial growth, driven by increasing digital adoption, supportive government initiatives, and a burgeoning demand for more accessible and efficient financial services. The market size is projected to witness a significant expansion from an estimated $50,000 Million in 2025 to over $120,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 12-15%. This growth trajectory is fueled by a strong consumer shift towards digital channels for all financial needs, from everyday banking and payments to complex investment decisions and insurance. The open banking revolution has further accelerated this trend, empowering consumers with greater control over their financial data and fostering innovation among fintech providers. Technological disruptions, such as the widespread adoption of cloud-based infrastructure and the integration of AI in customer service and risk management, are enhancing operational efficiency and customer experience.

The penetration of digital lending and payment solutions is expected to be a major growth engine, addressing the evolving needs of both consumers and businesses. Savings and investment platforms are also experiencing a surge in demand as Australians seek better ways to manage their wealth. Online insurance and insurtech solutions are transforming the traditional insurance landscape with personalized policies and streamlined claims processes. The competitive landscape is intensifying, with both domestic and international fintech players, including companies like Zeller Australia Pty Ltd, Paytron Pty Ltd, mx51 Pty Ltd, Airwallex Pty Ltd, Athena Mortgage Pty Ltd, DiviPay, Judo bank, Afterpay Touch, Sofi, Wise, and Stripe, actively innovating and expanding their offerings. The historical period (2019-2024) has laid a strong foundation, characterized by rapid experimentation and early adoption, setting the stage for accelerated growth in the forecast period. Consumer behavior shifts towards convenience, cost-effectiveness, and personalized experiences are consistently shaping the market, demanding that fintech companies remain agile and responsive to evolving preferences.

Dominant Regions, Countries, or Segments in Australia Fintech Market

The Money Transfer and Payments segment is projected to be the dominant force driving growth within the Australian Fintech market. This segment's leadership is underpinned by several key factors, including robust economic policies that encourage seamless cross-border transactions, a highly developed digital infrastructure facilitating rapid payment processing, and evolving consumer preferences for instant and cost-effective money transfer solutions. The increasing prevalence of e-commerce and the growing number of migrant populations further bolster the demand for efficient payment and remittance services.

- Market Share: The Money Transfer and Payments segment is anticipated to hold a substantial market share, estimated at around 30-35% of the overall Australian fintech market by 2025, with projected growth to 40-45% by 2033.

- Growth Potential: This segment is expected to exhibit a CAGR of 14-17% over the forecast period, outpacing other segments.

- Key Drivers:

- Economic Policies: Government initiatives promoting digital payments and reducing transaction costs.

- Infrastructure: Widespread availability of high-speed internet and mobile penetration.

- Consumer Behavior: Growing demand for contactless payments, mobile wallets, and peer-to-peer (P2P) transfer services.

- E-commerce Growth: The burgeoning online retail sector necessitates efficient and secure payment gateways.

- Remittance Market: A significant inflow and outflow of remittances due to a diverse population and globalized economy.

While Money Transfer and Payments leads, other segments are also experiencing significant growth:

- Digital Lending & Lending Marketplaces: Driven by the need for faster and more accessible credit for individuals and SMEs, this segment is expected to grow at a CAGR of 12-15%.

- Savings and Investments: Fueled by increased financial literacy and the desire for wealth creation, this segment is projected to grow at a CAGR of 10-13%, with robo-advisors and automated investment platforms gaining traction.

- Online Insurance & Insurance Marketplaces: Insurtech innovations are disrupting the traditional insurance model, leading to personalized products and streamlined claims, driving a CAGR of 11-14%.

The dominance of the Money Transfer and Payments segment is a testament to its foundational role in the digital economy and its direct impact on everyday consumer and business transactions.

Australia Fintech Market Product Landscape

The Australian fintech product landscape is a vibrant ecosystem of innovative solutions designed to enhance financial accessibility, efficiency, and user experience. Key product innovations include advanced digital payment platforms offering seamless transactions for both consumers and businesses, such as those provided by Stripe and Zeller Australia Pty Ltd. In the lending space, platforms like Athena Mortgage Pty Ltd are leveraging AI and alternative data for faster loan approvals. For wealth management, robo-advisors and automated investment tools are democratizing access to sophisticated investment strategies. DiviPay and mx51 Pty Ltd are at the forefront of corporate expense management solutions. The performance metrics of these products are characterized by high transaction speeds, low fee structures, enhanced security protocols, and intuitive user interfaces. Technological advancements in blockchain are being explored for secure and transparent cross-border payments, as exemplified by Airwallex Pty Ltd.

Key Drivers, Barriers & Challenges in Australia Fintech Market

Key Drivers:

The Australian fintech market is propelled by a confluence of powerful drivers. Technological advancements, particularly in AI, machine learning, and blockchain, are enabling the creation of more sophisticated and personalized financial products. The strong government support for innovation, including initiatives like open banking and the establishment of regulatory sandboxes, fosters a conducive environment for fintech growth. Increasing consumer demand for convenient, digital-first financial services, driven by a digitally savvy population, is a significant catalyst. Furthermore, the need for more efficient and cost-effective solutions for small and medium-sized enterprises (SMEs) presents a substantial market opportunity.

Barriers & Challenges:

Despite robust growth, the Australian fintech market faces several barriers and challenges. Regulatory hurdles, though supportive, can still be complex and time-consuming to navigate, impacting time-to-market for new products. Intense competition from both established financial institutions and a growing number of agile fintech startups puts pressure on margins and necessitates continuous innovation. Customer acquisition costs can be high, requiring significant investment in marketing and outreach. Data security and privacy concerns remain paramount, demanding robust cybersecurity measures and compliance with stringent regulations. Supply chain issues, particularly for hardware-dependent fintech solutions, can also pose logistical challenges.

Emerging Opportunities in Australia Fintech Market

Emerging opportunities in the Australian fintech market are abundant, driven by evolving consumer preferences and untapped market segments. The increasing demand for personalized financial advice and wealth management tools, particularly among younger demographics, presents a significant opportunity for robo-advisory and investment platforms. The burgeoning buy now, pay later (BNPL) sector, although facing increased scrutiny, continues to offer avenues for innovation in responsible credit solutions. Furthermore, the push for financial inclusion and access to digital financial services in rural and underserved communities presents a vast, largely untapped market. The integration of environmental, social, and governance (ESG) factors into investment products and services is another emerging trend, appealing to a growing segment of socially conscious consumers.

Growth Accelerators in the Australia Fintech Market Industry

Several key catalysts are accelerating the growth of the Australian fintech industry. Strategic partnerships between fintech startups and incumbent financial institutions are proving to be a significant growth accelerator, allowing for broader market reach and the integration of innovative technologies into established infrastructures. The ongoing expansion of open banking initiatives is fostering greater data sharing and innovation, leading to the development of more interconnected and customer-centric financial services. Technological breakthroughs in areas like real-time payments, digital identity verification, and decentralized finance (DeFi) are creating new business models and revenue streams. Market expansion strategies, including cross-border collaborations and the targeting of specific niche markets, are also playing a crucial role in driving sustained growth.

Key Players Shaping the Australia Fintech Market Market

- Zeller Australia Pty Ltd

- Paytron Pty Ltd

- mx51 Pty Ltd

- Airwallex Pty Ltd

- Athena Mortgage Pty Ltd

- DiviPay

- Judo bank

- Afterpay Touch

- Sofi

- Wise

- Stripe

Notable Milestones in Australia Fintech Market Sector

- March 2023: Financial platform Airwallex secured a payment business license in China, following the successful acquisition of a 100% stake in Guangzhou Shang Wu Tong Network Technology Co., Ltd., an information and online payment services company.

- February 2023: Fintech Zeller took on the big four banks to offer financial services to the small business sector, launching a new transaction account, debit card, and app.

In-Depth Australia Fintech Market Market Outlook

The Australian fintech market is set for continued robust growth, fueled by ongoing technological advancements and evolving consumer demands. The expansion of open banking, coupled with increasing digital literacy, will pave the way for more personalized and integrated financial solutions across all segments. Strategic partnerships and potential further consolidation through M&A will continue to shape the competitive landscape, driving efficiency and innovation. Emerging opportunities in areas such as ESG-focused financial products and the expansion of digital services into underserved regions present significant growth potential for agile and forward-thinking fintech players. The market's outlook remains exceptionally positive, with substantial opportunities for disruption and value creation over the coming decade.

Australia Fintech Market Segmentation

-

1. Service proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending & Lending Marketplaces

- 1.4. Online Insurance & Insurance Marketplaces

- 1.5. Other Service Propositions

Australia Fintech Market Segmentation By Geography

- 1. Australia

Australia Fintech Market Regional Market Share

Geographic Coverage of Australia Fintech Market

Australia Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Digital ID Framework Witnessing Growth in Australia Fintech Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending & Lending Marketplaces

- 5.1.4. Online Insurance & Insurance Marketplaces

- 5.1.5. Other Service Propositions

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Service proposition

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zeller Australia Pty Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Paytron Pty Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 mx51 Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Airwallex Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Athena Mortgage Pty Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DiviPay

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Judo bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Afterpay Touch

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sofi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wise

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Stripe**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Zeller Australia Pty Ltd

List of Figures

- Figure 1: Australia Fintech Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Fintech Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Fintech Market Revenue Million Forecast, by Service proposition 2020 & 2033

- Table 2: Australia Fintech Market Volume Billion Forecast, by Service proposition 2020 & 2033

- Table 3: Australia Fintech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Fintech Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Australia Fintech Market Revenue Million Forecast, by Service proposition 2020 & 2033

- Table 6: Australia Fintech Market Volume Billion Forecast, by Service proposition 2020 & 2033

- Table 7: Australia Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Australia Fintech Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Fintech Market?

The projected CAGR is approximately 10.32%.

2. Which companies are prominent players in the Australia Fintech Market?

Key companies in the market include Zeller Australia Pty Ltd, Paytron Pty Ltd, mx51 Pty Ltd, Airwallex Pty Ltd, Athena Mortgage Pty Ltd, DiviPay, Judo bank, Afterpay Touch, Sofi, Wise, Stripe**List Not Exhaustive.

3. What are the main segments of the Australia Fintech Market?

The market segments include Service proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.11 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Digital ID Framework Witnessing Growth in Australia Fintech Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: Financial platform Airwallex secured a payment business license in China, following the successful acquisition of a 100% stake in Guangzhou Shang Wu Tong Network Technology Co., Ltd., an information and online payment services company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Fintech Market?

To stay informed about further developments, trends, and reports in the Australia Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence