Key Insights

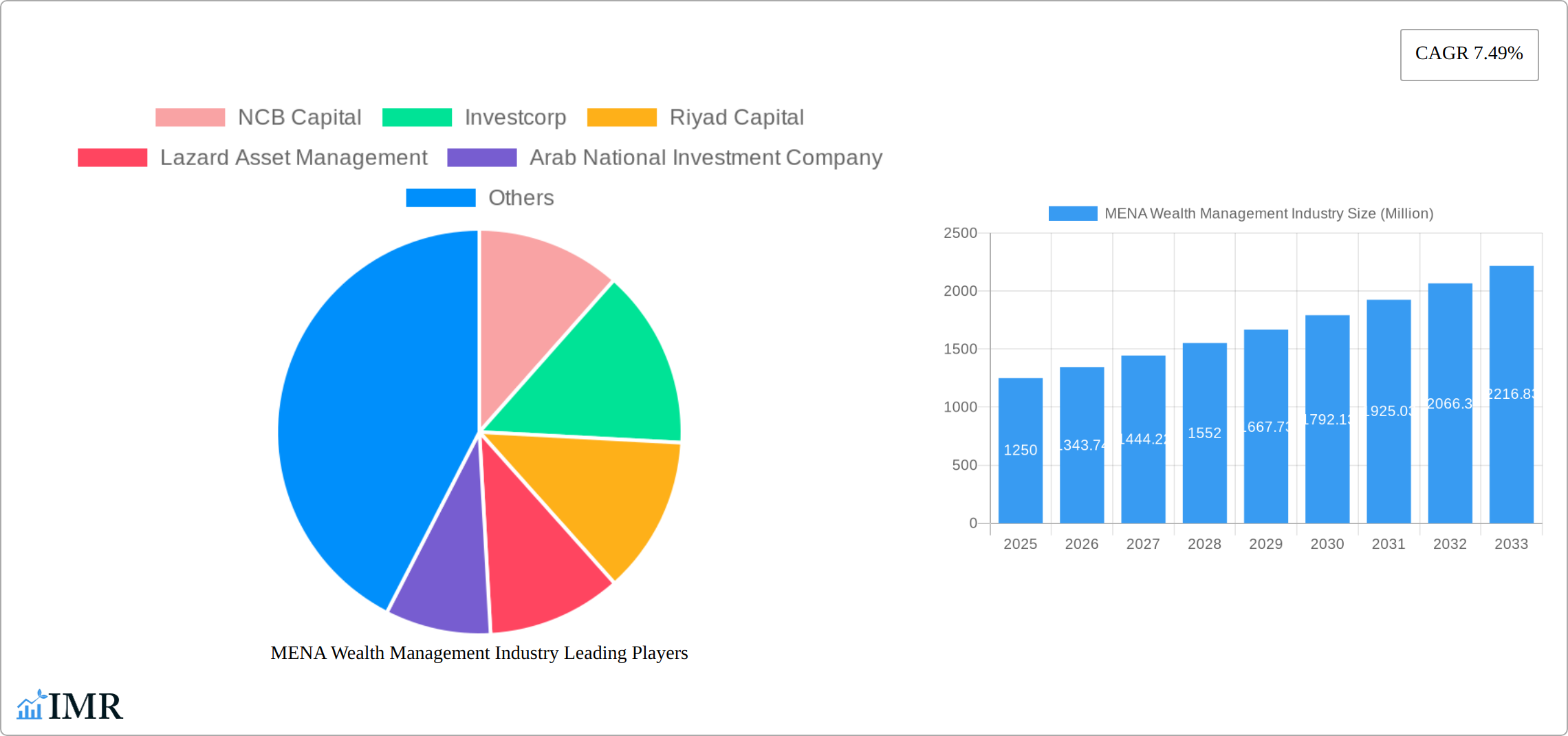

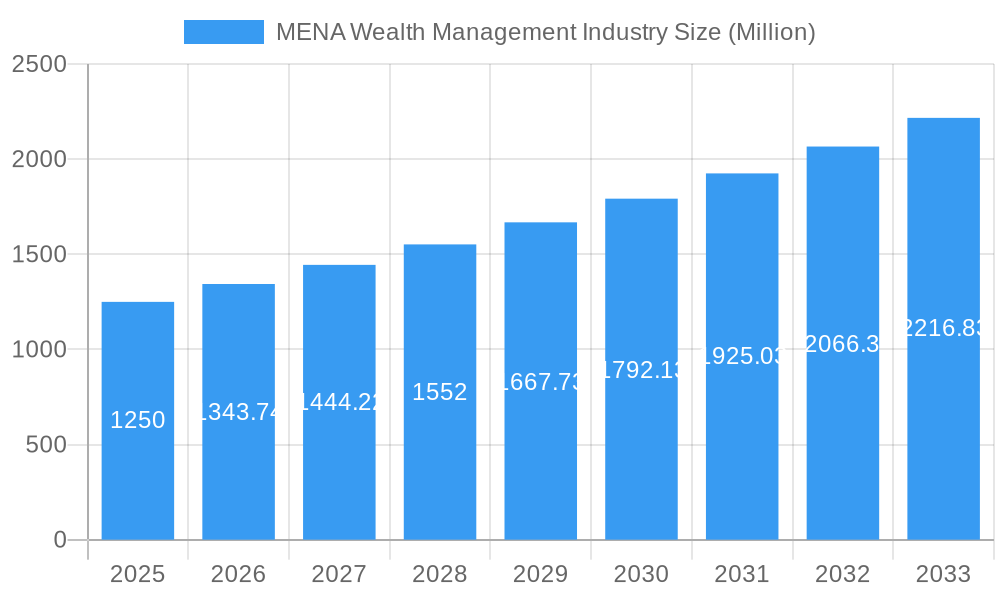

The MENA (Middle East and North Africa) wealth management industry is experiencing robust growth, projected to reach a market size of $1.25 billion in 2025, with a compound annual growth rate (CAGR) of 7.49% from 2025 to 2033. This expansion is fueled by several key drivers. A burgeoning middle class, coupled with increasing disposable incomes and a growing awareness of wealth management strategies, are driving demand for sophisticated financial services. Furthermore, supportive government initiatives aimed at diversifying economies and attracting foreign investment contribute to a positive investment climate. The rise of digital wealth management platforms is also streamlining access to services, making them more accessible to a wider range of investors. This digital transformation is impacting customer engagement and expectations, pushing incumbents to innovate and adapt to stay competitive. Geographic diversification of wealth within the region, alongside expanding international partnerships for wealth management firms, further enhances growth prospects. However, regulatory hurdles and geopolitical uncertainties present challenges that could temper growth in specific sub-sectors.

MENA Wealth Management Industry Market Size (In Billion)

The competitive landscape is dynamic, with both established international players like Lazard Asset Management and prominent regional firms such as NCB Capital, Investcorp, and Riyad Capital vying for market share. These firms are increasingly specializing in catering to the unique needs of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) within the region, offering bespoke investment solutions and wealth planning services. Smaller, niche players also contribute to the diverse offerings available, particularly focusing on specific market segments or investment strategies. The increasing sophistication of clients and their investment choices continues to present opportunities and challenges for players across the industry spectrum. The forecast period (2025-2033) anticipates sustained growth based on the continuing expansion of the region's economy and the evolving needs of its increasingly wealthy population.

MENA Wealth Management Industry Company Market Share

MENA Wealth Management Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the MENA (Middle East and North Africa) wealth management industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report is essential for investors, industry professionals, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic market. Parent market: Financial Services; Child market: Investment Management.

MENA Wealth Management Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the MENA wealth management sector. The market size in 2024 is estimated at XXX Million, with a projected value of XXXX Million by 2033.

- Market Concentration: The MENA wealth management market exhibits a moderately concentrated structure, with a few large players holding significant market share. The top five firms account for approximately xx% of the total market revenue in 2024.

- Technological Innovation: Fintech advancements, particularly in areas like robo-advisory, digital wealth management platforms, and AI-driven investment solutions, are transforming the landscape. However, adoption rates vary across the region due to factors such as digital literacy and infrastructure gaps.

- Regulatory Framework: Regulatory changes, including those related to KYC/AML compliance, data privacy, and cross-border investment regulations, significantly impact market operations. These regulations influence both the operational costs and the expansion strategies of wealth management firms.

- Competitive Product Substitutes: Traditional wealth management services face increasing competition from online investment platforms, crowdfunding initiatives, and alternative investment options. This competitive pressure is driving innovation and forcing incumbents to enhance their service offerings.

- End-User Demographics: The MENA region's diverse demographics, including a growing high-net-worth individual (HNWI) population and a rising middle class, are key drivers of industry growth. The changing demographic profile requires tailored financial solutions to appeal to various investor segments.

- M&A Trends: The MENA wealth management sector has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years. The number of deals is estimated to be xx in 2024, driven by consolidation efforts and expansion strategies by larger firms.

MENA Wealth Management Industry Growth Trends & Insights

The MENA wealth management landscape is undergoing a significant transformation, driven by robust economic growth and evolving investor demographics. Market size evolution is marked by a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This upward trajectory is underpinned by a confluence of factors, including a burgeoning high-net-worth individual (HNWI) population, expanding disposable incomes, and an increasing appetite for sophisticated investment solutions. Supportive government policies aimed at economic diversification and the promotion of financial services are also playing a pivotal role. Furthermore, a marked rise in financial literacy across the region is empowering individuals to seek professional wealth management guidance. Technological disruptions are at the forefront of this evolution, with digital platforms and advanced analytics revolutionizing customer engagement, service delivery, and operational efficiency. The adoption of robo-advisory services, AI-driven investment strategies, and seamless digital onboarding processes are becoming increasingly common, enhancing accessibility and personalization for a wider spectrum of investors.

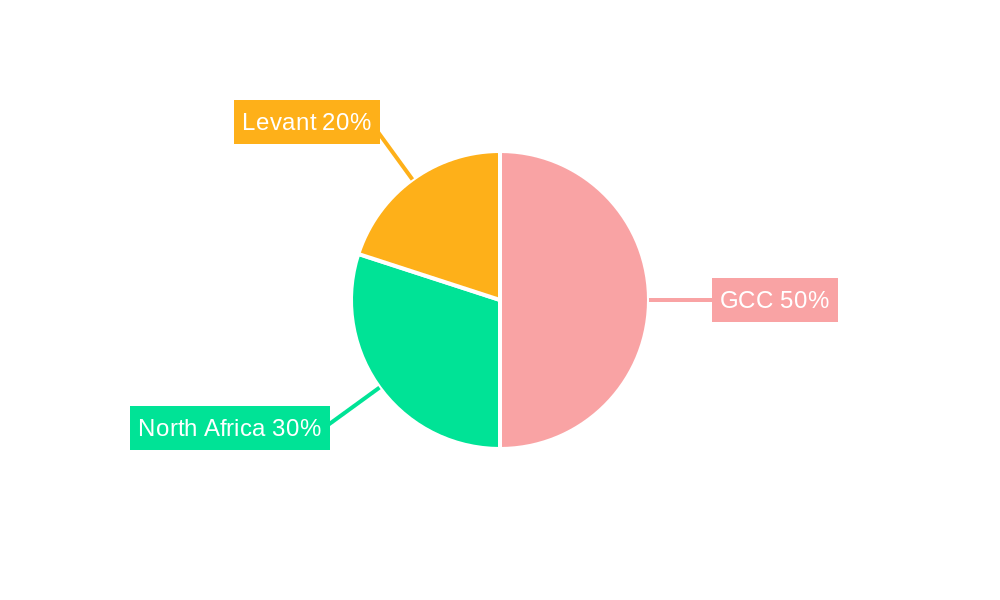

Dominant Regions, Countries, or Segments in MENA Wealth Management Industry

The UAE and Saudi Arabia are the leading markets in the MENA wealth management industry, holding the largest market share in 2024, estimated to be xx% and yy% respectively. Their dominance is driven by several factors:

- Strong Economic Growth: These countries boast robust economic growth, leading to higher levels of disposable income and wealth accumulation.

- Developed Financial Infrastructure: The UAE and Saudi Arabia possess well-established financial infrastructure, including sophisticated regulatory frameworks and advanced technological infrastructure.

- Government Support: Government initiatives promoting financial inclusion and investment activities further propel market growth in these countries.

- High Concentration of HNWIs: A significant proportion of the region's HNWIs reside in these countries, creating a large addressable market for wealth management services.

- Foreign Investment: Significant foreign investment flows into these countries attract international wealth management firms, boosting competition and innovation.

MENA Wealth Management Industry Product Landscape

The MENA wealth management industry offers a diverse range of products and services, including traditional investment management, portfolio advisory, financial planning, retirement planning, and wealth structuring solutions. Recent innovations include the rise of robo-advisors, AI-powered investment platforms, and digital wealth management solutions. These platforms offer personalized advice, automated portfolio management, and enhanced accessibility, catering to a wider range of investors. Performance metrics are primarily evaluated through metrics such as return on investment, risk-adjusted returns, and client satisfaction.

Key Drivers, Barriers & Challenges in MENA Wealth Management Industry

Key Drivers:

- Rising Affluence and Expanding HNWI Population: The consistent growth in the number of High-Net-Worth Individuals (HNWIs) and the burgeoning middle class represent a significant and sustained demand for specialized and tailored wealth management services, including sophisticated investment strategies, estate planning, and succession planning.

- Favorable Government Initiatives and Economic Diversification: Governments across the MENA region are actively supporting the development of their financial sectors through deregulation, incentives for foreign investment, and initiatives to diversify economies away from oil dependency. These efforts create a more conducive environment for the wealth management industry to thrive.

- Technological Advancements and Fintech Integration: The rapid adoption of FinTech innovations, including AI-powered advisory tools, blockchain for secure transactions, and advanced data analytics, is not only increasing operational efficiency but also expanding market penetration by offering more accessible and cost-effective solutions to a broader investor base.

- Growing Demand for Sharia-Compliant Products: A substantial segment of the MENA population seeks investment products and services that adhere to Islamic finance principles, presenting a unique opportunity for wealth managers to cater to this specific demand.

- Increased Cross-Border Investment Flows: The region's strategic location and growing economic ties with global markets are attracting increased cross-border investment, creating opportunities for wealth managers to advise on international portfolio diversification.

Key Challenges:

- Evolving Regulatory Landscape and Compliance Burden: Navigating an increasingly complex and dynamic regulatory environment across multiple jurisdictions can lead to higher compliance costs and operational complexities, requiring significant investment in legal and compliance infrastructure.

- Geopolitical Risks and Economic Volatility: Regional instability and global economic uncertainties can impact investor sentiment, market performance, and the overall attractiveness of the region for investment, posing challenges to long-term strategic planning and risk management.

- Intense Competition and Talent Acquisition: The MENA wealth management market is characterized by fierce competition from established global players, local institutions, and emerging FinTech startups. Attracting and retaining top talent with specialized skills in areas like digital transformation, investment research, and client relationship management remains a significant challenge.

- Digital Adoption Gaps: While technological adoption is growing, there remain segments of the population, particularly among older generations, who may be less inclined towards digital platforms, requiring a hybrid approach to service delivery.

- Cybersecurity Threats: With the increasing reliance on digital platforms, robust cybersecurity measures are paramount to protect sensitive client data and maintain trust.

Emerging Opportunities in MENA Wealth Management Industry

- Untapped Markets: Expansion into less developed markets within the MENA region presents significant growth potential.

- Sharia-compliant products: The development of tailored Sharia-compliant financial products is an emerging opportunity.

- Sustainable investing: The increasing demand for ESG (environmental, social, and governance) compliant investment solutions.

Growth Accelerators in the MENA Wealth Management Industry Industry

The future growth of the MENA wealth management industry will be significantly propelled by continued technological innovation, including the widespread adoption of AI for personalized financial advice, advanced data analytics for risk management, and blockchain for enhanced security and transparency. Strategic partnerships, particularly with innovative FinTech companies, will be crucial for developing cutting-edge solutions and expanding service offerings. Geographic expansion into underserved markets within the MENA region and the diversification into new product segments, such as sustainable and impact investing, will unlock new revenue streams. Government initiatives focused on fostering financial inclusion, enhancing investor education, and creating a stable and transparent regulatory framework will further solidify the industry's foundation and attract both domestic and international capital. The increasing demand for Sharia-compliant financial products also presents a substantial growth avenue for specialized wealth managers.

Key Players Shaping the MENA Wealth Management Industry Market

- NCB Capital

- Investcorp

- Riyad Capital

- Lazard Asset Management

- Arab National Investment Company

- Aljazira Capital

- Emirates NBD Asset Management

- Waha Capital

- Fippar Holdings

- Orange Asset Management

- HSBC Private Banking

- Standard Chartered Wealth Management

- Barclays Private Bank

- JP Morgan Private Bank

- List Not Exhaustive

Notable Milestones in MENA Wealth Management Industry Sector

- January 2023: Emirates NBD Securities collaborated with Abu Dhabi Securities Exchange (ADX) to enhance trading accessibility and streamline investment processes for their clients.

- January 2023: Emirates NBD successfully priced its inaugural AED 1 billion dirham-denominated bonds, underscoring its financial strength and commitment to the regional market.

- March 2023: Investcorp announced the acquisition of a leading European alternative investment firm, expanding its global footprint and service capabilities.

- April 2023: The Saudi Central Bank (SAMA) introduced new regulations aimed at enhancing consumer protection and promoting digital innovation within the financial sector, fostering greater trust and security.

- May 2023: Riyad Capital launched a new suite of Sharia-compliant investment funds, catering to the growing demand for ethical and faith-based financial products in the region.

In-Depth MENA Wealth Management Industry Market Outlook

The MENA wealth management industry is poised for sustained growth, driven by a confluence of factors including rising affluence, technological innovation, and supportive government policies. Strategic partnerships, expansion into new markets, and the development of innovative products tailored to evolving investor needs will be key to realizing the industry's vast potential. The forecast for 2033 indicates a strong market position, presenting lucrative opportunities for both established players and new entrants.

MENA Wealth Management Industry Segmentation

-

1. Client Type

- 1.1. HNWIs

- 1.2. Retail/ Individuals

- 1.3. Mass Affluents

- 1.4. Other Client Types

-

2. Provider Type

- 2.1. Private Bankers

- 2.2. Fintech Advisors

- 2.3. Family Offices

- 2.4. Other Provider Types

MENA Wealth Management Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. Algeria

- 3. Egypt

- 4. United Arab Emirates

- 5. Rest of MENA Region

MENA Wealth Management Industry Regional Market Share

Geographic Coverage of MENA Wealth Management Industry

MENA Wealth Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of New Age Digital Platforms by Millenials; Increasing HNWI in MENA Region

- 3.3. Market Restrains

- 3.3.1. Adoption of New Age Digital Platforms by Millenials; Increasing HNWI in MENA Region

- 3.4. Market Trends

- 3.4.1. Saudi Arabia Asset Under Management Trend Shows Growth in Wealth Management Industry on MENA Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. HNWIs

- 5.1.2. Retail/ Individuals

- 5.1.3. Mass Affluents

- 5.1.4. Other Client Types

- 5.2. Market Analysis, Insights and Forecast - by Provider Type

- 5.2.1. Private Bankers

- 5.2.2. Fintech Advisors

- 5.2.3. Family Offices

- 5.2.4. Other Provider Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. Algeria

- 5.3.3. Egypt

- 5.3.4. United Arab Emirates

- 5.3.5. Rest of MENA Region

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. Saudi Arabia MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 6.1.1. HNWIs

- 6.1.2. Retail/ Individuals

- 6.1.3. Mass Affluents

- 6.1.4. Other Client Types

- 6.2. Market Analysis, Insights and Forecast - by Provider Type

- 6.2.1. Private Bankers

- 6.2.2. Fintech Advisors

- 6.2.3. Family Offices

- 6.2.4. Other Provider Types

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 7. Algeria MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 7.1.1. HNWIs

- 7.1.2. Retail/ Individuals

- 7.1.3. Mass Affluents

- 7.1.4. Other Client Types

- 7.2. Market Analysis, Insights and Forecast - by Provider Type

- 7.2.1. Private Bankers

- 7.2.2. Fintech Advisors

- 7.2.3. Family Offices

- 7.2.4. Other Provider Types

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 8. Egypt MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 8.1.1. HNWIs

- 8.1.2. Retail/ Individuals

- 8.1.3. Mass Affluents

- 8.1.4. Other Client Types

- 8.2. Market Analysis, Insights and Forecast - by Provider Type

- 8.2.1. Private Bankers

- 8.2.2. Fintech Advisors

- 8.2.3. Family Offices

- 8.2.4. Other Provider Types

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 9. United Arab Emirates MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 9.1.1. HNWIs

- 9.1.2. Retail/ Individuals

- 9.1.3. Mass Affluents

- 9.1.4. Other Client Types

- 9.2. Market Analysis, Insights and Forecast - by Provider Type

- 9.2.1. Private Bankers

- 9.2.2. Fintech Advisors

- 9.2.3. Family Offices

- 9.2.4. Other Provider Types

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 10. Rest of MENA Region MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 10.1.1. HNWIs

- 10.1.2. Retail/ Individuals

- 10.1.3. Mass Affluents

- 10.1.4. Other Client Types

- 10.2. Market Analysis, Insights and Forecast - by Provider Type

- 10.2.1. Private Bankers

- 10.2.2. Fintech Advisors

- 10.2.3. Family Offices

- 10.2.4. Other Provider Types

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NCB Capital

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Investcorp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Riyad Capital

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lazard Asset Management

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Arab National Investment Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aljazira Capital

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Emirates NBD Asset Management

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Waha Capital

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fippar Holdings

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Orange Asset Management**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 NCB Capital

List of Figures

- Figure 1: MENA Wealth Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: MENA Wealth Management Industry Share (%) by Company 2025

List of Tables

- Table 1: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 2: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 3: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 4: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 5: MENA Wealth Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: MENA Wealth Management Industry Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 8: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 9: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 10: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 11: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 14: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 15: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 16: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 17: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 19: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 20: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 21: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 22: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 23: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 26: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 27: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 28: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 29: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 31: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 32: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 33: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 34: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 35: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MENA Wealth Management Industry?

The projected CAGR is approximately 7.49%.

2. Which companies are prominent players in the MENA Wealth Management Industry?

Key companies in the market include NCB Capital, Investcorp, Riyad Capital, Lazard Asset Management, Arab National Investment Company, Aljazira Capital, Emirates NBD Asset Management, Waha Capital, Fippar Holdings, Orange Asset Management**List Not Exhaustive.

3. What are the main segments of the MENA Wealth Management Industry?

The market segments include Client Type, Provider Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of New Age Digital Platforms by Millenials; Increasing HNWI in MENA Region.

6. What are the notable trends driving market growth?

Saudi Arabia Asset Under Management Trend Shows Growth in Wealth Management Industry on MENA Region.

7. Are there any restraints impacting market growth?

Adoption of New Age Digital Platforms by Millenials; Increasing HNWI in MENA Region.

8. Can you provide examples of recent developments in the market?

January 2023: Emirates NBD Securities, a leading brokerage firm in the UAE, partnered with Abu Dhabi Securities Exchange (ADX) to provide traders with instant access to the exchange's listed companies, enabling it to offer instant trading account opening and digital onboarding to another UAE stock exchange.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MENA Wealth Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MENA Wealth Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MENA Wealth Management Industry?

To stay informed about further developments, trends, and reports in the MENA Wealth Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence